MISC BERHAD - ChartNexus

MISC BERHAD - ChartNexus

MISC BERHAD - ChartNexus

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

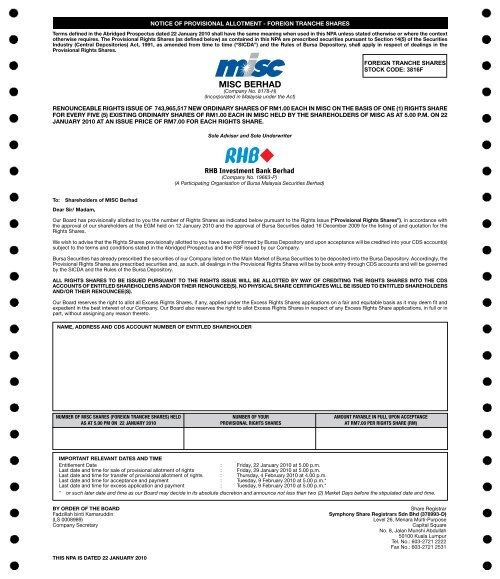

NOTICE OF PROVISIONAL ALLOTMENT - FOREIGN TRANCHE SHARESTerms defined in the Abridged Prospectus dated 22 January 2010 shall have the same meaning when used in this NPA unless stated otherwise or where the contextotherwise requires. The Provisional Rights Shares (as defined below) as contained in this NPA are prescribed securities pursuant to Section 14(5) of the SecuritiesIndustry (Central Depositories) Act, 1991, as amended from time to time (“SICDA”) and the Rules of Bursa Depository, shall apply in respect of dealings in theProvisional Rights Shares.<strong>MISC</strong> <strong>BERHAD</strong>(Company No. 8178-H)(Incorporated in Malaysia under the Act)RENOUNCEABLE RIGHTS ISSUE OF 743,965,517 NEW ORDINARY SHARES OF RM1.00 EACH IN <strong>MISC</strong> ON THE BASIS OF ONE (1) RIGHTS SHAREFOR EVERY FIVE (5) EXISTING ORDINARY SHARES OF RM1.00 EACH IN <strong>MISC</strong> HELD BY THE SHAREHOLDERS OF <strong>MISC</strong> AS AT 5.00 P.M. ON 22JANUARY 2010 AT AN ISSUE PRICE OF RM7.00 FOR EACH RIGHTS SHARE.Sole Adviser and Sole UnderwriterFOREIGN TRANCHE SHARESSTOCK CODE: 3816FRHB Investment Bank Berhad(Company No. 19663-P)(A Participating Organisation of Bursa Malaysia Securities Berhad)To:Shareholders of <strong>MISC</strong> BerhadDear Sir/ Madam,Our Board has provisionally allotted to you the number of Rights Shares as indicated below pursuant to the Rights Issue (“Provisional Rights Shares”), in accordance withthe approval of our shareholders at the EGM held on 12 January 2010 and the approval of Bursa Securities dated 16 December 2009 for the listing of and quotation for theRights Shares.We wish to advise that the Rights Shares provisionally allotted to you have been confirmed by Bursa Depository and upon acceptance will be credited into your CDS account(s)subject to the terms and conditions stated in the Abridged Prospectus and the RSF issued by our Company.Bursa Securities has already prescribed the securities of our Company listed on the Main Market of Bursa Securities to be deposited into the Bursa Depository. Accordingly, theProvisional Rights Shares are prescribed securities and, as such, all dealings in the Provisional Rights Shares will be by book entry through CDS accounts and will be governedby the SICDA and the Rules of the Bursa Depository.ALL RIGHTS SHARES TO BE ISSUED PURSUANT TO THE RIGHTS ISSUE WILL BE ALLOTTED BY WAY OF CREDITING THE RIGHTS SHARES INTO THE CDSACCOUNTS OF ENTITLED SHAREHOLDERS AND/OR THEIR RENOUNCEE(S). NO PHYSICAL SHARE CERTIFICATES WILL BE ISSUED TO ENTITLED SHAREHOLDERSAND/OR THEIR RENOUNCEE(S).Our Board reserves the right to allot all Excess Rights Shares, if any, applied under the Excess Rights Shares applications on a fair and equitable basis as it may deem fit andexpedient in the best interest of our Company. Our Board also reserves the right to allot Excess Rights Shares in respect of any Excess Rights Share applications, in full or inpart, without assigning any reason thereto.NAME, ADDRESS AND CDS ACCOUNT NUMBER OF ENTITLED SHAREHOLDERNUMBER OF <strong>MISC</strong> SHARES (FOREIGN TRANCHE SHARES) HELD NUMBER OF your AMOUNT PAYABLE IN FULL UPON ACCEPTANCEAS AT 5.00 PM ON 22 JANUARY 2010 PROvisional rights shares AT RM7.00 PER rights share (RM)IMPORTANT RELEVANT DATES and timeEntitlement Date : Friday, 22 January 2010 at 5.00 p.m.Last date and time for sale of provisional allotment of rights : Friday, 29 January 2010 at 5.00 p.m.Last date and time for transfer of provisional allotment of rights : Thursday, 4 February 2010 at 4.00 p.m.Last date and time for acceptance and payment : Tuesday, 9 February 2010 at 5.00 p.m.*Last date and time for excess application and payment : Tuesday, 9 February 2010 at 5.00 p.m.** or such later date and time as our Board may decide in its absolute discretion and announce not less than two (2) Market Days before the stipulated date and time.By order of the BoardFadzillah binti Kamaruddin(LS 0008989)Company SecretaryShare RegistrarSymphony Share Registrars Sdn Bhd (378993-D)Level 26, Menara Multi-PurposeCapital SquareNo. 8, Jalan Munshi Abdullah50100 Kuala LumpurTel. No.: 603-2721 2222Fax No.: 603-2721 2531THIS NPA IS DATED 22 JANUARY 2010

NOTES AND INSTRUCTIONS FOR COMPLETION OF THIS RSFTHIS RSF IS NOT A TRANSFERABLE OR NEGOTIABLE INSTRUMENT.If you are in any doubt as to the action you should take, you should consult your stockbroker, bank manager, solicitor, accountant or other professional adviser immediately. If youhave sold or transferred all your shares in our Company, you should at once hand this RSF, together with the Abridged Prospectus and the NPA (collectively known as the “Documents”), to theagent/broker through whom you have effected the sale or transfer for onward transmission to the purchaser or transferee. You should address all enquiries concerning the Rights Issue to ourShare Registrar, Symphony Share Registrars Sdn Bhd (378993-D) at Level 26, Menara Multi-Purpose, Capital Square, No. 8, Jalan Munshi Abdullah, 50100 Kuala Lumpur, Malaysia.YOU SHOULD READ AND UNDERSTAND THE CONTENTS OF THE ABRIDGED PROSPECTUS TO WHICH THIS RSF RELATES BEFORE COMPLETING THIS RSF. IN ACCORDANCEWITH THE CAPITAL MARKETS AND SERVICES ACT 2007, THIS RSF MUST NOT BE CIRCULATED UNLESS ACCOMPANIED BY THE ABRIDGED PROSPECTUS.This Abridged Prospectus is issued in compliance with the laws of Malaysia only. The Documents are not intended to be (and will not be) issued, circulated or distributed in countries orjurisdictions other than Malaysia and no action has been or will be taken to ensure that the Rights Issue and the Documents comply with the laws of any countries or jurisdictions other thanthe laws of Malaysia. The Rights Issue to which the Abridged Prospectus relates is only available to persons receiving the Documents or otherwise within Malaysia. Accordingly, the Documentswill not be despatched to entitled shareholders who do not have a registered address in Malaysia as stated in our Records of Depositors of our Company on the Entitlement Date. Entitledshareholders and/or their renouncee(s) who are resident in countries or jurisdictions other than Malaysia should therefore immediately consult their legal advisers and/or other professionaladviser as to whether the acceptance or renunciation (as the case may be) of their entitlements to the Provisional Rights Shares would result in the contravention of any laws of such countriesor jurisdictions. Such entitled shareholders and/or their renouncee(s) (as the case may be) should note the additional terms and restrictions set out in Section 3.7 of the Abridged Prospectus.Neither our Company nor the Sole Adviser for the Rights Issue, RHB Investment Bank Berhad shall accept any responsibility or liability in the event that any acceptance or renunciation madeby entitled shareholders and/or their renouncee(s) is or shall become illegal, unenforceable, voidable or void in such countries or jurisdictions in which the entitled shareholders and/or theirrenouncee(s) is a resident.A copy of the Documents has been registered with the Securities Commission Malaysia (“SC”). The registration of the Documents should not be taken to indicate that the SC recommends theRights Issue or assumes responsibility for the correctness of any statement made or opinion or report expressed in the Documents. The SC has not, in any way, considered the merits of thesecurities being offered for investment. A copy of the Documents has also been lodged with the Registrar of Companies who takes no responsibility for their contents.Approval for the Rights Issue has been obtained from our shareholders at the EGM held on 12 January 2010. Approval has also been obtained from Bursa Securities vide its letter dated 16December 2009 for the listing of and quotation for the Rights Shares on the Main Market of Bursa Securities. The listing of and quotation for the Rights Shares will commence after, amongstothers, receipt of confirmation from Bursa Depository that all the CDS accounts of the entitled shareholders and/or their renouncee(s) have been duly credited and notices of allotment forthe Rights Shares have been despatched to them. The listing of and quotation for the Rights Shares on the Main Market of Bursa Securities are in no way reflective of the merits of the RightsIssue. Neither Bursa Securities nor the SC takes any responsibility for the correctness of statements made or expressed herein.A copy of the Documents have been seen and approved by our Board and they individually and collectively accept full responsibility for the accuracy of the information given and confirmthat, after having made all reasonable inquiries, and to be best of their knowledge and belief, there are no false or misleading statements or other facts which, if omitted, would make thestatements in the Documents false or misleading.Unless otherwise stated, the unit of currency used in this RSF is Ringgit Malaysia (“RM”) and sen. Terms defined in the Abridged Prospectus shall have the same meaning when used in thisRSF, unless stated otherwise or the context otherwise requires.INSTRUCTIONS: -(I)(II)(III)(IV)(V)LAST DATE AND TIME FOR ACCEPTANCE AND PAYMENTThis RSF is valid for acceptance on 9 February 2010 by 5.00 p.m. or such later date and time as our Board in its absolute discretion may decide and announce. Where the closing date ofacceptance is extended from the original closing date, an announcement of such extension(s) will be made not less than two (2) Market Days before stipulated date and time.If acceptance of and payment for the Rights Shares provisionally allotted to you (whether in full or in part, as the case maybe) are not received by our Share Registrar on 9 February 2010by 5.00 p.m., being the last date and time for acceptance and payment, or such later date and time as our Board in its absolute discretion may decide and announce not less than two (2)Market Days before the stipulated date and time, the Provisional Rights Shares will be deemed to have been declined and will be cancelled. Such Provisional Rights Shares not taken upshall first be made available for application for Excess Rights Shares in a fair and equitable basis and in such manner as our Board may deem fit and expedient in the best interest of ourCompany as set out in item (III) below and if undersubscribed, any remaining Rights Shares will be taken up by the Sole Underwriter.FULL OR PART ACCEPTANCE OF THE PROVISIONAL RIGHTS SHARESThe Rights Issue is renounceable in full or in part. If you wish to accept your Provisional Rights Shares either in full or in part, please complete Parts I and III of this RSF. Each completedRSF must be accompanied by remittance(s) in RM for the full amount payable for the Rights Shares accepted in the form of banker’s draft(s), cashier’s order(s), money order(s) or postalorder(s) drawn on a bank or post office in Malaysia and must be made payable in favour of “<strong>MISC</strong> RIGHTS ISSUE ACCOUNT” and crossed “ACCOUNT PAYEE ONLY” and endorsedon the reverse side with your name, contact number and address in block letters and your CDS account number. The payment must be made in the exact amount. Any excess orinsufficient payment and other than in the manner stated above may be rejected at the absolute discretion of our Board. Cheques or any other mode of payments are not acceptable.No acknowledgement will be issued by our Company or our Share Registrar for the receipt of this RSF or the application monies in respect of the Rights Shares. Proof of time of postageshall not constitute proof of time of receipt by our Share Registrar. However, if your application is successful, the Rights Shares shall be credited into your CDS account and a Notice ofAllotment will be despatched to you by ordinary post to the address as stated in our Record of Depositors at your own risk within eight (8) Markets Days from the last date and time foracceptance of and payment for the Provisional Rights Shares or such other period as may be prescribed by Bursa Securities.In respect of unsuccessful or partially successful Provisional Rights Shares applications, the full amount or the surplus application monies, as the case may be, will be refunded withoutinterest and shall be despatched to you by ordinary post to the address as stated in our Record of Depositors at your own risk within fifteen (15) Market Days from the last date and timefor acceptance and payment for the Rights Shares.APPLICATION FOR EXCESS RIGHTS SHARESIf you wish to apply for additional Rights Shares in excess of those provisionally allotted to you, you may do so by completing Part II of this RSF (i.e. the “Application for Excess RightsShares” section) in addition to Parts I and III and forwarding it, together with a SEPARATE remittance for the full amount payable in respect of the Excess Rights Shares applied for to ourShare Registrar so as to arrive not later than 9 February 2010 by 5.00 p.m. or such later date and time as our Board in its absolute discretion may decide and announce not less than two(2) Market Days before stipulated date and time. Payment for the Excess Rights Shares applied for shall be made in the same manner described above except that the banker’s draft(s),cashier’s order(s), money order(s) or postal order(s) drawn on a bank or post office in Malaysia must be made payable in favour to “<strong>MISC</strong> EXCESS RIGHTS ISSUE ACCOUNT” and crossed“ACCOUNT PAYEE ONLY” and endorsed on the reverse side with your name, contact number and address in block letters and your CDS account number. The payment must bemade in the exact amount. Any excess or insufficient payment may be rejected at the absolute discretion of our Board. Cheques or any other mode of payments are not acceptable.No acknowledgement will be issued by our Company or our Share Registrar for the receipt of this RSF or the application monies in respect of the Excess Rights Shares application. Proofof time of postage shall not constitute proof of time of receipt by our Share Registrar. However, if your application is successful, the Excess Rights Shares shall be credited into your CDSaccounts and a Notice of Allotment will be despatched to you by ordinary post to the address stated in this RSF at your own risk within eight (8) Markets Days from the last date and timefor acceptance of and payment for the Excess Rights Shares or such other period as may be prescribed by Bursa Securities.In respect of unsuccessful or partially successful Excess Rights Shares applications, the full amount or the surplus application monies, as the case may be, will be refunded withoutinterest and shall be despatched to you by ordinary post to the address stated in this RSF at your own risk within fifteen (15) Markets Days from the last date and time for acceptance ofand payment for the Excess Rights Shares.Our Board reserves the right to allot any Excess Rights Shares, if any, applied under the Excess Rights Shares applications on a fair and equitable basis as it may deem fit and expedientin the best interest of our Company. Our Board also reserves the right to allot Excess Rights Shares in respect of any Excess Rights Share applications, in full or in part, without assigningany reason thereto.SALE/TRANSFER OF THE PROVISIONAL ALLOTMENT OF RIGHTS SHARESThe Rights Issue is renounceable in full or in part. Accordingly, as an entitled shareholder, you may wish to sell/transfer all or part of your entitlement to the Provisional Rights Shares toone (1) or more persons immediately through your stockbroker(s) without first having to request for a split of your Provisional Rights Shares standing to the credit of your CDS account(s).To sell/ transfer all or part of your entitlement to the Provisional Rights Shares, you may sell such entitlement on the open market or transfer such entitlement to such person(s) as may beallowed pursuant to the Rules of Bursa Depository, for the period up to the last date and time for the sale/transfer of the Provisional Rights Shares.In selling/transferring all or part of your Provisional Rights Shares, you need not deliver any document, including this RSF, to your stockbroker(s). You are however advised to ensure thatthere is sufficient Provisional Rights Shares standing to the credit of your CDS accounts for settlement of the sale/transfer.Purchaser(s) or renouncee(s) of the Provisional Rights Shares/transferee(s) may obtain a copy of this RSF from their stockbroker(s), our Share Registrar’s office or our registered office. ThisRSF is also available on Bursa Securities’ website at http://www.bursamalaysia.com.GENERAL INSTRUCTIONS(a) All applicants must sign on the front page of this RSF. All corporate bodies must affix their Common Seals on this RSF.(b) A Malaysian Revenue Stamp (NOT POSTAGE STAMP) of Ringgit Malaysia Ten (RM10.00) must be affixed on this RSF.(c) Any interest or other benefit accruing on or arising from or in connection with any remittancee shall be for the benefit of our Company and our Company shall not be under anyobligation to account for such interest or other benefit to you.(d) The contract arising from the acceptance of the Provisional Rights Shares by you shall be governed by and construed in accordance with the laws of Malaysia, and you shall bedeemed to have irrevocably and unconditionally submitted to the exclusive jurisdiction of the courts of Malaysia in respect of any matter in connection with this RSF and the contractarising therefrom.(e) Our Board reserves the right to accept or reject any acceptance and/or application (if applicable) if the instructions stated herein are not strictly adhered to or which are illegible.(f) The Provisional Rights Shares subscribed by you and/or your renouncee(s) (if applicable) will be credited into you and/or your renouncee(s) (if applicable) respective CDS accountsas stated in this RSF or the exact accounts appearing in Bursa Depository’s Record of Depositors.