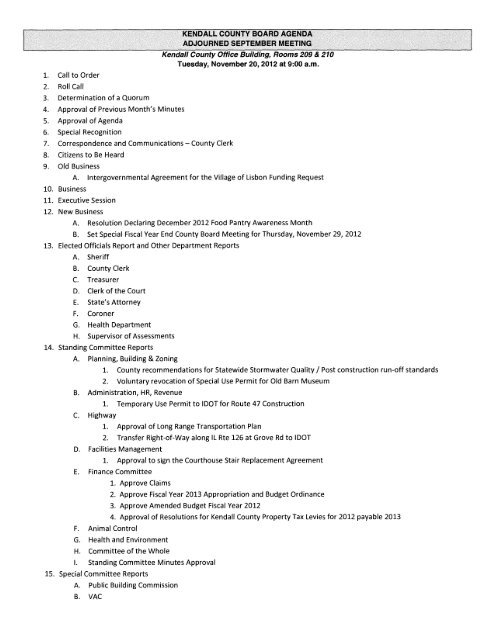

kendall county board agenda adjourned september meeting

kendall county board agenda adjourned september meeting

kendall county board agenda adjourned september meeting

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Member Martin moved to allow the Sheriff to sign the HIDT A Furniture Agreement. Member Hafenrichter secondedthe motion. Chairman Purcell asked for a roll call vote on the motion. All members present voting aye. Motioncarried.2013 Holiday ScheduleMember Hafenrichter moved to approve the 2013 Holiday Schedule. Member Flowers seconded the motion.Chairman Purcell asked for a voice vote on the motion. All members present voting aye except Vickery and Purcell.Motion carried.KENDALL COUNTY2013HOLIDAY SCHEDULEHOLIDAYNEW YEAR'S DAYMARTIN LUTHER KING, JR. DAYLINCOLN'S BIRTHDAYWASHINGTON'S BIRTHDAYSPRING HOLIDAYMEMORIAL DAYINDEPENDENCE DAYLABOR DAYCOLUMBUS DAYVETERAN'S DAYTHANKSGIVING DAYDAY FOLLOWING THANKSGIVINGCHRISTMAS DAYOBSERVED ONTUESDAY, JANUARY 1, 2013MONDAY, JANUARY 21,2013TUESDAY,FEBRUARY12,2013MONDAY, FEBRUARY 18, 2013FRIDAY, MARCH 29, 2013MONDAY, MAY 27,2013THURSDAY, JULY 4,2013MONDAY, SEPTEMBER 2,2013MONDAY, OCTOBER 14, 2013MONDAY, NOVEMBER 11,2013THURSDAY, NOVEMBER 28, 2013FRIDAY, NOVEMBER 29, 2013WEDNESDAY, DECEMBER 25, 2013Senior Services Proclamation DayMember Flowers moved to approve the Senior Services Proclamation. Member Wehrli seconded the motion.Chairman Purcell asked for a voice vote on the motion. All members present voting aye. Motion carried.PROCLAMATIONWHEREAS, on August 31, 1973, Senior Services Associates, Inc. was established as a non-profit agency dedicatedto sustaining and improving the quality of life for individuals and their caregivers by providingaccess to the social services they need. They are dedicated to preserving independence,promoting mental and physical well-being and protecting the rights and dignity of the seniors theyserve. andWHEREAS, Senior Services Associates, Inc. was designated by the Illinois Department on Aging to be the CareCoordination Unit for Kane, Kendall, and McHenry Counties. There is a total of five offices locatedin McHenry, Crystal Lake, Elgin, Aurora, and Yorkville serving over 27,000 seniors in 2011; andWHEREAS, Senior Services Associates, Inc. links seniors and their families with the resources they need to helpolder adults live the highest quality of life possible in their own homes as long as safelymanageable; and to assist seniors and their families in making choices and decisions when otheroptions must be considered; andWHEREAS, As Care Coordination Units (CCU's), Senior Services Associates, Inc. is the "one stop shop" for servicesfor adults, 60 years and older. In order to best advocate for seniors in the community, SeniorServices Associates, Inc. is a member organization of many organizations and agencies includingthe Community Care Advisory Committee, Senior Citizen Service committee, American SOCiety onAging, and a number of <strong>county</strong> and local organizations.NOW, THEREFORE, I, John Purcell, Board Chair, Kendall County Illinois, do hereby designate Friday, October

John PurcellKendall County Board ChairKencom Intergovernmental Agreement19 th , 2012 as Senior Services Associates, Inc. DayIN WITNESS WHEREOF, I have hereunto set my hand this16th Day of October, 2012Board members received a copy of the agreement to review; it must be approved by December 1 , 2012.Village of Lisbon Funding RequestCounty Administrator, Jeff Wilkins stated that the City of Yorkville's agreement was discussed and if the <strong>board</strong> was toapprove financing $400,000 it would be taken from the General Fund Special Reserve. Board members discussedthe fact that there is guaranteed income to pay the <strong>county</strong> back. They discussed whether or not to charge interestand whether or not the <strong>county</strong> could take part of the property tax revenue.Member Martin moved to direct the State's Attorney's Office to draw up an Intergovernmental Agreement with Lisbonthat includes no interest and a penalty clause after five years. Member Davidson seconded the motion. ChairmanPurcell asked for a roll call vote on the motion. All members present voting aye except Shaw who abstained. Motioncarried.SheriffNothing to report.County ClerkELECTED OFFICIALS REPORT AND OTHER DEPARTMENT REPORTSRevenue Report 9/1/12-9130112Line Item Fund RevenueCounty Clerk Fees $ 942.50County Clerk Fees - Marriage License $ 1,350.00County Clerk Fees - Civil Union $ 30.00County Clerk Fees - Misc $ 1,482.50County Clerk Fees - Recording $ 31,197.0001010061205 Total County Clerk Fees $ 35,002.0001010001185 County Revenue $ 20,064.7538010001320 Doc Storage $ 18,892.5051010001320 GIS Mapping $ 31,875.0037010001320 GIS Recording $ 3,983.0001010001135 Interest $ 37.0301010061210 Recorder's Misc $ 6,161.7581010001320 RHSP/Housing Surcharge $ 16,965.00CK # 17175 To KC Treasurer $ 132,981.03

TreasurerOffice of Jill FerkoKendall County Treasurer & Collector111 W. Fox Street Yorkville, IL 60560Kendall Counb! General FundQUICK ANALYSIS OF MAJOR REVENUES AND TOTAL EXPENDITURESFOR TEN MONTHS ENDED 09/30/2012Annual 2012 YTD 2012 YTD 2011 YTD 2011 YTDREVENUES' Budget Actual % ~ ~Personal Property Repl. Tax $315,000 $280,277 88.98% $315,888 103.91%State IncomeTax $1,800,000 $1,946,724 108.15% $1,786.481 127.54%Local Use Tax $340,000 $313,380 92.17% $323,345 148.97%State Sales Tax $970,000 $789,349 81.38% $828,484 118.35%County ClerkFees $380,000 $357,591 94.10% 1327,358 88.15%Circuit ClerkFees $1,300,000 $1,084,635 83.43% $1,104,021 78.88%Fines & ForeitsiSt Atty. $560,000 $437,644 78.15% $478,830 85.S1%Building andZoning $35,000 $39,005 111.44% 142.538 141.79%Interest Income $50,000 $24,530 49.06% $47,_ 59.96%Health Insurance - Empl. Ded. $981,698 $914,762 93.18% $802,802 94.02%1/4 Cent SalesTax $2,400,000 $2,036,107 84.84% $1,991.281 89.34%County Real Estate Transf Tax $170,000 $192,783 113.40% $189.403 108.86%Correction Dept. Board & Care $750,000 $687,543 91.67% $833,420 84.27%Sheriff Fees $450,000 $635,952 141 .32% $282,494 43.48%TOTALS $10,501,698 $9,740,284 92.75% ",153,117 .... ".84~Public Safety Sales Tax $4,000,000 $3,617,637 90.44% S3,5817T7 8U4~Transportation Sales Tax $4,000,000 $3,617,637 90.44% ~,H1.1J7 • .54%

Angela Zubko explained that this is a major amendment to the special use for the subdivision to change the privatehorse facility that allows only <strong>board</strong>ers that live within the subdivision to a private facility that also allows <strong>board</strong>erswho do not live in the subdivision.Wade Joyner who represents the petitioner pointed out that if they do not allow <strong>board</strong>ers outside of the subdivisionthen the facility would not be economically viable.Chairman Purcell asked for a roll call vote on the motion. All members present voting aye except Member Purcell.Motion carried 9-1.ORDINANCE # 2012 - 22GRANTING AN AMENDMENT TO RESCIND ORDINANCE 2006-29 & AMEND AN EXISTING SPECIAL USE FORTHEOPERATION OF A CENTRAL HORSE STABLE AND STABLE MANAGER HOUSINGFOR SUCCESS IN THE SUBURBS, INC.WHEREAS, Success in the Suburbs, Inc. filed a petition for a Special Use within the RPD-1 zoning district for an 8.5acre property located on, and identified as Lot 17 of the Equestrian Estates at Legacy Farm Subdivision, commonlyknown as 17 J Ashe Road, (PIN's#02-06-102-009 & 01-01-200-020); andWHEREAS, Ordinance 2006-29 allowed for construction and operation of a central horse stable serving the equine<strong>board</strong>ing needs of the homeowners and guests of homeowners of the Equestrian Estates at Legacy FarmSubdivision, as well as providing for the housing needs of the managers of the central horse stable; andWHEREAS, said petition is to amend the existing special use to change the private horse facility from allowing only<strong>board</strong>ers who live within the Subdivision into a private horse facility that also allows <strong>board</strong>er who do not live within theSubdivision; andWHEREAS, said property is legally described as:PARCEL 1:LOT 17, EQUESTRIAN ESTATES OF LEGACY FARMS SUBDIVISION, ACCORDING TO THE PLATTHEREOF RECORDED ON JUNE 9, 2006, AS DOCUMENT NUMBER 200600017122, AND PERCORRECTION INSTRUMENTS RECORDED MARCH 27, 2007 AS DOCUMENT 200700010031 AND ASDOCUMENT 200700010032 IN LITTLE ROCK AND BRISTOL TOWNSHIPS, KENDALL COUNTY,ILLINOIS.PARCEL 2:EASEMENT FOR THE BENEFIT OF PARCEL 1 FOR INGRESS AND EGRESS OVER LOT 19 (PRIVATEROAD) IN EQUESTRIAN ESTATES AT LEGACY FARMS, AFORESAID, AS CREATED BY INSTRUMENTRECORDED JUNE 9, 2006, AS DOCUMENT 200600017122 AND PER CORRECTION INSTRUMENTSRECORDED MARCH 27, 2007 AS DOCUMENT 200700010031 AND AS DOCUMENT 200700010032.WHEREAS, all procedures required by the Kendall County Zoning Ordinance were followed including notice forpublic hearing, preparation of the findings of fact, and recommendation for approval by the Special Use HearingOfficer on September 10,2012; andWHEREAS, on February 21, 2006 the Kendall County Board approved the necessary ordinance rezoning theproperty to RPD-1 and granted a Special Use for a stable to house horses and managers quarters to pursuant to theterms and conditions as specified per Ordinance #2006-05; andWHEREAS, condition number 1 of said ordinance granting the Special Use set a maximum limit of thirty-six (36)horses to be stored in said stable; andWHEREAS, on April 18, 2006 the Kendall County Board approved an ordinance reducing the maximum number ofhorses previously approved to be stored in said stable to not more than twenty-four (24) horses;WHEREAS, the Kendall County Board has considered the findings and recommendation of the Hearing Officer andfinds that said petition is in conformance with the provisions and intent of the Kendall County Zoning Ordinance; andWHEREAS, this special use shall be treated as a covenant running with the land and is binding on the successors,heirs, and assigns of the property owner as to the same special use conducted on the property; and

NOW, THEREFORE, BE IT ORDAINED, that the Kendall County Board hereby repeals Kendall County Ordinance#06-29 in its entirety and grants approval of a special use zoning permit to amend their existing special use permit tochange the private horse facility from allowing only <strong>board</strong>ers who live within the Subdivision into a private horsefacility that also allows <strong>board</strong>er who do not live within the Subdivision subject to the following conditions:1. A maximum of twenty-four (24) horses are allowed to be housed in the stable.2. Manure storage and disposal is to be according to a proposed manure storage and disposal plan approvedby the Kendall County Department of Environmental Health.3. The facility shall be exclusively used by the owners, trainers, <strong>board</strong>ers and their guests. In keeping with theprivate and quiet nature intended for the residential community, activities at the facility should never be solarge or noisy or late that it would be disruptive to residents of the Subdivision. If the facility hosts anoutdoor event exceeding fifty (50) guests, the owner, shall provide each of the property owners andHomeowners Association with at least thirty (30) days notice of the event. The Owner shall host no morethan two (2) such outdoor events a year. The Owner has no intention of hosting any activity with thegeneral public that would intentionally invite so much traffic that parking would spill off the stable property onto the private residential streets. Events at the stable will be consistent with the image of a small privateequestrian club.4. As a private equestrian facility, no school horses will be available for rent to the general public. Training isavailable to the owners, trainers, <strong>board</strong>ers and their guests, only.5. A maximum of two (2) adults and their immediate family can live in each of the two stable manager housingunits inside the stable.6. Private Road Maintenance: The Owner will solely maintain that portion of the road that is on Lot 17, with thatportion being shown on the Final Plat for Equestrian Estates at Legacy Farms Subdivision. TheHomeowners Association or property owners will maintain the remaining roads within the Subdivision. TheOwner will pay 29% of the cost of maintaining that portion of the roads running from Ashe Road to theturnabout, the turnabout road, and from the turnabout to that portion of the road that intersects with Lot 17.The Owner will notify all <strong>board</strong>ers that the residential roads are for private use only. With all things beingequal with other service providers, including price and quality of service, the Homeowners Associationand/or residents agrees to allow the Owner to provide landscaping and road maintenance services.7. Trails: The Homeowners Association or property owners will be responsible for maintaining any trails in Lot18. The Owner will be responsible for 29% of the cost to maintain the trails in Lot 18 and the HomeownersAssociation or property owners will be responsible for 71 % of the cost. With all things being equal withother service providers, including price and quality of service, the Homeowners Association or propertyowners agree to allow the Owner to provide trail improvement and maintenance services.8. Insurance: The Owner will maintain a comprehensive general liability policy in the minimum amount of$1,000,000.00. The Homeowners Association and/or property owners will be named as an additionalinsured.9. Lighting: The outdoor arena shall not be lighted. The existing lighting on the south side of the stable willonly be used before 8pm or in case of emergency.10. Sale of the Stable: In the event the Owner lists the property for sale, the Owner shall notify the HomeownersAssociation and property owners of such listing within five (5) business days.11. Stable Workers: All employees or independent contractors shall be retained by the Owner.12. There shall be no signage on the property indicating the stable accepts commercial stabling of horses. TheOwner may post upon Homeowners Association and/or property owners approval and/or request a smalldiscreet sign on Lot 17, at the entrance to the facility.13. No signs are permitted on the eastern portion of the outdoor riding arena.14. Horse trailers: Horse trailers shall be parked west of the outdoor arena.15. No rodeo, barrel racing or reining shows, but practicing such activities is a permitted use.Failure to comply with the terms of this ordinance may be cited as a basis for amending or revoking this special usepermit.IN WITNESS OF, this Ordinance has been enacted by the Kendall County Board this 18 th day of September, 2012.Attest:Kendall County ClerkDebbie GilletteKendall County Board ChairmanJohn Purcell

Petition 12-32 Semper Fi Yard ServicesMember Martin made a motion to approve Petition 12-32 Granting a special use for 1996 Cannonball trail, Semper FiYard Services Inc. Member Wehrli seconded the motion. Chairman Purcell asked for a roll call vote on the motion.All members present voting aye except Member Koukol who abstained. Motion carried.ORDINANCE NUMBER 2012 - 23GRANTING A SPECIAL USE FOR1996 CANNONBALL TRAILSEMPER FI YARD SERVICES INC.WHEREAS, Semper Fi Yard Services Inc. has filed a petition for a Special Use within the A-1 Agricultural ZoningDistrict for a 5.2 acre property located on the east side of Cannonball Trail about 0.5 miles south of Galena Road,commonly known as 1996 Cannonball Trail (PIN# 02-15-101-003), in Bristol Township, and;WHEREAS, said petition is to allow the operation of a landscape business and live in the house; andWHEREAS, said property is currently zoned A-1 Agricultural; andWHEREAS, said property is legally described as:THAT PART OF THE SOUTHWEST QUARTER OF SECTION 10, TOWNSHIP 37 NORTH, RANGE 7 EAST OFTHE THIRD PRINCIPAL MERIDIAN AND THAT PART OF THE NORTHWEST QUARTER OF SECTION 15 ,TOWNSHIP AND RANGE AFORESAID DESCRIBED AS FOLLOWS: COMMENCING AT THE SOUTWHESTCORNER OF SAID SOUTHWEST QUARTER, THENCE SOUTHEASTERLY ALONG A LINE WHICH IF EXTENDEDWOULD INTERSECT THE NORTHLY LINE OF THE FORMER LANDS OF CHARLES HUNT AT A POINT OF SAIDNORTHERLY LINE WHICH IS 1551.80 FEET WESTERLY OF THE WEST LINE OF A TRACT OF LANDCONVEYED BY NELSON C. RIDER TO JERRY W. RIDER BY A WARRANTY DEED RECORDED NOVEMBER 29,1911 IN BOOK 66 DEEDS, PAGE 25 AND DEPICTED IN THE PLAT BOOK 1 AT PAGE 62, A DISTANCE OF938.61 FEET TO THE CENTER LINE OF CANNONBALL TRAIL, FOR A POINT OF BEGINNING , THENCESOUTHEASTERLY ALONG THE LAST DESCRIBED COURSE EXTENDED, 447.72 FEET TO SAID NORTHERLYLINE; THENCE ESATERLY ALONG SAID NOTEHRLY LINE, WHICH FORMS AN ANGEL OF 160°49' 30" WITHTHE LAST DESCRIBED COURSE, MEASURED CLOCKWISE THEREFROM, 296.83 FET; THENCE NORTHERLYAT RIGHT ANGLES TO THE LAST DESCRIBED COURSE, 309.14 FEET; THENCE NORTHWESTERLY ALONG ALINE WHICH FORMS AN ANGLE OF 132°19'35" WITH THE LAST DESCRIBED COURSE, MEASUREDCLOCKWEISE THEREFROM, 386.56 FEET TO THE CENTER LINE OF CANNONBALL TRAIL; THENCESOUTHWESTERLY ALONG SAID CENTER LINE TO THE POINT OF BEGINNING IN BRISTOL TOWNSHIPKENDALL COUNTY ILLINOIS AND CONTAINING 5.727 ACRES.WHEREAS, all procedures required by the Kendall County Zoning Ordinance were followed including notice forpublic hearing, preparation of the findings of fact in accordance with Section 13.07.J of the Zoning Ordinance, andrecommendation for approval by the Special Use Hearing Officer on October 1, 2012; andWHEREAS, the findings of fact were approved as follows:That the establishment, maintenance, and operation of the special use will not be detrimental to, or endanger, thepublic health, safety, morals, comfort, or general welfare. All equipment will be stored inside the structuresand shall not be detrimental or endanger the public health, safety, morals, comfort or general welfare.That the special use will not be injurious to the use and enjoyment of other properties in the immediate vicinity forthe purposes already permitted, nor substantially diminish and impair property values within the neighborhood.The Zoning classification of property within the general area of the property in question shall be considered indetermining consistency with this standard. The proposed use shall make adequate provisions for appropriatebuffers, landscaping, fencing, lighting, building materials, open space and other improvements necessary toinsure that the proposed use does not adversely impact adjacent uses and is compatible with the surroundingarea and/or the County as a whole. All property surrounding this piece of land is farm land. The petitionerswill still be using the property as a landscape business which is compatible with agricultural farming. Thezoning classification within the general area is still agricultural.

WHEREAS, Kendall County regulates development under authority of its Zoning Ordinance and related ordinances;andWHEREAS, the Kendall County Board amends these ordinances from time to time in the public interest; andWHEREAS, all administrative procedures for amendments have been followed including a Public Hearing held beforethe Kendall County Zoning Board of Appeals on October 1 , 2012;NOW. THEREFORE. BE IT ORDAINED, the Kendall County Board hereby amends Section 9.02.C- "B-1 LocalShopping District- Special Uses", 9.03.C- "B-2 General Business District- Special Uses", Section 9.04.C "B-3Highway Business District- Special Uses", Section 9.0S.C "B-4 Commercial Recreation- Special Uses", Section9.07.C "B-6 Office & Research Park District- Special Uses", Section 10.01.C "M-1 Limited Manufacturing DistrictSpecial Uses" & Section 10.02.C "M-2 Heavy Industrial District- Special Uses" of the Kendall County ZoningOrdinance as provided:Sections 9.02.C, 9.03.C, 9.04.C, 9.0S.C & 9.07.Ca) Places of Worship subject to the following conditions:a. The height for the towers and steeples shall not exceed seventy-five (7S) feet and not more thanforty-five (4S) feet for the main structure.b. Other related uses, such as school, child day care services, kindergartens, <strong>meeting</strong> facilities shallbe permitted to the extent that the activity is otherwise permitted, and shall be subject to allapplicable regulations, including parking.c. Off-street parking, lighting and loading shall be provided as required or permitted in Section 11.00.IN WITNESS OF, this Ordinance has been enacted by the Kendall County Board this 16 th day of October, 2012.Attest:Kendall County ClerkDebbie GilletteKendall County Board ChairmanJohn PurcellPetition 12-36 Allow Performing Arts CentersMember Martin made a motion to approve Petition 12-36 amendment to the Zoning Ordinance to allow PerformingArts Centers. Member Wehrli seconded the motion. Chairman Purcell asked for a roll call vote on the motion. Allmembers present voting aye except Member Davidson. Motion carried 9-1.ORDINANCE # 2012-25AMENDMENT TO THE KENDALL COUNTY ZONING ORDINANCETO ALLOW PERFORMING ARTS CENTERSWHEREAS, Kendall County regulates development under authority of its Zoning Ordinance and related ordinances;andWHEREAS, the Kendall County Board amends these ordinances from time to time in the public interest; andWHEREAS, all administrative procedures for amendments have been followed including a Public Hearing held beforethe Kendall County Zoning Board of Appeals on October 1, 2012.NOW. THEREFORE. BE IT ORDAINED, the Kendall County Board hereby amends Section 3.02- "Definitions",Section 7.01.0 "A-1 Agricultural- Special Uses", Section 9.04.C "B-3 Business District- Special Uses", Section 9.0S.B"B-4 Commercial Recreation- Permitted Uses" & Section 1 0.01.C & 10.02.C "M-1 Limited Manufacturing District & M-2 Heavy Industrial District- Special Uses- Any use which may be allowed as a special use in the B-3 or B-4 BusinessDistricts ... " of the Kendall County Zoning Ordinance as provided:Section 3.02:PERFORMING ARTS CENTER. The performing arts are art forms in which artists use their body or voice toconvey artistic expression. Examples of performing arts may include: music, dance, fitness training, theatre arts,technical arts, online lessons, a performing arts preschool, etc. Regulated Uses that are specified in Section 4.16 ofthe Zoning Ordinance are specifically excluded from this category.Section 7.01.0, 9.04.C & 9.0S.Bb) Performing arts center subject to the following conditions:

THAT PART OF THE NORTHWEST QUARTER OF SECTION 16 AND THE NORTHEAST QUARTER OF SECTION17, TOWNSHIP 37 NORTH, RANGE 7 EAST OF THE THRID PRINCIPAL MERIDIAN, DESCRIBED AS FOLLOWS:COMMENCING AT THE NORTHEAST CORNER OF SAID NORTHEAST QUARTER; THENCE WESTERLYALONG THE NORTH LINE OF SAID NORTHEAST QUARTER, 28.74 FEET TO THE FORMER WESTERLY RIGHTOF WAY LINE OF ILLINOIS STATE ROUTE NUMBER 47; THENCE WESTERLY ALONG SAID NORTH LINE,213.30 FEET; THENCE SOUTHERLY PARALLEL WITH THE EAST LINE OF SAID NORTHEAST QUARTER,721.70 FEET; THENCE EASTERLY, PARALLEL WITH THE SOUTH LINE OF THE NORTHEAST QUARTER OFSAID NORTHEAST QUARTER, 0.43 FEET TO A LINE DRAWN PARALLE WITH AND 241.60 FEET (ASMEASURED ALONG SAID NORTH LINE) EAST OF SAID EAST LINE FOR A POINT OF BEGINNING; THENCESOUTHERLY ALONG SAID PARALLEL LINE, 404.76 FEET TO A LINE DRAWN PARALLEL WITH AND 200.0FEET (AS MEASURED ALONG SAID EAST LINE) NORTH OF SAID SOUTH LINE; THENCE EASTERLY ALONGSAID PARALEL LINE, 320.29 FET TO THE PRESENT WESTERLY RIGHT OF WAY LINE OF SAID ROUTE 47, ASDESCRIBED IN A CONVEYANCE RECORDED JANUARY 8,1991, AS DOCUMENT NUMBER 910137; THENCENORTHERLY ALONG SAID PRESENT WESTERLY RIGHT OF WAY LINE, 407.64 FEET TO A LINE DRAWNEASTERLY, PARALLEL WITH SAID SOUTH LINE FROM THE POINT OF BEGINNING; THENCE WETERL Y,PARALLEL WITH SAID SOUTH LINE, 259.13 FEET TO THE POINT OF BEGINNING, IN BRISTOL TOWNSHIP,KENDAL COUNTY, ILLINOIS.WHEREAS, all procedures required by the Kendall County Zoning Ordinance were followed including notice forpublic hearing, preparation of the findings of fact in accordance with Section 13.07.J of the Zoning Ordinance, andrecommendation for approval by the Special Use Hearing Officer on October 1, 2012; andWHEREAS. the findings of fact were approved as follows:That the establishment, maintenance, and operation of the special use will not be detrimental to, or endanger, thepublic health, safety, morals, comfort, or general welfare. All classes will be conducted inside the structures andshall not be detrimental or endanger the public health, safety, morals, comfort or general welfare.That the special use will not be injurious to the use and enjoyment of other properties in the immediate vicinity for thepurposes already permitted, nor substantially diminish and impair property values within the neighborhood. TheZoning classification of property within the general area of the property in question shall be considered in determiningconsistency with this standard. The proposed use shaH make adequate provisions for appropriate buffers,landscaping, fencing, lighting, building materials, open space and other improvements necessary to insure that theproposed use does not adversely impact adjacent uses and is compatible with the surrounding area and/or theCounty as a whole. To the north and south are residential properties, to the east is a commercial barn and tothe west is farm land. The petitioners will still be using the property as residential with the business in theexisting buildings. The zoning classification within the general area is still agricultural with business'moving in.That the establishment of the special use will not impede the normal and orderly development and improvement ofsurrounding property for uses permitted in the district. The subdivision development included the equestrianfacility and special use. Modifying the use to allow for <strong>board</strong>ing of horses by non-residents has no alteredeffect on the residential properties.That adequate utilities, access roads, drainage, and/or other necessary facilities have been or are being provided.The petitioners propose to widen the entrance onto Route 47 and no new access roads are being proposed.The petitioners are working with the Health Department with regard to an adequate septic system and allother utilities and facilities exist.That adequate measures have been or will be taken to provide ingress and egress so designed as to minimize trafficcongestion in the public streets. The petitioners propose to widen the entrance onto Route 47 and no newaccess roads are being proposed.That the special use shaH in all other respects conform to the applicable regulations of the district in which it islocated, except as such regulations may in each instance be modified by the County Board pursuant to therecommendation of the Hearing Officer. The petitioners conform to all applicable regulations of the district andare not requesting any variances.

That the special use is consistent with the spirit of the Land Resource Management Plan and other adopted County ormunicipal plans and policies. The LRMP and the future land use plan of the City of Yorkville call for thisproperty to be commercial, this use proposed transitions the property from residential to commercial exceptthe petitioners still wish to live in the home.WHEREAS, the Kendall County Board has considered the findings and recommendation of the Hearing Officer andfinds that said petition is in conformance with the provisions and intent of the Kendall County Zoning Ordinance; andWHEREAS, this special use shall be treated as a covenant running with the land and is binding on the successors,heirs, and assigns as to the same special use conducted on the property; andNOW. THEREFORE. BE IT ORDAINED. that the Kendall County Board hereby grants approval of a special usezoning permit to operate a performing arts center in accordance to the submitted Site Plan included as "Exhibit Anattached hereto and incorporated herein subject to the following conditions:1. No events may be hosted at this site that would require more parking than provided.2. No other manufacturing use can be performed on this site when this special use is in existence.3. Allow a lighted sign on the property.4. Follow the parking ratio of one (1) parking space shall be provided per each two hundred (200) square feetAND one per employee. The currently building is 4500 square feet and predict 6 employees so 28 parkingstalls will be needed before they open including 2 handicapped stalls5. The events to be held on the property will be community relationship events6. Allow a gravel parking lot for 2 (two) years. Two years from the date of the approving ordinance the gravelparking lot must be asphalted.Failure to comply with the terms of this ordinance may be cited as a basis for amending or revoking this special usepermit.IN WITNESS OF. this ordinance has been enacted on October 16, 2012.Attest:Debbie GilletteKendall County ClerkJohn PurcellKendall County Board ChairmanMember Vickery recognized Sylvia from Comed who worked to help Grainco FS get its power back up.BREAKRECONVENEEXECUTIVE SESSIONMember Martin made a motion to go into Executive Session for collective negotiating matters between the publicbody and its employees or their representatives. or deliberations concerning salary schedules for one or moreclasses of employees. the purchase or lease of real property for the use of the public body. including <strong>meeting</strong>s heldfor the purpose of discussing whether a particular parcel should be acquired. for litigation. when an action against.affecting or on behalf of the particular public body has been filed and is pending before a court or administrativetribunal and the appointment. employment. compensation. discipline. performance or dismissal of specific employeesof the public body or legal counsel for the public body. Member Wehrli seconded the motion. Chairman Purcellasked for a roll call vote on the motion. All members present voting aye. Motion carried.Member Flowers was excused at 11 :32am.Administration, HR, RevenueRECONVENEMember Hafenrichter reviewed the October 9, 2012 minutes in the packet.Property, Liability and Workers Compensation Policy Renewal

Member Hafenrichter made a motion to authorize the property. liability and workers compensation policy renewal for2012·2013. Member Wehrli seconded the motion. Chairman Purcell asked for a roll call vote on the motion. Allmembers voting aye except Member Purcell who voted present. Motion carried.Purchase Order for Transportation VehiclesCounty Administrator, Jeff Wilkins explained the bids received for transit vehicles which turned out to be less thanexpected.Member Hafenrichter made a motion to approve the purchase order for transportation vehicles. Member Koukolseconded the motion. Chairman Purcell asked for a roll call vote on the motion. All members present voting aye.Motion carried.HighwayMember Davidson reviewed the minutes in the packet for the October 9, 2012 <strong>meeting</strong>.NICOR Agreement for Relocation of Gas MainMember Davidson made a motion to have the County Chairman sign the NICOR Agreement for the relocation of GasMains at 126 and Grove Road in the amount of $120.000 from the Transportation Sales Tax Fund. Member Wehrliseconded the motion. Chairman Purcell asked for a roll call vote on the motion. All members present voting aye.Motion carried.Jim George & Sons Default of ContractsMember Davidson made a motion to declare Jim George & Sons default of 4 Township Contracts. Member Martinseconded the motion. Chairman Purcell asked for a roll call vote. All members present voting aye except MemberDavidson who voted present. Motion carried.Jim George & Sons Disposition of Proposal Guarantee ChecksMember Davidson made a motion to return the $12.000 bond fee back to Jim George & Sons. Member Wehrliseconded the motion. Chairman Purcell asked for a roll call vote. All members present voting aye except MembersShaw and Vickery. Motion carried 7-2.Facilities ManagementMember Shaw reviewed the October 1, 2012 minutes in the packet. Jim Smiley also reviewed the minutes of the<strong>meeting</strong>. The minutes reflected that Member Koukol was absent but also that he made a motion - minutes need tobe amended.FinanceCLAIMSMember Vickery moved to approve the claims submitted in the amount of $2.245.663.26. Member Martin secondedthe motion.COMBINED CLAIMS: FClT MGMT $81,432.01, B&Z $840.35, CO ClK & REC $525.73, ELECTION $2,850.00, EDSRV REG $5,963.15, SHRFF $6,017.99, CRRCTNS $12,740.62, EMA $420.43, CRCT CT ClK $938.72, CRCT CTJDG $6,769.61, CRNR $1,056.53, CMB CRT SRV $20,625.22, PUB DFNDR $2,885.16, ST ATTY $3,266.01, TRSR$2,398.43, EMPl Y Hl TH INS $31,545.36, PPPOST $72.99, OFF OF ADM SRV $4,008.94, GNRl INS & BNDG$98.00, CO BRD $127.10, TECH SRV $2,852.71, ECON DEV $34.97, CO HWY $16,316.36, CO BRDG $22,457.23,TRNSPRT SALES TX $658,908.39, Hl TH & HMN SRV $82,508.21, FRST PRSRV $18,878.80, KEN COM $285.97,ANMl CNTRl EXP $289.26, CO RCDR DOC STRG $25,500.00, SHRFF PREY $1,599.50, DRG ABS EXP $609.60,HIDTA $389,831.55, COMM FND $865.18, CRT SEC FND $1,291.60, LAW lBRY $747.52, CRT AUTOMA$20,621.38, PRBTN SRV $13,732.46, SHRFF FTA $1,110.63, VAC $4,351.44, SHRFF VEH FND $5,834.20, FPBND SERV 2007 $791 ,793.76, CRTHSE EXPNSN $660.19Chairman Purcell asked for a roll call vote on the motion. All members present voting aye except Purcell who votedpresent. Motion carried.Technology Expenditure from ContingencyMember Vickery made a motion to authorize the expenditure for Technology purchases from the Contingency Fund inthe amount of $265.000.00. Member Martin seconded the motion. Chairman Purcell asked for a roll call vote. Allmembers present voting aye except Member Davidson who voted nay. Motion carried 8-1.Co Board 10/16/12 ·14·

Fiscal Year 2013 Budget on fileMember Vickery made a motion to place the tentative fiscal year 2013 budget on file with the County Clerk. MemberPetrella seconded the motion.Board members discussed 4 employees getting a larger raise than other employees. It was emphasized that thebudget was tentative.Chairman Purcell asked for a roll call vote. Members votina ave include Hafenrichter, Martin, Petrella, Shaw andVickery. Members voting nay include Davidson, Koukol and Wehrli. Member Purcell voted present. Motion carried§±.LAnimal ControlAnna Payton highlighted the minutes from the packet from the September 19, 2012 <strong>meeting</strong>.Health & EnvironmentMember Petrella stated that there will be a <strong>meeting</strong> on October 26, 2012.Committee of the WholeMinutes are in the packet from the October 11, 2012 <strong>meeting</strong>.STANDING COMMITTEE MINUTES APPROVALMember Martin moved to approve all of the Standing Committee Minutes and Reports as submitted and amended.Member Koukol seconded the motion. Chairman Purcell asked for a voice vote on the motion. All members presentvoting aye. Motion carried.Public Building CommissionSPECIAL COMMITTEE REPORTSMember Wehrli reported that they improvements to the Public Safety Center for FY 2013.VACMember Martin reported that there was not a <strong>meeting</strong>.Historic PreservationMember Wehrli reported that they had a joint <strong>meeting</strong> with all their local groups.UCCIMember Petrella reported that the next <strong>meeting</strong> is October 19, 2012 in the Lincoln Museum in Springfield. TheCounty is paid $400.00 when Member Petrella attends the <strong>meeting</strong>.Board of HealthMember Wehrli reported that the <strong>meeting</strong> is October 16, 2012.708 Mental HealthMember Hafenrichter reported that they did not meet.Kencom Executive BoardMember Martin reported that the next <strong>meeting</strong> is on October 25, 2012.Housing AuthorityMember Hafenrichter stated that a liaison from the County Board is needed in the future.Co Board 10/16/12 - 15 -

CHAIRMAN'S REPORTChairman Purcell reminded the members that the next <strong>board</strong> <strong>meeting</strong> is on November ih at 6:00 pm due to theelection on November 6 th •Member Martin moved to approve the appointment. Member Wehrli seconded the motion. Chairman Purcell askedfor a voice vote on the motion. All members present voting aye. Motion carried.APPOINTMENTS*Bob Walker - Public Aid Appeals Committee Alternate - 2 yr term - expires September 30,2014CITIZENS TO BE HEARDTodd Milliron, 61 Cotswold Dr, Yorkville stated that the raises are really not part of the <strong>county</strong>'s growing budget; theyneed to look at the union contracts to save money. Mr. Milliron suggested sharing in the cost of benefits with theemployees.ADJOURNMENTMember Petrella moved to adjourn the County Board Meeting until the next scheduled <strong>meeting</strong>. Member Martinseconded the motion. Chairman Purcell asked for a voice vote on the motion. All members present voting aye.Motion carried.Approved and submitted this 31 st day of October, 2012.Respectfully submitted by,Debbie Gillette,Kendall County ClerkCo Board 10/16/12 - 16 -

A RESOLUTION DECLARING DECEMBER 2012AS KENDALL COUNTY FOOD PANTRY AWARENESS MONTHResolution No.----WHEREAS, the problem of hunger is a world-wide problem; andWHEREAS, the problem of hunger exists within Kendall County, Illinois; andWHEREAS, the Kendall County Food Pantry was established in 1983, in order to provide food to residentsof Kendall County that are unable to afford to purchase food for their families; andWHEREAS, the Kendall County Food Pantry is operated by a volunteer staff, with no paid employees; andWHEREAS, over fifty thousand families, consisting of over one hundred thousand people have been servedby the Kendall County Food Pantry since its inception, and within the last year, the Kendall County FoodPantry has served over seven thousand families; andWHEREAS, while national concerns and world-wide problems concern all Americans, the problem ofhunger and inadequate food for local citizens of Kendall County remains and it is the right and obligation ofall citizens of Kendall County to help alleviate hunger on a local basis; andWHEREAS, it is the intention of the Kendall County Board to increase the awareness of Kendall Countyresidents to the existence of the Kendall County Food Pantry, to recognize and support the Kendall CountyFood Pantry and its volunteers, and further to encourage the donation of food to the Kendall County FoodPantry by all residents of Kendall County that are able to contribute to said cause;BE IT HEREBY RESOLVED The Kendall County Board does hereby declare that December 2012 shallbe "Kendall County Food Pantry Month" in Kendall County.BE IT FURTHER RESOLVED that all residents of Kendall County are asked to contribute non-perishablefood items or make a monetary donation to the Kendall County Food Pantry.BE IT FURTHER RESOLVED that residents of Kendall County may donate items at the Kendall CountyCourthouse, Public Safety Center, Health and Human Services Building, County Highway Building orCounty Office Building during normal business hours.Passed and adopted by the County Board of Kendall County, Illinois this __ day of_________ , 2012.ATTEST: _______________ _Kendall County ClerkJohn Purcell, ChairmanKendall County Board

Kendall County ClerkRevenue Report 1011112-10131112Line Item Fund RevenueCounty Clerk Fees $ 1,217.00County Clerk Fees - Marriage License $ 960.00County Clerk Fees - Civil Union $ 30.00County Clerk Fees - Misc $ 2,067.00County Clerk Fees - Recording $ 40,712.0001010061205 Total County Clerk Fees $ 44,986.0001010001185 County Revenue $ 26,605.5038010001320 Doc Storage $ 24,634.0051010001320 GIS Mapping $ 41,558.0037010001320 GIS Recording $ 5,192.0001010001135 Interest $ 29.9401010061210 Recorder's Misc $ 5,961.7581010001320 RHSP/Housing Surcharge $ 21,906.00CK # 17203 To KC Treasurer $ 170,873.19Death Certificate Surcharge sent from Clerk's office $1052.00 ck # 17201Dom Viol Fund sent from Clerk's office $165.00 ck 17202

Office of Jill FerkoKendall County Treasurer & Collector111 W. Fox Street Yorkville, IL 60560Kendall County General FundQUICK ANALYSIS OF MAJOR REVENUES AND TOTAL EXPENDITURESFOR ELEVEN MONTHS ENDED 10/31/2012Annual 2012 YTD 2012 YTD 2011 vto 2011 YTOREVENUES" Budget Actual % ~ ~Personal Property Repl. Tax $315,000 $331 ,124 105.12% $397,747 130.84%State Income Tax $1 ,800,000 $2,159,461 119.97% $1 ,785,491 127.54%Local Use Tax $340,000 $342,456 100.72% $349,404 158.82%State Sales Tax $970,000 $863,680 89.04% $921 ,537 131 .65%County Clerk Fees $380,000 $392,593 103.31% $354,806 93.37%Circuit Clerk Fees $1 ,300,000 $1,173,695 90.28% $1 ,197,889 85.55%Fines & Foreits/St Atty. $560,000 $469,859 83.90% $518,834 92.65%Building and Zoning $35,000 $44,396 126.84% $46,338 154.46%Interest Income $50,000 $27,441 54.88% $52,883 65.85%Health Insurance - Empl. Oed. $981 ,698 $997,884 101 .65% $875,772 102.59%1/4 Cent Sales Tax $2,400,000 $2,236,345 93.18% $2,194,072 98.43%County Real Estate Transf Tax $170,000 $212,848 125.20% $210,351 120.89%Correction Dept. Board & Care $750,000 $987,903 131 .72% $731,940 74.27%Sheriff Fees $450,000 $713,659 158.59% $337,336 51 .90%TOTALS $10,501,698 $10,953,343 104.30% ",174,001 100.08%Public Safety Sales Tax $4,000,000 $3,972,402 99.31% $3,143,385Transportation Sales Tax $4,000,000 $3,972,402 99.31% $3,143,385 . 11.58%*Includes major revenue line items excluding real estate taxes which areto be collected later. To be on Budget after 11 months the revenue and expense should at 91.63%

KENDALL COUNTY BOARDIII West Fox StreetYOlrbrlll.e. Dnnois 60560-1498(630) 553-4171FAX (630) OO~""4;&November 20 1 2012Kelly ThompsonAssociation of Illinois Soil and Water Conservation Districts4285 North Walnut Street RoadSpringfield, Il 62707RE:Post-Development Stormwater Runoff Performance Standards WorkgroupDraft Recommendations to Illinois EPADear Ms. Thompson,Kendall County appreciates the opportunity to provide input on the development of Statewide PostDevelopment Stormwater Runoff Standards. We understand the national trend to focus on runoffvolume reduction to improve water quality, and concur in principle. Our comments are focused in twoareas related to the Kendall County Planning, Building and Zoning Department (PB&Z) and the KendallCounty Highway Department. PB&Z has primary oversight responsibility of development activitieswithin the unincorporated areas of the County. The Highway Department's mission and mandate is thedevelopment and maintenance of transportation infrastructure. These comments are provided throughconsultation with our engineering consultant Wills, Burke, Kelsey Associates, LTD. We believe ourcomments are also pertinent for small municipalities and township roadway agencies that rely on theCounty for review and project development. Comments are organized based on topic within the draftrecommendations.Applicability:• Definition of terms will be critical in determining the extent and applicability of the proposedregulation. Particularly "development" should be defined by the workgroup_.. We understand from the public <strong>meeting</strong>s that this regulation is not intended to apply toagricultural activities. The exemption for agricultural activities should be plainly stated in therecommendations.• We support the concept of differing standards for new development and redevelopment sites.The workgroup should consider differing threshold / applicability standards for redevelopmentactivities... It should be recognized that applying these standards through NPDES permits creates astatewide stormwater management standard. Statewide regulation typically does not recognize

Itlocal conditions that may make the requirements burdensome or ineffective in certainsituations.A statement is made in the last paragraph that "MS4 communities are in urbanized areas andare largely developed", This is not the case in Kendall County. Na Au Township is an MS4under the NPDES definition and is primarily rural! agricultural with little development and nourbanized areas. The workgroup should be careful to recommend standards and makeassumptions based on NPDES definitions.Requirements for Development Sites:~ We note that the 95 th percentile standard of 1.35 inches is a larger storm than is being used forequivalent design purposes in neither the City of Chicago nor the DuPage County CountywideStormwater Ordinance. A survey of programs nationally performed for DuPage County, did notidentify any program which had adopted a storm of that magnitude for BMP design. A morerealistic minimum should be considered. such as 1 inch... We support the concept of differing standards for new development and redevelopment sites.The revised standard for redevelopment sites should be a specific recommendation from thecommittee. A specific recommendation is not provided.Off-site Mitigation:• Off-site mitigation should be provided for redevelopment sites as well as development sites.Linear Projects:IIIWe are concerned that the menu of BMP's currently in fashion would not fit the rural context ofKendall County and the roadways maintained by the DOT. A majority of roads maintained byDOT are drained by grass swales, which already reduce runoff volume compared to an urbansection. The additional costs of employing professionals for inspections, reporting and reviewdo not seem justified for the expected benefits in our situation... We recognize that the development of a new roadway corridors afford opportunities to acquiresufficient right-of-way to implement new stormwater regulations. However, projects withinexisting roadway rights of way, including adding turn Janes, shoulders for bicycle and pedestrianusage, and the rehabilitation of existing stream crossings I approach pavements should all beconsidered exempt because they are either safety related or a maintenance activity.IIITerms such as "reasonable attempt" regarding ROW acquisition and "where practicable" whenapplying the standards are extremely vague and will lead to problems. A clear statement wasmade at the Public Information <strong>meeting</strong> that "where there is not adequate ROW the standardswould not apply". A plain and practical statement as to the intent of the workgroup would bemore useful than vague statements.• The use of the one-acre trigger for these standards is difficult to interpret for a transportationcorridor. The linear nature of roadways cause projects to often cross multiple small watersheds,with varying rates of change in impervious area in a sub watershed. While the aggregate of the

disturbance over the entire length of the project may go over the threshold, the disturbancewithin the sub watershed is often much smaller. We are concerned that in application, this willrequire a large number of small BMP applications at each outlet, which may be beyond theresources of most oors to maintain, document, inspect, and report.• Additional funding to adequately maintain the requirements of the workgroup suggestions willbe required. The funding will have to come from reduced pavement maintenance or congestionI capacity projects. These requirements could have impacts on air quality and roadway safetyprojects.We recognize the workgroup recommendations are still under development. We offer the followingspecific and process recommendations, in addition to those suggested above.• Existing highway right of way development intensity should be classified as "urban" and "rural"as the standards and guidance develop. Roadwavs with a rural cross-section need to berecognized as already reducing runoff volume.* We suggest a Local Roadways subcommittee made up of those engaged in the maintenance anddevelopment of transportation projects and corridors along with water quality profeSSionals andregulatory community to address the unique challenges of linear projects.Compliance Certifications/Enforcement:• We applaud the workgroup's vision of self certification. We believe local agencies are in thebest position to judge compliance and interpret the regulation relative to local situations. Thisapproach should not be proposed if the state intends to audit certifications and punish thosewho the state feels is not performing adequately. This approach should not be proposedbecause the state does not have enough money to regulate the standard.e Self certifications of owners I operators should recognize that ownership may changethroughout the construction and completion of a project. Also, different entities may own andoperate the drainage systems. Provisions to accommodate these situations need to beconsidered... The concept of requiring MS4's to update ordinances to incorporate the proposed standards isthe effective creation of a statewide stormwater management ordinance. We do not believethat a statewide stormwater ordinance mandate without funding assistance is a responsible wayto achieve improved water quality.• It appears the committee is recommending the burden of funding compliance is theresponsibility of land owners, communities and MS4's with no assistance from the state. At thevery least the State needs to have some responsibility to fund additional public inspections anddocumentation. An alternate approach to penalties is to offer incentives in the form of fundingassistance for maintenance of BMP's. Provide resources'for local agencies so they areencouraged to construct BMP's and not out of the fear of retribution... Compliance assurance of 0 & M plans would not work if the regulation is authorized as part of aconstruction activity for which a NOT has been issued. It would only work if authorized under an

MS4 permit. The core responsibility for enforcement is being pushed to MS4's without anyproposed funding assistance from the State. We disagree with this approach.• There are proposed consequences for non-compliance but no rewards for compliance. This typeof "bully" approach will work but will not foster cooperation from local agencies and will resultin minimum compliance.Green Infrastructure and BMP DesignIIItWe support the idea of creating a simple method to determine compliance. There are somesituations where complex methods will be necessary but allowing efficient methods forevaluating compliance is Important.There is a statement in the recommendations regarding gray infrastructure causing standingwater. This statement is not accurate and should be corrected.Maintenance of Stormwater BMP'sItWe do not support the concept of requiring the 0 & M plan to be a recorded covenant against aproperty. A covenant creates an interest or legal standing on property by a third party. Asmuch as we all want cleaner water we believe this approach could cause unintendedconsequences for property owners.Retrofits.. Funding of retrofit projects is a significant issue for all public agencies. Mandating retrofitswithout a cost solution is not responsible. A potential funding source for retrofit projects couldbe fee in lieu from redevelopment sites. The workgroup should consider this approach. Careshould be taken not to burden potential redevelopment such that raw land development ismore attractive.These draft recommendations were discussed and approved by the County Board on November 20,2012. I thank you in advance for your consideration of our concerns and welcome the opportunity tohave County staff discuss these issues with you further.Sincerely,John PurcellCounty Board Chairman

~------------------I. CALL TO ORDERThe <strong>meeting</strong> was called to order by Jessie Hafenrichter, at 4:00 p.m. in County Board Room209.II.III.IV.ROLL CALLCommittee Members Present: Jessie Hafenrichter, Nancy Martin, Dan Koukol, Jeff Wehrli,and Anne VickeryAlso present were: Jim Pajauskas, Jill Ferko, Becki Rudolph, Paul Lalonde, Glenn Campos,and Jeff WilkinsPUBLIC COMMENT-NoneCBIZ Benefits UpdateJim Pajauskas commented that the benefits fair was a big success and that participation wasvery strong this year. There were 90 employees who attended the benefits fair.V. OTHER BUSINESSServices Agreement for Flex 125 services - Jill FerkoJill Ferko described the FSA program and how it is administered through Flexible Benefits.Ms. Ferko would like to switch the FSA administrator from Flexible Benefits to CBIZ. Ms.Ferko stated this will allow the program to be more efficient. Flexible Benefits requires theTreasurer's Office to submit reports anytime that any County employee's information changes,regardless if they utilize the FSA program or not. By using CBIZ as the administrator for theFSA, reporting will only be required for those actually participating in the FSA program. WithCBIZ as the administrator, a debit card would also be introduced to the program for moreefficiency for employees enrolled in the FSA program. With CBIZ as the FSA administrator,there will no longer be the need for employees electing not to participate in the program to fillout FSA paperwork. Once the administration has been changed, the Treasurer's Office willnotify all employees.Anne Vickery made a motion, seconded by Nancy Martin, to support the switch to CBIZ asthe FSA administrator. With a voice vote of all ayes, the motion carried.Temporary Use Permit to IDOT for Route 47 Construction. Jeff Wilkins explained that the eastern half of Jefferson Street behind the County Building wasdeeded to the County from !DOT and this deed has been recorded. !DOT is requesting atemporary use permit to use this area during construction of the Route 47 road wideningproject. Mr. Wilkins stated that he has sent the request from !DOT to the State's Attorney forreview.

Nancy made a motion, seconded by Dan Koukol, to recommend approval of the temporary usepermit contingent on the approval by the Office of the State's Attorney. With a voice vote ofall ayes, the motion carried.This will be an action item at the November 20 th County Board <strong>meeting</strong>.Approve Lease Agreement for Transportation VehiclesThe State's Attorney's Office is reviewing the Vehicle Return Agreement for the leaseagreement for transportation vehicles. The State's Attorney's Office has provided some initialcomments on the agreement but has not completely finalized the review. At the end of thelease agreement term, the County would have the option to purchase the vehicles, per theagreement.Nancy Martin made a motion, seconded by Dan Koukol, to recommend approval of theVehicle Return Agreement contingent on the approval by the Office of the State's Attorney.With a voice vote of all ayes, the motion carried.This will be an action item at the November 7th County Board <strong>meeting</strong>.VI.VII.MONTHLY REPORT - County AdministratorMr. Wilkins commented on the fundraiser for the Kendall Area Transit program and that itwent well. Mr. Wilkins went through the enrollment changes from the month as well as theworkers comp claims for the last month and the year to date. Mr. Campos has documented allthe open workers comp claims to keep track of each.PUBLIC COMMENT - NoneVIII. ACTION ITEMS FOR COUNTY BOARD MEETINGa. Temporary Use Permit to IDOT for Route 47 Construction - November 20 thb. Approval of Lease Agreement for Transportation Vehicles - November 7thIX.EXECUTIVE SESSION - NoneX. ADJOURNMENTNancy Martin moved to adjourn the <strong>meeting</strong> at 4:39P.M. Anne Vickery seconded themotion. The motion was unanimously approved by a voice vote.Respectfully Submitted,John H. Sterrett

KENDALL COUNTYADMINISTRATION COMMITTEEGIS, REVENUE & TECHNOLOGYMINUTESNovember 13, 2012 at 9:00 a.m.Board of Review RoomMeeting was called to order at 9:00a.m. by chair, Jessie HafenrichterCommittee Members Present: Jessie Hafenrichter, Dan Koukol, Nancy Martin, and AnneVickery (9:03a.m.)Others Present: Don Clayton, Jill Ferko, Debbie Gillette, Stan Laken, Andy NicolettiTreasurer's Office: Jill Ferko reported that today is the tax sale at 1 :00 pm. This is the first yearit will be automated. There are 27 buyers coming this year, which is average. DShe said thereare 40 less parcels this year, than in the past. The areas are mainly coming from Windett,Raintree and Lakewood subdivisions. She said they will not be selling the Montgomery Special... because they failed to post on time.Clerk and Recorder's Office: Debbie Gillette said the election went well. There was a 69%tum-out. Election Day was busy with many calls regarding voting places, etc. and only onecomplaint about wait times for voting. Gillette said she hopes to work with GIS to get theCounty Polling Places listed on the County website for easier citizen access.Assessor's Office: Andy Nicoletti reported that they have 700 complaints so far. Board ofReview has received 561 requests for change. He should have a more accurate total by the endof the week.Technology: Stan Laken reported they are <strong>meeting</strong> with the auditor on Friday to discusshardware and software issues.Laken said they received a request from the FP Foundation, asking if the County would bewilling to house and maintain their website on the County servers. Laken said this would beadditional work and time for the Technology Department. Discussion on what would beinvolved, the amount of time to maintain the site, the content of the website, etc. Laken askedfor direction from the Committee. The Committee suggested asking Jason Petitt to present topicto the Forest Preserve Committee at the November 14,2012 <strong>meeting</strong>.Laken reported that Technology has updated Windows 7 in most County offices. Laken askedfor all Board members to return their laptops to Technology for updating and installation ofWindows 7 before the end of November, 2012.Laken said the Sheriffs Office Squad Car Computers have been ordered and are being tested byCounty Deputies.

GIS: Don Clayton reported 83 divisions, 20 combinations, 2 condos, 8 subdivisions, 18 ownerrequests, 480 parcels added, 711 Sheriffs deeds, and 1 tax deed.GIS received a request from the Sun-Times for corporate data, parcels requests, marriage licenseinformation, tax records, etc. The Sun-Times representative was advised to submit a FOIArequest so that information could be provided. Clayton has consulted with the State's Attorney'soffice and was told to comply with the request. The Committee suggested Clayton bring theFOIA request to the COW <strong>meeting</strong> for discussion.Clayton said the Subdivision Stormwater Discharge area map has been completed.Clayton also reported that they continue working with New World, and have had few complaintsfrom the Sheriffs office, or the Plano Police Department, and it seems to be operatingsuccessfully.Clayton said they will be working with the Clerk's Office regarding posting of Election PollingPlaces on the County website for the next election.Nancy Martin made a motion to adjourn the <strong>meeting</strong>, second by Anne Vickery. With all inagreement, the <strong>meeting</strong> <strong>adjourned</strong> at 9:50 a.m.The next <strong>meeting</strong> is scheduled in the Board of Review room on December 11, 2012 at9:00 a.m.Valarie McClainRecording Secretary

Route: FAP 326 (IL 47)County: KendallJob No.: R-93-018-84Parcel No.: 3EX0102TEMPORARY USE PERMITCounty of Kendall, (Grantor), of the County of Kendall and State of Illinois, for and inconsideration of the sum of One Dollar ($1.00), in hand paid, the receipt of which is herebyacknowledged, represents that Grantor owns the fee simple title to and hereby permits and licensesthe People of the State of Illinois, Department of Transportation, (Grantee), to enter upon the followingdescribed land for the purpose of grading and shaping.Part of vacated Jefferson Street lying between vacated Ridge Street and MadisonStreet described as follows with bearing based on the Illinois State Plane CoordinateSystem, NAD 1983 (east zone) beginning at the northwest corner of Lot 8 in Block 18 inthe original Town of Yorkville; thence south 5 degrees 55 minutes 21 seconds west60.962 meters [200.00 feet] along the south line of vacated Jefferson Street, thencesouth 4 degrees 09 minutes 32 seconds west 15.356 meters [50.38 feet] along saidsouth line of Jefferson Street; thence north 55 degrees 22 minutes 11 seconds west10.964 meters [35.97 feet] to the intersection of the centerlines of Ridge Street andJefferson Street; thence north 5 degrees 55 minutes 21 seconds east 71.020 meters[233.00 feet] along said centerline of Jefferson Street to a point on the north line ofBlock 18 extended westerly; thence south 84 degrees 13 minutes 43 seconds east9.144 meters [30.00 feet] to the point of beginning, containing 2218 square feet, moreor less, situated in the United City of Yorkville, County of Kendall and State of Illinois.The above-described real estate and improvements located thereon are herein referredto as the "premises."The right, easement and privilege granted herein shall terminate upon the completion of theabove stated purpose or five (5) years, whatever occurs first, or on the completion of the proposedproject, whichever is the sooner.

Grantor, without limiting the interest above granted and conveyed, acknowledges that uponpayment of the agreed consideration, all claims arising out of the above acquisition have beensettled, including without limitation, any diminution in value to any remaining property of the Grantorcaused by the opening, improving and using the premises for highway purposes. Notwithstandinganything in this agreement to the contrary, Grantee shall restore all pavement and curbs effected byits entry and usage of the herein described land to the condition that it was prior to such entry andusage and nothing contained herein shall be construed as prohibiting Grantor from seekingGrantee's compliance with such restoration, whether by law or otherwise. This acknowledgmentdoes not waive any claim for trespass or negligence against the Grantee or Grantee's agents whichmay cause damage to the Grantor's remaining property.Dated this dayof __________ _ 2012.By:SignatureFor Kendall CountyBy:State ofCounty of) ss.This instrument was acknowledged before me on________ 2012, by(SEAL)Notary PublicMy Commission Expires:Exempt under 35 ILCS 200/31-45(b), Real Estate Transfer Tax Law.Buyer, Seller or RepresentativeThis instrument was prepared by and after recording, return to:Illinois Department of Transportation700 East Norris DriveOttawa,IL 61350Attn: Land Acquisition

Grantor, without limiting the interest above granted and conveyed, acknowledges that uponpayment of the agreed consideration, all claims arising out of the above acquisition have beensettled, including without limitation, any diminution in value to any remaining property of the Grantorcaused by the opening, improving and using the premises for highway purposes. Notwithstandinganything in this agreement to the contrary, Grantee shall restore all pavement and curbs effectedby its entry and usage of the herein described land to the condition that it was prior to such entryand usage and nothing contained herein shall be construed as prohibiting Grantor from seekingGrantee's compliance with such restoration, whether by law or otherwise. This acknowledgmentdoes not waive any claim for trespass or negligence against the Grantee or Grantee's agents whichmay cause damage to the Grantor's remaining property.Dated this day of 2012.Corporation NameBy:ATTEST:By:Print Name and TitlePrint Name and TitleState of--------------------- ) ssCounty of --------------------- )This instrument was acknowledged before me on______________________________ ,as_____________ 2012, byandof, as(SEAL)NotaryMy Commission Expires:Exempt under 35 ILCS 200/31-45(b), Real Estate Transfer Tax Law.Buyer, Seller or RepresentativeThis instrument was prepared by and after recording, return to:Illinois Department of Transportation700 East Norris DriveOttawa,IL 61350Attn: Land Acquisition

HIGHWAY COMMITTEE MINUTESDATE:LOCATION:MEMBERS PRESENT:STAFF PRESENT:ALSO PRESENT:November 13,2012Kendall County Highway DepartmentBob Davidson, John Shaw, Suzanne Petrella & Jeff WehrliFran Klaas, Andy Myers, John Burscheid, Ginger Gates andAngela ZubkoJudy Gilmour & Matt Prochaska - County Board ElectMayor Bob Hausler, Chief Eaves & John McGinnis - City of PlanoJim Shaw & Preston Keefe of RS&H consulting engineersKelly Farley of CMT and P.J. Fitzpatrick of WBKThe committee <strong>meeting</strong> convened at 4:00 P.M. with introduction of guests. Chairman Davidsonmodified the order of the <strong>agenda</strong> to wait for the arrival of John McGinnis.Chairman Davidson discussed the goal of the Highway Committee to eventually make all <strong>county</strong>highways start and stop at other <strong>county</strong> highways or state highways. One of those locations isBen Street in the City of Plano, where the County and the City are working on an agreement totransfer that part of Ben Street in the City of Plano south of Route 34. Plano will be makingimprovements to underground utilities in the next year or two and the street will be ready toresurface by the end of calendar year 2014. The City's attorney and the SAO are working on theagreement, which will come back to the Committee at a later date.In regard to procurement procedures for the Highway Department, the States Attorney's Office isworking on a <strong>county</strong>-wide policy as opposed to a policy that would just govern the HighwayDepartment procurements. The SAO also thought it would be appropriate to wait until the newBoard is seated after December 1 st. So this matter will also be coming back to the Committee ata later date, after the new County Board members have taken office.Chairman Davidson summarized some of the major highlights of the County's 20-YearTransportation Plan, as well as the County's new initiative to assist agencies in constructing newsidewalks and bike paths along State and County Highways. He also informed the Committeethat the Board must approve the Long Range Transportation Plan as one of the requirements ofhaving a Transportation Sales Tax. Motion Petrella; second Shaw to recommend approval of theLong Range Transportation Plan to the County Board. Motion carried unanimously.Davidson discussed some of the alternatives and possibilities for trying to fund the EldamainBridge Project. He suggested that the County needs to continue working with elected officials atboth the State and Federal level in trying to obtain funds for the project. He also discussed theidea of earmarking funds annually out of the Transportation Sales Tax Fund to essentiallybankroll the project at a date in the future. Klaas informed the Committee that IDOT wasreluctant to take on the Eldamain Bridge project as a State Highway; and suggested that theCounty should continue to seek out funding sources, but keep the project as a local project.Mayor Hausler was very supportive of the Eldamain Bridge project.

Jim Shaw of Reynolds, Smith & Hills, Inc. presented information on the proposed intersectionimprovement at Little Rock Road, Creek Road and Abe Street in the City of Plano. Afterevaluating different alternatives for the improvement, the idea of constructing a roundabout keptrising to the surface as a very viable alternative to address capacity issues, crash problems andpedestrian issues at this location. Their studies identified that there were 2 paths to solvingintersection problems all the way out to year 2032. Those 2 alternatives included theconstruction of multiple turning lanes and traffic signals; or construction of a roundabout. TheCommittee then watched a lO-minute video about roundabouts that was produced by FHW A.Turning lanes and traffic signals would require more land acquisition, significant additionalconstruction costs, and more maintenance costs. A roundabout would require less landacquisition costs, less construction costs, no traffic signal maintenance costs, and the potentialfor significant reductions in crashes and injuries. The committee members asked severalquestions regarding the function of roundabouts and how that might compare to a moretraditional improvement; but in general, the Committee had a very favorable impression of theidea of constructing a roundabout at this location. The representatives from the City of Planowere also very supportive of moving the roundabout alternative forward. They also wanted tosee a lowering of the speed limit on Little Rock Road to 45 mph within the corporate limits. TheCommittee directed RS&H to move forward with the roundabout alternative.The Committee reviewed the plat for transferring right-of-way on Illinois Route 126 at GroveRoad back to the Illinois Department of Transportation (IDOT). This action is required becauseroOT requires that they own the right-of-way on State Highways. Motion Wehrli; second Shawto forward the right-of-way transfer documents to the County Board for approval and signaturesby the County Board Chairman. Motion approved unanimously.Engineer Klaas showed the Committee an aerial photo of Joliet Road in the area of CentralLimestone Quarry. There is a proposal by D Construction to use the northwesterly corner of thisproperty for earthwork material transfer associated with the Route 47 improvements throughYorkville. There is an existing access point at this location that has been previously used byCentral Limestone. Shaw discussed some of the historical uses of the existing entrance and hisunderstanding of what the proposed use would be, including a shooting range for the Sheriff'sDepartment when D Construction has completed their work. Although the proposed userepresents a significant change in the number of trips in and out of the access point, the use istemporary. Klaas indicated that the County's Access Ordinance is mostly silent on temporaryaccess uses, so he wanted direction from the Highway Committee. Wehrli asked about the flowof storm water along the north end of the property. Angela Zubko indicated that D Constructionwas obtaining a site development permit through her office. The Committee had no problem withusing the existing access point for the proposed use.Chairman Davidson showed the Committee a sales catalog from Accu-SteeL The County's saltstorage facility was featured on a couple pages in the catalog. Davidson suggested that theCounty should put up a sign on the building to identify the different agencies that participated inthe construction, and he has authorized the County Engineer to obtain proposals for that.Judy Gilmour thanked Bob Davidson for his many years with the County and for all his work onthis Committee. Shaw also thanked Davidson for his work as Chairman of the Committee.

Motion Wehrli; second Shaw, to forward payroll and bills for the month of November to theFinance Committee for approval. Motion carried unanimouslyThe next <strong>meeting</strong> is scheduled for Tuesday, December 11, 2012 at 4:00 P.M.Meeting <strong>adjourned</strong> at 5:20 P.M.Respectfully submitted,i!rG~Francis C. Klaas, P.E.Kendall County EngineerACTION ITEMS1. Approval of Long Range Transportation Plan2. Transfer Right-of Way along Ill. Rte. 126 at Grove Road to IDOT

111t1~m •• 111Chairman Shaw called the Facilities Management Committee <strong>meeting</strong>; located in the County Office Building at 111W. Fox Street, Room 209 to order at 3:31p.m.1) Roll Call - Chairman Shaw asked for a roll call attendance. Present were Chairman Shaw, MembersHafenrichter, Wehrli, Koukol and Vice-Chair Davidson. Enough members were present to form a quorumof the committee. Facilities Management Director Smiley was also present.2) Approval of the October <strong>meeting</strong> minutes - Chairman Shaw asked for a motion to approve theOctober committee minutes. Member Koukol motioned to approve the minutes. Member Hafenrichter 2 ndthe motion. All members voted aye via voice vote. Motion approved.3) Public Comment - No members of the public were present at the <strong>meeting</strong>.lIIIlJIUJlIIfIlB,111S1) Courthouse Fire Alarm Tests• The system was tested on Thursday, October 4,2012.• Further work needs to be done to determine if we have a bad power supply in the old section ofthe courthouse as several horn strobes were not working.• This will be scheduled on a Saturday since the alarm will need to be activated several times.Project complete.2) Water Heater Replacement at Health & Human Services• KCFM staff installed a new water heater on Saturday, October 27, 2012 so that the water wouldnot have to be shut off at the facility for an extended amount of time during a normal workday.• Project complete.3) Water Softener Issues at the Public Safety Center• Rick Spiegelhalter found the water softener was not softening the water properly.• Rick found one unit had bad resins in it and the other unit had a bad head end unit.• After evaluating the cost to repair both of these units and considering the age of the units, Jimdetermined it would be more cost effective to replace the units with different systems similar tonewer units we have installed on new projects. The new system will be installed by KCFM staffwhen it arrives.• Project complete.4) Historic Courthouse Water Leak Repair• Jim noticed the ceiling above the North entrance doors was showing water damage on the insidelobby. There was also a large bolt going into the wall in this area. The wall was opened up wefound the bolt was cutoff on the outside of the building and pulled out of the wall. We alsoexamined the area outside the windows on the 2 nd floor by breaking out a window pane. Waterwas found to have been getting trapped between the wrought iron walkway and the wall. Wefound the wood under the window ledge had partially rotted out. Jim had a flashing installed onthe outside under the window ledges and the wall repaired on the inside. Project complete.5) Historic Courthouse Window Replacements• Below the water damaged area and above the North entrance doors the two (2) arched glasswindows were found to be cracked. Replacement costs for the arched windows are $350.00.• Jim ordered the windows and they should be replaced before the next FM Committee <strong>meeting</strong>.• Jim would also like to add a removable window pane in place of the window we broke out to getout on the wrought iron walkway. That way we could more easily get access to the area instead ofbreaking a window or renting a lift. Cost to create a removable window $350.00.Report from <strong>meeting</strong>Member Wehrli motioned to go ahead and make the removable window as close as possible to the original windowand to split the costs between the HCH maintenance fund and KCFM. Member Hafenrichter 2 nd the motion. Allmembers voted aye via a voice vote. Motion approved.

fI"~J~~"JtlfJI~IAillt(C1l16) ArchitecturallEngineering Costs and Approval to Move Forward on the CountyOffice Building Projects• Jim received a quote for these services from FGM and Kluber.• See attached quotes. In order to put together drawings and specifications Jim needs approval to goforward with one of these firms.Report from <strong>meeting</strong>Vice-Chair Davidson asked why we needed to hire a firm for these projects. Director Smiley explained that in orderto hook up the backup generator electrical engineering would need to be done since the work would involve tyingthe generator and transfer switches to the main building switchgears. Jim further explained structural engineeringwould need to be done to make sure a replacement HV AC system would be able to be supported with the existingstructure. Professional drawings and specifications will also insure bidders are bidding the same equipment andscope of work. Committee members agreed with Jim's assessment of the need for these services on these projects.Member Wehrli motioned to invite the two firms to the next COW <strong>meeting</strong> to explain their way of doing businesswith a Master agreement between them and Kendall County. Member Koukol 2 nd the motion. All members votedaye via a voice vote. Motion approved.7) KenCom Phone Line Changes Request• Dave Farris sent Jim an email saying that he needed several changes made to lines that serveKenCom but are paid for by Kendall County. The biggest changes were to add Caller ID withname to several lines. These changes carry an order charge and an ongoing monthly servicecharge. Dave told Jim that he needed these changes to be made ASAP and that we could figureout who pays for what after the fact. Jim placed the order and the charges are going to be per theattached document.Report from <strong>meeting</strong>Since Director Farris told Director Smiley that it was imperative for these caller ID services to be added to theselines, Jim arranged to have the services added. Jim further explained the lease calls for lines specifically being usedfor 911 services are to be paid for by KenCom. Committee members agreed that KenCom should pay for lines fortheir operations. Member Wehrli motioned to refer this to the KenCom Executive Committee. MemberHafenrichter 2 nd the motion. All member s voted aye via a voice vote. Motion approved.8) City of Yorkville Light Pole Donation Request• Scott Sleezer City of Yorkville Parks & Recreation Superintendant asked Jim if Kendall Countywould be willing to donate one (1) more light pole for another City park.• They have hooked up the poles Kendall County donated to the City last year and they areproviding great benefits to the parks at night.Report from <strong>meeting</strong>Director Smiley was asked how many poles we still had. Jim said he did not count them before the <strong>meeting</strong>, but wassure we still had four to five poles in stock. No poles have been used since last year, so Jim said he would be okaywith donating one additional pole if the committee agreed. Member Wehrli motioned to donate one (1) additionalpole to the Yorkville Parks and Recreation department. Chairman Shaw & Members Hafenrichter, Wehrli andKoukol voted aye via a voice vote. Vice-Chair Davidson voted no via a voice vote. Motion approved 4-1.A .. t,I ••..,I.~I:II;.1) Janitorial Contract Extension• Cleaner Living Services has agreed to hold the costs on their annual contract at the same levelpresently being charged with a two (2) year extension as proposed by the Facilities Committee atthe last <strong>meeting</strong>.Report from <strong>meeting</strong>Director Smiley was asked how long Cleaner Living Services was currently in place. Jim said it was good until2015 and this would extend it until 2017. Member Wehrli motioned to extend the contract for two more years.Member Koukol 2 nd the motion. All members voted aye via a voice vote. Motion approved.2) Video Bond Call Move Request• The system was moved from CR#112 to CR#113 on Thursday and Friday October 18 th and 19 th •• Unfortunately when the system was hooked back up it did not power up. Jim arranged for arefurbished replacement unit and it was hooked up by Jim on the 22 nd • However, that unit wasfound to have a defective part in it and a 2 nd replacement unit was shipped out next day. The 2 ndunit was hooked up by Jim on the 23 rd and was found to be operating properly.• AOIC's audio recording vendor could not get out to hook up the system to the State recordingsystem until Monday, October 29,2012. The system was hooked up on the 29 th and Court startedusing the system again on the 30 th •• Project complete.