Ctac in figures 188

Building for the future / Annual Report 2010 - Ctac

Building for the future / Annual Report 2010 - Ctac

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Strong focus on strategyFocus<strong>in</strong>g on the future. In order to develop from ERP supplier <strong>in</strong>to adist<strong>in</strong>guish<strong>in</strong>g Solution Provider, <strong>Ctac</strong> <strong>in</strong>vests <strong>in</strong> susta<strong>in</strong>able solutions withadded value that are perfectly <strong>in</strong> l<strong>in</strong>e with today’s and tomorrow’s processes.8CTAC Annual Report 2010 9

Profile<strong>in</strong>novateco-<strong>in</strong>novationpowerfulComplete portfolio<strong>Ctac</strong> offers a complete portfolio.Our offer ranges from licens<strong>in</strong>gand solutions implementation tomanagement and host<strong>in</strong>g. Additionally,we deliver optimisation andenhancement projects. This enablesus to deliver complete end-to-endsolutions. Powerful, composed solutionsthat stand out through optimumattunement between software,bus<strong>in</strong>ess processes and staff. We offersector-specific applications on thebasis of standard software compo-knowledgeorientedS<strong>in</strong>ce 1992, <strong>Ctac</strong> has been assist<strong>in</strong>gsmall, medium-sized and largeorganisations with much passion andverve <strong>in</strong> sett<strong>in</strong>g up, ma<strong>in</strong>ta<strong>in</strong><strong>in</strong>g andrenovat<strong>in</strong>g their IT <strong>in</strong>frastructure.<strong>Ctac</strong> is widely recognised as a knowledgecompany for good reason.A computerisation firm, which constantlyreflects on the challenges oftoday and tomorrow and helps customersto flexibly adjust to chang<strong>in</strong>gcircumstances. A computerisationfirm, which <strong>in</strong>cessantly builds for thefuture of its customers and itself.People and technology<strong>Ctac</strong> connects extensive experience<strong>in</strong> the sector with thorough expertise<strong>in</strong> the area of IT solutions for bus<strong>in</strong>essprocesses. A comb<strong>in</strong>ation that makesorganisations more flexible and morepowerful under all circumstances. Weassist our customers <strong>in</strong> realis<strong>in</strong>g lowercosts, higher turnovers, better productsand/or a larger market share. Inshort: more competitive advantages.With our strategic solutions, we build<strong>Ctac</strong> Managed Servicesmarket-orientedcomposedsolutionsStrategyhealthcareservicesa bridge between people (users) andtechnology (software) <strong>in</strong> a pragmaticand results-oriented way. To this end,provid<strong>in</strong>g added value to customers –different k<strong>in</strong>ds of companies of everysize with<strong>in</strong> various sectors – is alwaysthe start<strong>in</strong>g po<strong>in</strong>t.<strong>Ctac</strong> th<strong>in</strong>ks aheadWhoever <strong>in</strong>vests <strong>in</strong> technology islook<strong>in</strong>g to benefit from it over a longperiod. That is why we deliver futureproof,durable solutions with addedvalue. Together with the customer, weth<strong>in</strong>k along and develop function<strong>in</strong>g,proven solutions that perfectly fit theprocesses of today and tomorrow.On top of that, we already keep aneye on the solutions for the day aftertomorrow. <strong>Ctac</strong> spends a lot of timeon research and development. Thatunderscores our <strong>in</strong>volvement andcustomer focus, which expla<strong>in</strong>s oursuccess <strong>in</strong> the market.Co-<strong>in</strong>novationOver the years, the professionals of<strong>Ctac</strong> have ga<strong>in</strong>ed broad and profoundexpertise <strong>in</strong> the bus<strong>in</strong>ess processeswith<strong>in</strong> various market sectors. Thatknow-how is the basis of a broadspectrum of <strong>in</strong>novative solutions thatlend support to all core processeswith<strong>in</strong> enterprises: from f<strong>in</strong>ancialadm<strong>in</strong>istration to logistics and fromprocurement to <strong>in</strong>ventory management.Solutions that each have come<strong>in</strong>to be<strong>in</strong>g step by step, through closecooperation with the market. Thanksto this process of co-<strong>in</strong>novation,our solutions and services connectoptimally with the ambitions of thecustomer, allow<strong>in</strong>g bus<strong>in</strong>esses toautomate more quickly and to operatemore efficiently.nents and profound knowledge of theprocesses. Speak<strong>in</strong>g of build<strong>in</strong>g: asone of the largest SAP Gold Partner<strong>in</strong> the Benelux and Gold Partner ofMicrosoft, <strong>Ctac</strong> builds tailor-madetemplates for specific sectors. Thesepre-configured solutions – that wesupply to wholesalers, retailers, foodcompanies and hous<strong>in</strong>g corporations,amongst others – can be quicklyimplemented and yield results with<strong>in</strong>a short period of time. Additionally,we offer a broad spectrum of ITsolutions for medium-sized and largeorganisations, amongst others forBus<strong>in</strong>ess Intelligence, WarehouseManagement and Customer RelationshipManagement. Moreover, we areready for new opportunities, such ascloud comput<strong>in</strong>g and Software-as-a-Service (SaaS). We complement oursolutions with an expansive portfolioof tra<strong>in</strong><strong>in</strong>g, host<strong>in</strong>g and management,secondment and consultancyservices.Whether for the implementation ofhigh-value bus<strong>in</strong>ess software or formanag<strong>in</strong>g systems, <strong>Ctac</strong> guaranteesto provide optimum service. To thisend, we should be pleased to actas IT director for our customers. Ifdesired, <strong>in</strong> conjunction with carefullyselected external parties <strong>in</strong> order to<strong>in</strong>troduce to total solution – without<strong>in</strong>terrupt<strong>in</strong>g the bus<strong>in</strong>ess operations.InternationalWith establishments <strong>in</strong> Belgium,Germany and France, our sectorspecificsolutions are also mak<strong>in</strong>gheadway <strong>in</strong>ternationally. In othercountries, we are be<strong>in</strong>g approachedby lead<strong>in</strong>g system <strong>in</strong>tegrators. Bynow, the specific solutions for retailare be<strong>in</strong>g offered <strong>in</strong> virtually thewhole of Europe.Powerful bus<strong>in</strong>ess model<strong>Ctac</strong> operates by the <strong>Ctac</strong> Powerhouse.A unique bus<strong>in</strong>ess modelwhich enables <strong>Ctac</strong> to position itselfpowerfully <strong>in</strong> the market by virtue ofits flexible, decisive and demandorientedmethods. The model isbased on different specialised,enterpris<strong>in</strong>g, <strong>in</strong>dependently operat<strong>in</strong>gbus<strong>in</strong>ess units that each servetheir focus area – sector, service orsolution – <strong>in</strong> a streaml<strong>in</strong>ed manner.As small, flexible players, they skilfullymove with the customer. They delivertailor-made work, develop productleadership and are keen on first classpartnerships with suppliers. Nonetheless,they are ‘powered by <strong>Ctac</strong>’,will all the advantages of a corporateidentity, central market<strong>in</strong>g and sales,f<strong>in</strong>ancial control at hold<strong>in</strong>g level andmutual attun<strong>in</strong>g. Together, they arelarge enough to offer customers thedesired cont<strong>in</strong>uity through a fullyfledgedpackage of products andservices.<strong>Ctac</strong> Powerhouse stands for synergythrough collaboration. Fruitful mutualcooperation between the bus<strong>in</strong>essunits, lead<strong>in</strong>g to surpris<strong>in</strong>g <strong>in</strong>novations,broader competencies and thepossibility of comb<strong>in</strong><strong>in</strong>g personalentrepreneurship with develop<strong>in</strong>gspecialism(s). A model that encouragesspecialisation, knowledgeand a results-oriented attitude. <strong>Ctac</strong>Powerhouse also stands for successfulnational and <strong>in</strong>ternational partnerships.Partnerships with pr<strong>in</strong>cipals.Partnerships with the distributors ofour solutions. And partnerships withsuppliers, as SAP and Microsoft. Theeffect is decisiveness, vigour andbroadly applicable, efficient solutions.With<strong>in</strong> <strong>Ctac</strong> Powerhouse, professionalismand <strong>in</strong>volvement go hand <strong>in</strong> handwith a pragmatic, entrepreneurial attitude.Consultants are content-drivenand work on projects with a truepersonal commitment. Develop<strong>in</strong>gand reta<strong>in</strong><strong>in</strong>g knowledge is a centralfocus po<strong>in</strong>t. Because of that, <strong>Ctac</strong>can offer more added value. In short,a rock-solid organisation that standsstrong <strong>in</strong> the dynamic IT market oftoday – and <strong>in</strong> the future.The New Approach.The ultimate objectives of theDNA programme are improvedemployment practices, maximumfacilitated knowledge-shar<strong>in</strong>g,maximum collaboration andbr<strong>in</strong>g<strong>in</strong>g the outside world <strong>in</strong>.Composed SolutionsThe market changes and <strong>Ctac</strong>changes with it. Bus<strong>in</strong>ess demandsolutions that quickly yield benefits,with a short implementation periodand manageable costs. Standard productsare preferred over tailor-madeones, which are expensive, timeconsum<strong>in</strong>gand additionally requirecomplex ma<strong>in</strong>tenance. <strong>Ctac</strong> knowswhat is go<strong>in</strong>g on <strong>in</strong> the market andreacts directly with so-called ComposedSolutions: unique, sector-specificapplications that are composedof off-the-shelf components. Theycan be easily cha<strong>in</strong>ed <strong>in</strong>to a broad,modular solution. It may be an endto-endsolution, but does not haveto be. See for <strong>in</strong>stance our Fit4Retailtemplate that we can populate with BIor document solutions, for example.The possibilities are countless. Andthe customer has the advantage of a‘customised standard solution’, whichis surpris<strong>in</strong>gly scalable and seamlesslyconnects with the bus<strong>in</strong>ess requirements.Many Composed Solutions comeabout <strong>in</strong> cooperation with our partners.Apart from SAP and Microsoft,who usually supply the templates,there are specialised niche players,such as Ricoh, W<strong>in</strong>shuttle, Qlikviewand Redwood.Cross-borderorganisational modelOur organisational model mirrors thecurrent market and clusters our specialismsand activities <strong>in</strong>to four focusareas: market-oriented units, SMEorientedunits, knowledge-orientedunits and <strong>Ctac</strong> Managed Services.In the Netherlands and Belgiumwe serve all areas. And we are nowrepresented <strong>in</strong> Germany as <strong>in</strong> France.38.806 m m10 CTAC Annual Report 201011

Thanks to this cross-border approach,we can support national as well as<strong>in</strong>ternational (roll out) projects.Market-oriented units<strong>Ctac</strong> possesses profound knowledgeof the various sectors and markets(verticals), rang<strong>in</strong>g from food and retailto logistics, utilities and wholesale. Forthe market and sector-oriented unitsof <strong>Ctac</strong>, the focus lies on knowledgeof the customer and his processes(customer <strong>in</strong>timacy). All segmentspecificsolutions that are suppliedby <strong>Ctac</strong> – for example, for utilities,logistics providers and retail – aresupported on a project basis. With<strong>in</strong>these sectors, <strong>Ctac</strong> also acts as a bus<strong>in</strong>esspartner and bus<strong>in</strong>ess consultantand additionally offers solutions thatare tailored to the sector. Our power:we know the challenges, closely follownew developments and speak thelanguage of the concerned market.Because we are ahead <strong>in</strong> signall<strong>in</strong>gchanges <strong>in</strong> markets, we can translatethem <strong>in</strong>to <strong>in</strong>novative IT solutionswhich give the pr<strong>in</strong>cipal an edge.SME-oriented unitsThe SME-oriented units are componentsof the market-oriented unitsthat cover all of <strong>Ctac</strong>’s activities <strong>in</strong>respect of small and medium-sizedenterprises. For these bus<strong>in</strong>esses, wesupply solutions that are based onSAP software (amongst others, SAPBus<strong>in</strong>ess One) and Microsoft Dynamics.The SME-oriented units are aone-stop shop for licens<strong>in</strong>g, implementationprojects, optimisationsand upgrades, functional support,technical support and host<strong>in</strong>g, andsolutions based on ASP models.Knowledge-oriented unitsThese specialised bus<strong>in</strong>ess units of<strong>Ctac</strong> apply profound, sector-<strong>in</strong>dependentproduct knowledge towardsoptimis<strong>in</strong>g core processes and solv<strong>in</strong>gspecific customer issues. Amongstothers, we have knowledge ofBus<strong>in</strong>ess Intelligence (BI), CustomerRelationship Management (CRM)and <strong>in</strong>tegration (SAP PI). We offeradvice, apply corrections and tra<strong>in</strong>users. Innovation assists <strong>in</strong> creat<strong>in</strong>gdiscern<strong>in</strong>g qualities and enhances thecompetitive position of customers. Torealise that time and aga<strong>in</strong>, the con-sultants comb<strong>in</strong>e profound technicalexpertise with a vast number of yearsof experience.<strong>Ctac</strong> Managed ServicesThe service-oriented bus<strong>in</strong>ess unitsof <strong>Ctac</strong> unlatch specific IT expertiseacross a broad spectrum and offersupport to organisations that wish toensure a professional <strong>in</strong>frastructure.“<strong>Ctac</strong> offers an extremely diverseportfolio. Our offer rangesfrom licens<strong>in</strong>g and solutionsimplementation to managementand host<strong>in</strong>g.”Our professionals have extensiveexperience <strong>in</strong> all aspects of automationand can be widely deployed foradvice, projects, project management,adm<strong>in</strong>istration and host<strong>in</strong>g,<strong>in</strong>terim management and full sizeimplementations.Lead<strong>in</strong>g <strong>in</strong> selected sectorsIn pr<strong>in</strong>ciple, <strong>Ctac</strong> supports every typeof organisation <strong>in</strong> every sector but isprom<strong>in</strong>ently present <strong>in</strong> the sectorsof Industrial Products and LogisticServices, Consumer Products, Healthcare,Leisure and Hospitality, RealEstate, Retail, Utilities, ProfessionalServices, Wholesale and DiscreteManufactur<strong>in</strong>g. With<strong>in</strong> these sectors,we set the mark with <strong>in</strong>novative, progressiveprojects, powerful templates,senior sector knowledge and a solidunderstand<strong>in</strong>g of the possibilities thatIT can offer bus<strong>in</strong>esses with<strong>in</strong> thesesectors. Apart from hav<strong>in</strong>g sectorknowledge, <strong>Ctac</strong> thoroughly knowsSAP and Microsoft.Specialisms• Market-directed specialismConsumer ProductsDelivers powerful SAP sector solutions,such as Run4Food, Run4Feedand Run4Fresh, which build uponyears of experience <strong>in</strong> food and thatare suitable for all organisationswith<strong>in</strong> the entire bus<strong>in</strong>ess cha<strong>in</strong> of thefoodstuff <strong>in</strong>dustry.Are focused on improv<strong>in</strong>g processeswhere supply and demand can greatlyfluctuate, with a limited use-by dateof the concerned goods.Discrete Manufactur<strong>in</strong>gIntroduces SAP Bus<strong>in</strong>ess All-<strong>in</strong>-OneManufactur<strong>in</strong>g as a compact templatefor the manufactur<strong>in</strong>g <strong>in</strong>dustry, whichsupports all common bus<strong>in</strong>ess processes<strong>in</strong> the manufactur<strong>in</strong>g <strong>in</strong>dustryand lays a solid foundation for full<strong>in</strong>tegration.HealthcareMeets the grow<strong>in</strong>g demand for <strong>in</strong>tegralERP and EPD functionality <strong>in</strong> thehealthcare <strong>in</strong>dustry. Amongst others,us<strong>in</strong>g SAP for Healthcare, a modularend-to-end solution for <strong>in</strong>tegratedbus<strong>in</strong>ess operations, electronicpatient files and for more efficientplann<strong>in</strong>g of treatments and care andpatient logistics.Industrial ProductsCoherent IT support for smoothproduction with<strong>in</strong> bus<strong>in</strong>esses, with anexpansive eng<strong>in</strong>eer<strong>in</strong>g component.Assists manufactur<strong>in</strong>g bus<strong>in</strong>esses witha comprehensive offer: from processoptimisations to total and complexSAP ERP implementations.Logistic ServicesMarket leader <strong>in</strong> SAP LES and SAPSCM consultancy. SAP ExpertisePartner for Supply Cha<strong>in</strong> Execution.Accompanies change processes, andoffers advanced solutions for issuessuch as storage methodology andstock plann<strong>in</strong>g. Delivers first classtotal solutions for manag<strong>in</strong>g thelogistical flow of goods, <strong>in</strong>clud<strong>in</strong>gproducts and services for warehous<strong>in</strong>g,transportation and customsand excise.Professional ServicesComplete solutions for projectadm<strong>in</strong>istration, <strong>in</strong>clud<strong>in</strong>g stag<strong>in</strong>g,time track<strong>in</strong>g (for the correct projectsat the correct customers with theconcomitant tariffs) and fast handl<strong>in</strong>gof the <strong>in</strong>voic<strong>in</strong>g processes. Supportsproject-based bus<strong>in</strong>esses <strong>in</strong> theiroperations.Real EstateThe IT partner of choice for the realestate sector. Assists many corporationsand dozens of other enterpriseswith the realisation of modern realestate <strong>in</strong>formation systems, on thebasis of the SAP platform. UsesCHARE as a flexible foundationfor process-oriented <strong>in</strong>formationmanagement for real estate processesand activities.RetailSmart SAP Retail solutions for retailand wholesale companies. QualifiedSAP retail templates. Project responsibilityand bus<strong>in</strong>ess consultancy. XVRetail is the complete and flexiblesoftware solution for optimum supportof multichannel retail processes,fully <strong>in</strong>tegrated with SAP. For profound<strong>in</strong>sight <strong>in</strong>to the bus<strong>in</strong>ess andthe entire supply cha<strong>in</strong>.UtilitiesBus<strong>in</strong>ess consultancy about and concern<strong>in</strong>gsystems (SAP ERP and SAPIS-U) and bus<strong>in</strong>ess processes <strong>in</strong> theworld of energy. Includ<strong>in</strong>g applicationconsultancy, project managementand bus<strong>in</strong>ess consultancy. Specialist<strong>in</strong> the utilities sector, with relations<strong>in</strong> production, commerce and (semi)government as well.WholesaleWith asset management, logisticalsupport and onl<strong>in</strong>e order<strong>in</strong>g systems,wholesale bus<strong>in</strong>esses respond to newcustomer requirements. SAP Bus<strong>in</strong>essAll-<strong>in</strong>-One supports all common bus<strong>in</strong>essprocesses and lays an excellentfoundation for full <strong>in</strong>tegration.Leisure & HospitalityUnprecedented, ready to use, completeand fully <strong>in</strong>tegrated functionalityfor the recreation and leisure market.All bus<strong>in</strong>ess processes are supportedfrom front desk to f<strong>in</strong>ancial adm<strong>in</strong>istration.The result is more visitorsand lower bus<strong>in</strong>ess costs whetheryou are an amusement park, zoo,swimm<strong>in</strong>g complex or theater.• Knowledge-directedspecialismApplication Lifecycle ManagementAimed at efficient utilisation ofsystems and applications – throughcost reduction, higher productivity orbetter provision of services to operationaldivisions. Realises significantsav<strong>in</strong>gs when us<strong>in</strong>g SAP SolutionManager. Gets bus<strong>in</strong>esses to getmore out of their SAP systems.Bus<strong>in</strong>ess IntelligenceProvides the management with accuratemanagement reports at everyrequired level. Assists bus<strong>in</strong>esseson the road to the best run bus<strong>in</strong>essthrough advice and implementationservices <strong>in</strong> the area of SAP BI. Fora better grip on the enterprise andmore focused reactions to marketopportunities at a lower cost.<strong>Ctac</strong> ConnectorSimple exchange of content, search<strong>in</strong>g,view<strong>in</strong>g, amend<strong>in</strong>g and stor<strong>in</strong>gwith <strong>Ctac</strong> Connector, an <strong>in</strong>novative<strong>in</strong>terface that <strong>in</strong>tegrates Alfresco – adocument management systembased on open standards – with SAP.E-bus<strong>in</strong>ess SolutionsYellow & Red realises user-friendlyand solidly <strong>in</strong>tegrated bus<strong>in</strong>esssolutions that bus<strong>in</strong>esses can startus<strong>in</strong>g immediately. Usability, contentmanagement and <strong>in</strong>tegration withexist<strong>in</strong>g processes and systems.Enterprise Asset ManagementImproved overall performance ofbus<strong>in</strong>ess assets at manageablecosts. Integral service for optimumsafety, availability of <strong>in</strong>stallation, issuemanagement and compliance. Forbus<strong>in</strong>esses that truly wish to operatewith durability <strong>in</strong> m<strong>in</strong>d.Enterprise Health CheckResearch <strong>in</strong>to the condition of bus<strong>in</strong>essesversus comparable organisations.Br<strong>in</strong>gs important bottlenecks<strong>in</strong> the operation to the fore andprovides start<strong>in</strong>g po<strong>in</strong>ts for improvement.The result: cost sav<strong>in</strong>gs,better grip on the bus<strong>in</strong>ess and moretransparency.Microsoft DynamicsERP and CRM bus<strong>in</strong>ess software fromMicrosoft Dynamics. Can be l<strong>in</strong>ked toSAP without problems. Complies withhigh standards of usability, adjustabilityand scalability. One uniform realitythroughout the entire organisation fora clear oversight of bus<strong>in</strong>ess <strong>in</strong>formationand higher productivity.SAP ERPSAP ERP optimises bus<strong>in</strong>ess processesby comb<strong>in</strong><strong>in</strong>g them <strong>in</strong>to onesystem. With greater efficiency andcosts sav<strong>in</strong>gs as a result. Staff get – onthe basis of their role <strong>in</strong> the organisation– access to bus<strong>in</strong>ess <strong>in</strong>formation,applications and analytical tools thatare essential for them.NetWeaver SolutionsOpen<strong>in</strong>g up the SAP environment <strong>in</strong>a user-friendly and safe manner. Yellow2B<strong>in</strong>troduces maKLIK®, a uniqueconcept that makes SAP availableto a broader audience. Even for theuntra<strong>in</strong>ed SAP user.12 CTAC Annual Report 201013

XV RetailWhat Retailers want is simplicity,efficiency and user-friendl<strong>in</strong>ess comb<strong>in</strong>edwith a complete solution. XVRetail offers the perfect <strong>in</strong>tegration ofpurchas<strong>in</strong>g, logistics, product rangemanagement and sales, giv<strong>in</strong>g you acomplete oversight of your bus<strong>in</strong>essand value cha<strong>in</strong>. Moreover, it createsa ‘super-highway’ to multi-channelretail<strong>in</strong>g.Invoice CockpitAn <strong>in</strong>novative total solution forelectronic <strong>in</strong>voice process<strong>in</strong>g that canlower the cost per <strong>in</strong>voice by some50-60%. Developed together withReadSoft and Ricoh, it saves you considerabletime and delivers significantefficiencies <strong>in</strong> <strong>in</strong>voice process<strong>in</strong>g.SAP Bus<strong>in</strong>ess All-<strong>in</strong>-OnePosition<strong>in</strong>g and implementation ofcomprehensive and adjustable SAPsolutions with<strong>in</strong> SME. A specialismthat mYuice consciously concentrateson with adjusted products (SAPtemplates), a different price propositionand specialised consultants, whospeak the language of the entrepreneur.SAP Bus<strong>in</strong>ess OneThe adm<strong>in</strong>istrative all-rounderfrom SAP for SME, <strong>in</strong>stalled with<strong>in</strong>maximum fifteen days. No huge<strong>in</strong>vestments and no high tra<strong>in</strong><strong>in</strong>gcosts, but fast <strong>in</strong>sight <strong>in</strong>to bus<strong>in</strong>essoperations.W<strong>in</strong>shuttleEasy, fast and safe exchang<strong>in</strong>g of databetween SAP and Microsoft Excel orAccess. A user-friendly and <strong>in</strong>expensivesolution for automat<strong>in</strong>g datafeed<strong>in</strong>g and reduc<strong>in</strong>g the cost of datamanagement.Warehouse Optimization ServicesDemonstrable improvement <strong>in</strong> yieldby us<strong>in</strong>g less space, fewer staff, morepallet locations and provid<strong>in</strong>g betterservice. Through physical rearrangement,advice on organisation and theapplication of hardware and software,logistics become a weapon. Sav<strong>in</strong>gsof sixty per cent on operational costsare no exception.EducationTra<strong>in</strong><strong>in</strong>g consultancy, practical tra<strong>in</strong><strong>in</strong>gcourses and workshops <strong>in</strong> the use andmanagement of SAP systems. Usespractical tools to implement changemanagement <strong>in</strong> the appropriatemanner and to achieve maximumresults from the projects. Professionalaudits <strong>in</strong> Bus<strong>in</strong>ess Intelligence, SAPSecurity, SAP F<strong>in</strong>ancials and ABAP.Secondment (Detacher<strong>in</strong>g)Resource management for <strong>Ctac</strong>. Staff<strong>in</strong>gof <strong>Ctac</strong> projects and secondmentsto clients of both <strong>in</strong>ternal andexternal consultants. In addition, PersityResourc<strong>in</strong>g employs consultants.Highly experienced SAP professionalswho are rewarded based on theturnover generated. All employmentconstructions are possible, but alwaysbased on a strong personal network.• Specialism: <strong>Ctac</strong> ManagedServicesHost<strong>in</strong>g & ManagementWith services, such as management,host<strong>in</strong>g and system optimisation,<strong>Ctac</strong> relieves customers of hav<strong>in</strong>g tocare for their systems (SAP and non-SAP). We support the complete lifecycle of systems, to enable customersto concentrate fully on their core bus<strong>in</strong>ess.The way <strong>in</strong> which <strong>Ctac</strong> managesSAP applications is generally consideredto be state-of-the art.Test ServicesFocused on the professional andstructural screen<strong>in</strong>g of SAP andadjacent applications dur<strong>in</strong>g releasechanges and other major changes tothe systems. Both for advice whensett<strong>in</strong>g up the management organisationsof our pr<strong>in</strong>cipals and alsofor jo<strong>in</strong>tly carry<strong>in</strong>g out the necessaryactivities dur<strong>in</strong>g the actual test<strong>in</strong>gitself.252.2 m m265 m mRecruitmentThe right candidate for the right job,with the focus on SAP. Recruiters wholook beyond the CV or job profile,and take <strong>in</strong>to account the characterof the candidate and the culture ofthe client to crate the best possiblematch.131 m m14

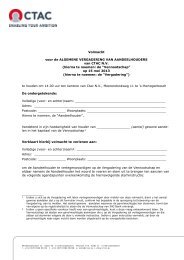

The <strong>Ctac</strong> share<strong>188</strong> m mF<strong>in</strong>ancial schedule for 2011/201216 March 2011 Publication of 2010 f<strong>in</strong>ancial results31 March 2011 Publication of 2010 Annual Report12 May 2011 Shareholders Annual General Meet<strong>in</strong>g12 May 2011 Publication of quarterly report for the first quarter 201116 May 2011 Share is quoted ex-dividend26 May 2011 Dividend payout31 August 2011 Publication of half-year <strong>figures</strong>10 November 2011 Publication of quarterly report for the third quarter 201114 March 2012 Publication of 2011 f<strong>in</strong>ancial results16 May 2012 Shareholders Annual General Meet<strong>in</strong>gKey <strong>figures</strong> ord<strong>in</strong>ary sharesWeighted average of ord<strong>in</strong>ary shares outstand<strong>in</strong>g 11,526,459Highest clos<strong>in</strong>g rate 2010 (EUR) 2.45Lowest clos<strong>in</strong>g rate 2010 (EUR) 1.85Clos<strong>in</strong>g rate at year-end 2010 (EUR) 2.09Net result per share (EUR) 0.02Operat<strong>in</strong>g result per share (EUR) 0.10Dividend per share (EUR) 0.00Dividend yield <strong>in</strong> % at year-end 2010 0%Intr<strong>in</strong>sic value (EUR) 1.61data per share of EUR 0.24 nom<strong>in</strong>al value 2010 2009Weighted average of ord<strong>in</strong>ary shares outstand<strong>in</strong>g 11,526,459 11,526,459Net result 0.02 (0.18)Cash flow (net result plus depreciation) 0.25 0.07Shareholders’ equity 1.61 1.59Proposed dividend <strong>in</strong> cash 0 0Issued and paid-up capitalThe company’s authorised capitalamounts to EUR 7,200,000, divided<strong>in</strong>to 30,000,000 shares with a nom<strong>in</strong>alvalue of EUR 0.24, consist<strong>in</strong>g of:14,999,999 ord<strong>in</strong>ary shares, 15,000,000preference shares and 1 priority share.The subscribed capital is comprisedof 11,526,459 ord<strong>in</strong>ary shares and 1priority share.Development of share capitalOn 31 December 2010, the totalnumber of outstand<strong>in</strong>g ord<strong>in</strong>aryshares was 11,526,459.Dividend policyIn pr<strong>in</strong>ciple, <strong>Ctac</strong>’s dividend policyaims to pay 30 to 40 percent of thenet profit to the shareholders. With aview to f<strong>in</strong>anc<strong>in</strong>g future growth, <strong>Ctac</strong>may deviate from this policy.(Major) shareholders structure year-end 2010Holders’InterestZuidwal Hold<strong>in</strong>g B.V. * 27.2%Alpha Hold<strong>in</strong>g B.V. ** 14.3%Verenig<strong>in</strong>g Friesland Bank 9.2%Otterbrabant Beheer B.V. 4.2%Free float 45.1%Totaal 100%* Is a subsidiary with<strong>in</strong> the mean<strong>in</strong>g of article 1, paragraph 1.d of the Disclosure of Major Hold<strong>in</strong>gs <strong>in</strong> Listed Companies Act 1996<strong>in</strong> conjunction with article 24a, Book 2 of the Netherlands Civil Code of Mr H.A.M. Cooymans.** idem of Mr H.P.W.P.T.M. van Groenendael16 CTAC Annual Report 201017

Board ofDirectorsSupervisoryBoardMr H.L.J. Hilgerdenaar (1960),Dutch nationality.Mr H.P.W.P.T.M. vanGroenendael (1960),Dutch nationality.Mr W.J. Wienbelt (1964),Dutch nationality.Mr H.G.B. Olde Hartmann (1959),Dutch nationality.Mr H.P.M. Jägers (1941),Dutch nationality.Mr E. Kraaijenzank (1956),Dutch nationality.Statutory DirectorChief Executive Officer (CEO)Statutory DirectorChief Information Officer (CIO)Statutory DirectorChief F<strong>in</strong>ancial Officer (CFO)Chairman of the Supervisory BoardDirector/owner F<strong>in</strong>ancieel Bedrijfsmanagement(FBM) B.V.Supervisory board memberships atPapierverwerkende Industrie Vanden Br<strong>in</strong>k B.V, VSI B.V. and AdimecHold<strong>in</strong>g B.V.Emeritus professor at the Facultyof Economics and Management &Organisation at the University ofAmsterdam. Important ancillary positions:member of the Economic Boardof Sticht<strong>in</strong>g Erfgoed, chairman of theWMO board Oisterwijk.Director, CFO and COO of AvebeAppo<strong>in</strong>ted Supervisory Director of<strong>Ctac</strong> <strong>in</strong> May 2005. Current term is forfour years, until the date of the 2013shareholders Annual General Meet<strong>in</strong>g.Appo<strong>in</strong>ted Supervisory Director of<strong>Ctac</strong> <strong>in</strong> May 2002. Current term is forfour years, until the date of the 2014shareholders Annual General Meet<strong>in</strong>g.Appo<strong>in</strong>ted Supervisory Director of<strong>Ctac</strong> <strong>in</strong> May 2009. Current term is forfour years, until the date of the 2013shareholders Annual General Meet<strong>in</strong>g.209.88 m m18 CTAC Annual Report 201019

Maximum balancebetween man and technologyIt has to make sense as a whole, but you also have to be able to do someth<strong>in</strong>g with it.The strategic solutions of <strong>Ctac</strong> create a bridge between user (man) and software(technology), based on the cont<strong>in</strong>uous aim to <strong>in</strong>crease value for the customer.20CTAC Annual Report 2010 21

The P of Profit is served by develop<strong>in</strong>gproducts and services, witha focus on susta<strong>in</strong>ability. Theseproducts will realise sav<strong>in</strong>gs for ourcustomers <strong>in</strong> the fields of energy,waste and CO 2emission. To that endwe will cooperate with customers,suppliers and partners to contributeto a healthier environment by meansof <strong>in</strong>novative products.Carbon Footpr<strong>in</strong>t Report<strong>Ctac</strong> has determ<strong>in</strong>ed its CarbonFootpr<strong>in</strong>t for 2010. The footpr<strong>in</strong>t isbased on the <strong>in</strong>ternational ISO 14064standard and the Green House Gas(GHG) protocol. The various locationsof the company, the means and thestaff have been taken <strong>in</strong>to account forcalculat<strong>in</strong>g the CO 2-footpr<strong>in</strong>t.The footpr<strong>in</strong>t consists of three parts,the so-called scopes:Scope 1These are direct CO 2emissions, i.e.,emissions by one’s own organisation,such as gas consumption and emissionsby one’s own vehicle fleet.Scope 2These are the <strong>in</strong>direct emissions, theemissions that are caused throughgenerat<strong>in</strong>g the energy that the organisationconsumes, such as emissionsby the power stations that supplyelectricity. Bus<strong>in</strong>ess travel by aeroplaneand private motorcar is also<strong>in</strong>cluded <strong>in</strong> scope 2.Scope 3These are the rema<strong>in</strong><strong>in</strong>g <strong>in</strong>directemissions, emissions that result fromthe activities by the company butthat arise from sources that are notowned by the company and are notmanaged by the company. Examples<strong>in</strong>clude emissions emanat<strong>in</strong>g fromthe production of procured materialsand waste management and fromus<strong>in</strong>g the work, service or supply thatis offered / sold by the company. Bus<strong>in</strong>esstravel by public transport andcommut<strong>in</strong>g also belong to scope 3.<strong>Ctac</strong> Carbon Footpr<strong>in</strong>t 2010In 2010, <strong>Ctac</strong> had total emissions of3,180 tonnes of CO 2.By far the largest part comes fromthe vehicle fleet; it is responsible foran emission of 2,313 tonnes of CO 2,which is 73% of total emissions.Another 794 tonnes of emissionsrelate to the consumption of electricity<strong>in</strong> the offices and data centres(25%) and 71 tonnes to the purchasednatural gas (2%).Risk profile andrisk managementRisk appetiteGenerally speak<strong>in</strong>g, the managementaims to keep risks as low as possibleand not to assume exposure tosubstantial risks without such risksrema<strong>in</strong><strong>in</strong>g manageable.General<strong>Ctac</strong>’s long-term strategy is aimed atthe cont<strong>in</strong>uity of the enterprise andat creat<strong>in</strong>g value for all stakeholdersby means of growth and a positivedevelopment of profitability. <strong>Ctac</strong> hasto deal with various risks <strong>in</strong> execut<strong>in</strong>gthe strategy. Risks of a strategic,operational and f<strong>in</strong>ancial nature, butalso risks with regard to the market<strong>in</strong> which it operates. It is the responsibilityof the Board of Directors toidentify these risks and to m<strong>in</strong>imisethem by tak<strong>in</strong>g suitable measures.<strong>Ctac</strong> gives high priority to <strong>in</strong>ternalmanagement. The <strong>in</strong>ternal managementis cont<strong>in</strong>uously assessed andmade ever more professional.The risk management system analysesthe risks and periodically measuresthe effectiveness of the measures asapplicable to all operat<strong>in</strong>g processeswith<strong>in</strong> <strong>Ctac</strong>. Risk management isan <strong>in</strong>tegral part of the plann<strong>in</strong>gand control cycle. Amongst others,the system consists of sett<strong>in</strong>g thestrategy and the budget. The Boardof Directors is answerable for this.The strategic direction is thoroughlydiscussed with the Supervisory Boardevery year. Together with the directorsof the bus<strong>in</strong>ess units, strategic aimsare translated <strong>in</strong>to bus<strong>in</strong>ess plans andbudgets. In addition to a f<strong>in</strong>ancialestimate, the bus<strong>in</strong>ess plan conta<strong>in</strong>sa number of concrete bus<strong>in</strong>essobjectives for each bus<strong>in</strong>ess unit thatare translated <strong>in</strong>to a few Key PerformanceIndicators (KPIs), which areconsistently measured for progressthroughout the year. Important KPIsat <strong>Ctac</strong> are, amongst others, occupancylevel, tariffs, number of directand <strong>in</strong>direct FTEs and efficiency ofthe processes. The Board of Directorsof <strong>Ctac</strong> assesses the occupancy rateevery week. The results per bus<strong>in</strong>essunit are compared every monthby the Board of Directors and themanagements of the bus<strong>in</strong>ess unitsto the results of the previous year andthe budgets for the current year.(If necessary, further actions aredef<strong>in</strong>ed.) Once a quarter, a comprehensivereview of their bus<strong>in</strong>essresults is conducted by the managementand the Board of Directorswith all bus<strong>in</strong>ess units of <strong>Ctac</strong>, andthe roll<strong>in</strong>g forecast is then updated.The <strong>Ctac</strong> organisation functions withuniform work processes, proceduresand <strong>in</strong>formation systems. Responsibilities,authorities, separation ofduties, directives, procedures andprocesses are clearly laid down at<strong>Ctac</strong> <strong>in</strong> the C-workguide, <strong>in</strong> an easilyaccessible manner. The most importantprocesses with<strong>in</strong> <strong>Ctac</strong> have beenelaborated <strong>in</strong> this automated tool.Through an on-go<strong>in</strong>g process of<strong>in</strong>ternal controls and measurements,<strong>Ctac</strong> ensures optimal managementand, if necessary, timely recognitionand mitigation of risks that havearisen.The risk management system with itscontrols and mitigat<strong>in</strong>g measures isa periodically return<strong>in</strong>g item on theagenda of the Advisory Board. Theexternal auditor also tests the designand performance of the <strong>in</strong>ternal controlsystems every year, to the extentit is relevant with<strong>in</strong> the framework ofaudit<strong>in</strong>g the f<strong>in</strong>ancial statements.In 2010, <strong>Ctac</strong> has done further workon optimis<strong>in</strong>g the risk managementand <strong>in</strong>ternal control systems. <strong>Ctac</strong> isaware that such systems do not offerabsolute certa<strong>in</strong>ty that no irregularitiesof material importance can occur.The follow<strong>in</strong>g important componentsmay be differentiated <strong>in</strong> <strong>Ctac</strong>’s riskmanagement and control system:- strategic risks/market risks;- f<strong>in</strong>ancial risks;- operational risks.The most relevant risks currentlyfac<strong>in</strong>g <strong>Ctac</strong> are elucidated <strong>in</strong> thesection below. Risks that are currentlynot recognised or are considered tobe immaterial cannot be mentionedhere.Strategic risks/market risks• Developments <strong>in</strong> the market where<strong>Ctac</strong> operates are fast. The riskexists that <strong>Ctac</strong> is <strong>in</strong>sufficiently ableto be <strong>in</strong>novative. To avoid that,<strong>Ctac</strong> leads as much as possible, <strong>in</strong>conjunction with the customer, <strong>in</strong>enhanc<strong>in</strong>g the customer’s processes.This way, <strong>Ctac</strong> is able todevelop IT solutions as adequatelyas possible. The <strong>in</strong>creas<strong>in</strong>g desireof customers to enter <strong>in</strong>to a fullyfledgedpartnership keeps manifest<strong>in</strong>gitself. Be<strong>in</strong>g able to counton each other <strong>in</strong> difficult timesis a great benefit. Organisationsdepend on optimally function<strong>in</strong>g ITsystems to support their (operat<strong>in</strong>g)processes. Because of this, a “onestop-shop”solution, with <strong>in</strong>-depthknowledge of the vertical market<strong>in</strong> comb<strong>in</strong>ation with a broad rangeof solutions on offer, is very muchsought after by the customer. Withits Powerhouse model, <strong>Ctac</strong> has theright solution at the ready. A susta<strong>in</strong>ableand strong bond with thecustomer is forged and expanded.• Because of the maturity of themarket for IT services provision,comb<strong>in</strong>ed with less than favourableeconomic circumstances, there ispressure on prices and marg<strong>in</strong>s.This makes it all the more importantto make clear strategic choiceswith regard to strategic position<strong>in</strong>g,as is stated <strong>in</strong> the report by theBoard of Directors.• After a noticeable set-back <strong>in</strong> theIT sector <strong>in</strong> 2009, 2010 witnesseda cautious recovery. In particular,through actively controll<strong>in</strong>g occupancylevels and tighter projectmanagement, <strong>Ctac</strong> was able tof<strong>in</strong>ish 2010 with a small profit, afterthe loss <strong>in</strong> 2009. The fact that <strong>in</strong>less favourable economic times,demand for IT services and projectscan be quite a bit under pressure,is someth<strong>in</strong>g we have experienceddur<strong>in</strong>g the past two years. In orderto restrict the sensitivity to fluctuations<strong>in</strong> the economy, <strong>Ctac</strong> tries toachieve around 50% of the annualturnover from management andhost<strong>in</strong>g contracts that span severalyears and from the services thatare required by our customer baseon a daily basis. That percentageis now somewhat above 40%. <strong>Ctac</strong>serves approximately 600 customers.Through a wide spread<strong>in</strong>g ofcustomers over various sectors andbroad exposure to larger customers,<strong>Ctac</strong> m<strong>in</strong>imises the downwardpressure on turnover.• <strong>Ctac</strong> attempted to m<strong>in</strong>imise theimpact of reduced demand for ITservices and projects by flexiblydeploy<strong>in</strong>g its own staff and reduc<strong>in</strong>gthe use of hired labour and/oroutsourc<strong>in</strong>g to a m<strong>in</strong>imum.F<strong>in</strong>ancial risks• <strong>Ctac</strong> is subject to a number off<strong>in</strong>ancial risks, such as market risk(<strong>in</strong>terest rate and foreign exchangerate risk), credit risk, liquidity riskand capital risk. An elaboratedescription of these risks and theway they are managed can befound under po<strong>in</strong>t 4 of the f<strong>in</strong>ancialstatements. <strong>Ctac</strong> tries to recognisethese potential risks <strong>in</strong> a timelymanner.Operational risks• Project control and order control:One of the most important pillarswith<strong>in</strong> <strong>Ctac</strong> is carry<strong>in</strong>g out projectsand orders. This pillar f<strong>in</strong>ds itsorig<strong>in</strong> <strong>in</strong> the demand by customersfor new products and services,which is cont<strong>in</strong>uously <strong>in</strong>creas<strong>in</strong>g <strong>in</strong>volume and complexity. The qualityof execution of these projects andorders can have a major impacton the performance and resultsof <strong>Ctac</strong>. An optimally function<strong>in</strong>g<strong>in</strong>ternal quality assurance andmanagement system is essential forreduc<strong>in</strong>g the related risks as muchas possible. <strong>Ctac</strong> has positioned itsrisk management system separatelywith<strong>in</strong> its organisation <strong>in</strong> order tohandle identification and mitigationof the risks as adequately aspossible. In cases where the directand complete impact of a risk onthe result to be achieved can beascribed to <strong>Ctac</strong>, <strong>Ctac</strong> obviouslytakes full responsibility.• <strong>Ctac</strong> is capable of fully carry<strong>in</strong>g thisresponsibility because of the presenceof a management with theright competencies and bus<strong>in</strong>ess/IT knowledge, <strong>in</strong> breadth and <strong>in</strong>depth.• <strong>Ctac</strong> has bought an <strong>in</strong>surancepolicy aga<strong>in</strong>st general and professionalliability <strong>in</strong> order to ensurecont<strong>in</strong>uity <strong>in</strong> the case of claims.<strong>Ctac</strong> has never made any claimsunder this policy.• Acquisitions: <strong>Ctac</strong> acquirescompanies with the ultimate aimof <strong>in</strong>tegrat<strong>in</strong>g them <strong>in</strong>to the <strong>Ctac</strong>organisation. It is important that the<strong>in</strong>tegration process runs smoothly<strong>in</strong> order to reduce undesired staffturnover to a m<strong>in</strong>imum.• Labour market: For an IT serviceprovider, staff are the mostimportant assets of the bus<strong>in</strong>ess.<strong>Ctac</strong> can only cont<strong>in</strong>ue to growbecause of its staff. The HR (HumanResources) policy of <strong>Ctac</strong> is aimedat creat<strong>in</strong>g a work<strong>in</strong>g atmospherewith space for growth, developmentand new challenges. Ongo<strong>in</strong>gscarcity <strong>in</strong> the labour marketmay <strong>in</strong>hibit growth <strong>in</strong> IT knowledgeor absolute growth. Keep<strong>in</strong>g andattract<strong>in</strong>g expert staff has been animportant objective and, togetherwith attract<strong>in</strong>g talented newcomers,will rema<strong>in</strong> a key focus po<strong>in</strong>tdur<strong>in</strong>g the com<strong>in</strong>g years.• Quality assurance: If the agreedquality cannot be delivered, <strong>Ctac</strong>runs the risk that performance andresults cannot be (completely)32 CTAC Annual Report 201033

achieved. As such, quality assuranceis an important pillar with<strong>in</strong>the organisation. Work is donecont<strong>in</strong>uously on improv<strong>in</strong>g theperformance towards our customers,<strong>in</strong> whichever form. Safety of<strong>in</strong>formation is an important aspectof quality assurance. Act<strong>in</strong>g <strong>in</strong>conformity with the NEN/ISO 27001standard has been embedded<strong>in</strong>to the organisation as a regularprocess. An important requirementis the cont<strong>in</strong>uous measur<strong>in</strong>g andreport<strong>in</strong>g on the effectiveness andefficiency of the measures that wereimplemented. The entire processis regularly tested for efficiency,suitability and fitness for the agreedstandardisation through an auditby external parties and throughan <strong>in</strong>ternal audit<strong>in</strong>g process. Nocritical f<strong>in</strong>d<strong>in</strong>gs emerged from thevarious audits <strong>in</strong> 2010.ConclusionOn the basis of the evaluationscarried out throughout 2010, theBoard of Directors f<strong>in</strong>ds that therisk management system and themanagement of operat<strong>in</strong>g processes,as well as the appropriate <strong>in</strong>ternalcontrols, functioned sufficientlyprofessionally, fitt<strong>in</strong>gly and effectivelywith<strong>in</strong> <strong>Ctac</strong>.It is the Board of Directors’ op<strong>in</strong>ionthat the risk management system,with its controls and measurements,offers a sufficient degree of assurancewith regard to reliability of thef<strong>in</strong>ancial <strong>in</strong>formation and managerial<strong>in</strong>formation <strong>in</strong> accordance with therelevant regulations and legislationsthat are provided by this system.ProspectsIn 2011, <strong>Ctac</strong> will concentrate onthe recovery of yields, to be realisedthrough further strengthen<strong>in</strong>gits market position. In addition tofocus<strong>in</strong>g on autonomous growth, thecompany will look for targeted acquisitionsand start-ups for the benefitof further growth that fits with<strong>in</strong> theSolution Provider concept. An <strong>in</strong>tegralpart of this is the further controlled,<strong>in</strong>ternational roll-out of the successful,XV Retail product, developed<strong>in</strong>-house.Partly from consider<strong>in</strong>g the grow<strong>in</strong>gnumber of potential orders, <strong>Ctac</strong>expects a further <strong>in</strong>crease <strong>in</strong> turnoverand profitability <strong>in</strong> 2011.A word of thanks<strong>Ctac</strong> is look<strong>in</strong>g back at a very excit<strong>in</strong>gyear, dur<strong>in</strong>g which, on the one hand,many <strong>in</strong>itiatives were taken thatmust make the transition from ERPservice provider to Solution Providerpossible over the com<strong>in</strong>g years anddur<strong>in</strong>g which, on the other hand, thefocus was on improv<strong>in</strong>g the marketposition through various acquisitions,but also through enter<strong>in</strong>g <strong>in</strong>tovarious cooperation agreements andpartnerships, establish<strong>in</strong>g a subsidiary<strong>in</strong> France and expansion towards theHealthcare sector. At the same time,after the pronounced setback <strong>in</strong> theIT sector <strong>in</strong> 2009, much attentionhas been paid to recovery of yieldsby more effectively look<strong>in</strong>g at theoccupancy level and stricter managementof projects. Therefore, 2010 canbe called an excit<strong>in</strong>g year <strong>in</strong> moreways than one. The Board of Directorslooks back with satisfaction at thepast year, dur<strong>in</strong>g which many goodsteps have been taken, and wishesto thank all staff for their cont<strong>in</strong>uousengagement and commitment.‘s-Hertogenbosch, 16 March 2011The Board of DirectorsMr H.L.J. HilgerdenaarMr H.P.W.P.T.M. van GroenendaelMr W.J. Wienbelt282 m m130 m m130.518 m m34

Ideal mix betweenknowledge and commitmentUse your expertise effectively - that’s what it’s all about. <strong>Ctac</strong> creatively works with itscustomers on improv<strong>in</strong>g their efficiency, on streaml<strong>in</strong><strong>in</strong>g and improv<strong>in</strong>g their bus<strong>in</strong>essprocesses and reduc<strong>in</strong>g the costs.36CTAC Annual Report 2010 37

Compliance with theDutch CorporateGovernance Code131 m mThe Supervisory Board and theBoard of Directors, jo<strong>in</strong>tly responsiblefor the corporate governancestructure of <strong>Ctac</strong>, support virtuallyall pr<strong>in</strong>ciples and best practices <strong>in</strong>the Dutch Corporate GovernanceCode and apply them. <strong>Ctac</strong> deviatesfrom this code only on a number ofoccasions (the numbers <strong>in</strong> bracketsrefer to the relevant provision of theCorporate Governance Code).• The current members of the SupervisoryBoard are not appo<strong>in</strong>ted fora fixed term (II 1.1). The directorsact on the basis of a strategic longtermperspective, and restrict<strong>in</strong>gthe term of appo<strong>in</strong>tment would notbe <strong>in</strong> l<strong>in</strong>e with that.• Possible compensation that MrHilgerdenaar, Mr Wienbelt andMr van Groenendael may receive<strong>in</strong> the event of separation is notlaid down <strong>in</strong> their contracts and,consequently, is not maximised(II.2.8). In the event of <strong>in</strong>voluntarydismissal as referred to <strong>in</strong> theaforementioned best practice provision,a compensation will be paidthat is reasonable by virtue of thecontractual relationship, the socialdevelopment and case law.• The remuneration of the Board ofDirectors is substantiated <strong>in</strong> thef<strong>in</strong>ancial statements as part of theannual report (II.2.14). The f<strong>in</strong>ancialstatements will be published on thewebsite. The remuneration policyapproved by the shareholdersAnnual General Meet<strong>in</strong>g will alsobe published on the website. TheSupervisory Board determ<strong>in</strong>ed theremuneration for the <strong>in</strong>dividualmembers of the Board of Directorson the basis of the remunerationpolicy.• <strong>Ctac</strong> has not appo<strong>in</strong>ted a secretaryfor the Board of Directors, asthis position does not fit <strong>in</strong> withits board structures (III.4.3). <strong>Ctac</strong>applies a structure that differs fromwhat the code prescribes <strong>in</strong> thatrespect.• The Board of Directors is appo<strong>in</strong>tedby the shareholders Annual GeneralMeet<strong>in</strong>g on the basis of a b<strong>in</strong>d<strong>in</strong>gnom<strong>in</strong>ation of at least two personsfor each vacancy, to be drawn up bythe Priority Foundation. The shareholdersAnnual General Meet<strong>in</strong>gis free <strong>in</strong> mak<strong>in</strong>g its appo<strong>in</strong>tmentsif no b<strong>in</strong>d<strong>in</strong>g nom<strong>in</strong>ation has beendrawn up with<strong>in</strong> the term stipulated<strong>in</strong> the articles of association. In derogationfrom the code (IV.1.1.), theshareholders Annual General Meet<strong>in</strong>gmay resolve that the nom<strong>in</strong>ationis not b<strong>in</strong>d<strong>in</strong>g by means of aresolution passed with a majority ofat least two thirds of the votes cast,which represents slightly more thanhalf of the subscribed capital.• <strong>Ctac</strong> chose not to deploy webcamsand/or other technical equipmentavailable for follow<strong>in</strong>g analysts’ andother conferences and third-partymeet<strong>in</strong>gs and the participation ofshareholders <strong>in</strong> meet<strong>in</strong>gs (IV 3.1),there will be no short-term <strong>in</strong>itiativeto enable this. The presentationsthat <strong>Ctac</strong> gives these target groupsare however available to everyoneon our website.Detailed <strong>in</strong>formation about <strong>Ctac</strong>Corporate Governance, (rules ofprocedure and regulations) can befound on <strong>Ctac</strong>’s website (www.ctac.nl)under Investor Relations, CorporateGovernance.The Corporate GovernanceCode Monitor<strong>in</strong>g CommitteeIn December 2008, the former CorporateGovernance Code Monitor<strong>in</strong>gCommittee (the Frijns Committee)presented an updated code (“Code2008”). By order <strong>in</strong> council of 10December 2009, the M<strong>in</strong>ister forJustice designated the Code 2008as the new code of conduct, and assuch replaced the former CorporateGovernance Code of 2003, designatedas code of conduct <strong>in</strong> 2004.The Code 2008 applies to fiscal yearson or after 1 January 2009.On 2 July 2009, the M<strong>in</strong>ister ofF<strong>in</strong>ance, also on behalf of the M<strong>in</strong>istersof Economic Affairs and Justice,set up a new Corporate GovernanceCode Monitor<strong>in</strong>g Committee (theStreppel Committee).The Streppel Committee’s evaluationreport of December 2010 particularlyfocuses on provisions that wereapplied for less than 90% dur<strong>in</strong>gthe past four years, and on the newprovisions <strong>in</strong> the Code 2008. TheStreppel Committee concludes thatcompliance <strong>in</strong> the 2009 fiscal yearwith provisions that were applied forless than 90% dur<strong>in</strong>g the past fouryears, has not significantly improvedor worsened compared to the 2008fiscal year. It does po<strong>in</strong>t out thatsociety f<strong>in</strong>ds non-compliance, particularly<strong>in</strong> terms of remuneration, moreand more unacceptable. The StreppelCommittee feels that the new bestpractice provisions <strong>in</strong> the Code 2008are <strong>in</strong> general applied or <strong>in</strong>terpreted.The Streppel Committee alsoexpressed its <strong>in</strong>tention for 2011 tofocus on diversity, sharehold<strong>in</strong>g <strong>in</strong> an<strong>in</strong>ternational perspective, the reportfrom the Supervisory Board and thequality of explanations <strong>in</strong> general.<strong>Ctac</strong> awaits the developments <strong>in</strong> thatrespect with <strong>in</strong>terest.Legislative proposal implementationof recommendationsfrom the CorporateGovernance Code Monitor<strong>in</strong>gCommitteeThe legislative proposal aims to contributeto re<strong>in</strong>forc<strong>in</strong>g the Dutch corporategovernance system by, amongother th<strong>in</strong>gs, improv<strong>in</strong>g the balancebetween directors and shareholders,as well as improv<strong>in</strong>g control over thepotential risks attached to excessive<strong>in</strong>volvement by shareholders. To thatend, a motion has been submitted toamend the F<strong>in</strong>ancial Supervision Act,the Securities (Bank Giro Transactions)Act and the Civil Code.The most important proposedamendments are:- <strong>in</strong> the event of a three percentequity <strong>in</strong>terest, shareholders mustreport their control and equity <strong>in</strong>terest<strong>in</strong> listed companies (currentlyfive percent);- shareholders <strong>in</strong> listed companiesare obliged to announce their“Detailed <strong>in</strong>formation about <strong>Ctac</strong>Corporate Governance can befound on <strong>Ctac</strong>’s website(www.ctac.nl) under InvestorRelations, Corporate Governance.”<strong>in</strong>tentions <strong>in</strong> the case of an equity<strong>in</strong>terest of at least three percent,after which each subsequentchange of <strong>in</strong>tentions must bereported;- a statutory regulation enables listedcompanies to trace the identities oftheir <strong>in</strong>vestors, <strong>in</strong> comb<strong>in</strong>ation witha regulation for communicationbetween listed companies and theirshareholders and, <strong>in</strong>directly, among<strong>in</strong>vestors;- the threshold for us<strong>in</strong>g the rightto put an item on the agenda forthe shareholders Annual GeneralMeet<strong>in</strong>g is raised from one percentto three percent.The legislative proposal has beensubmitted to the House of Representatives.<strong>Ctac</strong> awaits further developments<strong>in</strong> that respect.Legislative proposal toamend Book 2 of theNetherlands Civil Code<strong>in</strong> connection with theadjustment of rules aboutthe management andsupervision of public andprivate limited companies.This legislative proposal elaboratesan alternative management system <strong>in</strong>which executive and non-executivedirectors form part of a s<strong>in</strong>gle body(one-tier model). It also provides for anew regulation for the legal relationshipbetween director and company,a new regulation for conflicts of <strong>in</strong>terestwith<strong>in</strong> the Board of Directors, theSupervisory Board, and the decisionmak<strong>in</strong>gprocess of the company, atthe same time amend<strong>in</strong>g the regulationabout the b<strong>in</strong>d<strong>in</strong>g nom<strong>in</strong>ation ofdirectors. On 8 December 2009, theHouse of Representatives adoptedthe legislative proposal, which hasnow been submitted to the Senate fordiscussion. <strong>Ctac</strong> awaits the developments<strong>in</strong> that respect.Board of DirectorsThe <strong>Ctac</strong> Board of Directors is responsiblefor develop<strong>in</strong>g the objectivesand strategy, and for implement<strong>in</strong>gthe strategic and operational policiesof the company. In fulfill<strong>in</strong>g its taskthe Board of Directors focuses on the38 CTAC Annual Report 201039

<strong>in</strong>terest of the company and its affiliatedbus<strong>in</strong>esses. The <strong>in</strong>terests of allstakeholders are taken <strong>in</strong>to account.The <strong>Ctac</strong> Board of Directors is formedby Messrs Henny Hilgerdenaar,Jan-Willem Wienbelt and Harrie vanGroenendael. For details about themembers of the Board of Directors werefer to page 18.Supervisory BoardThe Supervisory Board is primarilyresponsible for supervis<strong>in</strong>g the policyand management of the Board ofDirectors, both from a strategic andoperational po<strong>in</strong>t of view. In addition,the Supervisory Board acts as advisorybody for the Board of Directors. Themethod and profile of the SupervisoryBoard are documented <strong>in</strong> rulesof procedure and <strong>in</strong> a profile that ispublished on our website.The Supervisory Board currentlycomprises Messrs Herman OldeHartmann (chairman), Hans Jägersand Ed Kraaijenzank. Mr Hans JägersShareholders GeneralMeet<strong>in</strong>gA shareholders General Meet<strong>in</strong>g isheld on an annual basis. All resolutionsare passed on the basis of the‘one share, one vote’ pr<strong>in</strong>ciple. Resolutionsare passed with an absolutemajority of votes, unless the articlesof association or the law prescribe alarger majority.The ma<strong>in</strong> powers of the shareholdersAnnual General Meet<strong>in</strong>g of <strong>Ctac</strong> are:- adopt<strong>in</strong>g the f<strong>in</strong>ancial statements;- adopt<strong>in</strong>g the profit appropriationand dividend;- discharg<strong>in</strong>g the Board of Directorsfrom liability for the managementconducted;- discharg<strong>in</strong>g the Supervisory Boardfrom liability for the supervision oncompliance with the managementconducted by the Board of Directors;- appo<strong>in</strong>t<strong>in</strong>g, suspend<strong>in</strong>g and dismiss<strong>in</strong>gthe members of the BoardCommunication<strong>Ctac</strong> attaches great value to open andtransparent communication with thef<strong>in</strong>ancial community <strong>in</strong> general and itsf<strong>in</strong>anciers <strong>in</strong> particular. <strong>Ctac</strong> ma<strong>in</strong>ta<strong>in</strong>sregular contact with analysts and<strong>in</strong>vestors, as well as with the f<strong>in</strong>ancialmedia that form the primary sourcesof <strong>in</strong>formation for private <strong>in</strong>vestors. Inits communication with these targetgroups, <strong>Ctac</strong> relies on <strong>in</strong>formationpublished by means of press releases.In a disclosure policy, <strong>Ctac</strong> has laiddown which <strong>in</strong>formation is publishedand when. This guarantees a prudentand simultaneous provision of <strong>in</strong>formationto all shareholders.151 m mSusta<strong>in</strong>abilityIn order to give the new <strong>Ctac</strong>office build<strong>in</strong>g maximum visibilityfrom the A2 motorway, thepark<strong>in</strong>g facilities are imbedded <strong>in</strong>the landscape.172.761 mm252.2 m m<strong>188</strong> m mma<strong>in</strong>ta<strong>in</strong>s contact with the jo<strong>in</strong>t workscouncil on behalf of the SupervisoryBoard. For details about the membersof the Supervisory Board we refer topage 19.of Directors and the SupervisoryBoard;- appo<strong>in</strong>t<strong>in</strong>g the external auditor;- resolv<strong>in</strong>g to amend the articles ofassociation follow<strong>in</strong>g a motion byPriority Foundation;- authoris<strong>in</strong>g the Board of Directorsto acquire shares held <strong>in</strong> the company’sequity;- determ<strong>in</strong><strong>in</strong>g the remuneration ofthe members of the SupervisoryBoard;- approv<strong>in</strong>g important board resolutions.40

Report from theSupervisory BoardIn 2010, <strong>Ctac</strong> took some importantsteps towards the strategic transitionfrom ERP service provider toa dist<strong>in</strong>ctive Solution Provider. Assuch, it anticipated the grow<strong>in</strong>gneed among organisations for an ITservice provider with more specialistknowledge of the activities and coreprocesses <strong>in</strong> their market sector.Based on this profound marketknowledge and comb<strong>in</strong>ed with theproduct knowledge present, <strong>Ctac</strong>is <strong>in</strong> an excellent position to offerclients composed IT solutions mostsuitable for them.Demand for IT services experienceda slight rise <strong>in</strong> 2010. Bus<strong>in</strong>essesrema<strong>in</strong>ed hesitant <strong>in</strong> mak<strong>in</strong>g large<strong>in</strong>vestments, with <strong>Ctac</strong>’s perspectivesfor new projects improv<strong>in</strong>gdur<strong>in</strong>g the last months of 2010.tion policies and technical developments.(from COO to CIO).Composition of theSupervisory BoardThe composition of the SupervisoryBoard was not changed dur<strong>in</strong>g theyear under review. The SupervisoryBoard comprises the follow<strong>in</strong>g threemembers: Mr Herman Olde Hartmann(1959), chairman, Mr Hans Jägers(1941) and Mr Ed Kraaijenzank (1956).Mr Jägers was reappo<strong>in</strong>ted at theshareholders Annual General Meet<strong>in</strong>gheld on 14 May 2010. This is his thirdand f<strong>in</strong>al term of four years.The Supervisory Board has two separatecommittees: an audit committeeand a remuneration committee. Thecomposition of both committees isthe same as that of the SupervisoryBoard, on the understand<strong>in</strong>g thatMr Kraaijenzank is the chairman ofthe audit committee and Mr Jägersis the chairman of the remunerationcommittee.Further <strong>in</strong>formation about the currentmembers of the SupervisoryBoard can be found on page 19 ofthis annual report. The compositionof the Supervisory Board complieswith the guidel<strong>in</strong>es of the CorporateGovernance Code. The compositionis balanced and such that thecomb<strong>in</strong>ation of experience, expertiseand <strong>in</strong>dependence enablesthe Supervisory Board to fulfil itsvarious tasks correctly. In the op<strong>in</strong>ionof the Board, the provisions <strong>in</strong> thebest practice provision III.2.1 havebeen complied with. All supervisorydirectors are <strong>in</strong>dependent with<strong>in</strong> themean<strong>in</strong>g of best practice provisionIII.2.2. There has been a conflict of<strong>in</strong>terest <strong>in</strong> the takeover of Yellow2BB.V., Yellow & Red B.V. and AlphaDistri B.V. Mr H.P.W.P.T.M. van Groenendaelwas shareholder of Yellow2BB.V. and Yellow & Red B.V., and alsodirector of <strong>Ctac</strong> N.V. Mr H.P.W.P.T.M.van Groenendael was shareholderand director of Alpha Distri B.V. andalso a director of <strong>Ctac</strong> N.V. The bestPettelaar Park office.Susta<strong>in</strong>ability is safeguarded bya number of measures, such asunderground heat/cold storage,green roofs with additionalwater storage and variousmeasures to reduce energyconsumption.95.3 m m“In 2010, <strong>Ctac</strong> took some importantsteps towards the strategic transitionfrom ERP service provider to adist<strong>in</strong>ctive Solution Provider.”Composition of theBoard of DirectorsOn 5 January 2010, the SupervisoryBoard asked Mr Henny Hilgerdenaarto fulfil the position of CEO. At theshareholders Annual General Meet<strong>in</strong>gheld on 14 May 2010, he was officiallyappo<strong>in</strong>ted CEO. No other changeswere made to the <strong>Ctac</strong> SupervisoryBoard <strong>in</strong> 2010. The three-man boardis formed by Messrs Henny Hilgerdenaar(CEO), Jan-Willem Wienbelt(CFO) and Harrie van Groenendael(CIO). Due to the nature of <strong>Ctac</strong>’sservices and the associated organizationthe responsibilities of Harrie vanGroenendael have shifted to <strong>in</strong>formapracticeprovisions II.3.2 - II.3.4 of theCorporate Governance Code werecomplied with.Activities of theSupervisory BoardActivitiesDur<strong>in</strong>g the 2010 year under review,the Supervisory Board met tentimes <strong>in</strong> the presence of the Boardof Directors and four times as auditcommittee, <strong>in</strong> accordance with apredeterm<strong>in</strong>ed schedule. The entireSupervisory Board was present at allmeet<strong>in</strong>gs. At the meet<strong>in</strong>gs with theBoard of Directors, a number of fixedsubjects were discussed, <strong>in</strong>clud<strong>in</strong>gstrategy, the budget, the f<strong>in</strong>ancialdevelopments and results (<strong>in</strong>clud<strong>in</strong>gcont<strong>in</strong>gency plan), market developments,employees’ affairs - <strong>in</strong>clud<strong>in</strong>gthe GOR -, the organisationalstructure, the general and operationalcourse of affairs, the remunerationpolicy and execution and implicationsthereof, and Corporate Governance.The strategy pursued by the companywas also a regular po<strong>in</strong>t of discussion,as were the ma<strong>in</strong> risks attached to thecompany’s operational management.For more <strong>in</strong>formation <strong>in</strong> that respect,reference is made to pages 32-34of this annual report. The setup andeffects of the <strong>in</strong>ternal risk managementand control systems l<strong>in</strong>ked tothat were assessed on a periodicbasis.Specific subjects covered <strong>in</strong> 2010<strong>in</strong>cluded the strategic key areas,the measures required to absorbthe effects of a lower demand forIT projects, and the possibilities tofurther improve the market positionof <strong>Ctac</strong>, also <strong>in</strong> economically lessfavourable times. With<strong>in</strong> that frameworkthe company (among otherth<strong>in</strong>gs) focused on the <strong>in</strong>tegrationof Yellow2B and Yellow & Red, the<strong>in</strong>corporation of <strong>Ctac</strong> France, <strong>Ctac</strong>Healthcare and <strong>Ctac</strong> WarehouseOptimization Services. Other po<strong>in</strong>tsfor attention <strong>in</strong>cluded the changeprocess currently experienced bythe Belgian organisation. The entireSupervisory Board and Board ofDirectors went to Belgium to discussthe plans with Belgian management.Specific issues such as future f<strong>in</strong>anc<strong>in</strong>gof <strong>Ctac</strong>, future accommodationand data centre facilities were alsocovered.In 2010, the Supervisory Board onceheld a plenary meet<strong>in</strong>g without theBoard of Directors. At this meet<strong>in</strong>gthey discussed their own performanceas well as that of the Board of Directors.The subjects covered <strong>in</strong>cluded:quality and timel<strong>in</strong>ess of <strong>in</strong>formation,substantiation of motions, assessmentof resolutions versus corporate strategy,balance between commitmentand keep<strong>in</strong>g a distance, teamworkbetween the Board of Directors, theSupervisory Board and works council,grip on foreseen and unforeseenevents, communication and personalrelationships, balance <strong>in</strong> composition,knowledge and skills, the profile ofthe Supervisory Board, fulfilment ofthe role of chairman.The entire Supervisory Boardattended the shareholders AnnualGeneral Meet<strong>in</strong>g held on 14 May2010.In addition to the formal meet<strong>in</strong>gs,there were regular <strong>in</strong>terim contactsabout current developments, bothamong the members of the SupervisoryBoard and those of the Board ofDirectors. On an <strong>in</strong>dividual basis, onemember of the Supervisory Boardand some members of the Boardof Directors attended a number ofconsultative meet<strong>in</strong>gs of the workscouncil. At these meet<strong>in</strong>gs, constructiveconsultations were held aboutthe consequences of the economicdevelopments and the measures tobe taken by <strong>Ctac</strong>.Remuneration of the Boardof Directors (and first-levelmanagers)In the f<strong>in</strong>al quarter, like every otheryear, the remuneration committeechecked the remuneration policyaga<strong>in</strong>st the developments and basicpr<strong>in</strong>ciples, and the elements basedon that will be either confirmed oradjusted. This year’s check did notlead to an adjustment of one or moreelements of remuneration.In l<strong>in</strong>e with these basic pr<strong>in</strong>ciples,the members of the Board ofDirectors receive a remunerationthat is determ<strong>in</strong>ed each year andwhich comprises a basic salary anda variable remuneration. The fixedelement of the remuneration is <strong>in</strong>l<strong>in</strong>e with the remuneration given bysimilar companies, and the variableelement of the remuneration is l<strong>in</strong>kedto a m<strong>in</strong>imum and maximum, andrelated to the fixed element of theremuneration. The variable elementof the remuneration of the Board ofDirectors is based on a number ofKey Performance Indicators (KPIs).Together, these KPIs form a weightedaverage of the percentage of thevariable element of the remuneration.The KPIs are made up of f<strong>in</strong>ancialdata and data about employees andcustomer satisfaction <strong>in</strong>dicators. Formore details on the remunerationpolicy and the remuneration of theBoard of Directors, reference is madeto the remuneration report on page82 of this report and to the corporatewebsite of <strong>Ctac</strong> (www.ctac.nl).Remuneration of theSupervisory BoardThe remuneration of the members ofthe Supervisory Board is not l<strong>in</strong>ked tothe company’s results. The shareholdersAnnual General Meet<strong>in</strong>gdeterm<strong>in</strong>es the remuneration of themembers of the Supervisory Board.None of the supervisory directorshold any shares and/or share options<strong>in</strong> <strong>Ctac</strong>. For the remuneration reportof the Supervisory Board, reference ismade to page 82 of this report.F<strong>in</strong>ancial statements anddischarge from liabilityThe f<strong>in</strong>ancial statements and 2010annual report prepared by the Board42 CTAC Annual Report 201043

of Directors have been submittedto the Supervisory Board and wereextensively discussed. HLB VanDaal & Partners N.V. Accountants& Belast<strong>in</strong>gadviseurs audited the2010 f<strong>in</strong>ancial statements and issuedan unqualified audit op<strong>in</strong>ion. Thisop<strong>in</strong>ion is <strong>in</strong>cluded on page 96 of thisannual report.The Supervisory Board has establishedthat the Board of Directors’report for 2010 meets the requirementsof transparency and that thef<strong>in</strong>ancial statements give a faithfulpicture of the f<strong>in</strong>ancial position andprofitability of the company. It istherefore recommended that theshareholders Annual General Meet<strong>in</strong>gadopts the f<strong>in</strong>ancial statementsand that it discharges the Board ofDirectors and Supervisory Board forthe management it conducted and, <strong>in</strong>the case of the Supervisory Board, forsupervis<strong>in</strong>g that management dur<strong>in</strong>gthe past fiscal year.Profit appropriation anddividend proposal<strong>Ctac</strong> concluded the year 2010 with amodest net profit of EUR 0.2 million,equivalent to a profit of EUR 0.02per share. As outl<strong>in</strong>ed on page 16of this annual report, <strong>in</strong> pr<strong>in</strong>ciple,<strong>Ctac</strong>’s dividend policy aims to pay30 - 40% of the profit to the shareholders.However, with a view to thelimited extent of the profit per share,the recommendation is not to pay adividend for the 2010 fiscal year. Assum<strong>in</strong>gadoption of the 2010 f<strong>in</strong>ancialstatements, the recommendationfor the shareholders Annual GeneralMeet<strong>in</strong>g is to approve the profitappropriation motion, as determ<strong>in</strong>edby the Board of Directors with theconsent of the Supervisory Board.Corporate GovernanceThe corporate governance structureof <strong>Ctac</strong> is the jo<strong>in</strong>t responsibility ofthe Board of Directors and the SupervisoryBoard. At least once a year, theSupervisory Board assesses the corporategovernance rules that apply tothe company, and it gives advice onpotential changes. Corporate governanceis also an item on the agendaand discussed at the shareholdersAnnual General Meet<strong>in</strong>g. S<strong>in</strong>ce 2003,<strong>Ctac</strong> has also been dedicat<strong>in</strong>g a separatesection of the annual report tocompliance with the Dutch CorporateGovernance Code.The Supervisory Board and the Boardof Directors support virtually all pr<strong>in</strong>ciplesand best practices <strong>in</strong> the CorporateGovernance Code and applythem. <strong>Ctac</strong> deviates from this code ona limited number of occasions only.For a list thereof, reference is made topage 39 of this report.A word of thanksFollow<strong>in</strong>g a difficult 2009, allemployees <strong>in</strong>volved aga<strong>in</strong> showeda lot of resilience <strong>in</strong> 2010. We havetaken solid steps towards a moredist<strong>in</strong>ctive market position. This hasalso led to changes and shifts <strong>in</strong> theorganisation, which affected a lot ofemployees. Demand for <strong>Ctac</strong> servicesmodestly improved dur<strong>in</strong>g the pastfew months, which gives us confidence<strong>in</strong> the chosen course and thesteps we have tak<strong>in</strong>g <strong>in</strong> that respectdur<strong>in</strong>g the past year.The Supervisory Board would thereforelike to express its appreciation toall employees, management and theBoard of Directors for their commitment,enthusiasm and flexibility.‘s-Hertogenbosch, 16 March 2011The Supervisory BoardMr H.G.B. Olde Hartmann,chairmanMr H.P.M. JägersMr E. Kraaijenzank208 m m131 m m<strong>188</strong> m m65 m m44