Foreign Trade Procedures 2008-2009 - Directorate General of ...

Foreign Trade Procedures 2008-2009 - Directorate General of ...

Foreign Trade Procedures 2008-2009 - Directorate General of ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

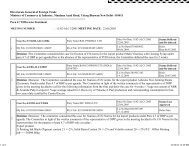

CHAPTER – 8DEEMED EXPORTSPolicy 8.1 Policy relating to Deemed Exports is in Chapter-8 <strong>of</strong> FTP.Criteria for claiming 8.2.1 In respect <strong>of</strong> supplies under Paragraph 8.2(a) <strong>of</strong> FTP, procedureDeemed Exportsfor issue <strong>of</strong> ARO and Back-to-Back Inland Letter <strong>of</strong> Credit isBenefits given in paragraphs 4.14 and 4.15 <strong>of</strong> HBP v1.8.2.2 In respect <strong>of</strong> supplies under paragraph 8.2(b) <strong>of</strong> FTP and DFIA,deemed export benefits may be claimed from DevelopmentCommissioner or RA concerned. Advance Authorisation andDFIA shall be claimed from the concerned RA. Such suppliesshall be certified by receiving agencies.8.2.3 In respect <strong>of</strong> supply <strong>of</strong> capital goods under paragraph 8.2 (c) <strong>of</strong>FTP, supplier shall produce a certificate from EPCG Authorisationholder evidencing supplies / receipt <strong>of</strong> manufactured capital goods.8.2.4 In respect <strong>of</strong> supplies under categories mentioned in paragraphs8.2(d), (e), (f), (g), (i) and (j) <strong>of</strong> FTP, application for advanceauthorisation shall be accompanied with a Project AuthorityCertificate in Appendix 27. Payment against such supplies shallbe certified by Project Authority concerned as inAppendix 22 C.Procedure for claiming 8.3.1 Procedure for claiming benefits under paragraph 8.3(b) and (c)Deemed Exports<strong>of</strong> FTP shall be as under:-Drawback & TerminalExcise Duty Refund/ (i) An application in ANF 8 along with prescribed documents,Exemption from paymentshall be made by supplier to RA concerned. Recipient<strong>of</strong> Terminal Excise Dutymay also claim benefits on production <strong>of</strong> a suitabledisclaimer from supplier along with a self declaration inAppendix 22C <strong>of</strong> HBP v1 regarding non-availment <strong>of</strong>CENVAT credit in addition to prescribed documents.(ii)In case <strong>of</strong> supplies under paragraph 8.2(a), (b) & (c) <strong>of</strong>FTP, claim shall be filed against receipt <strong>of</strong> payment throughnormal banking channel as in Appendix 22B. Claimsshould be filed within a period <strong>of</strong> twelve months from thedate <strong>of</strong> payment. In cases where payment is received inadvance, last date for submission <strong>of</strong> application may becorrelated with date <strong>of</strong> supply instead <strong>of</strong> date <strong>of</strong> receipt<strong>of</strong> payment. Claim can be filed ‘Invalidation Letter/AROwise’ against individual licences within the time limit asspecified above. 100% TED refund may be allowed after100% supplies have been made physically and paymentreceived at least up to 90%. However, grant <strong>of</strong> deemed125