File_2012_Document1

File_2012_Document1

File_2012_Document1

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

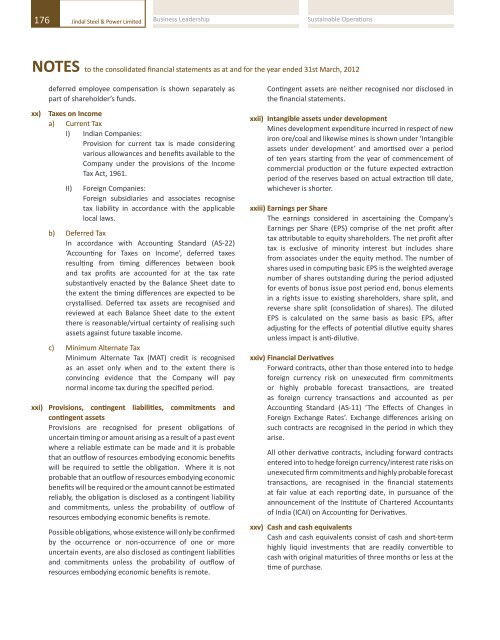

176 Jindal Steel & Power LimitedBusiness Leadership Sustainable Operations Excellent Governance Robust FinancialsAnnual Report 2011-12177ConsolidatedNOTES to the consolidated financial statements as at and for the year ended 31st March, <strong>2012</strong> NOTES to the consolidated financial statements as at and for the year ended 31st March, <strong>2012</strong>xx)deferred employee compensation is shown separately aspart of shareholder’s funds.Taxes on Incomea) Current TaxI) Indian Companies:Provision for current tax is made consideringvarious allowances and benefits available to theCompany under the provisions of the IncomeTax Act, 1961.II)Foreign Companies:Foreign subsidiaries and associates recognisetax liability in accordance with the applicablelocal laws.b) Deferred TaxIn accordance with Accounting Standard (AS-22)‘Accounting for Taxes on Income’, deferred taxesresulting from timing differences between bookand tax profits are accounted for at the tax ratesubstantively enacted by the Balance Sheet date tothe extent the timing differences are expected to becrystallised. Deferred tax assets are recognised andreviewed at each Balance Sheet date to the extentthere is reasonable/virtual certainty of realising suchassets against future taxable income.c) Minimum Alternate TaxMinimum Alternate Tax (MAT) credit is recognisedas an asset only when and to the extent there isconvincing evidence that the Company will paynormal income tax during the specified period.xxi) Provisions, contingent liabilities, commitments andcontingent assetsProvisions are recognised for present obligations ofuncertain timing or amount arising as a result of a past eventwhere a reliable estimate can be made and it is probablethat an outflow of resources embodying economic benefitswill be required to settle the obligation. Where it is notprobable that an outflow of resources embodying economicbenefits will be required or the amount cannot be estimatedreliably, the obligation is disclosed as a contingent liabilityand commitments, unless the probability of outflow ofresources embodying economic benefits is remote.Possible obligations, whose existence will only be confirmedby the occurrence or non-occurrence of one or moreuncertain events, are also disclosed as contingent liabilitiesand commitments unless the probability of outflow ofresources embodying economic benefits is remote.Contingent assets are neither recognised nor disclosed inthe financial statements.xxii) Intangible assets under developmentMines development expenditure incurred in respect of newiron ore/coal and likewise mines is shown under ‘Intangibleassets under development’ and amortised over a periodof ten years starting from the year of commencement ofcommercial production or the future expected extractionperiod of the reserves based on actual extraction till date,whichever is shorter.xxiii) Earnings per ShareThe earnings considered in ascertaining the Company’sEarnings per Share (EPS) comprise of the net profit aftertax attributable to equity shareholders. The net profit aftertax is exclusive of minority interest but includes sharefrom associates under the equity method. The number ofshares used in computing basic EPS is the weighted averagenumber of shares outstanding during the period adjustedfor events of bonus issue post period end, bonus elementsin a rights issue to existing shareholders, share split, andreverse share split (consolidation of shares). The dilutedEPS is calculated on the same basis as basic EPS, afteradjusting for the effects of potential dilutive equity sharesunless impact is anti-dilutive.xxiv) Financial DerivativesForward contracts, other than those entered into to hedgeforeign currency risk on unexecuted firm commitmentsor highly probable forecast transactions, are treatedas foreign currency transactions and accounted as perAccounting Standard (AS-11) ‘The Effects of Changes inForeign Exchange Rates’. Exchange differences arising onsuch contracts are recognised in the period in which theyarise.All other derivative contracts, including forward contractsentered into to hedge foreign currency/interest rate risks onunexecuted firm commitments and highly probable forecasttransactions, are recognised in the financial statementsat fair value at each reporting date, in pursuance of theannouncement of the Institute of Chartered Accountantsof India (ICAI) on Accounting for Derivatives.xxv) Cash and cash equivalentsCash and cash equivalents consist of cash and short-termhighly liquid investments that are readily convertible tocash with original maturities of three months or less at thetime of purchase.As at31st March, <strong>2012</strong>(` in Crore)As at31st March, 20113 SHARE CAPITALAuthorised2,000,000,000 (Previous year 2,000,000,000) Equity Shares of ` 1 each 200.00 200.00200.00 200.00Issued, Subscibed and Fully Paid-up934,833,818 (Previous year 934,269,031) Equity Shares of ` 1 each 93.48 93.43Total Share Capital 93.48 93.43(a)Reconciliation of the number of shares outstanding at the beginning and at the end of the reporting period:No. of Shares No. of SharesEquity Shares outstanding at the beginning of the year 93,42,69,031 93,12,34,082Add: Equity Shares issued under employees stock option scheme 5,64,787 30,34,949Equity Shares outstanding at the close of the year 93,48,33,818 93,42,69,031b) Terms/rights attached to equity sharesThe Company has only one class of equity shares having par value of ` 1 per share. Each holder of equity share is entitled to onevote per share. The Company declares dividends in Indian rupees. The dividend proposed by the board of Directors is subject tothe approval of the Shareholders in the ensuing Annual General Meeting.During the year ended 31st March, <strong>2012</strong>, the amount of per share dividend recognised as distributions to equity shareholders was` 1.60 (Previous Year ` 1.50)In the event of liquidation of the Company, the holders of equity shares will be entitled to receive remaining assets of theCompany after settlement of all preferential amounts. The distribution will be in proportion to the number of equity shares heldby the shareholders.c) Aggregate number of bonus shares issued, shares issued for consideration other than cash and shares bought back during theperiod of five years immediately preceding the reporting date:31st March, <strong>2012</strong> 31st March, 2011Equity shares alloted as fully paid bonus shares by capitalisation of securities premium - -Equity shares alloted as fully paid-up pursuant to contracts for consideration- -other than cashEquity shares bought back by the Company - -The Company has alloted total 775,651,530 fully paid equity shares upto the year ended 31st March, <strong>2012</strong> as fully paid bonusshares by capitalising securities premium reserve.In addition the Company has allotted the following equity shares during the preceding five years under its various EmployeesStock option schemes (Note no.-3f below)During the year endedNo. of Shares31st March, <strong>2012</strong> 5,64,78731st March, 2011 30,34,94931st March, 2010 9,29,86931st March, 2009 6,91,34331st March, 2008 -Total 52,20,948