S&P - Public Finance Criteria (2007). - The Global Clearinghouse

S&P - Public Finance Criteria (2007). - The Global Clearinghouse

S&P - Public Finance Criteria (2007). - The Global Clearinghouse

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

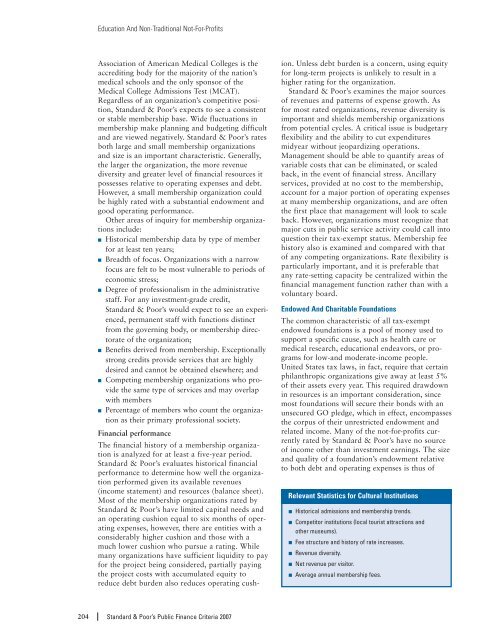

Education And Non-Traditional Not-For-ProfitsAssociation of American Medical Colleges is theaccrediting body for the majority of the nation’smedical schools and the only sponsor of theMedical College Admissions Test (MCAT).Regardless of an organization’s competitive position,Standard & Poor’s expects to see a consistentor stable membership base. Wide fluctuations inmembership make planning and budgeting difficultand are viewed negatively. Standard & Poor’s ratesboth large and small membership organizationsand size is an important characteristic. Generally,the larger the organization, the more revenuediversity and greater level of financial resources itpossesses relative to operating expenses and debt.However, a small membership organization couldbe highly rated with a substantial endowment andgood operating performance.Other areas of inquiry for membership organizationsinclude:■ Historical membership data by type of memberfor at least ten years;■ Breadth of focus. Organizations with a narrowfocus are felt to be most vulnerable to periods ofeconomic stress;■ Degree of professionalism in the administrativestaff. For any investment-grade credit,Standard & Poor’s would expect to see an experienced,permanent staff with functions distinctfrom the governing body, or membership directorateof the organization;■ Benefits derived from membership. Exceptionallystrong credits provide services that are highlydesired and cannot be obtained elsewhere; and■ Competing membership organizations who providethe same type of services and may overlapwith members■ Percentage of members who count the organizationas their primary professional society.Financial performance<strong>The</strong> financial history of a membership organizationis analyzed for at least a five-year period.Standard & Poor’s evaluates historical financialperformance to determine how well the organizationperformed given its available revenues(income statement) and resources (balance sheet).Most of the membership organizations rated byStandard & Poor’s have limited capital needs andan operating cushion equal to six months of operatingexpenses, however, there are entities with aconsiderably higher cushion and those with amuch lower cushion who pursue a rating. Whilemany organizations have sufficient liquidity to payfor the project being considered, partially payingthe project costs with accumulated equity toreduce debt burden also reduces operating cushion.Unless debt burden is a concern, using equityfor long-term projects is unlikely to result in ahigher rating for the organization.Standard & Poor’s examines the major sourcesof revenues and patterns of expense growth. Asfor most rated organizations, revenue diversity isimportant and shields membership organizationsfrom potential cycles. A critical issue is budgetaryflexibility and the ability to cut expendituresmidyear without jeopardizing operations.Management should be able to quantify areas ofvariable costs that can be eliminated, or scaledback, in the event of financial stress. Ancillaryservices, provided at no cost to the membership,account for a major portion of operating expensesat many membership organizations, and are oftenthe first place that management will look to scaleback. However, organizations must recognize thatmajor cuts in public service activity could call intoquestion their tax-exempt status. Membership feehistory also is examined and compared with thatof any competing organizations. Rate flexibility isparticularly important, and it is preferable thatany rate-setting capacity be centralized within thefinancial management function rather than with avoluntary board.Endowed And Charitable Foundations<strong>The</strong> common characteristic of all tax-exemptendowed foundations is a pool of money used tosupport a specific cause, such as health care ormedical research, educational endeavors, or programsfor low-and moderate-income people.United States tax laws, in fact, require that certainphilanthropic organizations give away at least 5%of their assets every year. This required drawdownin resources is an important consideration, sincemost foundations will secure their bonds with anunsecured GO pledge, which in effect, encompassesthe corpus of their unrestricted endowment andrelated income. Many of the not-for-profits currentlyrated by Standard & Poor’s have no sourceof income other than investment earnings. <strong>The</strong> sizeand quality of a foundation’s endowment relativeto both debt and operating expenses is thus ofRelevant Statistics for Cultural Institutions■ Historical admissions and membership trends.■ Competitor institutions (local tourist attractions andother museums).■ Fee structure and history of rate increases.■ Revenue diversity.■ Net revenue per visitor.■ Average annual membership fees.204 Standard & Poor’s <strong>Public</strong> <strong>Finance</strong> <strong>Criteria</strong> <strong>2007</strong>