2013 AnnuAl RepoRt - Australian Grand Prix

2013 AnnuAl RepoRt - Australian Grand Prix

2013 AnnuAl RepoRt - Australian Grand Prix

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

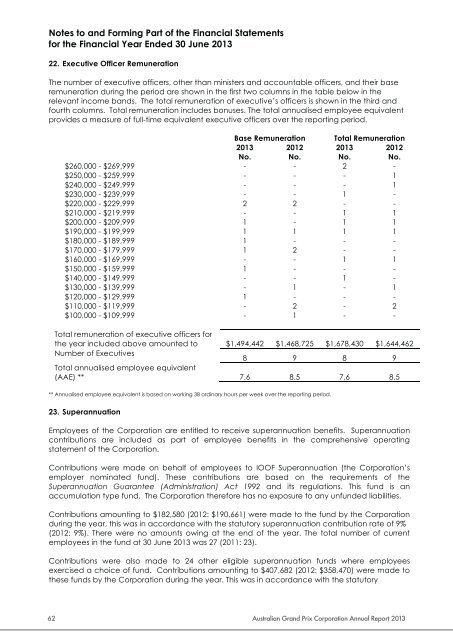

Notes to and Forming Part of the Financial Statementsfor the Financial Year Ended 30 June <strong>2013</strong>22. Executive Officer RemunerationThe number of executive officers, other than ministers and accountable officers, and their baseremuneration during the period are shown in the first two columns in the table below in therelevant income bands. The total remuneration of executive’s officers is shown in the third andfourth columns. Total remuneration includes bonuses. The total annualised employee equivalentprovides a measure of full-time equivalent executive officers over the reporting period.Base Remuneration Total Remuneration<strong>2013</strong> 2012 <strong>2013</strong> 2012No. No. No. No.$260,000 - $269,999 - - 2 -$250,000 - $259,999 - - - 1$240,000 - $249,999 - - - 1$230,000 - $239,999 - - 1 -$220,000 - $229,999 2 2 - -$210,000 - $219,999 - - 1 1$200,000 - $209,999 1 - 1 1$190,000 - $199,999 1 1 1 1$180,000 - $189,999 1 - - -$170,000 - $179,999 1 2 - -$160,000 - $169,999 - - 1 1$150,000 - $159,999 1 - - -$140,000 - $149,999 - - 1 -$130,000 - $139,999 - 1 - 1$120,000 - $129,999 1 - - -$110,000 - $119,999 - 2 - 2$100,000 - $109,999 - 1 - -Total remuneration of executive officers forthe year included above amounted to $1,494,442 $1,468,725 $1,678,430 $1,644,462Number of Executives8 9 8 9Total annualised employee equivalent(AAE) ** 7.6 8.5 7.6 8.5** Annualised employee equivalent is based on working 38 ordinary hours per week over the reporting period.23. SuperannuationEmployees of the Corporation are entitled to receive superannuation benefits. Superannuationcontributions are included as part of employee benefits in the comprehensive operatingstatement of the Corporation.Contributions were made on behalf of employees to IOOF Superannuation (the Corporation’semployer nominated fund). These contributions are based on the requirements of theSuperannuation Guarantee (Administration) Act 1992 and its regulations. This fund is anaccumulation type fund. The Corporation therefore has no exposure to any unfunded liabilities.Contributions amounting to $182,580 (2012: $190,661) were made to the fund by the Corporationduring the year, this was in accordance with the statutory superannuation contribution rate of 9%(2012: 9%). There were no amounts owing at the end of the year. The total number of currentemployees in the fund at 30 June <strong>2013</strong> was 27 (2011: 23).Contributions were also made to 24 other eligible superannuation funds where employeesexercised a choice of fund. Contributions amounting to $407,682 (2012: $358,470) were made tothese funds by the Corporation during the year. This was in accordance with the statutory6262<strong>Australian</strong> <strong>Grand</strong> <strong>Prix</strong> Corporation Annual Report <strong>2013</strong>