Capital Budgeting Problem Set - Building The Pride

Capital Budgeting Problem Set - Building The Pride

Capital Budgeting Problem Set - Building The Pride

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

only be $28,000. the firm is in a34% tax bracket. Given that the firm’s required rate of<br />

return is 13%, compute the NPV and IRR of the investment. Should they make the<br />

investment? (NPV –36,936.03; IRR 5.08%)<br />

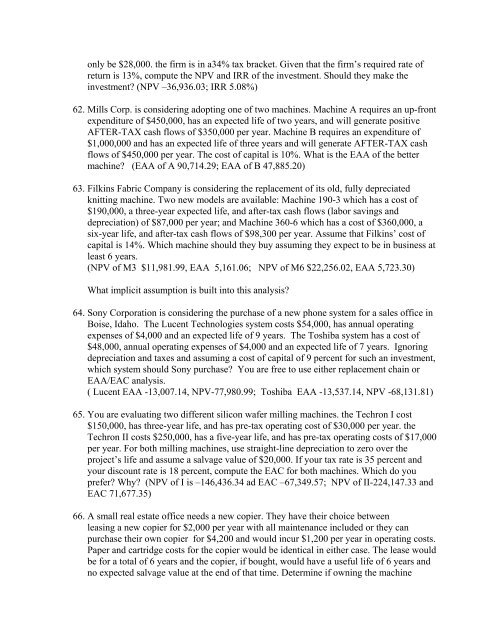

62. Mills Corp. is considering adopting one of two machines. Machine A requires an up-front<br />

expenditure of $450,000, has an expected life of two years, and will generate positive<br />

AFTER-TAX cash flows of $350,000 per year. Machine B requires an expenditure of<br />

$1,000,000 and has an expected life of three years and will generate AFTER-TAX cash<br />

flows of $450,000 per year. <strong>The</strong> cost of capital is 10%. What is the EAA of the better<br />

machine? (EAA of A 90,714.29; EAA of B 47,885.20)<br />

63. Filkins Fabric Company is considering the replacement of its old, fully depreciated<br />

knitting machine. Two new models are available: Machine 190-3 which has a cost of<br />

$190,000, a three-year expected life, and after-tax cash flows (labor savings and<br />

depreciation) of $87,000 per year; and Machine 360-6 which has a cost of $360,000, a<br />

six-year life, and after-tax cash flows of $98,300 per year. Assume that Filkins’ cost of<br />

capital is 14%. Which machine should they buy assuming they expect to be in business at<br />

least 6 years.<br />

(NPV of M3 $11,981.99, EAA 5,161.06; NPV of M6 $22,256.02, EAA 5,723.30)<br />

What implicit assumption is built into this analysis?<br />

64. Sony Corporation is considering the purchase of a new phone system for a sales office in<br />

Boise, Idaho. <strong>The</strong> Lucent Technologies system costs $54,000, has annual operating<br />

expenses of $4,000 and an expected life of 9 years. <strong>The</strong> Toshiba system has a cost of<br />

$48,000, annual operating expenses of $4,000 and an expected life of 7 years. Ignoring<br />

depreciation and taxes and assuming a cost of capital of 9 percent for such an investment,<br />

which system should Sony purchase? You are free to use either replacement chain or<br />

EAA/EAC analysis.<br />

( Lucent EAA -13,007.14, NPV-77,980.99; Toshiba EAA -13,537.14, NPV -68,131.81)<br />

65. You are evaluating two different silicon wafer milling machines. the Techron I cost<br />

$150,000, has three-year life, and has pre-tax operating cost of $30,000 per year. the<br />

Techron II costs $250,000, has a five-year life, and has pre-tax operating costs of $17,000<br />

per year. For both milling machines, use straight-line depreciation to zero over the<br />

project’s life and assume a salvage value of $20,000. If your tax rate is 35 percent and<br />

your discount rate is 18 percent, compute the EAC for both machines. Which do you<br />

prefer? Why? (NPV of I is –146,436.34 ad EAC –67,349.57; NPV of II-224,147.33 and<br />

EAC 71,677.35)<br />

66. A small real estate office needs a new copier. <strong>The</strong>y have their choice between<br />

leasing a new copier for $2,000 per year with all maintenance included or they can<br />

purchase their own copier for $4,200 and would incur $1,200 per year in operating costs.<br />

Paper and cartridge costs for the copier would be identical in either case. <strong>The</strong> lease would<br />

be for a total of 6 years and the copier, if bought, would have a useful life of 6 years and<br />

no expected salvage value at the end of that time. Determine if owning the machine