Annual Report 2011 - Analist.be

Annual Report 2011 - Analist.be

Annual Report 2011 - Analist.be

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

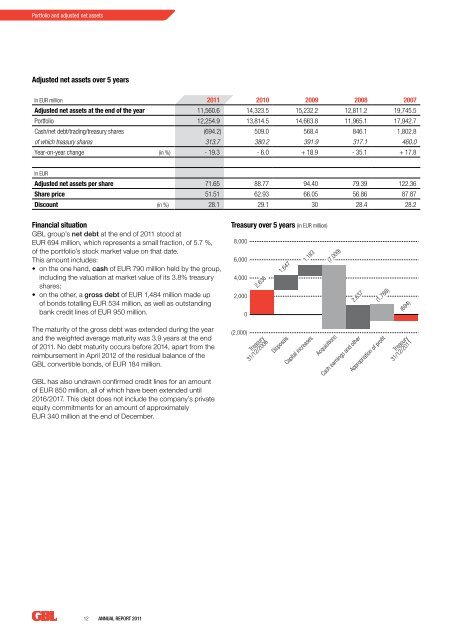

Selected Portfolio and financial adjusted information net assets500200220032004200520062007200820092010<strong>2011</strong>Adjusted net assets over 5 years16,000In EUR million <strong>2011</strong> 2010 2009 2008 200714,000Adjusted net assets at the end of the year 11,560.6 14,323.5 15,232.2 12,811.2 19,745.5Portfolio 12,254.912,00013,814.5 14,663.8 11,965.1 17,942.7Cash/net debt/trading/treasury shares (694.2) 10,000 509.0 568.4 846.1 1,802.8of which treasury shares 313.7 8,000 380.2 391.9 317.1 460.0Year-on-year change (in %) - 19.36,000- 6.0 + 18.9 - 35.1 + 17.8In EURAdjusted net assets per share 71.654,0002,000 88.77 94.40 79.39 122.36Share price 51.51 62.93 66.05 56.86 87.87Discount (in %) 28.1 29.1 30 28.4 28.220025,3956,178200320048,28411,458200513,4002006200714,1799,1752008200910,65810,15420108,3128,934<strong>2011</strong>02/2012Financial situationGBL group’s net debt at the end of <strong>2011</strong> stood atEUR 694 million, which represents a small fraction, of 5.7 %,of the portfolio’s stock market value on that date.This amount includes:• on the one hand, cash of EUR 790 million held by the group,including the valuation at market value of its 3.8% treasuryshares;• on the other, a gross debt of EUR 1,484 million made upof bonds totalling EUR 534 million, as well as outstandingbank credit lines of EUR 950 million.Treasury over 5 years (in EUR million)8,0006,0004,0002,00002,6361,6471,183(7,009)2,637(1,788)(694)The maturity of the gross debt was extended during the yearand the weighted average maturity was 3.9 years at the endof <strong>2011</strong>. No debt maturity occurs <strong>be</strong>fore 2014, apart from thereimbursement in April 2012 of the residual balance of theGBL convertible bonds, of EUR 184 million.GBL has also undrawn confirmed credit lines for an amountof EUR 850 million, all of which have <strong>be</strong>en extended until2016/2017. This debt does not include the company’s privateequity commitments for an amount of approximatelyEUR 340 million at the end of Decem<strong>be</strong>r.(2,000)Treasury31/12/2006DisposalsArkema 0.7%Suez Environnement 4.0%Pernod Ricard 6.7%Imerys 9.0%Capital increases<strong>2011</strong>AcquisitionsCash earnings and otherAppropriation of profitTreasury31/12/<strong>2011</strong>1.5% Other36.4% TotalLafarge 10.7%31.0% GDF SUEZTotalGDF SUEZPernod RicardLafarge12 <strong>Annual</strong> <strong>Report</strong> <strong>2011</strong>ImerysArkemaSuez Environnement(1.4)(21.3)1.9(42.1)(42.7)(28.7)1.5