Official Statement Airport Commission City and County of San ...

Official Statement Airport Commission City and County of San ...

Official Statement Airport Commission City and County of San ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

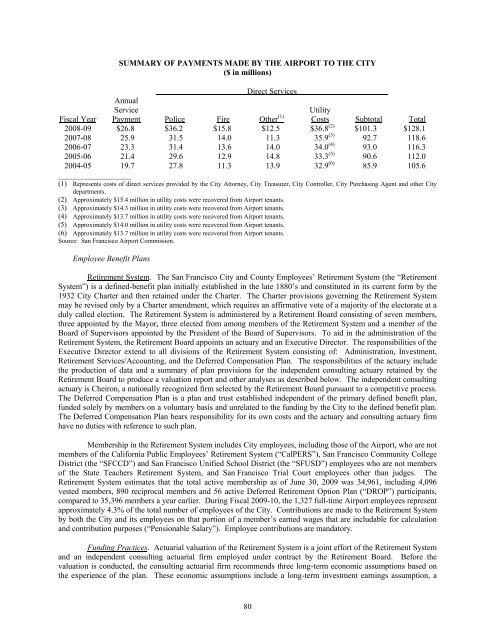

SUMMARY OF PAYMENTS MADE BY THE AIRPORT TO THE CITY<br />

($ in millions)<br />

Direct Services<br />

Annual<br />

Service<br />

Fiscal Year Payment Police Fire Other<br />

2008-09 $26.8 $36.2 $15.8<br />

__________________<br />

(1)<br />

Utility<br />

Costs<br />

$12.5 $36.8 (2)<br />

Subtotal Total<br />

$101.3 $128.1<br />

2007-08 25.9 31.5 14.0 11.3 35.9 (3) 92.7 118.6<br />

2006-07 23.3 31.4 13.6 14.0 34.0 (4) 93.0 116.3<br />

2005-06 21.4 29.6 12.9 14.8 33.3 (5) 90.6 112.0<br />

2004-05 19.7 27.8 11.3 13.9 32.9 (6) 85.9 105.6<br />

(1) Represents costs <strong>of</strong> direct services provided by the <strong>City</strong> Attorney, <strong>City</strong> Treasurer, <strong>City</strong> Controller, <strong>City</strong> Purchasing Agent <strong>and</strong> other <strong>City</strong><br />

departments.<br />

(2) Approximately $15.4 million in utility costs were recovered from <strong>Airport</strong> tenants.<br />

(3) Approximately $14.3 million in utility costs were recovered from <strong>Airport</strong> tenants.<br />

(4) Approximately $13.7 million in utility costs were recovered from <strong>Airport</strong> tenants.<br />

(5) Approximately $14.0 million in utility costs were recovered from <strong>Airport</strong> tenants.<br />

(6) Approximately $13.7 million in utility costs were recovered from <strong>Airport</strong> tenants.<br />

Source: <strong>San</strong> Francisco <strong>Airport</strong> <strong>Commission</strong>.<br />

Employee Benefit Plans<br />

Retirement System. The <strong>San</strong> Francisco <strong>City</strong> <strong>and</strong> <strong>County</strong> Employees’ Retirement System (the “Retirement<br />

System”) is a defined-benefit plan initially established in the late 1880’s <strong>and</strong> constituted in its current form by the<br />

1932 <strong>City</strong> Charter <strong>and</strong> then retained under the Charter. The Charter provisions governing the Retirement System<br />

may be revised only by a Charter amendment, which requires an affirmative vote <strong>of</strong> a majority <strong>of</strong> the electorate at a<br />

duly called election. The Retirement System is administered by a Retirement Board consisting <strong>of</strong> seven members,<br />

three appointed by the Mayor, three elected from among members <strong>of</strong> the Retirement System <strong>and</strong> a member <strong>of</strong> the<br />

Board <strong>of</strong> Supervisors appointed by the President <strong>of</strong> the Board <strong>of</strong> Supervisors. To aid in the administration <strong>of</strong> the<br />

Retirement System, the Retirement Board appoints an actuary <strong>and</strong> an Executive Director. The responsibilities <strong>of</strong> the<br />

Executive Director extend to all divisions <strong>of</strong> the Retirement System consisting <strong>of</strong>: Administration, Investment,<br />

Retirement Services/Accounting, <strong>and</strong> the Deferred Compensation Plan. The responsibilities <strong>of</strong> the actuary include<br />

the production <strong>of</strong> data <strong>and</strong> a summary <strong>of</strong> plan provisions for the independent consulting actuary retained by the<br />

Retirement Board to produce a valuation report <strong>and</strong> other analyses as described below. The independent consulting<br />

actuary is Cheiron, a nationally recognized firm selected by the Retirement Board pursuant to a competitive process.<br />

The Deferred Compensation Plan is a plan <strong>and</strong> trust established independent <strong>of</strong> the primary defined benefit plan,<br />

funded solely by members on a voluntary basis <strong>and</strong> unrelated to the funding by the <strong>City</strong> to the defined benefit plan.<br />

The Deferred Compensation Plan bears responsibility for its own costs <strong>and</strong> the actuary <strong>and</strong> consulting actuary firm<br />

have no duties with reference to such plan.<br />

Membership in the Retirement System includes <strong>City</strong> employees, including those <strong>of</strong> the <strong>Airport</strong>, who are not<br />

members <strong>of</strong> the California Public Employees’ Retirement System (“CalPERS”), <strong>San</strong> Francisco Community College<br />

District (the “SFCCD”) <strong>and</strong> <strong>San</strong> Francisco Unified School District (the “SFUSD”) employees who are not members<br />

<strong>of</strong> the State Teachers Retirement System, <strong>and</strong> <strong>San</strong> Francisco Trial Court employees other than judges. The<br />

Retirement System estimates that the total active membership as <strong>of</strong> June 30, 2009 was 34,961, including 4,096<br />

vested members, 890 reciprocal members <strong>and</strong> 56 active Deferred Retirement Option Plan (“DROP”) participants,<br />

compared to 35,396 members a year earlier. During Fiscal 2009-10, the 1,327 full-time <strong>Airport</strong> employees represent<br />

approximately 4.3% <strong>of</strong> the total number <strong>of</strong> employees <strong>of</strong> the <strong>City</strong>. Contributions are made to the Retirement System<br />

by both the <strong>City</strong> <strong>and</strong> its employees on that portion <strong>of</strong> a member’s earned wages that are includable for calculation<br />

<strong>and</strong> contribution purposes (“Pensionable Salary”). Employee contributions are m<strong>and</strong>atory.<br />

Funding Practices. Actuarial valuation <strong>of</strong> the Retirement System is a joint effort <strong>of</strong> the Retirement System<br />

<strong>and</strong> an independent consulting actuarial firm employed under contract by the Retirement Board. Before the<br />

valuation is conducted, the consulting actuarial firm recommends three long-term economic assumptions based on<br />

the experience <strong>of</strong> the plan. These economic assumptions include a long-term investment earnings assumption, a<br />

80