File_2012_Document1

File_2012_Document1

File_2012_Document1

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

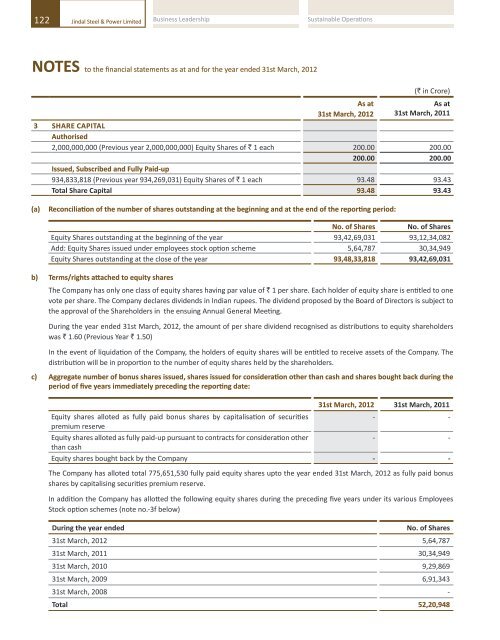

122 Jindal Steel & Power Limited Business Leadership Sustainable Operations Excellent Governance Robust FinancialsStandaloneAnnual Report 2011-12123NOTES to the financial statements as at and for the year ended 31st March, <strong>2012</strong> NOTES to the financial statements as at and for the year ended 31st March, <strong>2012</strong>As at31st March, <strong>2012</strong>(` in Crore)As at31st March, 20113 SHARE CAPITALAuthorised2,000,000,000 (Previous year 2,000,000,000) Equity Shares of ` 1 each 200.00 200.00200.00 200.00Issued, Subscribed and Fully Paid-up934,833,818 (Previous year 934,269,031) Equity Shares of ` 1 each 93.48 93.43Total Share Capital 93.48 93.43(a)Reconciliation of the number of shares outstanding at the beginning and at the end of the reporting period:No. of Shares No. of SharesEquity Shares outstanding at the beginning of the year 93,42,69,031 93,12,34,082Add: Equity Shares issued under employees stock option scheme 5,64,787 30,34,949Equity Shares outstanding at the close of the year 93,48,33,818 93,42,69,031b) Terms/rights attached to equity sharesThe Company has only one class of equity shares having par value of ` 1 per share. Each holder of equity share is entitled to onevote per share. The Company declares dividends in Indian rupees. The dividend proposed by the Board of Directors is subject tothe approval of the Shareholders in the ensuing Annual General Meeting.During the year ended 31st March, <strong>2012</strong>, the amount of per share dividend recognised as distributions to equity shareholderswas ` 1.60 (Previous Year ` 1.50)In the event of liquidation of the Company, the holders of equity shares will be entitled to receive assets of the Company. Thedistribution will be in proportion to the number of equity shares held by the shareholders.c) Aggregate number of bonus shares issued, shares issued for consideration other than cash and shares bought back during theperiod of five years immediately preceding the reporting date:Equity shares alloted as fully paid bonus shares by capitalisation of securitiespremium reserveEquity shares alloted as fully paid-up pursuant to contracts for consideration otherthan cash31st March, <strong>2012</strong> 31st March, 2011- -- -Equity shares bought back by the Company - -The Company has alloted total 775,651,530 fully paid equity shares upto the year ended 31st March, <strong>2012</strong> as fully paid bonusshares by capitalising securities premium reserve.In addition the Company has allotted the following equity shares during the preceding five years under its various EmployeesStock option schemes (note no.-3f below)During the year endedNo. of Shares31st March, <strong>2012</strong> 5,64,78731st March, 2011 30,34,94931st March, 2010 9,29,86931st March, 2009 6,91,34331st March, 2008 -Total 52,20,948d) Details of shareholders holding more than 5% shares in the CompanyName of the shareholder As at 31st March, <strong>2012</strong> As at 31st March, 2011No. of Shares % holding No. of Shares % holdingEquity Shares of ` 1 each fully paidGagan Infraenergy Limited 6,69,54,060 7.16% 6,69,54,060 7.17%Opelina Finance and Investment Limited 7,98,38,960 8.54% 7,55,46,540 8.09%Sun Investment Limited 8,69,78,940 9.30% 8,69,78,940 9.31%As per records of the Company, including its register of shareholders/members and other declarations received from shareholdersregarding beneficial interest, the above shareholding represents both legal and beneficial ownerships of shares.e) Forfeited shares:Pursuant to the resolution passed at the EGM dated4th September, 2009, the Company reclassified theauthorised share capital of the Company by cancellationof 10,000,000 Preference Shares of ` 100 each andsimultaneous creation of 1,000,000,000 fresh Equity Sharesof ` 1 each and increased the authorised share capital to` 2,000,000,000.Consequently, the Company had cancelled 100,000preference shares of ` 100 each, which were forefeitedearlier. Upon cancellation of such shares, the amount of` 10,000,000 was transferred to General Reserve.f) Shares reserved for issue under optionsThe details of shares reserved for issue under Employeestock option (ESOP) plan of the Company are as under:The Employees Stock Option Scheme - 2005 (ESOS-2005)was approved by the shareholders of the Company intheir Annual General Meeting held on 25th July, 2005 andamended by shareholders on 27th September, 2006. UnderESOS-2005, a maximum of 1,100,000 (Eleven lacs) equityshares of ` 5/- each could be granted to the employees ofthe Company and its subsidiary company(ies). In-principleapproval from National Stock Exchange of India Limited(NSE) and Bombay Stock Exchange Limited (BSE) was givenon 01.02.2006. A Compensation Committee was constitutedby the Board of Directors of the Company in their meetingheld on 12th May, 2005 for the administration of ESOS-2005. Under ESOS-2005, the Compensation Committee hasgranted stock options as follows:‐a) 859,400 (Eight lacs fifty nine thousand four hundred)stock options on 26.11.2005 at an exercise price of` 1,014/- per share (Series - 1) which would vest after2 years from the date of grant to the extent of 50% (Part1), after 3 years from the date of grant to the extent of25% (Part 2) and after 4 years from the date of grantto the extent of 25% (Part 3);b) 129,550 (One lac twenty nine thousand five hundredfifty) stock options on 02.09.2006 at an exercise priceof ` 1,121/- per share (Series - II) which would vestafter 2 years from the date of grant to the extent of50% (Part 1), after 3 years from the date of grant tothe extent of 25% (Part 2) and after 4 years from thedate of grant to the extent of 25% (Part 3); andc) 136,950 (One lac thirty six thousand nine hundred fifty)stock options on 27.04.2007 at an exercise price of` 1,819/- per share (Series - III) which would vest after2 years from the date of grant to the extent of 50% (Part1), after 3 years from the date of grant to the extent of25% (Part 2) and after 4 years from the date of grantto the extent of 25% (Part 3).Pursuant to Clause 5.3 (f) of SEBI (Employees StockOption Scheme and Employees Stock PurchaseScheme) Guidelines, 1999 and para 18 of theEmployees Stock Option Scheme -2005 of theCompany, the Compensation Committee is authorisedto make a fair and reasonable adjustment to thenumber of options and to the exercise price in respectof options granted to the employees under theScheme in case of corporate actions such as rightissue, bonus issue, merger etc.On 27.12.2007, sub-division of the face value of each equityshare of the Company from ` 5/- to 5 equity shares of` 1/- each was approved by the shareholders in their GeneralMeeting. Thereafter, the Compensation Committee has,in its meeting held on 27.01.2008, made an adjustmentto the exercise price by reducing it in case of Series I to` 203/- Series II to ` 225/- and Series III to ` 364/- perequity share of ` 1/- each and to the number of options byincreasing it 5 times the original grant consequent to whichthe number of maximum options that could be issued underthe Employees Stock Option Scheme-2005 increased to5,500,000 (Fifty five lacs) [originally 1,100,000 (Eleven lacs)