Annual Report 2009 - Toyota Financial Services

Annual Report 2009 - Toyota Financial Services Annual Report 2009 - Toyota Financial Services

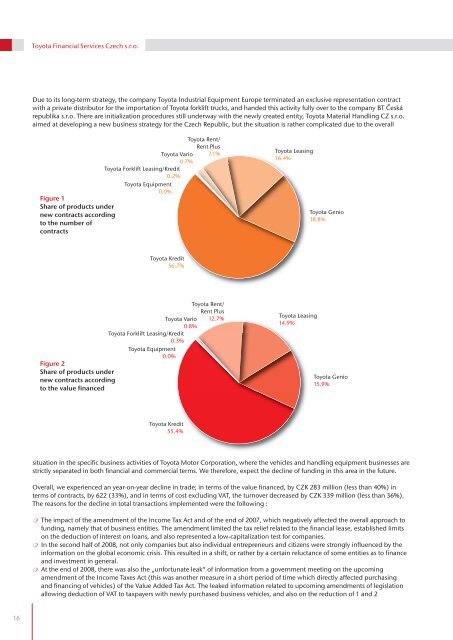

Toyota Financial Services Czech s.r.o.Due to its long-term strategy, the company Toyota Industrial Equipment Europe terminated an exclusive representation contractwith a private distributor for the importation of Toyota forklift trucks, and handed this activity fully over to the company BT Českárepublika s.r.o. There are initialization procedures still underway with the newly created entity, Toyota Material Handling CZ s.r.o.aimed at developing a new business strategy for the Czech Republic, but the situation is rather complicated due to the overallFigure 1Share of products undernew contracts accordingto the number ofcontractsToyota Vario0.7%Toyota Forklift Leasing/Kredit0.2%Toyota Equipment0.0%Toyota Rent/Rent Plus7.1%Toyota Leasing16.4%Toyota Genio18.8%Toyota Kredit56.7%Figure 2Share of products undernew contracts accordingto the value financedToyota Vario0.8%Toyota Forklift Leasing/Kredit0.3%Toyota Equipment0.0%Toyota Rent/Rent Plus12.7%Toyota Leasing14.9%Toyota Genio15.9%Toyota Kredit55.4%situation in the specific business activities of Toyota Motor Corporation, where the vehicles and handling equipment businesses arestrictly separated in both financial and commercial terms. We therefore, expect the decline of funding in this area in the future.Overall, we experienced an year-on-year decline in trade; in terms of the value financed, by CZK 283 million (less than 40%) interms of contracts, by 622 (33%), and in terms of cost excluding VAT, the turnover decreased by CZK 339 million (less than 36%).The reasons for the decline in total transactions implemented were the following :❍ The impact of the amendment of the Income Tax Act and of the end of 2007, which negatively affected the overall approach tofunding, namely that of business entities. The amendment limited the tax relief related to the financial lease, established limitson the deduction of interest on loans, and also represented a low-capitalization test for companies.❍ In the second half of 2008, not only companies but also individual entrepreneurs and citizens were strongly influenced by theinformation on the global economic crisis. This resulted in a shift, or rather by a certain reluctance of some entities as to financeand investment in general.❍ At the end of 2008, there was also the „unfortunate leak“ of information from a government meeting on the upcomingamendment of the Income Taxes Act (this was another measure in a short period of time which directly affected purchasingand financing of vehicles) of the Value Added Tax Act. The leaked information related to upcoming amendments of legislationallowing deduction of VAT to taxpayers with newly purchased business vehicles, and also on the reduction of 1 and 216

Annual Report 2009depreciation periods to 1 and 2 years respectively, as a direct response to the increasing financial crisis. In such a situation, theinterest of business entities in new investment, and thus also in the financing of cars, significantly decreased in anticipation ofthe approval of this amendment at the beginning of 2009.❍ The decrease of vehicle-funding potential was also due to the announcement of the ”scrap allowance“ in the neighbouringcountries, which resulted in the fact that all automobile producers, including Toyota, gradually directed their sales to thesecountries to meet the growing demand. However, these customers are not available to a company providing financial serviceson the territory of the Czech Republic. The so-called re-export sales are included in the official statistics and they distort theoverall view of the passenger car sales especially in the Czech Republic. According to unofficial estimates, these involved asmuch as 30% of the total sales of passenger cars in the Czech Republic in the first quarter of 2009.❍ Despite the negative developments in financial services, Toyota Financial Services focused on complementary productsdesigned to cash-paying customers (see Toyota Pojištění section) in order to compensate for the existing status and createa large potential for the future.❍ Despite the negative developments in the recent months, we assume that this is a temporary phenomenon that will soon beovercome.Table 2 offers an insight into the overall market share of Toyota and Lexus in sales of new vehicles in the Czech Republic togetherwith the share of financing provided by our company.Looking at the realized outcome (besides the facts mentioned in the previous paragraph), it is necessary to realize that theresulting 17.84% penetration was achieved due to the pro-active business activities of our company, without the support of a jointcampaign with subsidies by the importer which was implemented in the previous years. It is therefore not necessary to see theresult as a strictly negative one, since even in the absence of joint programs with the distributor and given the objective marketfactors, we were able to increase market penetration to the level of almost 60% of the market share of funding (50% market shareis perceived as a half of the funding achievable. If we know that 31% of out of 100% cars sold are funded in some way, thenachieving a 17.84% penetration means that more than a half of the business opportunities to finance the acquisition of the car wereimplemented). Yet there is still some room for expansion and for the resources which were not spent.Table 2 – Market share of new cars sold on the market by Toyota and Lexus (passenger and light commercial vehicles)Parameter / fiscal year 2004 20052006 20072008 2009Car sales in the Czech Republic (units) 171,116 158,308166,278 178,394199,885 195,694Sales of Toyota and Lexus makes (units) 4,418 4,7494,717 5,7266,041 6,402Toyota’s share on the Czech market 2.58% 3.00%2.84% 3.21%3.02% 3.27%Number of vehicles financed by the TFSCZ (units) 1,455 1,3361,571 1,676 1,644 1,142Penetration reached by the TFSCZ 32.93% 28.13%33.31% 29.27%27.21% 17.84%Figure 3 – Development of number of vehicles funded (newly contracted business cases) and of the penetration achieved1,800 32.93%1,6001,4551,4001,20028.13%1,33633.31%1,5711,67629.27%27.21%1,6441,14235.00%30.00%25.00%1,0008006004002000Units17.84%2004 2005 2006 2007 2008 200920.00%15.00%10.00%5.00%0.00%PenetrationAchieved TFSCZ penetrationNumber of vehicles financed by TFSCZ (units)17

- Page 1 and 2: Annual Report2009Toyota Financial S

- Page 3 and 4: Annual Report 20093

- Page 5 and 6: Annual Report 2009ContentIntroducti

- Page 7 and 8: Annual Report 2009In January 2009,

- Page 9 and 10: Annual Report 20092 0 0 3February 2

- Page 11 and 12: Annual Report 2009❍ the standard

- Page 13 and 14: Annual Report 200910% (a minimum of

- Page 15: Annual Report 2009The proportion of

- Page 19 and 20: Annual Report 2009As at 31 March 20

- Page 21 and 22: Annual Report 2009Risk ManagementCr

- Page 23 and 24: Annual Report 200923

- Page 25 and 26: Annual Report 2009Independent Audit

- Page 27 and 28: Annual Report 2009Independent Audit

- Page 29 and 30: Annual Report 200929

- Page 31 and 32: Annual Report 2009INCOME STATEMENT

- Page 33 and 34: Annual Report 2009CASH FLOW STATEME

- Page 35 and 36: Annual Report 20092. ACCOUNTING POL

- Page 37 and 38: Annual Report 20092. ACCOUNTING POL

- Page 39 and 40: Annual Report 20093. INTANGIBLE FIX

- Page 41 and 42: Annual Report 20094. TANGIBLE FIXED

- Page 43 and 44: Annual Report 20096. EQUITYIn accor

- Page 45 and 46: Annual Report 200910. TAXATIONThe i

- Page 47 and 48: Annual Report 200913. EMPLOYEE ANAL

- Page 49 and 50: Annual Report 200916. COMMITMENTSTh

- Page 51 and 52: Annual Report 20094. Relations amon

<strong>Toyota</strong> <strong>Financial</strong> <strong>Services</strong> Czech s.r.o.Due to its long-term strategy, the company <strong>Toyota</strong> Industrial Equipment Europe terminated an exclusive representation contractwith a private distributor for the importation of <strong>Toyota</strong> forklift trucks, and handed this activity fully over to the company BT Českárepublika s.r.o. There are initialization procedures still underway with the newly created entity, <strong>Toyota</strong> Material Handling CZ s.r.o.aimed at developing a new business strategy for the Czech Republic, but the situation is rather complicated due to the overallFigure 1Share of products undernew contracts accordingto the number ofcontracts<strong>Toyota</strong> Vario0.7%<strong>Toyota</strong> Forklift Leasing/Kredit0.2%<strong>Toyota</strong> Equipment0.0%<strong>Toyota</strong> Rent/Rent Plus7.1%<strong>Toyota</strong> Leasing16.4%<strong>Toyota</strong> Genio18.8%<strong>Toyota</strong> Kredit56.7%Figure 2Share of products undernew contracts accordingto the value financed<strong>Toyota</strong> Vario0.8%<strong>Toyota</strong> Forklift Leasing/Kredit0.3%<strong>Toyota</strong> Equipment0.0%<strong>Toyota</strong> Rent/Rent Plus12.7%<strong>Toyota</strong> Leasing14.9%<strong>Toyota</strong> Genio15.9%<strong>Toyota</strong> Kredit55.4%situation in the specific business activities of <strong>Toyota</strong> Motor Corporation, where the vehicles and handling equipment businesses arestrictly separated in both financial and commercial terms. We therefore, expect the decline of funding in this area in the future.Overall, we experienced an year-on-year decline in trade; in terms of the value financed, by CZK 283 million (less than 40%) interms of contracts, by 622 (33%), and in terms of cost excluding VAT, the turnover decreased by CZK 339 million (less than 36%).The reasons for the decline in total transactions implemented were the following :❍ The impact of the amendment of the Income Tax Act and of the end of 2007, which negatively affected the overall approach tofunding, namely that of business entities. The amendment limited the tax relief related to the financial lease, established limitson the deduction of interest on loans, and also represented a low-capitalization test for companies.❍ In the second half of 2008, not only companies but also individual entrepreneurs and citizens were strongly influenced by theinformation on the global economic crisis. This resulted in a shift, or rather by a certain reluctance of some entities as to financeand investment in general.❍ At the end of 2008, there was also the „unfortunate leak“ of information from a government meeting on the upcomingamendment of the Income Taxes Act (this was another measure in a short period of time which directly affected purchasingand financing of vehicles) of the Value Added Tax Act. The leaked information related to upcoming amendments of legislationallowing deduction of VAT to taxpayers with newly purchased business vehicles, and also on the reduction of 1 and 216