Official Statement Airport Commission City and County of San ...

Official Statement Airport Commission City and County of San ...

Official Statement Airport Commission City and County of San ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

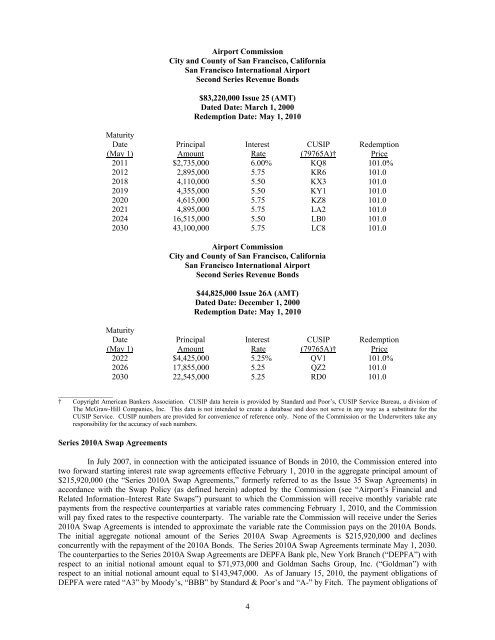

Maturity<br />

Date<br />

(May 1)<br />

2011<br />

2012<br />

2018<br />

2019<br />

2020<br />

2021<br />

2024<br />

2030<br />

Maturity<br />

Date<br />

(May 1)<br />

2022<br />

2026<br />

2030<br />

<strong>Airport</strong> <strong>Commission</strong><br />

<strong>City</strong> <strong>and</strong> <strong>County</strong> <strong>of</strong> <strong>San</strong> Francisco, California<br />

<strong>San</strong> Francisco International <strong>Airport</strong><br />

Second Series Revenue Bonds<br />

Principal<br />

Amount<br />

$2,735,000<br />

2,895,000<br />

4,110,000<br />

4,355,000<br />

4,615,000<br />

4,895,000<br />

16,515,000<br />

43,100,000<br />

$83,220,000 Issue 25 (AMT)<br />

Dated Date: March 1, 2000<br />

Redemption Date: May 1, 2010<br />

Interest<br />

Rate<br />

6.00%<br />

5.75<br />

5.50<br />

5.50<br />

5.75<br />

5.75<br />

5.50<br />

5.75<br />

CUSIP<br />

(79765A)†<br />

KQ8<br />

KR6<br />

KX3<br />

KY1<br />

KZ8<br />

LA2<br />

LB0<br />

LC8<br />

<strong>Airport</strong> <strong>Commission</strong><br />

<strong>City</strong> <strong>and</strong> <strong>County</strong> <strong>of</strong> <strong>San</strong> Francisco, California<br />

<strong>San</strong> Francisco International <strong>Airport</strong><br />

Second Series Revenue Bonds<br />

Principal<br />

Amount<br />

$4,425,000<br />

17,855,000<br />

22,545,000<br />

$44,825,000 Issue 26A (AMT)<br />

Dated Date: December 1, 2000<br />

Redemption Date: May 1, 2010<br />

Interest<br />

Rate<br />

5.25%<br />

5.25<br />

5.25<br />

CUSIP<br />

(79765A)†<br />

QV1<br />

QZ2<br />

RD0<br />

Redemption<br />

Price<br />

101.0%<br />

101.0<br />

101.0<br />

101.0<br />

101.0<br />

101.0<br />

101.0<br />

101.0<br />

Redemption<br />

Price<br />

101.0%<br />

101.0<br />

101.0<br />

_______________<br />

† Copyright American Bankers Association. CUSIP data herein is provided by St<strong>and</strong>ard <strong>and</strong> Poor’s, CUSIP Service Bureau, a division <strong>of</strong><br />

The McGraw-Hill Companies, Inc. This data is not intended to create a database <strong>and</strong> does not serve in any way as a substitute for the<br />

CUSIP Service. CUSIP numbers are provided for convenience <strong>of</strong> reference only. None <strong>of</strong> the <strong>Commission</strong> or the Underwriters take any<br />

responsibility for the accuracy <strong>of</strong> such numbers.<br />

Series 2010A Swap Agreements<br />

In July 2007, in connection with the anticipated issuance <strong>of</strong> Bonds in 2010, the <strong>Commission</strong> entered into<br />

two forward starting interest rate swap agreements effective February 1, 2010 in the aggregate principal amount <strong>of</strong><br />

$215,920,000 (the “Series 2010A Swap Agreements,” formerly referred to as the Issue 35 Swap Agreements) in<br />

accordance with the Swap Policy (as defined herein) adopted by the <strong>Commission</strong> (see “<strong>Airport</strong>’s Financial <strong>and</strong><br />

Related Information–Interest Rate Swaps”) pursuant to which the <strong>Commission</strong> will receive monthly variable rate<br />

payments from the respective counterparties at variable rates commencing February 1, 2010, <strong>and</strong> the <strong>Commission</strong><br />

will pay fixed rates to the respective counterparty. The variable rate the <strong>Commission</strong> will receive under the Series<br />

2010A Swap Agreements is intended to approximate the variable rate the <strong>Commission</strong> pays on the 2010A Bonds.<br />

The initial aggregate notional amount <strong>of</strong> the Series 2010A Swap Agreements is $215,920,000 <strong>and</strong> declines<br />

concurrently with the repayment <strong>of</strong> the 2010A Bonds. The Series 2010A Swap Agreements terminate May 1, 2030.<br />

The counterparties to the Series 2010A Swap Agreements are DEPFA Bank plc, New York Branch (“DEPFA”) with<br />

respect to an initial notional amount equal to $71,973,000 <strong>and</strong> Goldman Sachs Group, Inc. (“Goldman”) with<br />

respect to an initial notional amount equal to $143,947,000. As <strong>of</strong> January 15, 2010, the payment obligations <strong>of</strong><br />

DEPFA were rated “A3” by Moody’s, “BBB” by St<strong>and</strong>ard & Poor’s <strong>and</strong> “A-” by Fitch. The payment obligations <strong>of</strong><br />

4