Critical Illness Plan - My Lowe's Life

Critical Illness Plan - My Lowe's Life

Critical Illness Plan - My Lowe's Life

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

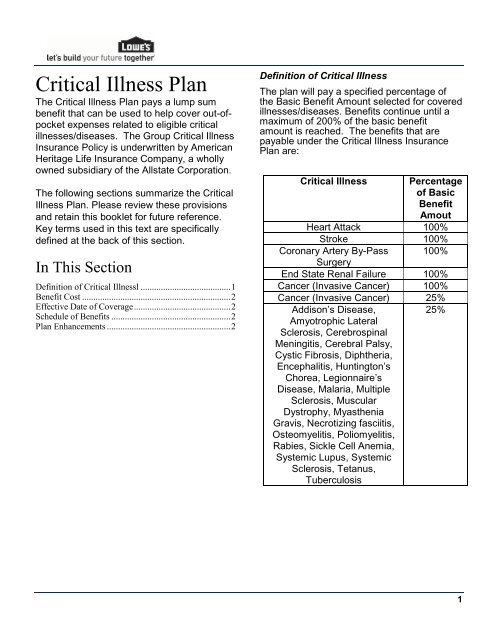

<strong>Critical</strong> <strong>Illness</strong> <strong>Plan</strong>The <strong>Critical</strong> <strong>Illness</strong> <strong>Plan</strong> pays a lump sumbenefit that can be used to help cover out-ofpocketexpenses related to eligible criticalillnesses/diseases. The Group <strong>Critical</strong> <strong>Illness</strong>Insurance Policy is underwritten by AmericanHeritage <strong>Life</strong> Insurance Company, a whollyowned subsidiary of the Allstate Corporation.The following sections summarize the <strong>Critical</strong><strong>Illness</strong> <strong>Plan</strong>. Please review these provisionsand retain this booklet for future reference.Key terms used in this text are specificallydefined at the back of this section.In This SectionDefinition of <strong>Critical</strong> <strong>Illness</strong>l ........................................ 1Benefit Cost .................................................................. 2Effective Date of Coverage ........................................... 2Schedule of Benefits ..................................................... 2<strong>Plan</strong> Enhancements ....................................................... 2Definition of <strong>Critical</strong> <strong>Illness</strong>The plan will pay a specified percentage ofthe Basic Benefit Amount selected for coveredillnesses/diseases. Benefits continue until amaximum of 200% of the basic benefitamount is reached. The benefits that arepayable under the <strong>Critical</strong> <strong>Illness</strong> Insurance<strong>Plan</strong> are:<strong>Critical</strong> <strong>Illness</strong> Percentageof BasicBenefitAmoutHeart Attack 100%Stroke 100%Coronary Artery By-Pass 100%SurgeryEnd State Renal Failure 100%Cancer (Invasive Cancer) 100%Cancer (Invasive Cancer) 25%Addison’s Disease,25%Amyotrophic LateralSclerosis, CerebrospinalMeningitis, Cerebral Palsy,Cystic Fibrosis, Diphtheria,Encephalitis, Huntington’sChorea, Legionnaire’sDisease, Malaria, MultipleSclerosis, MuscularDystrophy, <strong>My</strong>astheniaGravis, Necrotizing fasciitis,Osteomyelitis, Poliomyelitis,Rabies, Sickle Cell Anemia,Systemic Lupus, SystemicSclerosis, Tetanus,Tuberculosis1

charge must be incurred. We will pay thisbenefit regardless of the result of the test.Eligible services are as follows:1. One routine immunization per year fordiphtheria, tetanus, pertussis, polio, rubella,mumps, measles, HIB,hepatitis B, chicken pox, meningococcaldisease; and2. One routine immunization per year duringthe first 24 months of life to prevent invasivepneumococcal disease;and3. One routine immunization per year duringthe 6th through the 23rd months of life toprevent influenza; and4. One inpatient visit for routine newborn care;and5. One routine cervical cancer screening peryear for females; and6. One baseline mammogram for femalesages 35 to 39; and7. One mammogram per year for femalesages 40 and over; and8. One prostate specific antigen test per yearfor males ages 35 and over; and9. One cholesterol test every 5 years; and10. One routine sigmoidoscopy every 3 yearsfor ages 50 and over; and11. One routine hemocult stool check per yearfor ages 50 and over; and12. One Double-contrast barium enema every5 years for ages 50 and over; and13. One Colonoscopy every 10 years for ages50 and over; and14. One routine lab test to include a completeblood count, urinalysis, and TB skin test whenperformed with a routineoffice visit; and15. One office visit per year for the first 6years of a child’s life; and16. One routine office visit every 2 years forages 7 to 34 and one visit per year for ages35 and older; and17. One routine gynecological care exam peryear for females.National Cancer Institute Evaluation.The <strong>Critical</strong> <strong>Illness</strong> Insurance <strong>Plan</strong> may paythe following benefit when a covered personreceives an evaluation or consultation at anNational Cancer Institute (“NCI”) sponsoredcancer center as a result of a previousdiagnosis of a covered internal cancer:1. $500 for the evaluation or consultation; and2. $250 for the transportation and lodging ofthe covered person if the NCI-sponsoredcancer center is more than 100 miles from thecovered person’s home. The reason for suchevaluation or consultation at an NCIsponsoredcancer center must be todetermine the appropriate treatment for acovered cancer. This benefit is paid once perinitial and recurrence diagnosis of invasive orcarcinoma in situ cancer.Transportation BenefitThe <strong>Critical</strong> <strong>Illness</strong> Insurance <strong>Plan</strong> may paythe actual cost, up to $1,500, for round triptransportation coach fare on a common carrieror a personal vehicle allowance of $0.50 permile, up to $1,500, that is required fortreatment of a covered critical illness at ahospital (inpatient or outpatient); or radiationtherapy center; or chemotherapy or oncologyclinic; or any other specialized free-standingtreatment center. Mileage is measured fromthe covered person’s home to the treatmentfacility as described above. The benefit willnot be paid if the covered person lives within100 miles one-way of the treatment facility.We do not pay for: transportation for someoneto accompany or visit the covered personreceiving treatment; visits to a physician’soffice or clinic; or for other services. If thetreatment is for a covered child and commoncarrier travel is necessary, we will pay thisbenefit for up to 2 adults to accompany thechild.3

Lodging BenefitThe <strong>Critical</strong> <strong>Illness</strong> Insurance <strong>Plan</strong> may pay$60 per day when a covered person receivestreatment for a critical illness on an outpatientbasis. The benefit is for lodging at a motel,hotel, or other accommodations acceptable tous. This benefit is limited to 60 days percalendar year. This benefit is not payable forlodging occurring more than 24 hours prior totreatment or for lodging occurring more than24 hours following treatment. Outpatienttreatment must be received at a treatmentfacility more than 100 miles from the coveredperson’s home.ExclusionsThe <strong>Critical</strong> <strong>Illness</strong> Insurance <strong>Plan</strong> does notpay benefits for any critical illness due to, orresulting from (directly or indirectly):1. any act of war, whether or not declared,active participation in a riot or civil disorder,insurrection or rebellion; or2. intentionally self-inflicted injuries; or3. engaging in an illegal occupation orcommitting or attempting to commit a felony;or4. attempted suicide, while sane or insane; or5. being under the influence of narcotics orany other controlled chemical substanceunless administered upon the advice of aphysician; or6. participation in any form of aeronauticsexcept as a fare-paying passenger in alicensed aircraft provided by a common carrierand operating between definitely establishedairports.Pre-existing ConditionDefinition and LimitationPre-existing Condition DefinitionFor purposes of the benefits available in the<strong>Plan</strong>, pre-existing condition means any criticalillness for which the covered person hassought medical advice or treatment in the 12months immediately before the effective dateof their coverage. No diagnosis is required fora pre-existing condition. Preventive care andmaintenance treatment is not treatment of acritical illness, even if such care andmaintenance would have occurred but for thecovered person being diagnosed previouslywith the critical illness.Pre-existing Condition LimitationSome critical illness benefits are subject to thepre-existing condition limitation. For thesebenefits, if a covered person has a disease orphysical condition that meets the definition ofpre-existing condition, a benefit will bepayable for that disease or physical conditiononly if the date of diagnosis, as defined in thisbenefit, occurs more than 12 months after theeffective date of his or her coverage.Some critical illness benefits are never paid ifthe critical illness meets the definition of preexistingcondition. For those benefits, if acovered person has a critical illness thatmeets the definition of pre-existing condition,that critical illness is excluded from coveragefor that covered person.Major Organ TransplantLimitations and ExclusionsIn addition to the Limitations and Exclusionsshown above, the following also applies to theMajor Organ Transplant Benefits.If a covered person has been recommendedby a physician to have a major organtransplant prior to the effective date4

of the person’s coverage, coverage for thattransplant is excluded and no benefit will bepaid for the transplant of thatorgan.Pre-existing Condition LimitationIf a covered ;person has a disease or physicalcondition that meets the definition of preexistingcondition, a benefit will be payable forthat disease or physical condition only if thedate of diagnosis, as defined in the MajorOrgan Transplant Benefits, occurs more than12 months after the effective date of his or hercoverage.5