Capital Budgeting Practice Problems - Building The Pride

Capital Budgeting Practice Problems - Building The Pride

Capital Budgeting Practice Problems - Building The Pride

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

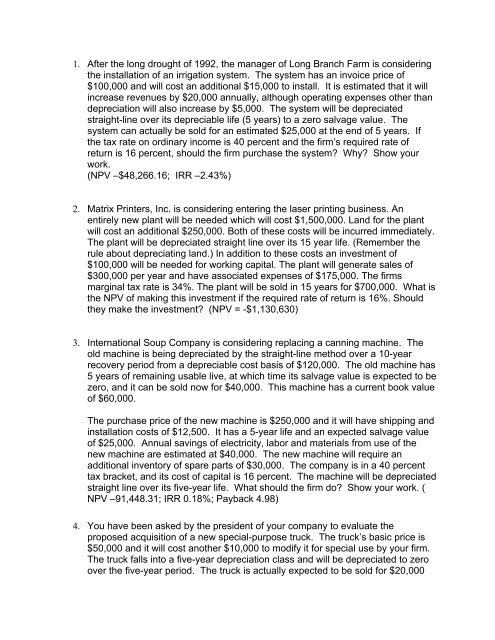

1. After the long drought of 1992, the manager of Long Branch Farm is considering<br />

the installation of an irrigation system. <strong>The</strong> system has an invoice price of<br />

$100,000 and will cost an additional $15,000 to install. It is estimated that it will<br />

increase revenues by $20,000 annually, although operating expenses other than<br />

depreciation will also increase by $5,000. <strong>The</strong> system will be depreciated<br />

straight-line over its depreciable life (5 years) to a zero salvage value. <strong>The</strong><br />

system can actually be sold for an estimated $25,000 at the end of 5 years. If<br />

the tax rate on ordinary income is 40 percent and the firm’s required rate of<br />

return is 16 percent, should the firm purchase the system? Why? Show your<br />

work.<br />

(NPV –$48,266.16; IRR –2.43%)<br />

2. Matrix Printers, Inc. is considering entering the laser printing business. An<br />

entirely new plant will be needed which will cost $1,500,000. Land for the plant<br />

will cost an additional $250,000. Both of these costs will be incurred immediately.<br />

<strong>The</strong> plant will be depreciated straight line over its 15 year life. (Remember the<br />

rule about depreciating land.) In addition to these costs an investment of<br />

$100,000 will be needed for working capital. <strong>The</strong> plant will generate sales of<br />

$300,000 per year and have associated expenses of $175,000. <strong>The</strong> firms<br />

marginal tax rate is 34%. <strong>The</strong> plant will be sold in 15 years for $700,000. What is<br />

the NPV of making this investment if the required rate of return is 16%. Should<br />

they make the investment? (NPV = -$1,130,630)<br />

3. International Soup Company is considering replacing a canning machine. <strong>The</strong><br />

old machine is being depreciated by the straight-line method over a 10-year<br />

recovery period from a depreciable cost basis of $120,000. <strong>The</strong> old machine has<br />

5 years of remaining usable live, at which time its salvage value is expected to be<br />

zero, and it can be sold now for $40,000. This machine has a current book value<br />

of $60,000.<br />

<strong>The</strong> purchase price of the new machine is $250,000 and it will have shipping and<br />

installation costs of $12,500. It has a 5-year life and an expected salvage value<br />

of $25,000. Annual savings of electricity, labor and materials from use of the<br />

new machine are estimated at $40,000. <strong>The</strong> new machine will require an<br />

additional inventory of spare parts of $30,000. <strong>The</strong> company is in a 40 percent<br />

tax bracket, and its cost of capital is 16 percent. <strong>The</strong> machine will be depreciated<br />

straight line over its five-year life. What should the firm do? Show your work. (<br />

NPV –91,448.31; IRR 0.18%; Payback 4.98)<br />

4. You have been asked by the president of your company to evaluate the<br />

proposed acquisition of a new special-purpose truck. <strong>The</strong> truck’s basic price is<br />

$50,000 and it will cost another $10,000 to modify it for special use by your firm.<br />

<strong>The</strong> truck falls into a five-year depreciation class and will be depreciated to zero<br />

over the five-year period. <strong>The</strong> truck is actually expected to be sold for $20,000

after three years when the project is ended. Use of the truck will require an<br />

increase in net working capital of $2,000 (spare parts). <strong>The</strong> truck will have no<br />

effect on revenue, but it is expected to save the firm $22,000 per year in beforetax<br />

operating costs, mainly labor. <strong>The</strong> firm’s marginal tax rate is 40 percent and<br />

the required rate of return on the project is 13 percent. What should you do?<br />

(NPV -$3143.27; IRR 10.39%)<br />

5. Blue Note Jazz Productions has decided to cash in on the country craze by<br />

starting a subsidiary that will promote concerts by "Country Jazz" artists for the<br />

next three years. <strong>The</strong> country music boom is expected to subside by this time<br />

and the subsidiary will be folded. Blue Note expects that average ticket prices will<br />

be $35 and that ticket sales for the three years will be 300,000 tickets per year.<br />

Fixed cost each year are expected to be $3,000,000 and variable costs are<br />

expected to be 25% of sales. <strong>The</strong> subsidiary will need $4,000,000 in new<br />

equipment to start up and requires a $300,000 investment in working capital. <strong>The</strong><br />

$4,000,000 in equipment will be depreciated straight-line over five years to a zero<br />

salvage value, but will be sold at the end of three years for an estimated<br />

$1,500,000. <strong>The</strong> firm's marginal tax rate is 40%. What is the NPV of this new<br />

investment if the firm's required rate of return is 12%? What is the IRR? Should<br />

the project be accepted?<br />

(IRR 37.20%; NPV $2,276,314.23; MIRR 29.04%)<br />

6. Southwest Airlines is considering the purchase of a new baggage-handling<br />

machine that moves bags quicker and with less damage. <strong>The</strong> cost is $160,000.<br />

<strong>The</strong> machine will be depreciated using the straight line method over its seven<br />

year life. If the machine is purchased, SWA will save $31,000 per year in<br />

damaged bags costs during the first five years. Because of higher maintenance<br />

costs during the last two years the savings will only be $28,000. the firm is in<br />

a34% tax bracket. Given that the firm’s required rate of return is 13%, compute<br />

the NPV and IRR of the investment. Should they make the investment? (NPV –<br />

36,936.03; IRR 5.08%)

7. Ball Corporation is currently evaluating two mutually exclusive projects which<br />

have the following net cash flows:<br />

A<br />

B<br />

0 -$5,000 -$10,000<br />

1 3,000 3,500<br />

2 3,000 3,500<br />

3 3,000 3,500<br />

4 3,500<br />

5 3,500<br />

6 3,500<br />

Both projects have a cost of capital of 10 percent. Totally new equipment must<br />

be procured in 6 years, but Project A would be replicated if it were chosen.<br />

Which project should Ball select, and why?<br />

8. Sony Corporation is considering the purchase of a new phone system for a sales<br />

office in Boise, Idaho. <strong>The</strong> Lucent Technologies system costs $54,000, has<br />

annual operating expenses of $4,000 and an expected life of 9 years. <strong>The</strong><br />

Toshiba system has a cost of $48,000, annual operating expenses of $4,000 and<br />

an expected life of 7 years. Ignoring depreciation and taxes and assuming a cost<br />

of capital of 9 percent for such an investment, which system should Sony<br />

purchase? You are free to use either replacement chain or EAA/EAC analysis.<br />

( Lucent EAA -13,007.14, NPV-77,980.99; Toshiba EAA -13,537.14, NPV -<br />

68,131.81)<br />

9. A small real estate office needs a new copier. <strong>The</strong>y have their choice between<br />

leasing a new copier for $2,000 per year with all maintenance included or they<br />

can purchase their own copier for $4,200 and would incur $1,200 per year in<br />

operating costs. Paper and cartridge costs for the copier would be identical in<br />

either case. <strong>The</strong> lease would be for a total of 6 years and the copier, if bought,<br />

would have a useful life of 6 years and no expected salvage value at the end of<br />

that time. Determine if owning the machine would be cheaper on a per-year basis<br />

than leasing the machine. <strong>The</strong>n firm’s tax rate is 34% and the proper required<br />

rate of return for the project would be 7%. (Annual after-tax cost of lease is<br />

$1,320 per year. NPV for purchase of copier is -$6840.66 giving an EAC of<br />

$1,435.14 per year. Take the one with the lowest annual cost – the lease.)<br />

10. You have become very successful and are considering the purchase of a plane<br />

for your firm. <strong>The</strong> Piper model has an initial cost of $375,000, annual operating<br />

costs of $24,000 and a salvage value of $150,000. Its estimated holding period<br />

is 7 years. <strong>The</strong> Cessna model has an initial cost of $325,000, but annual<br />

operating costs of $29,500 and an estimated salvage value of $100,000. Its<br />

estimated holding period is 8 years. Your cost of capital is fifteen percent.<br />

Ignoring depreciation and taxes, which model would be the best choice assuming<br />

they both would perform the required tasks?