Information Manual RIGHT TO INFORMATION ACT, 2005 - AP Online

Information Manual RIGHT TO INFORMATION ACT, 2005 - AP Online

Information Manual RIGHT TO INFORMATION ACT, 2005 - AP Online

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>AP</strong>ONLINE WEBSITEA. P. Scheduled Castes Coop. Finance Corpn. Ltd.Hyderabad<strong>Information</strong> <strong>Manual</strong><strong>RIGHT</strong> <strong>TO</strong> <strong>INFORMATION</strong> <strong>ACT</strong>, <strong>2005</strong>Vice Chairman and Managing Director,<strong>AP</strong> SC Finance Corporation, 5 th Floor, Dr.D.S.S. Bhavan,Masab Tank, Hyderabad – 500 028Website: www.sccorp.ap.gov.inE-mail – md_apsccfc@ap.gov.in1

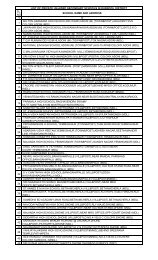

A P S C COOP. FINANCE CORPORATION LTD.Right to <strong>Information</strong> Act(Section – 5(1) )List of Assistant Public <strong>Information</strong> Officers, Public <strong>Information</strong> Officers andOfficers to act as Appellate AuthoritySl.No.1District<strong>AP</strong>SCCFC Ltd.,Hyderabad.Head OfficeAsst.Public<strong>Information</strong>OfficerSri A. NageswaraRao, ExecutiveOfficer, (Admin.)2 Srikakulam, Sri K.V. KrishnaRao,D S C S C S LtdAsst.Exe.Officer,Sri P.V.3 Vizianagaram, Koteswara Rao,D S C S C S Ltd Asst.ExecutiveOfficer,Public<strong>Information</strong>OfficerSmt. D. UmaDevi, GeneralManager,(Admin)9908495556Sri K. Kantha Rao,Asst. ExecutiveOfficer,9849905956Sri G.BB.Jayababu,Executive Officer,9849905958Officer to act asAppellateAuthorityDr. N. NageswaraRao, I.A.S.,VC & ManagingDirector9848125028Smt. Ch.Mahalaxmi,ExecutiveDirector98499-05955Sri G. Krishna,ExecutiveDirector98499-05957Smt. K. Sri D. Srinivasan,4 Visakhapatnam, Sri. D. Raghu,Kanakaratnam, ExecutiveAssistantD S C S C S LtdExecutive Officer, DirectorExecutive Officer,9849905960 98499-05959Sri. J. PrasadaSri V. Mahi Pal,Sri D. Anjaneyulu,E. Godavari, Rao,Executive5 Executive Officer,D S C S C S Ltd Ass.ExecutiveDirector9849905962Officer,98499-059616W. Godavari, Sri B. RajeswaraD S C S C S Ltd Rao, MEO7 Krishna, Sri G.Y. Prasad,D S C S C S Ltd Sr. Asst.8 Guntur, D S C S Sri GYV Prasad,C S Ltd Sr. Asst.Sri T. Veeranna,Executive Officer,9849905964Smt. P. Rani, Exe.Officer,9849905966Smt. PLMCRani,Ex. Officer,98499059689 Prakasam, Sri G. Babu Rao, Sri B. Prabhakar,Assistant Executive Officer,D S C S C S LtdExecutive Officer, 9849905970Sri U.VenkataiahSingh,ExecutiveDirector98499-05963Sri K.S.S. Raj,ExecutiveDirector98499-05965Sri M.Viswanath,ExecutiveDirector98499-05967Sri K. Raju,ExecutiveDirector98499-05969Officers AddressDSS Bhavan, 5th Floor,Masab Tank,Hyderabad-28040-23315970040-23321141040-23320747Tarakarama Complex,Srikakulam 08942-240580Dr. M. Chenna ReddyBhavan, Vizianagaram08908922-276459Samkshema Bhavan,Sector-6, MVP Colony,Visakhapatnam0891-2553501Pragathi Bhavan,Kakinada0884-2362196Pragathi Bhavan,Collectorate OfficeComplex, WestGodavari08812-230126Collectorate OfficeComplex,Machilipatnam08672-252412Behind Zilla PrajaParishad Office,Guntur0863-2234134Pragathi Bhavan,Ongole08592-2333962

10 Nellore, Sri M. Sadanand,D S C S C S Ltd Sr. Asst.Sri T. Chandra11 Kurnool, Sekhar Reddy, Sr.D S C S C S Ltd Asst., AssistantExecutiveOfficer,12 Kadapa, Sri M.Satyanarayana,D S C S C S LtdA.O.13 Anantapur, Sri H. Sunkanna,D S C S C S Ltd Sr. Asst.14 Chittoor, Smt. VijayaKumari, AssistantD S C S C S LtdAccounts Officer,Smt. T. PremKumari, Asst.Executive Officer,9849905972Sri M.Laxminarayana,8121793079Sri Y. Babanna,Executive Officer,9849905976Sri. T. MohanKumar, ExecutiveOfficer,9849901871Sri G. Dayanand,Executive Officer,984990598015 Adilabad, Sri N. Shankar, Sri U. Pundalik,Assistant Executive Officer,D S C S C S LtdExecutive Officer, 984990598216 Nizamabad, Sri B. Jayaram,D S C S C S Ltd Sr. Asst.Sri D. Nilakantam,Executive Officer9849905984Smt. GVSSNagalakshmi,Ex.Director98499-05971Sri D. AnandaNaik, ExecutiveDirector98499-05973Sri A. MuraliManohar, E.D.98499-14847Smt. C.Malleswari Devi,ExecutiveDirector98499-05977Sri I.VenkateswaraReddy, ExecutiveDirector98499-05979Sri C.Chakradhara Rao,ExecutiveDirector949343-2770Dr.A. Rajeswar,ExecutiveDirector98499-05983Sri D. Kumara17 Karimnagar, Sri T. Ravi,Sri S. WilsonSwamy, ExecutiveAssistantPrabhakar, E.D.D S C S C S LtdOfficer,Executive Officer,98499-05985984990598618 Warangal, Sri T. Ravi, Sri G. Venkataiah, Sri V. GangaAssistant Executive Officer, Reddy, E. D.D S C S C S LtdExecutive Officer, 9849905988 98499-05987Sri D.Sri Shaik Meera,19 Khammam,Sri K. Venkanarsu,MukubndamExecutiveExecutive Officer,D S C S C S Ltd AssistantDirector9849905990Executive Officer,98499-05989Sri K.20 Nalgonda, Sri SSNParthasarathi,Sharma,Asst.D S C S C S LtdExecutive Officer,Executive Officer,9849905992Smt. V.21 Medak, Kanakaranam,D S C S C S Ltd Assistant9849905994Executive Officer,Sri B. Devaiah,Executive Officer,Sri Ch. RavindraPrasad, E.D.98499-05991Sri K. ChandraSekhar Reddy,ExecutiveDirector98499-05993Dr. Ambedkar Bhavan,Nellore0861-2324763Social Welfare OfficeComplex, Kurnool08518-230836Pragathi Bhavan,Cuddapah08562-244729Penner Bhavan,Ananthapur08554-232167Opp. Z.P.P, Chittoor08572-233673Social Welfare OfficeComplex, Adilabad08542-242637Pragathi Bhavan,Nizamabad08462-222950Collectorate Complex,Karimnagar0878-2262243Pragathi Bhavan,Warangal0870-2511650DRDA Office Building,Khammam08742-228367Samkshema Bhavan,Nalgonda08682-244544Collectorate Complex,Sanga Reddy08455-2763913

MahaboobSri A. Harinatha22 Nagar,Reddy, Sr. Asst.D S C S C S LtdSri T. Bhumanna,Executive Officer,9849905996Sri K.S. Rao, Sri P. Ramaiah,Ranga Reddy,23 Assistant Executive Officer,D S C S C S LtdExecutive Officer, 9849905998Md. Yosuf Ali, Smt.24 Hyderabad, Assistant Seethayaninetha,D S C S C S Ltd Executive Officer, Executive Officer,(Plg.)9849906000Sri M. Mallaiah,ExecutiveDirector98499-05995Sri M.Ramchander, E.D.98499-05997Sri K.Satyanarayana,ExecutiveDirector98499-05999Collectorate Complex,Mahaboobnagar08542-242637Collectorate,Lakdikapul,Hyd. 040-23212273Collectorate Complex,Hyd.040-232015004

RTI Act, <strong>2005</strong>(Section4 (1) (b)(i)ORGANISATIONAL CHART OF <strong>AP</strong>SCCFC (H.O)(CHAIRMAN of C.O.P)[ Peshi = UD Steno + Driver + Attender]VICE-CHAIRMAN & MANAGING DIREC<strong>TO</strong>R[ Peshi = UD Steno + Driver + Jamedar+Attender]/General Manager (D&F) General Manager (Admn)[Pesh i= LD Steno + Driver + Attender] [Peshi= LD Steno + Driver + Attender]EO(Plg.&Audit)AEOEO (NSFDC&NSKFDC)AEOEO(Accounts)EO(Comp.)AEO AEOEO(Legal)AEOEO(Maint.,A&I)AEOEO(Estt)AEOS.A S.A S.A S.A S.A S.A S.A S.AS.AS.AT.O Z.O R.A J.A S.A S.A S.A S.ATypistAttenderTypistAttenderTypistAttenderDrivers (5)Watchman (2)TypistAttender5

ORGANISATIONAL CHART OF DIST. SCSC SOCIETYCOLLEC<strong>TO</strong>R & CHAIRMANEXECUTIVE DIREC<strong>TO</strong>R(L.D. Steno + Driver + Attender)Executive Officer (Dev. & Plg.)Executive Officer (Admn & Fin.)AEO (Dev. & Plg)AAO (Admn & Fin.)Jr. Asst. Sr. Asst. Sr. Asst. Sr. Asst.Sr. Asst. Sr. Asst. Sr. Asst. TypistDriver Attender Record Asst. Watchman Attender6

A P S C COOP. FINANCE CORPORATION LTD.Right to <strong>Information</strong> ActChapter - 1Organization, Functions and Duties[Section 4(1) (b) (i)]Normally the files will be processed by the Jr. Assistant/ Sr. Assistant and route the files throughthe concerned Asst. Executive Officer and the A.E.O. will route the files to the concernedExecutive officer and the Executive Officer to the General Manager (Admin)/General Manager(D&F) and to the VC & Managing Director. The VC & Managing Director is the final decisionmaking authority.Channel of supervisionThe channel of supervision begins with the Section Asst. Executive Officer and he will route thefiles to Executive Officers and General Managers.AccountabilityThe Section Assistant i.e Jr. Assistant or Senior Assistant is accountable for the tappals he receivedand he has to submit the files to the concerned Asst. Executive Officer.7

Norms set by organizationA P S C COOP. FINANCE CORPORATION LTD.Right to <strong>Information</strong> ActChapter - 4Norms Set For the Discharge of Functions[Section 4(1) (b) (IV)]The Corporation is being a Government assisted Department will follow the rules and regulationsissued by Government from time to time and the decisions of the Government are binding. Theofficers shall discharge their duties within the framework of rules and regulations as are applicableto the State Government employees.Discharge of dutiesThe duties will be discharged by the officers as prescribed from time to time. At present thefollowing is the duty chart of the officers of the Head office of A.P.S.C Finance Corporation.Sl Name of the Officers /No EmployeesDescription of the work to deal with1 V.C & Managing Director CHIEF EXECUTIVE OF THE CORPORATION2General ManagerOverall incharge of Administration, i.e., Establishment, Vigilance,(Administration)A.C.B. cases, Legal matters and Maintenance of the office.Overall incharge of Planning and Development, i.e., Budget andmobalisation of funds, Action Plan, formulation of Schemes and its3General Managerimplementation, Audit, Inspections and DCB, Recovery, Meetings(Development & Finance) and reports, LAQs, CMP, CMO references and all other mattersrelated to Development and Planning. Maintenance of Accountsand all other matters.4 Executive Officer (Admin)Sectoral in charge of Establishment Matters of Head Office,District Societies,. Convening of COP & General Body meetings.Sectoral incharge of Maintenance of the Office,i.e., Tools andPlants, Moveable & Immovable properties, Furniture and Fixtures,Records & Stationery.5 Executive Officer (Legal/AH)Sectoral incharge of Legal Matters of Head Office, DistrictSocieties including , Establishment matters and all court cases..Monitoring of Animal Husbandry schemes being implemented by6Executive Officer (Planning) &(Audit)all the District Societies.Sectoral incharge of Planning, Budget (Plan & Non Plan),Meetings, Reports. Preparation of Action Plan and itsimplementation. He is inchage of Minor irrigation and all Landbased schemes, Bank linked Schemes, ISB sector, Poultrycomplexes, Shopping complexes, Artisans, CMP cases, CMOreferences, all LAQs and any other reports to be sent to Govt.Sectoral incharge of Recovery of loans.Sectoral inchage of Audit& Inspections, PAC, Audit paras of C &AG and Cooperative Audit. He is responsible for Internal &External Audit of District Societies and Head office and relatedmatters.8

7 Executive Officer (Accounts)89Executive Officer (NSFDC &NSKFDCExecutive Officer(Vig.&Inspections)10 Executive Office (Comp.)Sectoral incharge of Accounts of the Corporation. He is responsiblefor all Receipts & Payments of the Corporation and related matters.He is responsible for maintenance of all accounts.Sectoral inchage of NSFDC, NSKFDC and Rehabilitation ofScavengers, Bonded Labour, Jogins, Land Purchase, Horticulture,Micro Credit, M.S.Y. and all related matters.Sectoral incharge for Vigilance cases, inward and outwards,Record Room, Inspections and all office maintenance.Sectoral incharge for computerization in head office, liaisoningwork at Secretariat.9

A P S C COOP. FINANCE CORPORATION LTD.Right to <strong>Information</strong> ActChapter - 5Rules, Regulations, Instructions, <strong>Manual</strong> and Records[Section 4(1) (b) (v)]Rules RegulationsA.P. Scheduled Castes Cooperative Finance Corporation Ltd follows the rules and regulations asissued by Government from time to time. A. P. State and Subordinate Service Rules 1996, A.P.C.C.A Rules 1991,A.P. Leave Rules, A.P. Last Grade Service Rules, Budget <strong>Manual</strong>, F.R.,Financial Code and are being followed.InstructionsThe Department follows the rules issued by Government from time to time.<strong>Manual</strong>s and recordsThe Department has two <strong>Manual</strong>s viz 1. Departmental <strong>Manual</strong> and Functionary <strong>Manual</strong> and alsomaintain the records i.e Service Registers, Annual Confidential Reports. The Society is governedby its Bye-Laws which are shown in the following pages.10

ANHDRA PRADESH SCHEDULED CASTES CO-OPEARTIVE FINANCECORPORATION LIMITED::HYDERABADBye-Law No.1 :BYE-LAWS OF CORPORATIONFIFTH FLOOR, D.S.S. BHAVAN, MASAB TANKHYDERABAD - 500 028ANDHRA PRADESH SCHEDULED CASTES COOPERATIVE FINANCECORPORATION LIMITED: HYDERABAD (No.T.A.570)Name Constitution and Address :The Andhra Pradesh Scheduled Castes Co-operative Finance Corporation is registered as a CooperativeSociety under the Andhra Pradesh Co-operative Societies Act 7 of 1964. Its address shallbe office of the Director of Social Welfare, Basheerbagh, Hyderabad, Andhra Pradesh. Its area ofoperations shall extend to the State of Andhra Pradesh.Bye-Law No.2 :1. "Corporation" means the Andhra Pradesh Scheduled Castes Co-operative FinanceCorporation Ltd., Hyderabad.2. "District Society" means Dist., Scheduled Castes Service Co-op. Society.3. "Act" means Andhra Pradesh Co-operative Societies Act 1964.4. "Rules" means Andhra Pradesh Co-operative Societies Rules 1964.5. "Committee" means the Board of Directors of the Corporation.6. "Government" means the Government of Andhra Pradesh.7. "Registrar" means the Registrar of Co-operative Societies, Andhra Pradesh, Hyderabad orany person on whom the powers of Registrar were conferred by the Government underSection 3 of the Act.Bye-Law No.3 :OBJECTS :The primary duty of the Corporation is to undertake the tasks of economic up-liftment of themembers of the Scheduled Castes in the State. The objects of Corporation shall therefore be asfollows:1. The Corporation shall plan, promote, undertake and assist programmes of AgriculturalDevelopment, Animal Husbandry, Marketing, processing, supply and storage of agriculturalproducts, small scale industry, village industry, cottage industry, trade, business or anyother activity which will enable the members of the Scheduled Castes to earn a better livingand help them improve their standards of living.2. To undertake a programme for setting up employment oriented industries, cottage and smallscale industries, village industries, etc., by providing technical know how managerialassistance financial assistance, and any other form of assistance which may be required inachieving the above objective including providing the necessary financial guarantees toinstitutions on behalf of the Societies concerned.3. To provide working capital to the affiliated societies by advancing loans and cash creditsand the like;11

4. To co-ordinate, supervise and control the activities of the affiliated societies;5. To act as the Agent of the Government for procurement supply and distribution ofAgricultural or other produce or other goods as and when required to do so;6. To provide facilities for survey, research or study of the problems relating to cottage andvillage industries, small businesses to assess potentialities of village, cottage and small scaleindustries and scope of their development with a view to promote such industries andbusiness for the purpose of providing employment to the members of the Scheduled Castes.7. To arrange for publicity and marketing of the finished products manufactured by themembers in the village industries if necessary by opening show rooms, emporiums,exhibitions etc.,8. To invest or deposit surplus funds of the Corporation in Government securities or in CooperativeBanks or other banks approved by the Registrar.9. To issue bonds and debentures for raising resources for fulfilling any of the objects of theCorporation.10. Generally to purchase, take on lease or in exchange, hire or otherwise acquire, any real andpersonal property and any rights or privileges which the Corporation may think necessary orconvenient for the purpose of its business and in particular any land building, easements,machinery plant and stocks-in-trade.11. To receive grants, gifts, donations, loans advances or other moneys on deposits, orotherwise from the Andhra Pradesh Government or the Government of India or Cooperativeor commercial banks, Life Insurance Corporation of India, Companies, Trusts orindividuals with or without allowance of interest thereon in pursuance of the above objects.12. To provide for the welfare of person in the employment of the Corporation and familiesincluding wives and widows of such persons, by establishing provident or other funds, bygrants of money, pensions or other payments towards educational and medical relief.13. To encourage self help, thrift and co-operation among the affiliated societies and theirmembers;14. To do all other things as are incidental to or conductive to the attainment of the aboveobjects.Bye-Law No. 4 :LIABILITY:The Liability of the members of the Corporation shall be limited to the share capital subscribed bythe respective members.Bye-Law No.5 :SHARE C<strong>AP</strong>ITAL :The authorized share capital of the Corporation shall be Rs.500 lakhs made up of the followingcategories.1. 'A' class shares of Rs.20/- each which shall be available only to the District Societies;2. 'B' class shares of Rs.100/- each which shall be available only to the State Government;3. 'C' class shares of Rs.50/- each which shall be available to any other Registered CooperativeSociety or Co-operative Society deemed to be registered under the Act.4. 'D' class shares of Rs.10/- each to Persons above the age of eighteen who sympathises withthe objects of the Corporation or have dealings with the Corporation.The Managing Committee may fix the number of A and C class shares to be contributed bymembers.12

Bye-Law No.6 :Membership and Eligibility :Membership of the Corporation shall be opened to the following in the area of operation.1. All Scheduled Castes Finance Co-operative Societies in the State shall be eligible foradmission and they shall be allotted 'A' Class shares.2. State Government shall be eligible for admission and shall be allotted 'B' Class shares.3. Any other Co-operative Society in the state shall be eligible for admission and shall beallotted 'C' Class shares.4. Any person sympathising with the objects of the Society or have dealings with the societymay be admitted as nominal member and shall be allotted 'D' class shares.'C' and 'D' class members shall have no right to vote participate in the management of the Societyand shall have no share in the dividend or rebate disbursed by the Corporation.Bye-Law No. 7:Every application for admission to the Corporation shall be in the from prescribed and addressed tothe Managing Director. The Committee may not without sufficient cause refuse admission tomembership to any Society duly qualified under bye-law No.6. Where admission is refused thedecision with the reasons therefor shall be communicated by the Corporation by Registered Post tosuch Society within 15 days from the date of decision or within 10 days from the date ofapplication for membership whichever is earlier. If no such decision is communicated to suchapplicant within 60 days from the date of application for membership, the Corporation shall bedeemed to have admitted such applicant as a member on payment of share capital etc. as requiredunder section 24 of the Act and as per bye-laws. The Managing Director shall give effect to theadmission. The name of every society either admitted as a member under sub-section (3) of Section19 of the Act or deemed to have been admitted as a member by virtue of the provision to the saidsection shall be entered in the admission register by the Managing Director of the Corporationwithin thirty days from the date of resolution passed by the competent authority to admit suchsocieties as member or from the date on which such society is deemed to have become a member asthe case may be.Bye - Law No. 8:Every district society shall hold shares of the face value of atleast 1/20th of its borrowings. Thisrestriction shall not apply to supplies on credit to district societies. Every district society shall onallotment pay an entrance fees of Rupee one per share allotted to it subject to maximum of Rs.100/-as entrance fee. No District Society shall, take more than Rs.5000/- in face value.The value of share, or shares allotted shall be paid in one lumpsum.Bye-Law No. 9:It shall be open to the Government to take shares in the Corporation subject to such terms andconditions as may be laid down by Government from time to time. No entrance fee is payable onsuch shares.13

Bye-Law No. 10:Every allotee of shares shall be entitled to receive grants in respect of the share or shares, acertificate or certificates signed by the Managing Director and countersigned by one other Director.If any such share certificate is lost a duplicate certificate may be issued on payment of Rs.2/- percertificate provided that such evidence as the committee may deem reasonable is adduced regardingthe loss of such certificate. If any certificate be worn out or damaged, the Managing Director mayorder the same to be cancelled and issue a duplicate certificate in lieu thereof payment of Rs.2/- percertificate and on surrending the certificate so worn out or damage.By - Law No. 11:a). No member shall be permitted to transfer any share or interest held by it unless.1. The society has held such shares for not less than one cooperative year.2. The society has cleared its dues to the Corporation.3. The transferee is a society which has been accepted by the committee of the Corporation foradmission to membership; and4. Until the name of the transferee has been entered in the shares transfer register;Note : Every endorsement upon the certificate of any share for transfer shall be signed by theManaging Director.b).No member shall at any time be permitted to withdraw any share or shares held by it. Thewithdrawal of shares held by the Government shall however be on such terms and conditions asmay be laid down by them from time to time which shall be binding on the Corporation. Should amember cease to be eligible for membership, the Corporation shall remove its name from the list ofthe members and arrange to pay back within reasonable period of such member the share capitalpaid by it together with dividend declared if any after deducting any sums due from it to theCorporation.Bye - Law No. 12:The membership of a Society in the Corporation shall cease on;1. The transfer of all the shares held by the member Society;2. The cancellation of its registration;Bye - Law No. 13:A past member shall be liable as provided in bye law No.4 for the debts due by the Corporation asthey existed on the date when it ceased to be a member for a period of 2 years from such date.Bye-law No. 14:FUNDS:The Corporation shall ordinarily raise funds in the following manner from all or any of thefollowing sources:1. Share capital;2. Entrance fees and other fees;3. Deposits from members;14

4. Loans from the Life Insurance Corporation Cooperative Financing Agencies, CommercialBank, State and Central Government, Zilla Parishad and Panchayat Samithis;5. From other financing agencies with the prior approval of the Registrar of Co-operativeSocieties;6. Grants / subsidies from the State and Central Governments;7. Grants / subsidies from any other Institution / Agencies with the prior approval of theRegistrar of Co-operative Societies;8. By floatation of debenture / bonds with the prior approval of the Registrar of Co-operativeSocieties;Bye-Law No 15:DEPOSITS:The Corporation may accept deposits from members on such terms and conditions as theCommittee may decide from time to time.Bye-Law No 16:BORROWINGS:The total borrowings of the Corporation by way of loans or by way of deposits shall not extend inaggregate 20 times the paid up share capital and reserve fund or such enhanced limit as may bepermitted by the Registrar from time to time.Bye-Law No 17:MANAGEMENT:Subject to such resolution as the General Body may from time to time pass, the ExecutiveManagement of the Corporation shall vest in the Board of Directors. The Committee shall consistof 15 persons of whom 5 shall be elected by the General Body from among the delegates ofaffiliated societies and the rest shall be the nominees of Government as specified below :1. Secretary, Employment and Social Welfare Chairman2. Deputy Secretary, Finance Member3. Joint Secretary or Deputy Secretary,Panchayat Raj Dept. Member4. Director of Social Welfare Member5. Director of Industries and Commerce Member6. Director of Agriculture Member To be7. Director of Animal Husbandry Member nominated8. Registrar of Cooperative Societies byor his nominee Member Government9. Managing Director, Agro Industries Corp. Member10. Managing Director Member15

Bye-law No. 18:COMMITTEE:The members of the Committee except those nominated by the Government shall be elected by theGeneral Body in accordance with the provisions with the provisions of the Andhra Pradesh CooperativeSocieties Act 1964 and the A.P. Co-op. Societies Rules 1964. The term of the membersof the Committee shall be for a period of 3 years. For the period of Office of the members of theCommittee, the year shall commence from the date of assumption of charge by the Chairman. Allthe members of the Committee shall vacate their office on the expiry of the term unless the periodis extended by the Registrar of Co-operative Societies under Section 31(2)(b) of the AndhraPradesh Co-operative Societies Act 7 of 1964. Any interim vacancy or vacancies of the electedmembers shall be filled by co-option by the remaining members of the committee at a meeting. Themembers of the Committee coopted in any interim vacancy shall also vacate their office on theexpiry of the term of office of the committee. The proceedings of the Committee shall not beinvalidate on account of any vacancy or vacancies on the Committee may which remain unfilled.Any member of the Committee may at any time resign from his office by sending a letter ofresignation to the Managing Director of the Corporation but such resignation shall take effect onlyfrom the date on which it is accepted by the Committee."Notwithstanding any thing contained in bye-law No.16th, 17th and 18th first set of committeeincluding the Chairman shall be nominated by the Government. They shall hold office for a periodof 3 years. The Government shall also have power to extend the nomination of the Directors fromtime to time for a further period of 3 years. The Government shall have power to cancel thenomination of any of the members of the Committee including the Chairman and nominate anyother person in his place without assigning any reasons. Any interim vacancy that may arise amongnominated members shall also be filled by the Government for the rest of the period."Bye-law No. 19:MANAGING DIREC<strong>TO</strong>R:The Board of Management shall appoint an official nominated by the Government as the ManagingDirector of the Corporation.Bye - law No. 20:MEETINGS OF THE COMMITTEE:The Committee shall meet as often as necessary for the conduct of the business of the Corporation.Such meetings shall be convened by the Managing Director giving 7 days notice of the Meeting.The quorum for the meeting of the Committee shall be 6. All questions before the Committee shallbe decided by majority of votes. In the case of equality of votes, the chairman or any other memberof the Committee presiding at the meeting in the absence of the Chairman shall exercise a castingvote. No member of the Committee shall be present at any meeting of the Committee when anymatter in which he is personally interested is being discussed. The Managing Director of theCorporation shall also within a period of 15 days from the date of receipt of requisition for ameeting of the Managing Committee from at-least five members of the Committee or from theRegistrar shall convene a meeting stating of the Managing Committee stating the subjects to beconsidered thereat.Notices for meeting shall be sent either by local delivery or by post under certificate of posting.16

The notice of the meetings shall be deemed sufficient and proper if sent to his address given by themembers, if being their duty to keep the Corporation informed of any change in their address.Any subject of an urgent and important nature not included in the agenda except the amendments tobye-laws may with leave of the house, be taken up for discussion. When leave is refused the subjectso brought up shall be deemed to be a subject for discussion at the next meeting.Bye - law No. 21:DISQUALIFICATION OF DELEGATE OF SOCIETY:No member of an affiliated Society which is in default to the Corporation or to any other societyfor a period exceeding 3 months or who is a defaulter to the Corporation or to another Society for asimilar period shall cease to be a Director in the Corporation or vote at the meeting of the GeneralBody on behalf of the affiliated Society.A member of an affiliated society who has been appointed to represent the Society in theCorporation and vote shall cease to hold his appointment as such if he is in default to the Society orany other Society for a period exceeding 3 months or if he becomes a defaulter to the society or anyother society for a like period.Bye-law No. 22:No delegate of an affiliated society shall be eligible for being chosen as, and for being a member ofthe Committee if:1. Is in default to the Society which the represents or to any other society for a periodexceeding three months or is a delegate of the society which is defunct or is in default to theCorporation or any other society for a period exceeding three months.2. Acquires any interest in any subsisting contract made with a work being done / forCorporation except as otherwise prescribed in the Rules.3. Is of unsound mind and stands so declared by a competent court, a deaf mute or a leper;4. Is appearing as a paid legal counsel on behalf of the Corporation or if he is appearingagainst the Corporation.5. Ceases to be a member of the Society which he represents.6. Has held office as a Director of two apex two Central or one and one central Society.7. Has held office as a director of the Corporation for two consecutive terms :8. His delegation is withdrawn9. The committee which elected him as a delegate has been superseded;10. The affairs of the affiliated society of which he is the delegate or wound up;11. He resignsBye - law No. 23:Any delegate of a member society sitting on the Board of Directors of the Corporation shall vacatethe seat if;1. His delegation is withdrawn by the society he is representing;2. The committee of the society which elected him as a delegate is superseded;3. The society of which is he a delegate or defunct or commits default for over 3 months to theCorporation.4. The affairs of the society of which he is the delegate or wound up; or5. He resigns;17

Bye - law No. 24:POWERS OF THE BOARD OF DIREC<strong>TO</strong>RS:1. To pay the preliminary expenses incurred in the promotion and registration of theCorporation;2. To appoint, suspend, remove or dismiss or other wise deal with the employees of theCorporation whose pay exceed Rs.1000/-3. To raise funds for the purpose of the Corporation in the form of loans and determine theterms on which they should be raised;4. To admit members;5. To establish and maintain provident fund or other benefit funds for the employees as laiddown in the bye-laws;6. To determine from time to time who shall be entitled to sign on behalf of the Corporationbills notes receipts, acceptances, endorsements, cheques, release contracts and documentsand to give the necessary authorities for purpose and in the absence of the ManagingDirector;7. To institute, conduct, defend, compound or abandon any legal proceedings by or against theCorporation or its officers;8. To frame subsidiary regulations for the conduct of business of the Corporation which willcome into effect after the approval of the Registrar;9. To grant loans and advances to members;10. To sanction or approve investment of funds of the Corporation;11. To authorise the Managing Director or any other paid employee of the Corporation tooperate on the Bank accounts.12. To scrutinise and put-up the annual budget to the General Body;13. To Prescribe or regulate from time to time the strength of office and field state and theirscales, salaries, allowances and other conditions of services and to incur such expenditure asmay be necessary for the management of the business of the Corporation subject to budgetallotment;14. To incur such expenditure as may be necessary for the management of the Corporation withreference to the scale and within the budget allotment sanctioned by the General body foreach year.15. To present to the General Body the annual report and the statement of accounts;16. To arrange for the efficient supervision of affiliated societies;17. To appoint or take on loan services of officers of the Government for carrying out thebusiness of the corporation.18. To create a cadres of key personnel, train them and allot to the affiliated societies;19. To sanction extension of the period for loans which become due for payment;20. To convene meetings of the General body21. To convene special meetings of the General body of the affiliated societies and to addressthem;22. To call for a list of defaulting borrowers in the affiliated societies and to direct the societiesconcerned to take action for recovery of amounts due from such members;23. To sanction advances and loans to employees for purposes specified in the Bylaws;24. To transact all other business incidential to the administration of the Corporation and25. To arrange to maintain such accounts and registers as are prescribed under the Act., Rulesand Bylaws.18

Bylaws No. 25 :Subject to such resolutions as the committee may form time to time pass the several officers of thecorporation shall have following powers.POWERS OF THE CHAIRMAN:He shall have General control over all the affairs of the Society :1. He shall preside over the meeting of the Managing Committee and the General body.2. The Chairman shall control and conduct meetings.3. He shall approve the minutes / proceedings and ensure that the resolutions are properlyimplemented.4. He shall be appointing and disciplinary authority of Employees in the pay range of Rs.500-1000. An appeal against his orders shall lie to the Board of Management.5. He shall incur expenditure upto Rs.1000/- of an emergent nature under contigencial.6. He shall be competent to incur expenditure relating to the business of the society subject tobudget provision upto Rs.25,000/-.7. He shall power to appoint legal advisors fix their remuneration.POWERS OF THE MANAGING DIREC<strong>TO</strong>R :1. The Managing Director, shall have the following powers besides such other powers as maybe entrusted to him from time to time by the Managing Committee.2. He shall be the Officer to sue or to be sued on behalf of the society and all bonds,agreements and contracts made by the Corporation shall be in his name.3. He shall be responsible for the general conduct, supervision and management of the day today business affairs and administration of the Corporation.4. He shall receive or arrange for receipt of all moneys, cheques, bank drafts and securities andmake or arrange to make all payments on behalf of the society and shall arrange for propermaintenance and custody of cash balance and other properties of the Corporation.5. He shall endorse and transfer promissory notes, Government and other securities andendorse sign negotiate or get enclosed signed and negotiated cheques and other negotiableinstruments on behalf of the Corporation. He shall also operate or arrange operative on theaccounts of the Society with any Bank subject to limits specified by the ManagingCommittee.6. He shall appoint members of the staff within the sanctioned scale of establishment upto andinclusive of posts of the grade pay in scales upto Rs.500/- subject to the procedure laiddown by the Managing Committee and qualifications and security prescribed by theRegistrar.7. He shall award penalties including dismissal from service of employees, he is competent toappointment subject to the condition that an appeal against his orders shall lie to theChairman.8. He shall determine from time to time the powers duties and responsibilities of variousemployees working in the corporation and held them responsible there for, but shallexercise effective supervision over them.9. He shall incur expenditure upto Rs.500/- of an emergent nature under contingencies in theinterest of the Corporation.10. He shall be competent to incur expenditure relating to the business of the Corporationsubject to budget provision upto Rs.10,000/-.11. He shall convene the meetings of the Managing Committee and General Body inconsultation with the Chairman.19

12. He shall prepare annual budget and programme or forecast of business and place it beforethe Board of Directors and General Body for approval.13. He shall place audit reports, statutory inspection notes and statutory enquiry reports beforethe next General Body Meeting of the Corporation after the date of their receipt and takenecessary further action.Bye-law No.26 :POWER <strong>TO</strong> MAKE SUBSIDIARY RULES :It shall be competent for the Committee of the Corporation to frame subsidiary regulations for theconduct of the business of the Corporation consistent with the Act, Rules and bye laws. Suchsubsidiary regulations shall be entered in the minute book of the Corporation and reported to theRegistrar for approval. They shall take effect only after their approval by the Registrar.Bye - law No.27 :The services of members of the Committee shall be gratitutions. The members of the Committeeshall be eligible for such T.A. and D.A. and may be decided by the Committee with the approval ofthe Registrar.Provided, however, they shall not be eligible for any other allowances from any CooperativeInstitution for journeys made for the meetings of such institution on or about the same date of themeeting of the Committee.The persons claiming T.A. and D.A. for journeys made should invariably furnish a certificatestating that he has not claimed or drawn T.A. and D.A. for the same journey from any otherinstitution.Bye - law No. 28 :The method of recruitment, condition of Service authority competent to recruit to the posts to fixthe scales of pay and allowances of the paid officers or employees of Corporation and theprocedure to be followed in the disposal of the disciplinary cases against them shall be governed bythe special bye-laws framed by the Board got approved by the General Body and registered by theRegistrar.Bye - law No. 29 :Subject to the provisions of the Act, the rules and bye - laws, the ultimate authority of theCorporation shall vest in the General Body. The General Body shall not however, interfere with thepowers of the committee or the Managing Director in respect of matters delegated to it by the Act,the Rules and the Bye - laws. The following matters shall be dealt with by the General Body.1. Election and removal of the elected members of the Committee;2. Annual report to the Registrar;3. Consideration of the audit report and the annual report;4. Disposal of the net profits;5. Amendment to bye-laws;6. Expulsion of a member;7. Approval of the annual budget of income and expenditure;8. Affiliation of the Corporation to the financing Bank or other federal societies and9. Election of delegates to the financing bank or federal society.20

Bye - law No 30:GENERAL MEETING :1. The Committee may at any time call a General Meeting of the Corporation but suchmeeting shall be called for and the held at least once in a Co-operative year.2. The General Meeting shall consist of the delegates of all the affiliated district societies andnominees of Government specified in bye-law 17. Any affiliated District society maywithdraw its delegate at any time and send another in his place. A delegate who ceases to bemember of the Society which he represent shall cease to represent it.3. The resolution of the District Society appointing a delegate shall be in writing and in suchform as may be prescribed by the Committee and shall be deposited at the registered officeof the Corporation before the time fixed for holding a meeting at which the delegate namedin the resolution proposed to vote except as other - wise provided in the Rules.4. A general meeting may be called at any time by the Committee and it shall be called withina period of 30 days from the date of receipt of a requisition from two thirds of the totalnumber of affiliated District Societies or at the instance of the Registrar or any personauthorised by him.5. A notice of the meeting of the General Body shall be issued specifying time, place and dateof the meetings at least 15 clear days in advance. Such notice shall be sent by any one of thefollowing modes namely.o by local delivery oro by post under certificate of posting6. The quorum for the General Meeting shall be 5 or 1/3rd of the total number of members onrolls whichever is less.7. The Chairman or in his absence one of the members elected for the purpose shall preside atthe General meeting are provided that in a General Meeting convened for the purpose ofelection of the members of the Committee, the election officer shall preside over themeeting and conduct proceedings.8. All questions before the General Body shall be decided by a majority of votes. In case ofequality of votes the Chairman of the meeting except the election officer or the Registrar ora person authorised by him under section - 32 (5) of the Act shall have a casting vote.Bye - law No. 31 :LOANS :1. Loans and cash credits shall be given only to District Societies. Provided that loans andcash credits on the security of fixed deposits may be sanctioned to nominal members.2. Loans and cash credits to members shall be sanctioned by the Managing Committee.3. The Managing Committee shall frame regulations to be approved by the registrar governingthe purpose, the security, the period, the rate of ineterest and such other terms andconditions in respect of the loans and cash credits that may be sanctioned by theCorporation.4. The Managing Committee shall also frame regulations to be approved by the Registrar,Governing the terms and conditions on which it may grant conversions of short term loansinto medium term loans or extension to the period of repayment of loans due to theCorporation from its members.5. Every District Society which sells the products of its members viz., Agriculture, Dairying,Poultry keeping, piggery, sheep-rearing, cottage Industry, etc., shall be bound to sell itthrough the Corporation or an agency specified by the Managing Committee of theCorporation and agree to have the loans or installments of loans due to the Corporationadjusted out of the sale proceeds to the extent specified by the Committee.21

6. Should the board of Director be of the opinion that a loan or cash credit granted by theCorporation has been misapplied it shall at once cancel it and take steps to recover it withinterest without waiting for the expiry of the period for which it is granted.7. The Managing Director shall arrange for verification of the security for the loans andadvances as often as necessary and in any case at least once in a year.Bye - law No.32 :<strong>AP</strong>PROPRIATION OF PAYMENT FROM MEMBERS :When a member from whom money is due, pays any sum, it shall be appropriated in the followingorder : Firstly to fees, fines, postal registration and other miscellaneous charges due by themembers, secondly to interest and Thridly to principal.Bye - law No.33 :BUSINESS :1. The Corporation shall carry on such business as may from time to time be decided upon bythe Committee, within the frame work of the objectives of the Corporation.2. The Committee shall frame suitable regulations with the approval of the Registrar for themarketing of agricultural produce, products of Dairy, Poultry, Piggery, sheep-rearing orcottage or small scale Industry of the District Societies.3. The Committee may arrange to get the produce pooled, graded and processed wherevernecessary in order to arrange for sale on more advantageous terms and conditions .Bye-law No.34 :SUPPLY OF AGRICULTURAL AND DOMESTIC REQUIREMENTS :The Committee shall frame suitable regulations with the approval of the Registrar for the conductof its business as principal or as an agent in the supply of agricultural or domestic requirements orthe requirements of cottage or small scale industry of its District societies.Bye - law No. 35:PROCESSING UNITS :It shall be competent to the Committee to own or hire processing plants and transport vehicles liketrucks, tractors etc. The Committee shall frame suitable regulations with the approval of theRegistrar in this regard.Bye - law No. 36 :The net profits of the Corporation as declared by the Chief Auditor or any person authorised by himin this behalf and after the issue of the audit certificate, may be disposed as follows :1. 25% of the net profits shall be carried to the reserve fund.2. 10% of the net profit shall be carried to the audit funds if the Corporation does not meet thecost of audit or if it does not have its accounts audited at its own expenses.3. 2% of the net profits subject to a maximum of Rs.25,000/- shall be credited to the Cooperativeeducation fund to be administered by the Andhra Pradesh State Co-operativeUnion Ltd., subject to the provision of the Rules 36(2)© of the A.P. Co-operative SocietiesRules 1964.4. Out of the remainder, a sum not exceeding 15% of the xxxxx net profit should be carried to(a) bad debt reserve and (b) for unforseen losses.22

The balance of the net profits may be utilised for all or any of the following purposes.1. Payment of dividend to affiliated District Societies on their share capital at a rate notexceeding (6 1/4 % per annum ).2. Bonus to the members of the establishment of the corporation as per the provisions in theBonus Act.3. A sum not exceeding ten percent of net profits shall be carried to the building fund.4. A sum not exceeding 7 1/2% of the net profits shall be carried to the common Good Fund.5. The balance if any and profits not allotted in the above manner shall be carried to theReserve Fund.All un-disbursable and indivisible profits shall be added to the Reserve Fund.Bye- Law No. 37 :1. The Reserve Fund shall belong to the Corporation as a whole and is intended to meetunforeseen losses. It shall be indivisible and no member shall have any claim to a share init.2. The Reserve Fund shall be invested, deposited or applied in the manner prescribed in Rule-37 and 38 of the Rules.Bye- Law No. 38:LOSSES <strong>TO</strong> BE WRITTEN OFF:Should any sum or property belonging to the Corporation or any loan due to the Corporation beeither stolen or otherwise lost, or found irrecoverable, it shall be open to the General Body to writeoff such amount or the value of property after obtaining the sanction of the Registrar.Bye- Law No. 39:ANNUAL STATEMENTS :The Corporation shall prepare annually in such form as may be prescribed by the Registrar.a) A Statement showing receipts and disbursements.1. A Profit and loss account.2. A balance sheet and3. Such other statements as may be prescribed by the registrar from time to time.These statements shall be made upto 30th June of every year and copy of each shall be sent to theRegistrar with in 15 days from the close of the Co-Operative year ending 30th June.Bye- Law No. 40:MINUTE BOOK :The proceedings of the General Body/Committee shall be recorded in the minute book of theCorporation kept by the Managing Director and singed by the Chairman of the meeting concernedat the close of the proceedings.Bye- Law No. 41CO-OPERATION <strong>TO</strong> KEEP COPY OF <strong>ACT</strong>., RULES AND BYLAWS:The Corporation shall keep a copy of the Act., the Rules and its Bylaws, the last audited annul23

alance sheet, the profit and loss account and list of the member of the Committee, open toinspection by its members free of charge at all reasonable times at its registered office.Bye-Law No.42:USE OF PREMISES:The Corporation shall not use, or allow to be use any premises or portion thereof which is intendedfor its business for any purpose other than such business or other activity relating to thecorporation.Bye-Law No.43:CASH :All cash balance of the Corporation shall be deposited in the nearest bank approved by theRegistrar. Payments shall as far as possible be made only by cheques. But where payments have tobe made by cash on certain items, the required amount of cash may be drawn from the Bank andpaid within 2 days from the date of receipt of cash. If for any reason payment is not made wihtin 2days, the amount standing undisbursed should be remitted into the Bank. A sum not exceeding Rs.500/- may be retained under imprest cash, to meet petty expenditure.The custody and preservation of cash shall be governed by the subsidiary regulations framed by theCorporation and approved by the Registrar.Bye- Law No. 44:LIMITATION :Any amount due by the Corporation and not claimed within the period of Limitation allowed by theIndian Limitation Act shall be added to the Reserve Fund of the Corporation.Bye- Law No. 45:MISCELLANEOUS :1. No amendment to, alteration in, or cancellation of bye-law, not the enactment of a new byelawshall be made except at a General Meeting of the members, nor shall it be deemed tohave been passed unless a majority of the members present vote for it, nor shall it takeeffect until it has been approved and registered by the Registrar. Provided, however if in theRegistrar's opinion an amendment of the bylaw of the Corporation is considered necessaryor desirable in the interest of the Corporation he may in the manner prescribed in the Rulesto issue direction to consider such amendment to the bye laws and register it. Suchamendment shall have the same effect as an amendment of any bylaw made by theCorporation.2. An amendment to the bylaws of the Corporation for which prior notice has been given tothe members indicating a reasonably clear idea of the nature of the amendment / proposed,shall be considered by its general body at a meeting and carried by a majority of themembers present and voting at such meeting. The amendment so carried out shall be sent tothe Registrar for registration with in 30 days from the date of the meeting.Sd/-REGISTRAR OF COOPERATIVE SOCIETIES.// True Copy //.24

Sl.No.1.A P S C COOP. FINANCE CORPORATION LTD.Right to <strong>Information</strong> ActChapter - 6Documents[Section 4(1) (b) (vi)]DocumentCategoryEach paper received in the department will be categorized intofiles such as service matters, budget, sanction and releases of 1. Service mattersfunds etc.The Service Registers will be opened for each employee soon 2. Public Importanceafter he joined duty and the Registers will be maintained till theemployee retires from service and the important events pertaining 3. Court Casesto the employee such as Earned Leaves and Half Pay leave andother type of leaves availed by the employee will be recorded, and 4. Otheralso the entries such as Promotions reversions, transfers, miscellaneouspunishments etc.Each sanction order released for various schemes will be Separate stock filesmaintained in separate stock filesare maintained.The List of documents that are maintained are as follows:1. Service Register2. Pay Bill Register3. Sanction orders (at District level only)4. Advance Register5. Cash Book6. Advance Register7. Attendance Register8. Late Attendance Register9. C.L. Register10. Turn Duty Register11. Log Books12. Inward and Outward Register13. Local Tappal Register14. Stamp Account Register15. Telephone Register16. Stock Registers17. Stock Files18. Vouchers19. Rule of Reservation Roaster28

A P S C COOP. FINANCE CORPORATION LTD.Right to <strong>Information</strong> ActChapter - 7Consultation[Section 4(1) (b) vii]At Head Office level, the Visitors can see the VC & Managing Director in all working daysbetween 3.00 P.M to 4.00 P.M and other officers such as General Manager (A), GeneralManager (D & F) and Executive Officers between 10.30 A.M to 5.00 P.M in all workingdays.At District level the visiting public can see the Executive Director on every Monday forreddressal of grievances, clarifications etc. Further citizens Charter is applicable toA.P.S.C. Finance Corporation and the redressal mechanism is putup on the Notice Boardof the office29

A P S C COOP. FINANCE CORPORATION LTD.Right to <strong>Information</strong> ActChapter - 8Boards and Committees[Section 4(1) (b) viii]1. Managing Committee of the Corporation:A provision has been made to constitute a Managing Committee for the management ofthe affairs of the Andhra Pradesh Scheduled Castes Cooperative Finance CorporationLimited, Hyderabad under the Cooperative Act 1964.In exercise of the powers conferred by Section-123 of the Andhra Pradesh CooperativeSocieties Act 1964 (Act-7 of 1964), the Government exempted the A.P.S.C.C.F.C Limited,Hyderabad, from the operation provision of Clause (a) of the Sub-Section 7 of Section -32of the said Act and appointed the Committee of Persons - in-charge with the followingGovernment Officials vide G.O. Ms. No.84, Social Welfare (SCP.II.1) Department dated27.7.2009. (copy appended)S.No Name Designation1Sri V. Nagi Reddy, IAS.,Principal Secretary to Government, SocialChairmanWelfare Deptt. , Secretariat, A.P., Hyderabad2Vice Chairman & Managing Director,A.P.S.C.C.F.C Ltd., Hyderabad.Person - Convener3 Commissioner of Social Welfare Person4Commissioner of Cooperative & Registrar ofCooperative Societies, A.P. Hyderabad.Person5Director, National Commission for S.C & ST.,Govt., of India,Person6Joint Secretary to Govt., of India, Ministry ofSocial Justice and Empowerment, New Delhi.Person7Chairman & Managing Director, N.S.F.D.C orhis nominee, New DelhiPerson8Principal Secretary to Govt., or his nominee,Finance DepartmentPerson9Deputy Secretary/Joint Secretary/Addl.Secretary, Social Welfare Deptt., ( Dealing with Person<strong>AP</strong>SCCFC Ltd., Hyderabad10 Director of Ground water, A.P, Hyderabad Person11Chairman & Managing Director, <strong>AP</strong> TRANSCO,HYDERABADPerson12Vice Chairman & Managing Director,A.P.S.I.D.C, Hyderabad.Person13 Commissioner of Agriculture, A.P, Hyderabad Person14 Commissioner of Horticulture, A.P, Hyderabad. Person15Vice- Chairman & Managing Director, LIDC<strong>AP</strong>,Hyderabad.Person16Chairman & Managing Director, NSKFDC, NewDelhiPerson30

Sl.No1A P S C COOP. FINANCE CORPORATION LTD.Right to <strong>Information</strong> ActChapter - 9Directory of Officers and Employees[Section 4(1) (b) ix]Name of the Officer /Designation Ph No Email AddressEmployeeDr. N. Nageswara Rao,IAS2 Sri J. Chennakesavulu3 Smt. D. Uma Devi4 Dr. B. Rangaiah5 Sri A. Nageswar Rao6 Sri B. Ranganath7 Sri B.V. Ramana,8 Sri T. Charandas9 Sri B. Ashok Babu10 Sri B. Anand KumarVice Chairman &Managing DirectorGeneral Manager(Development &Finance)General Manager(Administration)Executive Officer(Legal)Executive Officer(Admin)Executive Officer(Accounts)Executive Officer(NSFDC/NSKFDC)Executive Officer(Planning)Executive Officer,Vig.Executive Officer,Computers2331597098497920932332074780088451233211419908495556md_apsccfc@ap.gov.inDr. DamodaramSanjeevaiahSamkshemaBhavan, 5th Floor,Masab Tank, Hyd-do- - do --do- - do -9866939998 NIL - do -9866634094 NIL - do -9866634092 NIL - do -9866575232 NIL - do -98666340921 NIL - do -9652222725 NIL -do-9866634095 NIL -do-11 Smt.M.Blandeenamma. Superintendent - do - NIL - do -12 Smt.P.Uma Maheswari Superintendent - do - NIL - do -13 Smt.J.M.Sandya Devi Superintendent - do - NIL - do -14 Sri P.V. Ramesh Superintendent - do - NIL - do -15 Smt. K.Thulasi Devi Superintendent - do - NIL - do -16 Sri K. Shankaraiah Superintendent - do - NIL - do -17 Sri.K.R. Naresh Superintendent - do - NIL - do -18 Sri R. Rama Murthy L.D.STENO. - do - NIL - do -19 Sri.K,.Yadagiri. SA - do - NIL - do -20 Sri.A.Joseph SA - do - NIL - do -21 Smt.M.Lakshmi SA - do - NIL - do -22 Sri G.S.R.C. Murthy, SA - do - NIL - do -23 Kum.T.Sujnanamma. SA - do - NIL - do -24 Sri.N.Manga Rao SA - do - NIL - do -25 Sri A. Rushingamaiah SA - do - NIL - do -26 Sri T.A. Venkateswarlu SA - do - NIL - do -27 Smt. T. Nagamani JA - do - NIL - do -28 Sri J.N.Ajai Rao JA - do - NIL - do -29 Sri T.Eswar Senior Driver - do - NIL - do -30 Sri M.Anjaiah Driver - do - NIL - do -31 Sri G.Rangaiah Driver - do - NIL - do -32 Sri D.Prakash Driver - do - NIL - do -33 Sri M.Satyanarayana Driver - do - NIL - do -34 Sri P.Govinda Rajulu Driver - do - NIL - do -31

35 Sri N.Manya Driver - do - NIL - do -36 Smt. M. Kamalabai Record Asst. - do - NIL - do -37 Sri S.Narasinga Rao Xerox Operator - do - NIL - do -38 Sri M.Sathaiah Jamedar - do - NIL - do -39 Sri T.Venkateswarlu Attender - do - NIL - do -40 Smt.S,Laxmi Attender - do - NIL - do -41 Sri B.Srihari Attender - do - NIL - do -42 Smt.Gousia Begam Attender - do - NIL - do -43 Sri.B.Appanna Night Watchman - do - NIL - do -44 Sri K. Rajappa Attender - do - NIL - do -45 Sri J. Dayanand Attender - do - NIL - do -32

A P S C COOP. FINANCE CORPORATION LTD.Right to <strong>Information</strong> ActChapter - 10Monthly Remuneration paid to the employees.[Section 4(1) (b) x]<strong>AP</strong>SC FINANCE CORPORATION LTD.Right to <strong>Information</strong> ActChapter 11Budget Allocated to Each Agency including Plans etc.[Section 4(1) (b) xi]Budget Estimates for the year 2009-10Sl. Name of the Officer /MonthlyDesignationNo. EmployeeremunerationCompensation1 Dr. N. Nageswara Rao, IAS V.C. & M.D 91486.002 Sri J. Chenna Kesavulu G M(D&F) 46948.003 Smt. D. Uma Devi G M((Admin) 48087.004 Sri B. Ashok Kumar E.O./Vig. 34451.005 Sri B. Ranganath E.O./ A/Cs 31819.006 Sri A. Nageswara Rao E.O/Admn., 48718.007 Sri. B.V. Ramana E.O/NSFDC 35494.008 Sri T. Charan Das E.O., Plg. 31077.009 Sri B. Anand Kumar E.O., Computers 28819.0010 Sri B.Rangaiah A.D (AH) E.O 44229.0011 Smt.M.Bladeenamma Supdt. 28744.0012 Smt.P.Uma Maheswari Supdt. 29556.0013 Smt.J.M.Sandya Devi Supdt. 27806.0014 Sri. P.V. Ramesh Supdt. 26108.0015 Smt. K.Thulasi Devi Supdt. 28006.0016 Sri K.R. Naresh Supdt. 26108.0017 Sri.K. Shankaraiah Supdt. 26018.0018 Sri R. Rama Murthy L.D.STENO. 21208.0019 Sri.K,.Yadagiri. SA 24009.0020 Sri.A.Joseph SA 21560.0021 Smt.M.Lakshmi SA 33415.0022 Sri G.S.R.C. Murthy, SA 26018.0023 Kum.T.Sujnanamma. SA 23211.0024 Sri.N.Manga Rao SA 17811.0025 Sri A. Rushingamaiah SA 28126.0026 Sri T.A. Venkateswarlu SA 22918.0027 Smt. T. Nagamani JA 15095.0028 Sri J.N.Ajai Rao JA 20252.0029 Sri T.Eswar Senior Driver 30520.0030 Sri M.Anjaiah Driver 28306.0031 Sri G.Rangaiah Driver 23736.0032 Sri D.Prakash Driver 23686.0033 Sri M.Satyanarayana Driver 18156.0034 Sri P.Govinda Rajulu Driver 18236.0035 Sri N.Manya Driver 16579.0036 Smt. M. Kamalabai Record Asst. 13048.0037 Sri S.Narasinga Rao Xerox Operator 19813.00Underregulations33

38 Sri M.Sathaiah Jamedar 20257.0039 Sri T.Venkateswarlu Attender 18836.0040 Smt.S,Laxmi Attender 18536.0041 Sri B.Srihari Attender 16702.0042 Smt.Gousia Begam Attender 13937.0043 Sri.B.Appanna Night Watchman 16841.0044 Sri K. Rajappa Attender 16841.0045 Sri J. Dayanand Attender 18404.0034

A P S C COOP. FINANCE CORPORATION LTD.Right to <strong>Information</strong> ActChapter 12Manner of Execution of subsidy Programmes[Section 4(1) (b) xii]The Corporation plans, promotes and undertakes the schemes likeAgriculture Development, Horticulture, Animal Husbandry, Small ScaleIndustry, Village Industry, Business, Service etc, which enables thescheduled castes to earn a better living and help them improve theirstandard of living. The Action plans by are implemented through the Districtsocieties. The District Societies will identify the beneficiaries and groundingthe schemes as per the guide lines issued by the Corporation. The schemesimplemented by the District Societies are monitored by the Corporation. Abrief description about important schemes implemented by the Corporationis given belowa. ObjectivesThe Corporation has been established with the following mainobjectives:i. To provide financial assistance for creation of income generatingassets.ii.iii.iv.To offer training programmes for Skill up-gradation leading toSelf/Wage employmentTo empower Women Self-help Groups for taking up economicsupport activity.To plug critical gaps of finance in economic support schemes.b. The Corporation and affiliated District SocietiesThe Head Office of the Corporation formulates policy, in terms ofpreparation of annual Action Plans, monitors implementation of Schemesby way of conducting review meetings and Securing progress reports onmonthly basis. The Corporation mobilizes resources from Government ofIndia, State Government and other financial institutions and in turnreleases to District Societies for implementation of schemes. The DistrictSocieties also mobilize District Level Resources in terms of SGSY subsidy,subsidy from DRDAs, SCSP from line departments, loans from Banksand 5% of 15% earmarked funds from the local bodies, besides35

monitoring Scheduled Caste Sub Plan allocations and expenditure. TheVice Chairman and Managing Director, manages the affairs of theCorporation, under the guidance of the Committee of Persons (COP). TheVC & Managing Director is assisted by General Managers, subjectspecialists (Special Officers) and other supporting staff.The District Societies function under the guidance of a committeeunder the chairmanship of the District Collector (MC/PIC). The day-todayaffairs are managed by the Executive Director assisted by subjectspecialists and other subordinate staff in implementation of the Schemes.c. General profileThe State of Andhra Pradesh has 1,23,39,496 SC population (2001census) which forms nearly 16.2% of the total population. Among the 23Districts, Nellore has the highest SC population (22%) when compared toDistrict Population followed by Prakasam (21.29%), West Godavari(19.17%), Chittoor (18.75%), Karimnagar (18.62%), Adilabad (18.54%) andGuntur (18.32%). Out of 59 sub-castes, Madigas and Malas are the twoprominent Sub-Castes among Scheduled Castes in Andhra Pradesh. Theliteracy rate among the Scheduled Castes is 31.58% as against the overallliteracy rate of 44.1% in Andhra Pradesh.A vast majority of the SC families earn their livelihoods fromagriculture – mostly as agricultural labourers, and some from farmingoperations. Allied occupations i.e Dairy, Piggery, Sheep & Goat rearing,Poultry etc., also provide livelihood to a substantial number of ScheduledCastes. Many landless Scheduled Castes have migrated to urban andsemi-urban areas finding jobs as construction labourers and in the tertiarysector. As per the agricultural census, there are 115.32 lakh holderscovering 359.98 lakh acres in the State against which, 13.67 lakh SCfarmers hold 28.33 lakh acres. The percentage of land holdings held by theSC farmers is 11.85%, while the extent held by them is a meager 7.87% ofthe total extent.2. PERFORMANCE OF THE CORPORATIONDuring the last 35 years of its existence, the Corporation hasprovided assistance of Rs 3614.60 crores for the benefit of 46,10,639 SCsin the State. The year wise physical and financial performance from1974-75 to 2008-09 is given at Annexure - I. While the per capitainvestment during 1974-75 was only Rs 730/-, it has increasedgradually to Rs 18,000/- in recent years. It is expected to reach up to Rs50,000/- in the current Action Plan. The coverage provided during36

1974-75 was Rs 25.64 lakh and 3495 beneficiaries in terms of financialand physical achievements. This has increased multi-fold during thepast 35 years.a. Brief details about performance of a few important schemes aregiven below :i) Land Purchase SchemeThe Corporation started the Land Purchase Scheme in the year 1982-83 with the objective of providing a valuable and durable asset, sothat there is upliftment of not only the Economic Status but also theSocial Status of the beneficiaries. From 1982-83 till 2007-08, an extentof 70,140.51 acres of land has been purchased and allotted to 51211beneficiaries at a cost of Rs 185.57 crores. From 01.04.08 the schemeis implemented with Rs 30,000/- subsidy and balance as Bank Loanwith a unit cost of Rs 1.00 lakh.ii)Schemes financed by National Scheduled Castes FinanceDevelopment Corporation (NSFDC)The Corporation has started taking loan from NSFDC from the year1991-92 mainly to provide loan portion in the schemes, wherebankers were not coming forward to finance the same. An amountof Rs 299.08 crores has been provided by NSFDC from 1991-92 till2007-08 benefiting 3,07,881 beneficiaries under various schemes. Inview of Loan Waiver and new inclusion policy, the Corporation didnot avail any loan from 01.04.2007 onwards.iii) Schemes financed by National Safai Karamchari FinanceDevelopment Corporation (NSKFDC)The Corporation has started taking loan from NSKFDC from theyear 1997-98 mainly to provide loan portion in the schemes wherebankers were not coming forward to finance the same. An amountof Rs 80.72 crores has been provided by NSKFDC from 1997-98 till2007-08 benefiting 47,767 beneficiaries under various schemes. Inview of loan waiver and new inclusion policy, the Corporation didnot avail any loan from 01.04.07iv)Micro CreditThe success of Self-Help Groups formed by DRDAs has prompted theCorporation to strengthen such groups of SC women and a scheme ofMicro credit is being implemented from the year 2000-2001 with37

assistance from NSFDC. Under the scheme, a loan of Rs. 40.34crores was disbursed to 48,015 members of women Self Help Groupsupto 2007-08. During 2006-07, to improve group dynamics Rs.1.00lakh is provided to performing groups under Mahila Samrudhi Yojanaas loan. From 01.04.2008, Bank linkage is arranged for performingScheduled Caste SHGs for earning out, than group dynamics forEconomic Development.b. Monitoring & Evaluation of SchemesThe Corporation has developed software for monitoring progress ofimplementation of Schemes on regular basis. The Corporationscrutinizes the data related to Sanction and Grounding status withreference to funds received and mobilized by the District Societiesalong with recovery of loans, the staff cost and other relatedexpenditure. Similarly, the Corporation conducts review meetings withthe Executive Directors at frequent intervals on progress of Action Planand guidelines to be followed for implementation of the schemes.Annually the Corporation conducts “impact studies” by engagingcertain neutral agencies on schemes implemented by the DistrictSocieties to assess the performance of the assets and also the incomegenerated out of the assets provided to the beneficiaries.The Corporation takes up concurrent evaluation in addition to theproduct evaluation of certain important schemes.The Corporation has also taken up verification of assets during 2006-07,2007-08 and 2008-09 and the lapses noticed were communicated to theCollectors and Executive Directors for rectification. The Corporationhas also taken up Office inspections and random verification ofAccounts of all the District Societies during 2007-08. The lapses anddefects noticed were communicated to the Collectors and the ExecutiveDirectors for rectification.3. NEW INCLUSION POLICY FROM 2008-09The Hon’ble Chief Minister made a Statement on the floor of Assemblyon 17-03-2008 that all Welfare Corporations shall not be LendingAgencies and shall act only as Facilitators.In pursuance of the statement made by the Hon’ble Chief Minister,Government have modified the role of the Welfare Corporations asfacilitators providing Rs 30,000/- or 50% of the scheme cost as subsidyand the remaining cost of the scheme as institutional finance for38

eligible beneficiaries to ground Economic Support Schemes from01.04.2008.4. LOAN WAIVERThe 47 th COP on 23-01-2008 resolved to request the Government forwaiver of outstanding interest on Margin Money loans as One TimeSettlement and the proposal was submitted to the Government. Whenthe waiver of interest on Margin Money loans extended by <strong>AP</strong>SCCFCwas under consideration, during “Praja Patham” meeting of theHon’ble Chief Minister in Warangal District during September, 2006, aproposal was mooted for waiver of outstanding loans. In a series ofreview meetings later, the issue was discussed at length and with aview to give relief to the loanees of the weaker section Corporationbeneficiaries, the loans issued upto 29-02-2008 not exceeding Rs.1.00lakh per each loanee was proposed for waiver.The Hon’ble Chief Minister of Andhra Pradesh made a Statement onthe floor of Assembly for waiver of Rs.1690.60 crores of loans withinterest, of less than Rs.1.00 lakhs per each loanee, for 43,84,682beneficiaries on the floor of the <strong>AP</strong>LA on 17-03-2008. The loansoutstanding details are as follows:(Rs.in Crores)Sl.NoCorporationNo. ofBeneficiariesMMLoansOutstandingLoansfromNationalOutstandingTotalAmountOutstanding1 SC Corporation 17,80,842 692.20 484.62 1176.822 TRICOR 13,36,379 99.53 45.47 145.003 BC Corporation 10,28,974 224.17 68.57 292.744MinoritiesCorporation1,96,174 125.83 49.36 175.195 Women 33,715 24.75 -- 24.756 Disabled 8,598 2.74 3.22 5.96Total 43,84,682 1169.22 651.24 1820.4639

In the Hon’ble Chief Minister’s review meeting on 13-05-2008, it wasdecided to request the Committee of Persons of respective WelfareCorporations to make necessary resolutions for Waiver of loans upto Rs.1.00lakh per beneficiary, issued upto 29-02-2008 duly examining the competencyand legal implications.The following is the status of loans extended by <strong>AP</strong>SCCFC sinceinception upto 29-02-2008:Margin Money(Rs in crores)No.of benf. Principle Interest Total14,25,194 465.51 226.69 692.20NSFDC Loan(Rs in crores)No.of benf. Principle Interest Total307881 289.52 84.58 374.11NSKFDC Loan(Rs in crores)No.of benf. Principle Interest Total47767 80.72 29.79 110.52Grand Total(Rs in crores)No.of benf. Principle Interest Total17,80,842 835.76 341.06 1176.823,331 loanees have availed loans of more than Rs.1.00 lakh totalingRs.85.32 crores. It is proposed to extend waiver of Principle andInterest upto Rs.1.00 lakh even for these beneficiaries, if repayment ofbalance Principle and Interest is made as One Time Settlement within 640

months of issue of orders on loan waiver.guidelines for implementation of loan waivers.The following are thei. BACKGROUND :Extending monitory relief to the weaker section borrowers, who haveobtained loans from the Welfare Corporations is engaging the attentionof the Government for quite some time. The Hon’ble Chief Minister ofAndhra Pradesh had made a statement on the Floor of the A.P.Legislative Assembly on 17.3.2008, announced the waiver of loansextended by the Welfare Corporations as a measure of relief to theweaker sections belonging to SC, ST, BC, Minorities, Women andDisabled, who are finding it difficult to repay the small amounts ofloans extended by the Welfare Corporations. It is estimated that theloan waiver scheme would benefit 43,84,682 borrowers and the totalamount proposed for waiver is Rs.1690.60 crores.ii. ELIGIBILITY :All the Margin Money loans and loans extended by the weaker sectionCorporations by borrowing the funds from the National ApexOrganizations, not exceeding Rs.1.00 lakh per borrower and remainedas outstanding which includes principle and interest in the books ofaccounts of the Welfare Corporations are covered in the waiverscheme. The loans extended by the Commercial Banks, CooperativeBanks, <strong>AP</strong>SFC and specialized financial institutions are not covered inthe waiver scheme and such portion of the loans shall continue to bepaid to the respective institutions. The cases of fraud and malfeasanceshall not be covered in this scheme. Waiver Scheme shall not beapplicable to the cases which are covered under Court Cases andlitigations in various statutory Bodies.iii. CUT OFF DATE :All the loans, which were extended prior to 29.2.2008 remained as duesare covered by waiver scheme. In respect of the Corporations wherethe quantum of Margin Money loans proposed to be waived is morethan the equity base of the Corporations, such Corporations shall berestructured in a suitable manner, so that these bodies will continue to41

serve the respective categories of the weaker sections in future also.The respective Departments shall examine the financial status of eachCorporation and come up with proposals for additional equity supportwherever necessary. Where share capital of the Corporationscontributed by Government of India or other agencies, the concurrenceof such agencies shall also be obtained and inturn proposals shall alsobe submitted to the Government after placing the matter to therespective Board of Directors.iv. OPERATIONAL PLAN :a) Each Corporation with the assistance of its District Societies shallprepare a comprehensive list of borrowers to whom the waiver schemeis proposed to be extended and shall place before the respective Boardof Directors and after scrutiny of the proposals shall submit theproposals to the respective controlling Departments in Secretariat andobtain orders for waiver within one month from the date of issue oforders of waiver.b) The list of borrowers covered by the waiver scheme shall bemade available in public domain by publishing the same in respectiveDepartmental Websites as well as in District Society offices.c) The Welfare Corporations shall also inform to all the individualborrower in writing about the quantum of loan which includes theoutstanding principle and interest amounts and the scheme to whichthe loan is sanctioned that are waived by the Government in the formof a letter.d) The loans extended by the Welfare Corporations by borrowingthe funds from the National Apex Corporations viz., NSFDC,NSKFDC, NSTFDC, NBCFDC, NMDFC, NHFDC, etc., shall also becovered under the waiver scheme subject to maximum of Rs.1.00 lakhper borrower. The loan installments payable to the respectiveCorporations shall be paid by the Government as and when theseinstallments fall due.e) Additional funds required for payment of outstanding dues forthe year 2007-08 and 2008-09 to the National Apex Corporations, therespective Departments shall submit supplementary budget proposalsfor release of additional grants to meet the outstanding loan amountspayable to the National Apex Corporations.42

f) Government may also consider availing fresh loans directly fromNational Apex Corporations on lesser rate of interest on Governmentblock guarantee and pass it on to the respective Welfare Corporationsfor utilizing the same as Subsidy. Government will also providenecessary budget for effecting repayment of these loans obtained.As per the Bye-Law No.38 of <strong>AP</strong>SCCFC, the General Body of theCorporation is competent to write off loans which are not recoverablewith the permission of the Registrar of Cooperative Societies.Accordingly the General body of <strong>AP</strong> SC Finance Corporation andDistrict Societies have resolved for waiver of loans upto Rs 1.00 lakh(including principle and interest) as they are considered practicallyirrecoverable.v. Implementation of Loan Waiver Scheme:The District SC Societies have prepared the list of beneficiaries, whowere covered under loan waiver scheme as per the guidelines issuedand published the same duly indicating the principle and interestamount waived. In case of loanees whose dues are more than Rs.1.00lakh, notices were issued to the loanees for availing loan waiverbenefit, if the balance dues over and above Rs.1.00 lakh are paid withinsix months as one time settlement.All the District Societies have completed the distribution of loan waiverletters of the Chief Minister and issued notices to loanees of more thanone lakh for payment of dues over and above Rs One Lakh to avail loanwaiver. However necessary entries in to books of accounts are yet to bemade and a final report is yet to be received. Executive Directors mustsubmit their final reports in this regard before 31 st July’ 2009.5. EXTENSION OF PAVALAVADDI SCHEME:In order to lessen the burden of interest on loan provided by financialinstitutions and to encourage financial institutions to lend to ScheduledCaste beneficiaries for establishing units under Economic SupportProgramme, PAVALAVADDI scheme is extended to the beneficiariesof <strong>AP</strong> SC Finance Corporation from 1-04-2008.43

a. Salient features of the scheme:• Interest Subsidy on interest of more than 3% paid to the lending agencies(Institutional Finance) shall be released to the beneficiary on timely andprompt repayment of installments.• The participating Bank Manager has to inform the prompt repaymentsmade by the beneficiaries every six months to the District SC Society, whoin turn will obtain the interest subsidy from the Head Office and pass it onto the beneficiary in the form of a cheque.• Care must be taken and the Bank Managers properly advised to submitthe eligible repayments for interest subsidy to District SC Society on time.b. Operational Guidelines:• The Executive Director is requested to give wide publicity on Pavalavaddischeme to all the loanees sponsored by the District SC Society• Tie up must be made with the Bank Managers for getting eligible list ofbeneficiaries who have repaid the loan installments on time with theamount of interest paid• The Executive Directors are to work out the interest subsidy payable,beneficiary wise and submit consolidated requirement of interest subsidyrequired for the District every six months to the Head Office.• The Executive Director must also take necessary steps for promptrepayment of interest subsidy to the beneficiaries to promote regular andeffective repayment of loans taken.44

A P S C COOP. FINANCE CORPORATION LTD.Right to <strong>Information</strong> ActScheme-wise Targets 2009-10Sl.No.IIIName of the SchemeBank Linked Schemesa.Self-emloyment schemeUnitCostNo. of Benf.No. ofUnits M F PHTotal(M+F)Extent inacres(Rs.in lakhs)TotalOutlayi. SES (Small Enterprises) 0.500 1150 767 383 35 1150 0.00 575.00ii. SES (Medium Enterprises) 1.000 1150 767 383 35 1150 0.00 1150.00iii. SES (Major Enterprises) 5.000 110 73 37 3 110 0.00 550.00iv. Petty Business (DRI Loan) 0.100 2300 1534 766 69 2300 0.00 230.00v. Bore wells to own lands(Patta Lands)0.581 1000 1334 666 60 2000 5000.00 581.00vi. Submersible Pumpsets toDrilled sources of patta lands(Including Service Connection0.380 2300 3068 1532 138 4600 11500.00 874.00and Development charges)vii.. Assistance to S H G 1.000 6000 0 90000 2700 90000 0.00 6000.00viii. Assistance to SafaiKaramcharies1.000 2000 1334 666 60 2000 0.00 2000.00ix. Assistance to Flayers &Tanners0.200 2300 1534 766 69 2300 0.00 460.00x. Asstance to Cobblers 0.400 2300 1534 766 69 2300 0.00 920.00xi. Subsidy to Power Tillers 1.500 220 147 73 7 220 0.00 330.00b)Land Purchase Scheme 1.000 2500 0 2500 75 2500 2500.00 2500.00c) Animal HusbandrySchemesDairy Unit (Two Animals) 0.700 4600 3068 1532 138 4600 0.00 3220.00SES Total 27930 15161 100069 3457 115230 19000.00 19390.00OTHER SCHEMESa) Placement OrientedTraining Programmes0.100 6000 4002 1998 180 6000 0.00 600.00b) InfrastructureDevelopment10.000 23 0 0 0 0 0.00 230.00c) Beneficiary AwarenessProgramme1.000 23 0 0 0 0 0.00 23.00d) Interest Subsidy forprompt repayment at 9% of 0.040 20000 13340 6660 600 20000 0.00 800.00the total coste) Irrigation Schemesi) Bore Wells (as perWALTA Norms - Assigned 0.581 1000 1334 666 60 2000 5000.00 581.00Lands)ii) Submersible Pumpsets toBore wells Drilled under 0.330 600 800 400 36 1200 3000.00 198.00SCSP (Drilled by G.W. Dept)iii) Service ConnectionCharges (Development 0.060 6000 8004 3996 360 12000 0.00 360.00Charges)Irrigation Total 7600 10138 5061.6 456 15200 8000.00 1139.0045