Annual Report 2011 - Analist.be

Annual Report 2011 - Analist.be

Annual Report 2011 - Analist.be

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

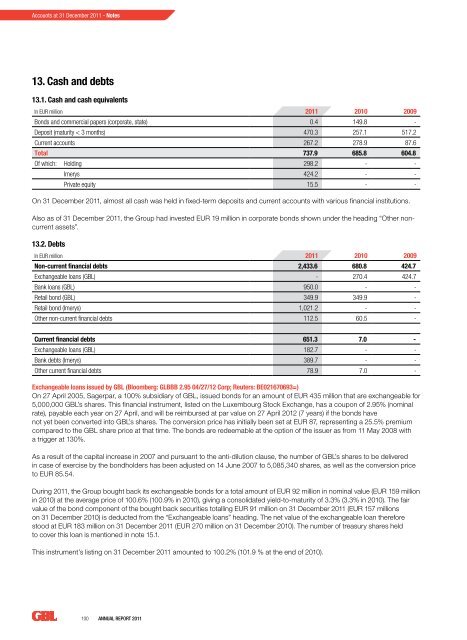

Accounts at 31 Decem<strong>be</strong>r <strong>2011</strong> - Notes13. Cash and debts13.1. Cash and cash equivalentsIn EUR million <strong>2011</strong> 2010 2009Bonds and commercial papers (corporate, state) 0.4 149.8 -Deposit (maturity < 3 months) 470.3 257.1 517.2Current accounts 267.2 278.9 87.6Total 737.9 685.8 604.8Of which: Holding 298.2 - -Imerys 424.2 - -Private equity 15.5 - -On 31 Decem<strong>be</strong>r <strong>2011</strong>, almost all cash was held in fixed-term deposits and current accounts with various financial institutions.Also as of 31 Decem<strong>be</strong>r <strong>2011</strong>, the Group had invested EUR 19 million in corporate bonds shown under the heading “Other noncurrentassets”.13.2. DebtsIn EUR million <strong>2011</strong> 2010 2009Non-current financial debts 2,433.6 680.8 424.7Exchangeable loans (GBL) - 270.4 424.7Bank loans (GBL) 950.0 - -Retail bond (GBL) 349.9 349.9 -Retail bond (Imerys) 1,021.2 - -Other non-current financial debts 112.5 60.5 -Current financial debts 651.3 7.0 -Exchangeable loans (GBL) 182.7 - -Bank debts (Imerys) 389.7 - -Other current financial debts 78.9 7.0 -Exchangeable loans issued by GBL (Bloom<strong>be</strong>rg: GLBBB 2.95 04/27/12 Corp; Reuters: BE021670693=)On 27 April 2005, Sagerpar, a 100% subsidiary of GBL, issued bonds for an amount of EUR 435 million that are exchangeable for5,000,000 GBL’s shares. This financial instrument, listed on the Luxembourg Stock Exchange, has a coupon of 2.95% (nominalrate), payable each year on 27 April, and will <strong>be</strong> reimbursed at par value on 27 April 2012 (7 years) if the bonds havenot yet <strong>be</strong>en converted into GBL’s shares. The conversion price has initially <strong>be</strong>en set at EUR 87, representing a 25.5% premiumcompared to the GBL share price at that time. The bonds are redeemable at the option of the issuer as from 11 May 2008 witha trigger at 130%.As a result of the capital increase in 2007 and pursuant to the anti-dilution clause, the num<strong>be</strong>r of GBL’s shares to <strong>be</strong> deliveredin case of exercise by the bondholders has <strong>be</strong>en adjusted on 14 June 2007 to 5,085,340 shares, as well as the conversion priceto EUR 85.54.During <strong>2011</strong>, the Group bought back its exchangeable bonds for a total amount of EUR 92 million in nominal value (EUR 159 millionin 2010) at the average price of 100.6% (100.9% in 2010), giving a consolidated yield-to-maturity of 3.3% (3.3% in 2010). The fairvalue of the bond component of the bought back securities totalling EUR 91 million on 31 Decem<strong>be</strong>r <strong>2011</strong> (EUR 157 millionson 31 Decem<strong>be</strong>r 2010) is deducted from the “Exchangeable loans” heading. The net value of the exchangeable loan thereforestood at EUR 183 million on 31 Decem<strong>be</strong>r <strong>2011</strong> (EUR 270 million on 31 Decem<strong>be</strong>r 2010). The num<strong>be</strong>r of treasury shares heldto cover this loan is mentioned in note 15.1.This instrument’s listing on 31 Decem<strong>be</strong>r <strong>2011</strong> amounted to 100.2% (101.9 % at the end of 2010).100 <strong>Annual</strong> <strong>Report</strong> <strong>2011</strong>