Depository Participants (DPs) - National Spot Exchange Limited

Depository Participants (DPs) - National Spot Exchange Limited

Depository Participants (DPs) - National Spot Exchange Limited

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

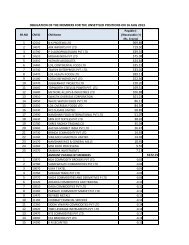

4 th July, 2011<strong>Depository</strong> <strong>Participants</strong> (<strong>DPs</strong>) gets new business avenues in commodities through NSEL<strong>National</strong> <strong>Spot</strong> <strong>Exchange</strong> <strong>Limited</strong> (NSEL) has pioneered the concept of commodities based investmentproduct in demat form under its E-series banner. Demat of commodity implies storage of commoditiesin <strong>Exchange</strong> designated vaults/ warehouses and keeping record of its ownership in electronic form. For<strong>Depository</strong> <strong>Participants</strong> (<strong>DPs</strong>) commodity based investment products are emerging businessopportunities.E-series is a unique investment product for enabling the small and retail investors to park their funds incommodities in smaller denominations. The investors hold the commodity units such as Gold, Silver,Copper, Zinc and Lead in smaller denominations in the demat account. At present more than 100 <strong>DPs</strong>are empanelled with NSEL providing demat services to the investors across the India. Prominent amongthem providing their services on pan India basis are Religare Securities, Nirmal bang, bonanza, GlobeCapital, Goldmine, Karvy, SHCIL,SMC and IL&FS. Complete list of NSEL empanelled <strong>DPs</strong> are available onNSEL website.Market participants willing to become empanelled DP of <strong>National</strong> <strong>Spot</strong> <strong>Exchange</strong> platform have twooptions:Option: 1: DP empanelment fees of Rs. 2 lakhs (non refundable) andOption: 2: Deposit of 10 lakhs (Refundable) In case of cancellation of the empanelment, the full amount(10 lakh) would be refundable within 7-10 working days.In stock market, there are around 1 crore unique demat accounts and in India, 20-25 crore people holdgold and silver in one form or the other. Hence, scope for demat account for holding e-gold and e silvercan be 25 times of stock market so this business potential can be captured by leading <strong>DPs</strong>. The totalmarket cap of stock market is Rs 58 lakh crores. Investors should diversify 20-25 % of their portfolio intocommodities by this logic, Rs. 14.5 lakh crores investment can come into commodities. Scope ofbusiness as DP one can open 1 lakh beneficiary accounts in the coming period generating a recurringincome of at least Rs. 5-10 crores a year.Going by overwhelming response on E-series NSEL It is anticipated that within 3 years of operation, thenumber of beneficiary account to be opened by investors in this segment will exceed the numberachieved in stock market so far. To start with, the existing clients holding their beneficiary account withtheir respective <strong>DPs</strong> will open separate account for trading in E-Series. If all equity shareholders havingtheir demat account open their account for investing in demat commodities, income on account of DPcharges will be double. Going forward, <strong>DPs</strong> will get opportunity to expand their business to hundreds ofother centers, where such opportunity is totally untapped.E-GOLD, E-silver, E-Copper, E-zinc and E-Lead are the products in the E-series kitty launched by NSEL.NSEL will launch similar trading facilities in around 20 non perishable commodities in near future. Thiswill create a huge cash segment of commodities. <strong>Exchange</strong> <strong>DPs</strong>, being the extension arm of the<strong>Exchange</strong> in servicing the clients, will be the largest beneficiary of this emerging market.

4 th July, 2011With the innovation in commodity investment product as done by NSEL, business opportunity isextending to commodity market as well for all these <strong>DPs</strong>. Scope and potential in commodity market ismuch bigger than that of Equity. Commodity investment is just emerging, a common man easily identifythemselves with the commodity then that of equity hence investor base is bigger than the equity.