profit and loss budget fact sheet - Grains Research & Development ...

profit and loss budget fact sheet - Grains Research & Development ...

profit and loss budget fact sheet - Grains Research & Development ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Page 3<strong>and</strong> can include:contract spaying <strong>and</strong> wind rowing, <strong>and</strong>ome also values what could have been sold but was retained. In this example, a numbersheep enterprise.(in this example at $7,500).rofit <strong>and</strong> <strong>loss</strong>, but is not recorded as income in a cash flow, as no cash was received ascan be viewed at different levels. These categories are:ck variable costs, <strong>and</strong> overheads.een paid in full, such as the management allowance, or depreciation of machinery whichmely interest rates <strong>and</strong> bank fee charges. In this example, the income from bank depositsthe ATO is a legitimate business cost, this can be included in the <strong>profit</strong> <strong>and</strong> <strong>loss</strong>.ing put back into the business by the family farm owners.0 <strong>and</strong> we have allowed for $80,000 in the <strong>profit</strong> <strong>and</strong> <strong>loss</strong> for the managerial allowance.$60,000 is being taken out for living. This means the difference of $20,000 is being left in<strong>and</strong> income if the <strong>profit</strong> <strong>and</strong> <strong>loss</strong> is to represent the whole business. In this farm caseInformation obtained from aProfit <strong>and</strong> Loss BudgetThe main observations coming from a <strong>profit</strong><strong>and</strong> <strong>loss</strong>, illustrated by the case study, areas follows:Farm EBIT - This is the farm’s earnings beforeinterest, leasing <strong>and</strong> tax (EBIT) are takeninto account <strong>and</strong> is a number that can becompared with other similar businesses. Thehigher the number, the better the businessperformance; if this number were negative,farm viability would be questionable. Moreimportantly, it is also the <strong>profit</strong> number used inthe calculation of efficiency, or return on capitalmanaged. Table 1 indicates the case studyFarm EBIT is $98,559. (NB. Do not confusethis with Business EBIT*). While this appearsquite a reasonable result, remember thatinterest, leasing <strong>and</strong> tax payments have notyet been removed, so it may not in <strong>fact</strong> be avery positive result.Farm Net Profit before Tax – This is the<strong>profit</strong> to the farm business once all cash <strong>and</strong>non-cash costs, depreciation <strong>and</strong> financecosts have been taken into account. In Table1, this figure is $12,403, which being abovezero, indicates that this business is <strong>profit</strong>able.However, such a low <strong>profit</strong> level leaves littleroom for managing risk.Return on Managed Capital – This isthe return to total assets managed by thefarm business (including leased <strong>and</strong> sharefarmed l<strong>and</strong>) <strong>and</strong> is the preferred indicator ofbusiness efficiency. A figure greater than 8%indicates an efficient farm business. This iscalculated by dividing the farm EBIT by totalassets managed, multiplied by 100 to give apercentage ratio.In the case study farm, the farm EBIT of$98.6k divided by the total assets managedof $2.17m, gives a ratio of 4.54%. This is wellbelow the efficiency mark of 8%, so there isplenty of room for improvement.Unfortunately, most dryl<strong>and</strong> farm businessesin Australia are performing at a 1% – 3% ratio.At this level, a business may be viable butnot efficient.Return on Capital – This is a measure ofreturn on the assets owned by the business,also used by industry as an efficiency indicatorat 8% or above. Return on capital is calculatedby farm EBIT divided by total assets owned.In the case study, the farm EBIT of $98.6kdivided by the total assets owned of $1.94mgives a ratio of 5.08%, which is also below theefficiency level of 8%.Return on Owners Equity – This is the returnon the owner’s capital in the business. If wewant to see if the business is earning morethan bank interest, then this is the number tobe compared. This number should be wellabove bank deposit rates, to reflect the rewardfrom managing in a higher risk environment.This is calculated by farm EBIT dividedby Net Worth.

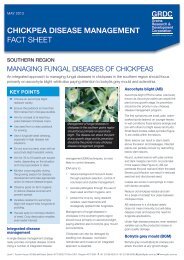

Page 4Figure 2 Profit <strong>and</strong> <strong>loss</strong>FarmgrossincomeVariablecostsTotalgrossmarginFixedcostsFarmEBITInterestFarm net<strong>profit</strong> (FNP)before taxTax/LivingFarm net<strong>profit</strong> after taxGrowthSource: Assoc. Prof. Bill Malcolm, ‘Pursuing Growth without Regret in Risky Crop-Farming’Using the farm case study in Table 1, thecalculation is $98.6k / $1.44m = 6.84%,which is above the current bank depositrate of 4%. However, is the difference of2.8% adequate compensation for the riskstaken by the farm? Only the owner cananswer this question.Some accounting thinkingWhen undertaking a <strong>profit</strong> <strong>and</strong> <strong>loss</strong> <strong>budget</strong>,a number of accounting procedures needto be kept in mind:• Accrual accounting – This is anaccounting term for including all theincome earned in one year against thecosts of that year, regardless of whenthe cash comes into or goes out of thebusiness account. A good example isthe payment schedule of grain pools.When you deliver to a grain pool, it cantake up to 18 months to get the finalpayment. In a cash flow, the incomeis recorded in the month it is received.However, for a <strong>profit</strong> <strong>and</strong> <strong>loss</strong>, the fullexpected income from that grain soldto the pools needs to be included inthe year of delivery to account for thetrue value of that season’s production.The same is true for expenses. If youbought two years supply of nitrogenfertiliser because it was a good price,but only use one in the current year, thenonly one year’s worth of the nitrogen isincluded as an expense in the <strong>profit</strong> <strong>and</strong><strong>loss</strong>. This is called accrual accounting.• The exclusion of GST – Theintroduction of a goods <strong>and</strong> servicetax (GST) does add a burden to cashflow, as receiving <strong>and</strong> paying GST canoccur at different times throughout theyear. However, by definition, the GSTcomponents should flow through thebusiness <strong>and</strong> not add to costs. A goodaccounting st<strong>and</strong>ard is to complete the<strong>profit</strong> <strong>and</strong> <strong>loss</strong> using income <strong>and</strong> coststhat do not have GST in them. This isalso the st<strong>and</strong>ard used to complete taxreturns. So, when doing a <strong>profit</strong> <strong>and</strong><strong>loss</strong>, complete the task without GST.• Keep a farming year in mind –All farmers have to complete a taxreturn, which is where a <strong>profit</strong> <strong>and</strong> <strong>loss</strong>is most likely first encountered. However,the tax year of July – June does not suitall farmers. For example, the financialyear for dryl<strong>and</strong> farmers takes theincome from one season <strong>and</strong> places itagainst the cropping cost of the next.When doing your own management<strong>profit</strong> <strong>and</strong> <strong>loss</strong>, select the year periodthat best suits your business. Fordryl<strong>and</strong> farmers, this will probably befrom March to February.• Managerial Allowance – Farmers tendto view the reward for their labour <strong>and</strong>management as their family drawings,but this is undervaluing their realcontribution. Rather, in a <strong>profit</strong> <strong>and</strong> <strong>loss</strong>,the true value of the owner’s labour<strong>and</strong> management should be used.This is what would need to be paidcommercially to employ a manager for ayear if the owner became incapacitated.If farmers began to value their ownlabour <strong>and</strong> management at commercialrates, they would be forced to improvetheir efficiency <strong>and</strong> decision making!USEFUL RESOURCESRelated GRDC Fact SheetsOther <strong>fact</strong> <strong>sheet</strong>s in this Farm BusinessManagement series provide furtherdetail on farm financial tools: FarmBusiness Overview (Order Code:GRDC909), Cash Flow Budget(Order Code: GRDC913), BalanceSheet (Order Code: GRDC917), CropGross Margin Budget (Order Code:GRDC914) <strong>and</strong> Livestock Gross MarginBudget (Order Code: GRDC915).Copies of all the above <strong>fact</strong> <strong>sheet</strong>s areFREE plus P&H <strong>and</strong> available from:Ground Cover Direct Freephone:1800 11 00 44 or email:ground-cover-direct@canprint.com.auThese can also be downloaded fromwww.GRDC.com.au/fbmPlan to Profit (P2P), a whole-farmfinancial management program thatcan help calculate a farm’s financial<strong>budget</strong>s: www.P2PAgri.com.auMORE INFORMATIONMike KrauseP2PAgri Pty Ltd08 8396 7122www.P2PAgri.com.auGRDC PROJECT CODEAES00006DISCLAIMERAny recommendations, suggestions or opinions contained in this publication do not necessarily represent the policy or views of the <strong>Grains</strong> <strong>Research</strong> <strong>and</strong> <strong>Development</strong> Corporation.No person should act on the basis of the contents of this publication without first obtaining specific, independent, professional advice.The Corporation <strong>and</strong> contributors to this Fact Sheet may identify products by proprietary or trade names to help readers identify particular types of products.We do not endorse or recommend the products of any manu<strong>fact</strong>urer referred to. Other products may perform as well as or better than those specifically referred to.The GRDC will not be liable for any <strong>loss</strong>, damage, cost or expense incurred or arising by reason of any person using or relying on the information in this publication.Copyright © All material published in this Fact Sheet is copyright protected <strong>and</strong> may not be reproduced in any form without written permission from the GRDC.