Annual Report 2010 - Leeden Limited

Annual Report 2010 - Leeden Limited

Annual Report 2010 - Leeden Limited

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

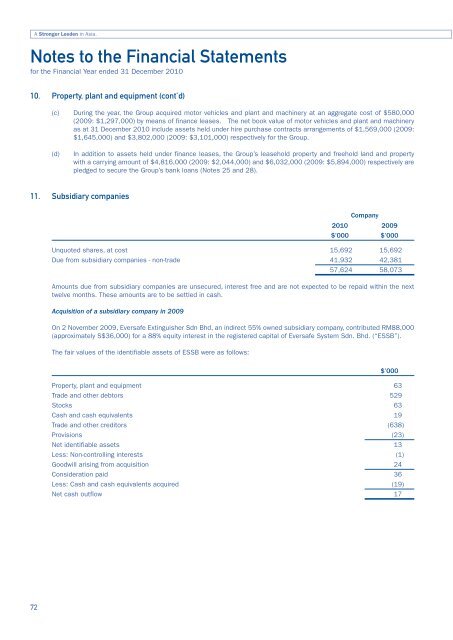

A Stronger <strong>Leeden</strong> in Asia.Notes to the Financial Statementsfor the Financial Year ended 31 December <strong>2010</strong>10. Property, plant and equipment (cont’d)(c) During the year, the Group acquired motor vehicles and plant and machinery at an aggregate cost of $580,000(2009: $1,297,000) by means of finance leases. The net book value of motor vehicles and plant and machineryas at 31 December <strong>2010</strong> include assets held under hire purchase contracts arrangements of $1,569,000 (2009:$1,645,000) and $3,802,000 (2009: $3,101,000) respectively for the Group.(d)In addition to assets held under finance leases, the Group’s leasehold property and freehold land and propertywith a carrying amount of $4,816,000 (2009: $2,044,000) and $6,032,000 (2009: $5,894,000) respectively arepledged to secure the Group’s bank loans (Notes 25 and 28).11. Subsidiary companiesCompany<strong>2010</strong> 2009$’000 $’000Unquoted shares, at cost 15,692 15,692Due from subsidiary companies - non-trade 41,932 42,38157,624 58,073Amounts due from subsidiary companies are unsecured, interest free and are not expected to be repaid within the nexttwelve months. These amounts are to be settled in cash.Acquisition of a subsidiary company in 2009On 2 November 2009, Eversafe Extinguisher Sdn Bhd, an indirect 55% owned subsidiary company, contributed RM88,000(approximately S$36,000) for a 88% equity interest in the registered capital of Eversafe System Sdn. Bhd. (“ESSB”).The fair values of the identifiable assets of ESSB were as follows:Property, plant and equipment 63Trade and other debtors 529Stocks 63Cash and cash equivalents 19Trade and other creditors (638)Provisions (23)Net identifiable assets 13Less: Non-controlling interests (1)Goodwill arising from acquisition 24Consideration paid 36Less: Cash and cash equivalents acquired (19)Net cash outflow 17$’00072