File_2012_Document1

File_2012_Document1

File_2012_Document1

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

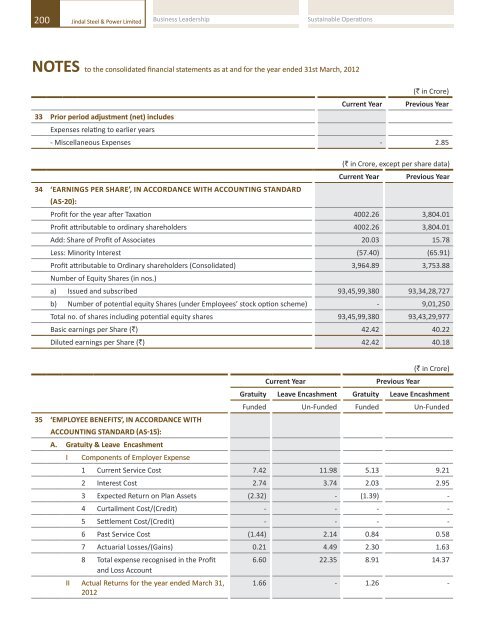

200 Jindal Steel & Power LimitedBusiness Leadership Sustainable Operations Excellent Governance Robust FinancialsAnnual Report 2011-12201ConsolidatedNOTES to the consolidated financial statements as at and for the year ended 31st March, <strong>2012</strong> NOTES to the consolidated financial statements as at and for the year ended 31st March, <strong>2012</strong>Current Year(` in Crore)Previous Year33 Prior period adjustment (net) includesExpenses relating to earlier years- Miscellaneous Expenses - 2.85(` in Crore, except per share data)Current Year Previous Year34 ‘Earnings per share’, in ACCORDANCE with ACCOUNTING STANDARD(AS-20):Profit for the year after Taxation 4002.26 3,804.01Profit attributable to ordinary shareholders 4002.26 3,804.01Add: Share of Profit of Associates 20.03 15.78Less: Minority Interest (57.40) (65.91)Profit attributable to Ordinary shareholders (Consolidated) 3,964.89 3,753.88Number of Equity Shares (in nos.)a) Issued and subscribed 93,45,99,380 93,34,28,727b) Number of potential equity Shares (under Employees’ stock option scheme) - 9,01,250Total no. of shares including potential equity shares 93,45,99,380 93,43,29,977Basic earnings per Share (`) 42.42 40.22Diluted earnings per Share (`) 42.42 40.18(` in Crore)Current YearPrevious YearGratuity Leave Encashment Gratuity Leave EncashmentFunded Un-Funded Funded Un-Funded35 ‘Employee Benefits’, in ACCORDANCE withACCOUNTING STANDARD (AS-15):A. Gratuity & Leave EncashmentI Components of Employer Expense1 Current Service Cost 7.42 11.98 5.13 9.212 Interest Cost 2.74 3.74 2.03 2.953 Expected Return on Plan Assets (2.32) - (1.39) -4 Curtailment Cost/(Credit) - - - -5 Settlement Cost/(Credit) - - - -6 Past Service Cost (1.44) 2.14 0.84 0.587 Actuarial Losses/(Gains) 0.21 4.49 2.30 1.638 Total expense recognised in the Profit6.60 22.35 8.91 14.37and Loss AccountII Actual Returns for the year ended March 31,<strong>2012</strong>1.66 - 1.26 -(` in Crore)Current YearPrevious YearGratuity Leave Encashment Gratuity Leave EncashmentFunded Un-Funded Funded Un-Funded35 ‘Employee Benefits’, in ACCORDANCE withACCOUNTING STANDARD (AS-15):III Net Assets/(Liability) recognised in theBalance Sheet1 Present value of Defined Benefit(40.21) (64.01) (32.65) (47.30)Obligation2 Fair Value of Plan Assets 31.63 - 21.70 -3 Status {Surplus/(Deficit)} (1-2) (8.56) (64.01) (10.95) (47.30)4 Unrecognised Past Service Cost 0.88 - 1.64 -Net Assets/(Liability) recognised in the (7.68) (64.01) (9.31) (47.30)Balance Sheet (3+4)IV Change in Defined Benefit Obligation (DBO)Present Value of DBO at the beginning of the year (32.71) (47.30) (23.79) (36.58)1 Current Service Cost (7.41) (11.98) (5.13) (9.21)2 Interest Cost (2.74) (3.74) (2.03) (2.95)3 Curtailment Cost/(Credit) - - - -4 Settlement Cost/(Credit) - - - -5 Plan Amendments 2.21 (2.14) (0.08) (0.58)6 Acquisitions (0.58) (0.69) 0.01 (0.01)7 Actuarial (Losses)/Gains (0.06) (4.49) (2.42) (1.63)8 Benefits Paid 1.08 6.33 0.79 3.66Present Value of DBO at the end of the year (40.21) (64.01) (32.65) (47.30)V Change in Fair Value of Assets21.70 11.90 -Plan Assets at the beginning of the year1 Acquisition Adjustment (0.10) - 1.28 -2 Expected Return on Plan Assets 2.32 - 1.39 -3 Actuarial (Losses)/Gains (0.18) - 0.12 -4 Actual Company Contribution 8.97 6.33 7.80 3.665 Benefit Paid (1.08) (6.33) (0.79) (2.84)Plan Assets at the end of the year 31.63 - 21.70 0.82VI Actuarial Assumptions1 Discount Rate (%)- Holding Company 8.50 8.50 8.50 8.50- Subsidiary Company 8.50 8.40 8.40 8.402 Expected Return on Plan Assets (%)- Holding Company 9.00 - 9.00 -- Subsidiary Company 9.15 - 9.15 -