Karuna Trust, Karnataka - ZEF

Karuna Trust, Karnataka - ZEF

Karuna Trust, Karnataka - ZEF

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

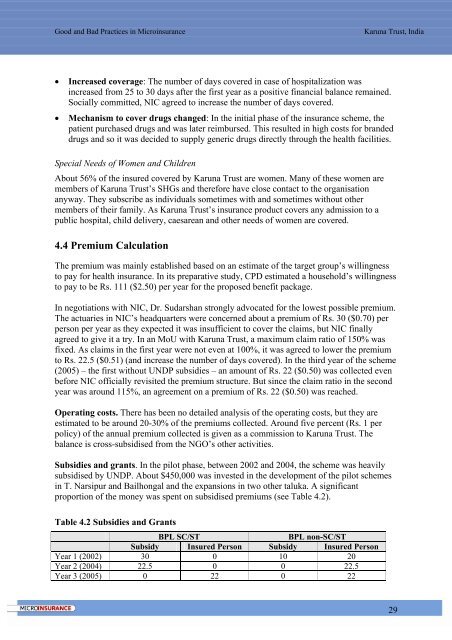

Good and Bad Practices in Microinsurance<strong>Karuna</strong> <strong>Trust</strong>, India• Increased coverage: The number of days covered in case of hospitalization wasincreased from 25 to 30 days after the first year as a positive financial balance remained.Socially committed, NIC agreed to increase the number of days covered.• Mechanism to cover drugs changed: In the initial phase of the insurance scheme, thepatient purchased drugs and was later reimbursed. This resulted in high costs for brandeddrugs and so it was decided to supply generic drugs directly through the health facilities.Special Needs of Women and ChildrenAbout 56% of the insured covered by <strong>Karuna</strong> <strong>Trust</strong> are women. Many of these women aremembers of <strong>Karuna</strong> <strong>Trust</strong>’s SHGs and therefore have close contact to the organisationanyway. They subscribe as individuals sometimes with and sometimes without othermembers of their family. As <strong>Karuna</strong> <strong>Trust</strong>’s insurance product covers any admission to apublic hospital, child delivery, caesarean and other needs of women are covered.4.4 Premium CalculationThe premium was mainly established based on an estimate of the target group’s willingnessto pay for health insurance. In its preparative study, CPD estimated a household’s willingnessto pay to be Rs. 111 ($2.50) per year for the proposed benefit package.In negotiations with NIC, Dr. Sudarshan strongly advocated for the lowest possible premium.The actuaries in NIC’s headquarters were concerned about a premium of Rs. 30 ($0.70) perperson per year as they expected it was insufficient to cover the claims, but NIC finallyagreed to give it a try. In an MoU with <strong>Karuna</strong> <strong>Trust</strong>, a maximum claim ratio of 150% wasfixed. As claims in the first year were not even at 100%, it was agreed to lower the premiumto Rs. 22.5 ($0.51) (and increase the number of days covered). In the third year of the scheme(2005) – the first without UNDP subsidies – an amount of Rs. 22 ($0.50) was collected evenbefore NIC officially revisited the premium structure. But since the claim ratio in the secondyear was around 115%, an agreement on a premium of Rs. 22 ($0.50) was reached.Operating costs. There has been no detailed analysis of the operating costs, but they areestimated to be around 20-30% of the premiums collected. Around five percent (Rs. 1 perpolicy) of the annual premium collected is given as a commission to <strong>Karuna</strong> <strong>Trust</strong>. Thebalance is cross-subsidised from the NGO’s other activities.Subsidies and grants. In the pilot phase, between 2002 and 2004, the scheme was heavilysubsidised by UNDP. About $450,000 was invested in the development of the pilot schemesin T. Narsipur and Bailhongal and the expansions in two other taluka. A significantproportion of the money was spent on subsidised premiums (see Table 4.2).Table 4.2 Subsidies and GrantsBPL SC/STBPL non-SC/STSubsidy Insured Person Subsidy Insured PersonYear 1 (2002) 30 0 10 20Year 2 (2004) 22.5 0 0 22.5Year 3 (2005) 0 22 0 2229