Official Statement Airport Commission City and County of San ...

Official Statement Airport Commission City and County of San ...

Official Statement Airport Commission City and County of San ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Postemployment Health Care Benefits. Eligibility <strong>of</strong> former <strong>City</strong> employees for retiree health care benefits<br />

is governed by the Charter, as amended by Proposition B, passed by voters on June 3, 2008. Employees <strong>and</strong> a<br />

spouse or dependent are potentially eligible for health benefits following retirement after age 50 <strong>and</strong> completing five<br />

years <strong>of</strong> <strong>City</strong> service, subject to other eligibility requirements.<br />

The <strong>City</strong> was required to begin reporting the liability <strong>and</strong> related information for unfunded post-retirement<br />

medical benefits in the <strong>City</strong>’s financial statements for the Fiscal Year ending June 30, 2008. This reporting<br />

requirement is defined in the Governmental Accounting St<strong>and</strong>ards Board (“GASB”) <strong>Statement</strong> No. 45<br />

(“GASB 45”), which addresses how state <strong>and</strong> local governments should account for <strong>and</strong> report their costs <strong>and</strong><br />

obligations related to post-employment health care <strong>and</strong> other non-pension benefits (“OPEB”). GASB 45 does not<br />

require that affected government agencies, including the <strong>City</strong> <strong>and</strong> the <strong>Airport</strong>, actually fund any portion <strong>of</strong> the<br />

OPEB, rather GASB 45 required that government agencies start to record <strong>and</strong> report a portion <strong>of</strong> the liability in each<br />

year if they do not fund the OPEB. GASB 45 also requires that non-pension benefits for retirees, such as retiree<br />

health care, be shown as an accrued liability on the financial statements.<br />

To help plan for the implementation <strong>of</strong> GASB 45, the <strong>City</strong> engaged an actuary to prepare a preliminary<br />

actuarial valuation <strong>of</strong> this liability. In its November 1, 2007 report on GASB 45 Valuation Results <strong>and</strong> Plan Design,<br />

Mercer Consulting estimated that if the <strong>City</strong> were to have a Funded Plan to cover post-employment medical<br />

benefits, the projected liability would be $4.0 billion <strong>and</strong> have an annual required contribution for Fiscal Year 2007<br />

08 <strong>of</strong> $409.1 million, assuming a 4.5% return on investments, while covering all <strong>City</strong> operations, including those<br />

that are General Fund supported. In Fiscal Year 2006-07, the <strong>City</strong>’s expenditures included $102.6 million for retiree<br />

health subsidies, which represented only the amount needed to pay for current costs due during such Fiscal Year.<br />

The additional potential liability to the <strong>City</strong> would, therefore, be the difference between the Mercer estimate <strong>and</strong> the<br />

Fiscal Year 2006-07 expenditures. The calculations in the Mercer Report are sensitive to a number <strong>of</strong> critical<br />

assumptions, including but not limited to the projected rate <strong>of</strong> increases in health plan costs.<br />

Proposition B, passed by <strong>San</strong> Francisco voters on June 3, 2008, tightens post-retirement health benefit<br />

eligibility rules for employees hired after January 10, 2009, <strong>and</strong> requires payments by the <strong>City</strong> <strong>and</strong> these employees<br />

equal to 3% <strong>of</strong> salary into a new retiree health trust fund. The <strong>City</strong>’s actuarial analysis shows that by 2031, this 3%<br />

funding will be sufficient to cover the cost <strong>of</strong> retiree health benefits for employees hired after January 10, 2009. The<br />

projected liability <strong>of</strong> $4.04 billion described above is designed to be partially addressed by the passage <strong>of</strong><br />

Proposition B which applies to future hires. See “–Retirement System–Voter Approved Changes to the Retirement<br />

Plan.”<br />

The <strong>City</strong> has determined a <strong>City</strong>-wide Annual Required Contribution (the “ARC”), interest on net OPEB<br />

Obligation, ARC adjustment, <strong>and</strong> OPEB cost based upon an actuarial valuation performed in accordance with<br />

GASB 45, by the <strong>City</strong>’s actuaries. The <strong>City</strong>’s allocation <strong>of</strong> the OPEB related costs to <strong>Airport</strong> for the year ended<br />

June 30, 2009 is based upon the <strong>Airport</strong>’s percentage <strong>of</strong> <strong>City</strong>-wide payroll costs.<br />

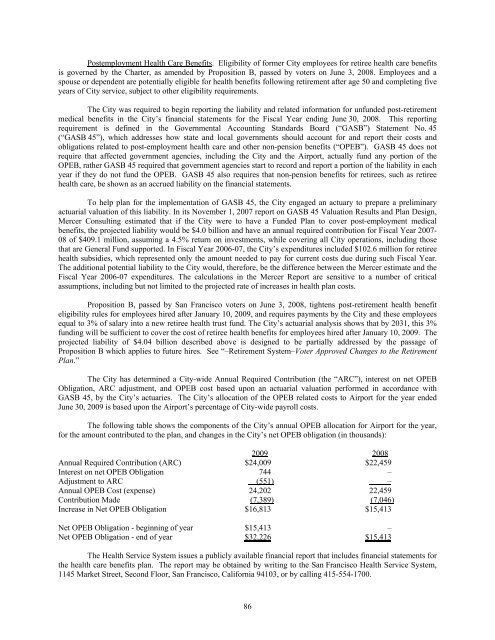

The following table shows the components <strong>of</strong> the <strong>City</strong>’s annual OPEB allocation for <strong>Airport</strong> for the year,<br />

for the amount contributed to the plan, <strong>and</strong> changes in the <strong>City</strong>’s net OPEB obligation (in thous<strong>and</strong>s):<br />

2009 2008<br />

Annual Required Contribution (ARC) $24,009 $22,459<br />

Interest on net OPEB Obligation 744 –<br />

Adjustment to ARC (551) –<br />

Annual OPEB Cost (expense) 24,202 22,459<br />

Contribution Made (7,389) (7,046)<br />

Increase in Net OPEB Obligation $16,813 $15,413<br />

Net OPEB Obligation - beginning <strong>of</strong> year $15,413 –<br />

Net OPEB Obligation - end <strong>of</strong> year $32,226 $15,413<br />

The Health Service System issues a publicly available financial report that includes financial statements for<br />

the health care benefits plan. The report may be obtained by writing to the <strong>San</strong> Francisco Health Service System,<br />

1145 Market Street, Second Floor, <strong>San</strong> Francisco, California 94103, or by calling 415-554-1700.<br />

86