Financial Stability Report No1 20 December 2010 - Banka Qendrore ...

Financial Stability Report No1 20 December 2010 - Banka Qendrore ...

Financial Stability Report No1 20 December 2010 - Banka Qendrore ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

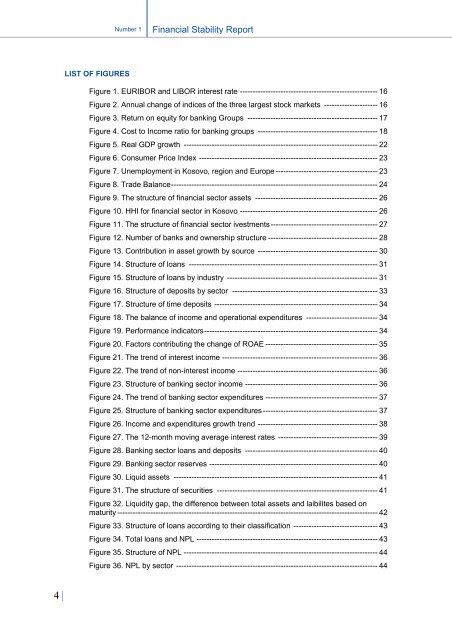

Number 1<strong>Financial</strong> <strong>Stability</strong> <strong>Report</strong>LIST OF FIGURESFigure 1. EURIBOR and LIBOR interest rate ------------------------------------------------------ 16Figure 2. Annual change of indices of the three largest stock markets --------------------- 16Figure 3. Return on equity for banking Groups --------------------------------------------------- 17Figure 4. Cost to Income ratio for banking groups ----------------------------------------------- 18Figure 5. Real GDP growth ---------------------------------------------------------------------------- 22Figure 6. Consumer Price Index ---------------------------------------------------------------------- 23Figure 7. Unemployment in Kosovo, region and Europe ---------------------------------------- 23Figure 8. Trade Balance --------------------------------------------------------------------------------- 24Figure 9. The structure of financial sector assets ------------------------------------------------ 26Figure 10. HHI for financial sector in Kosovo ------------------------------------------------------ 26Figure 11. The structure of financial sector ivestments ------------------------------------------ 27Figure 12. Number of banks and ownership structure ------------------------------------------- 28Figure 13. Contribution in asset growth by source ----------------------------------------------- 30Figure 14. Structure of loans -------------------------------------------------------------------------- 31Figure 15. Structure of loans by industry ----------------------------------------------------------- 31Figure 16. Structure of deposits by sector --------------------------------------------------------- 33Figure 17. Structure of time deposits ---------------------------------------------------------------- 34Figure 18. The balance of income and operational expenditures ---------------------------- 34Figure 19. Performance indicators -------------------------------------------------------------------- 34Figure <strong>20</strong>. Factors contributing the change of ROAE -------------------------------------------- 35Figure 21. The trend of interest income ------------------------------------------------------------- 36Figure 22. The trend of non-interest income ------------------------------------------------------- 36Figure 23. Structure of banking sector income ---------------------------------------------------- 36Figure 24. The trend of banking sector expenditures -------------------------------------------- 37Figure 25. Structure of banking sector expenditures --------------------------------------------- 37Figure 26. Income and expenditures growth trend ----------------------------------------------- 38Figure 27. The 12-month moving average interest rates --------------------------------------- 39Figure 28. Banking sector loans and deposits ---------------------------------------------------- 40Figure 29. Banking sector reserves ------------------------------------------------------------------ 40Figure 30. Liquid assets -------------------------------------------------------------------------------- 41Figure 31. The structure of securities --------------------------------------------------------------- 41Figure 32. Liquidity gap, the difference between total assets and laibilites based onmaturity ------------------------------------------------------------------------------------------------------ 42Figure 33. Structure of loans according to their classification --------------------------------- 43Figure 34. Total loans and NPL ----------------------------------------------------------------------- 43Figure 35. Structure of NPL ---------------------------------------------------------------------------- 44Figure 36. NPL by sector ------------------------------------------------------------------------------- 444 |