Annual Report 2011 - Analist.be

Annual Report 2011 - Analist.be

Annual Report 2011 - Analist.be

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

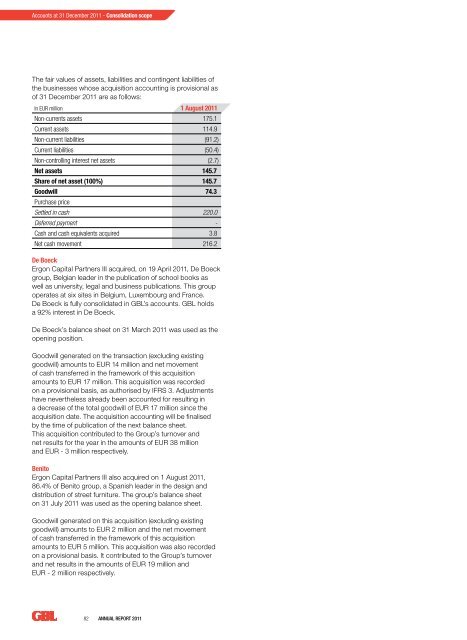

Accounts at 31 Decem<strong>be</strong>r <strong>2011</strong> - Consolidation scopeThe fair values of assets, liabilities and contingent liabilities ofthe businesses whose acquisition accounting is provisional asof 31 Decem<strong>be</strong>r <strong>2011</strong> are as follows:In EUR million 1 August <strong>2011</strong>Non-currents assets 175.1Current assets 114.9Non-current liabilities (91.2)Current liabilities (50.4)Non-controlling interest net assets (2.7)Net assets 145.7Share of net asset (100%) 145.7Goodwill 74.3Purchase priceSettled in cash 220.0Deferred payment -Cash and cash equivalents acquired 3.8Net cash movement 216.2De BoeckErgon Capital Partners III acquired, on 19 April <strong>2011</strong>, De Boeckgroup, Belgian leader in the publication of school books aswell as university, legal and business publications. This groupoperates at six sites in Belgium, Luxembourg and France.De Boeck is fully consolidated in GBL’s accounts. GBL holdsa 92% interest in De Boeck.De Boeck’s balance sheet on 31 March <strong>2011</strong> was used as theopening position.Goodwill generated on the transaction (excluding existinggoodwill) amounts to EUR 14 million and net movementof cash transferred in the framework of this acquisitionamounts to EUR 17 million. This acquisition was recordedon a provisional basis, as authorised by IFRS 3. Adjustmentshave nevertheless already <strong>be</strong>en accounted for resulting ina decrease of the total goodwill of EUR 17 million since theacquisition date. The acquisition accounting will <strong>be</strong> finalisedby the time of publication of the next balance sheet.This acquisition contributed to the Group’s turnover andnet results for the year in the amounts of EUR 38 millionand EUR - 3 million respectively.BenitoErgon Capital Partners III also acquired on 1 August <strong>2011</strong>,86.4% of Benito group, a Spanish leader in the design anddistribution of street furniture. The group’s balance sheeton 31 July <strong>2011</strong> was used as the opening balance sheet.Goodwill generated on this acquisition (excluding existinggoodwill) amounts to EUR 2 million and the net movementof cash transferred in the framework of this acquisitionamounts to EUR 5 million. This acquisition was also recordedon a provisional basis. It contributed to the Group’s turnoverand net results in the amounts of EUR 19 million andEUR - 2 million respectively.82 <strong>Annual</strong> <strong>Report</strong> <strong>2011</strong>