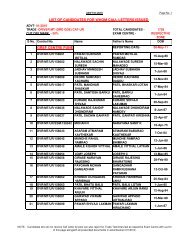

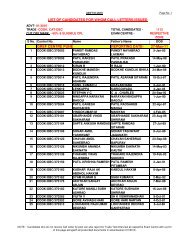

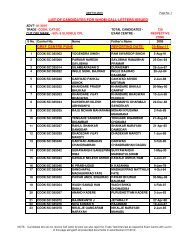

CA NO : CE (P) VIJAYAK/ /2012-13 Serial Page No : 01 ... - Bro.nic.in

CA NO : CE (P) VIJAYAK/ /2012-13 Serial Page No : 01 ... - Bro.nic.in

CA NO : CE (P) VIJAYAK/ /2012-13 Serial Page No : 01 ... - Bro.nic.in

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>CA</strong> <strong>NO</strong>. <strong>CE</strong> (P) <strong>VIJAYAK</strong>/ /<strong>2<strong>01</strong>2</strong>-<strong>13</strong> <strong>Serial</strong> <strong>Page</strong> <strong>No</strong>: 63TENDER <strong>NO</strong>: <strong>CE</strong> (P) <strong>VIJAYAK</strong>/46/ 2<strong>01</strong>1-<strong>2<strong>01</strong>2</strong>SPECIAL CONDITIONS (Contd…)26.2 The Contractor shall observe the laws/regulations applicable <strong>in</strong> the area regard<strong>in</strong>g the employmentof labour, payment of wages and other cognate matters relat<strong>in</strong>g to the conditions.27. RATES AND PRI<strong>CE</strong> ADJUSTMENT27.1 Rates quoted <strong>in</strong> Schedule “A” shall not be subjected to any adjustment whatsoever due tofluctuations <strong>in</strong> the local rates and rate of dearness allowances etc, for labour dur<strong>in</strong>g the contractperiod and/or any other cause whatsoever except as allowed only vide clause 63 of the GeneralConditions of Contract of IAFW-2249.27.2 Contractor’s rates quoted <strong>in</strong> the Schedule “A” shall be deemed to be <strong>in</strong>clusive of all sucharrangement as may be <strong>in</strong>volved <strong>in</strong> satisfactory execution of the work under the contract. <strong>No</strong> claimwhatsoever on account of any misunderstand<strong>in</strong>g or otherwise shall be admitted.27.3 Any Local taxes/charges <strong>in</strong>clud<strong>in</strong>g Octroi, Royalty charges, <strong>in</strong>come tax, Sales tax etc as perexist<strong>in</strong>g order of the Govt. shall be borne by the contractor and the rate quoted by the tenderershall be deemed to be <strong>in</strong>clusive of all such cont<strong>in</strong>gencies.28. DEDUCTION OF TAXES AT SOUR<strong>CE</strong>28.1 Income Tax : Income Tax at source shall be deducted as per exist<strong>in</strong>g <strong>in</strong>structions and as notifiedfrom time to time by the Income Tax authorities.28.2 Service Tax: The tax <strong>in</strong> respect of service provided <strong>in</strong> the shape of work, as payable to the stateGovt, as per their notification shall be deducted at source from the RAR/f<strong>in</strong>al bill of the contractoras per the rate prevail<strong>in</strong>g at the time of execution of work. For the calculation of Service tax aspayable, the value of Schedule ‘B’ store, issued, if any be deducted from the contract amount. Anysubsequent <strong>in</strong>crease/decrease <strong>in</strong> the service tax over and above the one prevail<strong>in</strong>g at the time ofsubmission of bid will be adjusted suitably.29. SPECIAL SECURITY DEPOSIT (SSD)29.1 3% of the contract value shall be deposited by the contractor as Special Security Deposit either <strong>in</strong>the form of bank guarantee or <strong>in</strong> the form of Deposit at Call receipt/Term Deposit/Special TermDeposit issued <strong>in</strong> favour of Chief Eng<strong>in</strong>eer, Project Vijayak, PIN-931721, C/o 56 APO byScheduled Bank, hav<strong>in</strong>g validity till expiry of defect liability period (i.e. One year after completion ofwork). In case the contractor fails to deposit the SSD <strong>in</strong> this form, the amount shall be deductedfrom the RAR/f<strong>in</strong>al bill of the contract. The special Security Deposit will be released on successfulcompletion of defect liability period, on receipt of no demand/no claim certificate from thecontractor and OC, Contract.Signature of ContractorDated : _________________<strong>2<strong>01</strong>2</strong>For Accept<strong>in</strong>g Officer