FINANCIAL LITERACY WORKSHOP 1

FINANCIAL LITERACY WORKSHOP 1

FINANCIAL LITERACY WORKSHOP 1

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

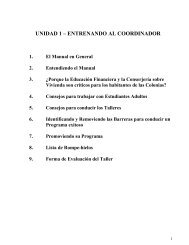

<strong>FINANCIAL</strong> <strong>LITERACY</strong> <strong>WORKSHOP</strong> 1Budgeting and Saving1 Facilitator NeededEstimated Time: 1hr 50 minThings to Prepare BEFORE <strong>WORKSHOP</strong>ITEM APPENDIX # PAGE # USEDFlip Chart 1-1 A-1-1 1-2,1-3Flip Chart 1-2 A-1-1 1-4Handout 1-1 Money ManagementA-1-2 1-3NovelaHandout 1-2 Budgeting & SavingsA-1-3 1-4PamphletHandout 1-3 Blank Budget Form A-1-4 1-5Evaluation form Trainer’s Section 1-6Activity Page Time MaterialsIntroduction• Introduction of facilitator,participants, icebreaker• Review WorkshopObjectivesLearning Activity 1: MoneyManagement• Money ManagementNovela• Novela Discussion1-21-315 min5 min20 min25 min5 min25 minBlank Flip Chart/MarkersFlip Chart 1-1 WorkshopObjectivesBlank Flip Chart/MarkersHandout 1-1 Novela:Money ManagementBreakLearning Activity 2: KeyConcepts• Budgeting Tips• Key Points DiscussionLearning Activity 3: BudgetPreparation• How to prepare a Budget15 min1-4 10 min5 min15 min1-525 min25 minWrap-up• Workshop Evaluation 1-6 10 min10 minBlank Flip Chart/MarkersFlip Chart 1-2 KeyConceptsHandout 1-2 Budget &Savings PamphletBlank Flip Chart/MarkersHandout 1-3 Blank BudgetSheetEvaluation Form1-1

IntroductionTime 20 minMaterials Need: Blank Flip Chart, Flip Chart 1-1, Markers.Reminder: The Trainer’s role is always to educate, not to provide advice.• Introduction of Facilitator and Participants Welcome the participants and introduce yourself to the group. Ask the participants to introduce themselves and conduct one icebreaker selected by thefacilitator from the icebreaker list. Tell the group that this session will focus on preparing a monthly budget and theimportance of savings habits.• Workshop objectives. Refer to Flip Chart 1.1 Objectives and review it with participants. Hang the Flip Chart so that it is visible to the entire group.1-2

oducLearning Activity 1 - Money Management:Time 35 minMaterials Need: Novela, Hand-out 1-1, Flip Chart 1-1, Markers• Novela ReadingDistribute Handout 1-1 Money Management Novela.Ask for volunteers to read the roles of each of the characters and the narrator (total offour volunteers). Read the Novela as a group.• Novela Discussion• During the reading make sure that every one is following and understandingit.Ask the group: What they learned from the novela?• Be prepared with a blank flip chart and write down all the answers that youreceive from the audience.• Once done, refer back to Flip Chart 1-1 and mention that the main points ofthe novela were the same as the workshop objectives.• Try to clarify any questions the group may have before this activity is over.• If you cannot answer a particular question, write it down along with theinformation of the contact person who asked it. Contact the person later withthe answer.------------15 min BREAK-------------1-3

Learning Activity 2: Key ConceptsTime 15 minMaterials Need: Hand-out 1-2 Flip Chart 1-2, Markers• Key Concepts: Budgeting TipsDistribute Handout 1-2 and refer to Flip Chart 1-2 Key Concepts.• Read the main topic headings that will be covered in the pamphlet and try togive examples for each.These are:‣ Financial Literacy‣ Financial Goals‣ Budget‣ Saving towards your Goals‣ Earned Income Tax Credit‣ Pay Yourself First‣ Credit Card Trap1-4

WRAP UPTime 10 minMaterials Need: Evaluation Form• Workshop EvaluationDistribute Evaluation Forms.Ask the group to please take a few minutes to complete the Evaluation Form.Let them know that their comments are important to further improve the module.Thank them for taking the time to attend this workshop and ask them if they have anyquestions.If you cannot answer a particular question, write it down along with the contactinformation for the person who asked the question. Contact them later with an answer.1-6

Flip Chart 1-1: Workshop Objectives.Setting Financial GoalsDeveloping a BudgetSaving for Your GoalsEarned Income Tax CreditPaying Yourself FirstStaying out of the Credit Card TrapFlip Chart 1-2: Key Concepts(Refers to Budgeting & Savings Novela 1-1)o Financial Literacyo Financial Goalso Budgeto Saving towards your Goalso Earned Income Tax Credito Pay Yourself Firsto Credit Card TrapA-1-1

BUDGET FORMMY MONTHLY NET INCOME IS…IF YOU ARE PAIDWEEKLY: $__________ X 52 ÷ 12 $____________________MONTHLY INCOMETWICE A MONTH: $___________ X 2 $____________________MONTHLY INCOMEEVERY TWO WEEKS: $___________ X 26 ÷ 12 $____________________MONTHLY INCOMESPOUSE'S MONTHLY NET INCOMEWEEKLY: $___________ X 52 ÷ 12 $____________________MONTHLY INCOMETWICE A MONTH: $___________ X 2 $____________________MONTHLY INCOMEEVERY TWO WEEKS: $__________ X 26 ÷ 12 $____________________MONTHLY INCOMEOTHER INCOMEREGULAR OVERTIMECHILD SUPPORTSSISECOND JOBOTHER$____________________$____________________$____________________$____________________$____________________TOTAL MONTHLY NET INCOME$____________________8

WHERE DOES MY MONEY GO?SAVINGSRENTELECTRICITYGASWATERTELEPHONE/CELLUARCABLECAR PAYMENT #1CAR PAYMENT #2GAS/MAINTENANCE/BUSCAR INSURANCEOTHER INSURANCECREDIT CARD #1CREDIT CARD #2TOTAL OTHER PAYMENTSFOOD/GROCERIESEATING OUTCHILD CARE/OR SUPPORTCLOTHINGMEDICAL/DENTALLAUNDRY/DRY CLEANINGHOUSEHOLD SUPPLIESFUN/ENTERTAINMENTSUPPORT FOR A RELATIVEMONTHLY EXPENSES$___________________$___________________$___________________$___________________$___________________$___________________$___________________$___________________$___________________$___________________$___________________$___________________$___________________$___________________$___________________$___________________$___________________$___________________$___________________$___________________$___________________$___________________$___________________$___________________$____________________9

DO I HAVE MONEY LEFT FOR THE SAVINGS?RESIDUAL INCOMEMONTHLY INCOME$___________–MONTHLY EXPENSES$________________________________________=RESIDUAL INCOME $___________ (SAVINGS FOR HOMEOR BUSINESS)WHAT IF I HAVE $0 RESIDUALINCOME?IF YOUR MONTHLY RESERVE IS $0, THEN IT'S TIME FOR CUTBACKS…SPENDING MONEY?LOTTERY TICKETS?FAST FOOD? COFFEE?LONG DISTANCE?CABLE?EXTRA BEVERAGES: BEER/WINE…?FINGER NAILS?HAIR?COSMETICS?CELL PHONE?PAGERS?CLOTHES?IF YOU HAVE A LARGE AMOUNT OF RESIDUAL INCOME, BUT IN REALITY DON’T HAVETHAT MUCH LEFT OVER EACH MONTH, EITHER YOUR EXPENSES WERE NOTCORRECTLY ESTIMATED, OR YOU DON’T REALLY KNOW WHERE YOUR MONEY GOES.10

This chart is taken from Finding Paths to Prosperity. The National Endowmentfor Financial Education, the Corporation for Enterprise Development and theFannie Mae Foundation collaborated to develop Finding Paths to Prosperity.How Does My Cash Flow?IncomeJanuary February March April May JuneIncomeTaxRefundExpensesIncomeJuly August September October November DecemberYear-endBonusExpensesBack toSchoolShoppingHolidayGiftsLook at the chart and try to anticipate any additional income you expect toreceive or expenses you will have. Some ideas to consider:Car insurance premiumsProperty taxesScheduled vehicle maintenance such as tune-upsVehicle registration and/or inspections11

This chart is taken from Finding Paths to Prosperity. The National Endowmentfor Financial Education, the Corporation for Enterprise Development and theFannie Mae Foundation collaborated to develop Finding Paths to Prosperity.Debt Reduction WorksheetUse one copy of this worksheet for each creditor.List how much you owe that creditor and how much you will pay each month.Fill it in monthly. Soon, if you make steady payments, you’ll see the amountowed go down. Put your worksheets in order, starting with the highest interestrate to the smallest. When one debt is eliminated, consider putting that moneyto work on other debts by making extra payments on them.Owed to PrincipalInterestRatePaymentDueDateAmountPaidCheckorMoneyOrderNo.DatePaidBalanceDue12

This chart is taken from Finding Paths to Prosperity. The National Endowmentfor Financial Education, the Corporation for Enterprise Development and theFannie Mae Foundation collaborated to develop Finding Paths to Prosperity.Can you make your dreams real? Goals are statements of what you want toachieve. Goals can help you reach your dreams.MY GOALSGoalCost orAmountNumber ofMonths to SaveMonthlySavingsWeeklySavings13

NOTES______________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________14

After stablingfinancial goals payyourself firstA savings concept wherebyyou put aside a set amount ofsavings before bill paying.Decide how much you savingeach month and deposit it intoyour savings account. Then,pay your other bills as usual.What if I can’t?If you find that you do nothave enough money to cover allthe expenses, write down howmuch you need to come up with- try to raise it. If this meansyou have to recycle cans,switch to an off-brand cereal,work a few extra hours, or cancelyour magazine subscriptionsBased on the principle of “buying nowand paying later”, the credit card trapsnares people without their realizing whatis happening.• Would you like to take the family out?Use the credit card.• Do the kids need some new clothes?Again, no cash but the credit card ishandy.And what’s the problem? – You’re workingand can pay for it…and, the monthly paymentsare small. Are you reaching themaximum limit on the card…it will beeasy to get another one…Get the picture!Little by little, without thinking, you couldaccumulate a large amount of debt. You’llsleep better knowing that you are in controlBudgetingand Savingsof your money.- do it. Handout 1-2For information about Free Income tax Preparationand Money Management Classes in yourarea pleas call:_________________________A-1-3

Financial goals are future plans to buysomething or save money. Example,buying a house, new refrigerator, savingfor school, or retirement.A Budget is another word for a spendingplan. When you plan how you will spendyour money, you are in control of your financialsituation.5. Include the amount you normally spendon meals eaten out, entertainment, allowances,donations, etc.These items can be reduced if yourbudget shows that you are spendingmore than you are earning or you areunable to saveThink about your financial goals. If youhave a spouse, discuss them together.Identify them as:• Short term (less than a year)• Medium term (1 to 3 years)• Long term ( 5 or more years)Determine how much you would have tosave each month to achieve that goal. Berealistic. Many people cannot save for eachof their goals at once. Prioritize them andbegin to save for those that are most importantto you and your family.Saving will become a powerfultool that will help you toachieve your financial goals.Preparing a budget means writing downyour income (after taxes) and then subtractingeach of your monthly expenses.1. Write down the amount you will put intosavings each month (even if the amountis small).2. Include your land or house payment, installmentloans (loans with a set monthlypayment) and auto insurance.3. Write in any credit card debt you mayhave.4. Write in the average amount you needeach month for food, utilities, and gasoline.• Is a federal program that provides additionalmoney a cash payment to eligible low-tomoderateincome workers. who qualify• The federal EITC is claimed by filing a federaltax return with the Internal RevenueService.• EITC can offer substantial sums to low incomeworkers, especially those who care forchildren.• It is worthwhile to see if you may claim theEITC.• Ask your employer about this credit. If youqualify, you may receive additional dollarsin your pay, instead of one large amount includedwith your Income Tax Refund.• Many communities have begun campaignsto inform workers about this credit.Some sites offer free income tax preparation.

Handout 1-3BUDGET FORMMY MONTHLY NET INCOME IS…IF YOU ARE PAID (Select one)WEEKLY$__________ X 52 ÷ 12$__________ MONTHLY INCOMETWICE A MONTH:$___________ X 2$___________ MONTHLY INCOMEEVERY TWO WEEKS:$___________ X 26 ÷ 12$___________ MONTHLY INCOMESPOUSE'S MONTHLY NET INCOMEIF YOU ARE PAID (Select one)WEEKLY:$___________ X 52 ÷ 12$___________ MONTHLY INCOMETWICE A MONTH:$__________ X 2$__________ MONTHLY INCOMEEVERY TWO WEEKS:$__________ X 26 ÷ 12$__________ MONTHLY INCOMEOTHER INCOMEREGULAR OVERTIME$________________________CHILD SUPPORT$_________________________SSI$_________________________EXPENSESSAVINGS$_______________RENT$_______________ELECTRICITY $_______________GAS$_______________WATER$_______________TELEPHONE/CELLUAR$_______________CABLE$_______________CAR PAYMENT #1 $_______________CAR PAYMENT #2 $_______________GAS/MAINTENANCE/BUS$_______________CAR INSURANCE $_______________OTHER INSURANCE $_______________CREDIT CARD #1 $_______________CREDIT CARD #2 $_______________TOTAL OTHER PAYMENTS$_______________FOOD/GROCERIES $_______________EATING OUT $_______________CHILD CARE/OR SUPPORT$_______________CLOTHING$_______________MEDICAL/DENTAL $_______________LAUNDRY/DRY CLEANING$_______________HOUSEHOLD SUPPLIES$_______________FUN/ENTERTAINMENT$_______________MONEY SENT TO RELATIVES$_______________MONTHLY EXPENSES$____________________SECOND JOB$_________________________OTHER$_________________________TOTAL MONTHLY NET INCOME$_________________________A-1-4