FSA Enrollment info & direct deposit form - Tufts Health Plan

FSA Enrollment info & direct deposit form - Tufts Health Plan

FSA Enrollment info & direct deposit form - Tufts Health Plan

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Flexible Spending Accounts(<strong>FSA</strong>s)What does theBeniversal <strong>FSA</strong> provide?• Tax-free money for medical and dependentcare expenses• Convenient access to account funds throughthe Beniversal ® Prepaid MasterCard ®• On-the-go account access with theBRiMobile app• Streamlined online account support throughBRiWeb• Friendly and knowledgable participantservices representatives to assist with yourquestionsVisit www.BenefitResource.comwww.BenefitResource.com

What is a Flexible Spending Account?A Flexible Spending Account (<strong>FSA</strong>) is an IRS-approved account that allowsyou to pay for eligible medical and dependent care expenses on a tax-freebasis.How does the tax savings work? When you enroll in your employersponsored Flexible Spending Account, your contributions are not subjectto Federal, FICA and most state taxes. This means you bring home moremoney in your paycheck!Tax Savings ExampleAnnual Income $50,000Anticipated Medical Expenses $2,500Without <strong>Plan</strong> With <strong>Plan</strong>Federal Income Tax Paid $12,500 $11,875State Income Tax Paid $3,000 $2,850FICA $3,825 $3,634Total Taxes Paid $19,325 $18,359Disposable Income $30,675 $31,640Annual Tax Savings $966The figures above are for illustration purposes only. Actual savings and tax rates may vary.Calculate your personalized tax savings at www.BenefitResource.com.Who can participate? In order to participate in the plan, you need to meet the eligibility requirements set byyour employer. If you or your spouse is reporting contributions to an HSA, generally you will not be eligibleto participate in a Medical <strong>FSA</strong>. Please contact your employer or refer to your plan documentation for moredetails and eligibility requirements.How do elections work? Prior to the start of a plan year or when you become eligible, you will make anannual election for medical and/or dependent care expenses separately (as applicable). Elections do notcarry over from year to year. Check with your employer about the maximum (and any applicable minimum)amounts you can set aside in a Medical <strong>FSA</strong> and Dependent Care <strong>FSA</strong>. Generally, once you have enrolled inthe plan, you cannot change your elections during that plan year unless you have a certain qualifying event(e.g. marriage, death, change in employment status, etc.) that may allow a change in your plan year electionamounts. More <strong>info</strong>rmation is also available in your plan documentation.When can I access <strong>FSA</strong> funds? Services must be provided during the plan year designated in your plandocumentation and you cannot access <strong>FSA</strong> funds until the service is provided. The IRS allows one exceptionfor orthodontia expenses. Funds must be used by the time frame indicated in your <strong>Plan</strong> Highlights or funds willbe forfeited.

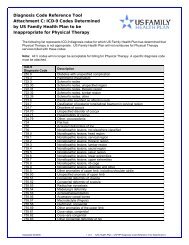

What are eligible medical expenses?This list is intended to be used as a quick reference of potentially eligible medical expenses and does notguarantee that an expense will be eligible. Please see your plan documents to verify what expenses arereimbursable under your plan. This list is not intended to be an all encompassing list and may be updated fromtime to time. Eligible expenses for Flexible Spending Accounts (<strong>FSA</strong>s) are governed by Section 213(d) of theInternal Revenue Code. In addition to the list below, there are over 150 additional items or expense typesthat are considered potentially eligible. These may require prescriptions or a letter of medical necessity whensubmitting a reimbursement request.AbortionAcupunctureAlcoholism treatmentAllergy treatments (if prescribed)AmbulanceArthritis glovesArtificial limbsArtificial teethAsthma devices and medicines(if prescribed)BandagesBlood-sugar test kits and test stripsBody scansBraille books and magazinesBreast pumpsBreast reconstruction surgeryfollowing mastectomyCancer screeningsCarpal tunnel wrist supportsChiropractorsCircumcisionCo-insurance amountsCo-paymentsCounseling, when used to treatdiagnosed medical conditionCPAP (continuous positive airwaypressure) devicesCrutchesDental sealantsDental services and proceduresDentures and denture adhesivesDiabetic suppliesDiagnostic items/servicesDrug addiction treatmentDrug overdose, treatment ofDurable medical equipmentEye examinations, eyeglasses,equipment, and materialsFirst aid kitsFlu shotsFluoridation servicesGauze padsGuide dogHearing aidsHospital servicesImmunizationsInsulinLaboratory feesLactation consultantLaser eye surgery, LasikLiquid adhesive for small cutsLodging at a hospital or similarinstitutionMastectomy-related special brasMedical alert bracelet or necklaceMedical <strong>info</strong>rmation plan chargesMedical monitoring and testingdevicesMedical practitioner’s fee for onlineor telephone consultationMedical records chargesMidwifeNorplant insertion or removalObstetrical expensesOcclusal guards to prevent teethgrindingOperations / SurgeriesOptometristOrgan donorsOrthodontiaOrthopedic shoe insertsOsteopath feesOvulation monitorOxygenPhysical examsPhysical therapyPregnancy test kitsPrescription drugs and medicines,for the purpose of medical care(not general health or cosmeticpurposes)Preventive care screeningsProsthesisPsychiatric careRadial keratotomyReading glassesRehydration solutionRubbing alcoholScreening testsSleep-deprivation treatmentSpeech therapySterilization proceduresStop-smoking programsTelephone equipment or televisionfor hearing-impaired personsThermometersTransplantsTransportation expenses for personto receive medical care, mayinclude car mileage or alternativetransportation costsVaccinesVasectomy / Vasectomy reversalVision correction proceduresWalkersWheelchairX-ray feesEligible Over-the-CounterMedical SuppliesAdult incontinence products (e.g. Depends)Birth control products (e.g. prophylactics)Contact lens solutionDenture adhesivesFirst aid supplies (e.g. band-aids)<strong>Health</strong> monitors (e.g. blood pressure, cholesterol, HIV,thermometers)Hearing aid batteriesHeat wraps (e.g. ThermaCare)Heating pads, hot water bottlesInsulin & diabetic suppliesMedicine dropper/spoonMotion sickness devicesSupports/braces (e.g. ankle, knee, wrist, therapeutic glove)Eligible Over-the-Counter Drugs & Medicines(require a prescription)Acne medicationsAllergy and sinus medications(e.g. Benadryl, Claritin, Sudafed)Anti-fungal medications(e.g. Lotramin AF)Anti-itch medications (e.g. Caladryl)Cold sore medicationsCough, cold & flu remediesDecongestantsDiaper rash ointmentsEar wax removal dropsFirst aid creamsGastrointestinal aids (e.g. antacids,anti-diarrhea medicines, non-fiberlaxatives, nausea medications)Lactose intolerance pillsMotion sickness pillsNasal sprays for congestion(e.g. Afrin)Pain relievers (e.g. aspirin, Excedrin,Tylenol, Advil, Motrin)Sleeping aidsSmoking cessation medications(e.g. nicotine gum or patches)SuppositoriesToothache relievers (e.g. Orajel)Wart remover medicationsYeast infection creams (e.g. Monistat)Once your account is open, you will have access to a detailed eligible expense look up table.Simply log in to your account at www.BenefitResource.com and selectEligible <strong>Health</strong> Care Expense Table under the <strong>FSA</strong>/HRA tab.

<strong>FSA</strong> Expense & Tax Savings Estimate WorksheetMedical <strong>FSA</strong> Estimate: Estimate your eligible out-of-pocket medical expenses. Out-of-pocket expenses includeservices for you, your spouse and eligible dependents.General Expenses$ ___________ Office visits / Doctor’s fees(actual cost if deductible applies or total co-payments)$ ___________ Immunizations / Vaccines$ ___________ Laboratory fees / X-rays$ ___________ Over-the-counter drugs and medicines(prescription required)$ ___________ Over-ther counter medical supplies$ ___________ Prescription drugs$ ___________ SUBTOTALHospitalization & Specialist Expenses$ ___________ Emergency room$ ___________ Hospital bills$ ___________ Specialists or alternative medicine(Acupuncture, chiropractor, physical therapy, specialists fees, etc.)$ ___________ Surgery$ ___________ OTHER MEDICAL EXPENSES NOT SPECIFIED$ ___________ SUBTOTALDental$ ___________ Cleanings / Dental exams$ ___________ Fillings / Dental procedures$ ___________ Orthodontia$ ___________ X-rays$ ___________ SUBTOTALVision$ ___________ Corrective eye surgery & eye wear$ ___________ Eye exams$ ___________ Prescription glasses / Contact lenses$ ___________ SUBTOTALHearing$ ___________ Hearing Aids$ ___________ Hearing Exams$ ___________ SUBTOTAL$ ___________ TOTAL MEDICAL <strong>FSA</strong> ESTIMATEDependent Care <strong>FSA</strong> Estimate: Estimate your eligible out-of-pocket dependent care expenses.Dependent Care Expenses$ _____________ Adult Day Care$ _____________ Child Day Care / In-home Dependent Care$ _____________ Nursery School$ _____________ TOTAL DEPENDENT CARE <strong>FSA</strong> ESTIMATETax Savings Estimate: Estimate your total annual estimated tax savings.Amounts .A. ENTER TOTAL MEDICAL <strong>FSA</strong> ESTIMATE (See <strong>Plan</strong> Highlights for the maximum limits that may apply.) $ __________________B. ENTER TOTAL DEPENDENT CARE <strong>FSA</strong> ESTIMATE (See <strong>Plan</strong> Highlights for the maximum limits that may apply.) $ __________________C. TOTAL EXPENSES (Line A + Line B) $ __________________D. TAX RATE (Enter percentage of your gross salary that you pay in Federal, State and Local Taxes. (If uncertain, use 30%.)) ________________ %E. FICA (includes Social Security and Medicare) ________________ %F. TOTAL TAX RATE (Line D + Line E) ________________ %G. ESTIMATED ANNUAL TAX SAVINGS (Line C x Line F) $ __________________

What do I need to know about <strong>FSA</strong>s?Medical <strong>FSA</strong>A Medical <strong>FSA</strong> can be used to pay for eligible medicalexpenses provided to you, your spouse or eligibledependents.• Upon enrolling in a Medical <strong>FSA</strong>, you have accessto your full plan year election amount.• The tax-free amount you can set aside in aMedical <strong>FSA</strong> per plan year can be found in your<strong>Plan</strong> Highlights. Your <strong>Plan</strong> Highlights also containother specific <strong>info</strong>rmation about your employersponsored plan.• Expenses must be primarily to prevent, treat,diagnose or mitigate a physical or mental defector illness. The eligibility of an expense is governedby the IRS. Common eligible expenses include:• Co-payments, co-insurance and deductibleexpenses• Dental care (e.g. exams, fillings, crowns)• Vision care, eyeglasses, contact lenses• Chiropractic care• Prescription drugs and certain over-the-countermedical items• Expenses cannot be for personal care, cosmeticor general health purposes.• Some expenses are only eligible if certified by alicensed medical provider as medically necessary.• Expenses cannot be reimbursed from any othersource (e.g. insurance).• You forfeit any remaining amount in this accountafter the time frame indicated in your plandocumentation.• While you can use the Medical <strong>FSA</strong> for medicalexpenses for a spouse or dependent, you cannotuse Medical <strong>FSA</strong> funds for dependent careexpenses (e.g. child care) and vice-versa.Dependent Care <strong>FSA</strong>A Dependent Care <strong>FSA</strong> can be used to reimbursedependent care expenses (e.g. child care) for aqualified person. These expenses enable you tobe gainfully employed and, if married, enable yourspouse to be gainfully employed, look for work orattend school full-time.• The qualified person must spend at least 8 hoursper day in your home and is one of the following:• Dependent child under the age of 13 and forwhom you can claim a tax exemption.• Spouse or dependent who is physically ormentally incapable of self-care, lives with youfor more than half of the year, and for whom youcan claim a tax exemption.• The tax-free amount you can set aside percalendar year in a Dependent Care <strong>FSA</strong> can befound in your <strong>Plan</strong> Highlights.• Common eligible expenses, include:• Before/after school care• Child Care / in-home dependent care• Day care facility• Nursery school• Adult care• Services provided for education, overnight campsor services provided by the child’s parent orother dependent for income tax purposes are noteligible expenses.• The amount available for reimbursement ofdependent care expenses is limited to the cashbalance in your Dependent Care <strong>FSA</strong>.• You forfeit any remaining amount in this account• You cannot claim a federal tax credit for anyexpenses reimbursed through a Dependent Care<strong>FSA</strong>. Consult a tax professional to determine ifit would be more to your advantage to elect aDependent Care <strong>FSA</strong> or to use the federal taxcredit.Use the <strong>FSA</strong> Expense & Tax Savings Estimate Worksheet included in the bookletto help you estimate how much you should elect.

How do I access my <strong>FSA</strong>?Use the Beniversal Card (if offered)The Beniversal Prepaid MasterCard can be used at qualified merchantsproviding medical products and services, such as: doctors, dentists, medicallabs, hospitals, medical supply stores, vision centers and certain drugstoresand retail merchants. (A list of drugstores and retail merchants is available atwww.BenefitResource.com).When using your card, always save your itemized receipts. With an <strong>FSA</strong>,the IRS requires Benefit Resource to verify that 100% of transactions are for eligible expenses. Sincesome qualified merchants also offer services/items that are not eligible, Benefit Resource may contact yourequesting additional documentation on a transaction.Requested receipts and documentation for card transactions can be submitted online atwww.BenefitResource.com, through the BRiMobile app or by fax/mail. Instructions will be provided in therequest.Submit a ClaimWhen not using the Beniversal Card or for Dependent Care expenses, you can submit a claim with youritemized receipt or supporting documentation. Claims can be submitted:• Online at www.BenefitResource.comOnce logged in to your account, go to the <strong>FSA</strong>/HRA tab and select Submit Online Claim. Follow the on screen instructions.• Through the BRiMobile appDownload the BRiMobile app from the Apple App Store or Google Play.• By faxing/mailing a claim <strong>form</strong>Claim <strong>form</strong>s can be downloaded and printed from www.BenefitResource.com.Reimbursements are paid weekly. To receive your reimbursements by <strong>direct</strong> <strong>deposit</strong>, please log intowww.BenefitResource.com and set up your <strong>direct</strong> <strong>deposit</strong> account <strong>info</strong>rmation.The Beniversal Card is issued by The Bancorp Bank pursuant to license by MasterCard International Incorporated. The Bancorp Bank; Member FDIC.MasterCard is a registered trademark of MasterCard International Incorporated. ©2013 Benefit Resource, Inc. All rights reserved.

Log into BRiWebBRiWeb is your secure participant login for managing your accountswith Benefit Resource. BRiWeb allows you to view balance andtransaction <strong>info</strong>rmation, submit claims, download plan documentsand much more.To log in, go to www.BenefitResource.com:1. Click Participants under Secure Login.2. Once on the Participant Login page, please enter:Company Code: Provided by your employerMember ID: Social Security Number or unique ID provided by your employerInitial Password: 5 digit home zip code (You will be prompted to change the password upon initial login.)3. BRiWeb will open to a Dashboard which provides a quick snapshot of your account(s) and profile. Tomanage your <strong>FSA</strong>, select the <strong>FSA</strong>/HRA tab.To view a quick video demo of BRiWeb, visit the Resource Center at www.BenefitResource.com.Download the BRiMobile appBRiMobile is your on-the-go account access to view balances and recent transactions, submitclaims and send receipts. BRiMobile app is available for iPhone, iPad and Android devices.Learn more at www.BenefitResource.com/tools or download the app from the Apple App Store orGoogle Play.Contact Participant ServicesParticipant Services is available to assist with your questionsby phone, chat and email. Representatives are available inEnglish and Spanish.Phone: (800) 473-9595, Monday - Friday, 8am - 8pm(Eastern Time)Email: ParticipantServices@BenefitResource.comLive Chat: Available through the participant login atwww.BenefitResource.com, Monday - Friday, 8am - 5pm(Eastern Time).For more <strong>info</strong>rmation on these or other account <strong>info</strong>rmation,please visit us at www.BenefitResource.com.

Getting Started1. Determine your election amount(s) for Medical <strong>FSA</strong>and Dependent Care <strong>FSA</strong> separately.Utilize the <strong>FSA</strong> Expense & Tax Savings Estimate Worksheet in thisbooklet or visit www.BenefitResource.com to access the onlinecalculators.TIPS: Be a little conservative in your estimates. Any funds you do not use, you lose. Also,be sure to check with your employer or review your <strong>Plan</strong> Highlights for any minimum ormaximum limits that may apply, along with any restrictions on eligible expenses.2. Enroll in the <strong>FSA</strong>Your employer will provide you detailed instructions regarding how andwhen enrollment will need to be completed.If online enrollment is offered by your employer, go towww.BenefitResource.com, click on Participants under Secure Login.To log in, enter:Company Code: Provided by your employerMember ID: Social Security Number or unique ID provided byyour employerInitial Password: 5 digit home zip code(You will be prompted to change the password upon initial login.)Once logged in, go to the <strong>FSA</strong>/HRA tab and select the enrollment link.Follow the on screen prompts to complete your enrollment.What do participantsthink of theirBeniversal <strong>FSA</strong>?“Everyone is very helpful andresponsive. I’ve used the LiveChat a few times- I love it!!!!”“The BRI staff have alwaysbeen very helpful, courteous,and knowledgeable; and yourwebsite is very user-friendly.Keep it up!”“I’m always pleased when I don’tneed to contact an organizationfor help or to sort out problemsbecause it means the businessis doing a lot of things right toavoid trouble in the first place.”“I recommend daily that myco-workers get this card!”3. Begin using your account.If you have enrolled in a Medical <strong>FSA</strong> for the first time and the BeniversalCard is offered, it will arrive in a plain white envelope from BenefitResource. Once you receive your card, you will need to activate itby calling the number on the activation sticker. If you already have aBeniversal Card, you can continue to use the card through the expirationdate. If you are not using a card or have dependent care expenses, youcan begin submitting claims for reimbursement.Please check with your employer or refer to your <strong>Plan</strong> Highlightsregarding any restrictions that may exist regarding eligible expenses andtime frames for using funds and reimbursing eligible expenses.Questions?Visit us online at: www.BenefitResource.comContact us: (800) 473-9595, Monday - Friday, 8am - 8pm (Eastern Time), by email atParticipantServices@BenefitResource.com or with Live Chat via participant login atwww.BenefitResource.com, Monday - Friday, 8am - 5pm (Eastern Time)Rev. 08/2013<strong>FSA</strong> 200-17245 Kenneth Drive ◊ Rochester NY 14623-4277Toll-free: (866) 996-5200 ◊ Fax: (585) 424-7273 ◊ www.BenefitResource.com