S&P - Public Finance Criteria (2007). - The Global Clearinghouse

S&P - Public Finance Criteria (2007). - The Global Clearinghouse

S&P - Public Finance Criteria (2007). - The Global Clearinghouse

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

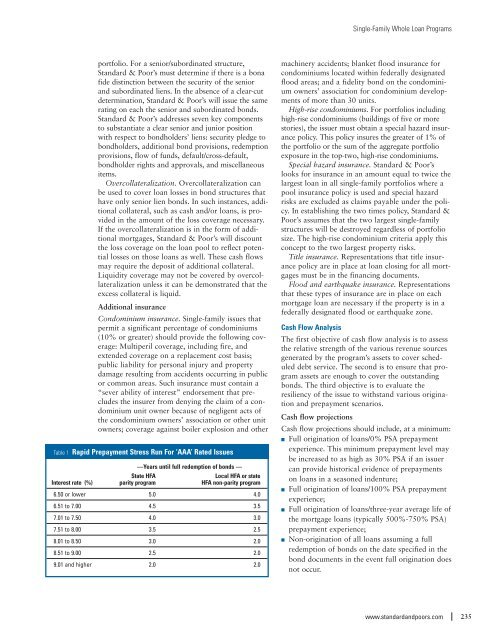

Single-Family Whole Loan Programsportfolio. For a senior/subordinated structure,Standard & Poor’s must determine if there is a bonafide distinction between the security of the seniorand subordinated liens. In the absence of a clear-cutdetermination, Standard & Poor’s will issue the samerating on each the senior and subordinated bonds.Standard & Poor’s addresses seven key componentsto substantiate a clear senior and junior positionwith respect to bondholders’ liens: security pledge tobondholders, additional bond provisions, redemptionprovisions, flow of funds, default/cross-default,bondholder rights and approvals, and miscellaneousitems.Overcollateralization. Overcollateralization canbe used to cover loan losses in bond structures thathave only senior lien bonds. In such instances, additionalcollateral, such as cash and/or loans, is providedin the amount of the loss coverage necessary.If the overcollateralization is in the form of additionalmortgages, Standard & Poor’s will discountthe loss coverage on the loan pool to reflect potentiallosses on those loans as well. <strong>The</strong>se cash flowsmay require the deposit of additional collateral.Liquidity coverage may not be covered by overcollateralizationunless it can be demonstrated that theexcess collateral is liquid.Additional insuranceCondominium insurance. Single-family issues thatpermit a significant percentage of condominiums(10% or greater) should provide the following coverage:Multiperil coverage, including fire, andextended coverage on a replacement cost basis;public liability for personal injury and propertydamage resulting from accidents occurring in publicor common areas. Such insurance must contain a“sever ability of interest” endorsement that precludesthe insurer from denying the claim of a condominiumunit owner because of negligent acts ofthe condominium owners’ association or other unitowners; coverage against boiler explosion and otherTable 1 Rapid Prepayment Stress Run For ‘AAA’ Rated Issues—Years until full redemption of bonds —State HFALocal HFA or stateInterest rate (%) parity program HFA non-parity program6.50 or lower 5.0 4.06.51 to 7.00 4.5 3.57.01 to 7.50 4.0 3.07.51 to 8.00 3.5 2.58.01 to 8.50 3.0 2.08.51 to 9.00 2.5 2.09.01 and higher 2.0 2.0machinery accidents; blanket flood insurance forcondominiums located within federally designatedflood areas; and a fidelity bond on the condominiumowners’ association for condominium developmentsof more than 30 units.High-rise condominiums. For portfolios includinghigh-rise condominiums (buildings of five or morestories), the issuer must obtain a special hazard insurancepolicy. This policy insures the greater of 1% ofthe portfolio or the sum of the aggregate portfolioexposure in the top-two, high-rise condominiums.Special hazard insurance. Standard & Poor’slooks for insurance in an amount equal to twice thelargest loan in all single-family portfolios where apool insurance policy is used and special hazardrisks are excluded as claims payable under the policy.In establishing the two times policy, Standard &Poor’s assumes that the two largest single-familystructures will be destroyed regardless of portfoliosize. <strong>The</strong> high-rise condominium criteria apply thisconcept to the two largest property risks.Title insurance. Representations that title insurancepolicy are in place at loan closing for all mortgagesmust be in the financing documents.Flood and earthquake insurance. Representationsthat these types of insurance are in place on eachmortgage loan are necessary if the property is in afederally designated flood or earthquake zone.Cash Flow Analysis<strong>The</strong> first objective of cash flow analysis is to assessthe relative strength of the various revenue sourcesgenerated by the program’s assets to cover scheduleddebt service. <strong>The</strong> second is to ensure that programassets are enough to cover the outstandingbonds. <strong>The</strong> third objective is to evaluate theresiliency of the issue to withstand various originationand prepayment scenarios.Cash flow projectionsCash flow projections should include, at a minimum:■ Full origination of loans/0% PSA prepaymentexperience. This minimum prepayment level maybe increased to as high as 30% PSA if an issuercan provide historical evidence of prepaymentson loans in a seasoned indenture;■ Full origination of loans/100% PSA prepaymentexperience;■ Full origination of loans/three-year average life ofthe mortgage loans (typically 500%-750% PSA)prepayment experience;■ Non-origination of all loans assuming a fullredemption of bonds on the date specified in thebond documents in the event full origination doesnot occur.www.standardandpoors.com235