Financial Stability Report No1 20 December 2010 - Banka Qendrore ...

Financial Stability Report No1 20 December 2010 - Banka Qendrore ...

Financial Stability Report No1 20 December 2010 - Banka Qendrore ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

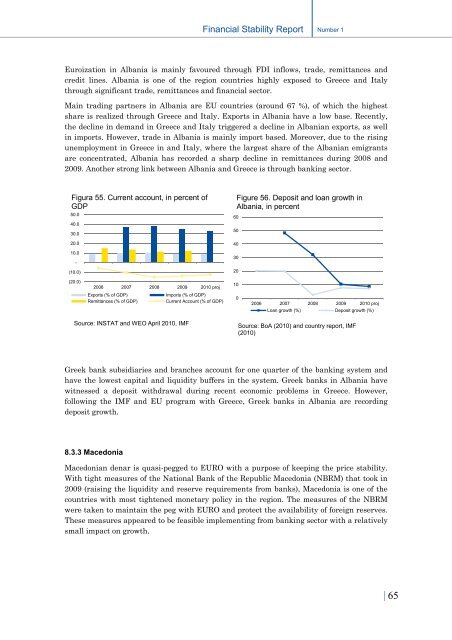

<strong>Financial</strong> <strong>Stability</strong> <strong>Report</strong>Number 1Euroization in Albania is mainly favoured through FDI inflows, trade, remittances andcredit lines. Albania is one of the region countries highly exposed to Greece and Italythrough significant trade, remittances and financial sector.Main trading partners in Albania are EU countries (around 67 %), of which the highestshare is realized through Greece and Italy. Exports in Albania have a low base. Recently,the decline in demand in Greece and Italy triggered a decline in Albanian exports, as wellin imports. However, trade in Albania is mainly import based. Moreover, due to the risingunemployment in Greece in and Italy, where the largest share of the Albanian emigrantsare concentrated, Albania has recorded a sharp decline in remittances during <strong>20</strong>08 and<strong>20</strong>09. Another strong link between Albania and Greece is through banking sector.Figura 55. Current account, in percent ofGDP50.040.030.0<strong>20</strong>.010.0-(10.0)Figure 56. Deposit and loan growth inAlbania, in percent60504030<strong>20</strong>(<strong>20</strong>.0)<strong>20</strong>06 <strong>20</strong>07 <strong>20</strong>08 <strong>20</strong>09 <strong>20</strong>10 proj10Exports (% of GDP)Imports (% of GDP)Remittances (% of GDP)Current Account (% of GDP)0<strong>20</strong>06 <strong>20</strong>07 <strong>20</strong>08 <strong>20</strong>09 <strong>20</strong>10 projLoan growth (%) Deposit growth (%)Source: INSTAT and WEO April <strong>20</strong>10, IMFSource: BoA (<strong>20</strong>10) and country report, IMF(<strong>20</strong>10)Greek bank subsidiaries and branches account for one quarter of the banking system andhave the lowest capital and liquidity buffers in the system. Greek banks in Albania havewitnessed a deposit withdrawal during recent economic problems in Greece. However,following the IMF and EU program with Greece, Greek banks in Albania are recordingdeposit growth.8.3.3 MacedoniaMacedonian denar is quasi-pegged to EURO with a purpose of keeping the price stability.With tight measures of the National Bank of the Republic Macedonia (NBRM) that took in<strong>20</strong>09 (raising the liquidity and reserve requirements from banks), Macedonia is one of thecountries with most tightened monetary policy in the region. The measures of the NBRMwere taken to maintain the peg with EURO and protect the availability of foreign reserves.These measures appeared to be feasible implementing from banking sector with a relativelysmall impact on growth.| 65