Finance Act 2010 - TRA

Finance Act 2010 - TRA Finance Act 2010 - TRA

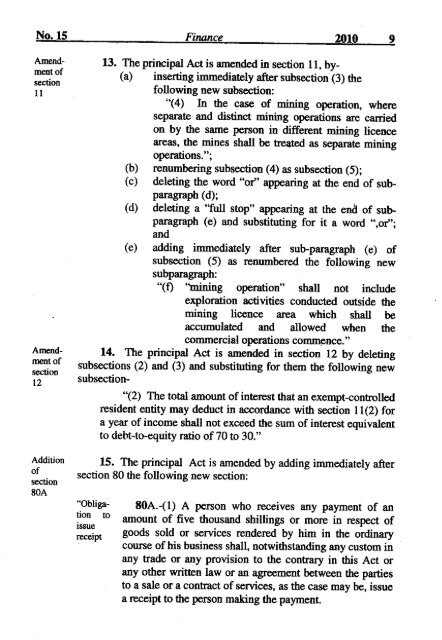

Amendmentofsection11Amendmentofsection12Additionofsection80A13. The principal Act is amended in section 11, by-(a) inserting immediately after subsection (3) thefollowing new subsection:"(4) In the case of mining operation, whereseparate and distinct mining operations are carriedon by the same person in different mining licenceareas, the mines shall be treated as separate miningoperations.";(b) renumbering subsection (4) as subsection (5);(c) deleting the word "or" appearing at the end of subparagraph(d);(d) deleting a ''full stop" appearing at the end of subparagraph(e) and substituting for it a word ",or";and(e) adding immediately after sub-paragraph (e) ofsubsection (5) as renumbered the following newsubparagraph:"(f) "mining operation" shall not includeexploration activities conducted outside themining licence area which shall beaccumulated and allowed when thecommercial operations commence."14. The principal Act is amended in section 12 by deletingsubsections (2) and (3) and substituting for them the following newsubsection-"(2) The total amount of interest that an exempt-controlledresident entity may deduct in accordance with section 11(2) fora year of income shall not exceed the sum of interest equivalentto debt-to-equity ratio of 70 to 30."15. The principal Act is amended by adding immediately aftersection 80 the following new section:"Obligationtoissuereceipt80A.-(l) A person who receives any payment of anamount of five thousand shillings or more in respect ofgoods sold or services rendered by him in the ordinarycourse of his business shall, notwithstanding any custom inany trade or any provision to the contrary in this Act orany other written law or an agreement between the partiesto a sale or a contract of services, as the case may be, issuea receipt to the person making the payment.

(2) A person issuing the receipt shall be required toenter or cause to be entered in the receipt and its duplicatecopy the following particulars:(a) the date on which the payment is made;(b) full name and address of the person who sold thegoods or rendered the services, as the case may be;(c) full description of the goods sold or the servicesrendered and a statement of the quantity and valueof the goods or, in the case of services, the amountcharged in respect of the services rendered;(d) full name and address of the person to whom thegoods were sold or to whom the services wererendered, as the case may be;(e) a Tax Identification Number (TIN); and(f) such other particulars as the Commissioner may, bynotice in writing, specify from time to· time for thepurposes of this section".(3) Every person who issues a receipt in accordancewith preceding provisions of this section shall be requiredto retain in his records the duplicate copy of every receiptissued by him and shan, unless the Commissioner directsotherwise, preserve that copy for a period of not less thanfive years after the year of income to which the receiptrelates."Amendmentofsection83AAmendmentofsection98Amendmentofsection10016. The principal Act is amended in section 83A, by deletingthe word "Government" wherever it appear in that section andsubstituting for it the word "Corporation".17. The principal Act is amended in section 98, by addingimmediately after subsection (2) the following new subsection:"(3) Any person who receives any payment and fails toissue a receipt in accordance with the requirement of section80A, commits an offence and shall, upon conviction, be liableto a fine not exceeding two million shillings or to imprisonmentfor a term not exceeding twelve months or to both."18. The principal Act is amended in section 100(1), by addingimmediately after the phrase "statutory rate", the phrase "plus 5%per annum" appearing the third line."

- Page 1 and 2: THE FINANCE ACT, 2010ARRANGEMENTOF

- Page 3 and 4: Additionof section17A4. The princip

- Page 5 and 6: - Other wine; grape must L Tsbs. Ts

- Page 7: 27.10 Petroleum oils and oilsobtain

- Page 11 and 12: "I.Produce Cess on buyers(a) Crop c

- Page 13 and 14: egulations, standards,systems and p

- Page 15 and 16: Officen;ofInternalAuditorGeneralDiv

- Page 17 and 18: (5) Where the investigation is comp

- Page 19 and 20: Amendmentof section 1138. The princ

- Page 21 and 22: (ii) adding immediately after a "co

- Page 23: (2) The relief provided in sub-item

Amendmentofsection11Amendmentofsection12Additionofsection80A13. The principal <strong>Act</strong> is amended in section 11, by-(a) inserting immediately after subsection (3) thefollowing new subsection:"(4) In the case of mining operation, whereseparate and distinct mining operations are carriedon by the same person in different mining licenceareas, the mines shall be treated as separate miningoperations.";(b) renumbering subsection (4) as subsection (5);(c) deleting the word "or" appearing at the end of subparagraph(d);(d) deleting a ''full stop" appearing at the end of subparagraph(e) and substituting for it a word ",or";and(e) adding immediately after sub-paragraph (e) ofsubsection (5) as renumbered the following newsubparagraph:"(f) "mining operation" shall not includeexploration activities conducted outside themining licence area which shall beaccumulated and allowed when thecommercial operations commence."14. The principal <strong>Act</strong> is amended in section 12 by deletingsubsections (2) and (3) and substituting for them the following newsubsection-"(2) The total amount of interest that an exempt-controlledresident entity may deduct in accordance with section 11(2) fora year of income shall not exceed the sum of interest equivalentto debt-to-equity ratio of 70 to 30."15. The principal <strong>Act</strong> is amended by adding immediately aftersection 80 the following new section:"Obligationtoissuereceipt80A.-(l) A person who receives any payment of anamount of five thousand shillings or more in respect ofgoods sold or services rendered by him in the ordinarycourse of his business shall, notwithstanding any custom inany trade or any provision to the contrary in this <strong>Act</strong> orany other written law or an agreement between the partiesto a sale or a contract of services, as the case may be, issuea receipt to the person making the payment.