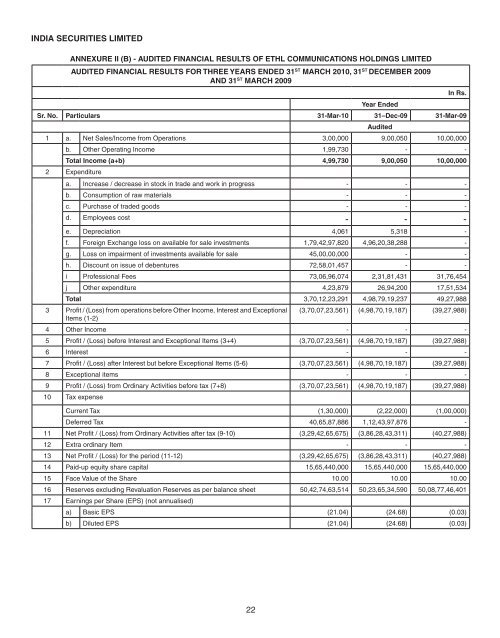

<strong>INDIA</strong> <strong>SECURITIES</strong> <strong>LIMITED</strong>ANNEXURE II (B) - AUDITED FINANCIAL RESULTS OF ETHL COMMUNICATIONS HOLDINGS <strong>LIMITED</strong>AUDITED FINANCIAL RESULTS FOR THREE YEARS ENDED 31 ST MARCH 2010, 31 ST DECEMBER 2009AND 31 ST MARCH 2009In Rs.Year EndedSr. No. Particulars 31-Mar-10 31–Dec-09 31-Mar-09Audited1 a. Net Sales/Income from Operations 3,00,000 9,00,050 10,00,000b. Other Operating Income 1,99,730 - -Total Income (a+b) 4,99,730 9,00,050 10,00,0002 Expenditurea. Increase / decrease in stock in trade and work in progress - - -b. Consumption of raw materials - - -c. Purchase of traded goods - - -d. Employees cost - - -e. Depreciation 4,061 5,318 -f. Foreign Exchange loss on available for sale investments 1,79,42,97,820 4,96,20,38,288 -g. Loss on impairment of investments available for sale 45,00,00,000 - -h. Discount on issue of debentures 72,58,01,457 - -i Professional Fees 73,06,96,074 2,31,81,431 31,76,454j Other expenditure 4,23,879 26,94,200 17,51,534Total 3,70,12,23,291 4,98,79,19,237 49,27,9883 Profit / (Loss) from operations before Other Income, Interest and ExceptionalItems (1-2)(3,70,07,23,561) (4,98,70,19,187) (39,27,988)4 Other Income - - -5 Profit / (Loss) before Interest and Exceptional Items (3+4) (3,70,07,23,561) (4,98,70,19,187) (39,27,988)6 Interest - - -7 Profit / (Loss) after Interest but before Exceptional Items (5-6) (3,70,07,23,561) (4,98,70,19,187) (39,27,988)8 Exceptional items - - -9 Profit / (Loss) from Ordinary Activities before tax (7+8) (3,70,07,23,561) (4,98,70,19,187) (39,27,988)10 Tax expenseCurrent Tax (1,30,000) (2,22,000) (1,00,000)Deferred Tax 40,65,87,886 1,12,43,97,876 -11 Net Profit / (Loss) from Ordinary Activities after tax (9-10) (3,29,42,65,675) (3,86,28,43,311) (40,27,988)12 Extra ordinary Item - - -13 Net Profit / (Loss) for the period (11-12) (3,29,42,65,675) (3,86,28,43,311) (40,27,988)14 Paid-up equity share capital 15,65,440,000 15,65,440,000 15,65,440,00015 Face Value of the Share 10.00 10.00 10.0016 Reserves excluding Revaluation Reserves as per balance sheet 50,42,74,63,514 50,23,65,34,590 50,08,77,46,40117 Earnings per Share (EPS) (not annualised)a) Basic EPS (21.04) (24.68) (0.03)b) Diluted EPS (21.04) (24.68) (0.03)22

IN THE HIGH COURT OF JUDICATURE AT MADRAS(Ordinary Original Civil Jurisdiction)COMPANY APPLICATION NO. 442 OF 2011In the matter of the Companies Act, 1956 (1 of 1956)AndIn the matter of Sections 391 to 394 of the Companies Act, 1956AndIn the matter of Scheme of Amalgamation of ETHL Communications HoldingsLimited with India Securities LimitedIndia Securities Limited, a Company incorporated )under the Companies Act, 1956 and having its Registered Office at )New no. 77/56, C.P. Ramaswamy Road, Abhirampuram, )Chennai 600 018, represented by Mr. V Parthasarathy, )Authorised Signatory _ … APPLICANT / TRANSFEREE COMPANYFORM OF PROXYI/We, the undersigned Equity Shareholder(s) of India Securities Limited hereby appointofand failing him /herofas as my/our proxy to act for me / us on my /our behalf at the Court Convened Meeting of the EquityShareholders of India Securities Limited to be held at Tuesday, 26 th July, 2011 at 10.30 A.M. at Chennai House, 5 th Floor, 7, Esplanade, Chennai – 600 108 for thepurpose of considering and if thought fit, approving with or without modification(s), the arrangement embodied in the Scheme of Amalgamation of ETHL CommunicationsHoldings Limited (the Transferor Company) with India Securities Limited (the Transferee Company) at such meeting and at any adjournment or adjournments thereofto vote for me/us and in my/our name, (here, if ‘for’, insert ‘for’, if ‘against’ insert ‘against’, and in thelatter case, strike out the words below after “Scheme of Amalgamation”) the said arrangement embodied in the Scheme of Amalgamation and the resolution, eitherwith or without modification, as my/our proxy may approve.[Strike out what is not necessary]Dated this day of 2011Name :Address :Folio No/Client Id/D.P. Id : No. of Shares :Note:1. All alterations made in the Form of Proxy should be initialed.2. Proxy, in order to be effective, to be deposited at the registered office ofthe Company at New no. 77/56, C.P. Ramaswamy Road, Abhirampuram,Chennai 600 018 not later than 48 hours before the meeting.Affix Re.1RevenueStampSIGNATURE<strong>INDIA</strong> <strong>SECURITIES</strong> <strong>LIMITED</strong>Regd. Office: New No, 77/56, C.P. Ramaswamy Road, Abhirampuram, Chennai – 600 018.ATTENDANCE SLIP(TO BE HANDLED OVER AT THE ENTRANCE OF THE MEETING HALL)I hereby record my presence at the COURT CONVENED MEETING of the Company to be held on Tuesday, 26 th July, 2011 at 10.30 A.M. at the Chennai House,5 th floor, 7, Esplanade, Chennai – 600 108.NAME OF THE MEMBER ATTENDING (IN BLOCK LETTER)_________________________________________________________________________NAME OF THE PROXY (To be filled - in if the Proxy Formhas been duly deposited with the Company)_________________________________________________________________________SIGNATURE OF THE MEMBER/PROXY_________________________________________________________________________Member’s Folio Number/Client ID and DP ID ______________________________ No. of Shares ______________________________23