Consolidated Financial Statements and Notes - Brookfield Asset ...

Consolidated Financial Statements and Notes - Brookfield Asset ...

Consolidated Financial Statements and Notes - Brookfield Asset ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

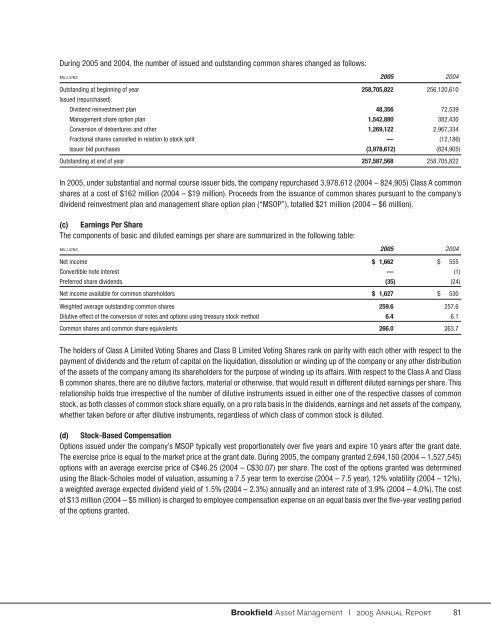

During 2005 <strong>and</strong> 2004, the number of issued <strong>and</strong> outst<strong>and</strong>ing common shares changed as follows:MILLIONS 2005 2004Outst<strong>and</strong>ing at beginning of year 258,705,822 256,120,610Issued (repurchased):Dividend reinvestment plan 48,356 72,539Management share option plan 1,542,880 382,430Conversion of debentures <strong>and</strong> other 1,269,122 2,967,334Fractional shares cancelled in relation to stock split — (12,186)Issuer bid purchases (3,978,612) (824,905)Outst<strong>and</strong>ing at end of year 257,587,568 258,705,822In 2005, under substantial <strong>and</strong> normal course issuer bids, the company repurchased 3,978,612 (2004 – 824,905) Class A commonshares at a cost of $162 million (2004 – $19 million). Proceeds from the issuance of common shares pursuant to the company’sdividend reinvestment plan <strong>and</strong> management share option plan (“MSOP”), totalled $21 million (2004 – $6 million).(c) Earnings Per ShareThe components of basic <strong>and</strong> diluted earnings per share are summarized in the following table:MILLIONS 2005 2004Net income $ 1,662 $ 555Convertible note interest — (1)Preferred share dividends (35) (24)Net income available for common shareholders $ 1,627 $ 530Weighted average outst<strong>and</strong>ing common shares 259.6 257.6Dilutive effect of the conversion of notes <strong>and</strong> options using treasury stock method 6.4 6.1Common shares <strong>and</strong> common share equivalents 266.0 263.7The holders of Class A Limited Voting Shares <strong>and</strong> Class B Limited Voting Shares rank on parity with each other with respect to thepayment of dividends <strong>and</strong> the return of capital on the liquidation, dissolution or winding up of the company or any other distributionof the assets of the company among its shareholders for the purpose of winding up its affairs. With respect to the Class A <strong>and</strong> ClassB common shares, there are no dilutive factors, material or otherwise, that would result in different diluted earnings per share. Thisrelationship holds true irrespective of the number of dilutive instruments issued in either one of the respective classes of commonstock, as both classes of common stock share equally, on a pro rata basis in the dividends, earnings <strong>and</strong> net assets of the company,whether taken before or after dilutive instruments, regardless of which class of common stock is diluted.(d) Stock-Based CompensationOptions issued under the company’s MSOP typically vest proportionately over fi ve years <strong>and</strong> expire 10 years after the grant date.The exercise price is equal to the market price at the grant date. During 2005, the company granted 2,694,150 (2004 – 1,527,545)options with an average exercise price of C$46.25 (2004 – C$30.07) per share. The cost of the options granted was determinedusing the Black-Scholes model of valuation, assuming a 7.5 year term to exercise (2004 – 7.5 year), 12% volatility (2004 – 12%),a weighted average expected dividend yield of 1.5% (2004 – 2.3%) annually <strong>and</strong> an interest rate of 3.9% (2004 – 4.0%). The costof $13 million (2004 – $5 million) is charged to employee compensation expense on an equal basis over the fi ve-year vesting periodof the options granted.<strong>Brookfield</strong> <strong>Asset</strong> Management | 2005 Annual Report 81