Atlas Amplifier PDF - Atlas Van Lines

Atlas Amplifier PDF - Atlas Van Lines

Atlas Amplifier PDF - Atlas Van Lines

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

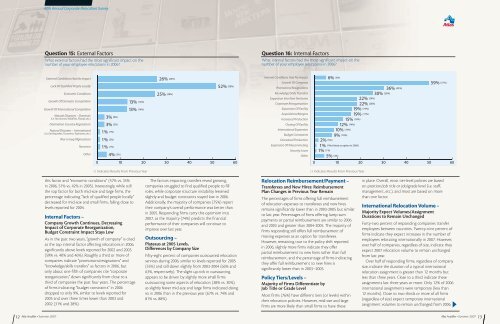

40th Annual Corporate Relocation SurveyQuestion 15: External FactorsWhat external factors had the most significant impact on thenumber of your employee relocations in 2006?Question 16: Internal FactorsWhat internal factors had the most significant impact on thenumber of your employee relocations in 2006?External Conditions Had No ImpactLack Of Qualified People LocallyEconomic ConditionsGrowth Of Domestic CompetitionGrowth Of International CompetitionNatural Disasters – Domestic(i.e. Hurricanes, Wildfires, Floods, etc.)Destination Country RegulationsNatural Disasters – International(i.e. Earthquakes,Tsunamis,Typhoons, etc.)War in Iraq/AfghanistanTerrorismOtherInternal Conditions Had No ImpactGrowth Of CompanyPromotions/ResignationsKnowledge/Skills TransfersExpansion Into New TerritoriesCorporate ReorganizationExpansion Of FacilityAcquisitions/MergersIncreased ProductionClosing Of FacilityInternational ExpansionBudget ConstraintsDecreased ProductionExpansion Of TelecommutingSecurity IssuesOther( ) Indicates Results From Previous Year( ) Indicates Results From Previous Yearthis factor and “economic conditions” (57% vs. 35%in 2006, 51% vs. 42% in 2005). Interestingly, while stillthe top factor for both mid-size and large firms, thepercentage indicating “lack of qualified people locally”decreased for mid-size and small firms, falling close tolevels reported for 2004.Internal Factors –Company Growth Continues, DecreasingImpact of Corporate Reorganization,Budget Constraint Impact Stays LowAs in the past two years, “growth of company” is citedas the top internal factor affecting relocations in 2006,significantly above levels reported for 2002 and 2003(59% vs. 40% and 46%). Roughly a third or more ofcompanies indicate “promotions/resignations” and“knowledge/skills transfers” as factors in 2006, butonly about one-fifth of companies cite “corporatereorganization,” down significantly from close to athird of companies the past four years. The percentageof firms indicating “budget constraints” in 2006dropped to only 9%, similar to levels reported for2005 and over three times lower than 2003 and2002 (31% and 28%).The factors impacting transfers reveal growingcompanies struggled to find qualified people to fillroles, while corporate structure instability lessenedslightly and budget constraints stayed low in 2006.Additionally, the majority of companies (75%) reporttheir company’s overall performance was better thanin 2005. Responding firms carry this optimism into2007, as the majority (74%) predicts the financialperformance of their companies will continue toimprove over last year.Outsourcing –Plateaus at 2005 Levels,Differences by Company SizeFifty-eight percent of companies outsourced relocationservices during 2006, similar to levels reported for 2005(55%) and still down slightly from 2003-2004 (66% and63%, respectively). The slight up-tick in outsourcingappears to be driven by slightly more small firmsoutsourcing some aspects of relocation (38% vs. 30%),as slightly fewer mid-size and large firms indicated doingso in 2006 than in the previous year (67% vs. 74% and81% vs. 88%).Relocation Reimbursement/Payment –Transferees and New Hires: ReimbursementPlan Changes in Previous Year RemainThe percentages of firms offering full reimbursementof relocation expenses to transferees and new hiresremains significantly lower than in 2003-2005 but similarto last year. Percentages of firms offering lump sumpayments or partial reimbursement are similar to 2006and 2003 and greater than 2004-2005. The majority offirms responding still offers full reimbursement ofmoving expenses as an option for transferees.However, remaining true to the policy shift reportedin 2006, slightly more firms indicate they offerpartial reimbursement to new hires rather than fullreimbursement, and the percentage of firms indicatingthey offer full reimbursement to new hires issignificantly lower than in 2003–2005.Policy Tiers/Levels –Majority of Firms Differentiate byJob Title or Grade LevelMost firms (76%) have different tiers (or levels) withintheir relocation policies. However, mid-size and largefirms are more likely than small firms to have thesein place. Overall, most tier-level policies are basedon position/job title or job/grade level (i.e. staff,management, etc.), and most are based on morethan one factor.International Relocation Volume –Majority Expect Volumes/AssignmentDurations to Remain UnchangedForty-two percent of responding companies transferemployees between countries. Twenty-nine percent offirms indicate they expect increases in the number ofemployees relocating internationally in 2007. However,over half of companies, regardless of size, indicate theyexpect 2007 relocation volume to remain unchangedfrom last year.Over half of responding firms, regardless of companysize, indicate the duration of a typical internationalrelocation assignment is greater than 12 months butless than three years. Close to a third indicate theseassignments last three years or more. Only 12% of 2006international assignments were temporary (less than12 months). Close to two-thirds or more of all firms(regardless of size) expect temporary internationalassignment volumes to remain unchanged from 2006.12 <strong>Atlas</strong> <strong>Amplifier</strong> • Summer 2007 <strong>Atlas</strong> <strong>Amplifier</strong> • Summer 2007 13