Consolidated Financial Statements and Notes - Brookfield Asset ...

Consolidated Financial Statements and Notes - Brookfield Asset ...

Consolidated Financial Statements and Notes - Brookfield Asset ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

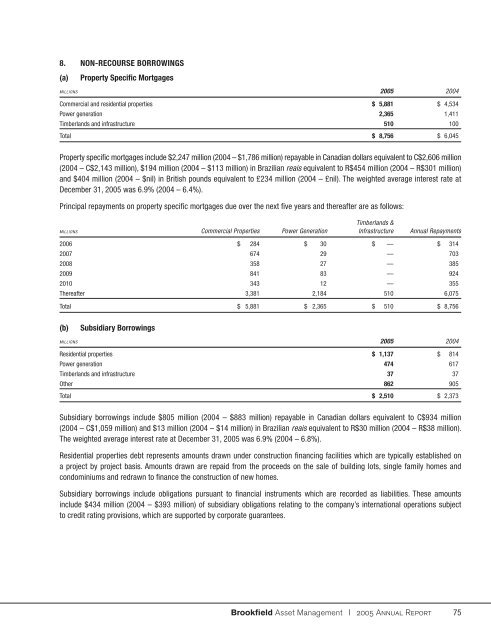

8. NON-RECOURSE BORROWINGS(a)Property Specific MortgagesMILLIONS 2005 2004Commercial <strong>and</strong> residential properties $ 5,881 $ 4,534Power generation 2,365 1,411Timberl<strong>and</strong>s <strong>and</strong> infrastructure 510 100Total $ 8,756 $ 6,045Property specifi c mortgages include $2,247 million (2004 – $1,786 million) repayable in Canadian dollars equivalent to C$2,606 million(2004 – C$2,143 million), $194 million (2004 – $113 million) in Brazilian reais equivalent to R$454 million (2004 – R$301 million)<strong>and</strong> $404 million (2004 – $nil) in British pounds equivalent to £234 million (2004 – £nil). The weighted average interest rate atDecember 31, 2005 was 6.9% (2004 – 6.4%).Principal repayments on property specifi c mortgages due over the next fi ve years <strong>and</strong> thereafter are as follows:Timberl<strong>and</strong>s &MILLIONS Commercial Properties Power Generation Infrastructure Annual Repayments2006 $ 284 $ 30 $ — $ 3142007 674 29 — 7032008 358 27 — 3852009 841 83 — 9242010 343 12 — 355Thereafter 3,381 2,184 510 6,075Total $ 5,881 $ 2,365 $ 510 $ 8,756(b)Subsidiary BorrowingsMILLIONS 2005 2004Residential properties $ 1,137 $ 814Power generation 474 617Timberl<strong>and</strong>s <strong>and</strong> infrastructure 37 37Other 862 905Total $ 2,510 $ 2,373Subsidiary borrowings include $805 million (2004 – $883 million) repayable in Canadian dollars equivalent to C$934 million(2004 – C$1,059 million) <strong>and</strong> $13 million (2004 – $14 million) in Brazilian reais equivalent to R$30 million (2004 – R$38 million).The weighted average interest rate at December 31, 2005 was 6.9% (2004 – 6.8%).Residential properties debt represents amounts drawn under construction fi nancing facilities which are typically established ona project by project basis. Amounts drawn are repaid from the proceeds on the sale of building lots, single family homes <strong>and</strong>condominiums <strong>and</strong> redrawn to fi nance the construction of new homes.Subsidiary borrowings include obligations pursuant to fi nancial instruments which are recorded as liabilities. These amountsinclude $434 million (2004 – $393 million) of subsidiary obligations relating to the company’s international operations subjectto credit rating provisions, which are supported by corporate guarantees.<strong>Brookfield</strong> <strong>Asset</strong> Management | 2005 Annual Report 75