Karuna Trust, Karnataka - ZEF

Karuna Trust, Karnataka - ZEF Karuna Trust, Karnataka - ZEF

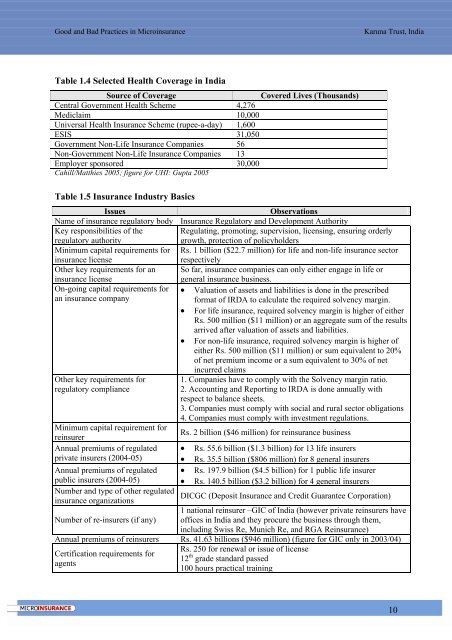

Good and Bad Practices in MicroinsuranceKaruna Trust, IndiaTable 1.4 Selected Health Coverage in IndiaSource of CoverageCovered Lives (Thousands)Central Government Health Scheme 4,276Mediclaim 10,000Universal Health Insurance Scheme (rupee-a-day) 1,600ESIS 31,050Government Non-Life Insurance Companies 56Non-Government Non-Life Insurance Companies 13Employer sponsored 30,000Cahill/Matthies 2005; figure for UHI: Gupta 2005Table 1.5 Insurance Industry BasicsIssuesObservationsName of insurance regulatory body Insurance Regulatory and Development AuthorityKey responsibilities of the Regulating, promoting, supervision, licensing, ensuring orderlyregulatory authoritygrowth, protection of policyholdersMinimum capital requirements for Rs. 1 billion ($22.7 million) for life and non-life insurance sectorinsurance licenserespectivelyOther key requirements for an So far, insurance companies can only either engage in life orinsurance licensegeneral insurance business.On-going capital requirements for • Valuation of assets and liabilities is done in the prescribedan insurance companyformat of IRDA to calculate the required solvency margin.• For life insurance, required solvency margin is higher of eitherRs. 500 million ($11 million) or an aggregate sum of the resultsarrived after valuation of assets and liabilities.• For non-life insurance, required solvency margin is higher ofeither Rs. 500 million ($11 million) or sum equivalent to 20%of net premium income or a sum equivalent to 30% of netOther key requirements forregulatory complianceMinimum capital requirement forreinsurerAnnual premiums of regulatedprivate insurers (2004-05)Annual premiums of regulatedpublic insurers (2004-05)Number and type of other regulatedinsurance organizationsincurred claims1. Companies have to comply with the Solvency margin ratio.2. Accounting and Reporting to IRDA is done annually withrespect to balance sheets.3. Companies must comply with social and rural sector obligations4. Companies must comply with investment regulations.Rs. 2 billion ($46 million) for reinsurance business• Rs. 55.6 billion ($1.3 billion) for 13 life insurers• Rs. 35.5 billion ($806 million) for 8 general insurers• Rs. 197.9 billion ($4.5 billion) for 1 public life insurer• Rs. 140.5 billion ($3.2 billion) for 4 general insurersDICGC (Deposit Insurance and Credit Guarantee Corporation)1 national reinsurer –GIC of India (however private reinsurers haveNumber of re-insurers (if any) offices in India and they procure the business through them,including Swiss Re, Munich Re, and RGA Reinsurance)Annual premiums of reinsurers Rs. 41.63 billions ($946 million) (figure for GIC only in 2003/04)Certification requirements foragentsRs. 250 for renewal or issue of license12 th grade standard passed100 hours practical training10

Good and Bad Practices in MicroinsuranceKaruna Trust, India1.3 The Role of the State in Social ProtectionThe Employee State Insurance Scheme (ESIS) founded in 1948 is another provider of formalinsurance, functioning as a social health insurance scheme. ESIS is obligatory in certainindustries when a certain number of employees are exceeded. The system is financed bycontributions collected as a percentage of the gross wage. Employees pay 1.75% of theirwages in contributions, while the employer adds 4.75%. The Indian states subsidise thesystem with general taxes.Administered by a state corporation, Employees State Insurance Corporation (ESIC), thisscheme covers illness, motherhood, disability and death from work accidents. ESIS runs anetwork of health care service providers consisting of individual physicians as well ashospitals. The services range from prevention and health counselling to curative treatmentand rehabilitation. With 8.5 million members, ESIS covers 33 million individuals in 22Indian states. However, ESIS is not unopposed. Some companies try to avoid the obligatoryinsurance or supplement it with their own service offers (Ellis/Alam/Gupta 2000). Thesystem is blamed for management weaknesses and poor service provision. Another problemis that ESIS health service providers are not working to full capacity.For central government employees and their dependants, health care services are providedthrough the Central Government Health Scheme (CGHS). Introduced in 1954, the system isprovided by the government for its employees, i.e. people receive health services withoutpaying contributions (Gumber/Kulkarni 2000). Overall 4.5 million individuals are covered bythe CGHS, which offers health care services through its own providers (Ellis/Alam/Gupta2000). Like ESIS, this system is blamed for inadequate and inefficient services.1.4 Brief Profile of MicroinsuranceIndia is a hot spot for the development of microinsurance. Many micro-schemes haveemerged in recent years, but there are some older schemes as well. The fast development ofthe microinsurance might be due to two reasons:1. All companies that operate in India must dedicate a fraction of their business to the lowincomemarket. Few companies regard the rural and social obligations as a businessopportunity. Nevertheless, the number of policies with poor customers increases withincreasing penetration of the higher-income market.2. India has a successful history with self-help groups in the area of microfinance. Manymicrofinance institutions have set up schemes to serve their clients. Other communitybasedorganizations have taken the same path, leading to the development of stand-alonecommunity schemes in which a growing number of people are covered.Government and the regulating authority acknowledge that insurance can be a riskmanagement mechanism for the poor. Therefore, rural and social obligations for the formalinsurance companies were introduced, which has led to the widespread use of the partneragentapproach, although other models of insurance provision exist as well. Some insuranceproducts of the formal (public) insurance companies are subsidised by the government.11

- Page 1 and 2: Karuna Trust, KarnatakaIndiaCGAP Wo

- Page 3 and 4: Good and Bad Practices in Microinsu

- Page 5 and 6: Good and Bad Practices in Microinsu

- Page 7 and 8: Good and Bad Practices in Microinsu

- Page 9 and 10: Good and Bad Practices in Microinsu

- Page 11 and 12: Good and Bad Practices in Microinsu

- Page 13 and 14: Good and Bad Practices in Microinsu

- Page 15: Good and Bad Practices in Microinsu

- Page 20 and 21: Good and Bad Practices in Microinsu

- Page 22 and 23: Good and Bad Practices in Microinsu

- Page 24 and 25: Good and Bad Practices in Microinsu

- Page 26 and 27: Good and Bad Practices in Microinsu

- Page 28 and 29: Good and Bad Practices in Microinsu

- Page 30 and 31: Good and Bad Practices in Microinsu

- Page 32 and 33: Good and Bad Practices in Microinsu

- Page 34 and 35: Good and Bad Practices in Microinsu

- Page 36 and 37: Good and Bad Practices in Microinsu

- Page 38 and 39: Good and Bad Practices in Microinsu

- Page 40 and 41: Good and Bad Practices in Microinsu

- Page 42 and 43: Good and Bad Practices in Microinsu

- Page 44 and 45: Good and Bad Practices in Microinsu

- Page 46 and 47: Good and Bad Practices in Microinsu

- Page 48 and 49: Good and Bad Practices in Microinsu

- Page 50 and 51: Good and Bad Practices in Microinsu

- Page 52 and 53: Good and Bad Practices in Microinsu

- Page 54: Good and Bad Practices in Microinsu

Good and Bad Practices in Microinsurance<strong>Karuna</strong> <strong>Trust</strong>, IndiaTable 1.4 Selected Health Coverage in IndiaSource of CoverageCovered Lives (Thousands)Central Government Health Scheme 4,276Mediclaim 10,000Universal Health Insurance Scheme (rupee-a-day) 1,600ESIS 31,050Government Non-Life Insurance Companies 56Non-Government Non-Life Insurance Companies 13Employer sponsored 30,000Cahill/Matthies 2005; figure for UHI: Gupta 2005Table 1.5 Insurance Industry BasicsIssuesObservationsName of insurance regulatory body Insurance Regulatory and Development AuthorityKey responsibilities of the Regulating, promoting, supervision, licensing, ensuring orderlyregulatory authoritygrowth, protection of policyholdersMinimum capital requirements for Rs. 1 billion ($22.7 million) for life and non-life insurance sectorinsurance licenserespectivelyOther key requirements for an So far, insurance companies can only either engage in life orinsurance licensegeneral insurance business.On-going capital requirements for • Valuation of assets and liabilities is done in the prescribedan insurance companyformat of IRDA to calculate the required solvency margin.• For life insurance, required solvency margin is higher of eitherRs. 500 million ($11 million) or an aggregate sum of the resultsarrived after valuation of assets and liabilities.• For non-life insurance, required solvency margin is higher ofeither Rs. 500 million ($11 million) or sum equivalent to 20%of net premium income or a sum equivalent to 30% of netOther key requirements forregulatory complianceMinimum capital requirement forreinsurerAnnual premiums of regulatedprivate insurers (2004-05)Annual premiums of regulatedpublic insurers (2004-05)Number and type of other regulatedinsurance organizationsincurred claims1. Companies have to comply with the Solvency margin ratio.2. Accounting and Reporting to IRDA is done annually withrespect to balance sheets.3. Companies must comply with social and rural sector obligations4. Companies must comply with investment regulations.Rs. 2 billion ($46 million) for reinsurance business• Rs. 55.6 billion ($1.3 billion) for 13 life insurers• Rs. 35.5 billion ($806 million) for 8 general insurers• Rs. 197.9 billion ($4.5 billion) for 1 public life insurer• Rs. 140.5 billion ($3.2 billion) for 4 general insurersDICGC (Deposit Insurance and Credit Guarantee Corporation)1 national reinsurer –GIC of India (however private reinsurers haveNumber of re-insurers (if any) offices in India and they procure the business through them,including Swiss Re, Munich Re, and RGA Reinsurance)Annual premiums of reinsurers Rs. 41.63 billions ($946 million) (figure for GIC only in 2003/04)Certification requirements foragentsRs. 250 for renewal or issue of license12 th grade standard passed100 hours practical training10