Early release of super - Colonial First State

Early release of super - Colonial First State

Early release of super - Colonial First State

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

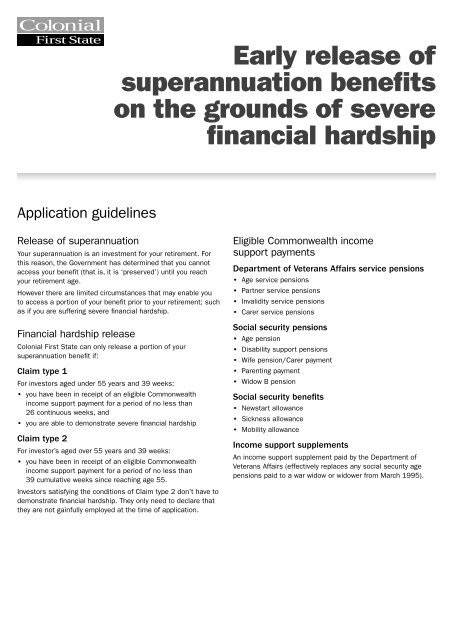

<strong>Early</strong> <strong>release</strong> <strong>of</strong><strong>super</strong>annuation benefitson the grounds <strong>of</strong> severefinancial hardshipApplication guidelinesRelease <strong>of</strong> <strong>super</strong>annuationYour <strong>super</strong>annuation is an investment for your retirement. Forthis reason, the Government has determined that you cannotaccess your benefit (that is, it is ‘preserved’) until you reachyour retirement age.However there are limited circumstances that may enable youto access a portion <strong>of</strong> your benefit prior to your retirement; suchas if you are suffering severe financial hardship.Financial hardship <strong>release</strong><strong>Colonial</strong> <strong>First</strong> <strong>State</strong> can only <strong>release</strong> a portion <strong>of</strong> your<strong>super</strong>annuation benefit if:Claim type 1For investors aged under 55 years and 39 weeks:••you have been in receipt <strong>of</strong> an eligible Commonwealthincome support payment for a period <strong>of</strong> no less than26 continuous weeks, and••you are able to demonstrate severe financial hardshipClaim type 2For investor’s aged over 55 years and 39 weeks:••you have been in receipt <strong>of</strong> an eligible Commonwealthincome support payment for a period <strong>of</strong> no less than39 cumulative weeks since reaching age 55.Investors satisfying the conditions <strong>of</strong> Claim type 2 don’t have todemonstrate financial hardship. They only need to declare thatthey are not gainfully employed at the time <strong>of</strong> application.Eligible Commonwealth incomesupport paymentsDepartment <strong>of</strong> Veterans Affairs service pensions••Age service pensions••Partner service pensions••Invalidity service pensions••Carer service pensionsSocial security pensions••Age pension••Disability support pensions••Wife pension/Carer payment••Parenting payment••Widow B pensionSocial security benefits••Newstart allowance••Sickness allowance••Mobility allowanceIncome support supplementsAn income support supplement paid by the Department <strong>of</strong>Veterans Affairs (effectively replaces any social security agepensions paid to a war widow or widower from March 1995).

Other payments••Drought relief payment under the Farm Household SupportAct 1992••An exceptional circumstances relief payment under the FarmHousehold Support Act 1992••A payment <strong>of</strong> income support for the purposes <strong>of</strong> the FarmFamily Support Scheme••A payment <strong>of</strong> salary or wages made under theCommonwealth Community Development EmploymentProjects SchemeIncome payments that are not eligible••Family payments(formerly known as family allowance payments).••Austudy/Abstudy or other youth allowance paymentsin relation to full time study.Demonstrating financial hardshipIf you are aged under 55 years and 39 weeks you must beable to demonstrate that you are in severe financial hardshipto access your <strong>super</strong> benefits on the grounds <strong>of</strong> severefinancial hardship.Severe financial hardship means that you are unable to meetreasonable and immediate family living expenses.An immediate living expense is one that is due and payableat the time <strong>of</strong> application. Generally, future expenses are notconsidered unless the expense is urgent in nature and willbecome payable very soon.Examples <strong>of</strong> immediate living expenses include:••urgent household repairs not yet commenced (eg leaking gasstove); and••urgent medical treatment not yet undertaken.Guidelines on common types <strong>of</strong> expenses are shown in the‘<strong>release</strong> guidelines’ section below.The Department <strong>of</strong> Human Services (Centrelink) will be able totell you whether the particular payment you receive qualifies.To demonstrate your eligibility, you will need to provide us withyour Customer Reference Number (CRN) on your application.More information on the CRN is detailed below.Customer Reference Number (CRN) andCustomer Confirmation eService (CCeS)To confirm whether you have been paid an eligibleCommonwealth income support payment, <strong>Colonial</strong> <strong>First</strong> <strong>State</strong>uses the Customer Confirmation eService (CCeS).CCeS is an internet based service <strong>of</strong>fered by the Department<strong>of</strong> Human Services (Centrelink) to help us verify your eligibilityelectronically and therefore immediately. This system replacesthe old written confirmation process (‘Q230’ letter).To confirm your details on CCeS, <strong>Colonial</strong> <strong>First</strong> <strong>State</strong> willuse your name, date <strong>of</strong> birth and your Customer ReferenceNumber (CRN).When accessing your details on the CCeS, <strong>Colonial</strong> <strong>First</strong> <strong>State</strong>is bound by the legislative requirements <strong>of</strong> confidentiality,including the Privacy Act 1988.This means <strong>Colonial</strong> <strong>First</strong> <strong>State</strong> cannot disclose your CRNto anyone other than the Department <strong>of</strong> Human Services(Centrelink) or use it for any purpose other than to verifywhether you have received qualifying Commonwealth incomesupport for the period required to be eligible to access yourbenefits on the grounds <strong>of</strong> severe financial hardship.To obtain your CRN you will need to contact the Department<strong>of</strong> Human Services (Centrelink).The relevant Customer numbers are:Newstart and other allowances 13 28 50Retirement and disabilities 13 23 00The Department <strong>of</strong> Veterans Affairs 13 32 54How much can be <strong>release</strong>d<strong>Colonial</strong> <strong>First</strong> <strong>State</strong> can only <strong>release</strong> a maximum <strong>of</strong> $10,000gross (before tax), including any other disclosed financialhardship payment, in any 12 month period. For investors overage 55 and 39 weeks, no maximum cashing restrictions apply.We may <strong>release</strong> up to your total account balance.The minimum amount that can be <strong>release</strong>d is $1,000.Only one payment can be made in any 12 month period.For information on the taxation that will be withheld from a financialhardship benefit please refer to the Taxation section below.AssetsIf you have any assets that could reasonably and realistically besold to meet your expenses (the family home excluded) you areunlikely to meet the requirements <strong>of</strong> financial hardship.For example, if your net assets exceed $50,000, you may beineligible to claim financial hardship.Documentary evidence<strong>Colonial</strong> <strong>First</strong> <strong>State</strong> requires that you provide enough documentaryevidence to support your claim for financial hardship.We may request additional information or decline your claimif the information provided is not sufficient.Release guidelinesWe have detailed below some <strong>of</strong> the common types <strong>of</strong>expenses and how they will be treated. These are guidelinesonly and if you have any questions on specific expenses, pleasecontact Investor Services on 13 13 36.Credit cards and other loansGenerally we will pay the immediate minimum outstandingbalance only. You will need to include copies <strong>of</strong> your latestcredit card or loan statements with your application.Personal loans from family or friends are generally not allowedunless you are able to provide a statutory declaration from theperson to whom the money is owed stating:••the details <strong>of</strong> the loan••that the loan is immediately due and payable

••evidence (bank statements, paid bills) that you did in factreceive the money lent to you by family or friends, and••that the loan was needed to meet reasonable and immediatefamily living expenses.General billsExpenses for utilities such as gas, water, electricity, phone etcwill generally be approved provided that the funds are to coveramounts due at the date <strong>of</strong> the application. Therefore you mustinclude copies <strong>of</strong> the most recent and due bills.We may also approve <strong>release</strong> for expenses such as ratesor body corporate expenses provided we receive sufficientdocumentary evidence <strong>of</strong> these being due and payable at thetime <strong>of</strong> application.InsuranceWe will generally <strong>release</strong> funds for payment <strong>of</strong> outstandinginsurance (house, car, contents, medical) provided we receivesufficient documentary evidence <strong>of</strong> these being due andpayable at the time <strong>of</strong> application.Motor vehicleWe can only approve payments for repairs to a motor vehiclewhere they are required to make the vehicle roadworthy. If youare claiming on these grounds you will need to provide a quotealong with documentary evidence that the repairs are essential.Funds for the purchase <strong>of</strong> a motor vehicle will not be approvedexcept in exceptional circumstances.Education expensesWe may <strong>release</strong> funds to meet educational expenses for youor your dependants (such as school fees, uniforms, books etc)where they are due and payable at the time <strong>of</strong> application or inthe very near future.Again, you will need to provide sufficient documentary evidence.Medical expensesWe may <strong>release</strong> funds for outstanding medical bills wheredocumentary evidence is provided.If you have substantial medical costs, you should considercontacting the Department <strong>of</strong> Human Services (Medicare)on 1300 131 160 as they can direct the <strong>release</strong> <strong>of</strong>funds in excess <strong>of</strong> $10,000 for such a purpose oncompassionate grounds.Mortgage paymentsWe may only <strong>release</strong> funds to cover minimum outstandingamounts.If you are in danger <strong>of</strong> defaulting on your mortgage, you shouldconsider contacting the Department <strong>of</strong> Human Services(Medicare) on 1300 131 160 as they can direct the <strong>release</strong><strong>of</strong> funds in excess <strong>of</strong> $10,000.00 for such a purpose oncompassionate grounds.Household goodsGenerally we can not <strong>release</strong> funds to cover the cost <strong>of</strong>household items unless they are essential. Examplesmay include a refrigerator. We will not <strong>release</strong> funds tocover discretionary expenses such as televisions, stereosand computers.Department <strong>of</strong> Human Services (Medicare)<strong>release</strong>s on compassionate groundsIf you do not qualify for early <strong>release</strong> <strong>of</strong> your <strong>super</strong>annuationbenefits on the grounds <strong>of</strong> severe financial hardship, youmay consider asking the Department <strong>of</strong> Human Services(Medicare) to approve the <strong>release</strong> <strong>of</strong> some or all <strong>of</strong> yourbenefits on compassionate grounds. You should contact theDepartment <strong>of</strong> Human Services (Medicare) on 1300 131 060for more information.Taxation<strong>Colonial</strong> <strong>First</strong> <strong>State</strong> may be required to deduct tax from yourfinancial hardship benefit. The tax payable will depend on thecomponents <strong>of</strong> the benefit being <strong>release</strong>d and your age. If youare age 60 or over, no tax is payable on your financial hardshipbenefit. Generally, if you are over your preservation age(currently age 55) and have not previously accessed your <strong>super</strong>,you are also not likely to pay any tax. For more informationplease refer to the Product Disclosure <strong>State</strong>ment availableat colonialfirststate.com.au or by calling us on 13 13 36.PrivacyThe personal information you provide to us on the attachedquestionnaire will only be used in accordance with privacydisclosure in the relevant Product Disclosure <strong>State</strong>ment (‘PDS’).You should refer to this information before completing thequestionnaire.If you have any concerns or concerns about your rights underthe privacy legislation, please contact Investor Serviceson 13 13 36.Want to find out more?Please speak with your financial adviser or visit our website at colonialfirststate.com.au. Alternatively, you can contact us:Enquiries about existing investments, please call 13 13 36This booklet provides general information only and is not financial advice or a recommendation. It does not take into account your individual objectives, financial situation or needs.<strong>Colonial</strong> <strong>First</strong> <strong>State</strong> Investments Limited ABN 98 002 348 352, AFS Licence 232468 (<strong>Colonial</strong> <strong>First</strong> <strong>State</strong>) is the issuer <strong>of</strong> interests in <strong>First</strong>Choice Personal Super from the <strong>Colonial</strong> <strong>First</strong><strong>State</strong> <strong>First</strong>Choice Superannuation Trust ABN 26 458 298 557. Product Disclosure <strong>State</strong>ments (PDS) are available from our website colonialfirststate.com.au or by calling 13 13 36. Youshould read the relevant PDS and assess whether the information is appropriate for you and consider talking to a financial adviser before making an investment decision. <strong>Colonial</strong> <strong>First</strong><strong>State</strong> Investments Limited is a wholly owned subsidiary <strong>of</strong> Commonwealth Bank <strong>of</strong> Australia. Commonwealth Bank <strong>of</strong> Australia and its subsidiaries do not guarantee the performance<strong>of</strong> these products or the repayment <strong>of</strong> capital by <strong>First</strong>Choice. Investments in these products are not deposits or other liabilities <strong>of</strong> Commonwealth Bank <strong>of</strong> Australia or its subsidiariesand investment-type products are subject to risk, including possible loss <strong>of</strong> income and capital invested.17582/FS4696/0613

<strong>Early</strong> <strong>release</strong> <strong>of</strong> <strong>super</strong>annuation benefits on the grounds<strong>of</strong> severe financial hardshipQuestionnaireSection A – Your personal details<strong>Colonial</strong> <strong>First</strong> <strong>State</strong> account numberMr Mrs Miss Ms OtherGiven NameSurnameHave you changed your address in the last 6 months? Yes NoIf yes, please detail your previous address below.Daytime contact phone numberWho does this application refer to? Myself only Myself and my dependants (please list below)Name Relationship AgeSection B – Customer Reference Number (CRN) declarationI wish to apply for early <strong>release</strong> <strong>of</strong> funds on the grounds <strong>of</strong> severe financial hardship. I confirm that I am (please tick one):Under age 55 and 39 weeks and have been in receipt <strong>of</strong> an eligible Commonwealth income support payment for a period <strong>of</strong> noless than 26 continuous weeksOver age 55 and 39 weeks and have been in receipt <strong>of</strong> an eligible Commonwealth income support payment for a period <strong>of</strong> noless than 39 cumulative weeks since reaching age 55. I also confirm that I am not gainfully employed at the time <strong>of</strong> application.My Customer Reference Number (CRN) isBy providing this number, I am giving consent to <strong>Colonial</strong> <strong>First</strong> <strong>State</strong> to confirm with the Department <strong>of</strong> Human Services (Centrelink)that my name, date <strong>of</strong> birth and Customer Reference Number (CRN) details supplied in this application match the Department <strong>of</strong>Human Services (Centrelink) records, and whether I have a qualifying income support payment for the period required for the early<strong>release</strong> <strong>of</strong> <strong>super</strong> my <strong>super</strong>annuation funds on the grounds <strong>of</strong> severe financial hardship.Your SignatureSection C – Amount you are claimingDateI wish to apply for a gross amount <strong>of</strong>Under age 55 and 39 weeks: The maximum amount you can apply for is the lesser <strong>of</strong> your account balance or $10,000 gross 1 and youcan only apply to have monies <strong>release</strong>d once each 12 month period. Please detail your calculations in section D.Over age 55 and 39 weeks: No maximum limits apply. We may <strong>release</strong> up to your total account balance 1 .1 If payment is approved, taxation may be deducted from your benefit. For more information, please contact Investor Services on 13 13 36.Section D – Your financial position (only applicable to members under age 55 and 39 weeks)Have you received any financial hardship payments in the past 12 months? Yes NoTotal <strong>of</strong> payments receivedWeekly income $My net incomeMy partner’s net incomeDependant’s net incomeAny other incomeTotalI have attached relevant supporting documentation including mythree most recent bank statements (ie at least the last 3 months)and any payslips – note: ATM slips are not acceptable.

Section D – Your financial position (continued)Weekly expensesMinimum credit card repaymentsMinimum loan repaymentsRent/boardFoodCar (petrol/service/registration)Utilities (gas & electricity)Telephone (home/mobile)Council, land & water ratesInsurance (home & car)School costsTravel expensesOther (please detail below)Assets (excluding your home)If your net liquid assets exceed $50,000.00, you may be ineligibleto claim financial hardship.SavingsInvestments (property, shares etc)Vehicle(s)Other itemsTotalLiabilitiesPersonal loanCredit card(s)Other debts (detail below)TotalI have attached documentation supporting all these claimsbeing as copies <strong>of</strong> the most recent outstanding bills that aredue and payable at the time <strong>of</strong> the claim.TotalI have attached documentation supporting these liabilities.for any loans where no paperwork exists (eg loans from familymembers) I have enclosed a separate statutory declarationcompleted by the lending party detailing the loan and evidence<strong>of</strong> my receipt <strong>of</strong> these funds. The statutory declaration statesthe amount immediately due.Section E – Your payment detailsPlease select you preferred payment method should your claim be approved: Cheque Bank accountAccount nameBranch numberAccount numberIf no payment instructions are provided, we will mail a cheque to your current address.Section F – Statutory declarationI<strong>of</strong>Full name <strong>of</strong> declarantAddressdo solemnly and sincerely declare that the information provided by me in the application for <strong>release</strong> <strong>of</strong> benefits on grounds <strong>of</strong> severefinancial hardship attached is true and correct.I also declare that I am unable to meet reasonable and immediate family living expenses and that I do not have any assets whichcould (reasonably and realistically) be used or sold to cover this gap.I also declare that the amount I am requesting to be <strong>release</strong>d is necessary to meet this reasonable and immediate family expense.I make this solemn declaration by virtue <strong>of</strong> the Statutory Declarations Act 1959 (Commonwealth), and subject to the penaltiesprovided in that Act for the making <strong>of</strong> false statements in statutory declarations, conscientiously believing the statements containedto be true in every particular.Signature <strong>of</strong> person making declaration Declared at OnSignature <strong>of</strong> authorised witnessName and capacity <strong>of</strong> witness (Must be a J.P or equivalent)Address <strong>of</strong> witness

PLEASE DO NOT STAPLEHead <strong>First</strong>Choice Personal SuperWithdrawal Head FormThis is an interactive formB3BTFZPlease phone <strong>Colonial</strong> <strong>First</strong> <strong>State</strong> Investor Services on 13 13 36 with any questions.Please complete this form using BLACK INK and print well within the boxes in CAPITAL LETTERS.Mark appropriate answer boxes with a cross like the following X . Start at the left <strong>of</strong> each answerspace and leave a gap between words.Please complete all fields to ensure that we hold the correct details.Fields marked with an asterisk (*) must be completed for the purposes <strong>of</strong> anti-money laundering laws.SAVE FORMPRINT FORM1 INVESTOR DETAILS<strong>First</strong>Choice Personal Super account numberHave you discussed this transaction with your adviser?0 1 0Yes NoTitleMr Mrs Miss Ms OtherFull given name(s)*Surname* (Please supply relevant certified documents if details have changed)Date <strong>of</strong> birth*dd/mm/yyyyOccupation and industry* (If retired, state RETIRED)Your main country <strong>of</strong> residence, if not Australia*Residential address (PO Box is NOT acceptable)*UnitnumberStreetnumberStreetnameSuburb <strong>State</strong> PostcodeCountryPostal address for all communications and cheque payments (if applicable)Cross (X) box where appropriate:Same as residential address, as aboveSame as existing postal address on accountUnitnumberDifferent address as provided below:Streetnumber PO BoxStreetnameSuburb <strong>State</strong> PostcodeCountryWork phone number Home phone number Fax number Mobile phone numberEmail addressBy providing your email address, you agree that we may use this address to provide you with information about your investment(such as transaction confirmations, statements, reports and other material). From time to time we may still need to send you lettersin the post.

2 RESIDENCY DETAILS – this section must be completedIf you do not complete this section your request may be delayed. If you are completing a rollover request to another <strong>super</strong>annuationfund, you can proceed to Section 3. If you are requesting to cash out your <strong>super</strong> benefit or requesting a rollover to commence apension, you must complete the section below.Cross (X) box as applicableAustralian citizen/residentNew Zealand citizenNon-resident (has never been a temporary resident visa holder <strong>of</strong> Australia)Holder <strong>of</strong> Retirement Visa subclass 405/410If you have selected any <strong>of</strong> the above, please proceed to section 3 <strong>of</strong> this form.Temporary resident visa holder <strong>of</strong> Australia••Please complete section 10 – Temporary resident visa holder – Conditions <strong>of</strong> <strong>release</strong>. Please obtain the ‘Temporary residentbrochure for <strong>super</strong>annuation’ available at colonialfirststate.com.au or by calling us on 13 13 36 for further information on the <strong>super</strong>benefits you are entitled to.3 WITHDRAWAL instructionsWITHDRAWAL AMOUNTUnless otherwise indicated, the amount shown should be NET <strong>of</strong> tax and withdrawal adjustments.ORI would like to close my accountORLeave minimum balance required (Minimum remaining account balance is $1,500.)I would like to withdraw $Please note: If you close your account without providing your Tax File Number, you may not be able to claim back any TFN tax thathas been deducted.PAYMENT DETAILSThis payment is to be:ORPaid to me (complete Section 4)Rolled over to another <strong>super</strong>annuation fund(s) (complete Section 8)WITHDRAWAL INVESTMENT OPTION/S – PARTIAL WITHDRAWALS ONLYCross (X) one box only. If no option is selected, we will redeem as per your existing investment weightings.I would like this withdrawal to be made in line with my investment allocation on the date <strong>of</strong> this transaction. If you hold fundsin a <strong>First</strong>Rate Wholesale Investment Deposit or <strong>First</strong>Rate Wholesale Term Deposit, we will exclude this from the transaction, unlessotherwise advised below.ORORI would like this withdrawal to be made in line with existing auto-rebalancing weightingsI would like this withdrawal to be made from my account as shown below. If this is a full withdrawal from an option, write‘balance’ next to that option.Please note: If you transact outside <strong>of</strong> existing auto-rebalancing weightings, we will automatically cancel this facility.

3 WITHDRAWAL instructions (continued)Option code(refer to theback page <strong>of</strong>this form)Amount$$$$$$TOTAL $Please note: If you have specified a restricted, suspended or unavailable option, we may not be able to process your request immediately.You should refer to our website for important information on any changes to the availability <strong>of</strong> particular investment options.4 PAYMENT instructionsYour instructions in this section overrides previous nominations. Only one method can be selected. Please cross (X) one:Credit x Credit my Australian financial institution account shown in section 7Cheque x Mail a cheque to my address. Cheques issued are not bank chequesPlease note: If no payment method is selected, a cheque will be issued.5 AUTO rebalancing (if applicable)If you have auto-rebalancing on your account and you transact outside your future investment selection weightings, your transactionwill cancel this facility. You should complete this section if you wish to re-establish the facility.(!) Please note: The auto-rebalancing facility switches your investments quarterly or annually to bring them in line with your futureinvestment selection weightings, (excluding <strong>First</strong>Rate Term Deposits, <strong>First</strong>Rate Investment Deposits and any suspended, restrictedor unavailable options). Transaction costs may apply and there may be tax consequences <strong>of</strong> using the auto-rebalancing facility. Youshould only complete this section under advice or if you are clear on how the facility works.Establish or re-establish auto-rebalancingI wish to establish or re-establish auto-rebalancing on my account. I understand that the rebalancing weightings will be inline with my future investment selection, being the weightings resulting from my withdrawal details specified in section 3 –‘withdrawal instructions’.How frequently would you like auto-rebalancing to occur?(If you make no frequency selection, we will rebalance your portfolio annually)Annually (<strong>First</strong> business day after 14 May)Quarterly (<strong>First</strong> business day after 14 February, May, August and November)

6 IMPORTANT information on your accountIf you are withdrawing the full balance <strong>of</strong> an investment option and have any <strong>of</strong> the following facilities, you will need to advise us <strong>of</strong> theinvestment option you wish to transfer this facility to.Regular investment planIf you are withdrawing 100% from an option and you do not tellus how you would like your Regular Investment Plan allocated,we will use a default process to determine the allocation. Thismay include using the account allocation resulting from thiswithdrawal or your future investment weightings.future investment selectionPlease indicate below how you would like your future investmentsallocated. If you do not tell us how you would like your futureinvestments allocated, we will allocate as per the investmentweightings resulting from this withdrawal.Option code(refer to theback page <strong>of</strong>this form)Regular investment plan amountOption code(refer to theback page <strong>of</strong>this form) %$$$$$$$$$TOTAL $TOTAL1 0 0 %MANAGEMENT COST REBATESelect the investment option for which any management cost rebate (fee rebate and portfolio rebate) that may be applicable is tobe credited.Option CODE (refer to back page <strong>of</strong> this form).Please note: you must have a current account balance within this option in order to nominate it for rebate purposes.A portfolio rebate may apply to account balances greater than $400,000.If no option or more than one option or an invalid option is nominated, we will credit this rebate in the order outlined on the back <strong>of</strong>this form.insurance premiumsIndicate one option onlyOption CODE (refer to the back page <strong>of</strong> this form)If no option or more than one option or an invalid option is nominated we will deduct the premiums in the order outlined on the backpage <strong>of</strong> this form.

7 Details <strong>of</strong> account to be creditedPlease note: New bank account details via fax cannot be accepted, unless sent from a Commonwealth Bank branch.Name <strong>of</strong> Australian financial institutionBranch nameBranch number (BSB)–Name <strong>of</strong> account holderAccount numberYou can only nominate a bank account that is held in your name. If you are rolling over to a self managed <strong>super</strong> fund, you mustnominate an account held in the name <strong>of</strong> the fund.8 ROLLOVER detailsComplete this section if you would like your withdrawal to be rolled over to another institution. Please complete all details and ensurethat you provide us with a valid Australian Business Number (ABN) or Unique Superannuation Identifier (USI).rollover 1AmountAccount/Membership number <strong>of</strong> fund$ABN AND USIRollover institution, fund name (eg <strong>First</strong>Choice Pension)Postal addressUnitnumberStreetnumber PO BoxStreetnameSuburb <strong>State</strong> PostcodeCountryrollover 2AmountAccount/Membership number <strong>of</strong> fund$ABN AND USIRollover institution, fund name (eg <strong>First</strong>Choice Pension)Postal addressUnitnumberStreetnumber PO BoxStreetnameSuburb <strong>State</strong> PostcodeCountryNote: If you require more than 2 rollovers to another institution, please attach a signed letter with your withdrawal form with theabove details.

9 Tax file number notificationI acknowledge that I am aware that:••my provision, and your receipt, <strong>of</strong> my tax file number are authorised under the Superannuation Industry (Supervision) Act 1993••if I provide my tax file number to you, you will use it only for legal purposes. This includes finding and identifying any <strong>super</strong>annuationbenefits which you hold on my behalf, calculating tax on any <strong>super</strong>annuation benefits, calculating tax on my <strong>super</strong>annuationcontributions and providing information to the Commissioner <strong>of</strong> Taxation. These purposes may change in future.If I provide my TFN to you, I consent to you using it to:••seek information about my <strong>super</strong>annuation accounts from the Australian Taxation Office (ATO) using the ATO’s Supermatch programor other facility provided by the ATO, or••to locate information about <strong>super</strong>annuation accounts which I hold with other <strong>super</strong>annuation providers, and••contacting those providers regarding my <strong>super</strong>annuation accounts.I don’t have to supply my tax file number, and if I choose not to, I will commit no <strong>of</strong>fence. However, if I don’t provide my tax file number:••more tax may become payable on my taxable <strong>super</strong>annuation contributions and <strong>super</strong>annuation benefits••you may be required to refund any other <strong>super</strong>annuation contributions (including a personal or self-employed contribution) to mewithin 30 days less taxes, fees and costs and insurance premiums and reduced or increased for market movements, and••in the future it may be more difficult to locate or amalgamate my <strong>super</strong>annuation benefitsThese consequences may change in the future.If I provide my tax file number to you, you may provide it to another <strong>super</strong>annuation fund trustee or Retirement Savings Accountprovider to whom my <strong>super</strong>annuation benefits are to be rolled over, unless I request you not to do so in writing. You may also givemy tax file number to the Commissioner <strong>of</strong> Taxation. In all other respects my TFN will be treated as confidential.My tax file number is:10 conditions <strong>of</strong> <strong>release</strong>Please indicate what type <strong>of</strong> <strong>super</strong> benefit you are eligible for. If you are, or once were, a temporary resident, please refer to Section 2.a retirement benefit – I am aged 55 to 64 and have permanently retired and never intend to become engaged in gainfulemployment for 10 or more hours per weeka retirement benefit – I am aged 60 to 64 and have ceased a gainful employment arrangement since turning age 60a retirement benefit – I am aged 65 or olderan unpreserved cash benefit – I am withdrawing unrestricted non-preserved amounts onlyan unpreserved cash benefit – I am withdrawing restricted non-preserved amounts only and have terminated my employment withan employer who has contributed to this fund 1a total and permanent disablement (TPD) benefit – I am permanently incapacitated 1a financial hardship benefit – I am in severe financial hardship 1a compassionate grounds benefit – Compassionate grounds as approved by the Department <strong>of</strong> Human Services (Medicare) 1a terminal illness benefit – I have a terminal medical condition 1a pre-retirement pension – I am aged 55 to 64 but have not permanently retired and wish to commence a pre-retirementincome stream. 1Please read the ‘About <strong>super</strong>’ section <strong>of</strong> our current PDS for more information on when you can be paid your <strong>super</strong>. This brochure isavailable free <strong>of</strong> charge on our website at colonialfirststate.com.au or by calling Investor Services on 13 13 36.Temporary Resident Visa Holder – Conditions <strong>of</strong> <strong>release</strong>Only complete this section if you are a temporary resident visa holder and wish to have any preserved or restricted non-preservedbenefits paid to you or rolled over to an income stream.Please indicate what type <strong>of</strong> <strong>super</strong> benefit you are eligible for:a total and permanent disablement (TPD) benefit – I am permanently incapacitated 1a terminal illness benefit – I have a terminal medical condition 1an unpreserved cash benefit – I am withdrawing unrestricted non-preserved amounts only (that existed prior to 1 April 2009)a retirement benefit – prior to 1 April 2009, I turned aged 60 or older and ceased a gainful employment arrangementa retirement benefit – prior to 1 April 2009, I turned age 65 or olderan unpreserved cash benefit – I am withdrawing restricted non-preserved amounts and prior to 1 April 2009, I terminated myemployment with an employer who has contributed to this fund. 11 We have additional requirements to process the withdrawal on these grounds. Please call Investor Services on 13 13 36 for further information.

11 declaration and signatureI declare that:••I have received and read the PDS and I acknowledge I haveaccess to all statements and information that are incorporated byreference, together referred to as ‘the PDS’••all details in this form are true and correct••if this form is signed under Power <strong>of</strong> Attorney, the Attorneydeclares that they have not received notice <strong>of</strong> revocation <strong>of</strong>that power (a certified copy <strong>of</strong> the Power <strong>of</strong> Attorney should besubmitted with this application unless we have already sighted it)Signature <strong>of</strong> member••I have read and understood the important information providedwith this form.Investments in <strong>First</strong>Choice Personal Super USI FSF0217AU(referred to as ‘<strong>First</strong>Choice’ or ‘the fund’) are <strong>of</strong>fered from<strong>Colonial</strong> <strong>First</strong> <strong>State</strong> <strong>First</strong>Choice Superannuation Trust ABN26 458 298 557 by <strong>Colonial</strong> <strong>First</strong> <strong>State</strong> Investments LimitedABN 98 002 348 352 AFS Licence 232468.Print nameDate signeddd/mm/yyyyIf you are signing under a Power <strong>of</strong> Attorney, please comply with the following:••attach a certified copy <strong>of</strong> the Power <strong>of</strong> Attorney document••each page <strong>of</strong> the Power <strong>of</strong> Attorney document must be certified by a Justice <strong>of</strong> the Peace, Notary Public or Solicitor. Additionalcertification options are available from our ‘Certification <strong>of</strong> documents – list <strong>of</strong> prescribed persons’ form at colonialfirststate.com.au/prospects/FS4523.pdf.••should the Power <strong>of</strong> Attorney NOT contain a sample <strong>of</strong> the Attorney’s signature, please also supply a certified copy <strong>of</strong> theidentification documents for the Attorney, containing a sample <strong>of</strong> their signature, eg Drivers Licence, Passport, etc. The Attorneywill also need to complete a power <strong>of</strong> attorney identification form which can be obtained from our forms library at colonialfirststate.com.au or by phoning Investor Services on 13 13 36.Please send the completed form to:<strong>Colonial</strong> <strong>First</strong> <strong>State</strong>, Reply Paid 27, Sydney NSW 2001

PLEASE DO NOT STAPLEHeadHeadIdentification and Verification Form – individualsADVISER USE ONLYFull name <strong>of</strong> memberYou or your adviser may also like to complete this form so that we can establish your identity (for the purposes <strong>of</strong> Anti-MoneyLaundering and Counter-Terrorism Financing laws) and assist us in processing any future request efficiently.Financial advisers undertake identification and verification procedures by completing sections A to C <strong>of</strong> this form or by using otherindustry standard forms.If you do not have a financial adviser, you are required to complete section A <strong>of</strong> this form and provide certified copies <strong>of</strong> theID documents (do not send original documents).The list <strong>of</strong> the parties who can certify copies <strong>of</strong> the documents is set out below. To be correctly certified we need the ID documents to beclearly noted ‘True copy <strong>of</strong> the original document’. The party certifying the ID documents will also need to state what position they holdand sign and date the certified documents. If this certification does not appear, you may be asked to send in new certified documents.List <strong>of</strong> persons who can certify documents* (for the purposes <strong>of</strong> Anti-Money Laundering and Counter-Terrorism Financing laws):••Justice <strong>of</strong> the Peace••Solicitor••Police Officer••Magistrate••Notary Public (for the purposes <strong>of</strong> the Statutory Declaration Regulations 1993)••Employee <strong>of</strong> Australia Post (with two or more years <strong>of</strong> continuous service)••Your financial adviser (provided they have two or more years <strong>of</strong> continuous service)••Your accountant (provided they hold a current membership to a pr<strong>of</strong>essional accounting body)••Australian consular <strong>of</strong>ficer or an Australian diplomatic <strong>of</strong>ficer (within the meaning <strong>of</strong> the Consular Fees Act 1955)••An <strong>of</strong>ficer <strong>of</strong> a bank, building society, credit union or finance company provided they have two or more years <strong>of</strong> continuous service.* There are additional persons who can certify documents. A full list <strong>of</strong> the persons who can certify documents is available from our forms library at colonialfirststate.com.au.Section a: verification procedureComplete Part 1 (or if the individual does not own a document from Part 1, then complete either Part 2 or Part 3).Part 1Cross XAcceptable primary photographic ID documentsSelect ONE valid option from this section onlyAustralian <strong>State</strong>/Territory driver’s licence containing a photograph <strong>of</strong> the personAustralian passport (a passport that has expired within the preceding two years is acceptable)Card issued under a <strong>State</strong> or Territory for the purpose <strong>of</strong> proving a person’s age containing a photograph <strong>of</strong> the personForeign passport or similar travel document containing a photograph and the signature <strong>of</strong> the person¹Continued over the page…1 Documents that are written in a language that is not English must be accompanied by an English translation prepared by an accredited translator. An accredited translatoris any person who is currently accredited by the National Accreditation Authority for Translators and Interpreters Ltd (NAATI) at the level <strong>of</strong> Pr<strong>of</strong>essional Translator or above.Please refer to www.naati.com.au for further information.

Part 2 Acceptable secondary ID documents – should only be completed if the individual does not own a document from Part 1Cross XSelect ONE valid option from this sectionAustralian birth certificateAustralian citizenship certificatePension card issued by Department <strong>of</strong> Human Services (previously known as Centrelink)Cross XAND ONE valid option from this sectionA document issued by the Commonwealth or a <strong>State</strong> or Territory within the preceding 12 months that records the provision <strong>of</strong> financialbenefits to the individual and which contains the individual’s name and residential addressA Notice <strong>of</strong> Assessment issued by the Australian Taxation Office within the preceding 12 months which contains the individual’s nameand residential addressA document issued by a local government body or utilities provider within the preceding three months which records the provision<strong>of</strong> services to that address or to that person (the document must contain the individual’s name and residential address)If under the age <strong>of</strong> 18, a notice that was issued to the individual by a school principal within the preceding three months; and containsthe name and residential address; and records the period <strong>of</strong> time that the individual attended that schoolPart 3 Acceptable foreign photographic ID documents – should only be completed if the individual does not own a document from Part 1Cross XSelect ONE valid option from this section onlyForeign driver’s licence that contains a photograph <strong>of</strong> the person in whose name it is issued and the individual’s date <strong>of</strong> birth¹National ID card issued by a foreign government containing a photograph and a signature <strong>of</strong> the person in whose name the cardwas issued¹Section B: RECORD OF VERIFICATION PROCEDUREFINANCIAL ADVISER USE ONLYIMPORTANT NOTE:••Either attach a legible certified copy <strong>of</strong> the ID documentation used to verify the individual (and any required translation) OR••Alternatively, if agreed between your licensee and the product issuer, complete the Record <strong>of</strong> Verification Procedure section belowand DO NOT attach copies <strong>of</strong> the ID documentsID document details Document 1 Document 2 (if required)Verified from Original Certified copy Original Certified copyDocument issuerIssue dateExpiry datedd/mm/yyyydd/mm/yyyydd/mm/yyyydd/mm/yyyyDocument numberAccredited English translation N/A Sighted N/A SightedSection C: FINANCIAL ADVISER DETAILS – identification and verification conducted by:By completing this Record <strong>of</strong> Verification Procedure I declare that I have verified the identity <strong>of</strong> the Customer as required by AML/CTFRules and that this identification procedure has been performed by an AFSL holder or an authorised representative <strong>of</strong> an AFSL holder.Date verified (dd/mm/yyyy)dd/mm/yyyyFinancial adviser namePhone numberAFS licensee nameAFS Licence number1 Documents that are written in a language that is not English must be accompanied by an English translation prepared by an accredited translator. An accredited translatoris any person who is currently accredited by the National Accreditation Authority for Translators and Interpreters Ltd (NAATI) at the level <strong>of</strong> Pr<strong>of</strong>essional Translator or above.Please refer to www.naati.com.au for further information.

Please use the following codes under section 3 <strong>of</strong> this form to indicate which investment option(s) you would like to withdraw from.Please note: Where amounts are to be deducted from your investment, for example adviser service fees, and no option or an invalidoption has been nominated by you, a default order exists. Generally, the default order draws from the more conservative option first,as determined by us. Please call Investor Services on 13 13 36 should you require further information.Option nameCodeMulti-manager multi-sector<strong>First</strong>Choice Defensive 001<strong>First</strong>Choice Conservative 013<strong>First</strong>Choice Moderate 014<strong>First</strong>Choice Balanced 251<strong>First</strong>Choice Growth 015<strong>First</strong>Choice High Growth 032<strong>First</strong>Choice Geared Growth Plus 240Multi-manager single sector<strong>First</strong>Choice Fixed Interest 012<strong>First</strong>Choice Property Securities 018<strong>First</strong>Choice Global Property Securities 204<strong>First</strong>Choice Global Infrastructure Securities 205<strong>First</strong>Choice Lower Volatility Australian Share 083<strong>First</strong>Choice Australian Share 016<strong>First</strong>Choice Australian Small Companies 071<strong>First</strong>Choice Global Share 017<strong>First</strong>Choice Global Share – Hedged 101<strong>First</strong>Choice Asian Share 202<strong>First</strong>Choice Emerging Markets 233<strong>First</strong>Choice Geared Australian Share 206<strong>First</strong>Choice Multi-Index Series<strong>First</strong>Choice Multi-Index Conservative 005<strong>First</strong>Choice Multi-Index Diversified 008<strong>First</strong>Choice Multi-Index Balanced 022Single manager multi-sectorConservative<strong>Colonial</strong> <strong>First</strong> <strong>State</strong> Conservative 004Perpetual Conservative Growth 006Moderate<strong>Colonial</strong> <strong>First</strong> <strong>State</strong> Balanced 007Perpetual Diversified Growth 009GrowthBT Active Balanced 030<strong>Colonial</strong> <strong>First</strong> <strong>State</strong> Diversified 021Perpetual Balanced Growth 031UBS Tax Effective Income 1 099High growth<strong>Colonial</strong> <strong>First</strong> <strong>State</strong> High Growth 033Perpetual Split Growth 034Single manager single sectorCash and deposits<strong>Colonial</strong> <strong>First</strong> <strong>State</strong> Cash 011<strong>First</strong>Rate Investment Deposits – 04/2017 2 850<strong>First</strong>Rate Investment Deposits – 05/2018 2 851<strong>First</strong>Rate Investment Deposits – 05/2018 2 852<strong>First</strong>Rate Investment Deposits – 12/2018 2 853<strong>First</strong>Rate Saver 800<strong>First</strong>Rate Term Deposit – 3 month 3 810<strong>First</strong>Rate Term Deposit – 6 month 3 811<strong>First</strong>Rate Term Deposit – 9 month 3 812<strong>First</strong>Rate Term Deposit – 12 month 3 813Option nameCodeFixed interest and incomeAberdeen Australian Fixed Income 003<strong>Colonial</strong> <strong>First</strong> <strong>State</strong> Diversified Fixed Interest 002<strong>Colonial</strong> <strong>First</strong> <strong>State</strong> Global Credit Income 078Macquarie Income Opportunities 252Perpetual Diversified Income 103PIMCO Global Bond 276Schroder Credit Securities 079UBS Diversified Fixed Income 254Enhanced yieldAcadian Quant Yield 236<strong>Colonial</strong> <strong>First</strong> <strong>State</strong> Enhanced Yield 047Goldman Sachs Income Plus 094PM Capital Enhanced Yield 091Property and infrastructure securitiesBT Property Investment 066<strong>Colonial</strong> <strong>First</strong> <strong>State</strong> Index Property Securities 087<strong>Colonial</strong> <strong>First</strong> <strong>State</strong> Property Securities 065Goldman Sachs Australian Infrastructure 235Principal Property Securities 090RREEF Property Securities 044SG Hiscock Property Securities 212Global property and infrastructure securitiesAMP Capital Global Property Securities 271<strong>Colonial</strong> <strong>First</strong> <strong>State</strong> Global Property Securities 093<strong>Colonial</strong> <strong>First</strong> <strong>State</strong> Global Listed Infrastructure Securities 226Australian shareBlackRock Scientific Australian Equity 025BT Core Australian Share 038<strong>Colonial</strong> <strong>First</strong> <strong>State</strong> Australian Share – Core 035<strong>Colonial</strong> <strong>First</strong> <strong>State</strong> Australian Share Long Short – Core 231<strong>Colonial</strong> <strong>First</strong> <strong>State</strong> Equity Income 232<strong>Colonial</strong> <strong>First</strong> <strong>State</strong> Imputation 024<strong>Colonial</strong> <strong>First</strong> <strong>State</strong> Index Australian Share 028Fidelity Australian Equities 050Maple-Brown Abbott Imputation 037Perpetual Australian Share 111Perpetual Industrial Share 026Realindex Australian Share 241Schroder Australian Equity 039UBS Australian Share 027Australian share – boutiqueAcadian Australian Equity 096Acadian Australian Equity Long Short 097Antares Elite Opportunities 073Ausbil Australian Active Equity 036Integrity Australian Share 068Integrity Australian Share – No. 2 1 069Investors Mutual Australian Share 074Ironbark Karara Australian Share 092Merlon Australian Share Income 234

Option nameCodePerennial Value Australian Share 075Solaris Core Australian Equity 072Australian share – small companiesAusbil Australian Emerging Leaders 211Celeste Australian Small Companies 049<strong>Colonial</strong> <strong>First</strong> <strong>State</strong> Developing Companies 080<strong>Colonial</strong> <strong>First</strong> <strong>State</strong> Future Leaders 081Realindex Australian Small Companies 242Global shareAcadian Global Equity 048Acadian Global Managed Volatility Equity 277Altrinsic Global Equity 076BT Core Global Share 043Capital International Global Share 042<strong>Colonial</strong> <strong>First</strong> <strong>State</strong> Global Share 029<strong>Colonial</strong> <strong>First</strong> <strong>State</strong> Index Global Share 041<strong>Colonial</strong> <strong>First</strong> <strong>State</strong> Index Global Share – Hedged 095DWS Global Equity Thematic 238MFS Global Equity 063Perpetual International 064Realindex Global Share 243Realindex Global Share – Hedged 244Zurich Investments Global Thematic Share 270Option nameCodeGlobal specialistAcadian Global Equity Long Short 203<strong>Colonial</strong> <strong>First</strong> <strong>State</strong> Global Emerging Markets Select 260<strong>Colonial</strong> <strong>First</strong> <strong>State</strong> Global Resources 040<strong>Colonial</strong> <strong>First</strong> <strong>State</strong> Global Resources Tactical 273<strong>Colonial</strong> <strong>First</strong> <strong>State</strong> Global S<strong>of</strong>t Commodity 268Generation Global Share 230Goldman Sachs Global Small Companies 077Magellan Global Share 267Platinum Asia 258Platinum International 070PM Capital Absolute Performance 100Realindex Emerging Markets 263AlternativesAspect Diversified Futures 261GearedAcadian Geared Global Equity 207<strong>Colonial</strong> <strong>First</strong> <strong>State</strong> Geared Global Property Securities 208<strong>Colonial</strong> <strong>First</strong> <strong>State</strong> Geared Australian Share – Core 082<strong>Colonial</strong> <strong>First</strong> <strong>State</strong> Geared Global Share 046<strong>Colonial</strong> <strong>First</strong> <strong>State</strong> Geared Share 0451 This option is only available to existing investors in this option.2 If you withdraw or switch from <strong>First</strong>Rate Investment Deposits within the specified period, early withdrawal adjustments may apply. Some, or all, <strong>of</strong> these options may no longerbe available for new investments. Please contact us for further information.3 If you withdraw from <strong>First</strong>Rate Term Deposits before maturity, early withdrawal adjustments may apply.