2008 Registration Document - Rexel

2008 Registration Document - Rexel

2008 Registration Document - Rexel

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

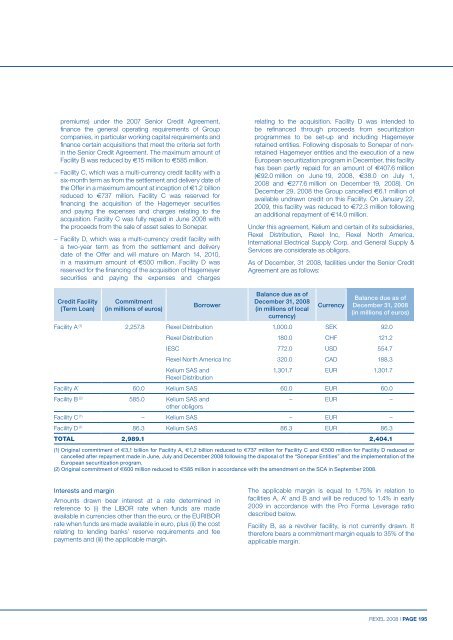

premiums) under the 2007 Senior Credit Agreement,finance the general operating requirements of Groupcompanies, in particular working capital requirements andfinance certain acquisitions that meet the criteria set forthin the Senior Credit Agreement. The maximum amount ofFacility B was reduced by €15 million to €585 million.− Facility C, which was a multi-currency credit facility with asix-month term as from the settlement and delivery date ofthe Offer in a maximum amount at inception of €1.2 billionreduced to €737 million. Facility C was reserved forfinancing the acquisition of the Hagemeyer securitiesand paying the expenses and charges relating to theacquisition. Facility C was fully repaid in June <strong>2008</strong> withthe proceeds from the sale of asset sales to Sonepar.− Facility D, which was a multi-currency credit facility witha two-year term as from the settlement and deliverydate of the Offer and will mature on March 14, 2010,in a maximum amount of €500 million. Facility D wasreserved for the financing of the acquisition of Hagemeyersecurities and paying the expenses and chargesrelating to the acquisition. Facility D was intended tobe refinanced through proceeds from securitizationprogrammes to be set-up and including Hagemeyerretained entities. Following disposals to Sonepar of nonretainedHagemeyer entities and the execution of a newEuropean securitization program in December, this facilityhas been partly repaid for an amount of €407.6 million(€92.0 million on June 19, <strong>2008</strong>, €38.0 on July 1,<strong>2008</strong> and €277.6 million on December 19, <strong>2008</strong>). OnDecember 29, <strong>2008</strong> the Group cancelled €6.1 million ofavailable undrawn credit on this Facility. On January 22,2009, this facility was reduced to €72.3 million followingan additional repayment of €14.0 million.Under this agreement, Kelium and certain of its subsidiaries,<strong>Rexel</strong> Distribution, <strong>Rexel</strong> Inc, <strong>Rexel</strong> North America,International Electrical Supply Corp. and General Supply &Services are considerate as obligors.As of December, 31 <strong>2008</strong>, facilities under the Senior CreditAgreement are as follows:Credit Facility(Term Loan)Commitment(in millions of euros)BorrowerBalance due as ofDecember 31, <strong>2008</strong>(in millions of localcurrency)CurrencyBalance due as ofDecember 31, <strong>2008</strong>(in millions of euros)Facility A (1) 2,257.8 <strong>Rexel</strong> Distribution 1,000.0 SEK 92.0<strong>Rexel</strong> Distribution 180.0 CHF 121.2IESC 772.0 USD 554.7<strong>Rexel</strong> North America Inc 320.0 CAD 188.3Kelium SAS and<strong>Rexel</strong> Distribution1,301.7 EUR 1,301.7Facility A’ 60.0 Kelium SAS 60.0 EUR 60.0Facility B (2) 585.0 Kelium SAS andother obligors– EUR –Facility C (1) – Kelium SAS – EUR –Facility D (1) 86.3 Kelium SAS 86.3 EUR 86.3TOTAL 2,989.1 2,404.1(1) Original commitment of €3,1 billion for Facility A, €1,2 billion reduced to €737 million for Facility C and €500 million for Facility D reduced orcancelled after repayment made in June, July and December <strong>2008</strong> following the disposal of the “Sonepar Entities” and the implementation of theEuropean securitization program.(2) Original commitment of €600 million reduced to €585 million in accordance with the amendment on the SCA in September <strong>2008</strong>.Interests and marginAmounts drawn bear interest at a rate determined inreference to (i) the LIBOR rate when funds are madeavailable in currencies other than the euro, or the EURIBORrate when funds are made available in euro, plus (ii) the costrelating to lending banks’ reserve requirements and feepayments and (iii) the applicable margin.The applicable margin is equal to 1.75% in relation tofacilities A, A’ and B and will be reduced to 1.4% in early2009 in accordance with the Pro Forma Leverage ratiodescribed below.Facility B, as a revolver facility, is not currently drawn. Ittherefore bears a commitment margin equals to 35% of theapplicable margin.REXEL <strong>2008</strong> | PAGE 195