SEG 45 Final_qx4 - Society of Economic Geologists

SEG 45 Final_qx4 - Society of Economic Geologists

SEG 45 Final_qx4 - Society of Economic Geologists

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Celebrating a Century <strong>of</strong> <strong>Economic</strong> Geology 1905-2005<br />

<strong>SEG</strong> www.segweb.org<br />

OCTOBER 2005 NUMBER 63<br />

The Founders <strong>of</strong> <strong>Economic</strong> Geology<br />

Brian J. Skinner (<strong>SEG</strong> 1960 SF)<br />

Part 4<br />

These three brief biographies bring to<br />

a close the vignettes <strong>of</strong> the 12 men<br />

who played key roles in the founding<br />

<strong>of</strong> <strong>Economic</strong> Geology a century ago.<br />

These final three, Spurr, Lindgren,<br />

and Ransome, like their founding<br />

colleagues, were very interesting<br />

people—interesting because they<br />

were major forces in the development<br />

<strong>of</strong> economic geology as a field, and<br />

also because they led varied and<br />

interesting lives.<br />

Josiah Edward Spurr,<br />

1870–1950<br />

In a brief biography<br />

for F.L. Ransome, published<br />

in volume 30 <strong>of</strong><br />

<strong>Economic</strong> Geology,<br />

Waldemar Lindgren<br />

wrote that Spurr was<br />

the man who first suggested<br />

the need for a<br />

journal devoted to<br />

mineral deposits. The<br />

suggestion was made in November or<br />

December 1904. The first issue <strong>of</strong> <strong>Economic</strong><br />

Geology appeared in October 1905. When<br />

it was decided that the new journal would<br />

be most appropriately published by an<br />

incorporated company rather than a<br />

newly founded scientific society, Spurr<br />

was elected first President <strong>of</strong> the <strong>Economic</strong><br />

Geology Publishing Company.<br />

Born in Maine, educated at Harvard—<br />

where he was strongly influenced by<br />

NEWSLETTER<br />

Pr<strong>of</strong>essor N.S. Shaler—Spurr went to<br />

work for the Minnesota Geological<br />

Survey and made the first geological<br />

map <strong>of</strong> the Mesabi Range. In 1894 he<br />

was hired by the U.S.Geological Survey<br />

and worked with S.F. Emmons at<br />

Leadville, Colorado, then at Mercur in<br />

Utah, and Aspen, Colorado. His Aspen<br />

work is published in USGS Monograph<br />

31. Assigned to mapping in Alaska during<br />

the years <strong>of</strong> the Yukon gold rush,<br />

Spurr is honored by the naming <strong>of</strong> Mt.<br />

Spurr, an active volcano, after him.<br />

There is a story in the Spurr family that<br />

when Mt. Spurr, which is not far from<br />

Anchorage, erupted about a year after<br />

his death, a reporter asked his wife if<br />

she thought her husband was trying to<br />

contact her? To which she replied “Well,<br />

I knew that Edward had passed on to<br />

another world, but until today I had not<br />

realized which one.”<br />

Spurr left the U.S. Geological Survey<br />

in 1906 to work for the American<br />

Smelting and Refining Company, and<br />

then in 1908 he moved full time to consulting,<br />

in which role he was much<br />

acclaimed. He was less acclaimed for<br />

his theorizing on the nature <strong>of</strong> the oreforming<br />

medium. He dispensed with<br />

hydrothermal solutions and argued<br />

instead for ore-magmas, which he envisioned<br />

as highly concentrated and<br />

dense magmatic residues. His twovolume<br />

work detailing his ideas, Ore<br />

Magmas; a Series <strong>of</strong> Essays on Ore Deposition,<br />

was published in 1923 by the McGraw-<br />

Hill Company. Despite skepticism for<br />

his ideas about ore magmas, Spurr was<br />

admired as an outstanding field<br />

observer. In his examination <strong>of</strong> the<br />

Velardeña district, Durango, Mexico, he<br />

observed minerals formed by contact<br />

metamorphism that he could not identify,<br />

and thought might be new.<br />

Examination <strong>of</strong> the minerals by F.E.<br />

Wright <strong>of</strong> the Geophysical Laboratory<br />

showed that two were new; one,<br />

Ca5(SiO4)2(CO3), was named spurrite.<br />

Ever active and ever enquiring, in<br />

1937 Spurr became interested in the<br />

geology <strong>of</strong> the moon. Eventually, in the<br />

years 1944 to 1949, he<br />

to page<br />

published four books on 4 ...<br />

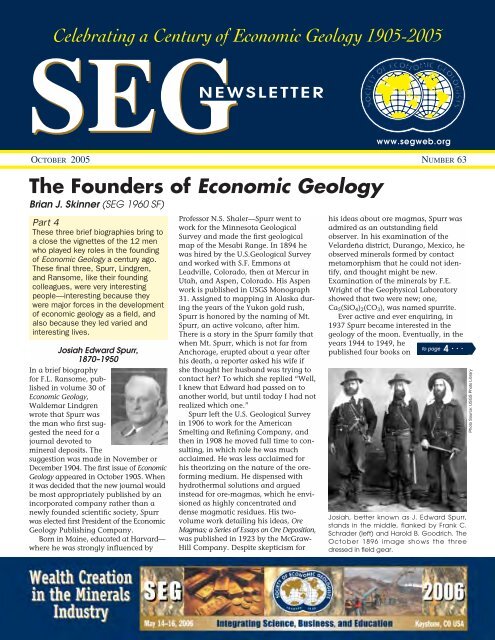

Josiah, better known as J. Edward Spurr,<br />

stands in the middle, flanked by Frank C.<br />

Schrader (left) and Harold B. Goodrich. The<br />

October 1896 image shows the three<br />

dressed in field gear.<br />

Photo Source: USGS Photo Library

ADVANCED ELEMENTAL EXPLORATION<br />

www.panalytical.com | HQ T: +31 (0) 546 534 444<br />

Europe, Middle East, Africa T: +31 (0) 546 834 444<br />

The Americas T: +1 508 647 1100 | Asia Pacific T: +65 6741 2868<br />

PAID ADVERTISEMENT<br />

Celebrating a Century <strong>of</strong><br />

Science and Discovery<br />

Take your library to the field with the<br />

HUGO T. DUMMETT MEMORIAL<br />

ECONOMIC GEOLOGY ARCHIVE<br />

Funded by<br />

<strong>SEG</strong> Canada<br />

Foundation<br />

• Charles Fipke<br />

• Stewart Blusson<br />

• Ivanhoe Mines Ltd.<br />

<strong>Economic</strong><br />

Geology<br />

<strong>Economic</strong> Geology<br />

Archive (from 1905)<br />

Complete digitization<br />

<strong>of</strong> 100 years <strong>of</strong><br />

<strong>Economic</strong> Geology<br />

On DVD ~ Linked,<br />

searchable index ~<br />

Linked references ~<br />

Available this year ~<br />

Celebrating a Century <strong>of</strong><br />

Science and Discovery 1905–2005<br />

BULLETIN OF<br />

THE SOCIETY<br />

OF ECONOMIC<br />

GEOLOGISTS<br />

THE HUGO DUMMETT MEMORIAL <strong>Economic</strong> Geology ARCHIVE<br />

Funded by the <strong>Society</strong> <strong>of</strong> <strong>Economic</strong> <strong>Geologists</strong><br />

Canada Foundation and generously<br />

supported by Charles Fipke,<br />

Stewart Blusson, and<br />

Ivanhoe Mines Ltd.<br />

www.segweb.org<br />

Use <strong>of</strong> this DVD<br />

implies acceptance<br />

<strong>of</strong> copyright conditions<br />

©2005, <strong>Society</strong> <strong>of</strong><br />

<strong>Economic</strong> <strong>Geologists</strong>, Inc.<br />

ISBN: 1-887483-00-4<br />

Members will be notified <strong>of</strong> availability by e-mail<br />

broadcast and <strong>SEG</strong> Newsletter ~ Order details will be<br />

published at the Publications Bookstore<br />

<br />

PRICE: MEMBERS USD $220 • INSTITUTIONAL USD $1500<br />

PANalytical’s X-ray fluorescence (XRF) spectrometers are<br />

established as providing high-performance analysis <strong>of</strong> trace<br />

and environmentally significant elements across a wide<br />

range <strong>of</strong> geological and mining applications. And now,<br />

Axios-Advanced is setting new standards <strong>of</strong> sensitivity,<br />

reproducibility and stability for even the most demanding<br />

XRF analysis.<br />

Developed in close co-operation with users, Axios-Advanced is<br />

equipped with our latest SST-mAX technology for unrivalled X-ray<br />

tube performance. Sophisticated counting electronics, the fastest<br />

and most accurate goniometer, and the best fundamental<br />

parameters s<strong>of</strong>tware package available complete the package.<br />

All backed by PANalytical’s truly global customer support network,<br />

which delivers expert advice, even in remote locations. Find out<br />

more about the complete PANalytical XRF range and get details<br />

<strong>of</strong> your local contact, at www.panalytical.com<br />

The Analytical X-ray Company<br />

PAID ADVERTISEMENT

OCTOBER 2005 • No 63 <strong>SEG</strong> NEWSLETTER 3<br />

<strong>SEG</strong><br />

NEWSLETTER<br />

Nº 63—OCTOBER 2005<br />

EXECUTIVE EDITOR<br />

Brian G. Hoal<br />

NEWS EDITOR<br />

Alice Bouley<br />

PRODUCTION MANAGER<br />

Christine Horrigan<br />

<strong>Society</strong> <strong>of</strong> <strong>Economic</strong> <strong>Geologists</strong>, Inc.<br />

7811 Shaffer Parkway<br />

Littleton, CO 80127 USA<br />

Tel. +1.720.981.7882<br />

Fax +1.720.981.7874<br />

Email: seg@segweb.org<br />

WEB PAGE:<br />

http://www.segweb.org<br />

Feature articles are<br />

peer reviewed before they<br />

are accepted for publication.<br />

Please submit material to the<br />

Executive Editor.<br />

Tel. +1.720.981.7882<br />

Fax +1.720.981.7874<br />

E-mail: director@segweb.org<br />

The <strong>SEG</strong> Newsletter is published quarterly in<br />

January, April, July and October by the <strong>Society</strong><br />

<strong>of</strong> <strong>Economic</strong> <strong>Geologists</strong>, Littleton, Colorado,<br />

exclusively for members <strong>of</strong> the <strong>Society</strong>.<br />

Opinions expressed herein are those <strong>of</strong> the writers<br />

and do not necessarily represent <strong>of</strong>ficial<br />

positions <strong>of</strong> the <strong>Society</strong> <strong>of</strong> <strong>Economic</strong> <strong>Geologists</strong>.<br />

When quoting material from the <strong>SEG</strong> Newsletter<br />

please credit both author and publication.<br />

©2005 The <strong>Society</strong> <strong>of</strong> <strong>Economic</strong> <strong>Geologists</strong>, Inc.<br />

Designed & Produced by Type Communications<br />

Westminster, Colorado<br />

Printed by Johnson Printing<br />

Boulder, Colorado<br />

— FOR CONTRIBUTORS —<br />

The <strong>SEG</strong> Newsletter is published for the benefit<br />

<strong>of</strong> the worldwide membership <strong>of</strong> the<br />

<strong>Society</strong> <strong>of</strong> <strong>Economic</strong> <strong>Geologists</strong>. We invite<br />

news items and short articles on topics <strong>of</strong><br />

potential interest to the membership. If you<br />

have questions on submittal <strong>of</strong> material,<br />

please call the <strong>SEG</strong> <strong>of</strong>fice at +1.720.981.7882<br />

or send details by FAX to +1.720.981.7874; by<br />

email to <br />

Format: Manuscripts should be double-spaced;<br />

if possible, please submit paper copy AND a<br />

computer diskette in PC format, using WORD or<br />

WordPerfect. Illustrations will be accepted in<br />

digital format or in camera-ready form at publication<br />

scale. All contributions may be edited<br />

for clarity or brevity.<br />

Advertising: Paid advertising is solicited to<br />

help <strong>of</strong>fset publication and mailing costs; for<br />

rates, contact the Production Manager.<br />

Employment opportunities for economic geologists<br />

will be listed free <strong>of</strong> charge.<br />

DEADLINE FOR NEWSLETTER #64:<br />

November 30, 2005<br />

Contents<br />

FEATURE ARTICLE<br />

5 Exploring For Deposits Under Deep Cover Using Geochemistry<br />

NEWSLETTER COLUMNS<br />

1 The Founders <strong>of</strong> <strong>Economic</strong> Geology, Part 4<br />

6 From the Executive Editor<br />

7 Presidential Perspective: <strong>Economic</strong> Geology — Science or Pr<strong>of</strong>ession?<br />

<strong>SEG</strong> NEWS<br />

16 <strong>SEG</strong> Thayer Lindsley Lecture Tour – 2004<br />

17 Mentoring: Regina Baumgartner, Student Member: An Interview<br />

18 <strong>SEG</strong> Student Chapter News<br />

19 $130,000 Available for Student Research Grants in 2006<br />

20 <strong>SEG</strong> Forum on Gold Deposits: Part II<br />

28 <strong>SEG</strong> Student Chapter Conference<br />

EXPLORATION REVIEWS<br />

21–Africa · 23–Alaska · 29–Asia · 32–Australasia · 34–Europe ·<br />

37–South America · 40–Western Canada · 41–Western United States<br />

MEMBERSHIP<br />

43 <strong>SEG</strong> Membership: Candidates and New Fellows, Members and Student Members<br />

<strong>45</strong> Personal Notes & News<br />

46 2006 Dues Notice<br />

47 Explanation <strong>of</strong> Member Benefits for 2006<br />

ANNOUNCEMENTS<br />

2 <strong>Economic</strong> Geology Archive<br />

6 Corrections and Amplifications<br />

44 Northwest Mining 111th Annual Meeting<br />

44 VIII Congreso Argentino de Geología Económica<br />

44 Feria Internacional Minera 2005 – Medellín, Colombia<br />

25-28 <strong>SEG</strong> 2006 Conference: Wealth Creation in the Minerals Industry<br />

51 <strong>Economic</strong> Geology 100th Anniversary Volume (inside back cover)<br />

52 <strong>SEG</strong> Contact Information (back cover)<br />

PUBLICATIONS<br />

48-49 Publications Order Form<br />

CALENDAR<br />

50 Calendar<br />

ADVERTISERS—<br />

2 Actlabs, Ltd. (inside front cover)<br />

14 Anzman, Joseph R.<br />

24 Balbach Colorado, Inc.<br />

14 Big Sky Geophysics<br />

50 DeRuyter, Vernon<br />

22 Geocon, Inc.<br />

8 IMDEX Inc.<br />

50 Kuhn, Paul W.<br />

30 Laravie, Joseph A.<br />

<strong>SEG</strong> 2006 DUES RENEWAL<br />

AND MEMBERSHIP OPTIONS<br />

(See pages 46–47)<br />

38 Laurentian University<br />

33 LTL Petrographics<br />

22 Lufkin, John L., Ph.,D.<br />

24 McKelvey, G.E.<br />

33 Mining Activity Update<br />

2 PANalytical (inside front cover)<br />

36 Petrographic Consultants Intl.<br />

15 Phelps Dodge<br />

34 Recursos del Caribe S.A.<br />

36 Resource Geosciences de Mexico<br />

52 RockWare (back cover)<br />

34 Shea Clark Smith<br />

30 Sheahan-MDRU Literature Service<br />

30 Sinclair Knight Merz<br />

38 Spectral International, Inc.<br />

6 Yerington, NV Course<br />

15 Zonge Engineering & Research

4 <strong>SEG</strong> NEWSLETTER No 63 • OCTOBER 2005<br />

... from the Cover<br />

the subject. In a memorial, published in<br />

the Proceedings <strong>of</strong> the GSA for 1968,<br />

Jack Green writes <strong>of</strong> Spurr’s original<br />

ideas about the moon. “…behind every<br />

sketch was 50 years <strong>of</strong> field training.<br />

Behind every analogue were decades <strong>of</strong><br />

mapping and observation.” Spurr’s<br />

work has been recognized by the naming<br />

<strong>of</strong> a lunar feature after him. At<br />

Lunar latitude 27.9 N and longitude 1.2<br />

W, adjacent to the landing site <strong>of</strong><br />

Apollo 15, is Spurr crater, 13 km in<br />

diameter and partially covered by lava.<br />

Spurr is credited with the suggestions<br />

that led to the founding <strong>of</strong> the <strong>Society</strong> <strong>of</strong><br />

<strong>Economic</strong> <strong>Geologists</strong> in 1920, and was<br />

<strong>Society</strong> President in 1923. His Presidential<br />

Address on “The Origin <strong>of</strong><br />

Metallic Concentrations by Magmation”<br />

is published on pages 617 to 638 <strong>of</strong><br />

Volume 18 <strong>of</strong> <strong>Economic</strong> Geology.<br />

Frederick Leslie Ransome,<br />

1868–1935<br />

The first Secretary to<br />

the Board <strong>of</strong> the<br />

<strong>Economic</strong> Geology<br />

Publishing Company,<br />

and for 30 years, to the<br />

day <strong>of</strong> his death, an<br />

Associate Editor,<br />

Ransome was a<br />

devoted and hardworking<br />

member <strong>of</strong> the small group <strong>of</strong><br />

people who founded and nurtured<br />

<strong>Economic</strong> Geology to the stature it has<br />

attained.<br />

Born in England but brought to the<br />

United States in infancy, Ransome grew<br />

up in California, where his father was a<br />

concrete pioneer, building the first concrete<br />

building and first concrete bridge<br />

in America. When Ransome entered the<br />

University <strong>of</strong> California, Berkeley, there<br />

seemed little chance he would become a<br />

geologist. But in 1890, Andrew C.<br />

Lawson, fresh from his PhD at Johns<br />

Hopkins, arrived and fired Ransome’s<br />

ambitions. Ransome graduated in 1893<br />

and stayed on to complete a PhD in<br />

1896. During that time he and Charles<br />

Palache worked on a mineral they discovered<br />

in the glaucophane schists <strong>of</strong><br />

Marin County—it turned out to be new<br />

and they named it lawsonite.<br />

Ransome joined the U.S. Geological<br />

Survey in 1898 and was assigned to<br />

California, where he worked on the<br />

Mother Lode—the results appeared in<br />

The Founders <strong>of</strong> <strong>Economic</strong> Geology (Continued)<br />

1900 in USGS Atlas folio number 63.<br />

From there he moved to Arizona, where<br />

be studied Globe and Bisbee, published<br />

in Pr<strong>of</strong>essional Papers 12 and 21,<br />

respectively. In 1904 he began a collaborative<br />

study with Lindgren <strong>of</strong> the<br />

Cripple Creek district, the result <strong>of</strong><br />

which is one <strong>of</strong> the classics <strong>of</strong> American<br />

geology, Pr<strong>of</strong>essional Paper 54. When<br />

Ransome joined the Survey he worked<br />

under the supervision <strong>of</strong> S.F. Emmons;<br />

following Emmons death in 1911,<br />

Lindgren succeeded as chief <strong>of</strong> the metals<br />

division. Then, when Lindgren<br />

became Chief Geologist in 1912,<br />

Ransome became head <strong>of</strong> metals, a<br />

position he held until he left the Survey<br />

in 1923 and moved to the University <strong>of</strong><br />

Arizona in Tucson as pr<strong>of</strong>essor <strong>of</strong> economic<br />

geology. Four years later he<br />

moved again when he was appointed to<br />

a similar position at California Institute<br />

<strong>of</strong> Technology in Pasadena, California.<br />

Ransome was President <strong>of</strong> the <strong>Society</strong><br />

<strong>of</strong> <strong>Economic</strong> <strong>Geologists</strong> in 1927. His<br />

Presidential address on “Directions <strong>of</strong><br />

Progress in <strong>Economic</strong> Geology” can be<br />

read in volume 23 <strong>of</strong> the journal, pages<br />

119 to 131.<br />

Waldemar Lindgren,<br />

1860–1939<br />

Lindgren is probably<br />

the most familiar<br />

name among the<br />

founders <strong>of</strong> <strong>Economic</strong><br />

Geology. It is familiar<br />

because <strong>of</strong> the breadth<br />

and depth <strong>of</strong> his writings<br />

and because <strong>of</strong><br />

his impact on the<br />

development <strong>of</strong> economic geology as a<br />

field <strong>of</strong> study and scientific investigation.<br />

Born in the southeast corner <strong>of</strong><br />

Sweden, near Kalmar, Lindgren was<br />

raised in a well-to-do and aristocratic<br />

family. Much attention was paid to his<br />

education and he developed a fluency<br />

in several modern languages—training<br />

that served him well in later life, even<br />

though his interests were more with science<br />

than languages. A brief working<br />

experience at the zinc mines at Ämmeberg<br />

at the end <strong>of</strong> high school convinced<br />

him that geology was his calling,<br />

and he entered the Bergakademie<br />

at Freiberg, Saxony, in 1878. A brief discussion<br />

<strong>of</strong> his training at this famous<br />

Photo Source: Library <strong>of</strong> Congress, Washington, DC<br />

old school was published in <strong>SEG</strong><br />

Newsletter number 43, October 2000,<br />

pages 30 to 32.<br />

After graduation as a mining engineer<br />

and surveyor and a further year<br />

spent studying chemistry and petrography,<br />

Lindgren sailed to United States<br />

and landed a job working under the<br />

direction <strong>of</strong> Raphael Pumpelly on the<br />

Northern Transcontinental Survey. On<br />

completion <strong>of</strong> the survey at the end <strong>of</strong><br />

1883, he worked as an assayer in<br />

Montana, then on smelter design at<br />

Anaconda. At the end <strong>of</strong> 1884, on the<br />

recommendation <strong>of</strong> Pumpelly, he joined<br />

the U.S. Geological Survey as a member<br />

<strong>of</strong> the staff <strong>of</strong> George F. Becker. He<br />

remained with the Survey for 31 years,<br />

rising to Chief Geologist in 1911.<br />

During his Survey years, Lindgren was<br />

author or co-author <strong>of</strong> a number <strong>of</strong><br />

classic papers and monographs. Among<br />

the classics is the first detailed study <strong>of</strong> a<br />

disseminated, or porphyry copper at<br />

Clifton-Morenci in Arizona, published<br />

in USGS Pr<strong>of</strong>essional Paper 43 in 1905,<br />

and in 1906, with F.L. Ransome, the<br />

Cripple Creek, Colorado Pr<strong>of</strong>essional<br />

Paper 54.<br />

Lindgren was appointed pr<strong>of</strong>essor <strong>of</strong><br />

economic geology at the Massachusetts<br />

Institute <strong>of</strong> Technology in 1912, in<br />

which position he remained until his<br />

retirement in 1933. The work for which<br />

Lindgren is best known was published<br />

soon after he arrived at MIT, his classic<br />

text Mineral Deposits. The text ran<br />

through four editions, the last in 1933,<br />

and was the standard against which all<br />

other texts in economic geology were<br />

measured for the first half <strong>of</strong> the 20 th<br />

century. Lindgren’s thoughts and ideas<br />

continue to pervade the literature <strong>of</strong><br />

economic geology today.<br />

Lindgren was a founding member<br />

<strong>of</strong> both the <strong>Economic</strong> Geology<br />

Publishing Company and the <strong>Society</strong><br />

<strong>of</strong> <strong>Economic</strong> <strong>Geologists</strong>. He was second<br />

President <strong>of</strong> the <strong>Society</strong>, in 1922. His<br />

Presidential address on “Concentration<br />

and Circulation <strong>of</strong> the Elements from<br />

the Standpoint <strong>of</strong> <strong>Economic</strong> Geology”<br />

can be read in volume 18 <strong>of</strong> <strong>Economic</strong><br />

Geology, pages 419 to 442. The paper<br />

is an attempt to trace the geochemical<br />

cycling <strong>of</strong> a number <strong>of</strong> chemical<br />

elements, and is a fascinating insight<br />

into the thoughts <strong>of</strong> a seminal<br />

scientist. 1

OCTOBER 2005 • No 63 <strong>SEG</strong> NEWSLETTER 5<br />

Exploring For Deposits Under<br />

Deep Cover Using Geochemistry<br />

Eion M. Cameron †, Eion Cameron Geochemical Inc., Carp, Ontario K0A 1L0, Canada, Matthew I. Leybourne, Department<br />

<strong>of</strong> Geosciences, University <strong>of</strong> Texas at Dallas, Richardson, Texas 75083-0688, USA, and David L. Kelley (<strong>SEG</strong> 1990 F) Newmont<br />

Technical Facility, 10101 E. Dry Creek Rd., Englewood, Colorado 80112<br />

INTRODUCTION<br />

In a recent article in the <strong>SEG</strong> Newsletter, Roy Woodall drew attention to the challenge<br />

<strong>of</strong> finding ore deposits under deep cover. He highlighted the importance <strong>of</strong><br />

structure: “…recognition <strong>of</strong> pathways for magma and fluid transport is highly relevant<br />

for effective ore search under deep cover. Structures not only focus the transport<br />

<strong>of</strong> ore metals and the ubiquitous carbon and sulfur, they also focus energy,<br />

which is the most critical and <strong>of</strong>ten forgotten essential component for the genesis<br />

<strong>of</strong> a major ore deposit” (Woodall, 2005).<br />

Over the period 1999 to 2002, the Canadian Mining Industry Research<br />

Organization (CAMIRO), supported by 26 companies, sponsored the project<br />

“Deep-Penetrating Geochemistry” to provide the mining industry with knowledge<br />

about processes that may form anomalies at surface over buried deposits, and to<br />

provide comparative data on methods used to detect these anomalies. The study<br />

areas were the porphyry belt <strong>of</strong> northern Chile, the Carlin belt <strong>of</strong> Nevada, and the<br />

Abitibi belt <strong>of</strong> Ontario. In Chile and Nevada, both seismically active regions, the<br />

work demonstrated the importance <strong>of</strong> structure and recent tectonism in the formation<br />

<strong>of</strong> anomalies, bearing out Woodall’s remarks. Here we discuss the influence <strong>of</strong><br />

structure on surface anomalies at the Mike gold-copper deposit, Nevada, and at<br />

the Spence copper deposit, Chile—work that is described in more detail by<br />

Cameron et al. (2004), and Cameron and Leybourne (2005).<br />

<strong>45</strong>18000N<br />

† Corresponding author: e-mail, eioncam@attglobal.net<br />

300 m<br />

Soap Creek Fault Zone<br />

563000E 564000E<br />

High-Grade Cu<br />

D-Day Fault<br />

A<br />

Hillside Fault<br />

WEST<br />

MIKE<br />

Lower-Grade Cu<br />

B<br />

Soil Sampling<br />

Line<br />

Roberts Mountain Thrust<br />

MAIN<br />

MIKE<br />

Good Hope<br />

Fault<br />

1a 1b<br />

Nebulous Fault Zone<br />

N-P Dog Fault<br />

C<br />

<strong>45</strong>18000N<br />

300 m<br />

Soil Sampling Line<br />

563000E<br />

28 o<br />

A<br />

MIKE DEPOSIT<br />

The Mike deposit, hosted by sedimentary<br />

rocks <strong>of</strong> Paleozoic age, was discovered<br />

by Newmont in 1989 while drilling<br />

on structural trends northwest from the<br />

previously discovered Tusc and Gold<br />

Quarry deposits into an area with a<br />

thick cover <strong>of</strong> Carlin Formation rocks.<br />

The first comprehensive account <strong>of</strong> the<br />

geology <strong>of</strong> the deposit was by Teal and<br />

Branham (1997). The Good Hope fault<br />

is the boundary between two portions <strong>of</strong><br />

the Mike deposit (Fig. 1a): the Main<br />

Mike, with a geological resource estimate<br />

<strong>of</strong> 43.2 Mt at 1.17 g/t Au and 76<br />

Mt at 0.22% Cu, and the West Mike,<br />

with an estimated 110 Mt at 0.86 Au<br />

and 74 Mt at 0.28% Cu (Teal and<br />

Branham, 1997). At Main Mike, copper<br />

mineralization consists<br />

<strong>of</strong> a subhorizontal<br />

to page<br />

supergene oxide and 9 ...<br />

B<br />

564000E<br />

FIGURE 1. The Mike deposit. (1a) Basement (Paleozoic) geology with solid lines showing faults and outlines <strong>of</strong> the copper zones. This is mainly<br />

derived from maps by Newmont Inc. with additional faults (D-Day, Hillside, Nebulous, and North-Pointing Dog) from Norby and Orobona<br />

(2002). (1b) Surface topography, with contours in 25 ft intervals. Based on the topographic features, three faults, A, B, and C, were interpreted<br />

by Cameron and Doherty (2001) to cut the Carlin Formation, which covers the deposit. These interpreted faults are also shown in Figure 1a,<br />

which shows that they lie close to and parallel with faults mapped in the basement by Norby and Orobona (2002): fault B with the Nebulous<br />

fault zone, fault C with the North-Pointing Dog fault. These pairs are interpreted to be the same faults, the <strong>of</strong>fsets between their positions at the<br />

surface and in the basement being due to a westerly dip. The topographic feature marking fault A may be the surface expression <strong>of</strong> the<br />

westerly dipping D-Day fault, or a down-faulted block between the D-Day and Hillside faults. Eastings and northings in meters.<br />

C

6 <strong>SEG</strong> NEWSLETTER No 63 • OCTOBER 2005<br />

FROM THE EXECUTIVE EDITOR<br />

This is the final issue <strong>of</strong> the <strong>SEG</strong><br />

Newsletter that celebrates the centenary<br />

<strong>of</strong> <strong>Economic</strong> Geology, our preeminent<br />

publication. The <strong>Economic</strong> Geology One<br />

Hundredth Anniversary Volume incorporates<br />

1,146 pages that capture the state<br />

<strong>of</strong> our science from the collective perspectives<br />

<strong>of</strong> leaders in the field. Together with<br />

a comprehensive digital appendix, this<br />

publication promises to be an industry<br />

benchmark for years to come. The volume<br />

is set to roll <strong>of</strong>f the printing presses<br />

in October this year, precisely 100 years<br />

after publication <strong>of</strong> the very first issue <strong>of</strong><br />

<strong>Economic</strong> Geology. There are many people<br />

responsible for accomplishing this<br />

remarkable feat, the most visible being<br />

the editors, the authors, and the sponsors.<br />

All <strong>of</strong> these contributors will be<br />

prominently acknowledged in the publication<br />

itself. It is equally important that<br />

we recognize other key contributions—<br />

especially with respect to the timeliness<br />

<strong>of</strong> publication—made by Alice Bouley,<br />

managing editor at <strong>SEG</strong>, and Mabel<br />

Peterson, contract copyeditor. The entire<br />

CORRECTIONS AND AMPLIFICATIONS<br />

In the October 2004 <strong>SEG</strong> Foundation Contributions<br />

acknowledgments (p. 7), David A. Groves’ country affiliation<br />

should have been listed as USA.<br />

In the July 2005 <strong>Economic</strong> Geology Invited Commentary<br />

column (p. 41), the authors <strong>of</strong> the original paper are<br />

Andrew Kerr and Alison M. Leitch.<br />

In the July 2005 feature article by Dominic Channer et al.<br />

(p. 5, 13–22), acknowledgment was made <strong>of</strong> miscellaneous<br />

public domain information; the author plans to<br />

issue an addendum specifying sources. This will appear in<br />

a future issue.<br />

process also benefited enormously from<br />

the assistance and guidance provided by<br />

both Brian Skinner and John Thoms,<br />

respectively former and present chairs <strong>of</strong><br />

the Publications Board.<br />

Somewhat less predictable than the<br />

traditional printing process followed by<br />

the 100th Anniversary Volume has<br />

been the parallel production <strong>of</strong> the<br />

Hugo Dummett Memorial <strong>Economic</strong><br />

Geology Archive, a DVD product that<br />

captures 792 issues <strong>of</strong> <strong>Economic</strong> Geology<br />

from the period 1905–2004. The technology<br />

employed merges two regular<br />

DVD-Rs into a single DVD-9, or doubledensity<br />

DVD that can accommodate the<br />

entire 7 to 8 gigabytes <strong>of</strong> information.<br />

At the time <strong>of</strong> writing, I have reviewed<br />

several prototypes and was suitably<br />

impressed by the speed and utility <strong>of</strong><br />

this research tool. The <strong>Society</strong> will demo<br />

the DVD at the GSA meeting in Salt<br />

Lake City and members may place<br />

orders for the product at that time. Over<br />

the past 18 months in carrying out the<br />

digital archiving <strong>of</strong> <strong>Economic</strong> Geology, I<br />

received tremendous<br />

assistance<br />

from Jean<br />

Thoms, formerly<br />

head <strong>of</strong><br />

Subscription<br />

Services. Jean<br />

recently retired<br />

from the <strong>SEG</strong>—<br />

not, we hope, as<br />

a result <strong>of</strong> her<br />

Herculean effort<br />

on this project.<br />

Major contributors<br />

to the DVD are prominently<br />

BRIAN G. HOAL<br />

<strong>SEG</strong> Executive Director<br />

and Editor<br />

acknowledged on the product but the<br />

instrumental participation <strong>of</strong> a few is,<br />

as for the 100th Anniversary Volume,<br />

not as noticeable. In particular, I wish<br />

to thank the President <strong>of</strong> the <strong>SEG</strong><br />

Canada Foundation, Gerry Carlson, for<br />

his strong support and his role in raising<br />

the significant funds required to<br />

carry out this initiative.<br />

Happy Centenary, <strong>Economic</strong><br />

Geology! 1<br />

ANATOMY OF A TILTED PORPHYRY Cu<br />

BATHOLITH AND ITS HYDROTHERMAL<br />

ALTERATION FEATURES, YERINGTON,<br />

NEVADA (U.S.A)<br />

Instructors: John Dilles, Oregon State University<br />

Dick Tosdal, MDRU<br />

Full course: April 8-15, 2006<br />

Field trip only: April 11-13, 2006<br />

The course revolves around an 8-day field trip and mapping<br />

exercise at Yerington, Nevada, where Jurassic porphyry<br />

Cu, related deposits, and volcanic and plutonic<br />

complex are exposed in cross section because <strong>of</strong> Tertiary<br />

extension. The course is an opportunity to enhance skills<br />

in detailed field geologic mapping techniques for recording<br />

age, structural, and igneous information as well as<br />

hydrothermal veining, mineralization, and alteration.<br />

Mapping exercises are in porphyry Cu and skarn deposits.<br />

A field trip through the Yerington Batholith, volcanic<br />

cover rocks, porphyry Cu, and related Na-Ca alteration<br />

and Fe oxide-Cu (Au) systems complete the course.<br />

There is an option to attend only the field trip.<br />

Contact John Dilles (dillesj@geo.oregonstate.edu) or Dick<br />

Tosdal (mdru@eos.ubc.ca) for details. Cost and registration<br />

information available at www.mdru.ubc.ca. Deadline<br />

for registration is March 8, 2006.<br />

PAID ADVERTISEMENT

OCTOBER 2005 • No 63 <strong>SEG</strong> NEWSLETTER 7<br />

PRESIDENTIAL PERSPECTIVE<br />

<strong>Economic</strong> Geology — Science or Pr<strong>of</strong>ession?<br />

Exactly 100 years ago, in the first issue<br />

<strong>of</strong> <strong>Economic</strong> Geology, Dr. Fredrick L.<br />

Ransome wrote in the journal’s first<br />

article, “<strong>Geologists</strong> as a class have<br />

looked upon the economic branch <strong>of</strong><br />

their science with rather languid interest<br />

or have even regarded it as occupying<br />

a somewhat lower plane where the<br />

pure light <strong>of</strong> science is slightly dimmed<br />

by the smoke <strong>of</strong> commercialism.”<br />

The tension Ransome noted between<br />

science and commercialism, between<br />

those who work in Surveys or academic<br />

laboratories and those who are<br />

employed by mines or mineral exploration<br />

companies is still with us. As<br />

Ransome noted, it is a healthy tension<br />

that enables our field to embrace the<br />

wide range <strong>of</strong> the natural sciences and<br />

their practical application.<br />

However, over the past several<br />

decades there appears to have been a<br />

branching within economic geology<br />

into an academic sector and an applied<br />

sector. While many <strong>of</strong> the <strong>SEG</strong>’s publications<br />

focus on the former, most <strong>of</strong> our<br />

members work in the latter. To address<br />

concerns <strong>of</strong> many <strong>of</strong> our industrial<br />

members, <strong>SEG</strong> is sponsoring the 2006<br />

meeting, Wealth Creation in the Minerals<br />

Industry. While this meeting will aid in<br />

remarrying the two sides <strong>of</strong> our <strong>Society</strong>,<br />

these tensions have pr<strong>of</strong>ound implications<br />

for the future <strong>of</strong> the pr<strong>of</strong>ession.<br />

I have been lucky enough to work in<br />

both industry and academia. There is<br />

no doubt that they are different worlds.<br />

Industry values discoveries and ways to<br />

produce more metal more cheaply.<br />

Science is critical in these endeavors,<br />

but rewards in industry are for practical<br />

applications. In academia, rewards are<br />

given for publications and presentations,<br />

and for successfully teaching and<br />

graduating students. To get published<br />

in the best journals (including <strong>Economic</strong><br />

Geology) requires “high tech” science<br />

and application <strong>of</strong> analytical tools.<br />

Good field mapping is valued but is<br />

rarely published in Science or Nature.<br />

Garnering research funding from mining<br />

and exploration companies is<br />

acknowledged in academia, but since<br />

most companies refuse to pay full overhead<br />

rates required by academic institutions<br />

(at least in the United States and<br />

increasingly in other countries), its<br />

value for academic advancement is<br />

much lower than fully overheaded<br />

research funding from governmental<br />

organizations such as the U.S. National<br />

Science Foundation (NSF) or the<br />

European Science Foundation.<br />

The reward ladder in academia<br />

results in academic geologists focusing<br />

more and more on relatively narrow<br />

research questions using very sophisticated<br />

analytical capabilities. The results<br />

are scientifically fascinating and provide<br />

important guides to our thinking<br />

on the formation <strong>of</strong> ore deposits, but the<br />

research rarely leads directly to new discoveries<br />

or novel means <strong>of</strong> mineral production.<br />

Most young economic geologists<br />

throughout the world are trained at<br />

universities. The pr<strong>of</strong>essors doing the<br />

training are excellent scientists who do<br />

outstanding research, but increasingly<br />

they have less and less industrial experience.<br />

Many have not worked in a<br />

mine or been actively engaged at a<br />

managerial level in mineral exploration.<br />

As a consequence, many economic<br />

geology students graduate with a<br />

high level <strong>of</strong> scientific competence and<br />

the ability to think critically, but little<br />

practical experience or sense <strong>of</strong> community<br />

values for the industrial field they<br />

are entering.<br />

Current economic geology education<br />

has close parallels in what is happening<br />

in American business schools. Pr<strong>of</strong>essors<br />

Bennis and O’Toole <strong>of</strong> the University <strong>of</strong><br />

Southern California, writing recently in<br />

the Harvard Business Review, stated,<br />

“During the past several decades, many<br />

leading B schools have quietly adopted<br />

an inappropriate—and ultimately selfdefeating—model<br />

<strong>of</strong> academic excellence.<br />

Instead <strong>of</strong> measuring themselves<br />

in terms <strong>of</strong> the competence <strong>of</strong> their<br />

graduates, or by how well their faculties<br />

understand important drivers <strong>of</strong> business<br />

performance, they measure themselves<br />

almost solely by the rigor <strong>of</strong> their<br />

scientific research. Some <strong>of</strong> the research<br />

produced is excellent, but because so little<br />

<strong>of</strong> it is grounded in actual business<br />

practices, the focus <strong>of</strong> graduate business<br />

education has become increasingly circumscribed—and<br />

less and less relevant<br />

to practitioners” (2005).<br />

The situation Bennis and O’Toole<br />

describe for American business schools<br />

mirrors what we have seen worldwide<br />

in economic geology<br />

over the past<br />

half century.<br />

<strong>Economic</strong> geology<br />

in the academic<br />

sphere has<br />

become scientifically<br />

rigorous.<br />

The results <strong>of</strong> the<br />

research provide important insights into<br />

mantle processes, magma differentiation<br />

and cooling, metal behavior in critical<br />

fluids, etc. While these insights can<br />

help clever exploration geologists determine<br />

new models for ore genesis, the<br />

research rarely has an immediate bottom<br />

line impact on business. More<br />

emphasis is needed to ensure that the<br />

science developed in academia can be<br />

applied industrially.<br />

Perhaps more importantly, academic<br />

research is not only conducted by pr<strong>of</strong>essors<br />

but also by the students earning<br />

advanced (MS and PhD) degrees in economic<br />

geology. While some <strong>of</strong> these students<br />

will go on to become academics<br />

and follow in their mentors’ footsteps,<br />

most students are looking for employment<br />

in industry. Are what they are<br />

being taught and the research they are<br />

conducting really relevant for the business<br />

world they will enter? I think it is<br />

clear that in many cases, the answer is<br />

“no.”<br />

Company disillusionment with<br />

academia and the consequent difficulty<br />

in securing significant industrial financial<br />

support for academic programs<br />

may have much to do with the differing<br />

goals <strong>of</strong> academic and industry economic<br />

geologists. We all respond to<br />

rewards. For most academics this is<br />

gaining tenure through high quality<br />

scientific publications and successful<br />

governmental research grants. The<br />

tenure process generally does not place<br />

a high value on producing graduates<br />

who easily and successfully make the<br />

transition into industry.<br />

Most academic economic geologists,<br />

or even departments with a focus on<br />

economic geology research, do not have<br />

the background to be able to teach the<br />

practical basis <strong>of</strong> economic geology—<br />

which includes excellent geology and<br />

geochemistry but also the values and<br />

pitfalls <strong>of</strong> differing<br />

exploration geophysical<br />

MURRAY W. HITZMAN<br />

<strong>SEG</strong> President<br />

2005<br />

to page 8 ...

8 <strong>SEG</strong> NEWSLETTER No 63 • OCTOBER 2005<br />

... from 7<br />

Presidential Perspective (Continued)<br />

and geochemical techniques, the intricacies<br />

<strong>of</strong> ore reserve estimation, 3-D computer<br />

modeling skills, strategic exploration<br />

design, mineral economics, and<br />

increasingly the social and humanistic<br />

skills required <strong>of</strong> geologists to secure<br />

social license for their company’s operations.<br />

As Bennis and O’Toole (2005)<br />

state, business is “a human activity in<br />

which judgments are made with messy,<br />

incomplete, and incoherent data.”<br />

Applied economic geology involves such<br />

“messy” data both in the science, but<br />

also in our inevitable interactions with<br />

people as part <strong>of</strong> the exploration and<br />

mining business.<br />

Given the existing divergence in our<br />

field between the academic and the<br />

applied, what is to be done? The first step<br />

is to recognize the problem. Bennis and<br />

O’Toole (2005) wrote that “The distinction<br />

between a pr<strong>of</strong>ession and an academic<br />

discipline in crucial.” In the early<br />

20 th century, economic geology was<br />

taught at both universities and at<br />

schools <strong>of</strong> mines—the latter largely trade<br />

schools for the mining industry. Schools<br />

<strong>of</strong> mines have essentially disappeared<br />

from the academic world or metamorphosed<br />

into institutes <strong>of</strong> technology. We<br />

cannot go backward to the trade school<br />

paradigm, but it may be worth trying, as<br />

Bennis and O’Toole (2005) suggest, “to<br />

strike a new balance between scientific<br />

rigor and practical relevance.”<br />

Accomplishing this task will not be<br />

easy and it will require commitment<br />

from both the academic and industrial<br />

communities. For many schools, practical<br />

relevance will not be an option. Most<br />

academic administrations will not have<br />

the patience to undertake the re-organization<br />

<strong>of</strong> what is a very small and generally<br />

unpr<strong>of</strong>itable (academic institutions<br />

are businesses too!) part <strong>of</strong> their<br />

organization.<br />

Industry needs to identify the few<br />

schools that have an orientation that<br />

will allow practical research and teaching<br />

to flourish. Critically, industry will<br />

have to provide significant financial<br />

support to ensure that school administrations<br />

nurture and follow such a path.<br />

Without such support there will be no<br />

incentive for schools to reward academics<br />

for applied research and for<br />

teaching students the practicalities <strong>of</strong><br />

mineral exploration and production. If<br />

the funding from “pure” research bodies<br />

such as NSF exceeds the money available<br />

from industry for “applied”<br />

research, universities will obviously follow<br />

the larger pot <strong>of</strong> funding.<br />

There is urgency to this task. Very few<br />

schools worldwide retain the ability to<br />

undertake the sort <strong>of</strong> applied research<br />

and education required by industry.<br />

However, the mining industry does not<br />

employ large numbers <strong>of</strong> people.<br />

Probably five schools worldwide could<br />

IMDEX/Cascabel –<br />

Fifteen years <strong>of</strong> geological consulting in Mexico . . .<br />

PAID ADVERTISEMENT<br />

provide the industry with the critical<br />

personnel needed. Schools themselves<br />

will not undertake this selection process.<br />

Without significant financial incentives<br />

from industry, all schools will choose the<br />

scientific route as a practical business<br />

decision. Only a significant and stable<br />

source <strong>of</strong> industrial funding will encourage<br />

some schools to look to a pr<strong>of</strong>essional<br />

education in economic geology as<br />

a worthy goal and a sound business<br />

decision.<br />

<strong>Economic</strong> geology is both a pr<strong>of</strong>ession<br />

and a scientific discipline.<br />

Individuals in both spheres are critical<br />

to our continued success at producing<br />

the commodities that the world needs in<br />

ways that are socially acceptable.<br />

However, we are at a crossroads where<br />

the world’s educational infrastructure is<br />

about to totally embrace the scientific,<br />

rather than applied, paradigm for economic<br />

geology. Industry needs to step<br />

up to the plate to ensure that education<br />

can deliver both science and pr<strong>of</strong>essional<br />

training. With this step, industry<br />

can ensure that it gets the best and<br />

brightest to move mining confidently<br />

into the 21 st century.<br />

REFERENCES<br />

Bennis, W.G. and O’Toole, J., 2005, How business<br />

schools lost their way: Harvard<br />

Business Review, v. 83 (5), p. 96–104. 1<br />

Especialistas en ExploraciÓn Minera<br />

• Full range <strong>of</strong> pr<strong>of</strong>essional and geotechnical services<br />

• Accounting, tax, and paralegal services<br />

• Experienced Mexican personnel<br />

• Familiarity with all aspects <strong>of</strong> new permitting requirements<br />

• Bilingual contact personnel...who also understand geology<br />

• Confidential, competitive and cost effective<br />

• Rapid response to your personnel, permitting, and logistics needs<br />

Cia. Minera Cascabel S.A. de C.V.<br />

Ave. Trece, No. 100 • Col. Bugambilias Hermosillo, Sonora C.P. 83140 MEXICO<br />

Phone +52 (662) 215-7477 • Fax +52 (662) 215-8622<br />

• Extensive in-house computerized databases and hard copy files on<br />

mineral properties throughout the country for customized research.<br />

• Proven track record <strong>of</strong> project generation for clients<br />

URL: www.imdex.com<br />

E-mail: info@imdex.com<br />

.....and we are ready for the next wave !!!!<br />

IMDEX Inc.<br />

P.O. Box 65538 • Tucson, AZ 85728 USA<br />

Phone (520) 797-1618 • Fax (520) 797-3955

OCTOBER 2005 • No 63 <strong>SEG</strong> NEWSLETTER 9<br />

... from 5<br />

Exploring for Deposits Under Deep Cover Using Geochemistry (Continued)<br />

sulfide blanket up to 120 m thick that<br />

mainly underlies, but also overlaps,<br />

largely oxidized Au mineralization.<br />

Subsequent to supergene alteration, the<br />

deposit was covered by up to 240 m <strong>of</strong><br />

Eocene Carlin Formation comprised <strong>of</strong><br />

piedmont gravel, finer clastic sediments,<br />

waterlain tuff, and a basal conglomerate<br />

and regolith that contains mineralized<br />

(oxidized) clasts.<br />

The most probable mechanism for<br />

generating geochemical anomalies<br />

through 240 m <strong>of</strong> postmineral cover is<br />

by the movement <strong>of</strong> fluids or gases up<br />

faults in this cover. Dohrenwend and<br />

Moring (1991) carried out photo-geological<br />

interpretations <strong>of</strong> recent faulting in<br />

this region, and noted that faults could<br />

be identified by a number <strong>of</strong> criteria,<br />

the most relevant to the Mike area<br />

being “prominent alignments <strong>of</strong> linear<br />

drainageways, ridges and swales, active<br />

springs or spring deposits, and linear<br />

discontinuities <strong>of</strong> structure, rock type,<br />

and vegetation.” This faulting, which<br />

they assign to early to middle<br />

Pleistocene time (0.13 to 1.5 Ma), with a<br />

mean orientation <strong>of</strong> 028°, resulted in<br />

dissection <strong>of</strong> the surface. The topography<br />

<strong>of</strong> the Mike area (Fig. 1b) shows<br />

deeply incised dry stream beds with orientations<br />

close to 028°, which were<br />

interpreted by Cameron and Doherty<br />

(2001) to represent faults that cut the<br />

Carlin Formation. Interpreted fault A is<br />

marked by a stream and floodplain.<br />

Faults B and C are marked by steepsided<br />

valleys, which were dry during our<br />

visits. The east slope <strong>of</strong> the valley marking<br />

fault B is precipitous, which may<br />

indicate a fault scarp. Climate is semiarid,<br />

with sparse sagebrush vegetation.<br />

A soil sampling line was chosen that<br />

was normal to the strike <strong>of</strong> the interpreted<br />

faults cutting the Carlin Formation.<br />

Soils were collected from sites at 30<br />

m intervals; at each site, sub-samples<br />

were taken from a depth <strong>of</strong> 40 to 50 cm<br />

from five holes dug within a radius <strong>of</strong><br />

1.5 to 3.0 m. The five sub-samples were<br />

mixed to form a composite sample.<br />

Composite samples reduce sampling<br />

error, permitting less distinct anomalies<br />

to be identified. The soils were found to<br />

be immature with a weak B-horizon<br />

below 15 to 30 cm and a low organic<br />

content, except in alluvial soils around<br />

the stream that marks Channel A.<br />

Analyses <strong>of</strong> the soils after aqua regia<br />

extraction are shown in Figure 2. There<br />

are strong anomalies for Au and Cu on<br />

the steep west-facing (scarp) slope <strong>of</strong> the<br />

dry valley along fault B. There are no<br />

recognizable anomalies for these elements<br />

where the sampling line crosses<br />

fault A. A number <strong>of</strong> other elements<br />

show anomalies along the sampling<br />

line, the most prominent being Zn and<br />

Cd Aqua Regia, ppm<br />

Cu Aqua Regia, ppm<br />

Au Aqua Regia, ppb<br />

2.0<br />

1.6<br />

1.2<br />

0.8<br />

0.4<br />

0.0<br />

60<br />

40<br />

20<br />

0<br />

16<br />

12<br />

8<br />

4<br />

0<br />

Cadmium<br />

Copper<br />

Gold<br />

Fault'A'<br />

Cd. Cadmium shows a distinct anomaly<br />

along the scarp slope <strong>of</strong> fault B and a<br />

weaker anomaly where the line crosses<br />

fault A.<br />

During the period <strong>of</strong> 1999 to 2001,<br />

when our work on Mike<br />

was being carried out, to page 10 ...<br />

Fault 'B'<br />

0 500 1000 1500 m<br />

FIGURE 2. Plots <strong>of</strong> Au, Cu, and Cd by aqua regia extraction in soils from the line shown in<br />

Figure 1. Zero on the horizontal scale is at the northwest limit <strong>of</strong> the line. The strongest<br />

anomalies are found in the eastern (scarp) slope <strong>of</strong> the valley formed by fault B. This valley<br />

is the surface expression <strong>of</strong> the Nebulous fracture zone that dips west to the basement<br />

to form the bounding structure for secondary mineralization in the West Mike (Norby and<br />

Orobona, 2002)

10 <strong>SEG</strong> NEWSLETTER No 63 • OCTOBER 2005<br />

... from 9<br />

Exploring for Deposits Under Deep Cover Using Geochemistry (Continued)<br />

the strong anomalies for Zn and Cd<br />

were enigmatic. Why would these elements<br />

be strongly anomalous over an<br />

Au-Cu deposit? Further drilling by<br />

Newmont described by Norby and<br />

Orobona (2002) revealed the presence <strong>of</strong><br />

a deposit-wide blanket <strong>of</strong> sphalerite concentrated<br />

in the upper 60 m <strong>of</strong> the sulfide<br />

zone, approximately 500 m below<br />

surface. The secondary Zn blanket, containing<br />

1 to 4% Zn, contains submicrometer-sized<br />

framboids <strong>of</strong> sphalerite<br />

that have extremely low values for δ 34 S,<br />

down to –70‰, indicative <strong>of</strong> bacterial<br />

reduction <strong>of</strong> sulfate during supergene<br />

alteration (Bawden et al., 2003).<br />

Cadmium is a ubiquitous constituent <strong>of</strong><br />

sphalerite, with contents typically in the<br />

range 0.1 to 0.8% (Piatak et al., 2004).<br />

Newmont is currently measuring the Cd<br />

content <strong>of</strong> the sphalerite-rich zone.<br />

Preliminary results give average Cd/Zn<br />

ratios above that obtained from crustal<br />

abundance data for these elements.<br />

Norby and Orobona (2002) provide<br />

additional structural detail for the<br />

deposit. The interpreted post-Carlin<br />

Formation fault B, where the strongest<br />

geochemical anomalies are found at the<br />

surface, corresponds to the Nebulous<br />

fracture zone, which forms the boundary<br />

structure for the West Mike secondary<br />

mineralization, including the Zn-rich<br />

zone (John Norby, pers. commun., 2003).<br />

Its location in the basement was recognized<br />

by gravity contrast caused by <strong>of</strong>fsets<br />

along the basement unconformity.<br />

This fault has a westerly dip (Norby and<br />

Orobona, 2002), and thus the surface<br />

trace (fault B) shown by the topographic<br />

relief is east <strong>of</strong> the gravity expression in<br />

the basement (Figure 1a). Similarly, fault<br />

C is the surface expression <strong>of</strong> the westerly<br />

dipping North-Pointing Dog fault <strong>of</strong><br />

Norby and Orobona (2002). Fault A may<br />

be the surface topographic expression <strong>of</strong><br />

a westerly dipping D-Day fault or a<br />

down-faulted block between the<br />

D-Day and Hillside faults. North-northeast–striking<br />

faults, such as the<br />

Nebulous, locally control gold mineralization<br />

and also down-drop mineralization<br />

and the base <strong>of</strong> oxidation. There are<br />

landslides along the southwest projections<br />

<strong>of</strong> the Nebulous and D-Day faults<br />

(John Norby, pers. commun., 2003),<br />

which may reflect recent earthquakes.<br />

We interpret the anomalies at the<br />

surface intersection <strong>of</strong> the Nebulous<br />

fracture zone to be the result <strong>of</strong> mobilization<br />

<strong>of</strong> metals where the permeable<br />

fault zone cuts the ores, and pumping<br />

<strong>of</strong> the resulting metalliferous fluids up<br />

the fault. It is likely that it was the constituents<br />

<strong>of</strong> the sulfide zone that were<br />

the most amenable to oxidation and<br />

mobilization. In addition to Au, Cu, Cd,<br />

and Zn, other elements such as Ag, As,<br />

Ba, Hg, Mo, Ni, Sb, Se, and V are<br />

anomalous along the surface intersection<br />

<strong>of</strong> the Nebulous fault. Major elements<br />

such as K and Na, which might<br />

indicate hydrothermal alteration, are<br />

not enhanced. Isotopic studies by<br />

Dublyansky et al. (2003) at the Yucca<br />

Mountain nuclear waste disposal site,<br />

also in Nevada, have shown that fluids<br />

<strong>of</strong> deep-seated origin have moved up<br />

several hundred meters along a permeable<br />

fault through a thick vadose zone.<br />

SPENCE DEPOSIT<br />

Spence is a supergene-enriched copper<br />

porphyry deposit located between<br />

Ant<strong>of</strong>agasta and Calama in the<br />

Atacama Desert <strong>of</strong> northern Chile.<br />

RioChilex discovered the deposit in<br />

1996 by reconnaissance drilling.<br />

Porphyry intrusion and hypogene mineralization<br />

took place during the<br />

Palaeocene. Following supergene<br />

enrichment, the deposit was covered by<br />

50 to 100 m <strong>of</strong> piedmont gravels <strong>of</strong><br />

Miocene age. The gravels are indurated<br />

and for the most part are poorly sorted<br />

with a fine grained matrix that makes<br />

them relatively impermeable, except<br />

where fractured or in better sorted layers,<br />

as near their base. Copper minerals<br />

are atacamite and brochantite within<br />

the oxide zone, and chalcocite and covellite<br />

in the enriched zone. The primary<br />

sulfides comprise chalcopyrite, bornite,<br />

molybdenite, tennantite, and pyrite.<br />

Reserves recoverable by open-pit mining<br />

are 79 Mt <strong>of</strong> oxide ore at 1.18% Cu<br />

and 231 Mt <strong>of</strong> sulfide ore at 1.13% Cu.<br />

The long axis <strong>of</strong> the deposit and the<br />

porphyry intrusions trend north-northeast,<br />

similar to the orientation <strong>of</strong> a<br />

prominent lineament that runs through<br />

the area. We carried out sampling <strong>of</strong><br />

soils and groundwaters within and<br />

around the deposit in 1999 and 2000;<br />

results are described by Cameron et al.<br />

(2004) and Cameron and Leybourne<br />

(2005).<br />

In this region, groundwater flows<br />

southwest. Over most <strong>of</strong> the deposit, the<br />

water table lies within the basal gravels,<br />

which act as an aquifer, but in the<br />

south <strong>of</strong> the deposit it lies below the<br />

unconformity. Contents <strong>of</strong> Cl in the<br />

groundwaters (Fig. 3) show two distinct<br />

types <strong>of</strong> groundwater: low-salinity water<br />

east <strong>of</strong> the long axis <strong>of</strong> the deposit, and<br />

saline water west and downstream from<br />

the axis. There is an order <strong>of</strong> magnitude<br />

difference in the Cl content <strong>of</strong> the two<br />

waters, which average 1,300 mg/L and<br />

11,600 mg/L, respectively. The maximum<br />

for the saline water is 21,200<br />

mg/L, compared to seawater with<br />

19,000 mg/L Cl. The saline water is distinguished<br />

by high contents <strong>of</strong> a number<br />

<strong>of</strong> elements, most notably As (Fig. 3)<br />

and Se, but also, B, Br, Ca, I, K, Li , Mg,<br />

Sr, and Rb (Cameron and Leybourne,<br />

2005).<br />

The two waters are also distinguished<br />

by differences in their isotopic composition.<br />

On a δ 2 H vs. δ 18 O plot (Fig. 4), the<br />

low-salinity waters plot near the global<br />

meteoric water line (GMWL), whereas<br />

the saline waters plot well to the right<br />

(Cameron and Leybourne, 2005). Formation<br />

waters recovered from deep sedimentary<br />

basins are different from meteoric<br />

waters, both in their higher salinity<br />

and the deviation in δ 2 H and δ 18 O values<br />

from the GMWL. The saline groundwaters<br />

from Spence plot within the field<br />

<strong>of</strong> formation waters indicating that the<br />

waters found on either side <strong>of</strong> the axis<br />

<strong>of</strong> the deposit are <strong>of</strong> different origins:<br />

those to the east are meteoric waters,<br />

those to the west are formation waters,<br />

with mixing <strong>of</strong> the two as they flow<br />

down-gradient towards the southwest.<br />

The Atacama Desert is hyper-arid;<br />

rainfall may occur only once every few<br />

years. Recharge for the groundwater<br />

that lies beneath the desert floor is in<br />

the Andes mountains and foothills ca.<br />

120 km to the east, and precipitation is<br />

significant only above altitudes <strong>of</strong> 3,000<br />

m (Spence lies at 1,700 m). The δ 18O<br />

composition <strong>of</strong> precipitation varies with<br />

the altitude <strong>of</strong> the land surface, becoming<br />

increasingly negative with greater<br />

altitude. In northern Chile, Aravena et<br />

al. (1999) found values <strong>of</strong> δ 18O in the<br />

range –5 to –7 ‰ at 2,500 m altitude,<br />

decreasing to –20 ‰ above 4,000 m.<br />

The least saline <strong>of</strong> the Spence groundwaters,<br />

which are interpreted to be <strong>of</strong><br />

meteoric origin, range in δ 18 O from –8<br />

to –11 ‰, consistent with derivation<br />

from precipitation at higher altitudes<br />

east <strong>of</strong> Spence.<br />

Over the deposit, Cu is enriched in<br />

both saline and meteoric waters (Fig. 5),

OCTOBER 2005 • No 63 <strong>SEG</strong> NEWSLETTER 11<br />

7482000N<br />

7481000N<br />

7480000N<br />

473000E 474000E<br />

475000E 476000E 473000E 474000E<br />

475000E 476000E<br />

10500<br />

8500<br />

Cl mg/l<br />

15100<br />

21200 6900 900<br />

Groundwater<br />

Flow<br />

8600<br />

7100<br />

15000<br />

7000<br />

11200 00<br />

13500 350<br />

6600 660<br />

as a result <strong>of</strong> oxidation <strong>of</strong> the Cu minerals<br />

within the deposit, but high values<br />

do not persist downflow from the<br />

deposit. Copper dissolves in groundwaters<br />

as a cation Cu 2+, which is readily<br />

adsorbed on negatively charged Fe and<br />

Al oxyhydroxide colloids and coatings.<br />

17500<br />

200<br />

1700<br />

3900<br />

2400 24<br />

13600 00<br />

600 60<br />

n/a<br />

100<br />

100<br />

33200<br />

n/a<br />

200<br />

1000<br />

Approximate Limits<br />

<strong>of</strong> Mineralization<br />

By contrast, higher values for Mo, As,<br />

and Se persist in the downflow waters.<br />

The latter three elements dissolve as<br />

anions, which are not adsorbed by oxyhydroxide<br />

colloids. In order to determine<br />

which elements are most prone to<br />

be adsorbed on oxyhydroxide colloids<br />

50<br />

36<br />

As, ppb<br />

93<br />

73<br />

33 71<br />

29<br />

12 <strong>SEG</strong> NEWSLETTER No 63 • OCTOBER 2005<br />

... from 11<br />

7482000N<br />

7481000N<br />

7480000N<br />

7479000N<br />

13<br />

Exploring for Deposits Under Deep Cover Using Geochemistry (Continued)<br />

473000E 474000E<br />

475000E 24 476000E<br />

10<br />

Cu ppb<br />

Analyses <strong>of</strong> the soils showed that<br />

zones <strong>of</strong> high conductivity <strong>of</strong> soil-water<br />

slurries is due to the dissolution <strong>of</strong> NaCl<br />

(Na is shown in Fig. 6). Figure 6 also<br />

shows As and Se by Enzyme Leach, and<br />

Cu by Enzyme Leach, Mobile Metal Ions<br />

(MMI), and aqua regia. Enzyme Leach<br />

and MMI are proprietary leach methods<br />

designed to extract the weakly soluble<br />

fraction <strong>of</strong> metals, whereas aqua regia<br />

is a strong reagent that dissolves a<br />

much higher proportion <strong>of</strong> the total element<br />

in the soil. The active reagents in<br />

the Enzyme Leach solution are hydrogen<br />

peroxide and gluconic acid, the former<br />

solubilizing manganese oxides and<br />

their contained metals, with the gluconic<br />

acid stabilizing the metals in solution.<br />

In the soils from Spence, Enzyme<br />

Leach dissolves approximately the same<br />

amounts <strong>of</strong> elements as deionized<br />

water, but provides more reproducible<br />

analyses. The formulation <strong>of</strong> the MMI<br />

leach has not been revealed, but contains<br />

reagents that extract the most<br />

readily soluble fraction <strong>of</strong> elements,<br />

including those in carbonates.<br />

Sodium, As, and Se are all enriched<br />

in the soils lying above the fracture<br />

zone over the deposit and in the soils<br />

13<br />

Groundwater<br />

Flow<br />

14<br />

14<br />

19 191<br />

195<br />

1200 200<br />

121<br />

812<br />

10<br />

224<br />

88<br />

48<br />

25<br />

955<br />

1180<br />

4490<br />

53<br />

9<br />

41<br />

127 27<br />

12<br />

29<br />

Boundary between<br />

saline and non-saline<br />

waters<br />

Approximate Limits<br />

<strong>of</strong> Mineralization<br />

above the eastern fracture zone. Copper<br />

is enriched only in soils over the<br />

deposit. The anomaly/background contrast<br />

for Cu is much better for Enzyme<br />

Leach and MMI analyses than for aqua<br />

regia (Fig. 6). Much <strong>of</strong> the anomalous<br />

Cu in soils over the deposit is hosted by<br />

carbonate minerals. Analyses after<br />

extraction by ammonium acetate, a<br />

reagent that specifically dissolves carbonates,<br />

shows even higher values for<br />

Cu than MMI, but similar<br />

anomaly/background contrast<br />

(Cameron et al., 2004).<br />

We have interpreted these results to<br />

be caused by pumping <strong>of</strong> saline basement<br />

waters to the surface during earthquake<br />

activity (Cameron et al., 2002,<br />

2004). We interpret the data to indicate<br />

two faults in the basement, one directly<br />

along the axis <strong>of</strong> the deposit, and the<br />

other coincident with the eastern fracture<br />

zone. Saline water with high contents<br />

<strong>of</strong> As and Se were moved to the<br />

surface above the deposit and above the<br />

eastern fracture zone. Copper is only<br />

enriched in groundwaters within the<br />

deposit and these were entrained by the<br />

rising basement waters and taken to the<br />

surface. There is no increase in Cu in<br />

473000E 474000E<br />

475000E 476000E<br />

60 0<br />

15<br />

Mo, ppb<br />

24<br />

263<br />

105<br />

354<br />

<strong>45</strong><br />

2<br />

53<br />

66<br />

Soil Traverse<br />

63<br />

5<br />

18<br />

221<br />

222<br />

25<br />

33<br />

38<br />

soils above the eastern fracture zone.<br />

Drilling has shown the basement in this<br />

area to be barren. The above scenario is<br />

summarized in Figure 7. Saline water<br />

moves up from the basement along the<br />

axis <strong>of</strong> the deposit, where it mixes with<br />

meteoric water flowing in from the east.<br />

During earthquake activity, the basement<br />

water, plus mineralized water<br />

bathing the deposit, is forced to the surface.<br />

As noted by Woodall (2005), structures<br />

form pathways for magma, fluids,<br />

and energy. Thus, the interpreted fault<br />

zone along the axis <strong>of</strong> the deposit could<br />

have provided a pathway for porphyry<br />

magma, hypogene fluids, the fracturing<br />

<strong>of</strong> the mostly impermeable cover gravels<br />

during reactivation, and the movement<br />

<strong>of</strong> groundwaters to the surface.<br />

These points are unproven, but with<br />

mining <strong>of</strong> the deposit now commenced<br />

by BHP-Billiton, more definitive answers<br />

are expected.<br />

DISCUSSION AND<br />

CONCLUSIONS<br />

7<br />

40<br />

69<br />

Approximate Limits<br />

<strong>of</strong> Mineralization<br />

FIGURE 5. Plots <strong>of</strong> Cu and Mo (both in ppb) in groundwaters from in and around the Spence deposit. The line running roughly north-south<br />

near the axis <strong>of</strong> the deposit on the Cu plot separates low salinity meteoric waters to the east from saline deep formation waters to the<br />

west (Fig. 3). Within the deposit, higher values for Cu occur in both types <strong>of</strong> water, but are absent in the waters flowing away from the<br />

deposit to the southwest. By contrast, higher values <strong>of</strong> Mo are present in the downflow waters. The location <strong>of</strong> the soil sampling traverse is<br />

shown in the Mo plot. Eastings and northings in meters.<br />

The use <strong>of</strong> soil geochemistry in the<br />

search for buried deposits requires that<br />

32<br />

9<br />

54<br />

136<br />

9

OCTOBER 2005 • No 63 <strong>SEG</strong> NEWSLETTER 13<br />

2000<br />

1600<br />

1200<br />

800<br />

400<br />

0<br />

500<br />

400<br />

300<br />

200<br />

100<br />

0<br />

6000<br />

4000<br />

2000<br />

As Enzyme Leach, ppb<br />

Se Enzyme Leach, ppb<br />

Na Deionized Water Leach, ppm<br />

0<br />

473500 474000 47<strong>45</strong>00 475000 475500 476000<br />

Spence<br />

Deposit<br />

elements be moved from depth to the<br />

surface, either in gaseous form or dissolved<br />

in water. In arid regions, advective<br />

transfer, as by barometric pumping<br />

<strong>of</strong> air containing gas through fractured<br />

rock or seismic pumping <strong>of</strong> mineralized<br />

groundwater through fractured rock,<br />

appears to be more effective than diffusive<br />

processes (Cameron et al., 2004).<br />

The diffusion <strong>of</strong> gas through air and<br />

rock is slower than advection, and diffusion<br />

<strong>of</strong> dissolved constituents in the<br />

water film that exists around grains in<br />

the vadose zone is ineffective because<br />

the rate that these films migrate downward<br />

is orders <strong>of</strong> magnitude faster than<br />

the upward rates <strong>of</strong> diffusion.<br />

Exploration methods based on diffusion<br />

(e.g., Hamilton, 1998; Smee, 2003) may<br />

have greater application in regions like<br />

the Canadian Shield, where recent<br />

seismicity is rare, where the climate is<br />

wetter, and where sediments <strong>of</strong> glacial<br />

Eastern Fracture<br />

Zone<br />

120000<br />

80000<br />

40000<br />

15000<br />

10000<br />

5000<br />

origin that are generally unfractured<br />

cover mineralized basement rocks.<br />

In this article we have described two<br />

examples from seismically active,<br />