Frequent Ticketing Errors - Air Canada

Frequent Ticketing Errors - Air Canada

Frequent Ticketing Errors - Air Canada

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Frequent</strong> <strong>Ticketing</strong> <strong>Errors</strong>This document is an outline of frequent errors that cause travel agencies to receive debit memos.It is not meant to replace your normal resources for fares, ticketing rules and regulations.The references for taxes, surcharges, fees and CICs contained in this document are subject tochanges updates, additions and/or deletions at any time.It is the travel agent’s responsibility to ensure that the most current CIC, contract rules, ticketinginstructions, or web information is used and applied at time of ticketing.For further information or clarification of items contained herein, or for correct ticketingtransactions please contact <strong>Air</strong> <strong>Canada</strong> or the GDS.Prepared by Linda Haberstock<strong>Air</strong> <strong>Canada</strong> Sales Audit DepartmentWinnipegRevised May 2011Subject to change without prior notice. Revised May 2, 2011.

List of CICsThe information provided in this document and in the CICs is subject to changes. It is the travel agent’sresponsibility to ensure that all rules and regulations are verified and applied at time of ticketing.SubjectGST Application (XG) Goods & ServicesQST Application (XQ) Quebec Sales TaxHST Application (RC) Harmonized Sales TaxGST Exemption for Government Entity, andGST for AboriginalsContinuous JourneyConnecting Flights (Schedule, Charter, Cruise)PlatingCorporate Contract FaresReduced Rate Travel (AD75 / AD50)Escapes ProgramBereavement travel (Bereave)Back to Back <strong>Ticketing</strong>/Throwaway TicketsCRS Bookings and <strong>Ticketing</strong> ProceduresChangesQ - Navcan, Insurance and YQ Fuel SurchargesAIF (SQ) <strong>Air</strong>port Improvement FeesATSC (CA) <strong>Air</strong> Travellers Security ChargeTaxes on Charges and FeesInfantsChildren and Infant DiscountsAttendant Travel ProceduresCIC ReferenceCIC*162/31CIC*162/7CIC*162/5CIC*162/33CIC*162/50CIC*26/13CIC*160/35CIC*170/19CIC*170/8CIC*160/33CIC*26/19CIC*170/49CIC*160/29Verify general ruleCIC*162/10CIC*162/25CIC*162/162CIC*26/2CIC*160/116CIC*57/15CICs are accessed through the GDS. Contact your GDS if you are unable to access.Subject to change without prior notice. Revised May 2, 2011. 2

CIC*162/33 - GST ExemptionFor Government issued tickets:Revenue <strong>Canada</strong> advised that some Provincial and Territorial Governments are granted GST relief at point ofpurchase. Provincial/Territorial Government employees purchasing airline tickets must provide the issuingoffice/agency with a statement of certification. As the statement of certification may vary by province/ territory, thefollowing wording, as developed by Revenue <strong>Canada</strong>, must be included:“This is to certify that the property, and or services ordered, purchased hereby, are for the use of, and are beingpurchased by, (Name of Provincial / Territorial Government Department or Institution) with Crown funds, and aretherefore not subject to the Goods and Services Tax.”The above exemption applies only when the government body is billed directly by the issuing office/agency.If the provincial government employee purchases a ticket with his/her own funds, even if travelling on governmentbusiness, he/she is not relieved from the GST. These types of purchases include purchases by employees, whichare reimbursed through petty cash, and, purchases which are made with a credit card issued in the name of theemployee. Once the GST certificate is presented to the agency and GST exemption is established, the ticket mustbe cross- referenced correctly. The certificate must be retained on file by the agency for 7 years to support each‘GST Exempt’ ticket issued.The travel agent must maintain meticulous records (copies of exemption certificates) that would serve as evidenceof the exemption. If evidence cannot be documented or retained at the time of the sale, then the applicable taxesmust be collected.The ticket must indicate the name of the government body, and COF to indicate the certificate is kept on file bythe agency. Example: Social Services COFA service fee of $25 CA/US (plus applicable taxes) will be assessed for missing or an incorrect cross-reference where a taxexemption may apply.NOTE:The Federal Government and Provincial Government Entities for Quebec can also be exempted from paying theQST provided that the above requirements are met. Refer to CIC*162/7The Federal Government and Provincial Government Entities for Nova Scotia, New Brunswick and Newfoundlandare not exempt from paying the HST. Refer to CIC*162/5For aboriginal issued tickets:Natives, native bands and native band-empowered entities are required to pay the GST on the purchases of airtransportation. However, the band or band-empowered entity may file a General Rebate application for the GSTpaid, as per “GST Technical Information Bulletin B-039 ADMINISTRATIVE POLICY ON APPLICATION OF GSTTO INDIANS“.Subject to change without prior notice. Revised May 2, 2011. 3

Example: GST exemption for Government issued ticketsAIR CANADAENDORSEMENTS/RESTRICTIONSSOCIAL SERVICES COFPASSENGER NAMESMITH/R MRConjunctive TicketsDATE OF ISSUE01 JUL 09ORIGIN/DESTINATIONYWG/YWGBOOKING REFERENCEABCDEFISSUED IN EXCHANGE FOR9617728980TRAVEL AGENCY’S NAMETRAVEL AGENCY’ADDRESSTRAVEL AGENCY’S IATA #O/XFROMWINNIPEGTOTORONTOTOWINNIPEGTOCARRIERACFLIGHT190CLASSYDATE01 JUL 09TIME6:00STATUSFARE BASIS / TICKET DESIGNATORYIOKAC 175 Y 06 JUL 09 19:35 OK Y1NOT VALIDBEFORENOT VALIDAFTERALLOWTOFARECAD 2024.00EQUIV. FARE PAIDCA 9.90FARE CALCULATIONYWG AC YYZ Q3.00 Q15.00 994.00 Y1 AC YWG Q 3.00 Q 15.00 994.00 Y1 CAD 1024 SQ 20.00 YWG + 25.00 YYZTAXSQ 45.00TAXFORM OF PAYMENTAX 373534345561009APPROVALTOUR CODETOTAL FARECAD 2078.90CPN AIRLINE CODE FORM SERIALNUMBER 014 9617728980 6DO NOT MARK OR WRITE IN THE WHITE AREA ABOVECKISS014CK/COMMISSION0TAXCOMMRATEA service fee of $ 25 CA/US (plus applicable taxes) will be assessed for missing or incorrect cross-reference where anexemption may apply.Note: AIFs (SQ) are subject to the GST, QST and HST as applicable to each airport of departure irrespective ofthe type of journey or point of sale. AIFs must be shown and collected on the ticket to which the AIFs apply.ATSC (CA) for tickets sold in <strong>Canada</strong> for domestic travel:• $4.67 per emplanement where GST does apply to the ticket, with a max of $9.34• $4.95 per emplanement where GST does not apply to the ticket, with a max of $9.90Taxes and FeesQ Navcan, InsuranceYQ Fuel SurchargesSQ <strong>Air</strong>port Improvement FeesCA <strong>Air</strong> Travellers Security ChargeTaxes on Charges and FeesVerify general ruleCIC*162/10CIC*162/25CIC*162/162For complete list of applicable taxes and fees, use the applicable GDS transaction followed by the country code:Example: FTAX-CA FQNTAX/CA or FTAX-US FQNTAX/USSubject to change without prior notice. Revised May 2, 2011. 4

CIC*162/50 - Continuous Journey for Canadian tax purposesGST (XG) Canadian Goods and Services: for application CIC*162/31QST (XQ) Quebec Sales Tax: for application CIC*162/7HST (RC) Harmonized Sales Tax: for application CIC*162/5ATSC (CA) Canadian <strong>Air</strong> Travellers Security Fee: for application CIC*162/25AIF (SQ) Canadian <strong>Air</strong>port Improvement Fee: for application CIC*162/10Some exemptions may apply:When two or more tickets are issued for different portions of a single continuous journey, the ticket may be GST, QST,HST, AIF or ATSC exempt if issued in connection with an international ticket as long as the conditions and restrictionsregarding stopovers and/or connections are met.• Domestic or transborder connection is within 4 hours. Over 4 hours is considered a stop.• International connection is within 24 hours. Over 24 hours is considered a stop.GST, QST, HST, AIFExempt if connecting within 24 hours to international ticket or journey. The exemption allows one stop in either directioninbound or inbound. If stop in both directions outbound and inbound the tax is not exempt. For tax exemption, the domesticticket must be cross referenced in the endorsement box with Carrier, Flight Number Date, Origin and Destination of theconnecting Flights (see below).AIFsSubject to GST, QST, and HST as applicable to each airport of departure irrespective of type of journey or point of sale.ATSCExempt if the domestic ticket is connecting within 24 hours to an international ticket or journey. There are no stops allowedin either direction inbound or outbound for ATSC exemption. If a stop exists in either inbound or outbound direction, thenATSC will apply (unlike the GST, QST, HST, AIF which does allow a stop in either direction). For ATSC exemption, thedomestic ticket must be cross referenced in the endorsement box with the Carrier, Flight Number, Date, Origin andDestination of both the outbound and inbound connecting flights. The endorsement box of all connecting ticket(s) must becross-referenced showing the following information:Scheduled Flights• Carrier, flight number, date and (O&D) of connecting scheduled flights (require both inbound & outboundconnections when ATSC exempt)• <strong>Air</strong> <strong>Canada</strong> 014 connecting ticket number ( if space permitted in endorsement box)• Example: AC 856 28MAR YYZ/LHR or 014 3721621112• Note: OAL ticket number is NOT an acceptable cross-reference without the connecting carrier flight number,date, origin and destination of the connecting flights.Charter Flights• Endorse “Conx to Charter”• Carrier, flight number date and O&D of connecting flights (require both inbound & outbound when ATSCexempt)• <strong>Air</strong> <strong>Canada</strong> 014 connecting ticket number (if space permitted in endorsement box)• Example: AC993 28MAR YYZ/PVR or 014 3721 621112Connection with a CruiseEndorse “Conx to Cruise,” port of sail, sail date and length of cruise (i.e. 7 days – 7D). Example: Conx to Cruise name MIA28/11/09 7DTickets issued in conjunction with International travel must connect at one point, either outbound or inbound in order for thetrip to be considered continuous journey for tax exemptions as outlined in CIC*162/50.Subject to change without prior notice. Revised May 2, 2011. 5

If the travel agent does not issue all tickets making the “continuous journey”, the travel agent must maintain, for 7 years,records on file (copies of all documents, which would serve as evidence that the journey was “continuous” and that allconditions were satisfied regarding stopover restrictions.) If evidence cannot be documented, or retained at time of sale,then the applicable taxes MUST be collected.Example: Continuous Journey Tax Exemption, connecting to a scheduled flightAIR CANADAENDORSEMENTS/RESTRICTIONSAC 856 28 JUL YYZ/LHRAC 857 06 AUG LHR/YYZPASSENGER NAMESMITH/R MRO/XFROMWINNIPEGTOTORONTOTOWINNIPEGTOFARE CAD 2024.00TAX SQ 28.00TAXXG 1.40CARRIERACFLIGHT190CLASSYConjunctive TicketsDATE OF ISSUE15 JUL 09DATE28 JUL 09TIME6:00ORIGIN/DESTINATIONYWG/YWGBOOKING REFERENCEABCDEFISSUED IN EXCHANGE FORSTATUFARE BASIS / TICKET DESIGNATORY1OKAC 175 Y 6 AUG 09 19:35 OK Y19617728980TRAVEL AGENCY’S NAMETRAVEL AGENCY’ADDRESSTRAVEL AGENCY’S IATA #NOT VALIDBEFORENOT VALIDAFTERFARE CALCULATIONYWG AC YYZ Q3.00 Q15.00 994.00 Y1 AC YYZ Q3.00 Q15.00 994.00 Y1 CAD 2024.00 SQ 20.00 YWG + 8.00 YYZ *FORM OF PAYMENTAX 373534345561009APPROVALTOUR CODEALLOWTOTAL FARECAD 2053.40CPN AIRLINE CODE FORM SERIALNUMBER 014 9617728980 6DO NOT MARK OR WRITE IN THE WHITE AREA ABOVECKISS014CK028.00TAXCOMMRATENo stopover in YYZ -- therefore:• The CA does NOT apply on the domestic ticket, the $17.00 CA applies to and on international ticket• *The YYZ SQ is only $8.00 CA for connecting passengersSubject to change without prior notice. Revised May 2, 2011. 6

Example: Continuous Journey Tax Exemption, connecting to charterAIR CANADAENDORSEMENTS/RESTRICTIONSAC 993 28 JUL YYZ/PVRAC 990 06 AUG PVR/YYZPASSENGER NAMESMITH/R MRConjunctive TicketsDATE OF ISSUE15 JUL 09ORIGIN/DESTINATIONYWG/YWGBOOKING REFERENCEABCDEFISSUED IN EXCHANGE FOR9617728980TRAVEL AGENCY’S NAMETRAVEL AGENCY’ADDRESSTRAVEL AGENCY’S IATA #O/XFROMWINNIPEGTOTORONTOTOWINNIPEGTOCARRIERACFLIGHT190CLASSYAC 175 Y28 JUL0916 AUG09TIME6:0019:35STATUSOKOKFARE BASIS / TICKET DESIGNATORY1Y1NOT VALIDBEFORENOT VALIDAFTERALLOWFARECAD 2024.00EQUIV. FARE PAIDCA * 9.90FARE CALCULATION22YWG AC YYZ Q3.00 Q12.00 99400 Y1 AC YYZ Q3.00 Q15.00 994.00 Y1 CAD 2024.00 SQ 20.00 YWG + 25.00 YYZTAXSQ 45.00TAXXG 2.25FORM OF PAYMENTAX 373534345561009APPROVALTOUR CODETOTAL FARECAD 2099.15CPN AIRLINE CODE FORM 014 9617728980 6SERIALNUMBERCKISS014CK/COMMISSION0TAXCOMMRATEDO NOT MARK OR WRITE IN THE WHITE AREA ABOVE• 1 stopover in YYZ -- therefore: for CA tax purposes, because a stopover exists where the two tickets intersect (Aug 6 th inYYZ), each ticket must be taxed separately. The AIF must be shown and collected on ticket to which the AIF applies.• $4.95 CA applies per emplanement on the domestic ticket, to a max of $9.90.• $17.00 CA also applies on the international ticket for the CA Intl rate.• $20.00 for YYZ SQ and 20.00 for YUL SQ + taxNote: The GST exemption allows for 1 stopover either inbound or outbound, when connecting to international ticket. No stopovers are allowed forCA exemption, if stopover the CA applies on both the domestic and international tickets.AIFs (SQ) are subject to GST, QST and HST as applicable to each airport departure irrespective of the type of journey or point of sale. A service feeof $25.00 CA/US (plus applicable taxes) will be assessed for missing or an incorrect cross-reference where a tax exemption may apply.Subject to change without prior notice. Revised May 2, 2011. 7

Example: Continuous Journey Tax Exemption, connecting to cruiseConjunctive TicketsAIR CANADAENDORSEMENTS/RESTRICTIONSCNX TO RCCL MIA 28 JUL 09 7DPASSENGER NAMESMITH/R MRDATE OF ISSUE15 JUL 09ORIGIN/DESTINATIONYYZ/YYZBOOKING REFERENCEABCDEFISSUED IN EXCHANGE FOR9617728980TRAVEL AGENCY’S NAMETRAVEL AGENCY’ADDRESSTRAVEL AGENCY’S IATA #O/XFROMTORONTOTOMIAMITOTORONTOTOCARRIERACFLIGHT910CLASSYDATE28 JUL 09TIME06:00STATUSFARE BASIS / TICKET DESIGNATORY1OKAC 919 Y 06 AUG 09 19:35 OK Y1NOT VALIDBEFORENOT VALIDAFTERALLOWFARECAD 1871.00FARE CALCULATIONYYZ AC MIA Q 7.50 928.00 Y1 AC YYZ Q7.50 928.00 YI CAD 1871.00 SQ 25..00 YYZ XT- XY 8.07 XF 5.19 AY 2.88EQUIV. FARE PAIDCA 8.42SQ 25.00XG 1.25TAXUS 35.04TAXXT 17.40FORM OF PAYMENTAX 373534345561009APPROVALTOUR CODETOTAL FARECAD 1958.11CPN AIRLINE CODE FORM SERIALNUMBER 014 9617728980 6DO NOT MARK OR WRITE IN THE WHITE AREA ABOVECKISS014CK/COMMISSION0TAXCOMM RATEThe <strong>Air</strong> Travellers Security Charge (ATSC-CA) is NOT exempt when connecting to a cruise, as this is not connecting with <strong>Air</strong>transportation. The above example is considered a ‘Transborder’ itinerary.ATSC for Domestic travel sold in <strong>Canada</strong>:• $ 4.67 per emplanement where GST does apply to the ticket, with a max of $ 9.34• $ 4.95 per emplanement where GST does not apply to the ticket, with a max of $9.90ATSC for Transborder travel sold in <strong>Canada</strong>:• $ 7.94 per emplanement where GST does apply to the ticket, with a max of $15.89• $ 8.42 per emplanement where GST does not apply to the ticket, with a max of $16.84ATSC for International travel sold in <strong>Canada</strong>:• $17.00 for International travelATSC for Transborder travel sold outside <strong>Canada</strong>:• $7.94 per emplanement where GST does apply to the ticket, with a max of $15.89• $8.42 per emplanement where GST does not apply to the ticket, with a max of $16.84ATSC for International travel sold outside <strong>Canada</strong>:• $17.00 per international travelAIFs are subject to GST, QST and HST as applicable to each airport of departure irrespective of type of journey or point of sale.Taxes and FeesQ Navcan, Insurance & YQ Fuel Surcharges Verify general ruleSQ <strong>Air</strong>port Improvement FeesCIC*162/10CA <strong>Air</strong> Travellers Security Charge CIC*162/25AY US Security Fee CIC*162/6Taxes on Charges and FeesCIC*162/162For complete list of applicable taxes and fees, use the applicable CRS transaction followed by the country code:Example: FTAX-CA FQNTAX/CA or FTAX-US FQNTAX/USA service fee of $25.00 CA/US (plus applicable taxes) will be assessed for a missing or an incorrect cross-reference where a taxexemption may apply.Subject to change without prior notice. Revised May 2, 2011. 8

CIC*26/13 - Use of <strong>Air</strong> <strong>Canada</strong> PlateThe commission structure of the plating carrier applies.When travel is issued on another carrier but in conjunction with <strong>Air</strong> <strong>Canada</strong> where 2 separate tickets are required, the <strong>Air</strong><strong>Canada</strong> ticket number, and/or the AC flight number, date, origin and destination MUST be cross-referenced in theendorsement box to avoid a service charge.($50.00 CA/US service charge will be assessed for the missing / incorrect cross reference of the conjunctive <strong>Air</strong><strong>Canada</strong> travel.)When travel is issued on another carrier and <strong>Air</strong> <strong>Canada</strong> is not part of the itinerary, the <strong>Air</strong> <strong>Canada</strong> plate may be usedwithout a service fee only if the other carrier is listed in the “exceptions” under CIC*26/13 for <strong>Ticketing</strong> and Plating Policy andExceptions, and provided a valid published fare is used.Therefore before using the AC 014 plate, ensure the other carrier is listed under the “exceptions” under the CIC. If the OALcarrier is not listed, a debit memo will be issued for a service fee of $50.00 plus GST, QST or HST.The <strong>Air</strong> <strong>Canada</strong> Plate MAY NOT BE USED when ticketing other carriers’:• Contracted fares• Agreements / Contracts• Private fares• Published fares that specify in the sales restriction that the ticketing must be on the OAL Plate<strong>Air</strong> <strong>Canada</strong> does not maintain other carriers’ agreements, contracts or private fares and will issue Debit Memos for undercollectedfares and / or over-claimed commissions. Agencies will be required to pay the <strong>Air</strong> <strong>Canada</strong> Debit Memos and settledirectly with the other carrier.No other exceptions will be authorized by <strong>Air</strong> <strong>Canada</strong>.Note: <strong>Ticketing</strong> and Plating CIC*26/13 and Interline agreement CIC*26/8 are separate documents.Subject to change without prior notice. Revised May 2, 2011. 9

Example: Cross-reference for plating when in conjunction with <strong>Air</strong> <strong>Canada</strong> travel(issued in CAD)AIR CANADAENDORSEMENTS/RESTRICTIONSAC 369 YYZ MKE 22 JULPASSENGER NAMESMITH/R MRConjunctive TicketsDATE OF ISSUE15 JUL 09ORIGIN/DESTINATIONMKE/MKEBOOKING REFERENCEABCDEFISSUED IN EXCHANGE FOR9617728980TRAVEL AGENCY’S NAMETRAVELAGENCY’ADDRESSTRAVEL AGENCY’S IATA #O/XFROMCARRIERNWFLIGHT107CLASSYDATE22 JUL 09TIME6:00STATUOKFARE BASIS / TICKET DESIGNATORYMILWAUKEETOATLANTA NW 108 Y 31 JUL 09 19:35 OK YTOMILWAUKEETONOT VALIDBEFORENOT VALIDAFTERALLOWTOFAREUSD 1049.30CAD 1210.00TAXUS 90.75TAXFARE CALCULATIONMKE YX ATL 524.65 Y YX MKE 524.65 Y USD 1049.30 EQU CAD 1210.00 XT- AY 5.76 ZP 7.62 XF 8.65= ( MKE 3.00 ATL 4.50USD )TAXXT 22.03CAD 1322.78FORM OF PAYMENTAX 373534345561009CPN AIRLINE CODE FORM SERIALNUMBER 014 9617728980 6DO NOT MARK OR WRITE IN THE WHITE AREA ABOVECKISS014APPROVALCK/TOUR CODECOMMISSION0TAXCOMMRATETaxes and FeesQ Navcan, InsuranceVerify general rule AY US Security Fee CIC*162/6YQ Fuel SurchargesSQ <strong>Air</strong>port Improvement Fees CIC*162/10 Taxes on Charges and Fees CIC*162/162There is no GST for tickets originating in US or Saint-Pierre-et-Miquelon, irrespective of where payment is made.The GST does not apply to international journeys.Domestic segments of an international journey are not GST taxable.For a complete list of applicable taxes and fees, please use the applicable GDS transaction followed by the country code:Example: FTAX-CA FQNTAX/CA or FTAX-US FQNTAX/USSubject to change without prior notice. Revised May 2, 2011. 10

CIC*160/35 - Corporate Contract Fares• Valid contract number MUST appear in the TOUR CODE Box. Example: CC1234• ALL conditions and restrictions of the applicable published fare apply• Fares Basis Code will be followed by a slash and ticket designator “CORP”. Example: JOW/CORP• Tickets must be issued in the applicable booking class of the fare paid• Tickets must be issued in accordance with the terms of the contract• Contracts have expiry datesNote: When ticket issued with corporate contract includes an <strong>Air</strong> <strong>Canada</strong> Authorization, the contract numbermust appear in the tour code box and the Authorization number(s) must be shown in the endorsement box. Failure tocomply with your ticketing instructions will result in a Debit Memo.($50.00 CA/US service charge + tax will be assessed for the missing/ incorrect cross reference of the <strong>Air</strong> <strong>Canada</strong>contract number.)Common errors are:• No contract # in the Tour Code Box Incorrect contract # in the Tour Code Box• Incorrect Fare Basis Code Incorrect contract formats for net faresExample: Corporate Contract ticket with Authorization numberConjunctive TicketsAIR CANADAENDORSEMENTS/RESTRICTIONSV9HBM12345ABPASSENGER NAMESMITH/R MRDATE OF ISSUE15 JUL 09ORIGIN/DESTINATIONYWG/YWGBOOKING REFERENCEABCDEFISSUED IN EXCHANGE FOR9617728980TRAVEL AGENCY’S NAMETRAVEL AGENCY’ADDRESSTRAVEL AGENCY’S IATA #O/XFROMTORONTOTOLONDONTOTORONTOTOCARRIERACFLIGHT190CLASSYDATE28 JUL 09TIME06:00STATUSFARE BASIS / TICKET DESIGNATORY/CORPOKAC 175 Y 16 AUG 09 19:35 OK Y/CORPNOT VALIDBEFORENOT VALIDAFTERALLOWTOFARECAD 3098.00FARE CALCULATIONYYZ AC LHR 1549.00 Y/CORP AC YYZ 1549.00 Y/CORPSQ 25.00 YYZCA 17.00XG 1.25SQ 25.00YQ 38.00GB 47.58UB 26.25TOTAL FARECAD 3253.08FORM OF PAYMENTAX 373534345561009CPN AIRLINE CODE FORM SERIALNUMBER 014 9617728980 6DO NOT MARK OR WRITE IN THE WHITE AREA ABOVECKISS014CK/ 0TOUR CODE CC1234TAXCOMM RATETaxes and FeesQ Navcan, InsuranceVerify general rule AY US Security Fee CIC*162/6YQ Fuel SurchargesSQ <strong>Air</strong>port Improvement Fees CIC*162/10 GB UK Travel Tax CIC*162/14Taxes on Charges and FeesCIC*162/162For a complete list of applicable taxes and fees, please use the applicable GDS transaction followed by the country code:Example: FTAX-CA FQNTAX/CA or FTAX-US FQNTAX/USSubject to change without prior notice. Revised May 2, 2011. 11

CIC*170/19 - Reduced Rate Travel (AD75/50)AD75 Authorization numbers entitle agency personnel to a 75% reduction (and 50% for spouses AD50) on applicable fares,when travelling on <strong>Air</strong> <strong>Canada</strong>, <strong>Air</strong> <strong>Canada</strong> Express ® (Sky Regional <strong>Air</strong>lines Inc., Jazz, Central Mountain <strong>Air</strong>, <strong>Air</strong> Alliance/<strong>Air</strong>Georgian), Lufthansa, and the Austrian <strong>Air</strong>line Group (Austrian, Lauda <strong>Air</strong>, Tyrolean <strong>Air</strong>ways, Rheintaflug).Reservations and issuance of reduced rate tickets are subject to the published rules and conditions for travel as specified foreach fare type, along with all applicable taxes, fees and surcharges.Cancel and rebook are not permitted to secure space outside the required ticketing deadlines.Booking Codes for <strong>Air</strong> <strong>Canada</strong> / <strong>Air</strong> <strong>Canada</strong> Express ®LH / OSoperatedFirst Class N/A O / OExecutive-North America & InternationalEconomy-North AmericaEconomy- InternationalJ fares (book in Z class) - (Z fares excluded)Refer to fare rule to ensure an agent discount is permittedY fares (book in B class) within <strong>Canada</strong> (Z fares excluded)Y and B fares to the USA, Hawaii, Puerto Rico(Z fares excluded)Refer to fare rule to Ensure an agent discount is permittedY and B fares (book in B class) for International(Z fares excluded)Refer to fare rule to Ensure an agent discount is permittedZ / RS / NS / N• J/AD75 travel in AC Executive must be booked and ticketed in Z class, using applicable ‘J’ fare. The ticket cannotbe booked in 'J' class.• The complete 12 digit-alpha numeric <strong>Air</strong> <strong>Canada</strong> AD75 reduced rate authorization number, must be clearlyindicated in the tour code box of both tickets and in the PNR. Example: A91234567001• An AD75 Authorization number can only be used once. It cannot be reused for another trip or file.• AD75 numbers are subject to BLACKOUT periods.• It is the agent’s responsibility to check for blackouts, as they are subject to change without notice.• During Blackout periods, travel is permitted for:• AD75 for standby or AD50• AD50 for confirmed bookings anytime within 21 day of first outbound flight for all segments.• If itinerary has one or more segments within a blackout period, the blackout applies to the entire journey.• When blackouts specify reservations permitted within 72 hours of departure, this applies to each segment of theitinerary.• Confirmed Executive “Z” class travel must be priced with applicable J fare, and can only be booked within 72 hoursof departure of each segment. For segments with departures over 72 hours of booking, book and ticket in "Y" class,and once within the 72 hours of that segment’s departure, segment can be upgraded to “Z” class.• Fare Basis Code must indicate discount. Example: Y/AD75 for the employee and Y/AD50 for spouse• When other Interline Carriers are part of a reduced rate journey, it is the travel agent’s responsibility to contact theother airline directly for full approval in advance of ticket issuance. The OAL authorization number or approvalreference must be cross-referenced in the endorsement box of the AC ticket and the PNR. When discount is takenon OAL portion and no OAL authorization has been indicated, a Debit Memo will be issued for the full value.• Not valid for: Commission, Cash Rewards, <strong>Frequent</strong> Flyer Miles accumulation, Advance seat selection, VATs,Inventory clearance or waitlisting, denied boarding compensation, protection or re-routing on other carriers, travelin Executive Class ® when accompanied by infant, Seniors discount, PTAs, MPD as payment, Codeshare andcharter flights or with other promotions.Subject to change without prior notice. Revised May 2, 2011. 12

Example: AD75 TicketAIR CANADAENDORSEMENTS/RESTRICTIONPASSENGER NAMESMITH/R MRO/XFROMTORONTOTOMONTREALTOTORONTOTOCARRIERACFLIGHTCLASSConjunctive Tickets15 JUL 09ORIGIN/DESTINATIONYYZ/YYZISSUED IN EXCHANGE FORDATETIMESTATUS432 B 22 JUL 09 07:30 OKAC 439 B 30 JUL 09 18:30 OK Y/AD75FARE BASIS / TICKET DESIGNATORY/AD759617728980TRAVEL AGENCY’S NAMETRAVELAGENCY’ADDRESSTRAVEL AGENCY’S IATA #NOT VALIDBEFORENOT VALIDAFTERALLOWFARECAD 239.50EQUIV. FARE PAIDCA 9.34TAXXG 14.69TAXSQ 45.00TAXXQ 1.96FARE CALCULATIONYYZ AC YUL Q3.00 Q15.00 101.75 Y/AD75 AC YYZ AC Q3.00 Q15.00 101.75 YAD75 CAD 239.50FORM OF PAYMENTAX 373534345561009APPROVALSQ 25.00 YYZ + 20.00 YULTOUR CODEA91234567001TOTAL FARECAD 310.49CPN AIRLINE CODE FORM SERIALNUMBER 014 9617728980 6DO NOT MARK OR WRITE IN THE WHITE AREA ABOVECKISS014CK/COMMISSION0.00TAXCOMMRATE0Note: For applicable surcharges, refer to ticketed fare rule.Example: AD75 Ticket during Blackout Period (for standby travel)Conjunctive TicketsAIR CANADAENDORSEMENTS/RESTRICTIONPASSENGER NAMESMITH/R MRDATE OF ISSUE15 JUL 09ORIGIN/DESTINATIONYYZ/YYZBOOKING REFERENCEABCDEFISSUED IN EXCHANGE FOR9617728980TRAVEL AGENCY’S NAMETRAVEL AGENCY’ADDRESSTRAVEL AGENCY’S IATA #O/XFROMTORONTOTOMontrealTOTORONTOTOCARRIERACFLIGHTCLASSDATEOPENOPEN BSAAC OPEN B OPEN SA Y/AD75TIMESTATUSFARE BSIS / TICKET DESIGNATORY/AD75NOT VALIDBEFORENOT VALIDAFTERALLOWFARECAD 239.50CA 9.34TAXXG 14.69TAXSQ 45.00TAXXQ 1.57TOTAL FARECAD 310.10FARE CALCULATIONYYZ AC YUL Q3.00 Q15.00 101.75 Y/AD75 AC YYZFORM OF PAYMENTAX 373534345561009CPN AIRLINE CODE FORM SERIALNUMBER 014 9617728980 6DO NOT MARK OR WRITE IN THE WHITE AREA ABOVEAC Q3..00. Q15.00 101.75 Y/AD75 CAD 219.48 SQ 25.00 YYZ + 20.00 YULCKISS014APPROVALCK/TOUR CODEA91234567001COMMISSION0.00TAXCOMMRATEFor space available tickets: Complete flight, date and time boxes as open. Enter SA in the 'STATUS' box.AIFs (SQ) are subject to GST, QST and HST as applicable to each airport departure irrespective of the type of journey orpoint of sale. The AIF must be shown and collected on ticket to which the AIF applies.Example: XG 14.69 = 5% GST x 239.50 FARE + 9.34 CA + 25.00 YYZ SQ + 20.00 YUL SQXQ 1.57 = 7.5% QST x 20.00 YUL SQ + 1.00 GST (5% GST x 20.00 YUL SQ =1.00 GST)Subject to change without prior notice. Revised May 2, 2011. 13

Example: Executive Class AD75 requires booking in 'Z' classAIR CANADAENDORSEMENTS/RESTRICTIONPASSENGER NAMESMITH/R MRO/XFROMTORONTOTOMIAMITOTORONTOTOCARRIERACFLIGHT791CLASSConjunctive TicketsDATE OF ISSUE15 JUL 09ORIGIN/DESTINATIONYYZ/YYZBOOKING REFERENCEABCDEFISSUED IN EXCHANGE FORDATETIMESTATUSZ 17 JUL 09 6:00OKAC 792 Y 27 AUG 09 19:35 OK J/AD75FARE BASIS / TICKET DESIGNATORJ/AD759617728980TRAVEL AGENCY’S NAMETRAVEL AGENCY’ADDRESSTRAVEL AGENCY’S IATA #NOT VALIDBEFORENOT VALIDAFTERALLOWFARECAD 1022.00CA 7.94TAXXY 8.43TAXXG 52.74SQ 25.00TAXXT 42.41TOTAL FARECAD 1158.52FARE CALCULATIONYYZ AC LAX Q7.50 503.50 J1/AD75AC YYZ Q7.50 503.50 J1/AD75 XT = ( US 33.98 + AY3.01 + XF 5.42) SQ 25.00YYZFORM OF PAYMENTAX 373534345561009CPN AIRLINE CODE FORM SERIALNUMBER 014 9617728980 6DO NOT MARK OR WRITE IN THE WHITE AREA ABOVECKISS014APPROVALCK/TOUR CODEA91234567001COMMISSION0TAXCOMMRATEXG 52.74 = ( 5% GST x 1022.00 fare + 7.94 CA = 51.49 ) + ( 5% GST x 25.00SQ = 1.25 )CA is based on chargeable emplanement in <strong>Canada</strong> and differs depending on where the ticket is acquired.As this is a transborder return trip, $7.94 CAD for one-way is assessed as only one enplanement in <strong>Canada</strong>.Taxes and Fees:Q Navcan, InsuranceYQ Fuel SurchargesSQ <strong>Air</strong>port Improvement FeesCA <strong>Air</strong> Travellers Security ChargeAY US Security FeeTaxes on Charges and FeesVerify general ruleCIC*162/10CIC*162/25CIC*162/6CIC*162/162For a complete list of applicable taxes and fees, please use the applicable GDS transaction followed by the country code:Example: FTAX-CA FQNTAX/CA or FTAX-US FQNTAX/USSubject to change without prior notice. Revised May 2, 2011. 14

CIC*170/8 *S* Escapes ProgramEscapes are valid for travel originating in <strong>Canada</strong> on carriers and booking class as indicated:<strong>Air</strong> <strong>Canada</strong> / <strong>Air</strong> <strong>Canada</strong>Express ®United <strong>Air</strong>linesLufthansaAustrian <strong>Air</strong>line GroupS Class on <strong>Air</strong> <strong>Canada</strong>, <strong>Air</strong> <strong>Canada</strong> Express ® , <strong>Air</strong> Alliance, Central Mountain flights 7200-7299 onlyG Class on UA true flights as long as travel originates in <strong>Canada</strong> & 1 st flight leg is on ACoperated flights. Travel on UA can only be to USA. UA* flights operated by UnitedExpress, series UA 5000, UA 6000, UA 7000 are excluded.S Class on LH operated flights onlyN Class on OS operated by Austrian <strong>Air</strong>lines, Lauda <strong>Air</strong>, Tyrolean <strong>Air</strong>ways & Rheintalflug• 'Original' Bookings are permitted only within 14 days of departure day. Cancel and rebook is not permitted tosecure space outside the required ticketing deadline of 14 days.• Travel must originate <strong>Canada</strong> with the 1st segment on <strong>Air</strong> <strong>Canada</strong>, <strong>Air</strong> <strong>Canada</strong> Express ® , Austrian <strong>Air</strong>lines, orLufthansa operated flights.• The complete 12 Alpha-numeric reduced rate authorization number must be indicated in both the Tour Code Box oftravel agent’s and companion’s tickets. Example: E9SES1234567 (A $50.00 + tax ticketing error fee will apply formissing/incorrect authorization numbers)• S Escapes Travel, per CIC*170/8 must also be indicate in the PNR in order for validation.• Fare Basis Code : SESCAPES• Cross-reference the companion’s ticket with the agent’s ticket. The Escapes Authorization number can only beused once; it cannot be reused for another trip or file.• The Travel Agent and Companion must travel together throughout the entire journey, at the same Escape fare, andmust be on the same PNR.• When travelling within 2 seasons, such as departing in low season and returning in high season, the fare is to becalculated at 50% of each season’s fare.• All Taxes & Surcharges that apply to any published fare, including the AIF Fees, Navcan, Insurance, and Canadian<strong>Air</strong> Travel Security Charge (ATSC).Not Permitted with Escapes travelAdvance Seat SelectionStand-By Travel or WaitlistingDenied Boarding Compensation / refundsRe-issues, any changes to Itinerary and/or NamesCommission, Cash RewardsRequest for inventory clearance<strong>Frequent</strong> Flyer Miles AccumulationAny Codeshare flightsVMPD or VMCO s Agency Waiver Authorizations ( VATS )Not combinable with any other <strong>Air</strong> <strong>Canada</strong>’s promotionsIt is mandatory to comply with all escapes travel requirements to avoid receiving a debit memo for the difference betweenthe Escapes fare and the applicable fare.Refer to CIC*170/11 ESCAPES * Z * program for travel in Executive Class.Subject to change without prior notice. Revised May 2, 2011. 15

Example: ESCAPES ticketAIR CANADAENDORSEMENTS/RESTRICTIONTRVLG WITH COMP. 0149617728981PASSENGER NAMESMITH/R MRO/XXOFROMMONTREALTOTORONTOTOVANCOUVERTOMONTREALFARECAD 458.00EQUIV. FARE PAIDCA 9.34TAXXG 25.51TAXSQ 43.00TAXXQ 38.37TOTAL FARECAD 574.22CARRIERACFLIGHT407CLASSSConjunctive Tickets01 JUL 09DATE02 JUL 09TIME10:00ORIGIN/DESTINATIONYUL/YULISSUED IN EXCHANGE FORSTATUSFARE BASIS / TICKET DESIGNATORSESCAPESOKAC 109 S 02 JUL 09 13:15 OK SESCAPESAC 114 S 12 JUL 09 23:55 OK SESCAPES9617728980TRAVEL AGENCY’S NAMETRAVEL AGENCY’ADDRESSTRAVEL AGENCY’S IATA #NOT VALIDBEFORENOT VALIDAFTERFARE CALCULATIONYUL AC x/YYZ AC Q20.00 Q3.00 YVR 206.00 LESCAPES AC YUL Q20.00 Q3.00 206.00 LESCAPES CAD 458.00 SQ 8.00 YYZ + 20.00 YUL+ 15.00 YVRFORM OF PAYMENTAX 373534345561009CPN AIRLINE CODE FORM SERIALNUMBER 014 9617728980 6DO NOT MARK OR WRITE IN THE WHITE AREA ABOVECKISS014APPROVALCK/TOUR CODEE9SES2881844XG 25.51 = (5% GST x 458.00 Fare + 9.34 CA + 20.00 YUL SQ + 15.00 YVR SQ + 8.00 YYZ SQ)XQ 38.37 = (7.5% QST x 458.00 Fare + 9.34 CA + 20.00 YUL SQ + 24.36 GST)(5% GST x 458.00 Fare + 9.34 CA + 20.00 YUL SQ = 24.36 GST. The QST does not apply to the YVR or YYZ SQ)COMMISSION0.00AIFs are subject to GST/QST/HST as applicable to each airport departure irrespective of type of journey or point of sale.The AIF must be shown and collected on ticket to which the AIF applies.Example: ESCAPES companion ticketAIR CANADAENDORSEMENTS/RESTRICTIONTRVLG WITH COMP. 0149617728980PASSENGER NAMEJONES/R MRO/XXOFAREFROMMONTREALTOTORONTOTOVANCOUVERTOMONTREALCAD 458.00EQUIV. FARE PAIDCA 9.34TAXXG 25.51TAXSQ 43.00TAXXQ 38.37TOTAL FARECAD 574.22CARRIERACFLIGHT407CLASSSConjunctive TicketsDATE OF ISSUE01 JUL 09DATE02 JUL 09TIME10:00ORIGIN/DESTINATIONYUL/YULBOOKING REFERENCEABCDEFISSUED IN EXCHANGE FORSTATUSFARE BASIS / TICKET DESIGNATORSESCAPESOKAC 109 S 02 JUL 09 13:15 OK SESCAPESAC 114 S 12 JUL 09 23:55 OK SESCAPES9617728981TAXALLOWCOMMRATE0TRAVEL AGENCY’S NAMETRAVEL AGENCY’ADDRESSTRAVEL AGENCY’S IATA #NOT VALIDBEFORENOT VALIDAFTERFARE CALCULATIONYUL AC x /YYZ AC YVR Q20.00 Q3.00 YVR 206.00 LESCAPES AC YUL Q20.00 Q3.00 206.00 LESCAPES CAD 458.00 SQ 8.00 YYZ + 20.00 YUL + 15.00 YVRFORM OF PAYMENTAX 373534345561009CPN AIRLINE CODE FORM SERIALNUMBER 014 9617728981 6DO NOT MARK OR WRITE IN THE WHITE AREA ABOVECKISS014APPROVALCK/TOUR CODEE9SES2881844COMMISSION0.00Taxes and Fees:Q Navcan, InsuranceVerify general rule XG GST CIC*162/31YQ Fuel SurchargesCA <strong>Air</strong> Travellers Security Charge CIC*162/25 XQ QST CIC*162/7SQ <strong>Air</strong>port Improvement Fees CIC*162/10 Taxes on Charges & Fees CIC*162/162For complete list of applicable taxes and fees, use the applicable GDS transaction followed by the country code.Example: FTAX-CA FQNTAX/CA or FTAX-US FQNTAX/USTAXALLOWCOMM RATE0Subject to change without prior notice. Revised May 2, 2011. 16

CIC*160/33 - Bereavement TravelThe North American policy allows an advance purchase waiver on published fares (except T, E, S, L and P and J, C, D, Z Executive class)for travel within <strong>Canada</strong>, and between <strong>Canada</strong>-US, including Hawaii and Puerto Rico, provided bereavement information is given prior toticketing.The International policy offers a private bereavement fare (except: Japan to <strong>Canada</strong> and <strong>Canada</strong> to/from Hong Kong) provided thebereavement information is given prior to ticketing.Fare basis code: ‘BEREAVE’ booking class M (IF M class is not available, book in Y class)- Travel Agent MUST contact <strong>Air</strong> <strong>Canada</strong> for authorization.- Authorization number MUST be in the TOUR CODE BOX of the ticket and on the PNR.- Ticket MUST be referenced “BEREAVE TRAVEL” CIC*160/33 in the endorsement box.- Ensure that all required information is also included in PNR. Failure to do so will result in a debit.- Travel must commence within 7 days of reservation- Instant <strong>Ticketing</strong> with North America Itineraries and within 72 hours after booking with International itinerariesDocuments/information required for immediate discount prior to departure:- In case of death: death certificate, funeral director's statement/coroner's statement.- Name of deceased immediate family member, relationship to passenger. Name, address, date and phone number of where funeral isto be held.- In case of imminent death: A letter from the treating physician on official letterhead that clearly defines the situation as one of imminentdeath of family member.- Name, Address, Phone# of attending physician and of location of dying immediate family memberIf Authorization cannot be obtained prior to ticketing, then the passenger must pay the full fare, and request a deferred refund with therequired documents within 90 days of completing travel, for International travel onlyNot Valid for: Open Return, stopovers, Interline travel, <strong>Air</strong> <strong>Canada</strong> Vacations, Charters, AC Codeshare flights, Interline flights, other airlinesticket stocks/plates, bookings in Executive/First or travel due to illness which is not life threatening or for settling an EstateExample: International Bereavement Ticket with the AC AuthorizationAIR CANADAConjunctive TicketsENDORSEMENTS/RESTRICTIONSBEREAVEPASSENGER NAMESMITH/R MRO/ FROMX TORONTOTOLONDONTOTORONTOFARECAD 1456.00EQUIV. FARE PAIDCA 17.00TAXSQ 25.00XG 1.25TAXYQ 38.00TAXGB 46.35UB 26.25TOTAL FARECAD 1609.85XG 1.25 = 5% x 25.00 YYZ SQCARRIERACFLIGHT401CLASSMORIGIN/DESTINATIONYUL/YULDATE OF ISSUE BOOKING REFERENCEABCDEF01 JUL 09 ISSUED IN EXCHANGE FORDATE02 JUL 09TIME6:00STATSOKFARE BASIS / TICKETDESIGNATORBEREAVEAC 402 M 15 AUG 09 19:35 OK BEREAVEFARE CALCULATIONYYZ AC LHR AC 728.00.00 BEREAVE AC YYZ 728 .00 BEREAVE SQ 25.00 YYZ YQ38.00FORM OF PAYMENTAX 373534345561009CPN AIRLINE CODE FORM SERIALNUMBERCK 014 9617728980 6 ISS0149617728980TRAVEL AGENCY’S NAMETRAVEL AGENCY’ADDRESSTRAVEL AGENCY’S IATA #APPROVALCK/NOT VALIDBEFORENOT VALIDAFTERTOUR CODEV9BER12345ABCOMMISSION0TAXALLOWCOMMRATEAIFs are subject to GST/QST/HST as applicable to each airport of departure irrespective of type of journey or point of sale.The AIF must be shown and collected on ticket to which the AIF applies.Subject to change without prior notice. Revised May 2, 2011. 17

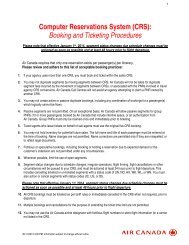

Taxes and Fees:Q Navcan, InsuranceVerify general rule XG GST CIC*162/31YQ Fuel SurchargesCA <strong>Air</strong> Travellers Security Charge CIC*162/25 GB UK TAXES CIC*162/14SQ <strong>Air</strong>port Improvement Fees CIC*162/10 Taxes on Charges & Fees CIC*162/162For complete list of applicable taxes and fees, use the applicable GDS transaction followed by the country code.Example: FTAX-CA FQNTAX/CA or FTAX-US FQNTAX/USCIC*26/19 - Back to Back <strong>Ticketing</strong>/ThrowawaysCIC*170/49 - CRS Booking and <strong>Ticketing</strong> Procedures<strong>Air</strong> <strong>Canada</strong> specifically prohibits:Back to Back <strong>Ticketing</strong>:These are tickets comprised of a combination of 2 or more round-trip excursion fares, end-to-end and/or using coupons from2 or more tickets issued at round-trip fares for the Purpose of circumventing applicable tariff rules such as advancepurchase/minimum stay requirements. Customers shall not purchase one or more tickets or use flight coupons of one ormore tickets in order to obtain a lower fare than would otherwise be applicable.The CRS will not guarantee these fares although they are auto-priced because the agency booked two separate trips on onePNR, and therefore manipulated the fare quotation system. The CRS will auto price this itinerary because it thinks this is onetrip and looks at the 1 st and last sector for minimum stay requirement. <strong>Air</strong> <strong>Canada</strong> will issue debit memos for this violation.Throwaway Tickets:These are tickets sold as round trip excursion fares to be used for one-way travel or the purchase of a ticket from a pointother than the passenger’s actual originating city or to a point beyond the passenger’s actual destination.The practice of selling a ticket with a fictitious point of origin or destination in order to undercut the applicable fare is contraryto the Industry Resolutions and applicable tariffs and fares, even if the passenger asks for such a ticket.We are reminded, by our Law Branch, that non-compliance with these instructions constitutes a breach of Section 2.1 ofthe Passenger Sales Agency Agreement, and section 14.3 of Passenger Sales Agency Rules. In such event, Section13.2 of the Passenger Sales Agency rules on Indemnities and Waivers applies, and default action may be taken.***ALL CRS BOOKINGS*** must be ticketed as per tariff rules or immediately cancelled in the CRS when not required, priorto departure.You may not:• Hold inventory for future sales• Create duplicate bookings, or multiple bookings and cancellations to extend ticketing time limits• Create fictitious or speculative bookings, including blocking or holding a reservation due to expected demandor customer’s indecision, under any circumstances• Make name changes; name corrections are only permitted if misspelled• Book and ticket using more than one CRS system at a time• Use AC <strong>Air</strong>line designator to store flight information on a carrier not listed in the CRS• Enter segments created for test or training purposes using the <strong>Air</strong> <strong>Canada</strong> designator• Create Booking in one System and Ticket in another if using more than one CRSFor additional information on CRS Bookings & <strong>Ticketing</strong>, please refer to CIC*170/49.Subject to change without prior notice. Revised May 2, 2011. 18

CIC*170 / 105 TICKET CHANGES AND CIC*160 / 29 CHANGESChanges may require additional charges for the difference between the fare of the original ticket and the new fareplus change fees applicable to the fare of original ticketed fare.Changes to round trip fare journeys, prior to commencement of travel:• Changes to the Outbound requires the entire itinerary to be repriced using current and applicable fares. All therules of the new fare must be met, including: Advance Purchase, Sale period, Blackouts, Inventory, Same citypairs, Flight Restrictions, Min & Max Stay, or any other conditions of original fare.• If the new fare is of higher value, the difference is fare must be collected plus the applicable change fee.• If the new fare is of a lower fare, the fare difference is lost and a change fee must be collected.• Changes to the Inbound may be made anytime provided no change to city pairs. Min and Max stay, Seasonality,day or time, blackout, Inventory is available and a change fee is collected.• If these provisions are not met, the value of the ticket can be used according to policy “Ticket Validity andOwnership policy” towards future travel CIC*26/76.Changes to round trip fare journeys after travel started:• Changes to the outbound on round trip fares may be made anytime as long as the following provisions are met: nochange to city pairs, Min and Max stay, seasons/day or time, Inventory is available, and a change fee is collected.• If these provisions are not met, follow procedures in CIC*160/29.Note: A ticket exchange involving a currency conversion is based on the BSP/ROE of the original date of issue, not theBSR/ROE of the date of the exchange.Refer to CIC*160/29 “<strong>Ticketing</strong> Changes, Procedures and Exceptions” for:Application of change fees on: Single fare components, multi fare component journey, circle trip journeys, end on endjourneys, and to One Way fares.Non-Refundable round trip and one way fares: The value of an unused ticket may be applied towards the purchase ofnew AC tickets provided the customer notifies AC of the cancellation on/prior to the original ticketed departure time of theirflight, failure will:• For round trip fares, renders the remainder of the ticket null and void• For one way fares, renders the coupon for that flight and connecting flights void as per CIC*170/78Fully unused Non-Refundable tickets, the ticket must be exchanged, and the outbound of new travel must commencewithin one year of the **ORIGINAL ** ISSUE DATE, regardless of any other reissues.Partially used Non-Refundable tickets, all travel must be completed within one year of original outbound date. Allconditions of original fare must be met.Additional CIC references applicable to exchanges:• CIC*170/101 Change Fee Collection Procedures and Fees• CIC*170/4 Name Correction• CIC*170/17 Negative Tax / Residual Value• CIC*77/1 Schedule change (SKCH) General Policy and Handling Guidelines• CIC*160/34 Downgrades• CIC*162/162 Taxes on Change Fees• CIC*26/76 Ticket Validity and Ownership Policy• CIC*160/29 <strong>Ticketing</strong> Changes Procedures and Exceptions• CIC*160/5 Death Exceptions PolicyPlease contact your GDS for further assistance on changes. Debit memos will be issued, for changes issuedoutside the guidelines.Subject to change without prior notice. Revised May 2, 2011. 19