Agent Registration - Visa Asia Pacific

Agent Registration - Visa Asia Pacific

Agent Registration - Visa Asia Pacific

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Agent</strong> <strong>Registration</strong>Program Guidelines(For use in <strong>Asia</strong> <strong>Pacific</strong>, Central Europe, Middle East and Africa)

Contents1 INTRODUCTION ........................................................................................................................... 31.1 BACKGROUND........................................................................................................................... 31.2 PURPOSE OF DOCUMENT ........................................................................................................... 41.3 WHO NEEDS TO BE REGISTERED? .............................................................................................. 51.4 WHY IS IT NECESSARY TO REGISTER THE AGENT? ..................................................................... 72 REGISTRATION PROCESS......................................................................................................... 82.1 REGISTRATION PROCESS........................................................................................................... 82.2 WHEN TO REGISTER .................................................................................................................. 82.3 REGISTRATION FORMS.............................................................................................................. 93 REGISTRATION FEES ............................................................................................................... 104 REGISTRATION NON-COMPLIANCE.................................................................................... 115 OTHER COMPLIANCE REQUIREMENTS............................................................................. 125.1 VISA PROGRAM COMPLIANCE................................................................................................. 126 FREQUENTLY ASKED QUESTIONS....................................................................................... 147 REFERENCES .............................................................................................................................. 187.1 AGENT WEBSITE ..................................................................................................................... 187.2 THIRD PARTY COMPLIANCE REQUIREMENTS.......................................................................... 187.3 OTHER PROGRAM LINKS......................................................................................................... 187.4 EMAIL CONTACT..................................................................................................................... 18GLOSSARY............................................................................................................................................. 19

<strong>Agent</strong> <strong>Registration</strong> Program Guidelines1 Introduction1.1 Background<strong>Agent</strong>s can be an effective resource for <strong>Visa</strong> clients to use whenmanaging their acquiring and issuing programs.The <strong>Agent</strong> <strong>Registration</strong> Program is a <strong>Visa</strong>-mandated program enactedto ensure that <strong>Visa</strong> clients are in compliance with <strong>Visa</strong> Inc. OperatingRegulations (“VIOR”) and policies regarding their use of <strong>Agent</strong>s. <strong>Visa</strong>clients are required to perform due diligence reviews to ensure thatthey understand the <strong>Agent</strong>’s business model, financial conditions,background and Payment Card Industry Data Security Standard (PCIDSS) compliance status (where applicable).<strong>Agent</strong> registration is required for all entities that provide <strong>Visa</strong> paymentrelated services, directly or indirectly, to a <strong>Visa</strong> client.3

<strong>Agent</strong> <strong>Registration</strong> Program Guidelines1.2 Purpose of DocumentThis document explains the <strong>Agent</strong> registration requirements for <strong>Visa</strong>clients and their agents. <strong>Visa</strong>’s <strong>Agent</strong> registration program is intendedto help the clients and agents:• Understand their accountabilities and responsibilities to the<strong>Visa</strong> payment system;• Ensure their compliance with the <strong>Visa</strong> International OperatingRegulations (VIOR) and regional operating regulation.These guidelines for <strong>Agent</strong> <strong>Registration</strong> should serve as a referencefor <strong>Visa</strong> clients and <strong>Agent</strong>s when outsourcing <strong>Visa</strong> payment relatedservices to <strong>Agent</strong>s within and outside the <strong>Asia</strong> <strong>Pacific</strong> region.4

<strong>Agent</strong> <strong>Registration</strong> Program Guidelines1.3 Who needs to be registered?Generally, an agent is an entity engaged to provide <strong>Visa</strong> paymentrelatedservices, directly or indirectly, to a <strong>Visa</strong> client. An <strong>Agent</strong> can bea <strong>Visa</strong>Net Processor (VNP), Third Party, or both.A <strong>Visa</strong>Net Processor (VNP) – is a <strong>Visa</strong> client or <strong>Visa</strong> approved non-<strong>Visa</strong> client that is directly connected to <strong>Visa</strong>Net and providesAuthorization, Clearing, Settlement, or payment-related processingservices for merchants or other <strong>Visa</strong> clients.A Third Party is an entity, not defined as a <strong>Visa</strong>Net Processor, thatprovides payment related services, directly or indirectly, to a <strong>Visa</strong> clientand/or stores, transmits, or processes cardholder data. Paymentrelated activities may include:‣ Cardholder related services:• Solicitation• Customer service• Application processing• Instant card issuance• Prepaid solicitation, sales, activation and/or loading• Loyalty program management• Statement processing and/or printing‣ Payment processing services• Authorization processing• Clearing/settlement processing• Chargeback/exception item processing• Remittance processing• Data warehousing/capture• Risk reporting/control services‣ Merchant related services• Solicitation and sales• Training• Customer service• Internet Payment Service Providers (IPSPs)• Payment gateway services5

<strong>Agent</strong> <strong>Registration</strong> Program Guidelines‣ Card related services• Card vendor sales agents• Prepaid solicitation services• Distribution channel vendors (prepaid)• PIN mailing‣ ATM/POS Services‣ Others• ATM/POS terminal deployment• ATM/POS terminal maintenance• ATM transaction processing• Key management• 3-D Secure Access Control services• Payment software development• Switching• <strong>Visa</strong> PIN Processing at POS terminalsA third party does not include:‣ Co branding partners‣ Vendors listed on the list of <strong>Visa</strong> Approved Card Vendors(available from <strong>Visa</strong> Online)Exemption:‣ A Third Party is exempted from the registration requirementand any associated fees if it provides services only on behalfof its affiliates (includes parents and subsidiaries) and thoseaffiliates are <strong>Visa</strong> clients that own and control at least 25percent of the third party agent.6

<strong>Agent</strong> <strong>Registration</strong> Program Guidelines1.4 Why is it necessary to register the agent?Compliance with VIORUnder the <strong>Visa</strong> International Operating Regulations (VIOR), the <strong>Visa</strong>client has an obligation to register <strong>Agent</strong>s with <strong>Visa</strong>.<strong>Agent</strong> RelationshipThe <strong>Agent</strong> <strong>Registration</strong> database provides <strong>Visa</strong> and <strong>Visa</strong> clients withrecords of <strong>Agent</strong> relationships. This will help ensure that anyobligations and liabilities as required by the VIOR relating to activitiesperformed by the agents are recognized and are clearly associated toa <strong>Visa</strong> client.Risk Controls and Brand ProtectionIt is the client’s responsibility and liability to monitor the practices of its<strong>Agent</strong>s. <strong>Visa</strong> clients are responsible that their <strong>Agent</strong>s comply with therelevant standards and requirements, as specified in the VIOR and inthe Third Party <strong>Agent</strong> Due Diligence Risk Standards (a copy can bedownloaded from the TPA website). This reduces the risk to <strong>Visa</strong>, <strong>Visa</strong>clients, and <strong>Visa</strong> cardholders from brand damage and financial lossesdue to agent compromises, operational errors, contractual issues, orother non-compliance with VIOR.7

2 <strong>Registration</strong> Process2.1 <strong>Registration</strong> ProcessA <strong>Visa</strong> client using a <strong>Visa</strong> Net Processor or Third Party must:Step 1:Step 2:Complete due diligence of the <strong>Visa</strong>Net Processoror Third PartyComplete <strong>Visa</strong>Net Processor and Third Party<strong>Registration</strong> and Designation formStep 3: Submit form to <strong>Visa</strong> at agents@visa.com<strong>Visa</strong> will dispatch an acknowledgement email to the client as soonas the <strong>Registration</strong> forms have been received and processed.<strong>Visa</strong>’s acknowledgement of the registration does not imply that<strong>Visa</strong> approves or endorses the relationship with the <strong>Agent</strong>, or thatthe <strong>Agent</strong> complies with <strong>Visa</strong> requirements.2.2 When to registerBEFORE: <strong>Visa</strong> clients are required to properly register their<strong>Visa</strong>Net Processor or Third Party with <strong>Visa</strong> before theentity provides <strong>Visa</strong>-related services for the client.AFTER:<strong>Visa</strong> clients are required to complete the <strong>Visa</strong>NetProcessor and Third Party <strong>Registration</strong> andDesignation form when:‣ Designating additional services for the <strong>Visa</strong>NetProcessor or Third Party‣ Terminating the contract with the <strong>Visa</strong>NetProcessor or Third Party‣ Change of Status of the <strong>Visa</strong>Net Processor orThird Party, e.g.• Change of Ownership and Name of entity(due to acquisition, merger, etc.)

<strong>Agent</strong> <strong>Registration</strong> Program Guidelines• Change of Address (due to relocation,addition or closure of “additional” sitewithin the same country)• Change of <strong>Visa</strong>-related services<strong>Visa</strong> clients are required to notify <strong>Visa</strong> of any changeof status within 5 business days of the change.2.3 <strong>Registration</strong> FormsThe agent registration form can be downloaded from http://visaasia.com/ap/sea/merchants/riskmgmt/.Upon completion, print theform, sign it and scan the signed form. Email the scanned form toagents@visa.com.9

<strong>Agent</strong> <strong>Registration</strong> Program Guidelines3 <strong>Registration</strong> Fees‣ There is no <strong>Agent</strong> registration fee for <strong>Visa</strong> clients in <strong>Asia</strong><strong>Pacific</strong>, Central Europe, Middle East and Africa, but, <strong>Visa</strong>reserves the right in future to impose registration fees.10

<strong>Agent</strong> <strong>Registration</strong> Program Guidelines4 <strong>Registration</strong> Non-ComplianceA <strong>Visa</strong> client may be subject to fines starting at US$10,000 for thefirst violation in the following situations:• Using a Third Party or <strong>Visa</strong>Net Processor that has not beenregistered• Using a Third Party or <strong>Visa</strong>Net Processor that fails to complywith the VIOR.The schedule of fines is specified in the VIOR.11

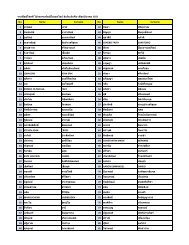

<strong>Agent</strong> <strong>Registration</strong> Program Guidelines5 Other ComplianceRequirements5.1 <strong>Visa</strong> Program ComplianceDepending on the <strong>Visa</strong> payment related services the <strong>Agent</strong>provides, <strong>Visa</strong> may require the <strong>Agent</strong> to comply with one or moreof <strong>Visa</strong>’s compliance programs.The table below outlines the applicable <strong>Visa</strong> program andcompliance standards per payment related service. Thecompliance standards can be downloaded from http://visaasia.com/ap/sea/merchants/riskmgmt/.Payment Related ServiceProcess Verified by <strong>Visa</strong> passwordsAny <strong>Agent</strong> that that stores,processes and/or transmits:- <strong>Visa</strong> Account Numbers- ‘CVV, CVV2, iCVV2- Other cardholder dataPayment Software DevelopmentProcesses PINs for <strong>Visa</strong>TransactionsInstant Card IssuancepersonalizationWarehousing, packaging,distribution of prepaid cards(Distribution Channel Vendors)<strong>Visa</strong> ProgramComplianceAccess Control Server(ACS)Account InformationSecurity Program (AIS)Account InformationSecurity Program (AIS)PIN Security ProgramInstant Card IssuanceProgram (ICIP)Approved Card VendorProgram (optional) 1Applicable Security StandardsPCI Data Security Standards3-D Secure Security Requirements -Enrollment and Access Control ServersPCI Data Security StandardsPayment Application Data SecurityStandardsPCI PIN Security Standards<strong>Visa</strong> Global Instant CardPersonalization IssuanceSecurity Standards<strong>Visa</strong> Global Physical Security ValidationRequirements for Data Preparation,Encryption Support and Fulfillment CardVendors1It is up to the <strong>Visa</strong> client and the <strong>Agent</strong> if they want the <strong>Agent</strong> to be enrolled and reviewed annually via the <strong>Visa</strong>Approved Card Vendor Program. Card Vendor Program participation is not mandatory.12

<strong>Agent</strong> <strong>Registration</strong> Program GuidelinesAfter registration, a <strong>Visa</strong> program manager will contact the <strong>Visa</strong>client to discuss compliance validation of the <strong>Agent</strong>. The <strong>Visa</strong> clientis expected to complete the necessary due diligence of the <strong>Agent</strong>to ensure the <strong>Agent</strong> complies with the VIOR and the applicablesecurity standards prior to <strong>Agent</strong> registration with <strong>Visa</strong>.13

<strong>Agent</strong> <strong>Registration</strong> Program Guidelines6 Frequently AskedQuestionsQ: What is the <strong>Agent</strong> <strong>Registration</strong> Program?A: The <strong>Agent</strong> <strong>Registration</strong> Program is a <strong>Visa</strong>-mandated programenacted to ensure that <strong>Visa</strong> clients are in compliance with <strong>Visa</strong>Inc. Operating Regulations (“<strong>Visa</strong> rules”) and policiesregarding their use of <strong>Agent</strong>s.Q: Why do I need to register <strong>Agent</strong>s?A: <strong>Visa</strong> wants to ensure that clients attest to having completedthe required due diligence reviews, and that they are engagedwith <strong>Agent</strong>s in a manner that is compliant with the VIOR.Q: Who needs to be registered?A: <strong>Agent</strong> registration is required for all entities performingsolicitation activities and / or storing, processing or transmitting<strong>Visa</strong> account numbers for <strong>Visa</strong> clients (or on behalf of theirmerchants).Clients must register all <strong>Agent</strong>s 2 regardless of whether the<strong>Agent</strong> has registered directly with <strong>Visa</strong> via the <strong>Visa</strong> Registry ofService Provider program.<strong>Visa</strong> client may be assessed a fine per <strong>Agent</strong> for notregistering an <strong>Agent</strong>.Q: What is a Third Party or TPA?A: A Third Party (also referred to as “TPA”) is an entity, notdirectly connected to <strong>Visa</strong>Net, that provides payment-relatedservices, directly or indirectly, to a <strong>Visa</strong> client (or theirmerchants) and/or stores, processes or transmits <strong>Visa</strong> accountnumbers. TPAs perform multiple functions on the issuing andacquiring side of a <strong>Visa</strong> client’s business. Each function2 An <strong>Agent</strong> is exempted from the registration requirements and any associated fees if it providesservices only on behalf of its affiliates (includes parents and subsidiaries) and those affiliates are<strong>Visa</strong> client that own and control at least 25 percent of the third party agent.14

<strong>Agent</strong> <strong>Registration</strong> Program Guidelinesperformed by the TPA must be registered by each <strong>Visa</strong> clientthat is utilizing those services. TPA functions that requireregistration are listed under item 1.3 of this guideline.Depending on the function the TPA performs, the TPA may berequired to be approved under one or many of <strong>Visa</strong>’scompliance programs. <strong>Visa</strong> clients will be notified by theindividual program owner for further follow-up.Q: Who can register <strong>Agent</strong>s?A: Only <strong>Visa</strong> clients can register <strong>Agent</strong>s (including any <strong>Agent</strong>stheir merchants are utilizing).Q: Can <strong>Agent</strong>s register directly with <strong>Visa</strong>?A: Yes but this is a separate program to the <strong>Agent</strong> <strong>Registration</strong>program. In <strong>Asia</strong> <strong>Pacific</strong> an <strong>Agent</strong> can register directly with<strong>Visa</strong> via the <strong>Visa</strong> Registry of Service Providers program(VRSP). The Registry is a listing of service providers thatprovide payment related services to <strong>Visa</strong> client banks and themerchants. It serves as a source of reference for <strong>Visa</strong> clientbanks and merchants when selecting service providers foroutsourcing <strong>Visa</strong> payment related services. For detailedinformation on the VRSP Program, please visit www.visaasia.com/spregistry.Note, clients must register all <strong>Agent</strong>s regardless of whether the<strong>Agent</strong> has registered directly with <strong>Visa</strong> via the VRSP program.Q: What is the <strong>Visa</strong> clients responsibility in relation to<strong>Agent</strong>s?A: <strong>Visa</strong> clients are responsible for their <strong>Agent</strong>s; therefore, a <strong>Visa</strong>client must perform its own due diligence and weigh theoperational and financial risks of utilizing the <strong>Agent</strong>.<strong>Visa</strong> clients are responsible for ensuring that their <strong>Agent</strong>scomply with PCI DSS (where applicable) and <strong>Visa</strong>International Operating Regulations. <strong>Visa</strong> clients may besubject to fines and penalties for any <strong>Agent</strong> found to be out ofcompliance with the PCI DSS or <strong>Visa</strong> Operating Regulations.15

<strong>Agent</strong> <strong>Registration</strong> Program GuidelinesQ: Is there a fee for <strong>Visa</strong> clients to register <strong>Agent</strong>s?A: Currently, there are no fees applicable to <strong>Visa</strong> clients toregister an <strong>Agent</strong> in <strong>Asia</strong> <strong>Pacific</strong>, Central Europe, Middle Eastand Africa.Q: Prior to registering an <strong>Agent</strong>, what due diligence must a<strong>Visa</strong> client perform?A: <strong>Visa</strong> provides a minimum due diligence standard that all <strong>Visa</strong>clients must perform prior to registering an <strong>Agent</strong>. <strong>Visa</strong>’sminimum standard includes basic background, financial andoperational reviews. However, each <strong>Visa</strong> client is encouragedto increase the scope of review based on the <strong>Agent</strong> businesstype, services performed, relative program risk, <strong>Visa</strong> accountdata held or processed and the individual <strong>Visa</strong> client’s internalrisk appetite and requirements.Q: Can a <strong>Visa</strong> client register an <strong>Agent</strong> before the <strong>Agent</strong>validates PCI DSS compliance?A: Yes, if the <strong>Visa</strong> client registers an <strong>Agent</strong> prior to the <strong>Agent</strong>validating compliance, the <strong>Agent</strong> must be contracted with anapproved Qualified Security Assessor (QSA), or commit tocompleting a Self Assessment Questionnaire (SAQ) and havean expected date of compliance. A list of QSAs can be foundat https://www.pcisecuritystandards.org/pdfs/pci_qsa_list.pdf.Q: What does an <strong>Agent</strong> have to do to get registered?A: To start the registration process, <strong>Agent</strong>s should contact theircontracted <strong>Visa</strong> client. If the <strong>Agent</strong> has a contract with a <strong>Visa</strong>client’s merchant, the <strong>Agent</strong> can pursue two avenues: 1) theycan directly contact the merchant’s <strong>Visa</strong> client (usuallyidentified by asking the merchant for their acquiring/merchantbank contact information); or 2) <strong>Visa</strong> can facilitate theregistration by contacting the merchant’s <strong>Visa</strong> client on behalfof the <strong>Agent</strong>.Also, the <strong>Agent</strong> has the option to enroll in <strong>Visa</strong>’s Registry ofService Providers (VRSP) Program. The Registry is a listing ofservice providers that provide payment related services to <strong>Visa</strong>client banks and the merchants. It serves as a source ofreference for <strong>Visa</strong> client banks and merchants when selecting16

<strong>Agent</strong> <strong>Registration</strong> Program Guidelinesservice providers for outsourcing <strong>Visa</strong> payment relatedservices. For detailed information on the VRSP Program,please visit www.visa-asia.com/spregistry.17

<strong>Agent</strong> <strong>Registration</strong> Program Guidelines7 References7.1 <strong>Agent</strong> WebsiteFor <strong>Agent</strong> <strong>Registration</strong>, go tohttp://www.visa-asia.com/ap/sea/merchants/riskmgmt/7.2 Third Party Compliance RequirementsFor PCI DSS requirements, go tohttp://www.pcisecuritystandards.org/For PIN Security requirements, go tohttp://www.visa.com/pinsecurityFor 3-D Secure Access Control Server security requirements, gotohttp://www.visa.com/3-dsecure7.3 Other Program LinksFor Account Information Security (AIS), go tohttp://www.visa-asia.com/ap/sea/merchants/riskmgmt/ais.shtmlFor <strong>Visa</strong> Registry of Service Providers (Registry), go tohttp://www.visa-asia.com/spregistryFor Adobe Reader download and installation, go tohttp://www.adobe.comFor <strong>Visa</strong> Online access application, go tohttps://www.ap.visaonline.com7.4 Email ContactFor <strong>Agent</strong> <strong>Registration</strong> queries, please contact us atagents@visa.com18

<strong>Agent</strong> <strong>Registration</strong> Program GuidelinesGlossary3-D Secure AccessControl Services(ACS)Acquirer<strong>Agent</strong>Applicationprocessing servicesATM/POS terminaldeployment servicesATM/POS terminalmaintenance servicesATM transactionProcessing servicesAuthorizationAuthorization CenterCardholder DataCard Vendor Sales<strong>Agent</strong>sProvider of a software protocol that enables secureprocessing of Verified by <strong>Visa</strong> transactions over the Internetand other networks.A member that signs a merchant or disburses currency to aCardholder in a Cash Disbursement, and directly or indirectlyenters the resulting Transaction Receipt into Interchange.An entity that acts as a <strong>Visa</strong>Net Processor (VNP), Third Party,or both.A Third Party that processes applications for <strong>Visa</strong> cards onbehalf of the issuer.A Third Party that installs ATMs or POS terminals.A Third Party that performs maintenance of ATMs or POSterminals, both hardware and software.A Third Party that processes <strong>Visa</strong> transactions originatingthrough ATMs.A process where an issuer, a <strong>Visa</strong>Net Processor, or Stand-InProcessing approves a Transaction. This includes:• Domestic Authorization• International Authorization• Offline AuthorizationFacilities established by members in-house or by third partyprocessors to respond to merchants’ or other members’requests for authorizations for transactions or cashdisbursements.Data encoded in the card magnetic stripe such as cardholdername, card expiry date, CVV, etc.A Third Party that acts on behalf of the <strong>Visa</strong> client or <strong>Visa</strong>Approved Card vendor to solicit sales of <strong>Visa</strong> cards orpersonalization of <strong>Visa</strong> cards.19

<strong>Agent</strong> <strong>Registration</strong> Program GuidelinesChargeback/exceptionitem processingservicesCustomer ServiceDatawarehouse/captureservicesDistribution ChannelVendorInternet PaymentService Provider(IPSP)IssuerInstant CardPersonalizationInstant Card IssuanceservicesKey managementLoyalty programmanagementMerchantMerchant Servicer(MS)Merchant TrainingServicesA Third Party that processes transactions that an Issuerreturns to an Acquirer.A Third Party that provides support for cardholder or merchantqueries.A Third Party that is a data warehouse that stores orprocesses cardholder data.A Third Party responsible for storage and shipping of premanufactured,commercially ready <strong>Visa</strong> Products(warehouses, card packagers, logistic companies)A Third Party that contracts with an acquirer to provide e-commerce payment services to a Sponsored Merchant. Alsoreferred to as a Merchant Aggregator.A member that issues <strong>Visa</strong> Cards, <strong>Visa</strong> Electron Cards, orProprietary Cards bearing the Plus Symbol, and whose nameappears on the Card as the issuer (or, for Cards that do notidentify the issuer, the member that enters into the contractualrelationship with the Cardholder).The ability to instantly personalize <strong>Visa</strong> cards as the customerwaits or to respond immediately to the request for anemergency replacement of a cardholder’s lost or stolen card.A Third Party that performs instant card personalization andissuance for the issuer.The generation, transmission, storage, loading, safeguarding,use, and replacement of keys in a cryptography system.A Third Party that provides management services for a <strong>Visa</strong>Clients loyalty program and has access to cardholder data.A principal or entity entering into a card acceptanceagreement with a <strong>Visa</strong> member financial institution.An organization that stores, processes, or transmits <strong>Visa</strong>account numbers on behalf of the member’s merchant. TheMS has a contract with the merchant, not the member.A Third Party who provides terminal, fraud, or cardacceptance training for merchants.20

<strong>Agent</strong> <strong>Registration</strong> Program GuidelinesPayment GatewayPayment SoftwareDevelopmentPersonalIdentification Number(PIN)PIN transactionprocessing at POSTerminalPrepaid CardPrepaid solicitation,sales, activation,and/or loadingRemittanceProcessingRisk reporting/controlservicesSettlementStatement Processingand/or printingSolicitationSwitchingThird PartyV.I.P. SystemA system that provides electronic commerce services tomerchants for the Authorization and Clearing of ElectronicCommerce Transactions.A Third Party who develops software applications containedwithin a Chip or payment data encoded on a Magnetic Stripethat defines the parameters for processing a <strong>Visa</strong> or <strong>Visa</strong>Electron Transaction.A personal identification alpha or numeric code that identifiesa cardholder in an Authorization Request originating at aterminal with Authorization-Only or Data Capture-OnlyCapability.A third party that processes <strong>Visa</strong> transactions containing PINsoriginating from Point-of-Sale (POS) terminalsA card used to access funds in a Prepaid Account or a cardwhere monetary value is stored on a Chip.A Third Party that distributes prepaid <strong>Visa</strong> cards to merchantsor end sellers, provides prepaid activation or load services.A Third Party who processes money transfer transactionsbetween one individual to another.A Third Party who provides transaction screening to identifyrisks or fraudulent transactions and has access to cardholderdata.The reporting and transfer of Settlement Amounts owed byone Client to another, or to <strong>Visa</strong>, as a result of Clearing.A Third Party who processes cardholder data for the purposesof printing cardholder statements or actually prints thestatements.A Third Party that solicits for new cardholders or merchants.A Third Party that processes <strong>Visa</strong> transactions and routes thetransactions from the merchant to the issuer of the card.A Third Party is a non-<strong>Visa</strong> client that is not directly connectedto <strong>Visa</strong>Net and provides payment-related services, directly orindirectly, to a <strong>Visa</strong> client.<strong>Visa</strong>Net Integrated Payment System. The Online processing21

<strong>Agent</strong> <strong>Registration</strong> Program Guidelinescomponent of <strong>Visa</strong>Net.<strong>Visa</strong> Client<strong>Visa</strong>Net<strong>Visa</strong>Net Processor(VNP)An organization which is a client of <strong>Visa</strong> and which issuescards and/or signs merchants.The systems and services, including the V.I.P. System, <strong>Visa</strong>Authorization, European Customized Services, and BASE II,through which <strong>Visa</strong> delivers Online Financial Processing,Authorization, Clearing, and Settlement services to members.A member or <strong>Visa</strong>-approved non-member that is directlyconnected to <strong>Visa</strong>Net and provides Authorization, Clearing,Settlement, or payment-related processing services formerchants or members. The <strong>Visa</strong> International OperatingRegulations also refer to a V.I.P. System User as a type of<strong>Visa</strong>Net Processor.22