S&P - Public Finance Criteria (2007). - The Global Clearinghouse

S&P - Public Finance Criteria (2007). - The Global Clearinghouse

S&P - Public Finance Criteria (2007). - The Global Clearinghouse

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

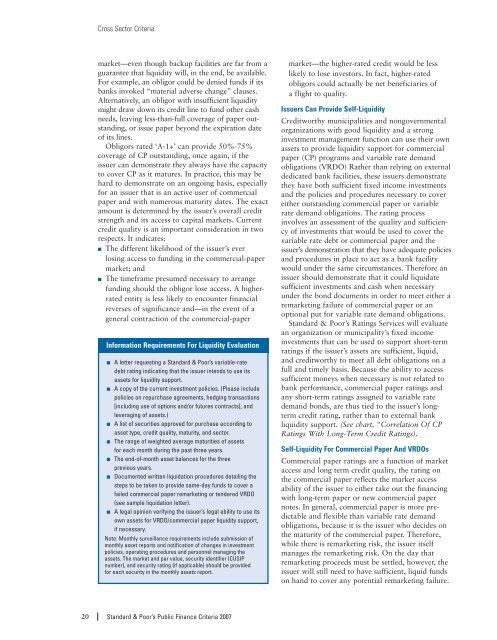

Cross Sector <strong>Criteria</strong>market—even though backup facilities are far from aguarantee that liquidity will, in the end, be available.For example, an obligor could be denied funds if itsbanks invoked “material adverse change” clauses.Alternatively, an obligor with insufficient liquiditymight draw down its credit line to fund other cashneeds, leaving less-than-full coverage of paper outstanding,or issue paper beyond the expiration dateof its lines.Obligors rated ‘A-1+’ can provide 50%-75%coverage of CP outstanding, once again, if theissuer can demonstrate they always have the capacityto cover CP as it matures. In practice, this may behard to demonstrate on an ongoing basis, especiallyfor an issuer that is an active user of commercialpaper and with numerous maturity dates. <strong>The</strong> exactamount is determined by the issuer’s overall creditstrength and its access to capital markets. Currentcredit quality is an important consideration in tworespects. It indicates:■ <strong>The</strong> different likelihood of the issuer’s everlosing access to funding in the commercial-papermarket; and■ <strong>The</strong> timeframe presumed necessary to arrangefunding should the obligor lose access. A higherratedentity is less likely to encounter financialreverses of significance and—in the event of ageneral contraction of the commercial-paperInformation Requirements For Liquidity Evaluation■ A letter requesting a Standard & Poor’s variable-ratedebt rating indicating that the issuer intends to use itsassets for liquidity support.■ A copy of the current investment policies. (Please includepolicies on repurchase agreements, hedging transactions[including use of options and/or futures contracts], andleveraging of assets.)■ A list of securities approved for purchase according toasset type, credit quality, maturity, and sector.■ <strong>The</strong> range of weighted average maturities of assetsfor each month during the past three years.■ <strong>The</strong> end-of-month asset balances for the threeprevious years.■ Documented written liquidation procedures detailing thesteps to be taken to provide same-day funds to cover afailed commercial paper remarketing or tendered VRDO(see sample liquidation letter).■ A legal opinion verifying the issuer’s legal ability to use itsown assets for VRDO/commercial paper liquidity support,if necessary.Note: Monthly surveillance requirements include submission ofmonthly asset reports and notification of changes in investmentpolicies, operating procedures and personnel managing theassets. <strong>The</strong> market and par value, security identifier (CUSIPnumber), and security rating (if applicable) should be providedfor each security in the monthly assets report.market—the higher-rated credit would be lesslikely to lose investors. In fact, higher-ratedobligors could actually be net beneficiaries ofa flight to quality.Issuers Can Provide Self-LiquidityCreditworthy municipalities and nongovernmentalorganizations with good liquidity and a stronginvestment management function can use their ownassets to provide liquidity support for commercialpaper (CP) programs and variable rate demandobligations (VRDO) Rather than relying on externaldedicated bank facilities, these issuers demonstratethey have both sufficient fixed income investmentsand the policies and procedures necessary to covereither outstanding commercial paper or variablerate demand obligations. <strong>The</strong> rating processinvolves an assessment of the quality and sufficiencyof investments that would be used to cover thevariable rate debt or commercial paper and theissuer’s demonstration that they have adequate policiesand procedures in place to act as a bank facilitywould under the same circumstances. <strong>The</strong>refore anissuer should demonstrate that it could liquidatesufficient investments and cash when necessaryunder the bond documents in order to meet either aremarketing failure of commercial paper or anoptional put for variable rate demand obligations.Standard & Poor’s Ratings Services will evaluatean organization or municipality’s fixed incomeinvestments that can be used to support short-termratings if the issuer’s assets are sufficient, liquid,and creditworthy to meet all debt obligations on afull and timely basis. Because the ability to accesssufficient moneys when necessary is not related tobank performance, commercial paper ratings andany short-term ratings assigned to variable ratedemand bonds, are thus tied to the issuer’s longtermcredit rating, rather than to external bankliquidity support. (See chart, “Correlation Of CPRatings With Long-Term Credit Ratings).Self-Liquidity For Commercial Paper And VRDOsCommercial paper ratings are a function of marketaccess and long term credit quality, the rating onthe commercial paper reflects the market accessability of the issuer to either take out the financingwith long-term paper or new commercial papernotes. In general, commercial paper is more predictableand flexible than variable rate demandobligations, because it is the issuer who decides onthe maturity of the commercial paper. <strong>The</strong>refore,while there is remarketing risk, the issuer itselfmanages the remarketing risk. On the day thatremarketing proceeds must be settled, however, theissuer will still need to have sufficient, liquid fundson hand to cover any potential remarketing failure.20 Standard & Poor’s <strong>Public</strong> <strong>Finance</strong> <strong>Criteria</strong> <strong>2007</strong>