Annual Report 2011 - Analist.be

Annual Report 2011 - Analist.be

Annual Report 2011 - Analist.be

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

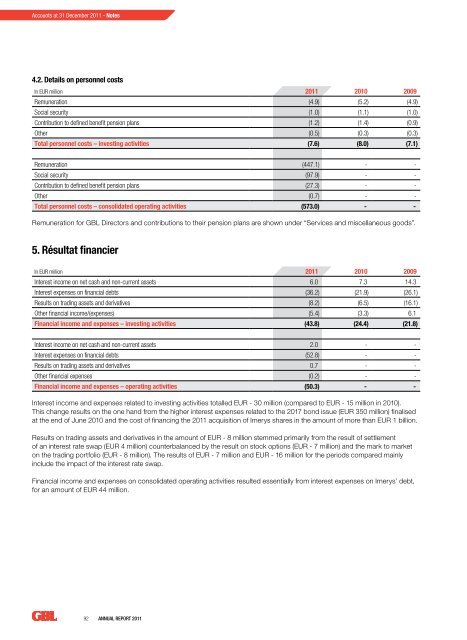

Accounts at 31 Decem<strong>be</strong>r <strong>2011</strong> - Notes4.2. Details on personnel costsIn EUR million <strong>2011</strong> 2010 2009Remuneration (4.9) (5.2) (4.9)Social security (1.0) (1.1) (1.0)Contribution to defined <strong>be</strong>nefit pension plans (1.2) (1.4) (0.9)Other (0.5) (0.3) (0.3)Total personnel costs – investing activities (7.6) (8.0) (7.1)Remuneration (447.1) - -Social security (97.9) - -Contribution to defined <strong>be</strong>nefit pension plans (27.3) - -Other (0.7) - -Total personnel costs – consolidated operating activities (573.0) - -Remuneration for GBL Directors and contributions to their pension plans are shown under “Services and miscellaneous goods”.5. Résultat financierIn EUR million <strong>2011</strong> 2010 2009Interest income on net cash and non-current assets 6.0 7.3 14.3Interest expenses on financial debts (36.2) (21.9) (26.1)Results on trading assets and derivatives (8.2) (6.5) (16.1)Other financial income/(expenses) (5.4) (3.3) 6.1Financial income and expenses – investing activities (43.8) (24.4) (21.8)Interest income on net cash and non-current assets 2.0 - -Interest expenses on financial debts (52.8) - -Results on trading assets and derivatives 0.7 - -Other financial expenses (0.2) - -Financial income and expenses – operating activities (50.3) - -Interest income and expenses related to investing activities totalled EUR - 30 million (compared to EUR - 15 million in 2010).This change results on the one hand from the higher interest expenses related to the 2017 bond issue (EUR 350 million) finalisedat the end of June 2010 and the cost of financing the <strong>2011</strong> acquisition of Imerys shares in the amount of more than EUR 1 billion.Results on trading assets and derivatives in the amount of EUR - 8 million stemmed primarily from the result of settlementof an interest rate swap (EUR 4 million) counterbalanced by the result on stock options (EUR - 7 million) and the mark to marketon the trading portfolio (EUR - 8 million). The results of EUR - 7 million and EUR - 16 million for the periods compared mainlyinclude the impact of the interest rate swap.Financial income and expenses on consolidated operating activities resulted essentially from interest expenses on Imerys’ debt,for an amount of EUR 44 million.92 <strong>Annual</strong> <strong>Report</strong> <strong>2011</strong>