IndiaFirst Money Balance Plan Vs IndiaFirst Secure ... - Life Insurance

IndiaFirst Money Balance Plan Vs IndiaFirst Secure ... - Life Insurance

IndiaFirst Money Balance Plan Vs IndiaFirst Secure ... - Life Insurance

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

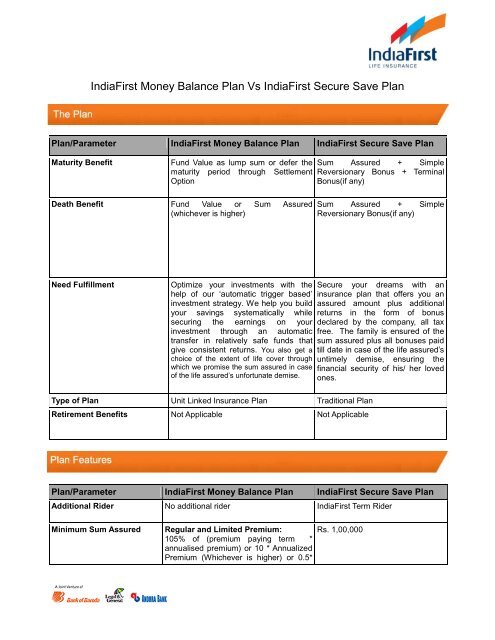

<strong>IndiaFirst</strong> <strong>Money</strong> <strong>Balance</strong> <strong>Plan</strong> <strong>Vs</strong> <strong>IndiaFirst</strong> <strong>Secure</strong> Save <strong>Plan</strong><strong>Plan</strong>/Parameter <strong>IndiaFirst</strong> <strong>Money</strong> <strong>Balance</strong> <strong>Plan</strong> <strong>IndiaFirst</strong> <strong>Secure</strong> Save <strong>Plan</strong>Maturity BenefitFund Value as lump sum or defer thematurity period through SettlementOptionSum Assured + SimpleReversionary Bonus + TerminalBonus(if any)Death Benefit Fund Value or Sum Assured(whichever is higher)Sum Assured + SimpleReversionary Bonus(if any)Need FulfillmentOptimize your investments with thehelp of our ‘automatic trigger based’investment strategy. We help you buildyour savings systematically whilesecuring the earnings on yourinvestment through an automatictransfer in relatively safe funds thatgive consistent returns. You also get achoice of the extent of life cover throughwhich we promise the sum assured in caseof the life assured’s unfortunate demise.<strong>Secure</strong> your dreams with aninsurance plan that offers you anassured amount plus additionalreturns in the form of bonusdeclared by the company, all taxfree. The family is ensured of thesum assured plus all bonuses paidtill date in case of the life assured’suntimely demise, ensuring thefinancial security of his/ her lovedones.Type of <strong>Plan</strong> Unit Linked <strong>Insurance</strong> <strong>Plan</strong> Traditional <strong>Plan</strong>Retirement Benefits Not Applicable Not Applicable<strong>Plan</strong>/Parameter <strong>IndiaFirst</strong> <strong>Money</strong> <strong>Balance</strong> <strong>Plan</strong> <strong>IndiaFirst</strong> <strong>Secure</strong> Save <strong>Plan</strong>Additional Rider No additional rider <strong>IndiaFirst</strong> Term RiderMinimum Sum AssuredRegular and Limited Premium:105% of (premium paying term *annualised premium) or 10 * AnnualizedPremium (Whichever is higher) or 0.5*Rs. 1,00,000

<strong>Plan</strong> Term * Annualized PremiumSingle Premium:125% of Single Premium<strong>Plan</strong> Term Regular/Limited Premium: 10 /15/ 20/25 yearsSingle Premium: 5/ 10/ 15/ 20 yearsMinimum PremiumRegular Premium: 10 to 30 yearsRegular Premium: Rs. 12,000 (Yearly) Rs. 12,000 (Yearly)Limited Premium: Rs. 15,000 (Yearly)Single Premium: Rs. 45,000 (Yearly)Minimum Age At Entry 5 years as on last birthday 5 years as on last birthdayLoan Facility Before 5 years: Maximum loan amount -a) 40% of the surrender value in thosepolicies where equity accounts for morethan 60% of the total shareb) 50% of the surrender value of thosepolicies where debt instrument accountsfor more than 60% of total shareAfter 5 years: Not allowedMaximum upto 90% of surrendervaluePartial WithdrawalWithdraw partially after the fifth planyear. Partial Withdrawal is not allowedprior to completion of 5 plan years. Theminimum amount that you can withdrawpartially is Rs 5,000.Not ApplicableMaximum Age At Entry 65 years as on last birthday 65 years as on last birthdayMaximum Age At Maturity 75 years as on last birthday 75 years as on last birthdayPremium Paying Modes Regular / Limited Premium: Sixmonthly and yearlySingle - One time lump sum premiumMaximum Sum AssuredRegular Premium:40 * AP (Age < 45 yrs).30 * AP (Age 46 – 50 yrs).25 * AP (Age 51 – 55 yrs).20 * AP (Age 56 – 60 yrs).Limited Premium:25 * AP (Age < 45 yrs).15 * AP (Age 46 – 50 yrs).11 * AP (Age 51 – 55 yrs).11 * AP (Age 56 – 60 yrs).Single Premium:Regular Premium: Monthly, Sixmonthly and yearlyRs. 20,00,00,000

5 * AP (Age < 45 yrs).5 * AP (Age 46 – 50 yrs).1.1 * AP (Age 51 – 55 yrs).1.1 * AP (Age 56 – 60 yrs).<strong>Plan</strong>/Parameter <strong>IndiaFirst</strong> <strong>Money</strong> <strong>Balance</strong> <strong>Plan</strong> <strong>IndiaFirst</strong> <strong>Secure</strong> Save <strong>Plan</strong>Debt (Max) Debt1 Fund: 70% to 100% Not ApplicableEquity (Max) Equity1 Fund: 80% to100% Not Applicable<strong>Money</strong> Market (Max) Equity1 Fund: 0% to 20%Debt1 Fund: 0% to 30%Not ApplicableInvestment Funds Equity1 Fund , Debt1 Fund Not Applicable<strong>Plan</strong>/Parameter <strong>IndiaFirst</strong> <strong>Money</strong> <strong>Balance</strong> <strong>Plan</strong> <strong>IndiaFirst</strong> <strong>Secure</strong> Save <strong>Plan</strong>Policy AdministrationChargesFund Management Charges 1.35 % paRegular/ Limited Premium - 1.8% offirst year’s premium p.a inflating by 5%every plan year, subject to a maximum ofRs. 6,000 per annum.Single premium - 1.20% of the singlepremium for the first ten years and 0%thereafter, subject to a maximum of Rs.6,000Not ApplicableNot ApplicablePremium AllocationChargesPremium RedirectionCharges1 st year – 6.70 %2 nd year - 4 th year – 4.00 %5 th year onwards – 3.50 %Not ApplicableNot ApplicableNot Applicable

Switching Charges Free for 52 switches a year Not Applicable<strong>Plan</strong>/Parameter <strong>IndiaFirst</strong> <strong>Money</strong> <strong>Balance</strong> <strong>Plan</strong> <strong>IndiaFirst</strong> <strong>Secure</strong> Save <strong>Plan</strong>Discontinuance/SurrenderChargesDiscontinuance charge for planshaving annualized premium up to Rs.25,000Yr1- Lower of 20%* (AP or FV) subject tomax. of Rs.3000;Yr2- Lower of 15%* (AP or FV) subject tomax of Rs.2000Yr3 -Lower of 10%* (AP or FV) subject tomax of Rs.1500Yr4 -Lower of 5%* (AP or FV) subject tomaximum of Rs.1000Yr5- & above NilDiscontinuance charge for planshaving annualised premium above Rs.25,000Yr1-Lower of 6%* (AP or FV) subject tomaximum of Rs.6000Yr2-Lower of 4%* (AP or FV) subject tomaximum of Rs.5000Yr3-Lower of 3%* (AP or FV) subject tomaximum of Rs.4000Yr4-Lower of 2%* (AP or FV) subject tomaximum of Rs.2000Yr5 - NilPartial Withdrawal Charges No Charges Not ApplicableGSV(Gross Surrender Value):30% of total premium paidLess:i. First year premiumii. Any extra premium and riderpremium, if anySSV(Special Surrender Value):Paid up value * SSV factor at thetime of surrenderThe SSV factor will be determinedby us from time to timeMinimumWithdrawalsPartialRs. 5,000 (after completion of 5 policyyears)Not ApplicableMaximumWithdrawalsPartialRegular/ Limited Premium: Up to 25%of the fund value, only if your fund is leftwith a minimum balance equal to 110%of your annual premium after thewithdrawalNot ApplicableSingle Premium: Fund value after thewithdrawal should not be less than Rs.

45,000