Outline of Coverage - Premera Blue Cross

Outline of Coverage - Premera Blue Cross

Outline of Coverage - Premera Blue Cross

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

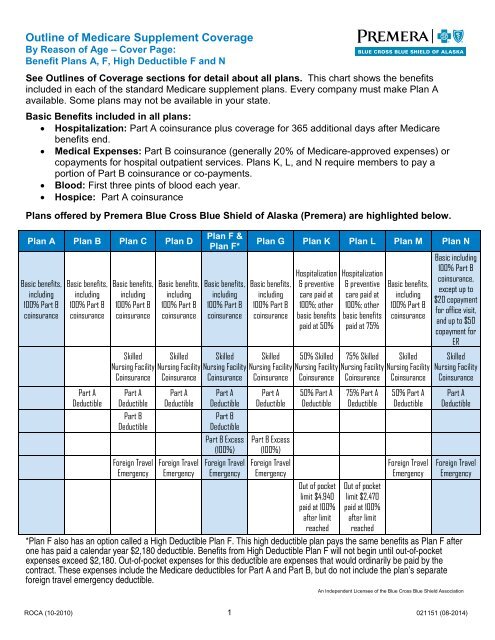

<strong>Outline</strong> <strong>of</strong> Medicare Supplement <strong>Coverage</strong>By Reason <strong>of</strong> Age – Cover Page:Benefit Plans A, F, High Deductible F and NSee <strong>Outline</strong>s <strong>of</strong> <strong>Coverage</strong> sections for detail about all plans. This chart shows the benefitsincluded in each <strong>of</strong> the standard Medicare supplement plans. Every company must make Plan Aavailable. Some plans may not be available in your state.Basic Benefits included in all plans:• Hospitalization: Part A coinsurance plus coverage for 365 additional days after Medicarebenefits end.• Medical Expenses: Part B coinsurance (generally 20% <strong>of</strong> Medicare-approved expenses) orcopayments for hospital outpatient services. Plans K, L, and N require members to pay aportion <strong>of</strong> Part B coinsurance or co-payments.• Blood: First three pints <strong>of</strong> blood each year.• Hospice: Part A coinsurancePlans <strong>of</strong>fered by <strong>Premera</strong> <strong>Blue</strong> <strong>Cross</strong> <strong>Blue</strong> Shield <strong>of</strong> Alaska (<strong>Premera</strong>) are highlighted below.Plan A Plan B Plan C Plan DBasic benefits,including100% Part BcoinsuranceBasic benefits,including100% Part BcoinsurancePart ADeductibleBasic benefits,including100% Part BcoinsuranceSkilledNursing FacilityCoinsurancePart ADeductiblePart BDeductibleForeign TravelEmergencyBasic benefits,including100% Part BcoinsuranceSkilledNursing FacilityCoinsurancePart ADeductibleForeign TravelEmergencyPlan F &Plan F*Basic benefits,including100% Part BcoinsuranceSkilledNursing FacilityCoinsurancePart ADeductiblePart BDeductiblePart B Excess(100%)Foreign TravelEmergencyPlan G Plan K Plan L Plan M Plan NBasic benefits,including100% Part BcoinsuranceSkilledNursing FacilityCoinsurancePart ADeductiblePart B Excess(100%)Foreign TravelEmergencyHospitalization& preventivecare paid at100%; otherbasic benefitspaid at 50%50% SkilledNursing FacilityCoinsurance50% Part ADeductibleOut <strong>of</strong> pocketlimit $4,940paid at 100%after limitreachedHospitalization& preventivecare paid at100%; otherbasic benefitspaid at 75%75% SkilledNursing FacilityCoinsurance75% Part ADeductibleOut <strong>of</strong> pocketlimit $2,470paid at 100%after limitreachedBasic benefits,including100% Part BcoinsuranceSkilledNursing FacilityCoinsurance50% Part ADeductibleForeign TravelEmergencyBasic including100% Part Bcoinsurance,except up to$20 copaymentfor <strong>of</strong>fice visit,and up to $50copayment forERSkilledNursing FacilityCoinsurancePart ADeductibleForeign TravelEmergency*Plan F also has an option called a High Deductible Plan F. This high deductible plan pays the same benefits as Plan F afterone has paid a calendar year $2,180 deductible. Benefits from High Deductible Plan F will not begin until out-<strong>of</strong>-pocketexpenses exceed $2,180. Out-<strong>of</strong>-pocket expenses for this deductible are expenses that would ordinarily be paid by thecontract. These expenses include the Medicare deductibles for Part A and Part B, but do not include the plan’s separateforeign travel emergency deductible.An Independent Licensee <strong>of</strong> the <strong>Blue</strong> <strong>Cross</strong> <strong>Blue</strong> Shield AssociationROCA (10-2010) 1 021151 (08-2014)

SUBSCRIPTION CHARGES AND PAYMENT INFORMATION(Rates effective January 1, 2015)SUBSCRIPTION CHARGE INFORMATIONWe (<strong>Premera</strong>) can only raise your subscription charges if we raise the subscription charges for allcontracts like yours in this state.In each year, we base your subscription charge rate on your age on January 1. For instance, ifyou are already 66 on January 1, 2015, we will charge you the rate for subscribers who are age 66.If, on January 1, 2015, you have not turned 66 yet, we will charge you the rate for subscribers whoare age 65.PAYMENT MODE OPTIONSMonthly payment by Automatic Funds Transfer (AFT). Rates shown reflect a $5 monthly discount forAFT payments compared to the Paper Bill Option.ORIf you prefer us to bill you, <strong>Premera</strong> will send you a paper bill in the mail each month.AFT Payment OptionMonthly Subscription Charges Per PersonAge onPlan A Plan F Plan F* Plan N1/1/15Paper Bill OptionMonthly Subscription Charges Per PersonAge onPlan A Plan F Plan F* Plan N1/1/15Age 65-69 $111 $149 $61 $113 Age 65-69 $116 $154 $66 $118Age 70-74 $136 $182 $75 $138 Age 70-74 $141 $187 $80 $143Age 75+ $169 $227 $95 $173 Age 75+ $174 $232 $100 $178*High Deductible Plan F*High Deductible Plan F2

FPLAN F:MEDICARE (PART A) - HOSPITAL SERVICES - PER BENEFIT PERIOD*A benefit period begins on the first day you receive service as an inpatient in a hospital and ends after you have been out <strong>of</strong>the hospital and have not received skilled care in any other facility for 60 days in a row.SERVICESMEDICAREPAYSPLAN F PAYS YOU PAYHOSPITALIZATION*Semi-private room and board, general nursing and miscellaneous services and suppliesFirst 60 days All but $1,260$1,260(Part A Deductible)$061st through 90th day All but $315 a day $315 a day $091st day and after:(while using 60 lifetime reserve days)All but $630 a day $630 a day $0Once lifetime reserve days are used:• Additional 365 days$0100% <strong>of</strong> Medicareeligible expenses$0***• Beyond the additional 365 days $0 $0 All costsSKILLED NURSING FACILITY CARE*You must meet Medicare's requirements, including having been in a hospital for at least 3 days andentered a Medicare-approved facility within 30 days after leaving the hospitalFirst 20 daysAll approvedamounts$0 $021st through 100th dayAll but $157.50a dayUp to $157.50a day101st day and after $0 $0 All costsBLOODFirst 3 pints $0 3 pints $0Additional amounts 100% $0 $0HOSPICE CAREYou must meet Medicare'srequirements, including a doctor'scertification <strong>of</strong> terminal illness.All but very limitedcopayment /coinsurance foroutpatient drugsand inpatientrespite careMedicarecopayment /coinsurance***NOTICE: When your Medicare Part A hospital benefits are exhausted, the carrier stands in the place <strong>of</strong> Medicare and willpay whatever amount Medicare would have paid for up to an additional 365 days as provided in the plan’s Basic Benefits.During this time, the hospital is prohibited from billing you for the balance based on any difference between its billed chargesand the amount Medicare would have paid.$0$06

FPLAN F (continued):MEDICARE (PART B) - MEDICAL SERVICES - PER CALENDAR YEAR* Once you have been billed $147 <strong>of</strong> Medicare-approved amounts for covered services (which are noted with an asterisk),your Part B deductible will have been met for the calendar year.SERVICESMEDICAREPAYSPLAN F PAYSYOU PAYMEDICAL EXPENSESIn or out <strong>of</strong> the Hospital and Outpatient Hospital Treatment, such as physician's services, inpatientand outpatient medical and surgical services and supplies, physical and speech therapy, diagnostictests, durable medical equipment.First $147 <strong>of</strong> Medicare approvedamounts*Remainder <strong>of</strong> Medicare approvedamountsPart B Excess Charges(above Medicare approved amounts)BLOOD$0$147(Part B Deductible)$0Generally 80% Generally 20% $0$0 100% $0First 3 pints $0 All costs $0Next $147 <strong>of</strong> Medicare approvedamounts*Remainder <strong>of</strong> Medicare approvedamountsCLINICAL LABORATORY SERVICES$0$147(Part B Deductible)$080% 20% $0Tests for diagnostic services 100% $0 $0MEDICARE (PARTS A & B)SERVICESMEDICAREPAYSPLAN F PAYS YOU PAYHOME HEALTH CARE - Medicare approved servicesMedically Necessary Skilled CareServices and Medical Supplies100% $0 $0Durable Medical EquipmentFirst $147 <strong>of</strong> Medicare approvedamounts*Remainder <strong>of</strong> Medicare approvedamounts$0$147(Part B Deductible)$080% 20% $07

FPLAN F (continued):OTHER BENEFITS - NOT COVERED BY MEDICAREMEDICARESERVICESPLAN F PAYS YOU PAYPAYSFOREIGN TRAVEL - Not covered by MedicareMedically necessary emergency care services beginning during the first 60 days <strong>of</strong> each trip outsidethe USAFirst $250 each calendar year $0 $0 $250Remainder <strong>of</strong> charges $080% to a lifetimemaximum benefit<strong>of</strong> $50,00020% and amountsover the $50,000lifetime maximum8

FHIGH DEDUCTIBLE PLAN F:MEDICARE (PART A) - HOSPITAL SERVICES - PER BENEFIT PERIOD*A benefit period begins on the first day you receive service as an inpatient in a hospital and ends after you have been out <strong>of</strong>the hospital and have not received skilled care in any other facility for 60 days in a row.**This high deductible plan pays the same benefits as Plan F after one has paid a calendar year $2,180 deductible. Benefitsfrom the High Deductible Plan F will not begin until out <strong>of</strong> pocket expenses are $2,180. Out-<strong>of</strong>-pocket expenses for thisdeductible are expenses that would ordinarily be paid by the plan. This includes the Medicare deductibles for Part A and PartB, but does not include the plan’s separate foreign travel emergency deductible.SERVICESMEDICAREPAYSAFTER YOU PAY$2,180DEDUCTIBLE**,PLAN F PAYSIN ADDITION TO$2,180DEDUCTIBLE**,YOU PAYHOSPITALIZATION*Semi-private room and board, general nursing and miscellaneous services and suppliesFirst 60 days All but $1,260$1,260(Part A Deductible)$061st through 90th day All but $315 a day $315 a day $091st day and after:(while using 60 lifetime reserve days)All but $630 a day $630 a day $0Once lifetime reserve days are used:• Additional 365 days$0100% <strong>of</strong> Medicareeligible expenses$0***• Beyond the additional 365 days $0 $0 All costsSKILLED NURSING FACILITY CARE*You must meet Medicare's requirements, including having been in a hospital for at least 3 days andentered a Medicare-approved facility within 30 days after leaving the hospitalFirst 20 daysAll approvedamounts$0 $021st through 100th dayAll but $157.50a dayUp to $157.50a day101st day and after $0 $0 All costsBLOODFirst 3 pints $0 3 pints $0Additional amounts 100% $0 $0HOSPICE CAREYou must meet Medicare'srequirements, including a doctor'scertification <strong>of</strong> terminal illness.All but very limitedcopayment /coinsurance foroutpatient drugsand inpatientrespite careMedicarecopayment /coinsurance***NOTICE: When your Medicare Part A hospital benefits are exhausted, the carrier stands in the place <strong>of</strong> Medicare and willpay whatever amount Medicare would have paid for up to an additional 365 days as provided in the plan’s Basic Benefits.During this time, the hospital is prohibited from billing you for the balance based on any difference between its billed chargesand the amount Medicare would have paid.$0$09

FHIGH DEDUCTIBLE PLAN F (continued):MEDICARE (PART B) - MEDICAL SERVICES - PER CALENDAR YEAR*Once you have been billed $147 <strong>of</strong> Medicare-approved amounts for covered services (which are noted with an asterisk),your Part B deductible will have been met for the calendar year.**This high deductible plan pays the same or <strong>of</strong>fers the same benefits as Plan F after one has paid a calendar year $2,180deductible. Benefits from the High Deductible Plan F will not begin until out <strong>of</strong> pocket expenses are $2,180. Out-<strong>of</strong>-pocketexpenses for this deductible are expenses that would ordinarily be paid by the plan. This includes the Medicare deductiblesfor Part A and Part B, but does not include the plan’s separate foreign travel emergency deductible.SERVICESMEDICAREPAYSAFTER YOU PAY$2,180DEDUCTIBLE**,PLAN F PAYSIN ADDITION TO$2,180DEDUCTIBLE**,YOU PAYMEDICAL EXPENSESIn or out <strong>of</strong> the Hospital and Outpatient Hospital Treatment, such as physician's services, inpatientand outpatient medical and surgical services and supplies, physical and speech therapy, diagnostictests, durable medical equipment.First $147 <strong>of</strong> Medicare approvedamounts*Remainder <strong>of</strong> Medicare approvedamountsPart B Excess Charges(above Medicare approved amounts)BLOOD$0$147(Part B Deductible)$0Generally 80% Generally 20% $0$0 100% $0First 3 pints $0 All costs $0Next $147 <strong>of</strong> Medicare approvedamounts*Remainder <strong>of</strong> Medicare approvedamountsCLINICAL LABORATORY SERVICES$0$147(Part B Deductible)$080% 20% $0Tests for diagnostic services 100% $0 $010

FHIGH DEDUCTIBLE PLAN F (continued):MEDICARE (PARTS A & B)*Once you have been billed $147 <strong>of</strong> Medicare-approved amounts for covered services (which are noted with an asterisk),your Part B deductible will have been met for the calendar year.SERVICESMEDICAREPAYSHOME HEALTH CARE - Medicare approved servicesMedically Necessary Skilled CareServices and Medical SuppliesDurable Medical EquipmentFirst $147 <strong>of</strong> Medicare approvedamounts*Remainder <strong>of</strong> Medicare approvedamountsAFTER YOU PAY$2,180DEDUCTIBLE**,PLAN F PAYSIN ADDITION TO$2,180DEDUCTIBLE**,YOU PAY100% $0 $0$0$147(Part B Deductible)$080% 20% $0HIGH DEDUCTIBLE PLAN F (continued):OTHER BENEFITS - NOT COVERED BY MEDICARESERVICESMEDICAREPAYSAFTER YOU PAY$2,180DEDUCTIBLE**,PLAN F PAYSIN ADDITION TO$2,180DEDUCTIBLE**,YOU PAYFOREIGN TRAVEL - Not covered by MedicareMedically necessary emergency care services beginning during the first 60 days <strong>of</strong> each trip outsidethe USAFirst $250 each calendar year $0 $0 $250Remainder <strong>of</strong> charges $080% to a lifetimemaximum benefit<strong>of</strong> $50,00020% and amountsover the $50,000lifetime maximum11

NPLAN N:MEDICARE (PART A) - HOSPITAL SERVICES - PER BENEFIT PERIOD* A benefit period begins on the first day you receive service as an inpatient in a hospital and ends after you have been out <strong>of</strong>the hospital and have not received skilled care in any other facility for 60 days in a row.SERVICESMEDICAREPAYSPLAN N PAYSHOSPITALIZATION*Semi-private room and board, general nursing and miscellaneous services and suppliesFirst 60 days All but $1,260$1,260(Part A Deductible)YOU PAY61st through 90th day All but $315 a day $315 a day $091st day and after:(while using 60 lifetime reserve days)Once lifetime reserve days are used:• Additional 365 days$0All but $630 a day $630 a day $0$0100% <strong>of</strong> Medicareeligible expenses• Beyond the additional 365 days $0 $0 All costsSKILLED NURSING FACILITY CARE*You must meet Medicare's requirements, including having been in a hospital for at least 3 days andentered a Medicare-approved facility within 30 days after leaving the hospitalFirst 20 days21st through 100th dayAll approvedamountsAll but $157.50a day$0**$0 $0Up to $157.50a day101st day and after $0 $0 All costsBLOODFirst 3 pints $0 3 pints $0Additional amounts 100% $0 $0HOSPICE CAREYou must meet Medicare'srequirements, including a doctor'scertification <strong>of</strong> terminal illness.All but very limitedcopayment /coinsurance foroutpatient drugsand inpatientrespite careMedicarecopayment /coinsurance**NOTICE: When your Medicare Part A hospital benefits are exhausted, the carrier stands in the place <strong>of</strong> Medicare and willpay whatever amount Medicare would have paid for up to an additional 365 days as provided in the plan’s Basic Benefits.During this time, the hospital is prohibited from billing you for the balance based on any difference between its billed chargesand the amount Medicare would have paid.$0$012

NPLAN N (continued):MEDICARE (PART B) - MEDICAL SERVICES - PER CALENDAR YEAR*Once you have been billed $147 <strong>of</strong> Medicare-approved amounts for covered services (which are noted with an asterisk),your Part B deductible will have been met for the calendar year.SERVICESMEDICAREPAYSPLAN N PAYSYOU PAYMEDICAL EXPENSESIn or out <strong>of</strong> the Hospital and Outpatient Hospital Treatment, such as physician's services, inpatientand outpatient medical and surgical services and supplies, physical and speech therapy, diagnostictests, durable medical equipment.First $147 <strong>of</strong> Medicare approvedamounts*Remainder <strong>of</strong> Medicare approvedamountsPart B Excess Charges(above Medicare approved amounts)BLOOD$0 $0Generally 80%Balance, otherthan up to $20 per<strong>of</strong>fice visit and upto $50 peremergency roomvisit. Thecopayment <strong>of</strong> up to$50 is waived if themember isadmitted to anyhospital and theemergency visit iscovered as aMedicare Part Aexpense$147(Part B Deductible)Up to $20 per<strong>of</strong>fice visit and upto $50 peremergency roomvisit. Thecopayment <strong>of</strong> upto $50 is waivedif the member isadmitted to anyhospital and theemergency visitis covered as aMedicare Part Aexpense$0 $0 All costsFirst 3 pints $0 All costs $0Next $147 <strong>of</strong> Medicare approvedamounts*Remainder <strong>of</strong> Medicare approvedamountsCLINICAL LABORATORY SERVICES$0 $0$147(Part B Deductible)80% 20% $0Tests for diagnostic services 100% $0 $013

NPLAN N (continued):MEDICARE (PARTS A & B)*Once you have been billed $147 <strong>of</strong> Medicare-approved amounts for covered services (which are noted with an asterisk),your Part B deductible will have been met for the calendar year.SERVICESMEDICAREPAYSHOME HEALTH CARE - Medicare approved servicesMedically Necessary Skilled CareServices and Medical SuppliesDurable Medical EquipmentFirst $147 <strong>of</strong> Medicare approvedamounts*Remainder <strong>of</strong> Medicare approvedamountsPLAN N PAYSYOU PAY100% $0 $0$0 $0$147(Part B Deductible)80% 20% $0PLAN N (continued):OTHER BENEFITS - NOT COVERED BY MEDICAREMEDICARESERVICESPLAN N PAYS YOU PAYPAYSFOREIGN TRAVEL - Not covered by MedicareMedically necessary emergency care services beginning during the first 60 days <strong>of</strong> each trip outsidethe USAFirst $250 each calendar year $0 $0 $250Remainder <strong>of</strong> charges $080% to a lifetimemaximum benefit<strong>of</strong> $50,00020% and amountsover the $50,000lifetime maximum14