Consolidated Financial Statements and Notes - Brookfield Asset ...

Consolidated Financial Statements and Notes - Brookfield Asset ...

Consolidated Financial Statements and Notes - Brookfield Asset ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

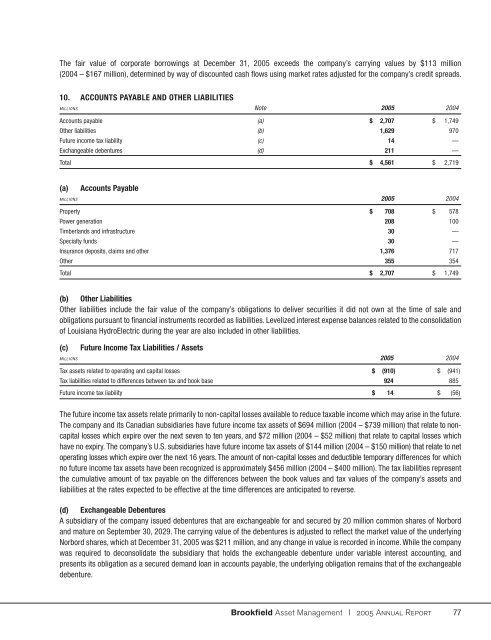

The fair value of corporate borrowings at December 31, 2005 exceeds the company’s carrying values by $113 million(2004 – $167 million), determined by way of discounted cash fl ows using market rates adjusted for the company’s credit spreads.10. ACCOUNTS PAYABLE AND OTHER LIABILITIESMILLIONS Note 2005 2004Accounts payable (a) $ 2,707 $ 1,749Other liabilities (b) 1,629 970Future income tax liability (c) 14 —Exchangeable debentures (d) 211 —Total $ 4,561 $ 2,719(a) Accounts PayableMILLIONS 2005 2004Property $ 708 $ 578Power generation 208 100Timberl<strong>and</strong>s <strong>and</strong> infrastructure 30 —Specialty funds 30 —Insurance deposits, claims <strong>and</strong> other 1,376 717Other 355 354Total $ 2,707 $ 1,749(b) Other LiabilitiesOther liabilities include the fair value of the company’s obligations to deliver securities it did not own at the time of sale <strong>and</strong>obligations pursuant to fi nancial instruments recorded as liabilities. Levelized interest expense balances related to the consolidationof Louisiana HydroElectric during the year are also included in other liabilities.(c) Future Income Tax Liabilities / <strong>Asset</strong>sMILLIONS 2005 2004Tax assets related to operating <strong>and</strong> capital losses $ (910) $ (941)Tax liabilities related to differences between tax <strong>and</strong> book base 924 885Future income tax liability $ 14 $ (56)The future income tax assets relate primarily to non-capital losses available to reduce taxable income which may arise in the future.The company <strong>and</strong> its Canadian subsidiaries have future income tax assets of $694 million (2004 – $739 million) that relate to noncapitallosses which expire over the next seven to ten years, <strong>and</strong> $72 million (2004 – $52 million) that relate to capital losses whichhave no expiry. The company’s U.S. subsidiaries have future income tax assets of $144 million (2004 – $150 million) that relate to netoperating losses which expire over the next 16 years. The amount of non-capital losses <strong>and</strong> deductible temporary differences for whichno future income tax assets have been recognized is approximately $456 million (2004 – $400 million). The tax liabilities representthe cumulative amount of tax payable on the differences between the book values <strong>and</strong> tax values of the company’s assets <strong>and</strong>liabilities at the rates expected to be effective at the time differences are anticipated to reverse.(d) Exchangeable DebenturesA subsidiary of the company issued debentures that are exchangeable for <strong>and</strong> secured by 20 million common shares of Norbord<strong>and</strong> mature on September 30, 2029. The carrying value of the debentures is adjusted to refl ect the market value of the underlyingNorbord shares, which at December 31, 2005 was $211 million, <strong>and</strong> any change in value is recorded in income. While the companywas required to deconsolidate the subsidiary that holds the exchangeable debenture under variable interest accounting, <strong>and</strong>presents its obligation as a secured dem<strong>and</strong> loan in accounts payable, the underlying obligation remains that of the exchangeabledebenture.<strong>Brookfield</strong> <strong>Asset</strong> Management | 2005 Annual Report 77