Board of Review Assessment Complaint Form - Kendall County

Board of Review Assessment Complaint Form - Kendall County

Board of Review Assessment Complaint Form - Kendall County

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

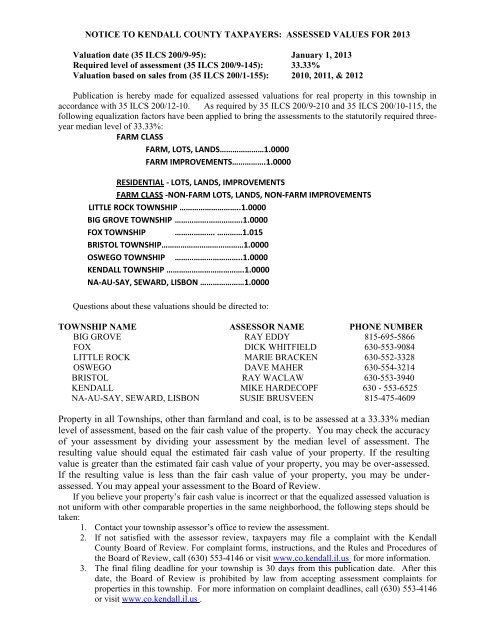

NOTICE TO KENDALL COUNTY TAXPAYERS: ASSESSED VALUES FOR 2013Valuation date (35 ILCS 200/9-95): January 1, 2013Required level <strong>of</strong> assessment (35 ILCS 200/9-145): 33.33%Valuation based on sales from (35 ILCS 200/1-155): 2010, 2011, & 2012Publication is hereby made for equalized assessed valuations for real property in this township inaccordance with 35 ILCS 200/12-10. As required by 35 ILCS 200/9-210 and 35 ILCS 200/10-115, thefollowing equalization factors have been applied to bring the assessments to the statutorily required threeyearmedian level <strong>of</strong> 33.33%:FARM CLASSFARM, LOTS, LANDS…………………1.0000FARM IMPROVEMENTS…………….1.0000RESIDENTIAL - LOTS, LANDS, IMPROVEMENTSFARM CLASS -NON-FARM LOTS, LANDS, NON-FARM IMPROVEMENTSLITTLE ROCK TOWNSHIP ………………………..1.0000BIG GROVE TOWNSHIP …………….…………….1.0000FOX TOWNSHIP ………………. …………1.015BRISTOL TOWNSHIP…………………………………1.0000OSWEGO TOWNSHIP …………………………..1.0000KENDALL TOWNSHIP ……………………………….1.0000NA-AU-SAY, SEWARD, LISBON …………………1.0000Questions about these valuations should be directed to:TOWNSHIP NAME ASSESSOR NAME PHONE NUMBERBIG GROVE RAY EDDY 815-695-5866FOX DICK WHITFIELD 630-553-9084LITTLE ROCK MARIE BRACKEN 630-552-3328OSWEGO DAVE MAHER 630-554-3214BRISTOL RAY WACLAW 630-553-3940KENDALL MIKE HARDECOPF 630 - 553-6525NA-AU-SAY, SEWARD, LISBON SUSIE BRUSVEEN 815-475-4609Property in all Townships, other than farmland and coal, is to be assessed at a 33.33% medianlevel <strong>of</strong> assessment, based on the fair cash value <strong>of</strong> the property. You may check the accuracy<strong>of</strong> your assessment by dividing your assessment by the median level <strong>of</strong> assessment. Theresulting value should equal the estimated fair cash value <strong>of</strong> your property. If the resultingvalue is greater than the estimated fair cash value <strong>of</strong> your property, you may be over-assessed.If the resulting value is less than the fair cash value <strong>of</strong> your property, you may be underassessed.You may appeal your assessment to the <strong>Board</strong> <strong>of</strong> <strong>Review</strong>.If you believe your property’s fair cash value is incorrect or that the equalized assessed valuation isnot uniform with other comparable properties in the same neighborhood, the following steps should betaken:1. Contact your township assessor’s <strong>of</strong>fice to review the assessment.2. If not satisfied with the assessor review, taxpayers may file a complaint with the <strong>Kendall</strong><strong>County</strong> <strong>Board</strong> <strong>of</strong> <strong>Review</strong>. For complaint forms, instructions, and the Rules and Procedures <strong>of</strong>the <strong>Board</strong> <strong>of</strong> <strong>Review</strong>, call (630) 553-4146 or visit www.co.kendall.il.us for more information.3. The final filing deadline for your township is 30 days from this publication date. After thisdate, the <strong>Board</strong> <strong>of</strong> <strong>Review</strong> is prohibited by law from accepting assessment complaints forproperties in this township. For more information on complaint deadlines, call (630) 553-4146or visit www.co.kendall.il.us .

Your property may be eligible for homestead exemptions, which can reduce your property’staxable assessment. For more information on homestead exemptions, call (630) 553-4146 or visitwww.co.kendall.il.us .Your property tax bill will be calculated as follows:Final Equalized Assessed Value – Exemptions = Taxable <strong>Assessment</strong>;Taxable <strong>Assessment</strong> x Current Tax Rate = Total Tax Bill.All equalized assessed valuations are subject to further equalization and revision by the <strong>Kendall</strong><strong>County</strong> <strong>Board</strong> <strong>of</strong> <strong>Review</strong> as well as equalization by the Illinois Department <strong>of</strong> Revenue.A complete list <strong>of</strong> assessments for this township for the current assessment year is as follows:

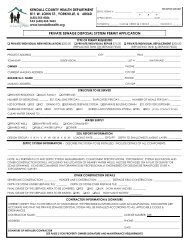

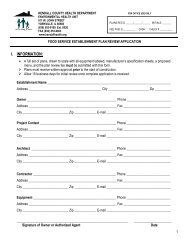

KENDALL COUNTY BOARD OF REVIEW111 West Fox Street, Yorkville, IL 60560 (630-553-4148)REAL ESTATE ASSESSMENT APPEAL FOR YEAR January 1, 2013Office use only:Appeal # Hearing Date ______________________ Hearing Time _____________________-_________-_________-_________ (ONE PARCEL PER FORM)PROPERTY INDEX NUMBER (PIN)FILING THIS APPEAL IS NOT A PROTEST OF TAXES. THS APPEAL ASSURES YOU OF A HEARING RELATIVE TO THE ASSESSMENT OF YOUR PROPERTY AS PLACED BY THETOWNSHIP ASSESSOR AND/OR SUPERVISOR OF ASSESSMENTS.PROPERTY ADDRESS__________________________________________________DATE_________________________________________________OWNER NAME_______________________________________________________HOME PHONE_________________________________________ADDRESS___________________________________________________________BUSINESS PHONE_______________________________________CITY /ZIP CODE______________________________________________________TOWNSHIP____________________________________________The assessment is HIGHER / LOWER than the assessment <strong>of</strong> comparable properties.Reason for appeal:Property is assessed at more/less than 1/3 <strong>of</strong> its MARKET VALUE. CLASS: Single family residence APTS Vacant LandUniformity Commercial/Industrial FARMIntervener STATUS: Owner Occupied RENTAL-Rent/Month ________PURCHASE PRICE $___________________________________________OTHER_________________________________________________________What do you think the FAIR MARKET VALUE <strong>of</strong> your property should be?PROPOSED PROPERTY ASSESSMENT$_____________________________________ DIVIDED BY 3 = $_____________________________________(Fair market value <strong>of</strong> property, as <strong>of</strong> January 1, 2013.)(Divide fair market value by 3 to equal your proposed assessment.)If the above information is not filled out, the <strong>Board</strong> <strong>of</strong> <strong>Review</strong> will assume the assessment reduction request is less than $100,000.THE RESIDENTIAL GRID SHEET ON PAGE 2 MUST BE FILLED OUT AND SUBMITTED WITH APPEAL.Oath: I do solemnly confirm that the statements made and the facts set forth in the foregoing complaint are true and correct to the best <strong>of</strong> my knowledge.OWNERS/INTERVENERS SIGNATURE_________________________________________________________________________________________I WISH TO APPEAR AT THE HEARING. Please notify me by mail <strong>of</strong> my designated hearing date and time.I WILL NOT APPEAR AT THE HEARING. I request the <strong>Board</strong> make a decision based on the evidence submitted. Iunderstand that I will NOT receive a hearing notice, but will receive notice <strong>of</strong> the <strong>Board</strong>’s decision.OWNER WILL NOT APPEAR; ATTORNEY WILL APPEAR.If the owner is represented by an attorney, a separate letter <strong>of</strong> authorization is required to be submitted at the time <strong>of</strong> filing thecomplaint form. Failure to provide proper authorization with this filing may result in no scheduled hearing.ATTORNEY’S NAME _______________________________________ ATTORNEY’S SIGNATURE ___________________________________________(PLEASE PRNT)ADDRESS _______________________________________________________________________________________________________________(Street Address) (City) (State) (Zip) (Phone)IL ARDC Registration No.Office use only:PRESENT ASSESSMENT (AS OF JANUARY 1, CURRENT YEAR)LAND____________________________________________________BUILDING________________________________________________TOTAL___________________________________________________Office use only:ACTION OF BOARD OF REVIEWLAND______________________________________________________BUILDING___________________________________________________TOTAL______________________________________________________

RESIDENTIAL COMPARISON GRIDPlease complete the Residential Comparison Grid. Information necessary to complete this form is available from your local townshipassessor, and from your own firsthand knowledge <strong>of</strong> comparable properties. Please include pictures <strong>of</strong> the subject property andcomparable properties. A copy <strong>of</strong> your information will be sent to your local assessor.1. (PIN) Parcel IDNumber2. Street AddressSubject Property Comparable #1 Comparable #2 Comparable #33. Neighborhood/Subdivision4. Lot size/Acreage5. Structure type/Style/Number <strong>of</strong>stories6. ExteriorConstruction7. Age <strong>of</strong> Property8. Living Area (SquareFeet)Excluding basementand/or garage square feet.9. Basement Area(Full or partial)10. Air Conditioning11. Fireplace12. Garage Sq. footage(Number <strong>of</strong> cars)13. Other (i.e. inground pool)14. Date <strong>of</strong> sale15. Sale Price16. Land <strong>Assessment</strong>17. Building<strong>Assessment</strong>18. Total <strong>Assessment</strong>19. Price per squarefoot(Building <strong>Assessment</strong>, line17, divided by living area,line 8.)

KENDALL COUNTY BOARD OF REVIEW111 W. FOX STYORKVILLE, IL 60560630-553-4146RULES 2013Rule 1 Only a taxpayer or owner <strong>of</strong> property dissatisfied with the property’s assessment fortaxation purposes, or a taxing body that has a tax revenue interest in the decision <strong>of</strong> the<strong>Board</strong> on an assessment made by any local assessment <strong>of</strong>ficer, may file a complaint with the<strong>Board</strong>.a. Any attorney filing a complaint on behalf <strong>of</strong> a taxpayer or property owner musthave authorization by an owner <strong>of</strong> record; this authorization must accompany the originalcomplaint form. Authorizations signed by management company representatives andassociation presidents must be accompanied by a resolution <strong>of</strong> authorization by theassociation’s board pursuant to 765 ILCS 605/10.b. Any taxpayer who is not the owner <strong>of</strong> record or the beneficial owner via anIllinois Land Trust must, at the time <strong>of</strong> filing the complaint, provide a copy <strong>of</strong> the writteninstrument that transfers property tax liability from the owner to the taxpayer.c. Any non-owner representing an owner before the <strong>Board</strong> <strong>of</strong> <strong>Review</strong> is engaged inthe practice <strong>of</strong> law (See In Re: Yamaguchi, Ill. Supreme Court (1987), 118 Ill.2d 417, 515N.E.2d 1235, 113 Ill.Dec. 928); therefore, only attorneys licensed to practice law in Illinoismay file a complaint on behalf <strong>of</strong>, or represent at hearing, a taxpayer or property owner.d. Nothing in this section shall be deemed to prevent third-party assistance so that thosetaxpayers and property owners with language and/or disability barriers may participate inhearings before the <strong>Board</strong> <strong>of</strong> <strong>Review</strong>.Rule 2 All parties testifying at the hearing will be formally sworn in as witnesses by the Clerk <strong>of</strong> the<strong>Board</strong> <strong>of</strong> <strong>Review</strong>.Rule 3 All persons or corporations having complaints shall make the same in writing on formsfurnished by the board. A separate form must be submitted for each parcel. All forms mustcontain the property address as well as the mailing address <strong>of</strong> the complainant and shall besigned by the property owner.Rule 4 <strong>Complaint</strong> <strong>Form</strong>sa. FULLY COMPLETED FORMS AND GRIDS must be filed with the Clerk <strong>of</strong> the <strong>Board</strong> <strong>of</strong><strong>Review</strong> on or before: SEE BELOW FOR YOUR TOWNSHIP.Little Rock 10/21/2013 Na-Au-Say 10/21/2013Bristol 10/21/2013 Big Grove 10/21/2013Oswego 10/21/2013 Lisbon 10/21/2013Fox 10/21/2013 Seward 10/21/2013<strong>Kendall</strong> 10/21/2013b. All evidence to support the complainant’s opinion <strong>of</strong> market value must be submitted tothe board at the time <strong>of</strong> filing the complaint form.

c. When filing on commercial, industrial or residential property <strong>of</strong> 12 units or more and thecontention is based on income, you must submit one copy <strong>of</strong> your income/expensestatement for the last 3 years proceeding the current assessment year. Also include onecopy <strong>of</strong> your individual rents (per square foot, per unit, per <strong>of</strong>fice, etc.).d. When you intend to support your opinion <strong>of</strong> market value with a real estate appraisal, itmust be done by a Licensed Illinois Real Estate Appraiser and have an effective date <strong>of</strong>January 1 <strong>of</strong> the assessment year. One original copy <strong>of</strong> the appraisal must be submittedat the time <strong>of</strong> filing. An appraisal is NOT mandatory in order to have your propertyreviewed by the board. Please note that an appraisal that was done for a mortgage orrefinance will be given less weight than one that was done for ad valorum purposes.e. Reductions <strong>of</strong> $100,000 or more require the taxing bodies to be notified. Therefore theProposed Property <strong>Assessment</strong> box must be filled in. If this box is not filled in, the board<strong>of</strong> review will not make a reduction <strong>of</strong> $100,000 or more.f. Petitions addressed to the board regarding a matter <strong>of</strong> equalization must show the classor classes <strong>of</strong> property or the taxing jurisdictions that appear to be out <strong>of</strong> line with thegeneral assessment level prevailing in the county. If such petitions are to receivefavorable consideration, they shall be supported by assessment ratio data.g. Failure to comply with any <strong>of</strong> the above will cause the board <strong>of</strong> review to make a decisionbased on the evidence presented at the time <strong>of</strong> filing.Rule 5 Hearingsa. Complainants will be notified by mail as to the date and time <strong>of</strong> their hearing. If acomplainant fails to appear for the hearing, the board will take such action as they deemto be legal and just.b. At the hearing, the board <strong>of</strong> review will hear evidence from both the complainant and thetownship assessor as to over or under-valuation. The board will take all evidence intoconsideration and will render its decision at the hearing or at a subsequent date. Whenpresenting your evidence, please bear in mind that the members <strong>of</strong> the board havereviewed the submitted material and have a good deal <strong>of</strong> knowledge and real estateexperience. A recitation <strong>of</strong> the evidence is not necessary. The board will ask thenecessary questions to obtain an understanding <strong>of</strong> your position.c. The appellant will be notified in writing <strong>of</strong> the board <strong>of</strong> review’s FINAL decision. Alldecisions made by the board are subject to equalization. All decisions made by the board<strong>of</strong> review can be appealed to the Illinois Property Tax Appeal <strong>Board</strong>. Those petitionsmust be filed with the state within 30 days <strong>of</strong> the date printed on the board’s writtendecision.Rule 6 Any taxing body or entity wishing to intervene in a matter already before the board must fileon a proper board <strong>of</strong> review form. Such filing must be within 10 days <strong>of</strong> the postmarked dateappearing on the $100,000 notice. Said intervener must file their supporting evidence within14 days <strong>of</strong> the aforementioned postmark.Rule 7 The final filing date for the township assessors to submit requests for change shall bedetermined by the board <strong>of</strong> review.Any or all <strong>of</strong> the foregoing rules may be waived in a particular instance upon a majority vote <strong>of</strong> theboard <strong>of</strong> review for good cause shown.These rules will be updated as needed.