You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

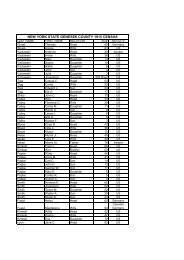

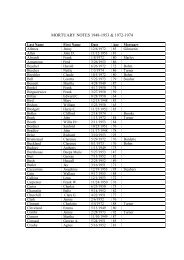

STATE OF NEW YORK 2 0 1 3 T E N T A T I V E A S S E S S M E N T R O L L PAGE 1COUNTY - <strong>Genesee</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2012TOWN - <strong>Alexander</strong> THESE ASSESSMENTS ARE ALSO USED FOR VILLAGE PURPOSES TAXABLE STATUS DATE-MAR 01, 2013VILLAGE - <strong>Alexander</strong> OWNERS NAME SEQUENCESWIS - 182201 UNIFORM PERCENT OF VALUE IS 100.00TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE-----VILLAGE------COUNTY--------TOWN------SCHOOLCURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUECURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.******************************************************************************************************* 3.-1-9.1 *******************Broadway Rd 000001143003.-1-9.1 311 Res vac land VILLAGE TAXABLE VALUE 3,400Affordable Great Loc <strong>Alexander</strong> Schoo 182202 3,400 COUNTY TAXABLE VALUE 3,400Inc FRNT 50.00 DPTH 250.00 3,400 TOWN TAXABLE VALUE 3,4004249 Route 5 ACRES 0.29 SCHOOL TAXABLE VALUE 3,400Caledonia, NY 14423 EAST-1232476 NRTH-1057858DEED BOOK 602 PG-294FULL MARKET VALUE 3,400******************************************************************************************************* 3.-1-6 *********************3189 Broadway Rd 000001141003.-1-6 416 Mfg hsing pk STAR B 41854 0 0 0 49,230Affordable Great Locations Inc <strong>Alexander</strong> Schoo 182202 40,400 VILLAGE TAXABLE VALUE 160,0004294 Avon Caledonia Rd 3.-1-7 (1.5 AC) 160,000 COUNTY TAXABLE VALUE 160,000Caledonia, NY 14423 FRNT 225.00 DPTH 387.00 TOWN TAXABLE VALUE 160,000ACRES 3.40 SCHOOL TAXABLE VALUE 110,770EAST-1232247 NRTH-1057940DEED BOOK 602 PG-294FULL MARKET VALUE 160,000******************************************************************************************************* 2.-1-36 ********************3266 Buffalo St 000001101002.-1-36 431 Auto dealer VILLAGE TAXABLE VALUE 136,800<strong>Alexander</strong> Equipment <strong>Alexander</strong> Schoo 182202 17,400 COUNTY TAXABLE VALUE 136,800Box 215 15%, 485B 136,800 TOWN TAXABLE VALUE 136,800<strong>Alexander</strong>, NY 14005 ACRES 4.10 SCHOOL TAXABLE VALUE 136,800EAST-1233783 NRTH-1057608DEED BOOK 438 PG-01105FULL MARKET VALUE 136,800******************************************************************************************************* 2.-2-15 ********************10575 Main St 000001117002.-2-15 220 2 Family Res STAR B 41854 0 0 0 30,000Allen Scott <strong>Alexander</strong> Schoo 182202 8,100 VILLAGE TAXABLE VALUE 102,00010575 Main St FRNT 87.33 DPTH 132.00 102,000 COUNTY TAXABLE VALUE 102,000PO Box 155 BANKFAR0100 TOWN TAXABLE VALUE 102,000<strong>Alexander</strong>, NY 14005 EAST-1235976 NRTH-1057324 SCHOOL TAXABLE VALUE 72,000DEED BOOK 853 PG-74FULL MARKET VALUE 102,000******************************************************************************************************* 1.-1-54 ********************3345 Buffalo St 000001052001.-1-54 210 1 Family Res VILLAGE TAXABLE VALUE 75,900Amedick Jeffrey <strong>Alexander</strong> Schoo 182202 6,000 COUNTY TAXABLE VALUE 75,9003345 Buffalo St FRNT 66.00 DPTH 125.40 75,900 TOWN TAXABLE VALUE 75,900PO Box 234 EAST-1235296 NRTH-1057493 SCHOOL TAXABLE VALUE 75,900<strong>Alexander</strong>, NY 14005 DEED BOOK 893 PG-850FULL MARKET VALUE 75,900************************************************************************************************************************************

STATE OF NEW YORK 2 0 1 3 T E N T A T I V E A S S E S S M E N T R O L L PAGE 2COUNTY - <strong>Genesee</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2012TOWN - <strong>Alexander</strong> THESE ASSESSMENTS ARE ALSO USED FOR VILLAGE PURPOSES TAXABLE STATUS DATE-MAR 01, 2013VILLAGE - <strong>Alexander</strong> OWNERS NAME SEQUENCESWIS - 182201 UNIFORM PERCENT OF VALUE IS 100.00TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE-----VILLAGE------COUNTY--------TOWN------SCHOOLCURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUECURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.******************************************************************************************************* 2.-1-14 ********************10654 Main St 000001079002.-1-14 210 1 Family Res STAR B 41854 0 0 0 30,000Anauo Brian <strong>Alexander</strong> Schoo 182202 14,100 VILLAGE TAXABLE VALUE 102,000Anauo Lori Interior Unfinished 102,000 COUNTY TAXABLE VALUE 102,00010654 Main St FRNT 128.40 DPTH 255.00 TOWN TAXABLE VALUE 102,000PO Box 95 EAST-1234943 NRTH-1056668 SCHOOL TAXABLE VALUE 72,000<strong>Alexander</strong>, NY 14005 DEED BOOK 607 PG-313FULL MARKET VALUE 102,000******************************************************************************************************* 1.-1-48 ********************3323 Buffalo St 000001047001.-1-48 210 1 Family Res VETS-CV-C 41132 0 24,350 0 0Antonucci Vera <strong>Alexander</strong> Schoo 182202 4,100 VETS-CV-T 41133 15,000 0 15,000 03323 Buffalo St FRNT 99.00 DPTH 120.00 97,400 VETS-DV-C 41142 0 4,870 0 0PO Box 103 EAST-1234934 NRTH-1057583 VETS-DV-T 41143 4,870 0 4,870 0<strong>Alexander</strong>, NY 14005 DEED BOOK 755 PG-28 STAR EN 41834 0 0 0 63,300FULL MARKET VALUE 97,400 VILLAGE TAXABLE VALUE 77,530COUNTY TAXABLE VALUE 68,180TOWN TAXABLE VALUE 77,530SCHOOL TAXABLE VALUE 34,100******************************************************************************************************* 1.-1-23 ********************3361 Church St 000001024001.-1-23 210 1 Family Res AGED C/T/S 41800 0 49,600 49,600 49,600Bartz Harvey <strong>Alexander</strong> Schoo 182202 8,600 Senior V 41807 39,680 0 0 0Bartz Nancy Includes 1.-1-24 (.124 99,200 STAR EN 41834 0 0 0 49,6003361 Church St FRNT 66.00 DPTH 305.00 VILLAGE TAXABLE VALUE 59,520PO Box 4 EAST-1235316 NRTH-1057931 COUNTY TAXABLE VALUE 49,600<strong>Alexander</strong>, NY 14005 DEED BOOK 512 PG-00263 TOWN TAXABLE VALUE 49,600FULL MARKET VALUE 99,200 SCHOOL TAXABLE VALUE 0******************************************************************************************************* 2.-3-13.2 ******************3543 Telephone Rd2.-3-13.2 210 1 Family Res STAR B 41854 0 0 0 30,000Basso Donna <strong>Alexander</strong> Schoo 182202 7,400 VILLAGE TAXABLE VALUE 93,500Basso Thomas FRNT 94.00 DPTH 197.00 93,500 COUNTY TAXABLE VALUE 93,5003543 Railroad Ave BANKBAC0100 TOWN TAXABLE VALUE 93,500<strong>Alexander</strong>, NY 14005 EAST-1238542 NRTH-1056678 SCHOOL TAXABLE VALUE 63,500DEED BOOK 576 PG-143FULL MARKET VALUE 93,500******************************************************************************************************* 2.-3-14.12 *****************Telephone Rd2.-3-14.12 311 Res vac land VILLAGE TAXABLE VALUE 500Basso Donna <strong>Alexander</strong> Schoo 182202 500 COUNTY TAXABLE VALUE 500Basso Thomas ACRES 0.20 BANKBAC0100 500 TOWN TAXABLE VALUE 5003543 Railroad Ave EAST-1238604 NRTH-1056657 SCHOOL TAXABLE VALUE 500<strong>Alexander</strong>, NY 14005 DEED BOOK 576 PG-143FULL MARKET VALUE 500************************************************************************************************************************************

STATE OF NEW YORK 2 0 1 3 T E N T A T I V E A S S E S S M E N T R O L L PAGE 3COUNTY - <strong>Genesee</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2012TOWN - <strong>Alexander</strong> THESE ASSESSMENTS ARE ALSO USED FOR VILLAGE PURPOSES TAXABLE STATUS DATE-MAR 01, 2013VILLAGE - <strong>Alexander</strong> OWNERS NAME SEQUENCESWIS - 182201 UNIFORM PERCENT OF VALUE IS 100.00TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE-----VILLAGE------COUNTY--------TOWN------SCHOOLCURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUECURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.******************************************************************************************************* 2.-3-21 ********************3416 Telephone Rd 000001135002.-3-21 210 1 Family Res VILLAGE TAXABLE VALUE 57,000Basso Joseph M <strong>Alexander</strong> Schoo 182202 2,100 COUNTY TAXABLE VALUE 57,0003416 Telephone Rd FRNT 76.00 DPTH 105.00 57,000 TOWN TAXABLE VALUE 57,000<strong>Alexander</strong>, NY 14005 BANKBAC0100 SCHOOL TAXABLE VALUE 57,000EAST-1235982 NRTH-1057105DEED BOOK 858 PG-762FULL MARKET VALUE 57,000******************************************************************************************************* 1.-1-18.21 *****************3322 Broadway Rd 000001019001.-1-18.21 210 1 Family Res VILLAGE TAXABLE VALUE 123,000Blowers Nathan <strong>Alexander</strong> Schoo 182202 9,500 COUNTY TAXABLE VALUE 123,000Blowers Heidi FRNT 103.70 DPTH 339.00 123,000 TOWN TAXABLE VALUE 123,0003322 Broadway BANKFNG0100 SCHOOL TAXABLE VALUE 123,000PO Box 43 EAST-1235020 NRTH-1058266<strong>Alexander</strong>, NY 14005 DEED BOOK 870 PG-380FULL MARKET VALUE 123,000******************************************************************************************************* 2.-1-21 ********************10612 Main St 000001086002.-1-21 210 1 Family Res STAR B 41854 0 0 0 30,000Boyce Matthew J <strong>Alexander</strong> Schoo 182202 5,100 VILLAGE TAXABLE VALUE 88,000Koch Stephanie L FRNT 58.00 DPTH 88,000 COUNTY TAXABLE VALUE 88,00010612 Main St ACRES 0.23 BANKFAR0100 TOWN TAXABLE VALUE 88,000<strong>Alexander</strong>, NY 14005 EAST-1235375 NRTH-1057093 SCHOOL TAXABLE VALUE 58,000DEED BOOK 825 PG-26FULL MARKET VALUE 88,000******************************************************************************************************* 2.-2-11 ********************10549 Main St 000001113002.-2-11 210 1 Family Res STAR B 41854 0 0 0 30,000Brade Gerald T <strong>Alexander</strong> Schoo 182202 6,200 VILLAGE TAXABLE VALUE 112,800Brade Lori L FRNT 66.06 DPTH 112,800 COUNTY TAXABLE VALUE 112,80010549 Main St ACRES 0.42 BANKFAR0100 TOWN TAXABLE VALUE 112,800PO Box 139 EAST-1236308 NRTH-1057543 SCHOOL TAXABLE VALUE 82,800<strong>Alexander</strong>, NY 14005 DEED BOOK 599 PG-119FULL MARKET VALUE 112,800******************************************************************************************************* 1.-1-12.12 *****************10512 Main St 000001011001.-1-12.12 210 1 Family Res STAR B 41854 0 0 0 30,000Breton Jason P <strong>Alexander</strong> Schoo 182202 6,900 VILLAGE TAXABLE VALUE 128,80010606 S Main St FRNT 134.00 DPTH 206.00 128,800 COUNTY TAXABLE VALUE 128,800PO Box 53 EAST-1236409 NRTH-1058364 TOWN TAXABLE VALUE 128,800<strong>Alexander</strong>, NY 14005 DEED BOOK 879 PG-937 SCHOOL TAXABLE VALUE 98,800FULL MARKET VALUE 128,800************************************************************************************************************************************

STATE OF NEW YORK 2 0 1 3 T E N T A T I V E A S S E S S M E N T R O L L PAGE 4COUNTY - <strong>Genesee</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2012TOWN - <strong>Alexander</strong> THESE ASSESSMENTS ARE ALSO USED FOR VILLAGE PURPOSES TAXABLE STATUS DATE-MAR 01, 2013VILLAGE - <strong>Alexander</strong> OWNERS NAME SEQUENCESWIS - 182201 UNIFORM PERCENT OF VALUE IS 100.00TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE-----VILLAGE------COUNTY--------TOWN------SCHOOLCURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUECURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.******************************************************************************************************* 1.-1-71.1 ******************3263 Broadway Rd1.-1-71.1 210 1 Family Res STAR B 41854 0 0 0 30,000Brinkworth Thomas M <strong>Alexander</strong> Schoo 182202 16,500 VILLAGE TAXABLE VALUE 201,000Brinkworth Lisa M ACRES 3.58 BANKFAR0100 201,000 COUNTY TAXABLE VALUE 201,0003263 Broadway EAST-1233781 NRTH-1058382 TOWN TAXABLE VALUE 201,000<strong>Alexander</strong>, NY 14005 DEED BOOK 693 PG-326 SCHOOL TAXABLE VALUE 171,000FULL MARKET VALUE 201,000******************************************************************************************************* 1.-1-18.112 ****************3 Bartz Dr1.-1-18.112 210 1 Family Res STAR B 41854 0 0 0 30,000Brokaw Howard L <strong>Alexander</strong> Schoo 182202 5,700 VILLAGE TAXABLE VALUE 146,6003 Bartz Dr FRNT 120.00 DPTH 132.00 146,600 COUNTY TAXABLE VALUE 146,600<strong>Alexander</strong>, NY 14005 BANKWFB0100 TOWN TAXABLE VALUE 146,600EAST-1235359 NRTH-1058423 SCHOOL TAXABLE VALUE 116,600DEED BOOK 744 PG-230FULL MARKET VALUE 146,600******************************************************************************************************* 1.-1-75 ********************Bartz Dr1.-1-75 314 Rural vac

STATE OF NEW YORK 2 0 1 3 T E N T A T I V E A S S E S S M E N T R O L L PAGE 5COUNTY - <strong>Genesee</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2012TOWN - <strong>Alexander</strong> THESE ASSESSMENTS ARE ALSO USED FOR VILLAGE PURPOSES TAXABLE STATUS DATE-MAR 01, 2013VILLAGE - <strong>Alexander</strong> OWNERS NAME SEQUENCESWIS - 182201 UNIFORM PERCENT OF VALUE IS 100.00TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE-----VILLAGE------COUNTY--------TOWN------SCHOOLCURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUECURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.******************************************************************************************************* 2.-2-16 ********************10571 Main St 000001118002.-2-16 484 1 use sm bld VILLAGE TAXABLE VALUE 92,600Browns Entrepreneurs LLC <strong>Alexander</strong> Schoo 182202 4,600 COUNTY TAXABLE VALUE 92,6003163 Stannard Rd FRNT 82.95 DPTH 92,600 TOWN TAXABLE VALUE 92,600<strong>Alexander</strong>, NY 14005 ACRES 0.13 SCHOOL TAXABLE VALUE 92,600EAST-1235928 NRTH-1057274DEED BOOK 863 PG-924FULL MARKET VALUE 92,600******************************************************************************************************* 2.-1-11 ********************10643 Main St 000001076002.-1-11 210 1 Family Res STAR EN 41834 0 0 0 63,300Bruggman William E <strong>Alexander</strong> Schoo 182202 12,200 VILLAGE TAXABLE VALUE 105,200Bruggman Connie L FRNT 112.62 DPTH 105,200 COUNTY TAXABLE VALUE 105,200Main St ACRES 0.97 TOWN TAXABLE VALUE 105,200PO Box 26 EAST-1235336 NRTH-1056581 SCHOOL TAXABLE VALUE 41,900<strong>Alexander</strong>, NY 14005 DEED BOOK 395 PG-295FULL MARKET VALUE 105,200******************************************************************************************************* 3.-1-10.11 *****************3225 Broadway Rd 000001145003.-1-10.11 220 2 Family Res VILLAGE TAXABLE VALUE 130,000Buckenmeyer Gerard <strong>Alexander</strong> Schoo 182202 13,500 COUNTY TAXABLE VALUE 130,000Buckenmeyer Ann L ACRES 1.90 130,000 TOWN TAXABLE VALUE 130,00010695 Sandpit Rd EAST-1232786 NRTH-1058015 SCHOOL TAXABLE VALUE 130,000<strong>Alexander</strong>, NY 14005 DEED BOOK 590 PG-317FULL MARKET VALUE 130,000******************************************************************************************************* 2.-3-14.111 ****************Telephone Rd 000001131002.-3-14.111 105 Vac farmland VILLAGE TAXABLE VALUE 7,300Buckenmeyer Gerrard <strong>Alexander</strong> Schoo 182202 7,300 COUNTY TAXABLE VALUE 7,300Buckenmeyer Ann L 2.-3-15 7,300 TOWN TAXABLE VALUE 7,30010691 Sandpit Rd ACRES 10.60 SCHOOL TAXABLE VALUE 7,300<strong>Alexander</strong>, NY 14005 EAST-1238934 NRTH-1056722 AG010 Ag. district #10 .00 MTDEED BOOK 866 PG-265FULL MARKET VALUE 7,300******************************************************************************************************* 1.-1-15.11 *****************10536 Main St 000001014001.-1-15.11 210 1 Family Res STAR B 41854 0 0 0 30,000Burke Nelson <strong>Alexander</strong> Schoo 182202 3,400 VILLAGE TAXABLE VALUE 151,200Burke Edith FRNT 70.00 DPTH 184.00 151,200 COUNTY TAXABLE VALUE 151,20010536 Main St EAST-1236186 NRTH-1057985 TOWN TAXABLE VALUE 151,200<strong>Alexander</strong>, NY 14005 DEED BOOK 846 PG-430 SCHOOL TAXABLE VALUE 121,200FULL MARKET VALUE 151,200************************************************************************************************************************************

STATE OF NEW YORK 2 0 1 3 T E N T A T I V E A S S E S S M E N T R O L L PAGE 6COUNTY - <strong>Genesee</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2012TOWN - <strong>Alexander</strong> THESE ASSESSMENTS ARE ALSO USED FOR VILLAGE PURPOSES TAXABLE STATUS DATE-MAR 01, 2013VILLAGE - <strong>Alexander</strong> OWNERS NAME SEQUENCESWIS - 182201 UNIFORM PERCENT OF VALUE IS 100.00TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE-----VILLAGE------COUNTY--------TOWN------SCHOOLCURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUECURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.******************************************************************************************************* 3.-1-5 *********************3171 Broadway Rd 000001140003.-1-5 210 1 Family Res VILLAGE TAXABLE VALUE 79,000Burkhardt James H Jr <strong>Alexander</strong> Schoo 182202 22,100 COUNTY TAXABLE VALUE 79,000Burkhardt Wendy F ACRES 1.30 BANKFAR0100 79,000 TOWN TAXABLE VALUE 79,0003171 Broadway Rd EAST-1232027 NRTH-1057888 SCHOOL TAXABLE VALUE 79,000<strong>Alexander</strong>, NY 14005 DEED BOOK 835 PG-869FULL MARKET VALUE 79,000******************************************************************************************************* 3.-1-24 ********************3180 Broadway Rd 000001159003.-1-24 210 1 Family Res STAR B 41854 0 0 0 30,000Burt Lawrence W <strong>Alexander</strong> Schoo 182202 9,100 VILLAGE TAXABLE VALUE 105,5003180 Broadway Rd FRNT 105.00 DPTH 237.00 105,500 COUNTY TAXABLE VALUE 105,500<strong>Alexander</strong>, NY 14005 BANKBAC0100 TOWN TAXABLE VALUE 105,500EAST-1231980 NRTH-1057594 SCHOOL TAXABLE VALUE 75,500DEED BOOK 872 PG-704FULL MARKET VALUE 105,500******************************************************************************************************* 1.-1-64.1 ******************3399 Buffalo St 000001061001.-1-64.1 310 Res Vac VILLAGE TAXABLE VALUE 11,120C&D Design, Build Development, <strong>Alexander</strong> Schoo 182202 11,120 COUNTY TAXABLE VALUE 11,1209877 Simonds Rd FRNT 101.87 DPTH 208.38 11,120 TOWN TAXABLE VALUE 11,120Corfu, NY 14036 EAST-1235656 NRTH-1057436 SCHOOL TAXABLE VALUE 11,120DEED BOOK 891 PG-251FULL MARKET VALUE 11,120******************************************************************************************************* 2.-3-16 ********************3540 Telephone Rd 000001132002.-3-16 443 Feed sales VILLAGE TAXABLE VALUE 530,000Cargill Incorporated <strong>Alexander</strong> Schoo 182202 44,000 COUNTY TAXABLE VALUE 530,000PO Box 5626 ACRES 3.70 530,000 TOWN TAXABLE VALUE 530,000Minneapolis, MN 55440-5626 EAST-1238308 NRTH-1056323 SCHOOL TAXABLE VALUE 530,000DEED BOOK 810 PG-197FULL MARKET VALUE 530,000******************************************************************************************************* 1.-1-5.1 *******************3387 Broadway Rd 000001005001.-1-5.1 432 Gas station VILLAGE TAXABLE VALUE 42,500Cashin Dennis H <strong>Alexander</strong> Schoo 182202 12,600 COUNTY TAXABLE VALUE 42,5004435 Vernal Rd ACRES 1.39 42,500 TOWN TAXABLE VALUE 42,500Attica, NY 14011 EAST-1235369 NRTH-1058791 SCHOOL TAXABLE VALUE 42,500DEED BOOK 469 PG-00727FULL MARKET VALUE 42,500******************************************************************************************************* 3.-1-8 *********************3191 Broadway Rd 000001142003.-1-8 210 1 Family Res STAR EN 41834 0 0 0 63,300Church Ronald W <strong>Alexander</strong> Schoo 182202 10,900 VILLAGE TAXABLE VALUE 76,9003191 Broadway FRNT 100.00 DPTH 217.00 76,900 COUNTY TAXABLE VALUE 76,900<strong>Alexander</strong>, NY 14005 EAST-1232400 NRTH-1057859 TOWN TAXABLE VALUE 76,900DEED BOOK 750 PG-91 SCHOOL TAXABLE VALUE 13,600FULL MARKET VALUE 76,900************************************************************************************************************************************

STATE OF NEW YORK 2 0 1 3 T E N T A T I V E A S S E S S M E N T R O L L PAGE 7COUNTY - <strong>Genesee</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2012TOWN - <strong>Alexander</strong> THESE ASSESSMENTS ARE ALSO USED FOR VILLAGE PURPOSES TAXABLE STATUS DATE-MAR 01, 2013VILLAGE - <strong>Alexander</strong> OWNERS NAME SEQUENCESWIS - 182201 UNIFORM PERCENT OF VALUE IS 100.00TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE-----VILLAGE------COUNTY--------TOWN------SCHOOLCURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUECURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.******************************************************************************************************* 1.-1-70 ********************10594 Main St 000001066001.-1-70 481 Att row bldg VILLAGE TAXABLE VALUE 125,000Clark Kim <strong>Alexander</strong> Schoo 182202 4,900 COUNTY TAXABLE VALUE 125,000Clark Leland FRNT 68.80 DPTH 125,000 TOWN TAXABLE VALUE 125,000Main St ACRES 0.41 SCHOOL TAXABLE VALUE 125,000PO Box 216 EAST-1235744 NRTH-1057423<strong>Alexander</strong>, NY 14005 DEED BOOK 434 PG-00799FULL MARKET VALUE 125,000******************************************************************************************************* 2.-1-15 ********************10650 Main St 000001080002.-1-15 210 1 Family Res STAR B 41854 0 0 0 30,000Cogdill Maryann Barbara <strong>Alexander</strong> Schoo 182202 4,400 VILLAGE TAXABLE VALUE 89,50010650 <strong>Alexander</strong> Rd FRNT 40.00 DPTH 246.00 89,500 COUNTY TAXABLE VALUE 89,500Attica, NY 14011 BANKFAR0100 TOWN TAXABLE VALUE 89,500EAST-1234992 NRTH-1056733 SCHOOL TAXABLE VALUE 59,500DEED BOOK 852 PG-180FULL MARKET VALUE 89,500******************************************************************************************************* 2.-1-22.2 ******************Buffalo St2.-1-22.2 311 Res vac land VILLAGE TAXABLE VALUE 400<strong>County</strong> <strong>of</strong> <strong>Genesee</strong> <strong>Alexander</strong> Schoo 182202 400 COUNTY TAXABLE VALUE 40015 Main St ACRES 0.09 400 TOWN TAXABLE VALUE 400Batavia, NY 14020 EAST-1235241 NRTH-1057219 SCHOOL TAXABLE VALUE 400DEED BOOK 897 PG-477PRIOR OWNER ON 3/01/2013 FULL MARKET VALUE 400Hersee David N Jr******************************************************************************************************* 1.-1-43 ********************3326 Church St 000001042001.-1-43 210 1 Family Res STAR EN 41834 0 0 0 63,300Crittenden Gloria <strong>Alexander</strong> Schoo 182202 4,500 VILLAGE TAXABLE VALUE 127,700Watroba Cynda FRNT 121.00 DPTH 147.00 127,700 COUNTY TAXABLE VALUE 127,7003326 Church St EAST-1234654 NRTH-1057665 TOWN TAXABLE VALUE 127,700<strong>Alexander</strong>, NY 14005 DEED BOOK 894 PG-602 SCHOOL TAXABLE VALUE 64,400FULL MARKET VALUE 127,700******************************************************************************************************* 1.-1-62 ********************3380 Church St 000001059001.-1-62 210 1 Family Res STAR EN 41834 0 0 0 63,300Dayton Douglas W <strong>Alexander</strong> Schoo 182202 22,000 VILLAGE TAXABLE VALUE 115,500Dayton Martha A Incls 1.-1-61 (.209 AC) 115,500 COUNTY TAXABLE VALUE 115,5003380 Church St FRNT 100.00 DPTH 155.00 TOWN TAXABLE VALUE 115,500PO Box 92 EAST-1235658 NRTH-1057631 SCHOOL TAXABLE VALUE 52,200<strong>Alexander</strong>, NY 14005 DEED BOOK 427 PG-935FULL MARKET VALUE 115,500************************************************************************************************************************************

STATE OF NEW YORK 2 0 1 3 T E N T A T I V E A S S E S S M E N T R O L L PAGE 8COUNTY - <strong>Genesee</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2012TOWN - <strong>Alexander</strong> THESE ASSESSMENTS ARE ALSO USED FOR VILLAGE PURPOSES TAXABLE STATUS DATE-MAR 01, 2013VILLAGE - <strong>Alexander</strong> OWNERS NAME SEQUENCESWIS - 182201 UNIFORM PERCENT OF VALUE IS 100.00TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE-----VILLAGE------COUNTY--------TOWN------SCHOOLCURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUECURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.******************************************************************************************************* 1.-1-65 ********************3384 Church St 000001062001.-1-65 311 Res vac land VILLAGE TAXABLE VALUE 7,900Dayton Douglas W <strong>Alexander</strong> Schoo 182202 7,900 COUNTY TAXABLE VALUE 7,9003380 Church St FRNT 152.00 DPTH 7,900 TOWN TAXABLE VALUE 7,900PO Box 92 ACRES 0.51 SCHOOL TAXABLE VALUE 7,900<strong>Alexander</strong>, NY 14005 EAST-1235739 NRTH-1057636DEED BOOK 835 PG-803FULL MARKET VALUE 7,900******************************************************************************************************* 1.-1-52 ********************3364 Church St 000001050001.-1-52 210 1 Family Res STAR B 41854 0 0 0 30,000Dayton Jonathan <strong>Alexander</strong> Schoo 182202 7,400 VILLAGE TAXABLE VALUE 98,5003364 Church St FRNT 130.00 DPTH 152.00 98,500 COUNTY TAXABLE VALUE 98,500<strong>Alexander</strong>, NY 14005 EAST-1235315 NRTH-1057644 TOWN TAXABLE VALUE 98,500DEED BOOK 825 PG-157 SCHOOL TAXABLE VALUE 68,500FULL MARKET VALUE 98,500******************************************************************************************************* 2.-1-31 ********************3288 Buffalo St 000001096002.-1-31 270 Mfg housing VETS-CV-C 41132 0 3,700 0 0Dean Lorraine <strong>Alexander</strong> Schoo 182202 7,400 VETS-CV-T 41133 3,700 0 3,700 0Dean Jason FRNT 66.00 DPTH 308.88 14,800 STAR EN 41834 0 0 0 14,8003288 Buffalo St EAST-1234313 NRTH-1057454 VILLAGE TAXABLE VALUE 11,100<strong>Alexander</strong>, NY 14005 DEED BOOK 755 PG-56 COUNTY TAXABLE VALUE 11,100FULL MARKET VALUE 14,800 TOWN TAXABLE VALUE 11,100SCHOOL TAXABLE VALUE 0******************************************************************************************************* 1.-1-49 ********************3348 Church St 000001048001.-1-49 210 1 Family Res STAR B 41854 0 0 0 30,000Dick Alan S <strong>Alexander</strong> Schoo 182202 3,300 VILLAGE TAXABLE VALUE 93,800Dick Terry J FRNT 106.00 DPTH 110.00 93,800 COUNTY TAXABLE VALUE 93,8003348 Church St EAST-1234966 NRTH-1057678 TOWN TAXABLE VALUE 93,800PO Box 82 DEED BOOK 430 PG-00817 SCHOOL TAXABLE VALUE 63,800<strong>Alexander</strong>, NY 14005 FULL MARKET VALUE 93,800******************************************************************************************************* 1.-1-66.1 ******************10558 Main St 000001063001.-1-66.1 411 Apartment VILLAGE TAXABLE VALUE 104,500Dominick Gary <strong>Alexander</strong> Schoo 182202 5,200 COUNTY TAXABLE VALUE 104,500Dominick Beatrice FRNT 150.00 DPTH 104,500 TOWN TAXABLE VALUE 104,50010536 Main St ACRES 0.44 BANKFAR0100 SCHOOL TAXABLE VALUE 104,500<strong>Alexander</strong>, NY 14005 EAST-1235885 NRTH-1057645DEED BOOK 821 PG-219FULL MARKET VALUE 104,500************************************************************************************************************************************

STATE OF NEW YORK 2 0 1 3 T E N T A T I V E A S S E S S M E N T R O L L PAGE 9COUNTY - <strong>Genesee</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2012TOWN - <strong>Alexander</strong> THESE ASSESSMENTS ARE ALSO USED FOR VILLAGE PURPOSES TAXABLE STATUS DATE-MAR 01, 2013VILLAGE - <strong>Alexander</strong> OWNERS NAME SEQUENCESWIS - 182201 UNIFORM PERCENT OF VALUE IS 100.00TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE-----VILLAGE------COUNTY--------TOWN------SCHOOLCURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUECURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.******************************************************************************************************* 1.-1-69 ********************10592 Main St 000001065001.-1-69 482 Det row bldg STAR B 41854 0 0 0 22,250Dominick Gary <strong>Alexander</strong> Schoo 182202 5,500 VILLAGE TAXABLE VALUE 44,500Dominick Beatrice FRNT 64.10 DPTH 112.10 44,500 COUNTY TAXABLE VALUE 44,5009877 Simonds Rd ACRES 0.08 TOWN TAXABLE VALUE 44,500Corfu, NY 14036 EAST-1235804 NRTH-1057398 SCHOOL TAXABLE VALUE 22,250DEED BOOK 282 PG-841FULL MARKET VALUE 44,500******************************************************************************************************* 1.-1-66.2 ******************10560 Main St1.-1-66.2 210 1 Family Res VILLAGE TAXABLE VALUE 130,700Dominick Virginia <strong>Alexander</strong> Schoo 182202 2,600 COUNTY TAXABLE VALUE 130,700Attn: Gary Dominick FRNT 60.00 DPTH 110.00 130,700 TOWN TAXABLE VALUE 130,7009877 Simonds Rd BANKFAR0100 SCHOOL TAXABLE VALUE 130,700Corfu, NY 14036 EAST-1235894 NRTH-1057554DEED BOOK 803 PG-27FULL MARKET VALUE 130,700******************************************************************************************************* 1.-1-72.1 ******************3273 Broadway Rd1.-1-72.1 210 1 Family Res STAR B 41854 0 0 0 30,000Donnelly Craig M <strong>Alexander</strong> Schoo 182202 14,400 VILLAGE TAXABLE VALUE 131,200Donnelly Maria ACRES 2.40 131,200 COUNTY TAXABLE VALUE 131,2003273 Broadway EAST-1233924 NRTH-1058407 TOWN TAXABLE VALUE 131,200<strong>Alexander</strong>, NY 14005 DEED BOOK 806 PG-160 SCHOOL TAXABLE VALUE 101,200FULL MARKET VALUE 131,200******************************************************************************************************* 2.-1-28 ********************3334 Buffalo St 000001093002.-1-28 210 1 Family Res STAR EN 41834 0 0 0 63,300Donnelly Donald J <strong>Alexander</strong> Schoo 182202 9,200 VILLAGE TAXABLE VALUE 94,200Donnelly Joan C FRNT 82.50 DPTH 308.22 94,200 COUNTY TAXABLE VALUE 94,2003334 Buffalo St EAST-1235034 NRTH-1057270 TOWN TAXABLE VALUE 94,200PO Box 97 DEED BOOK 425 PG-946 SCHOOL TAXABLE VALUE 30,900<strong>Alexander</strong>, NY 14005 FULL MARKET VALUE 94,200******************************************************************************************************* 1.-1-76.11 *****************7 Bartz Dr1.-1-76.11 210 1 Family Res STAR B 41854 0 0 0 30,000Dunbar David E <strong>Alexander</strong> Schoo 182202 8,800 VILLAGE TAXABLE VALUE 160,000Dunbar Sharleen N FRNT 180.00 DPTH 242.00 160,000 COUNTY TAXABLE VALUE 160,0007 Bartz Dr EAST-1235652 NRTH-1058403 TOWN TAXABLE VALUE 160,000<strong>Alexander</strong>, NY 14005 DEED BOOK 891 PG-691 SCHOOL TAXABLE VALUE 130,000FULL MARKET VALUE 160,000************************************************************************************************************************************

STATE OF NEW YORK 2 0 1 3 T E N T A T I V E A S S E S S M E N T R O L L PAGE 10COUNTY - <strong>Genesee</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2012TOWN - <strong>Alexander</strong> THESE ASSESSMENTS ARE ALSO USED FOR VILLAGE PURPOSES TAXABLE STATUS DATE-MAR 01, 2013VILLAGE - <strong>Alexander</strong> OWNERS NAME SEQUENCESWIS - 182201 UNIFORM PERCENT OF VALUE IS 100.00TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE-----VILLAGE------COUNTY--------TOWN------SCHOOLCURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUECURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.******************************************************************************************************* 1.-1-26 ********************3351 Church St 000001026001.-1-26 210 1 Family Res STAR B 41854 0 0 0 30,000Dyrbala Francis E <strong>Alexander</strong> Schoo 182202 11,900 VILLAGE TAXABLE VALUE 126,600Dyrbala Barbara K FRNT 135.00 DPTH 305.00 126,600 COUNTY TAXABLE VALUE 126,6003351 Church St EAST-1235082 NRTH-1057929 TOWN TAXABLE VALUE 126,600PO Box 263 DEED BOOK 99999 PG-99999 SCHOOL TAXABLE VALUE 96,600<strong>Alexander</strong>, NY 14005 FULL MARKET VALUE 126,600******************************************************************************************************* 1.-1-17 ********************3385 Church St 000001017001.-1-17 210 1 Family Res STAR B 41854 0 0 0 30,000Dyrbala John F <strong>Alexander</strong> Schoo 182202 11,900 VILLAGE TAXABLE VALUE 110,000Dyrbala Beverly L FRNT 123.76 DPTH 110,000 COUNTY TAXABLE VALUE 110,0003385 Church St ACRES 1.00 TOWN TAXABLE VALUE 110,000PO Box 193 EAST-1235756 NRTH-1057894 SCHOOL TAXABLE VALUE 80,000<strong>Alexander</strong>, NY 14005 DEED BOOK 554 PG-00067FULL MARKET VALUE 110,000******************************************************************************************************* 2.-1-34 ********************3274 Buffalo St 000001099002.-1-34 210 1 Family Res STAR B 41854 0 0 0 30,000Egl<strong>of</strong>f Robert T <strong>Alexander</strong> Schoo 182202 11,200 VILLAGE TAXABLE VALUE 119,500Egl<strong>of</strong>f Mari FRNT 120.00 DPTH 119,500 COUNTY TAXABLE VALUE 119,5003274 Buffalo St ACRES 0.47 TOWN TAXABLE VALUE 119,500<strong>Alexander</strong>, NY 14005 EAST-1234023 NRTH-1057606 SCHOOL TAXABLE VALUE 89,500DEED BOOK 837 PG-880FULL MARKET VALUE 119,500******************************************************************************************************* 1.-1-18.12 *****************3340 Broadway Rd 000001018001.-1-18.12 210 1 Family Res STAR B 41854 0 0 0 30,000Eisele Heath W <strong>Alexander</strong> Schoo 182202 9,500 VILLAGE TAXABLE VALUE 125,000Eisele Tracy L ACRES 0.68 125,000 COUNTY TAXABLE VALUE 125,0003340 Broadway EAST-1235167 NRTH-1058456 TOWN TAXABLE VALUE 125,000<strong>Alexander</strong>, NY 14005 DEED BOOK 880 PG-669 SCHOOL TAXABLE VALUE 95,000FULL MARKET VALUE 125,000******************************************************************************************************* 1.-1-40.11 *****************3301 Church St 000001039001.-1-40.11 210 1 Family Res STAR B 41854 0 0 0 30,000Farnsworth Gary P <strong>Alexander</strong> Schoo 182202 5,600 VILLAGE TAXABLE VALUE 90,600Farnsworth Betsy P FRNT 105.69 DPTH 148.00 90,600 COUNTY TAXABLE VALUE 90,6003301 Church St BANKWFB0100 TOWN TAXABLE VALUE 90,600<strong>Alexander</strong>, NY 14005 EAST-1234277 NRTH-1057853 SCHOOL TAXABLE VALUE 60,600DEED BOOK 775 PG-20FULL MARKET VALUE 90,600************************************************************************************************************************************

STATE OF NEW YORK 2 0 1 3 T E N T A T I V E A S S E S S M E N T R O L L PAGE 11COUNTY - <strong>Genesee</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2012TOWN - <strong>Alexander</strong> THESE ASSESSMENTS ARE ALSO USED FOR VILLAGE PURPOSES TAXABLE STATUS DATE-MAR 01, 2013VILLAGE - <strong>Alexander</strong> OWNERS NAME SEQUENCESWIS - 182201 UNIFORM PERCENT OF VALUE IS 100.00TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE-----VILLAGE------COUNTY--------TOWN------SCHOOLCURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUECURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.******************************************************************************************************* 1.-1-57 ********************3378 Church St 000001055001.-1-57 210 1 Family Res STAR EN 41834 0 0 0 63,300Fletcher Patricia C <strong>Alexander</strong> Schoo 182202 12,200 VILLAGE TAXABLE VALUE 79,6003378 Church St FRNT 114.84 DPTH 79,600 COUNTY TAXABLE VALUE 79,600<strong>Alexander</strong>, NY 14005 ACRES 0.48 TOWN TAXABLE VALUE 79,600EAST-1235521 NRTH-1057652 SCHOOL TAXABLE VALUE 16,300DEED BOOK 874 PG-825FULL MARKET VALUE 79,600******************************************************************************************************* 2.-1-16 ********************10646 Main St 000001081002.-1-16 210 1 Family Res VETS-CV-C 41132 0 22,000 0 0Ford Daniel <strong>Alexander</strong> Schoo 182202 7,200 VETS-CV-T 41133 15,000 0 15,000 0Ford Shirley FRNT 65.00 DPTH 246.00 88,000 VETS-DV-C 41142 0 17,600 0 010646 Main St EAST-1235026 NRTH-1056770 VETS-DV-T 41143 13,200 0 13,200 0<strong>Alexander</strong>, NY 14005 DEED BOOK 441 PG-00962 STAR B 41854 0 0 0 30,000FULL MARKET VALUE 88,000 VILLAGE TAXABLE VALUE 59,800COUNTY TAXABLE VALUE 48,400TOWN TAXABLE VALUE 59,800SCHOOL TAXABLE VALUE 58,000******************************************************************************************************* 2.-1-35 ********************3270 Buffalo St 000001100002.-1-35 312 Vac w/imprv VILLAGE TAXABLE VALUE 5,700Gadd Thomas <strong>Alexander</strong> Schoo 182202 5,700 COUNTY TAXABLE VALUE 5,700Box 215 FRNT 98.77 DPTH 5,700 TOWN TAXABLE VALUE 5,700PO Box 215 ACRES 0.47 SCHOOL TAXABLE VALUE 5,700<strong>Alexander</strong>, NY 14005 EAST-1233925 NRTH-1057607DEED BOOK 454 PG-00905FULL MARKET VALUE 5,700******************************************************************************************************* 1.-1-10.1 ******************3406 Broadway Rd 000001009101.-1-10.1 210 1 Family Res VETS-WV-C 41122 0 15,000 0 0Gartley Craig K <strong>Alexander</strong> Schoo 182202 12,200 VETS-WV-T 41123 9,000 0 9,000 0Gartley Christine L ACRES 1.20 BANKTRN0100 118,000 VETS-CV-C 41132 0 25,000 0 03406 Broadway Rd EAST-1236131 NRTH-1058589 VETS-CV-T 41133 15,000 0 15,000 0<strong>Alexander</strong>, NY 14005 DEED BOOK 637 PG-277 VETS-DV-C 41142 0 35,400 0 0FULL MARKET VALUE 118,000 VETS-DV-T 41143 30,000 0 30,000 0STAR B 41854 0 0 0 30,000VILLAGE TAXABLE VALUE 64,000COUNTY TAXABLE VALUE 42,600TOWN TAXABLE VALUE 64,000SCHOOL TAXABLE VALUE 88,000******************************************************************************************************* 1.-1-1.113 *****************3281 Broadway Rd1.-1-1.113 210 1 Family Res VILLAGE TAXABLE VALUE 116,800George Paul F <strong>Alexander</strong> Schoo 182202 12,000 COUNTY TAXABLE VALUE 116,8002212 Attica Rd ACRES 1.08 116,800 TOWN TAXABLE VALUE 116,800Darien Center, NY 14040 EAST-1234014 NRTH-1058283 SCHOOL TAXABLE VALUE 116,800DEED BOOK 845 PG-656FULL MARKET VALUE 116,800************************************************************************************************************************************

STATE OF NEW YORK 2 0 1 3 T E N T A T I V E A S S E S S M E N T R O L L PAGE 12COUNTY - <strong>Genesee</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2012TOWN - <strong>Alexander</strong> THESE ASSESSMENTS ARE ALSO USED FOR VILLAGE PURPOSES TAXABLE STATUS DATE-MAR 01, 2013VILLAGE - <strong>Alexander</strong> OWNERS NAME SEQUENCESWIS - 182201 UNIFORM PERCENT OF VALUE IS 100.00TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE-----VILLAGE------COUNTY--------TOWN------SCHOOLCURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUECURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.******************************************************************************************************* 2.-1-25 ********************3352 Buffalo St 000001090002.-1-25 210 1 Family Res VILLAGE TAXABLE VALUE 83,400Gill Heather <strong>Alexander</strong> Schoo 182202 5,400 COUNTY TAXABLE VALUE 83,4002266 Angling Rd FRNT 61.50 DPTH 119.46 83,400 TOWN TAXABLE VALUE 83,400Corfu, NY 14036 EAST-1235332 NRTH-1057292 SCHOOL TAXABLE VALUE 83,400DEED BOOK 850 PG-216FULL MARKET VALUE 83,400******************************************************************************************************* 1.-1-36 ********************3316 Broadway Rd 000001036001.-1-36 210 1 Family Res STAR B 41854 0 0 0 30,000Glotzbach Jack M <strong>Alexander</strong> Schoo 182202 6,600 VILLAGE TAXABLE VALUE 83,9003316 Broadway Rd FRNT 103.00 DPTH 240.00 83,900 COUNTY TAXABLE VALUE 83,900<strong>Alexander</strong>, NY 14005 BANKFAR0100 TOWN TAXABLE VALUE 83,900EAST-1234601 NRTH-1058133 SCHOOL TAXABLE VALUE 53,900DEED BOOK 773 PG-269FULL MARKET VALUE 83,900******************************************************************************************************* 3.-1-18 ********************3238 Broadway Rd 94 PCT OF VALUE USED FOR EXEMPTION PURPOSES 000001153003.-1-18 210 1 Family Res VETS-WV-C 41122 0 15,000 0 0Glover Lance <strong>Alexander</strong> Schoo 182202 20,800 VETS-WV-T 41123 9,000 0 9,000 0Glover Cheryl FRNT 125.00 DPTH 800.00 109,500 STAR EN 41834 0 0 0 63,3003238 Rt 20 ACRES 6.00 VILLAGE TAXABLE VALUE 100,500<strong>Alexander</strong>, NY 14005 EAST-1232871 NRTH-1057388 COUNTY TAXABLE VALUE 94,500DEED BOOK 416 PG-1066 TOWN TAXABLE VALUE 100,500FULL MARKET VALUE 109,500 SCHOOL TAXABLE VALUE 46,200******************************************************************************************************* 2.-1-13 ********************10660 Main St 000001078002.-1-13 210 1 Family Res VILLAGE TAXABLE VALUE 47,200Graff Harold E <strong>Alexander</strong> Schoo 182202 8,500 COUNTY TAXABLE VALUE 47,200Graff Hilda M FRNT 77.00 DPTH 255.00 47,200 TOWN TAXABLE VALUE 47,200Route 98 EAST-1234849 NRTH-1056564 SCHOOL TAXABLE VALUE 47,200Attica, NY 14011 DEED BOOK 443 PG-00133FULL MARKET VALUE 47,200******************************************************************************************************* 1.-1-53 ********************3339 Buffalo St 000001051001.-1-53 210 1 Family Res STAR EN 41834 0 0 0 63,300Grant Emma Jean <strong>Alexander</strong> Schoo 182202 4,300 VILLAGE TAXABLE VALUE 96,8003339 Buffalo St FRNT 91.00 DPTH 127.00 96,800 COUNTY TAXABLE VALUE 96,800PO Box 24 EAST-1235223 NRTH-1057515 TOWN TAXABLE VALUE 96,800<strong>Alexander</strong>, NY 14005 DEED BOOK 684 PG-186 SCHOOL TAXABLE VALUE 33,500FULL MARKET VALUE 96,800************************************************************************************************************************************

STATE OF NEW YORK 2 0 1 3 T E N T A T I V E A S S E S S M E N T R O L L PAGE 13COUNTY - <strong>Genesee</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2012TOWN - <strong>Alexander</strong> THESE ASSESSMENTS ARE ALSO USED FOR VILLAGE PURPOSES TAXABLE STATUS DATE-MAR 01, 2013VILLAGE - <strong>Alexander</strong> OWNERS NAME SEQUENCESWIS - 182201 UNIFORM PERCENT OF VALUE IS 100.00TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE-----VILLAGE------COUNTY--------TOWN------SCHOOLCURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUECURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.******************************************************************************************************* 1.-1-22 ********************3371 Church St 000001023001.-1-22 210 1 Family Res STAR EN 41834 0 0 0 63,300Graybeal Roger <strong>Alexander</strong> Schoo 182202 6,900 VILLAGE TAXABLE VALUE 85,500Graybeal Sharlyn FRNT 66.00 DPTH 305.00 85,500 COUNTY TAXABLE VALUE 85,5003371 Church St EAST-1235383 NRTH-1057929 TOWN TAXABLE VALUE 85,500PO Box 243 DEED BOOK 453 PG-00838 SCHOOL TAXABLE VALUE 22,200<strong>Alexander</strong>, NY 14005 FULL MARKET VALUE 85,500******************************************************************************************************* 2.-3-4.1 *******************3435 Telephone Rd 000001122002.-3-4.1 210 1 Family Res STAR B 41854 0 0 0 30,000Green Bonnie <strong>Alexander</strong> Schoo 182202 6,200 VILLAGE TAXABLE VALUE 52,1003435 Telephone Rd FRNT 77.00 DPTH 238.00 52,100 COUNTY TAXABLE VALUE 52,100<strong>Alexander</strong>, NY 14005 BANKFAR0100 TOWN TAXABLE VALUE 52,100EAST-1236490 NRTH-1057234 SCHOOL TAXABLE VALUE 22,100DEED BOOK 859 PG-91FULL MARKET VALUE 52,100******************************************************************************************************* 2.-3-2 *********************3427 Telephone Rd 000001120002.-3-2 210 1 Family Res STAR B 41854 0 0 0 30,000Green Thomas M <strong>Alexander</strong> Schoo 182202 11,800 VILLAGE TAXABLE VALUE 47,2003427 Telephone Rd FRNT 107.00 DPTH 47,200 COUNTY TAXABLE VALUE 47,200<strong>Alexander</strong>, NY 14005 ACRES 0.60 BANKFAR0100 TOWN TAXABLE VALUE 47,200EAST-1236269 NRTH-1057305 SCHOOL TAXABLE VALUE 17,200DEED BOOK 848 PG-967FULL MARKET VALUE 47,200******************************************************************************************************* 1.-1-8.2 *******************3384 Broadway Rd1.-1-8.2 210 1 Family Res STAR EN 41834 0 0 0 63,300Grinnell James G <strong>Alexander</strong> Schoo 182202 9,100 VILLAGE TAXABLE VALUE 115,000Grinnell Jean E Also Liber 689/96 115,000 COUNTY TAXABLE VALUE 115,0003384 Broadway FRNT 129.00 DPTH 235.00 TOWN TAXABLE VALUE 115,000PO Box 32 EAST-1235609 NRTH-1058608 SCHOOL TAXABLE VALUE 51,700<strong>Alexander</strong>, NY 14005 DEED BOOK 605 PG-17FULL MARKET VALUE 115,000******************************************************************************************************* 3.-1-10.12 *****************3221 Broadway Rd3.-1-10.12 210 1 Family Res STAR B 41854 0 0 0 30,000Guarino Richard <strong>Alexander</strong> Schoo 182202 2,700 VILLAGE TAXABLE VALUE 88,900Guarino Colette FRNT 70.00 DPTH 145.00 88,900 COUNTY TAXABLE VALUE 88,9003221 Broadway EAST-1232803 NRTH-1057829 TOWN TAXABLE VALUE 88,900<strong>Alexander</strong>, NY 14005 DEED BOOK 790 PG-110 SCHOOL TAXABLE VALUE 58,900FULL MARKET VALUE 88,900************************************************************************************************************************************

STATE OF NEW YORK 2 0 1 3 T E N T A T I V E A S S E S S M E N T R O L L PAGE 14COUNTY - <strong>Genesee</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2012TOWN - <strong>Alexander</strong> THESE ASSESSMENTS ARE ALSO USED FOR VILLAGE PURPOSES TAXABLE STATUS DATE-MAR 01, 2013VILLAGE - <strong>Alexander</strong> OWNERS NAME SEQUENCESWIS - 182201 UNIFORM PERCENT OF VALUE IS 100.00TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE-----VILLAGE------COUNTY--------TOWN------SCHOOLCURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUECURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.******************************************************************************************************* 2.-1-30 ********************3292 Buffalo St 000001095002.-1-30 210 1 Family Res STAR B 41854 0 0 0 30,000Halle James J <strong>Alexander</strong> Schoo 182202 8,900 VILLAGE TAXABLE VALUE 87,500Halle Ann Marie FRNT 80.00 DPTH 308.00 87,500 COUNTY TAXABLE VALUE 87,5001649 Sumner Rd EAST-1234389 NRTH-1057436 TOWN TAXABLE VALUE 87,500Corfu, NY 14036 DEED BOOK 726 PG-350 SCHOOL TAXABLE VALUE 57,500FULL MARKET VALUE 87,500******************************************************************************************************* 2.-1-4 *********************10599 Main St 000001069002.-1-4 482 Det row bldg VILLAGE TAXABLE VALUE 124,500Harder Neal <strong>Alexander</strong> Schoo 182202 10,900 COUNTY TAXABLE VALUE 124,500Harder Shannon FRNT 183.70 DPTH 220.00 124,500 TOWN TAXABLE VALUE 124,50011062 Bowen Rd EAST-1235715 NRTH-1057033 SCHOOL TAXABLE VALUE 124,500Attica, NY 14011 DEED BOOK 884 PG-618FULL MARKET VALUE 124,500******************************************************************************************************* 2.-2-12 ********************10557 Main St 000001114002.-2-12 210 1 Family Res VETS-WV-C 41122 0 15,000 0 0Harmon Shirley <strong>Alexander</strong> Schoo 182202 9,000 VETS-WV-T 41123 9,000 0 9,000 010557 Main St FRNT 181.83 DPTH 277.00 119,800 AGED C 41802 0 10,480 0 0PO Box 283 EAST-1236153 NRTH-1057508 STAR EN 41834 0 0 0 63,300<strong>Alexander</strong>, NY 14005 DEED BOOK 499 PG-00116 VILLAGE TAXABLE VALUE 110,800FULL MARKET VALUE 119,800 COUNTY TAXABLE VALUE 94,320TOWN TAXABLE VALUE 110,800SCHOOL TAXABLE VALUE 56,500******************************************************************************************************* 2.-2-4 *********************10519 Main St 000001106002.-2-4 210 1 Family Res STAR B 41854 0 0 0 30,000Hartl Paul M <strong>Alexander</strong> Schoo 182202 7,800 VILLAGE TAXABLE VALUE 75,700Hartl Patricia A FRNT 71.28 DPTH 264.00 75,700 COUNTY TAXABLE VALUE 75,70010519 Main St BANKFAR0100 TOWN TAXABLE VALUE 75,700PO Box 204 EAST-1236603 NRTH-1058100 SCHOOL TAXABLE VALUE 45,700<strong>Alexander</strong>, NY 14005 DEED BOOK 612 PG-147FULL MARKET VALUE 75,700******************************************************************************************************* 2.-2-7 *********************10531 Main St 000001109002.-2-7 210 1 Family Res STAR B 41854 0 0 0 30,000Hartwick Paul <strong>Alexander</strong> Schoo 182202 9,100 VILLAGE TAXABLE VALUE 111,800Hartwick Kathleen FRNT 83.82 DPTH 267.30 111,800 COUNTY TAXABLE VALUE 111,80010531 Main EAST-1236461 NRTH-1057882 TOWN TAXABLE VALUE 111,800PO Box 233 DEED BOOK 460 PG-00702 SCHOOL TAXABLE VALUE 81,800<strong>Alexander</strong>, NY 14005 FULL MARKET VALUE 111,800************************************************************************************************************************************

STATE OF NEW YORK 2 0 1 3 T E N T A T I V E A S S E S S M E N T R O L L PAGE 15COUNTY - <strong>Genesee</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2012TOWN - <strong>Alexander</strong> THESE ASSESSMENTS ARE ALSO USED FOR VILLAGE PURPOSES TAXABLE STATUS DATE-MAR 01, 2013VILLAGE - <strong>Alexander</strong> OWNERS NAME SEQUENCESWIS - 182201 UNIFORM PERCENT OF VALUE IS 100.00TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE-----VILLAGE------COUNTY--------TOWN------SCHOOLCURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUECURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.******************************************************************************************************* 1.-1-35 ********************3320 Broadway Rd 000001035001.-1-35 210 1 Family Res STAR B 41854 0 0 0 30,000Henry Kenneth R <strong>Alexander</strong> Schoo 182202 7,400 VILLAGE TAXABLE VALUE 114,900Henry Julie L FRNT 85.00 DPTH 256.00 114,900 COUNTY TAXABLE VALUE 114,9003320 Broadway EAST-1234692 NRTH-1058154 TOWN TAXABLE VALUE 114,900<strong>Alexander</strong>, NY 14005 DEED BOOK 645 PG-8 SCHOOL TAXABLE VALUE 84,900FULL MARKET VALUE 114,900******************************************************************************************************* 2.-1-8 *********************10631 Main St 000001073002.-1-8 210 1 Family Res STAR B 41854 0 0 0 30,000Hess James G <strong>Alexander</strong> Schoo 182202 7,700 VILLAGE TAXABLE VALUE 86,80010631 Main St FRNT 69.60 DPTH 86,800 COUNTY TAXABLE VALUE 86,800<strong>Alexander</strong>, NY 14005 ACRES 0.52 BANKFAR0100 TOWN TAXABLE VALUE 86,800EAST-1235473 NRTH-1056736 SCHOOL TAXABLE VALUE 56,800DEED BOOK 743 PG-111FULL MARKET VALUE 86,800******************************************************************************************************* 2.-3-1 *********************3421 Telephone Rd 000001119002.-3-1 210 1 Family Res STAR B 41854 0 0 0 30,000Hinca Christopher J <strong>Alexander</strong> Schoo 182202 4,800 VILLAGE TAXABLE VALUE 82,000Hinca Lisa M FRNT 160.00 DPTH 82,000 COUNTY TAXABLE VALUE 82,0003421 Railroad Ave ACRES 0.40 BANKWFB0100 TOWN TAXABLE VALUE 82,000<strong>Alexander</strong>, NY 14005 EAST-1236152 NRTH-1057300 SCHOOL TAXABLE VALUE 52,000DEED BOOK 627 PG-337FULL MARKET VALUE 82,000******************************************************************************************************* 1.-1-30 ********************3330 Broadway Rd 000001030001.-1-30 210 1 Family Res STAR B 41854 0 0 0 30,000Hinz Martin T <strong>Alexander</strong> Schoo 182202 12,100 VILLAGE TAXABLE VALUE 109,600Hinz Jill A ACRES 1.11 BANKFAR0100 109,600 COUNTY TAXABLE VALUE 109,6003330 Broadway Rd EAST-1234881 NRTH-1058239 TOWN TAXABLE VALUE 109,600<strong>Alexander</strong>, NY 14005 DEED BOOK 718 PG-90 SCHOOL TAXABLE VALUE 79,600FULL MARKET VALUE 109,600******************************************************************************************************* 1.-1-44 ********************3338 Church St 000001043001.-1-44 210 1 Family Res STAR EN 41834 0 0 0 63,300Hittle James E <strong>Alexander</strong> Schoo 182202 3,500 VILLAGE TAXABLE VALUE 89,700Hittle Lolette M FRNT 146.00 DPTH 69.00 89,700 COUNTY TAXABLE VALUE 89,7003338 Church St EAST-1234788 NRTH-1057694 TOWN TAXABLE VALUE 89,700PO Box 84 DEED BOOK 423 PG-414 SCHOOL TAXABLE VALUE 26,400<strong>Alexander</strong>, NY 14005 FULL MARKET VALUE 89,700************************************************************************************************************************************

STATE OF NEW YORK 2 0 1 3 T E N T A T I V E A S S E S S M E N T R O L L PAGE 16COUNTY - <strong>Genesee</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2012TOWN - <strong>Alexander</strong> THESE ASSESSMENTS ARE ALSO USED FOR VILLAGE PURPOSES TAXABLE STATUS DATE-MAR 01, 2013VILLAGE - <strong>Alexander</strong> OWNERS NAME SEQUENCESWIS - 182201 UNIFORM PERCENT OF VALUE IS 100.00TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE-----VILLAGE------COUNTY--------TOWN------SCHOOLCURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUECURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.******************************************************************************************************* 3.-1-15 ********************3256 Broadway Rd 000001150003.-1-15 210 1 Family Res STAR B 41854 0 0 0 30,000Hoover Michael R <strong>Alexander</strong> Schoo 182202 13,800 VILLAGE TAXABLE VALUE 113,400Hoover Teresa L FRNT 124.00 DPTH 318.29 113,400 COUNTY TAXABLE VALUE 113,4003256 Broadway Rd EAST-1233459 NRTH-1057541 TOWN TAXABLE VALUE 113,400<strong>Alexander</strong>, NY 14005 DEED BOOK 522 PG-00328 SCHOOL TAXABLE VALUE 83,400FULL MARKET VALUE 113,400******************************************************************************************************* 2.-1-22.1 ******************10606 Main St 000001087002.-1-22.1 210 1 Family Res STAR B 41854 0 0 0 30,000Hoover Todd R <strong>Alexander</strong> Schoo 182202 3,400 VILLAGE TAXABLE VALUE 80,000Wolcott Bethany R FRNT 74.58 DPTH 256.00 80,000 COUNTY TAXABLE VALUE 80,00010606 Main St EAST-1235380 NRTH-1057166 TOWN TAXABLE VALUE 80,000<strong>Alexander</strong>, NY 14005 DEED BOOK 888 PG-8 SCHOOL TAXABLE VALUE 50,000FULL MARKET VALUE 80,000******************************************************************************************************* 3.-1-14 ********************3260 Broadway Rd 000001149003.-1-14 210 1 Family Res STAR B 41854 0 0 0 30,000Hulsh<strong>of</strong>f Linda A <strong>Alexander</strong> Schoo 182202 16,200 VILLAGE TAXABLE VALUE 80,9003260 Broadway Formerly 8.-1-76 80,900 COUNTY TAXABLE VALUE 80,900<strong>Alexander</strong>, NY 14005 ACRES 8.20 TOWN TAXABLE VALUE 80,900EAST-1233695 NRTH-1057151 SCHOOL TAXABLE VALUE 50,900DEED BOOK 729 PG-239FULL MARKET VALUE 80,900******************************************************************************************************* 1.-1-7 *********************3391 Broadway Rd 000001007001.-1-7 210 1 Family Res VETS-WV-C 41122 0 15,000 0 0Hulsh<strong>of</strong>f Robert <strong>Alexander</strong> Schoo 182202 13,500 VETS-WV-T 41123 9,000 0 9,000 0Hulsh<strong>of</strong>f Ruth FRNT 362.00 DPTH 124,800 STAR EN 41834 0 0 0 63,3003391 Broadway ACRES 1.90 VILLAGE TAXABLE VALUE 115,800<strong>Alexander</strong>, NY 14005 EAST-1235930 NRTH-1058946 COUNTY TAXABLE VALUE 109,800DEED BOOK 425 PG-1101 TOWN TAXABLE VALUE 115,800FULL MARKET VALUE 124,800 SCHOOL TAXABLE VALUE 61,500******************************************************************************************************* 1.-1-5.2 *******************Broadway Rd 000001005101.-1-5.2 311 Res vac land VILLAGE TAXABLE VALUE 105Hulsh<strong>of</strong>f Robert L <strong>Alexander</strong> Schoo 182202 105 COUNTY TAXABLE VALUE 105Hulsh<strong>of</strong>f Ruth ACRES 0.11 105 TOWN TAXABLE VALUE 1053391 Broadway EAST-1235662 NRTH-1058870 SCHOOL TAXABLE VALUE 105<strong>Alexander</strong>, NY 14005 DEED BOOK 492 PG-00336FULL MARKET VALUE 105******************************************************************************************************* 1.-1-11 ********************10506 Main St 000001010001.-1-11 484 1 use sm bld VILLAGE TAXABLE VALUE 234,000Katholos Trust Theodore II <strong>Alexander</strong> Schoo 182202 28,200 COUNTY TAXABLE VALUE 234,0001779 Bullis Rd ACRES 1.22 234,000 TOWN TAXABLE VALUE 234,000Elma, NY 14059 EAST-1236512 NRTH-1058527 SCHOOL TAXABLE VALUE 234,000DEED BOOK 776 PG-288FULL MARKET VALUE 234,000************************************************************************************************************************************

STATE OF NEW YORK 2 0 1 3 T E N T A T I V E A S S E S S M E N T R O L L PAGE 17COUNTY - <strong>Genesee</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2012TOWN - <strong>Alexander</strong> THESE ASSESSMENTS ARE ALSO USED FOR VILLAGE PURPOSES TAXABLE STATUS DATE-MAR 01, 2013VILLAGE - <strong>Alexander</strong> OWNERS NAME SEQUENCESWIS - 182201 UNIFORM PERCENT OF VALUE IS 100.00TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE-----VILLAGE------COUNTY--------TOWN------SCHOOLCURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUECURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.******************************************************************************************************* 2.-1-19 ********************10624 Main St 000001084002.-1-19 210 1 Family Res STAR B 41854 0 0 0 30,000Knapp Edward C <strong>Alexander</strong> Schoo 182202 10,600 VILLAGE TAXABLE VALUE 57,300Knapp Hope A FRNT 153.78 DPTH 255.00 57,300 COUNTY TAXABLE VALUE 57,30010624 <strong>Alexander</strong> Rd EAST-1235201 NRTH-1056983 TOWN TAXABLE VALUE 57,300Attica, NY 14011 DEED BOOK 674 PG-198 SCHOOL TAXABLE VALUE 27,300FULL MARKET VALUE 57,300******************************************************************************************************* 1.-1-58 ********************3355 Buffalo St 000001056001.-1-58 210 1 Family Res STAR B 41854 0 0 0 30,000Koch John H <strong>Alexander</strong> Schoo 182202 5,000 VILLAGE TAXABLE VALUE 93,6003355 Buffalo St FRNT 50.00 DPTH 168.81 93,600 COUNTY TAXABLE VALUE 93,600PO Box 78 EAST-1235443 NRTH-1057487 TOWN TAXABLE VALUE 93,600<strong>Alexander</strong>, NY 14005 DEED BOOK 885 PG-911 SCHOOL TAXABLE VALUE 63,600FULL MARKET VALUE 93,600******************************************************************************************************* 2.-2-8 *********************10537 Main St 000001110002.-2-8 210 1 Family Res STAR B 41854 0 0 0 30,000Koch Robert T <strong>Alexander</strong> Schoo 182202 9,800 VILLAGE TAXABLE VALUE 109,200PO Box 314 Aleta Green Lu 109,200 COUNTY TAXABLE VALUE 109,200<strong>Alexander</strong>, NY 14005 FRNT 89.10 DPTH 270.60 TOWN TAXABLE VALUE 109,200BANKFAR0100 SCHOOL TAXABLE VALUE 79,200EAST-1236412 NRTH-1057801DEED BOOK 844 PG-66FULL MARKET VALUE 109,200******************************************************************************************************* 3.-1-22 ********************Broadway Rd 000001157003.-1-22 431 Auto dealer VILLAGE TAXABLE VALUE 52,500Kohl Jeffrey A <strong>Alexander</strong> Schoo 182202 15,400 COUNTY TAXABLE VALUE 52,500Konfederath Richard A FRNT 225.00 DPTH 257.00 52,500 TOWN TAXABLE VALUE 52,5009673 Simonds Rd EAST-1232474 NRTH-1057564 SCHOOL TAXABLE VALUE 52,500Corfu, NY 14036 DEED BOOK 845 PG-527FULL MARKET VALUE 52,500******************************************************************************************************* 1.-1-28 ********************3343 Church St 000001028001.-1-28 210 1 Family Res STAR B 41854 0 0 0 30,000LaDuke Adam J <strong>Alexander</strong> Schoo 182202 6,200 VILLAGE TAXABLE VALUE 93,600LaDuke Karen J FRNT 69.00 DPTH 319.00 93,600 COUNTY TAXABLE VALUE 93,6003343 Church St BANKFAR0100 TOWN TAXABLE VALUE 93,600<strong>Alexander</strong>, NY 14005-0013 EAST-1234899 NRTH-1057931 SCHOOL TAXABLE VALUE 63,600DEED BOOK 836 PG-805FULL MARKET VALUE 93,600************************************************************************************************************************************

STATE OF NEW YORK 2 0 1 3 T E N T A T I V E A S S E S S M E N T R O L L PAGE 18COUNTY - <strong>Genesee</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2012TOWN - <strong>Alexander</strong> THESE ASSESSMENTS ARE ALSO USED FOR VILLAGE PURPOSES TAXABLE STATUS DATE-MAR 01, 2013VILLAGE - <strong>Alexander</strong> OWNERS NAME SEQUENCESWIS - 182201 UNIFORM PERCENT OF VALUE IS 100.00TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE-----VILLAGE------COUNTY--------TOWN------SCHOOLCURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUECURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.******************************************************************************************************* 1.-1-73 ********************1 Bartz Dr1.-1-73 210 1 Family Res STAR B 41854 0 0 0 30,000Laird Terry <strong>Alexander</strong> Schoo 182202 5,300 VILLAGE TAXABLE VALUE 136,800Laird Candy Mary Jane FRNT 142.00 DPTH 126.00 136,800 COUNTY TAXABLE VALUE 136,8001 Bartz Dr EAST-1235366 NRTH-1058557 TOWN TAXABLE VALUE 136,800<strong>Alexander</strong>, NY 14005 DEED BOOK 660 PG-275 SCHOOL TAXABLE VALUE 106,800FULL MARKET VALUE 136,800******************************************************************************************************* 1.-1-3.1 *******************3325 Broadway Rd 000001003001.-1-3.1 220 2 Family Res STAR B 41854 0 0 0 30,000Lang Ruth A <strong>Alexander</strong> Schoo 182202 12,300 VILLAGE TAXABLE VALUE 144,5003325 Broadway Rd ACRES 1.25 144,500 COUNTY TAXABLE VALUE 144,500<strong>Alexander</strong>, NY 14005 EAST-1234658 NRTH-1058580 TOWN TAXABLE VALUE 144,500DEED BOOK 790 PG-171 SCHOOL TAXABLE VALUE 114,500FULL MARKET VALUE 144,500******************************************************************************************************* 1.-1-25 ********************3349 Church St 000001025001.-1-25 210 1 Family Res STAR B 41854 0 0 0 30,000Lange David N <strong>Alexander</strong> Schoo 182202 10,400 VILLAGE TAXABLE VALUE 130,000Lange Marilyn F FRNT 79.00 DPTH 305.00 130,000 COUNTY TAXABLE VALUE 130,000Church St EAST-1235216 NRTH-1057931 TOWN TAXABLE VALUE 130,000PO Box 245 DEED BOOK 458 PG-00917 SCHOOL TAXABLE VALUE 100,000<strong>Alexander</strong>, NY 14005 FULL MARKET VALUE 130,000******************************************************************************************************* 3.-1-9.2 *******************3193 Broadway Rd 000001144003.-1-9.2 210 1 Family Res STAR B 41854 0 0 0 30,000Lennon Justin C <strong>Alexander</strong> Schoo 182202 11,200 VILLAGE TAXABLE VALUE 84,200Lennon Christy A FRNT 150.00 DPTH 217.00 84,200 COUNTY TAXABLE VALUE 84,2003193 Broadway EAST-1232578 NRTH-1057858 TOWN TAXABLE VALUE 84,200<strong>Alexander</strong>, NY 14005 DEED BOOK 811 PG-182 SCHOOL TAXABLE VALUE 54,200FULL MARKET VALUE 84,200******************************************************************************************************* 2.-1-9 *********************10635 Main St 000001074002.-1-9 210 1 Family Res Senior V 41807 68,000 0 0 0Leto Carolyn <strong>Alexander</strong> Schoo 182202 7,100 AGED C/T/S 41800 0 85,000 85,000 85,000Leto Mark FRNT 72.00 DPTH 320.00 170,000 STAR EN 41834 0 0 0 63,30010635 <strong>Alexander</strong> Rd EAST-1235423 NRTH-1056684 VILLAGE TAXABLE VALUE 102,000Attica, NY 14011 DEED BOOK 881 PG-323 COUNTY TAXABLE VALUE 85,000FULL MARKET VALUE 170,000 TOWN TAXABLE VALUE 85,000SCHOOL TAXABLE VALUE 21,700******************************************************************************************************* 2.-3-22.1 ******************Telephone (Rear) Rd2.-3-22.1 311 Res vac land VILLAGE TAXABLE VALUE 400Lor Rob Dairy Farms <strong>Alexander</strong> Schoo 182202 400 COUNTY TAXABLE VALUE 40010171 Bethany Center Rd ACRES 1.30 400 TOWN TAXABLE VALUE 400East Bethany, NY 14054 EAST-1238027 NRTH-1056943 SCHOOL TAXABLE VALUE 400DEED BOOK 879 PG-573FULL MARKET VALUE 400************************************************************************************************************************************

STATE OF NEW YORK 2 0 1 3 T E N T A T I V E A S S E S S M E N T R O L L PAGE 19COUNTY - <strong>Genesee</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2012TOWN - <strong>Alexander</strong> THESE ASSESSMENTS ARE ALSO USED FOR VILLAGE PURPOSES TAXABLE STATUS DATE-MAR 01, 2013VILLAGE - <strong>Alexander</strong> OWNERS NAME SEQUENCESWIS - 182201 UNIFORM PERCENT OF VALUE IS 100.00TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE-----VILLAGE------COUNTY--------TOWN------SCHOOLCURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUECURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.******************************************************************************************************* 1.-1-37 ********************3314 Broadway Rd 000001037001.-1-37 210 1 Family Res STAR B 41854 0 0 0 30,000Lowe Thomas J <strong>Alexander</strong> Schoo 182202 4,900 VILLAGE TAXABLE VALUE 85,600Lowe Jacqueline M FRNT 93.00 DPTH 191.00 85,600 COUNTY TAXABLE VALUE 85,6003314 Rt 20 EAST-1234521 NRTH-1058116 TOWN TAXABLE VALUE 85,600<strong>Alexander</strong>, NY 14005 DEED BOOK 745 PG-167 SCHOOL TAXABLE VALUE 55,600FULL MARKET VALUE 85,600******************************************************************************************************* 1.-1-76.12 *****************3376 Broadway Rd1.-1-76.12 210 1 Family Res STAR B 41854 0 0 0 30,000Lukasik Robert Jr <strong>Alexander</strong> Schoo 182202 7,400 VILLAGE TAXABLE VALUE 135,400Lukasik Lori A 1.-1-8.111 135,400 COUNTY TAXABLE VALUE 135,4003376 Broadway FRNT 121.00 DPTH 207.00 TOWN TAXABLE VALUE 135,400<strong>Alexander</strong>, NY 14005 BANKWFB0100 SCHOOL TAXABLE VALUE 105,400EAST-1235490 NRTH-1058542DEED BOOK 724 PG-150FULL MARKET VALUE 135,400******************************************************************************************************* 3.-1-20 ********************3220 Broadway Rd 000001155003.-1-20 210 1 Family Res VILLAGE TAXABLE VALUE 88,200Marinaccio Anthony <strong>Alexander</strong> Schoo 182202 10,200 COUNTY TAXABLE VALUE 88,2003236 Broadway Rd FRNT 100.00 DPTH 167.00 88,200 TOWN TAXABLE VALUE 88,200<strong>Alexander</strong>, NY 14005 BANKBAC0100 SCHOOL TAXABLE VALUE 88,200EAST-1232878 NRTH-1057607DEED BOOK 839 PG-877FULL MARKET VALUE 88,200******************************************************************************************************* 3.-1-19 ********************3236 Broadway Rd 000001154003.-1-19 210 1 Family Res STAR B 41854 0 0 0 30,000Marinaccio Anthony K <strong>Alexander</strong> Schoo 182202 13,300 VILLAGE TAXABLE VALUE 150,0003236 Broadway FRNT 125.00 DPTH 200.00 150,000 COUNTY TAXABLE VALUE 150,000<strong>Alexander</strong>, NY 14005 BANKBAC0100 TOWN TAXABLE VALUE 150,000EAST-1232990 NRTH-1057593 SCHOOL TAXABLE VALUE 120,000DEED BOOK 756 PG-41FULL MARKET VALUE 150,000******************************************************************************************************* 1.-1-21 ********************3375 Church St 000001022001.-1-21 210 1 Family Res STAR B 41854 0 0 0 30,000Marino John J <strong>Alexander</strong> Schoo 182202 6,900 VILLAGE TAXABLE VALUE 92,1003628 Dodgeson Rd FRNT 66.00 DPTH 296.00 92,100 COUNTY TAXABLE VALUE 92,100<strong>Alexander</strong>, NY 14005 BANKFAR0100 TOWN TAXABLE VALUE 92,100EAST-1235449 NRTH-1057930 SCHOOL TAXABLE VALUE 62,100DEED BOOK 871 PG-14FULL MARKET VALUE 92,100************************************************************************************************************************************

STATE OF NEW YORK 2 0 1 3 T E N T A T I V E A S S E S S M E N T R O L L PAGE 20COUNTY - <strong>Genesee</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2012TOWN - <strong>Alexander</strong> THESE ASSESSMENTS ARE ALSO USED FOR VILLAGE PURPOSES TAXABLE STATUS DATE-MAR 01, 2013VILLAGE - <strong>Alexander</strong> OWNERS NAME SEQUENCESWIS - 182201 UNIFORM PERCENT OF VALUE IS 100.00TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE-----VILLAGE------COUNTY--------TOWN------SCHOOLCURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUECURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.******************************************************************************************************* 1.-1-80 ********************Church St1.-1-80 311 Res vac land VILLAGE TAXABLE VALUE 100Mc Carthy John D <strong>Alexander</strong> Schoo 182202 100 COUNTY TAXABLE VALUE 100Mc Carthy Mary Ellen FRNT 22.00 DPTH 87.00 100 TOWN TAXABLE VALUE 1003660 Sprague Rd EAST-1235507 NRTH-1057562 SCHOOL TAXABLE VALUE 100<strong>Alexander</strong>, NY 14005 FULL MARKET VALUE 100******************************************************************************************************* 1.-1-45 ********************3307 Buffalo St 000001044001.-1-45 210 1 Family Res STAR B 41854 0 0 0 30,000McArthur Jenifer L <strong>Alexander</strong> Schoo 182202 2,700 VILLAGE TAXABLE VALUE 77,3003307 Buffalo St FRNT 87.00 DPTH 98.00 77,300 COUNTY TAXABLE VALUE 77,300<strong>Alexander</strong>, NY 14005 BANKFAR0100 TOWN TAXABLE VALUE 77,300EAST-1234731 NRTH-1057622 SCHOOL TAXABLE VALUE 47,300DEED BOOK 802 PG-258FULL MARKET VALUE 77,300******************************************************************************************************* 2.-3-22.2 ******************Telephone (Rear) Rd2.-3-22.2 323 Vacant rural VILLAGE TAXABLE VALUE 300McCormick Daniel M <strong>Alexander</strong> Schoo 182202 300 COUNTY TAXABLE VALUE 30010889 Sandpit Rd ACRES 1.30 300 TOWN TAXABLE VALUE 300<strong>Alexander</strong>, NY 14005 EAST-1237796 NRTH-1056483 SCHOOL TAXABLE VALUE 300DEED BOOK 759 PG-315FULL MARKET VALUE 300******************************************************************************************************* 2.-1-18 ********************10638 Main St 000001083002.-1-18 210 1 Family Res STAR B 41854 0 0 0 21,700McPhee Sean M <strong>Alexander</strong> Schoo 182202 11,400 STAR EN 41834 0 0 0 63,30010638 <strong>Alexander</strong> Rd FRNT 105.00 DPTH 85,000 VILLAGE TAXABLE VALUE 85,000aTTICA, NY 14011 ACRES 0.52 COUNTY TAXABLE VALUE 85,000EAST-1235129 NRTH-1056881 TOWN TAXABLE VALUE 85,000DEED BOOK 893 PG-826 SCHOOL TAXABLE VALUE 0FULL MARKET VALUE 85,000******************************************************************************************************* 1.-1-14.1 ******************10532 Main St 000001013001.-1-14.1 210 1 Family Res STAR B 41854 0 0 0 30,000Meek-Grimes Molly A <strong>Alexander</strong> Schoo 182202 19,100 VILLAGE TAXABLE VALUE 153,800PO Box 246 FRNT 233.00 DPTH 153,800 COUNTY TAXABLE VALUE 153,800<strong>Alexander</strong>, NY 14005 ACRES 5.06 TOWN TAXABLE VALUE 153,800EAST-1236065 NRTH-1058273 SCHOOL TAXABLE VALUE 123,800DEED BOOK 894 PG-634FULL MARKET VALUE 153,800************************************************************************************************************************************

STATE OF NEW YORK 2 0 1 3 T E N T A T I V E A S S E S S M E N T R O L L PAGE 21COUNTY - <strong>Genesee</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2012TOWN - <strong>Alexander</strong> THESE ASSESSMENTS ARE ALSO USED FOR VILLAGE PURPOSES TAXABLE STATUS DATE-MAR 01, 2013VILLAGE - <strong>Alexander</strong> OWNERS NAME SEQUENCESWIS - 182201 UNIFORM PERCENT OF VALUE IS 100.00TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE-----VILLAGE------COUNTY--------TOWN------SCHOOLCURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUECURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.******************************************************************************************************* 1.-1-2 *********************3313 Broadway Rd 000001002001.-1-2 210 1 Family Res STAR B 41854 0 0 0 30,000Merkle Brandon <strong>Alexander</strong> Schoo 182202 12,100 VILLAGE TAXABLE VALUE 141,500Merkle Ella Also Liber 316/Page 448 141,500 COUNTY TAXABLE VALUE 141,5003313 Broadway Rd ACRES 1.10 BANKFAR0100 TOWN TAXABLE VALUE 141,500<strong>Alexander</strong>, NY 14005 EAST-1234529 NRTH-1058576 SCHOOL TAXABLE VALUE 111,500DEED BOOK 844 PG-265FULL MARKET VALUE 141,500******************************************************************************************************* 2.-3-8.1 *******************3453 Telephone Rd 000001126002.-3-8.1 210 1 Family Res VETS-WV-T 41123 9,000 0 9,000 0Merle Paul <strong>Alexander</strong> Schoo 182202 6,200 STAR B 41854 0 0 0 30,000Merle Sheila ACRES 1.33 73,800 VETS-WV-C 41122 0 11,070 0 03453 Railroad Ave EAST-1236906 NRTH-1057262 VILLAGE TAXABLE VALUE 64,800<strong>Alexander</strong>, NY 14005 DEED BOOK 625 PG-187 COUNTY TAXABLE VALUE 62,730FULL MARKET VALUE 73,800 TOWN TAXABLE VALUE 64,800SCHOOL TAXABLE VALUE 43,800******************************************************************************************************* 2.-3-7.2 *******************Telephone Rd2.-3-7.2 311 Res vac land VILLAGE TAXABLE VALUE 500Merle Paul E <strong>Alexander</strong> Schoo 182202 500 COUNTY TAXABLE VALUE 500Merle Sheila M ACRES 0.22 500 TOWN TAXABLE VALUE 5003453 Railroad Ave EAST-1236826 NRTH-1057111 SCHOOL TAXABLE VALUE 500<strong>Alexander</strong>, NY 14005 DEED BOOK 751 PG-347FULL MARKET VALUE 500******************************************************************************************************* 2.-1-26 ********************3346 Buffalo St 000001091002.-1-26 220 2 Family Res STAR B 41854 0 0 0 30,000Metz Michael J <strong>Alexander</strong> Schoo 182202 8,000 VILLAGE TAXABLE VALUE 74,5003346 Buffalo St FRNT 91.08 DPTH 119.46 74,500 COUNTY TAXABLE VALUE 74,500<strong>Alexander</strong>, NY 14005 BANKBAC0100 TOWN TAXABLE VALUE 74,500EAST-1235258 NRTH-1057307 SCHOOL TAXABLE VALUE 44,500DEED BOOK 865 PG-613FULL MARKET VALUE 74,500******************************************************************************************************* 1.-1-20 ********************3379 Church St 000001021001.-1-20 210 1 Family Res STAR B 41854 0 0 0 30,000Meyer David L <strong>Alexander</strong> Schoo 182202 6,800 VILLAGE TAXABLE VALUE 86,700Meyer Cindy A FRNT 66.00 DPTH 296.00 86,700 COUNTY TAXABLE VALUE 86,7001753 <strong>County</strong> Line Rd BANKFAR0100 TOWN TAXABLE VALUE 86,700Alden, NY 14004 EAST-1235514 NRTH-1057929 SCHOOL TAXABLE VALUE 56,700DEED BOOK 882 PG-113FULL MARKET VALUE 86,700************************************************************************************************************************************

STATE OF NEW YORK 2 0 1 3 T E N T A T I V E A S S E S S M E N T R O L L PAGE 22COUNTY - <strong>Genesee</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2012TOWN - <strong>Alexander</strong> THESE ASSESSMENTS ARE ALSO USED FOR VILLAGE PURPOSES TAXABLE STATUS DATE-MAR 01, 2013VILLAGE - <strong>Alexander</strong> OWNERS NAME SEQUENCESWIS - 182201 UNIFORM PERCENT OF VALUE IS 100.00TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE-----VILLAGE------COUNTY--------TOWN------SCHOOLCURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUECURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.******************************************************************************************************* 2.-1-17 ********************10642 Main St 000001082002.-1-17 210 1 Family Res STAR B 41854 0 0 0 30,000Miller Donald <strong>Alexander</strong> Schoo 182202 7,200 VILLAGE TAXABLE VALUE 86,600Miller Debra FRNT 65.00 DPTH 248.00 86,600 COUNTY TAXABLE VALUE 86,60010642 Main St EAST-1235077 NRTH-1056817 TOWN TAXABLE VALUE 86,600PO Box 154 DEED BOOK 578 PG-177 SCHOOL TAXABLE VALUE 56,600<strong>Alexander</strong>, NY 14005 FULL MARKET VALUE 86,600******************************************************************************************************* 1.-1-56 ********************3374 Church St 000001054001.-1-56 210 1 Family Res STAR EN 41834 0 0 0 63,300Miller George <strong>Alexander</strong> Schoo 182202 7,400 VILLAGE TAXABLE VALUE 130,0003374 Church St FRNT 89.00 DPTH 130,000 COUNTY TAXABLE VALUE 130,000<strong>Alexander</strong>, NY 14005 ACRES 0.24 TOWN TAXABLE VALUE 130,000EAST-1235431 NRTH-1057662 SCHOOL TAXABLE VALUE 66,700DEED BOOK 871 PG-884FULL MARKET VALUE 130,000******************************************************************************************************* 2.-1-20.1 ******************10616 Main St 000001085002.-1-20.1 220 2 Family Res STAR B 41854 0 0 0 30,000Miller Sheri <strong>Alexander</strong> Schoo 182202 8,600 VILLAGE TAXABLE VALUE 120,00010616 Main St FRNT 112.00 DPTH 243.00 120,000 COUNTY TAXABLE VALUE 120,000<strong>Alexander</strong>, NY 14005 BANKFAR0100 TOWN TAXABLE VALUE 120,000EAST-1235270 NRTH-1057095 SCHOOL TAXABLE VALUE 90,000DEED BOOK 854 PG-992FULL MARKET VALUE 120,000******************************************************************************************************* 3.-1-1 *********************3115 Broadway Rd 000001136003.-1-1 210 1 Family Res VETS-WV-C 41122 0 14,070 0 0Minihan Phyllis B <strong>Alexander</strong> Schoo 182202 16,100 VETS-WV-T 41123 9,000 0 9,000 0Minihan Joseph ACRES 5.60 93,800 AGED C/T 41801 0 39,865 42,400 03115 Broadway Rd EAST-1231154 NRTH-1057980 AGED S 41804 0 0 0 37,520<strong>Alexander</strong>, NY 14005 DEED BOOK 810 PG-260 Senior V 41807 25,440 0 0 0FULL MARKET VALUE 93,800 STAR EN 41834 0 0 0 56,280VILLAGE TAXABLE VALUE 59,360COUNTY TAXABLE VALUE 39,865TOWN TAXABLE VALUE 42,400SCHOOL TAXABLE VALUE 0******************************************************************************************************* 1.-1-9 *********************3400 Broadway Rd 000001009001.-1-9 210 1 Family Res VILLAGE TAXABLE VALUE 134,800Mitzel David G <strong>Alexander</strong> Schoo 182202 12,500 COUNTY TAXABLE VALUE 134,800Mitzel Laurie A FRNT 267.00 DPTH 221.00 134,800 TOWN TAXABLE VALUE 134,8003400 Broadway Rd EAST-1235915 NRTH-1058614 SCHOOL TAXABLE VALUE 134,800<strong>Alexander</strong>, NY 14005 DEED BOOK 857 PG-205FULL MARKET VALUE 134,800************************************************************************************************************************************