Annual Report 2010 - Leeden Limited

Annual Report 2010 - Leeden Limited

Annual Report 2010 - Leeden Limited

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

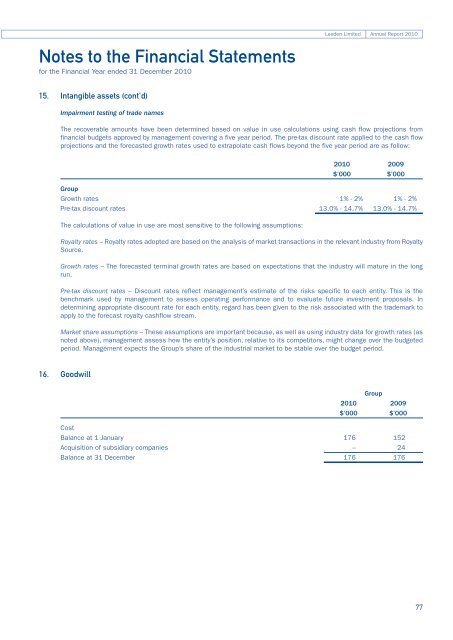

Notes to the Financial Statementsfor the Financial Year ended 31 December <strong>2010</strong><strong>Leeden</strong> <strong>Limited</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2010</strong>15. Intangible assets (cont’d)Impairment testing of trade namesThe recoverable amounts have been determined based on value in use calculations using cash flow projections fromfinancial budgets approved by management covering a five year period. The pre-tax discount rate applied to the cash flowprojections and the forecasted growth rates used to extrapolate cash flows beyond the five year period are as follow:<strong>2010</strong> 2009$’000 $’000GroupGrowth rates 1% - 2% 1% - 2%Pre-tax discount rates 13.0% - 14.7% 13.0% - 14.7%The calculations of value in use are most sensitive to the following assumptions:Royalty rates – Royalty rates adopted are based on the analysis of market transactions in the relevant industry from RoyaltySource.Growth rates – The forecasted terminal growth rates are based on expectations that the industry will mature in the longrun.Pre-tax discount rates – Discount rates reflect management’s estimate of the risks specific to each entity. This is thebenchmark used by management to assess operating performance and to evaluate future investment proposals. Indetermining appropriate discount rate for each entity, regard has been given to the risk associated with the trademark toapply to the forecast royalty cashflow stream.Market share assumptions – These assumptions are important because, as well as using industry data for growth rates (asnoted above), management assess how the entity’s position, relative to its competitors, might change over the budgetedperiod. Management expects the Group’s share of the industrial market to be stable over the budget period.16. GoodwillGroup<strong>2010</strong> 2009$’000 $’000CostBalance at 1 January 176 152Acquisition of subsidiary companies – 24Balance at 31 December 176 17677