August - Bharti AXA Life Insurance

August - Bharti AXA Life Insurance

August - Bharti AXA Life Insurance

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

investmentnewsletter<strong>August</strong>2013

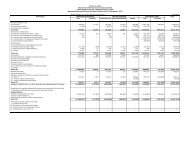

Rs. in Crores1-Aug-133-Aug-135-Aug-137-Aug-139-Aug-1311-Aug-1313-Aug-1315-Aug-1317-Aug-1319-Aug-1321-Aug-1323-Aug-1325-Aug-1327-Aug-1329-Aug-1331-Aug-13Monthly Equity Roundup – <strong>August</strong> 2013<strong>August</strong> 2013 - ReviewIndian bourses dropped on the back of sluggish domestic and global market conditions. The depreciation of the domesticcurrency, which fell around 9% over the month, hit equity markets severely. Key benchmark indices, S&P BSE Sensexand CNX Nifty, plunged 3.75% and 4.71%, respectively during the month. There was no respite for broader indices either,as S&P BSE Mid-Cap and S&P BSE Small-Cap fell 4.38% and 2.26%, respectively.Indian markets started the month on a subdued note following sluggish Services Purchasing Managers’ Index (PMI) data.This was the first time in 20 months that Services PMI data witnessed a contraction and fell to 47.9 in July from 51.7 in theprevious month. Weak quarterly earnings numbers by key corporate houses and the possibility that the U.S. FederalReserve might scale back its stimulus measures soon weighed on sentiments. A downgrade of India’s rating by a globalinvestment bank further dented sentiments, even as the Finance Ministry relaxed certain Foreign Direct Investment (FDI)norms. In the interim, modest decline in retail inflation numbers supported the markets to some extent.Better-than-expected exports data and initiatives taken by the RBI to support the domestic currency boosted marketsentiments to some extent. However, the central bank’s fresh measures to tighten capital outflows and curb gold importscould not ease investor concerns over the rupee. Rather, they weighed the possibility that such measures could furtherundermine the confidence of foreign investors. Market participants also became cautious after the industrial productiondata fell for the second consecutive month in June after having increased for four months in a row.Markets witnessed intense volatility in the second half of the month. Bourses fell on speculation that the Fed will soonstart scaling back its stimulus program. Concerns over sovereign downgrade by rating agencies also weighed onsentiments. However, value buying in blue chip stocks and some recovery in the rupee checked the downfall. Positivemanufacturing data from China, Europe and the U.S. suggested that the global economy is improving, and providedadditional support to the domestic bourses. Risk appetite of market participants took a hit on concerns over a possiblemilitary strike on Syria by the U.S.According to data released by theSecurities and Exchange Board ofIndia (SEBI), Foreign InstitutionalInvestors (FIIs) continued toremain net sellers in the equitysegment during the month. Theysold equities to the tune of Rs.4,859 crore compared to netpurchases of Rs. 6,086 crore500300100(100)(300)(500)(700)(900)(1100)(1300)(1500)Institutional Flows in EquitiesFIIMF

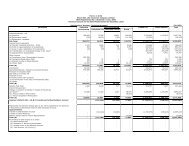

ecorded in the previous month. On the contrary, domestic mutual funds turned net buyers in Indian equity markets to thetune of Rs. 1750.1 crore.S&P BSE METALS&P BSE ITS&P BSE TeckS&P BSE HCS&P BSE AUTOS&P BSE Oil & GasS&P BSE FMCGS&P BSE Power IndexS&P BSE PSUS&P BSE BankexS&P BSE CDS&P BSE RealtyS&P BSE CG-13.88-9.93-10.32-10.88-6.62-7.29-8.44-3.47-5-1.193.897.6313.11Majority of the sectoral indices on S&P BSE ended on a negative note. The major laggards for the month were S&P BSECapital Goods, Realty, Consumer Durables and Bankex. Capital Goods stocks witnessed huge sell-off on concerns thatthe economic downturn in the country may lead to a fall in fresh order inflows and hit earnings going forward. Stocks fromthe Oil and Gas sector witnessed significant selling as a weak rupee raised concerns about higher cost of oil imports.However, S&P BSE Metal, IT and TECk sectors were the top gainers. IT stocks gained on the back of weakness in therupee.Global Markets:U.S. markets witnessed the toughest month so far in 2013 due to uncertainty over global growth and on speculation thatthe U.S. Fed might start tapering its stimulus program soon. Later, the threat of a strike on Syria pushed stocks lower andoil and gold prices higher.European bourses closed the month in red. Initially, markets got support after the ECB kept its main interest rateunchanged and the Euro zone manufacturing activity grew for the first time in two years, in July. However, bourses cameunder pressure after the German Finance Minister raised concerns over another bailout requirement by Greece after itscurrent rescue program ends next year. Meanwhile, Asian markets remained firm initially after Chinese manufacturingPMI data expanded in July. Investor sentiments dampened after Japan's all industry activity contracted for the first time infive months in June. Moreover, concerns over a possible strike on Syria triggered selling pressure in exporters and othercyclical stocks.Economic UpdateJuly WPI inflation at 4-month high of 5.79%The Wholesale Price Index-based inflation again moved out of the comfort zone of the Reserve Bank of India and rose toa five-month high to 5.79% in July against 4.86% in June as food items, particularly vegetables, became costlier.Industrial production (IIP) contracted by 2.2%The Index of Industrial Production contracted by 2.2% in June against a revised fall of 2.8% in May. The manufacturingsector, which constitutes about 76% of the industrial production, shrank by 2.2% from a year ago. Capital goodsproduction also contracted 6.6% in June on an annualized basis.OutlookMarket participants will closely track the movement of the rupee, developments related to the Fed’s bond-buyingprogram and the investment activity of FIIs, which might help set the near-term direction of the bourses. Auto andcement stocks will remain in focus as the companies from these sectors will start unveiling their monthly sales volumedata for <strong>August</strong> 2013. Developments related to a possible military action on Syria may hit market sentiments further.

Monthly Debt Roundup – <strong>August</strong> 2013Source :CCIL, <strong>Bharti</strong>-<strong>AXA</strong> <strong>Life</strong> <strong>Insurance</strong>Fixed Income OverviewParticulars Aug-13 Jul-13 Aug-12Exchange Rate (Rs./$) 66.57 61.12 55.72WPI Inflation (In %) 6.10 5.79 8.0110 Yr Gilt Yield (In %) 8.60 8.17 8.245 Yr Gilt Yield (In %) 9.35 8.86 8.235 Yr Corporate Bond Yield (In %) 10.08 9.80 9.26Source: Reuters, <strong>Bharti</strong> <strong>AXA</strong> <strong>Life</strong> <strong>Insurance</strong>Bond yields remained volatile during the month and touched the highest level in five years after the rupee breached thecrucial mark of 68 against the dollar despite efforts from policymakers to control the exchange rate volatility. Moreover,large supply of Government bonds during the month also made investors cautious. The 10-year benchmark bond endedup 42 bps to close at 8.60% compared to its previous month’s close of 8.07%, after touching a high of 9.23% on <strong>August</strong>19.Bonds yields found some support after the Reserve Bank of India (RBI) announced measures to sort out the problem ofliquidity deficit in the banking system. Since mid-July, the central bank has taken various steps to drain out liquidity fromthe system, which in turn would raise the short-term interest rate and help curb volatility in the exchange market. Tomanage liquidity conditions and to ensure adequate credit flow to the productive sectors of the economy, the central bankconducted the open market purchase operations of long-dated Government of India Securities worth Rs. 16,000 crore.Moreover, the requirement of Statutory Liquidity Ratio (SLR) securities in Held-to-Maturity (HTM) category has beenrelaxed at 24.5% of their respective total deposits or Net Demand and Time Liabilities (NDTL). Banks can transfer SLRsecurities to HTM category from Available for Sale (AFS) / Held for Trading (HFT) categories as a one-time measure. Inaddition, banks can spread the Mark-to-Market losses held under AFS/ HFT categories over the remaining period of FY14in equal installments.The RBI announced in the second week of <strong>August</strong> that it will auction Cash Management Bills (CMBs) for a notifiedamount of Rs. 22,000 crore once every week on Mondays. This is an additional measure to drain liquidity from thebanking system which in turn will help address volatility in the foreign exchange market. The RBI seems to have chosenthe path of CMBs as it provides greater flexibility than Treasury bills in terms of structure. The duration of the CMBs will beannounced one day prior to the date of auction. Concerns over fiscal deficit increased after the Government announcedits massive food-subsidy program.

YTMInterbank call money rates moved in the range of 8.68% to 10.30% during the month compared to 6.58% to 10.03% in theprevious month. The borrowing in the Liquidity Adjustment Facility (LAF) eased during <strong>August</strong> after the RBI capped LAFborrowings at 0.5% of banks’ NDTL. However, banks have started borrowing through the Marginal Standing Facility(MSF) window at 10.25% (higher 300 bps from the repo rate). Banks’ average borrowings through LAF window stood atRs. 38,394.60 crore while under the MSF window, borrowings stood at Rs. 40,426.65 crore.The RBI conducted the auction of Government bonds worth Rs. 79,000 crore in <strong>August</strong> compared to Rs. 60,000 crore inJune. In addition, the central bank also auctioned Treasury Bills worth Rs. 48,000 crore, State Developmental Loansworth Rs. 16,105 crore and Cash Management Bills worth Rs. 72,000 crore during the month. The RBI also purchasedsecurities worth Rs. 12,462.16 crore against the notified amount of Rs. 16,000 crore through open market operation.10.00%Yield Curve9.50%9.00%8.50%8.00%Source: Reuters1 2 3 4 5 6 7 9 10 15PeriodSource: CCIL, <strong>Bharti</strong> <strong>AXA</strong> <strong>Life</strong> <strong>Insurance</strong>On the global front, the U.S. Labor Department reported a rise in the July non-farm payroll employment by 162,000 jobsfollowing a downwardly revised increase of 188,000 jobs in June. Investors welcomed the U.S. economy’s 2.5% growthrate for the second quarter, which was better than estimates. Moreover, the U.S. manufacturing sector accelerated in Julyto its highest level since June 2011 as new orders surged. The Bank of England left its interest rates unchanged at 0.5%,as expected, under its new Governor. Apart from this, a series of encouraging reports on Chinese industrial output, retailsales, fixed asset investment and bank lending pointed that growth in the world’s second-largest economy isstrengthening after two quarters of slowdown.Corporate Bond:Corporate Bond yields also surged on the entire segment in the range of 28 bps to 100 bps. The increase was muchhigher at the shorter end of the curve while it was lower at the longer end. The highest change was seen on 1-year paper.Yields on the Gilt Securities increased across the tenure in the range of 15 basis points (bps) to 61 bps, barring 1-yearsecurity, where yields declined by 41 bps. Yields increased by 15 bps only on 2-year paper while on all other maturities,yields surged in the range of 32 bps to 61 bps. The highest change was seen on 15-year maturity. Spread between AAAcorporate bond and Gilt remained mixed. It expanded on 1-year to 3-year and 9-year maturities in the range of 4 bps to141 bps, whereas contracted on all other securities by up to 23 bps.OutlookIn the coming month, bond yields are likely to take cues from the WPI inflation and industrial production data, which mayhint towards the future action of the RBI at its Mid-Quarter Monetary Policy Review. Moreover, bond markets may foundsome support on hopes that the new RBI Governor will take some more steps to check the volatility in the rupee.Investors will also focus on the movement of the rupee and direction of foreign fund inflows in the debt market. The RBIwill conduct the auction of Government Securities and Treasury Bills for an aggregate amount of Rs. 45,000 crore and48,000 crore respectively in September.

Grow Money FundULIF00221/08/2006EGROWMONEY130Fund PerformanceFundBenchmark3 Months -8.22 -9.546 Months -3.13 -4.581 year 5.02 4.34Since Inception 7.48 7.36Benchmark: CNX 100*Inception Date- 24 Aug 2006, =1yr CAGRAssets Under Management (in Rs. Lakhs)54973.82Asset Class Fund Performance % To FundCash4%Equity96%Equity portfolioITC LTDRELIANCE INDUSTRIES LTDINFOSYS TECHNOLOGIES LTDHDFC BANK LTDICICI BANK LTDTCS LTDSUN PHARMACEUTICALS INDUSTRIESHDFC LTDDR REDDYS LABORATORIES LTDLUPIN LTDCAIRN INDIA LTDTATA MOTORS LTDLARSEN & TOUBRO LTDM&M LTDBHARTI AIRTEL LTD.MARUTI UDYOG LTDUNITED SPIRITS LTDONGCTECH MAHINDRA LTDHCL TECHNOLOGIES LTDBAJAJ AUTO LTDTORRENT PHARMACEUTICALS LTDOthersCash And Current AssetsGrand Total% To Fund8.556.686.566.104.744.674.323.323.192.822.272.202.182.062.052.001.721.661.441.431.241.2023.484.13100.00Sector AllocationOthersInfrastructureCementFMCGTelecommunicationTobacco productsCommercialvehicles,Auto & …Oil & GasDrugs &pharmaceuticalsITBanking & Finance2.592.892.893.11% To Fund9.938.558.8410.7113.3714.7218.270 5 10 15 20 25

Growth Opportunities Pension FundULIF00814/12/2008EGRWTHOPRP130Fund PerformanceAsset ClassFund Performance % To FundFundBenchmark3 Months -8.66 -10.806 Months -3.58 -6.741 year 4.22 1.12Since Inception 13.97 14.37Benchmark: CNX 500 Index*Inception Date- 10 Dec 2008, =1yr CAGRAssets Under Management (in Rs. Lakhs)1083.20Cash5%Equity95%Equity portfolio% To FundSector Allocation% To FundITC LTDRELIANCE INDUSTRIES LTDINFOSYS TECHNOLOGIES LTDHDFC BANK LTDTCS LTDSUN PHARMACEUTICALS INDUSTRIES LTDHDFC LTDICICI BANK LTDDR REDDYS LABORATORIES LTDLUPIN LTDCAIRN INDIA LTDM&M LTDTECH MAHINDRA LTDHCL TECHNOLOGIES LTDMARUTI UDYOG LTDTATA MOTORS LTDLARSEN & TOUBRO LTDBHARTI AIRTEL LTD.ONGCULTRA TECH CEMENT LTDUNITED SPIRITS LTDHINDUSTAN ZINC LTDOthersCash And Current AssetsGrand Total7.245.535.384.624.564.274.133.862.992.842.202.192.021.991.961.861.851.701.331.321.251.2329.144.52100.00OthersInfrastructureTelecommunicationFMCGCementTobacco productsCommercialvehicles,Auto & …Oil & GasDrugs &pharmaceuticalsITBanking & Finance2.402.593.173.547.248.259.2013.9613.2814.490 5 10 15 2017.36

Grow Money Pension FundULIF00526/12/2007EGROWMONYP130Fund PerformanceAsset Class Fund Performance % To FundFundBenchmark3 Months -8.59 -9.546 Months -3.38 -4.581 year 4.71 4.34Since Inception -1.40 -2.35Benchmark: CNX 100*Inception Date- 03 Jan 2008, =1yr CAGRAssets Under Management (in Rs. Lakhs)10878.73Cash3%Equity97%Equity portfolioITC LTDRELIANCE INDUSTRIES LTDINFOSYS TECHNOLOGIES LTDHDFC BANK LTDTATA CONSULTANCY SERVICES LTDICICI BANK LTDSUN PHARMACEUTICALS INDUSTRIESHDFC LTDDR REDDYS LABORATORIES LTDLUPIN LTDLARSEN & TOUBRO LTDTATA MOTORS LTDCAIRN INDIA LTDBHARTI AIRTEL LTD.MARUTI UDYOG LTDM&M LTDUNITED SPIRITS LTDONGCTORRENT PHARMACEUTICALS LTDHCL TECHNOLOGIES LTDULTRA TECH CEMENT LTDTECH MAHINDRA LTDOthersCash And Current AssetsGrand Total% To Fund8.646.696.456.015.074.754.684.612.842.822.172.132.041.851.841.821.801.681.601.441.411.2523.173.24100.00Sector AllocationOthersInfrastructureTelecommunicationCementFMCGCommercialvehicles,Auto & Auto …Tobacco productsOil & GasDrugs & pharmaceuticalsITBanking & Finance2.662.933.023.08% To Fund9.638.338.6410.4713.5514.7519.690 5 10 15 20 25

Grow Money Pension Plus FundULIF01501/01/2010EGRMONYPLP130Fund PerformanceAsset Class Fund Performance % To fundFundBenchmark3 Months -9.62 -9.546 Months -4.82 -4.581 year 3.99 4.34Since Inception 1.86 2.29Benchmark: CNX 100*Inception Date- 22 Dec 2009, =1yr CAGRAssets Under Management (in Rs. Lakhs)5963.24Cash4%Equity96%Equity portfolio% To FundSector Allocation% To FundITC LTDRELIANCE INDUSTRIES LTDINFOSYS TECHNOLOGIES LTDHDFC BANK LTDTCS LTDICICI BANK LTDSUN PHARMACEUTICALS INDUSTRIESHDFC LTDDR REDDYS LABORATORIES LTDLUPIN LTDMARUTI UDYOG LTDM&M LTDLARSEN & TOUBRO LTDTATA MOTORS LTDONGCBHARTI AIRTEL LTD.HCL TECHNOLOGIES LTDUNITED SPIRITS LTDCAIRN INDIA LTDTECH MAHINDRA LTDULTRA TECH CEMENT LTDINDUSIND BANK LTDOthersCash And Current AssetsGrand Total8.606.636.255.664.854.644.514.273.182.772.422.292.132.111.901.791.721.711.691.341.311.0723.523.65100.00OthersInfrastructureTelecommunicationFMCGCementTobacco productsCommercialvehicles,Auto & Auto …Oil & GasDrugs & pharmaceuticalsITBanking & Finance2.392.822.953.759.018.609.0910.5313.2714.5719.370 5 10 15 20 25

Growth Opportunities FundULIF00708/12/2008EGROWTHOPR130Fund PerformanceAsset Class Fund Performance % To fundFundBenchmark3 Months -9.39 -10.806 Months -4.53 -6.741 year 3.41 1.12Since Inception 15.05 14.37Benchmark: CNX 500 Index*Inception Date- 10 Dec 2008, =1yr CAGRAssets Under Management (in Rs. Lakhs)6377.84Cash4%Equity96%Equity portfolioITC LTDINFOSYS TECHNOLOGIES LTDRELIANCE INDUSTRIES LTDHDFC BANK LTDTCS LTDSUN PHARMACEUTICALS INDUSTRIESICICI BANK LTDHDFC LTDDR REDDYS LABORATORIES LTDLUPIN LTDM&M LTDCAIRN INDIA LTDMARUTI UDYOG LTDTECH MAHINDRA LTDTATA MOTORS LTDLARSEN & TOUBRO LTDHCL TECHNOLOGIES LTDBHARTI AIRTEL LTD.UNITED SPIRITS LTDONGCULTRA TECH CEMENT LTDAXIS BANK LTDOthersCash And Current AssetsGrand Total% To Fund7.205.545.224.944.574.564.274.032.842.702.242.092.072.031.921.911.751.701.631.531.141.0428.594.48100.00Sector AllocationOthersInfrastructureTelecommunicationFMCGCementTobacco productsCommercialvehicles,Auto & Auto …Oil & GasDrugs &pharmaceuticalsITBanking & Finance2.412.503.243.41% To Fund7.208.859.1812.8113.2014.6818.030 5 10 15 20

Growth Opportunities Plus FundULIF01614/12/2009EGRWTHOPPL130Fund PerformanceFundBenchmark3 Months -9.66 -10.806 Months -5.10 -6.741 year 3.93 1.12Since Inception 1.40 -0.86Benchmark: CNX 500 Index*Inception Date- 29 Dec 2009, =1yr CAGRAssets Under Management (in Rs. Lakhs)15993.36Asset Class Fund Performance % To fundCash5%Equity95%Equity portfolio% To FundSector Allocation% To FundITC LTDINFOSYS TECHNOLOGIES LTDRELIANCE INDUSTRIES LTDHDFC BANK LTDICICI BANK LTDTCS LTDHDFC LTDSUN PHARMACEUTICALS INDUSTRIESDR REDDYS LABORATORIES LTDLUPIN LTDM&M LTDUNITED SPIRITS LTDMARUTI UDYOG LTDTATA MOTORS LTDTECH MAHINDRA LTDLARSEN & TOUBRO LTDHCL TECHNOLOGIES LTDBHARTI AIRTEL LTD.ONGCCAIRN INDIA LTDZEE ENTERTAINMENT ENTERPRISES LTDAXIS BANK LTDOthersCash And Current AssetsGrand Total7.275.915.394.444.354.244.174.063.332.452.222.122.092.051.931.821.691.601.591.501.121.1128.824.73100.00OthersInfrastructureTelecommunicationCementFMCGTobacco productsOil & GasCommercialvehicles,Auto & Auto …DRUGS &PHARMACEUTICALSITBanking & Finance2.162.573.063.607.278.888.9613.1213.0514.600 5 10 15 2018.01

Grow Money Plus FundULIF01214/12/2009EGROMONYPL130Fund PerformanceAsset Class Fund Performance % To FundFundBenchmark3 Months -9.03 -9.546 Months -4.23 -4.581 year 5.18 4.34Since Inception 2.29 1.70Benchmark: CNX 100*Inception Date- 14 Dec 2009, =1yr CAGRAssets Under Management (in Rs. Lakhs)12903.49Cash5%Equity95%Equity portfolioITC LTDINFOSYS TECHNOLOGIES LTDRELIANCE INDUSTRIES LTDHDFC BANK LTDICICI BANK LTDSUN PHARMACEUTICALS INDUSTRIESTCS LTDHDFC LTDDR REDDYS LABORATORIES LTDLUPIN LTDMARUTI UDYOG LTDM&M LTDTATA MOTORS LTDLARSEN & TOUBRO LTDUNITED SPIRITS LTDBHARTI AIRTEL LTD.ONGCCAIRN INDIA LTDHCL TECHNOLOGIES LTDTECH MAHINDRA LTDAXIS BANK LTDIDEA CELLULAR LTDOthersCash And Current AssetsGrand Total% To Fund8.486.936.215.454.614.484.294.183.462.742.222.182.172.061.841.721.711.691.471.281.241.1723.425.01100.00Sector AllocationOthersInfrastructureTelecommunicationFMCGCementTobacco productsCommercialvehicles,Auto & Auto …Oil & GasDrugs & pharmaceuticalsITBanking & Finance2.242.902.993.03% To Fund9.178.489.049.9513.1714.7419.290 5 10 15 20 25

Growth Opportunities Pension Plus FundULIF01801/01/2010EGRWTHOPLP130Fund PerformanceAsset Class Fund Performance % To FundFundBenchmark3 Months -10.11 -10.806 Months -5.56 -6.741 year 3.07 1.12Since Inception 1.98 -0.98Benchmark: CNX 500 Index*Inception Date- 02 Jan 2010, =1yr CAGRAssets Under Management (in Rs. Lakhs)Equity portfolio8096.02% To FundSector AllocationCash4%Equity96%% To FundITC LTDINFOSYS TECHNOLOGIES LTDRELIANCE INDUSTRIES LTDHDFC BANK LTDICICI BANK LTDTCS LTDHDFC LTDSUN PHARMACEUTICALS INDUSTRIESDR REDDYS LABORATORIES LTDM&M LTDLUPIN LTDMARUTI UDYOG LTDTATA MOTORS LTDTECH MAHINDRA LTDLARSEN & TOUBRO LTDCAIRN INDIA LTDHCL TECHNOLOGIES LTDBHARTI AIRTEL LTD.ONGCUNITED SPIRITS LTDULTRA TECH CEMENT LTDBOSCH LIMITEDOthersCash And Current AssetsGrand Total7.376.245.494.794.224.184.083.882.852.702.542.481.941.931.881.871.691.591.591.521.181.1529.093.77100.00OthersInfrastructureTelecommunicationFMCGCementTobacco productsOil & GasCommercialvehicles,Auto & …Drugs &pharmaceuticalsITBanking & Finance2.372.422.833.507.379.3310.1312.7212.7314.580 5 10 15 2018.26

Build India Pension FundULIF01704/01/2010EBUILDINDP130Fund PerformanceAsset Class Fund Performance % To fundFundBenchmark3 Months -9.27 -9.546 Months -4.31 -4.581 year 4.70 4.34Since Inception -0.94 1.21Benchmark: CNX 100*Inception Date- 02 Jan 2010, =1yr CAGRAssets Under Management (in Rs. Lakhs)2934.19Cash3%Equity97%Equity portfolio% To FundSector Allocation% To FundITC LTDINFOSYS TECHNOLOGIES LTDRELIANCE INDUSTRIES LTDHDFC BANK LTDTCS LTDICICI BANK LTDSUN PHARMACEUTICALS INDUSTRIESHDFC LTDDR REDDYS LABORATORIES LTDM&M LTDLUPIN LTDCAIRN INDIA LTDMARUTI UDYOG LTDLARSEN & TOUBRO LTDTATA MOTORS LTDBHARTI AIRTEL LTD.HCL TECHNOLOGIES LTDUNITED SPIRITS LTDONGCULTRA TECH CEMENT LTDTECH MAHINDRA LTDBAJAJ AUTO LTDOthersCash And Current AssetsGrand Total8.726.666.605.704.734.684.604.353.262.542.502.412.242.182.171.901.761.751.741.321.171.1323.162.71100.00OthersTelecommunicationFMCGInfrastructureCementTobacco productsCommercialvehicles,Auto & Auto …Oil & GasDrugs & pharmaceuticalsITBanking & Finance2.872.983.133.668.888.729.6811.0312.0914.8119.430 5 10 15 20 25

Build India FundULIF01909/02/2010EBUILDINDA130FundBenchmark3 Months -9.12 -9.546 Months -4.36 -4.581 year 4.77 4.34Since Inception 0.20 3.35Benchmark: CNX 100Fund Performance*Inception Date- 15 Feb 2010, =1yr CAGRAssets Under Management (in Rs. Lakhs)Equity portfolio4066.78ITC LTDINFOSYS TECHNOLOGIES LTDRELIANCE INDUSTRIES LTDHDFC BANK LTDTCS LTSSUN PHARMACEUTICALS INDUSTRIESICICI BANK LTDHDFC LTDDR REDDYS LABORATORIES LTDLUPIN LTDMARUTI UDYOG LTDM&M LTDLARSEN & TOUBRO LTDTATA MOTORS LTDCAIRN INDIA LTDUNITED SPIRITS LTDBHARTI AIRTEL LTD.ONGCHCL TECHNOLOGIES LTDTECH MAHINDRA LTDULTRA TECH CEMENT LTDAXIS BANK LTDOthersCash And Current AssetsGrand Total% To Fund8.386.416.115.454.774.484.483.953.262.692.462.382.112.102.071.841.681.681.611.311.211.1923.454.93100.00Asset Class Fund Performance % To FundSector AllocationCash5%OthersTelecommunicationInfrastructureFMCGCementTobacco productsCommercialvehicles,Auto & …Oil & GasDrugs &pharmaceuticalsITBanking & FinanceEquity95%2.772.813.093.51% To Fund8.758.389.6010.2112.5814.7118.670 5 10 15 20 25

Save and Grow Money FundULIF00121/08/2006BSAVENGROW130Fund PerformanceFundBenchmark3 Months -7.52 -7.746 Months -2.96 -2.851 year 4.07 3.76Since Inception 7.17 6.63Benchmark: CNX 100=45%, Crisil Composite Bond Fund Index=55%*Inception Date- 21 Aug 2006, =1yr CAGRAssets Under Management (in Rs. Lakhs)Equity portfolio8268.04INFOSYS TECHNOLOGIES LTDHCL TECHNOLOGIES LTDITC LTDTCS LTDRELIANCE INDUSTRIES LTDHDFC BANK LTDWIPRO LTDICICI BANK LTDSUN PHARMACEUTICALS INDUSTRIESHDFC LTDOthersGrand TotalDebt portfolio% To Fund% To Fund5.443.413.362.652.542.242.202.001.591.5417.0944.059.27% POWER FIN CORP 21/08/20175.189.65% HDFC 13/09/20163.219.55% HINDALCO 27/06/20223.048.70% PGC 15/07/20182.878.82% REC 12/04/20232.8410.25% RGTIL 22/08/20212.479.45% NABARD 09/07/20152.38182 D TB 14/02/2014 2.309.40% REC 20/07/20171.77Others 21.93Cash And Current Assets7.96Grand Total 55.95Equity44%Sector AllocationTelecommunicationTobacco productsBanking & Finance20.0010.000.00AA & Below1%Asset Fund Class Performance ( % To Fund)OthersFMCGCementInfrastructureCommercial …Oil & GasDrugs & …P1+ & Eq2%AA+ & Eq8%ITCash8%0.660.890.931.192.94Debt Ratings ProfileSovereign21%3.363.363.834.03Debt48%% To Fund8.830 5 10 15AAA & Eq68%Debt Maturity Profile (%To Fund)8.706.3915.2314.0417.670-1 Yrs 1-3 Yrs 3-5 Yrs >5 Yrs

Save and Grow Money Pension FundULIF00426/12/2007BSNGROWPEN130FundBenchmark3 Months -7.54 -7.746 Months -2.91 -2.851 year 3.87 3.76Since Inception 4.64 2.17Benchmark: CNX 100=45%, Crisil Composite Bond Fund Index=55%*Inception Date- 03 Jan 2008, =1yr CAGRAssets Under Management (in Rs. Lakhs)Equity portfolio1865.53INFOSYS TECHNOLOGIES LTDITC LTDHDFC BANK LTDRELIANCE INDUSTRIES LTDHCL TECHNOLOGIES LTDTCS LTDWIPRO LTDICICI BANK LTDSUN PHARMACEUTICALS INDUSTRIESHDFC LTDOthersGrand TotalDebt portfolioFund Performance% To Fund% To Fund6.173.682.792.752.432.402.242.091.791.6517.6445.659.55% HINDALCO 27/06/20224.668.20% GOI 2025 2.7710.25% RGTIL 22/08/20212.7411.45% RELIANCE 25/11/2013 2.709.45% NABARD 09/07/20152.649.57% LIC HOUSING 07/09/2017 2.619.27% POWER FIN CORP 21/08/20172.618.70% PGC 15/07/2018 2.548.94% POWER FIN CORP 25/03/20282.51Others 18.00Cash And Current Assets10.57Grand Total 54.35Equity46%Sector AllocationAA+ & Eq13%Asset Fund Class Performance ( % To Fund)P1+ & Eq2%Cash10%TelecommunicationBanking & Finance30.0020.0010.00Tobacco products0.00OthersCementPowerInfrastructureCommercial …Drugs & …Oil & GasITDebt44%0 5 10 15Debt Ratings ProfileSovereign15%0.971.061.272.701.383.203.684.074.28% To Fund9.50Debt Maturity Profile (% To Fund)7.39 7.079.9813.55AAA & Eq70%19.330-1 Yrs 1-3 Yrs 3-5 Yrs >5 Yrs

True Wealth FundULIF02104/10/2010BTRUEWLTHG130Fund PerformanceFund3 Months -10.03 --6 Months -7.67 --1 year -7.51 --Since Inception -7.49 --*Inception Date- 13 Oct 2010, =1yr CAGRBenchmarkAsset Fund Class Performance ( % To Fund)Equity10%Cash12%Debt78%Assets Under Management (in Rs. Lakhs)Equity portfolio8972.89HDFC LTDTIMKEN INDIA LTD.HINDUSTAN ZINC LTDALLAHABAD BANKDEN NETWORKS LIMITEDZUARI HOLDINGS LTDMARUTI UDYOG LTDINFOSYS TECHNOLOGIES LTDACC LTDINEOS ABS (INDIA) LIMITEDOthersGrand TotalDebt portfolio% To Fund% To Fund1.511.081.070.990.960.960.900.690.500.481.4510.578.15% GOI 202214.548.12% GOI 2020 14.237.80% GOI 202013.688.20% GOI 2025 10.597.80% GOI 20215.668.79% GOI 2021 5.598.19% GOI 20205.307.28% GOI 2019 4.597.35% GOI 20241.16Others 2.23Cash And Current Assets11.84Grand Total 89.43Sector AllocationBanking & Finance100.0050.000.00InfrastructureMFR OF …PolymersCementITCommercial …FertilisersINFORMATION …Metal & Mining0.040.180.480.620.690.900.961.232.15Debt Ratings ProfileSovereign100%3.32% To Fund0 2 4 6 8 10Debt Maturity Profile (% To Fund)1.1776.410-1 Yrs >5 Yrs

Steady Money FundULIF00321/08/2006DSTDYMOENY130Fund PerformanceFundBenchmark3 Months -5.19 -6.276 Months -0.23 -1.431 year 4.85 3.28Since Inception 7.09 6.03Benchmark: Crisil Composite Bond Fund Index*Inception Date- 05 Sep 2006, =1yr CAGRAssets Under Management (in Rs. Lakhs)5916.57Asset Fund Class Performance ( % To Fund)Cash17%Debt83%Debt portfolio% To FundDebt Ratings Profile11.60% SHRIRAM TRAAPORT FIN 11/07/20168.20% GOI 20258.94% POWER FIN CORP 25/03/20289.55% HINDALCO 27/06/20228.33% GOI 202656 D TB 20/09/20139.80% LIC HOUSING 04/03/20159.45% NABARD 09/07/20159.27% POWER FIN CORP 21/08/2017182 D TB 14/02/20148.70% PGC 15/07/20188.82% REC 12/04/20237.28% GOI 20198.79% GOI 20219.65% HDFC 13/09/20169.40% REC 20/07/20176.125.414.744.573.423.363.333.333.293.223.203.173.103.082.652.482.479.57% LIC HOUSING 07/09/201710.25% RGTIL 22/08/2021 2.257.80% GOI 2021 1.829.60% HFINANCE 22/03/2023 1.668.30% HDFC 23/06/2015 1.628.12% GOI 2020 1.60OthersCash And Current Assets13.0117.10Grand Total 100.0040.0035.0030.0025.0020.0015.0010.005.000.00Sovereign32%P1+ & Eq1%AA & Below7%12.38AA+& Eq7%Debt Maturity Profile (% To Fund)17.9815.11AAA & Eq53%37.430-1 Yrs 1-3 Yrs 3-5 Yrs >5 Yrs

Build n Protect Series 1 FundULIF00919/05/2009BBUILDNPS1130FundBenchmark3 Months -9.15 -21.306 Months -3.71 -15.751 year 2.72 -9.94Since Inception 3.09 -6.10Benchmark: 15 Years G-Sec Yield**Inception Date- 19 May 2009, =1yr CAGRAssets Under Management (in Rs. Lakhs)Debt portfolioFund Performance1328.22% To Fund6.35% GOI 202445.118.20% GOI 202413.677.95% GOI 202513.298.03% GOI 20247.816.90% GOI 20266.118.20% GOI 20234.348.00% GOI 20262.358.20% GOI 2024 1.758.01% GOI 20231.46Cash And Current Assets 4.10Grand Total 100.00100.00Asset Fund Class Performance ( % To Fund)Cash4%Debt96%Debt Ratings ProfileSovereign100%Debt Maturity Profile (%To Fund)95.9075.0050.0025.000.000-1 Yrs 1-3 Yrs 3-5 Yrs >5 Yrs

Safe Money FundULIF01007/07/2009LSAFEMONEY130Fund PerformanceFundBenchmark3 Months 1.99 1.736 Months 3.96 3.851 year 8.17 7.84Since Inception 6.69 6.81Benchmark: Crisil Liquid Fund Index*Inception Date- 08 Jul 2009, =1yr CAGRAssets Under Management (in Rs. Lakhs)1888.50Asset Fund Class Performance ( % To Fund)Debt portfolio % To Fund Debt Ratings ProfileCash6%Debt94%182 D TB 30/01/2014364 D TB 24/07/20149.65% YES BK 24/02/20149.25% VIJAYA BK 12/04/201428.679.737.945.829.00% INDIAN OVERSEAS BK 02/05/2014 4.24364 D TB 06/02/2014 4.089.00% FEDERAL BK 07/01/2014 3.929.25% FEDERAL BK 03/04/2014 3.7191 D TB 26/09/2013 3.6956 D TB 20/09/2013 3.229.25% SBBJ 28/09/2013 2.709.25% PSB 20/04/2014 2.659.25% BOI 26/07/2014 2.650.00% HDFC 05/08/2014 2.410.00% IDBI BANK 10/09/2013 2.389.50% VIJAYA BK 25/10/20132.129.25% SBT 29/06/2014 2.129.25% BOI 31/07/2014 1.329.00% INDIAN OVERSEAS BK 12/12/2013 0.79Cash And Current Assets 5.84Grand Total 100.00100.0075.0050.0025.00Sovereign91%94.16P1+ & Eq9%Debt Maturity Profile (% To Fund)0.000-1 Yrs 1-3 Yrs

Safe Money Pension FundULIF01107/12/2009LSAFEMONYP130Fund PerformanceFundBenchmark3 Months 1.94 1.736 Months 3.85 3.851 year 8.00 7.84Since Inception 6.64 6.81Benchmark: Crisil Liquid Fund Index*Inception Date- 08 Jul 2009, =1yr CAGRAssets Under Management (in Rs. Lakhs)812.58Asset Fund Class Performance ( % To Fund)Cash20%Debt80%Debt portfolio% To FundDebt Ratings Profile182 D TB 30/01/20149.25% PSB 20/04/20149.65% YES BK 24/02/201423.586.156.159.25% BOI 26/07/2014 6.030.00% IDBI BANK 10/09/2013 4.9127 D TB 17/09/2013 4.849.50% VIJAYA BK 25/10/2013 4.319.00% ANDHRA BK 13/12/2013 3.699.25% SBT 29/06/2014 3.6991 D TB 26/09/2013 3.679.00% FEDERAL BK 07/01/2014 3.089.25% FEDERAL BK 03/04/2014 2.469.00% INDIAN OVERSEAS BK 02/05/2014 2.469.10% VIJAYA BK 24/01/2014 2.229.25% SBBJ 28/09/2013 1.230.00% HDFC 05/08/2014 1.129.00% INDIAN OVERSEAS BK 12/12/2013 0.62Cash And Current Assets 19.79Grand Total 100.009080706050403020100AA+& Eq84%Debt Maturity Profile (% To Fund)80.21P1+ & Eq16%0-1 Yrs 1-3 Yrs

Steady Money Pension FundULIF00626/12/2007DSTDYMONYP130Fund PerformanceFundBenchmark3 Months -4.77 -6.276 Months 0.08 -1.431 year 5.17 3.28Since Inception 6.56 5.87Benchmark: Crisil Composite Bond Fund Index*Inception Date- 03 Jan 2008, =1yr CAGRAssets Under Management (in Rs. Lakhs)2012.01Asset Fund Class Performance ( % To Fund)Cash21%Debt79%Debt portfolio% To FundDebt Ratings Profile8.20% GOI 20256.5511.60% SHRIRAM TRAAPORT FIN 11/07/20165.0056 D TB 20/09/20134.947.28% GOI 20194.558.68% PGC 07/12/20133.738.33% GOI 20263.5810.25% RGTIL 22/08/20213.569.27% POWER FIN CORP 21/08/20173.390.00% HDFC 05/08/20143.179.50% VIJAYA BK 25/10/2013 2.499.75% REC 11/11/20212.469.60% HFINANCE 22/03/2023 2.459.45% NABARD 09/07/20152.459.57% LIC HOUSING 07/09/2017 2.428.12% GOI 20202.358.82% REC 12/04/2023 2.338.70% PGC 15/07/20232.3210.40% RPTL 18/07/2021 2.0510.90% REC 30/09/20131.998.79% GOI 2021 1.969.65% HDFC 13/09/20161.958.70% POWER FIN CORP 14/05/2015 1.93Others11.42Cash And Current Assets20.98Grand Total100.00Sovereign35%P1+ & Eq4%AA & Below7%40.0035.0030.0025.0020.0015.0010.005.000.00Debt Maturity Profile (% To Fund)20.61AA+ & Eq4%14.288.36AAA & Eq50%35.770-1 Yrs 1-3 Yrs 3-5 Yrs >5 Yrs

Disclaimers: 1.This Investment Newsletter is for information purpose only and should not be construed as financial advice, offer,recommendation or solicitation to enter into any transaction. While all reasonable care has been ensured in preparing this newsletter,<strong>Bharti</strong> <strong>AXA</strong> <strong>Life</strong> <strong>Insurance</strong> Company limited or any other person connected with it, accepts no responsibility or liability for errors of factsor accuracy or opinions expressed and Policyholder should use his/her own discretion and judgment while investing in financial markets.2. The information contained herein is as on 31st <strong>August</strong> 2013. 3. Past performance of the funds, as shown above, is not indicative offuture performance or returns. 4. Grow Money Fund, Save n Grow Money Fund, Steady Money Fund, Growth Opportunities Fund, GrowMoney Pension Fund, Save n Grow Money Pension Fund, Steady Money Pension Fund, Growth Opportunities Pension Fund, Build n ProtectFund Series 1, Safe Money Fund, Safe Money Pension Fund, Grow Money Plus, Grow Money Pension Plus, Growth Opportunities Plus,Growth Opportunities Pension Plus Fund, Build India Pension, Build India Fund and True Wealth Fund are only the names of the fundsand do not indicate its expected future returns or performance. 5. ABS=Absolute Return, CAGR=Compounded Annual Growth Rate.6. Sector allocations as shown in the newsletter are only for presentation purpose and do not necessarily indicate industry exposure.<strong>Bharti</strong> <strong>AXA</strong> <strong>Life</strong> <strong>Insurance</strong> Company Limited. (Regd. No. 130), Regd. Address: 6th Floor, Unit- 601 & 602,Raheja Titanium, Off Western Express Highway, Goregaon (East), Mumbai- 400 063.Toll free: 1800 102 4444SMS SERVICE to 56677 (We will be in touch within 24 hours to address your query),Email: service@bharti-axalife.com, www.bharti-axalife.comCompliance No.: Comp-October-2013-2344